From the Desk of Deborah Weinswig

The Third Annual Amazon Prime Day Is Coming in Mid-July

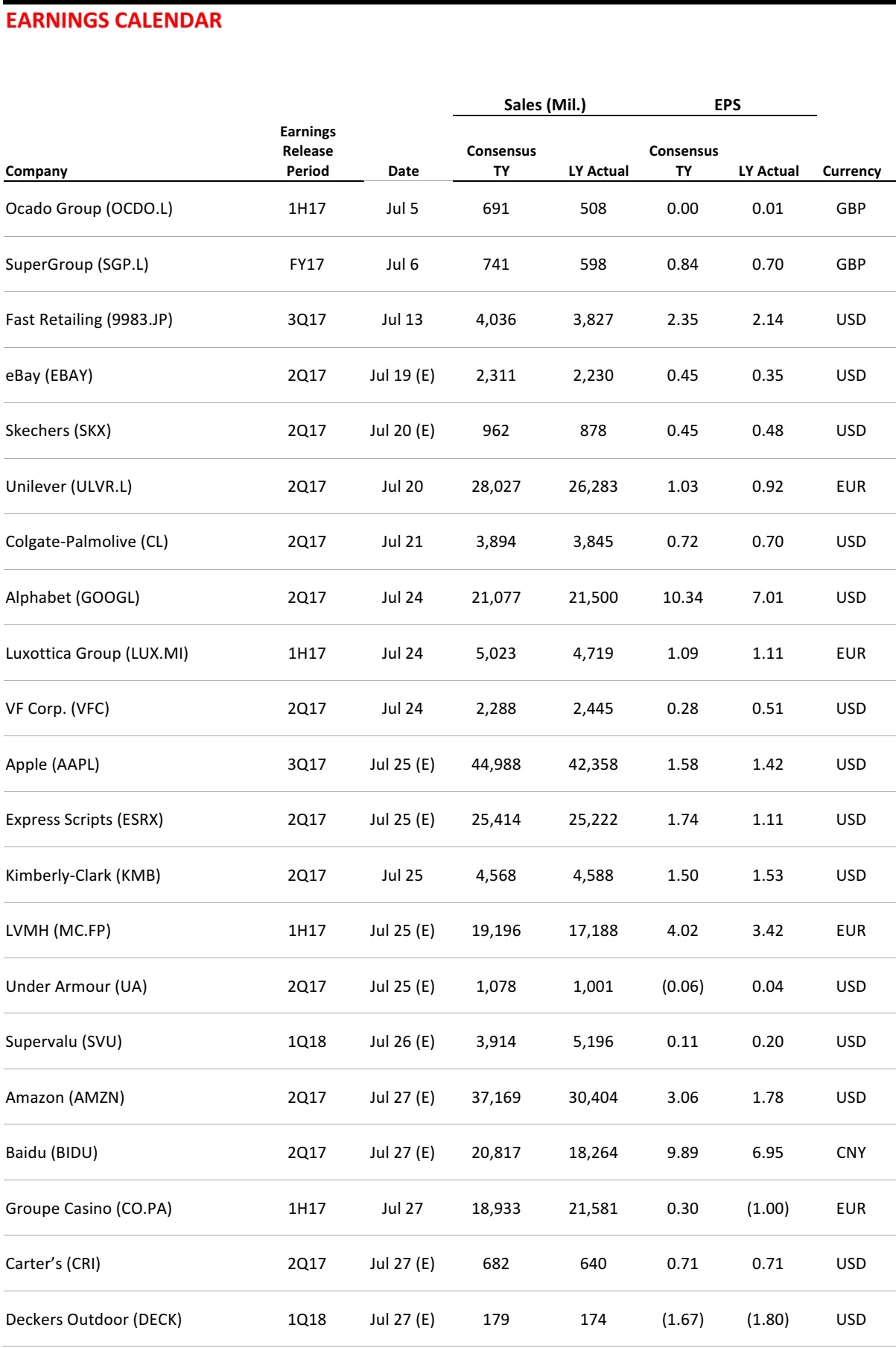

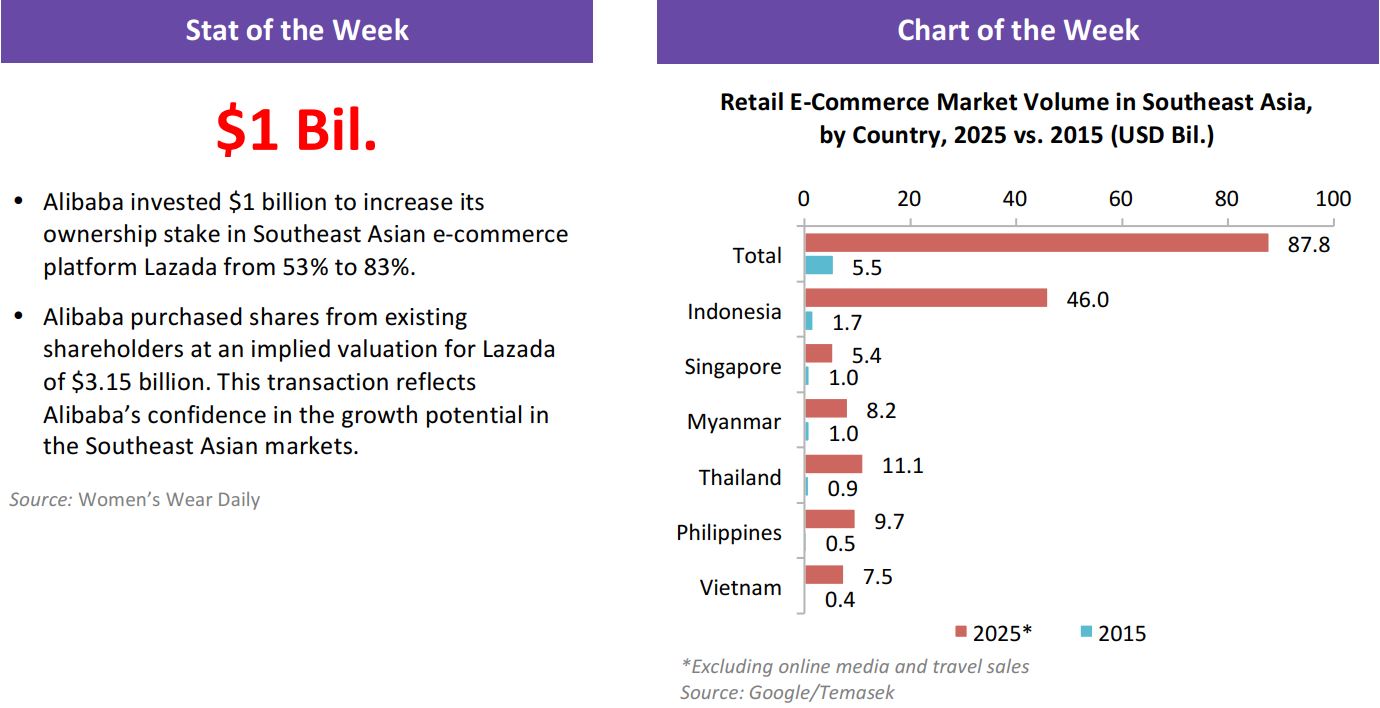

As we look forward to the Fourth of July holiday and start easing into the dog days of summer, we also approach a major, if recently invented, shopping event—Amazon Prime Day—which will celebrate its third anniversary on Tuesday, July 11. The event commemorates the company’s founding in 1994 and it became Amazon’s biggest sales day ever last year. Although the official Prime Day date is July 11, the sales will actually start at 6:00 p.m., Pacific Time, the evening before and run for a total of 30 hours.

Just how big Prime Day really is remains a well-kept secret. Last year, estimates of the day’s sales ranged as high as $2.5 billion (according to

Internet Retailer). Amazon reported that orders increased by 60% worldwide and by 50% in the US on Prime Day. Even in 2015, Amazon commented that its Prime Day sales exceeded its Black Friday sales in 2014. Still, as made-up shopping holidays go, Prime Day pales in comparison with Alibaba’s Singles’ Day, which saw $17.8 billion worth of gross merchandise volume last year. JD.com held a shopping holiday of its own on June 18 this year, and announced that total transaction volume totaled $17.6 billion from June 1 through June 18.

Last year, Alexa played a role in Prime Day, as Alexa-equipped Prime members received discounts and early access to Prime Day deals via the device. Other typical deals include discounts on Amazon’s consumer electronics products (naturally), including tablets, video devices such as the Fire TV stick and Echo intelligent assistants.

Tech gadgets do seem to be the major theme for Prime Day, although TVs, toys, laptops, cleaning robots, headphones, pressure cookers and hammocks have all sold briskly on Prime Day in the past.

The shopping holiday serves several purposes. First, it offers exclusive deals for Prime members, rewarding them for their membership. Second, it drives Prime membership, as nonmembers are offered free trial memberships. Amazon figured out long ago that Prime memberships represent a virtuous circle for the company: signing up Prime members and providing them with exclusive benefits encourages them to renew their membership the next year and encourages others to sign up for the program who will then renew

their own membership.

