FROM THE DESK OF DEBORAH WEINSWIG

“The Instagram Effect” Drives Consumers to Spend on Services

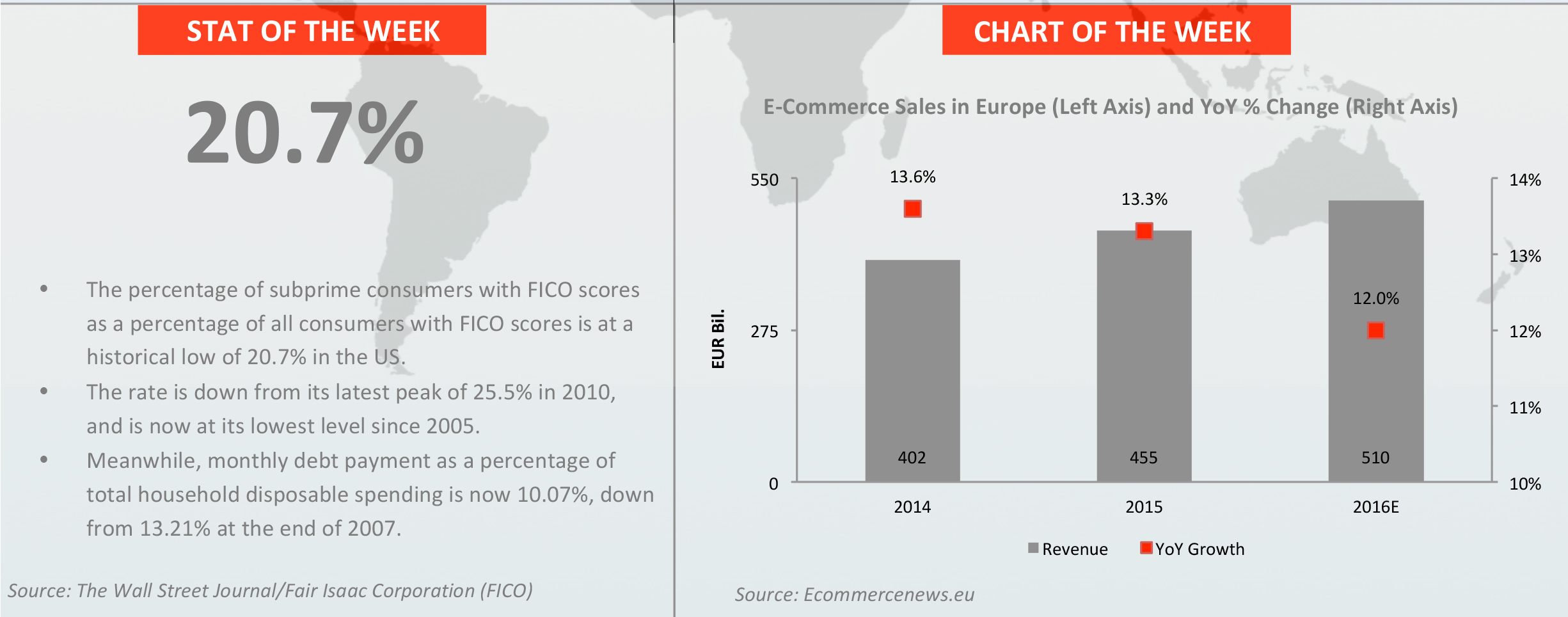

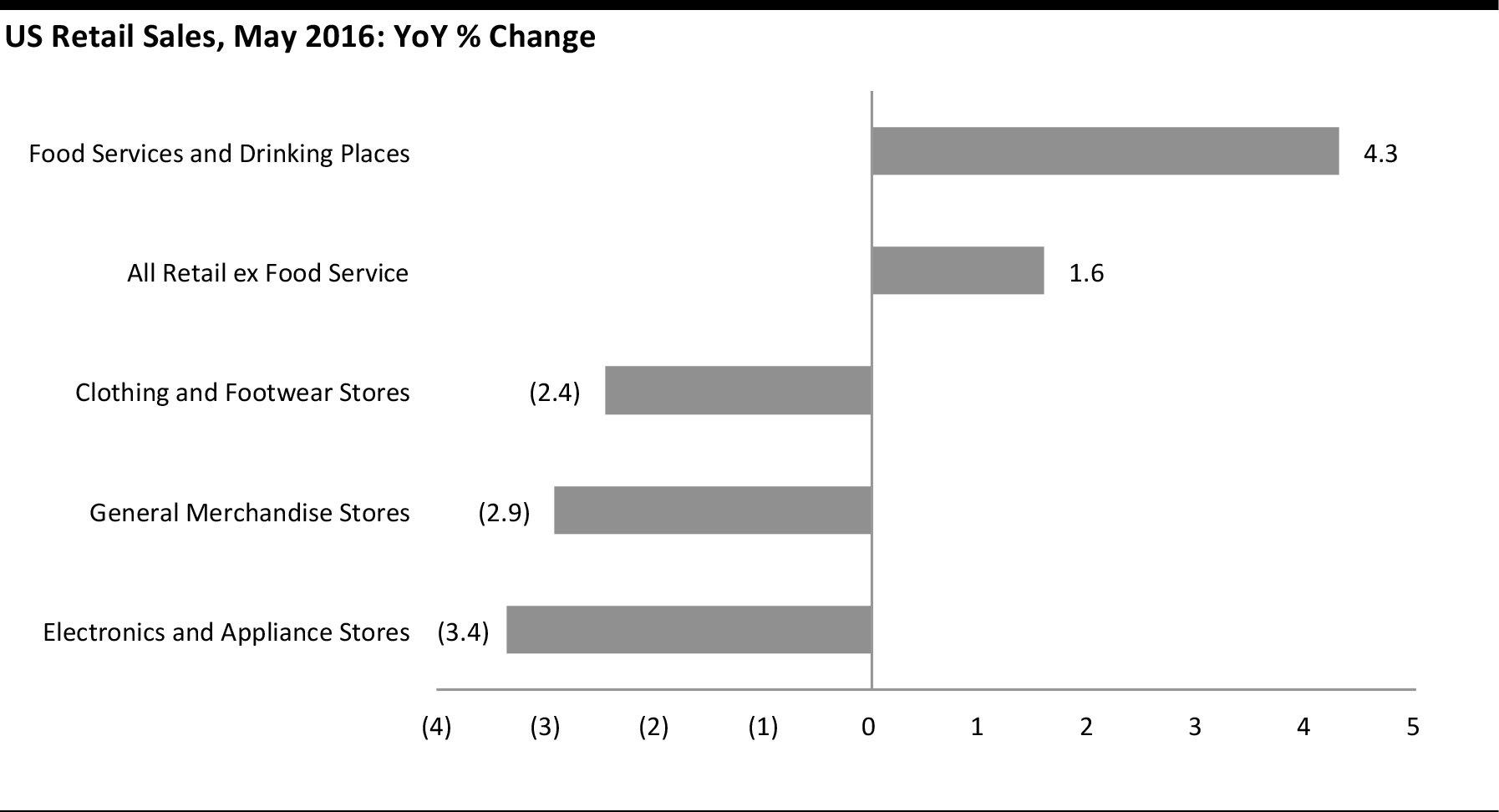

New data published in the last week show that US shoppers are continuing to prioritize spending on leisure services, such as dining out, ahead of retail categories, such as apparel. This week, we outline two possible reasons for this ongoing shift in spending.