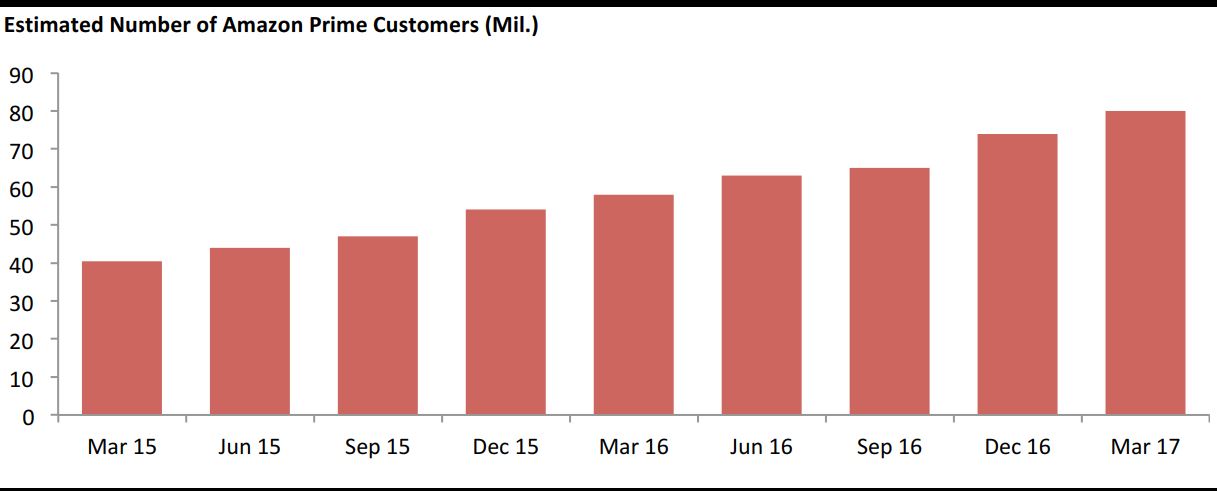

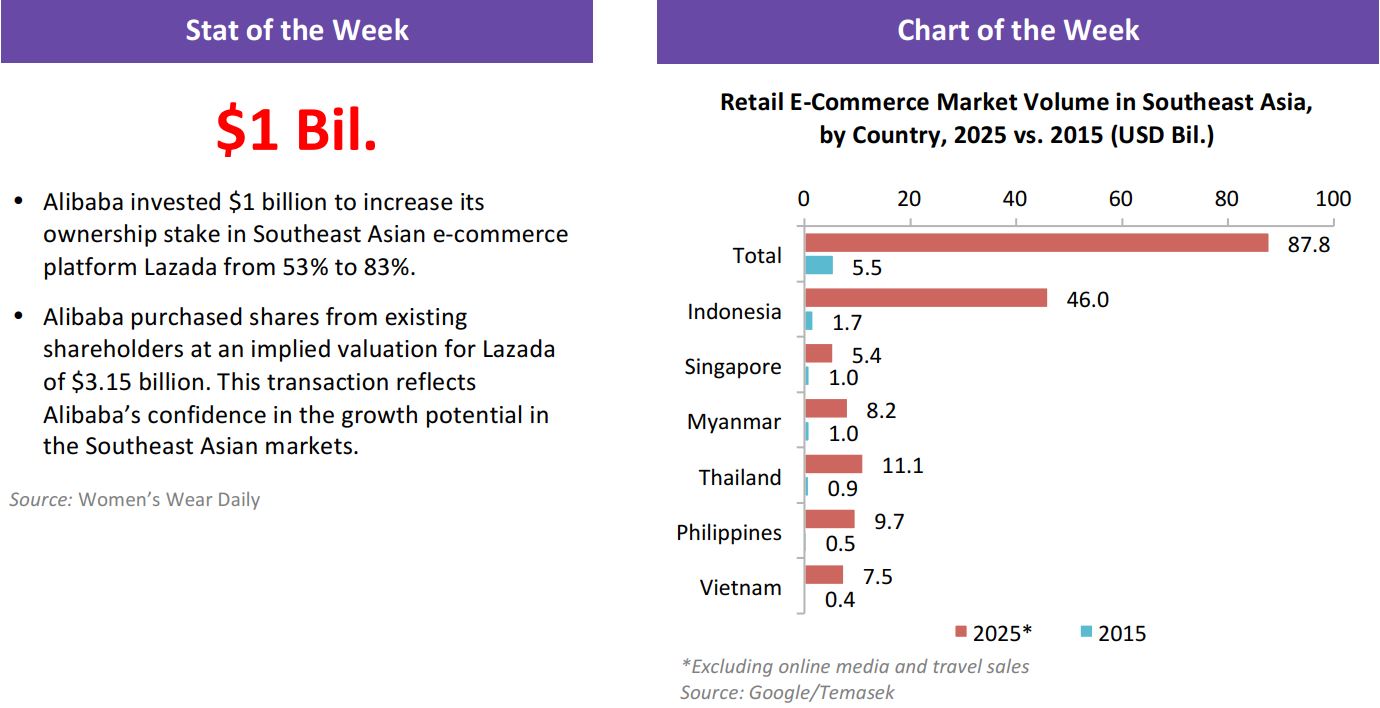

It is possible that the Prime program is becoming a victim of its own success, however. According to Consumer Intelligence Research Partners, there were 80 million Prime members in the US in March 2017, twice as many as two years earlier. Those members represent 64% of US households, as was mentioned recently at the Internet Retailer Conference + Exhibition in Chicago. This high adoption raises the question of whether the US market is becoming saturated—and it is notable that Amazon recently offered reduced membership fees for individuals receiving government assistance, which expands its addressable market and enables it to pick off some customers from its chief rival, Walmart.

Source: Consumer Intelligence Research Partners

Amazon has truly hit its stride in developing and fine-tuning its Prime program, and this year’s Prime Day is likely to include several surprises, as the holiday has in the past two years. The Fung Global Retail & Technology team will continue to provide details on Prime Day as they unfold.

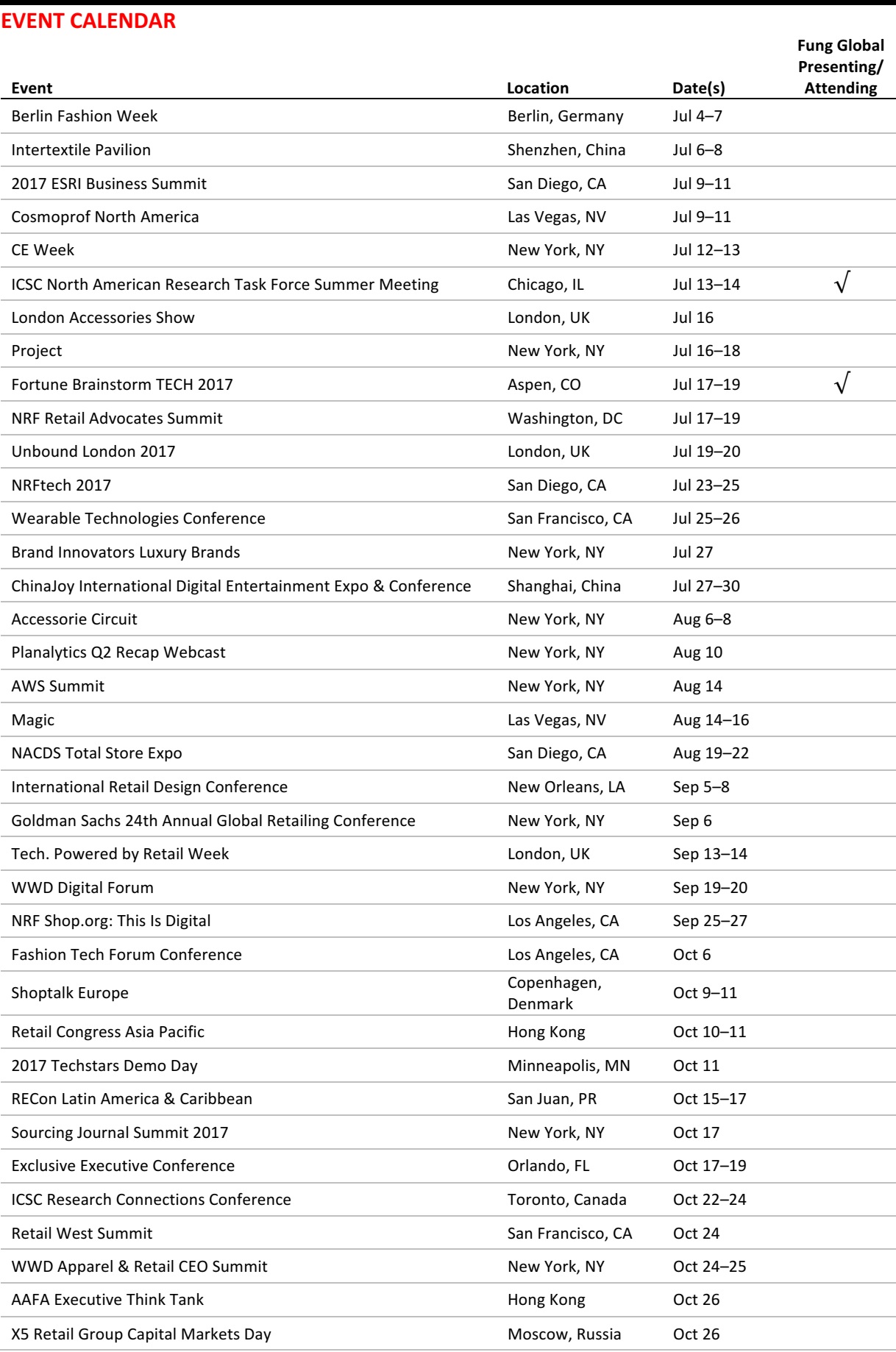

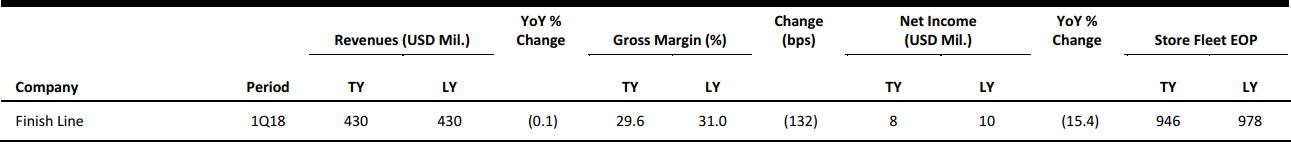

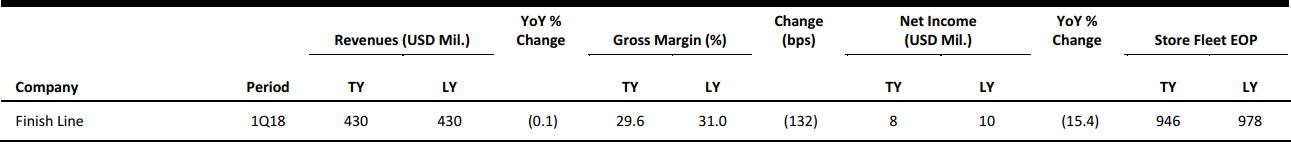

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Blue Apron Cuts IPO Price Range to $10–$11