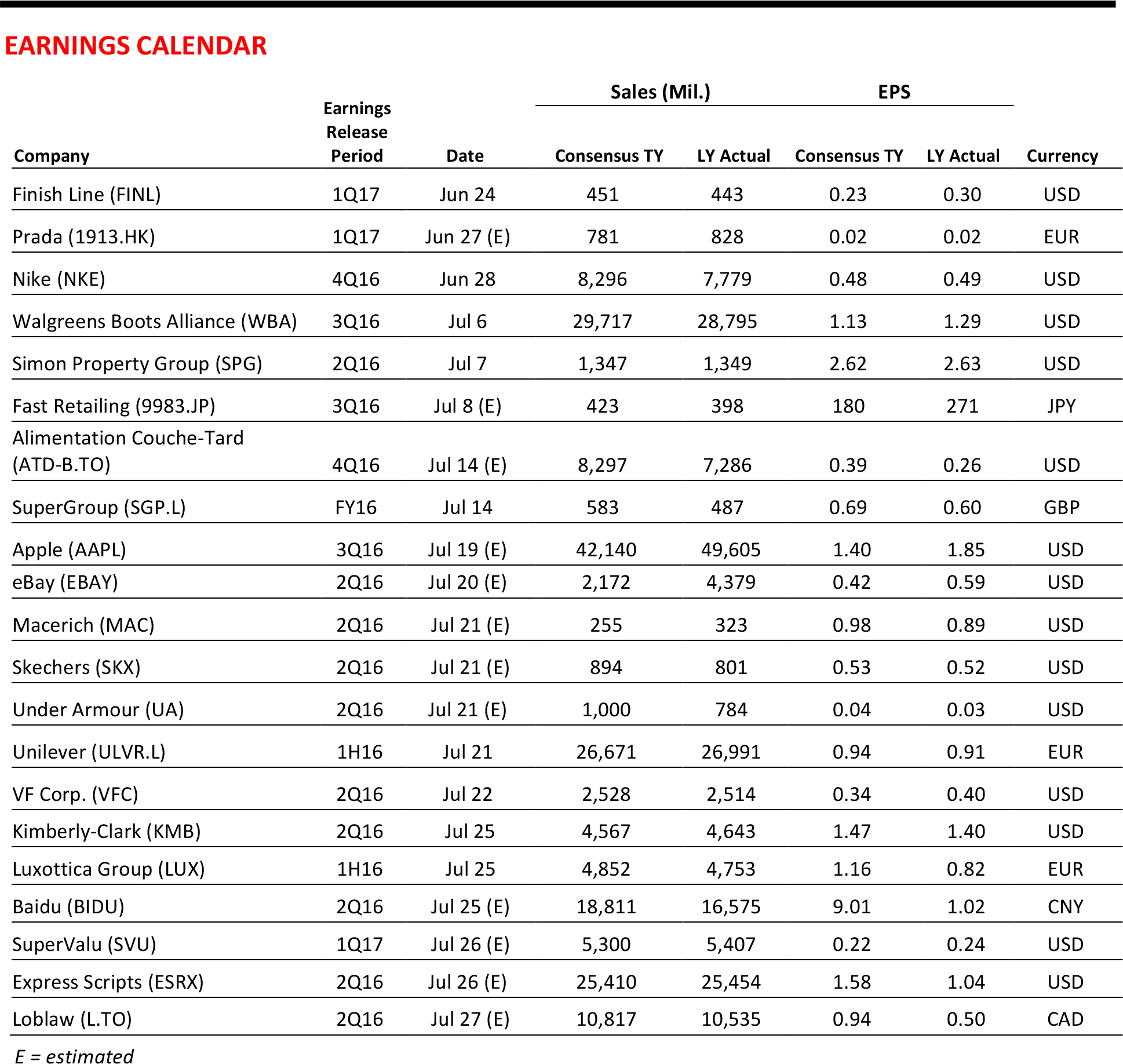