(June 28) USA Today

Blue Apron Cuts IPO Price Range to $10–$11

(June 28) USA Today

- Timing may have been a bit off for Blue Apron. The meal-kit delivery company, which is backed by Silicon Valley investors, said that it is cutting the expected pricing range of its 30 million common shares that will be sold in an upcoming IPO to $10–$11, a one-third cut in its valuation that reflects investors’ increasingly skeptical outlook on the food retail business.

- Less than two weeks ago, the company expected to price shares between $15 and $17, which would have allowed it to raise about $500 million to fund expansion plans. The earlier pricing came just three days after Amazon announced a blockbuster deal to buy Whole Foods Market for about $13.7 billion, triggering sell-offs in grocery stocks and speculation that grocery retailers will seek mergers to fend off competition.

US Retail Mall Vacancies Edge Up in Second Quarter

(June 27) Reuters.com

US Retail Mall Vacancies Edge Up in Second Quarter

(June 27) Reuters.com

- US retail mall vacancies increased in the second quarter and rents were slightly higher, real estate research firm Reis said in a report. The national retail vacancy rate rose to 10% in the second quarter from 9.9% in the first quarter, partly due to new construction that was only partially absorbed by new leasing, Reis said.

- The mall vacancy rate inched up 0.2%, to 8.1%, in the quarter from the earlier quarter due to confirmed closings of Macy’s stores, the research firm added. Net absorption, which is measured in terms of available retail space sold in the market during a certain time period, fell from 2 million square feet in the first quarter to 421,000 square feet in the second quarter, the lowest level since 2011.

The Amazon-Whole Foods Deal Is Less About Stores and More About Data

(June 25) CNBC.com

The Amazon-Whole Foods Deal Is Less About Stores and More About Data

(June 25) CNBC.com

- Amazon’s acquisition of specialty grocer Whole Foods is not only about acquiring hundreds of stores and affluent customers—the real value of the deal is in all of that customer data, according to one data expert. Kenneth Sanford, data scientist at Dataiku, told CNBC recently that one of Amazon’s goals should be to combine the data it already collects from its online platforms, Echo and Alexa, with Whole Foods’ customer transaction data.

- By using the combined data, the company can predict what customers need and automatically send it to them, creating a personalized “auto grocery” experience, Sanford said. Essentially, Amazon will leverage its know-how in technology to customize the individual grocery shopping experience, all without the consumer ever even leaving the house.

Eddie Bauer May Be Put Up for Sale

(June 23) USA Today

Eddie Bauer May Be Put Up for Sale

(June 23) USA Today

- Golden Gate Capital, the private equity firm that owns Eddie Bauer, is reviewing strategic options for the sportswear maker, including a potential sale. Eddie Bauer filed for Chapter 11 bankruptcy protection in June 2009, and about a month later, Golden Gate won a bankruptcy auction to buy it with a $286 million offer.

- Sales of Eddie Bauer, which has 370 stores in the US and Canada, totaled $745 million in the 12 months ended April 1, down 16.5% from fiscal 2012. As of April, the company had $3 million in cash.

EUROPE RETAIL HEADLINES

Holland & Barrett Sold for £1.8 Billion

(June 26) BBC.co.uk

Holland & Barrett Sold for £1.8 Billion

(June 26) BBC.co.uk

- Holland & Barrett, the UK’s biggest health food retailer, is being bought by investment fund L1 Retail for £1.8 billion (US$2.3 billion) and will change hands in September.

- L1 Retail Managing Partner Stephan DuCharme said about Holland & Barrett, “We believe that the company is well positioned to benefit from structural growth in the growing £10 billion health and wellness market and has multiple levers for long-term growth and value creation.”

Google Receives Record EU Fine

(June 27) BBC.co.uk

Google Receives Record EU Fine

(June 27) BBC.co.uk

- Multinational technology company Google has been fined €2.42 billion (US$2.7 billion) by the European Commission after the commission ruled that the company has abused its power as a search engine. The ruling orders Google to end its anticompetitive practices within 90 days or face further penalties.

- The European Commission has been investigating Google Shopping since late 2010 and found that the company had promoted its own shopping comparison service over those of competitors at the top of the search results.

Metro Group Invests in Mobile Payment Solution

(June 27) RetailDetail.eu

Metro Group Invests in Mobile Payment Solution

(June 27) RetailDetail.eu

- German retailer Metro Group has invested €14 million (US$15.8 million), together with other companies, in British fintech startup Yoyo Wallet.

- Yoyo Wallet provides a “branded mobile experience” by giving customers access to mobile ordering, payments and a personalized loyalty program, while retailers get an analytics and campaign platform.

Aldi Süd Launches Nonfood Delivery Service

(June 21) Company press release

Aldi Süd Launches Nonfood Delivery Service

(June 21) Company press release

- Discounter Aldi Süd has launched a new online service for the German market that offers delivery of selected nongrocery items that cannot be purchased in stores. The products covered under the service are primarily large-volume and heavy goods.

- The service, called Aldi Liefert, is supported by web promotions as well as by flyers and handouts that are given to customers in stores. Customers can pay for the nongrocery goods along with their normal purchases in stores and then have the special items delivered to either their local store or their home.

JD.com Invests $397 Million in Farfetch

(June 22) FT.com

JD.com Invests $397 Million in Farfetch

(June 22) FT.com

- Chinese e-commerce giant JD.com is investing $397 million in UK luxury online retailer Farfetch as part of a new strategic partnership.

- Farfetch will gain access to JD.com’s marketing platform, social media channels and delivery service. In return, JD.com will receive an equity stake that will make it one of Farfetch’s largest shareholders and JD.com’s founder and chief executive will receive a seat on Farfetch’s board.

ASIA TECH HEADLINES

Singapore Computer Vision Company Trax Raises $64 Million in Warburg Pincus–Led Round

(June 28) TechinAsia.com

Singapore Computer Vision Company Trax Raises $64 Million in Warburg Pincus–Led Round

(June 28) TechinAsia.com

- Singapore-based computer vision and retail intelligence company Trax has just closed a funding round of $64 million, the company’s largest capital injection to date. The round was led by US private equity firm Warburg Pincus, which will become Trax’s largest institutional shareholder.

- This follows Trax’s $19.5 million funding round in February, which was led by Investec Bank, and a $40 million series C round that closed in June last year. The company said in a statement that it will use the latest funds for product development and to drive capacity in its core markets.

Singapore’s 4xLabs and Malaysia’s Moneybay Team Up to Cash in on Each Other’s Sweet Spots

(June 28) TechinAsia.com

Singapore’s 4xLabs and Malaysia’s Moneybay Team Up to Cash in on Each Other’s Sweet Spots

(June 28) TechinAsia.com

- Singapore’s 4xLabs and Malaysia’s Moneybay have entered into a strategic partnership with the hope of leveraging one another’s strengths in their respective markets. Both startups have developed software platforms for currency exchange that are designed to streamline the distribution of foreign currency for travelers and service providers.

- The startups will share some of their data, technology and user networks in order to boost each other’s presence in Malaysia, Singapore and other countries they are targeting for expansion.

Security Software Player Trend Micro Launches $100 Million Venture Fund

(June 27) TechinAsia.com

Security Software Player Trend Micro Launches $100 Million Venture Fund

(June 27) TechinAsia.com

- Tokyo-based cybersecurity company Trend Micro launched a $100 million venture fund to invest in startups working on key emerging technologies. The new corporate venture arm allows the company to nurture a portfolio of startups at the epicenter of hypergrowth markets such as the Internet of Things.

- Investments would give the company a more significant foothold in the booming connected-devices market. This could provide opportunities for Trend Micro to encourage greater adoption of its security software products and services, which are already widely used in home PC and cloud-computing contexts.

Alibaba Said to Be in Talks to Buy ZTE’s Software Arm for Cloud Unit

(June 28) Bloomberg.com

Alibaba Said to Be in Talks to Buy ZTE’s Software Arm for Cloud Unit

(June 28) Bloomberg.com

- Alibaba Group is closing in on a deal to acquire the software subsidiary of Chinese telecommunications gearmaker ZTE, an acquisition that could help strengthen its global Internet computing business.

- China’s leading e-commerce operator has been in negotiations to buy ZTEsoft Technology for months and is nearing an agreement. Alibaba could pay ¥2–¥3 billion (US$294–US$441 million) for a division that provides software support and services to carriers around the world.

LATAM RETAIL AND TECH HEADLINES

Brazil-Based Neoway Raises $45 Million to Bring Its Sales Analytics to the US

(June 23) VentureBeat.com

Brazil-Based Neoway Raises $45 Million to Bring Its Sales Analytics to the US

(June 23) VentureBeat.com

- Neoway, which provides data and analytics to companies in Brazil, announced that it has raised $45 million to expand into the US. QMS Capital led the round, with existing investors Accel, Monashees and Endeavor Catalyst joining. New investors include Point Break and Pollux.

- The company, which is based in Florianópolis, Brazil, helps clients manage sales by aggregating and curating massive amounts of highly detailed information about prospective customers and a range of markets. Neoway uses more than 3,000 databases from 600 different sources, according to a company statement.

BYD Sets Up First Overseas Photovoltaic Research Center in Brazil

(June 22) AutomotiveWorld.com

BYD Sets Up First Overseas Photovoltaic Research Center in Brazil

(June 22) AutomotiveWorld.com

- BYD, the world’s largest manufacturer of batteries and electric vehicles, signed a letter of cooperation with Brazil’s Universidade Estadual de Campinas (Unicamp), in which the company commits to transfer more than R$5 million (~US$1.5 million) by 2020 to set up BYD’s first overseas Photovoltaic Research Center at the university.

- The agreement between BYD and Unicamp will enable cooperation in scientific research and technological development activities. BYD’s investment is a counterpart of the federal government’s Program of Support to the Technological Development of the Semiconductor Industry and Displays, under which BYD is registered.

Kambi Signs Sports Betting Deal with Latin American Giant Corredor Empresarial

(June 22) iGamingBusiness.com

Kambi Signs Sports Betting Deal with Latin American Giant Corredor Empresarial

(June 22) iGamingBusiness.com

- Kambi Group has become the exclusive supplier of sports betting services for BetPlay, Corredor Empresarial’s new Latin America–facing online sports betting platform. Kambi said the deal shows its commitment to expansion in Latin America.

- Kambi will also provide its services to Corredor Empresarial’s entire Colombian land-based lottery and payment service network through the Chance Game operators, which include more than 25,000 retail outlets.

China’s Alipay, UnionPay and WeChat Pay Join LatAm Fintech’s Digital-Payments Platform Revolution

(June 23) Forbes.com

China’s Alipay, UnionPay and WeChat Pay Join LatAm Fintech’s Digital-Payments Platform Revolution

(June 23) Forbes.com

- Fintech company dLocal, which specializes in cross-border payments for emerging markets, has integrated Alipay, UnionPay and WeChat Pay—China’s three major digital payments providers—into its platform. Collectively, these three providers captured the majority (more than 70%) of the Chinese market for online payments in 2016, which translated into $2.9 trillion in payments.

- The addition for Uruguay-based dLocal is touted as enabling global merchants to reach some 300 million Chinese consumers. dLocal has previously focused on the Latin America region and other emerging markets.

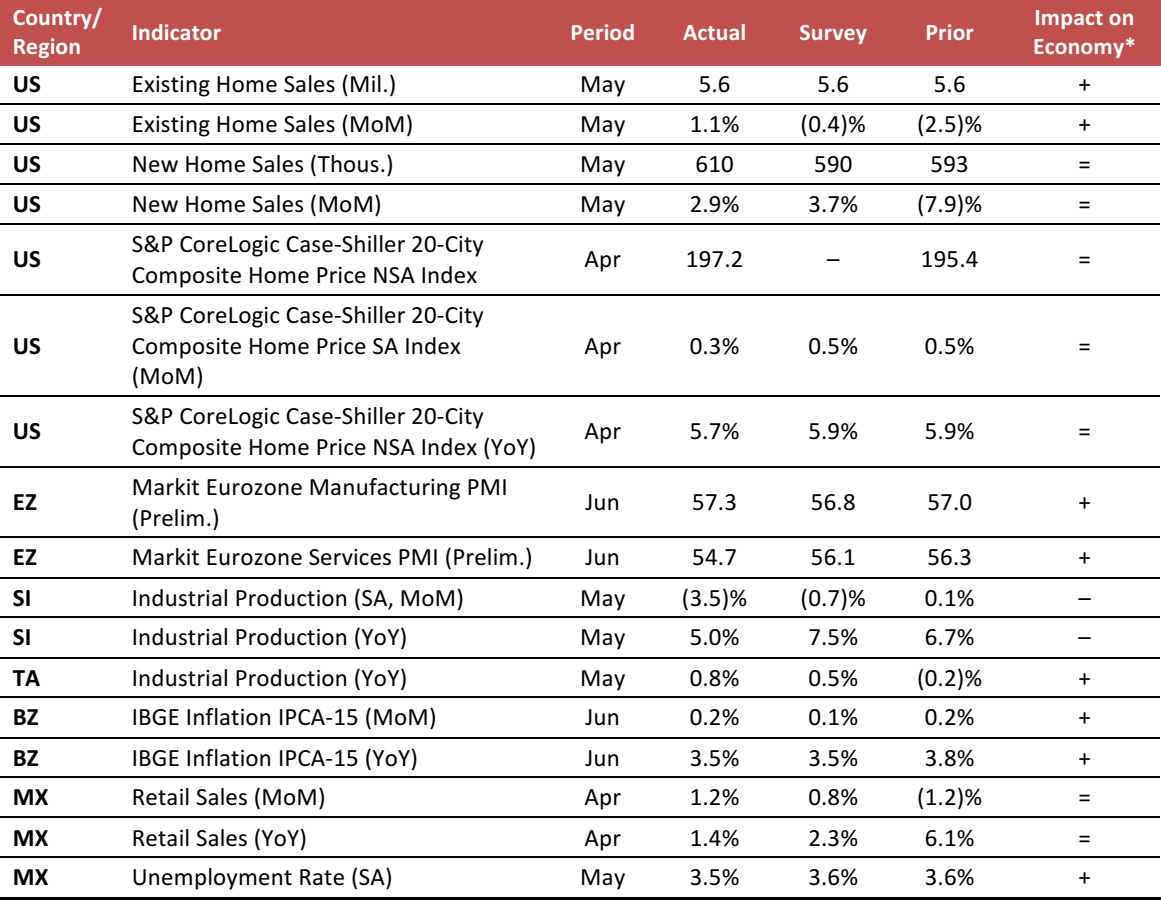

MACRO UPDATE

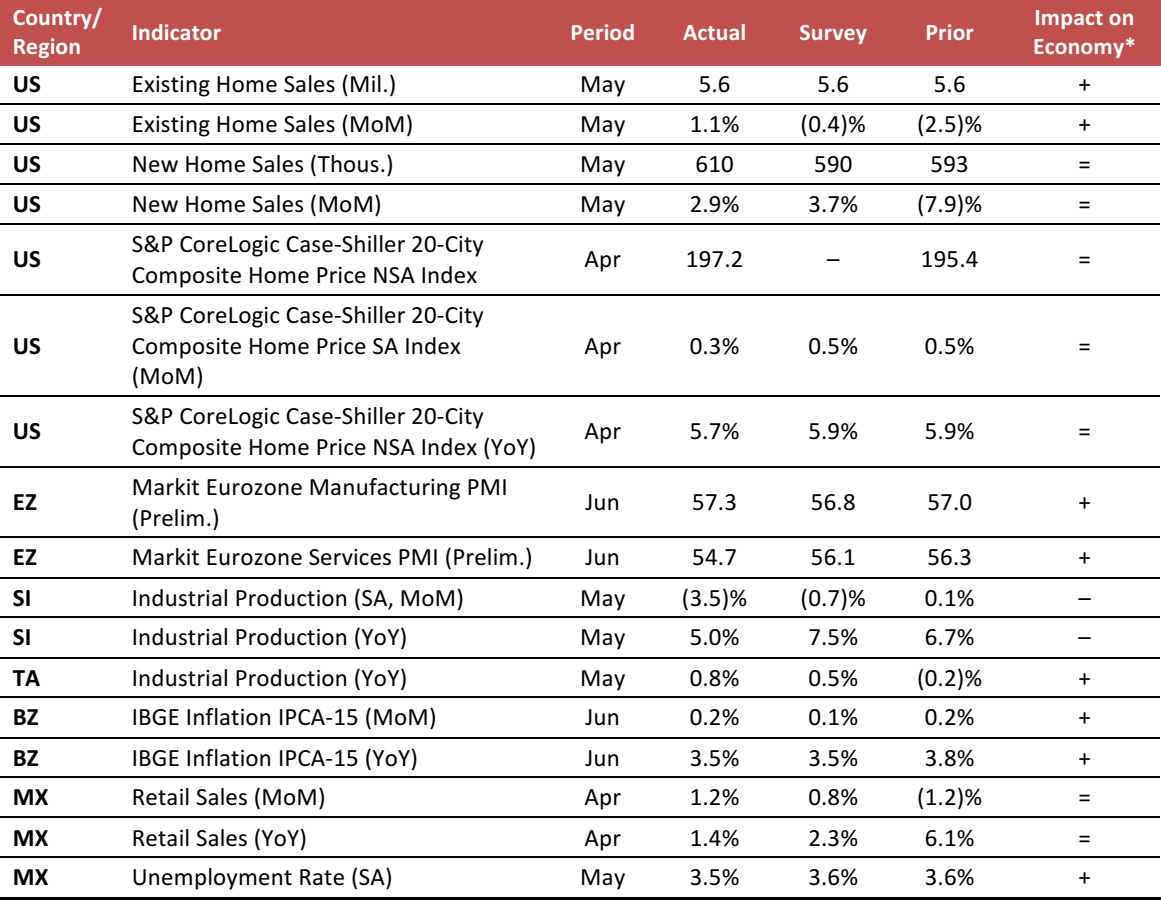

Key points from global macro indicators released June 21–28, 2017:

- US: Existing home sales stood at 5.6 million in May, in line with the consensus estimate. New home sales increased by 2.9% month over month, a lower rate than the market had expected for May following an upward revision to April’s figure. House prices in April also increased by less than had been expected.

- Europe: The Markit Eurozone Manufacturing Purchasing Managers’ Index (PMI) increased to 57.3 in June, while the Services PMI ticked down to 54.7. Both indexes stayed above the 50.0 threshold, indicating an expansion in the manufacturing and the services sectors.

- Asia-Pacific: In Singapore, industrial production was down 3.5% month over month in May, below the consensus estimate of a 0.7% drop. In Taiwan, industrial production edged up 0.8% year over year in May, which was slightly better than the market’s estimate.

- Latin America: In Brazil, inflation continued to edge down to a more favorable level in June. In Mexico, retail sales increased by 1.2% month over month in April and by 1.4% year over year. The unemployment rate in Mexico remained at a low level in May.

*Fung Global Retail & Technology’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/US Census Bureau/S&P Dow Jones/Markit/European Commission/Monetary Authority of Singapore/Singapore Department of Statistics/Singapore Economic Development Board/Ministry of Economic Affairs Taiwan/Instituto Brasileiro de Geografia e Estatística (IBGE)/Instituto Nacional de Estadística y Geografía (INEGI)/Fung Global Retail & Technology.