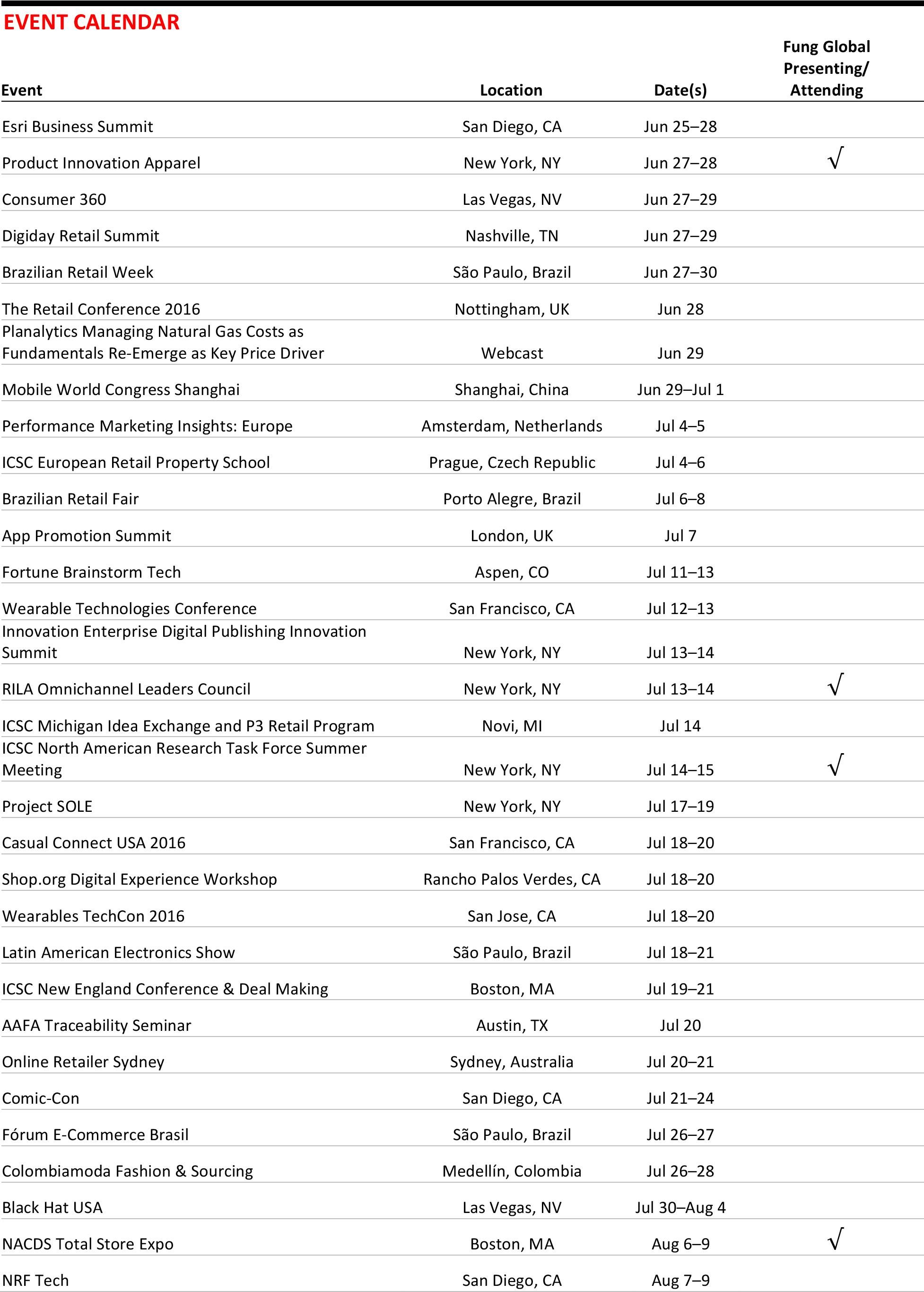

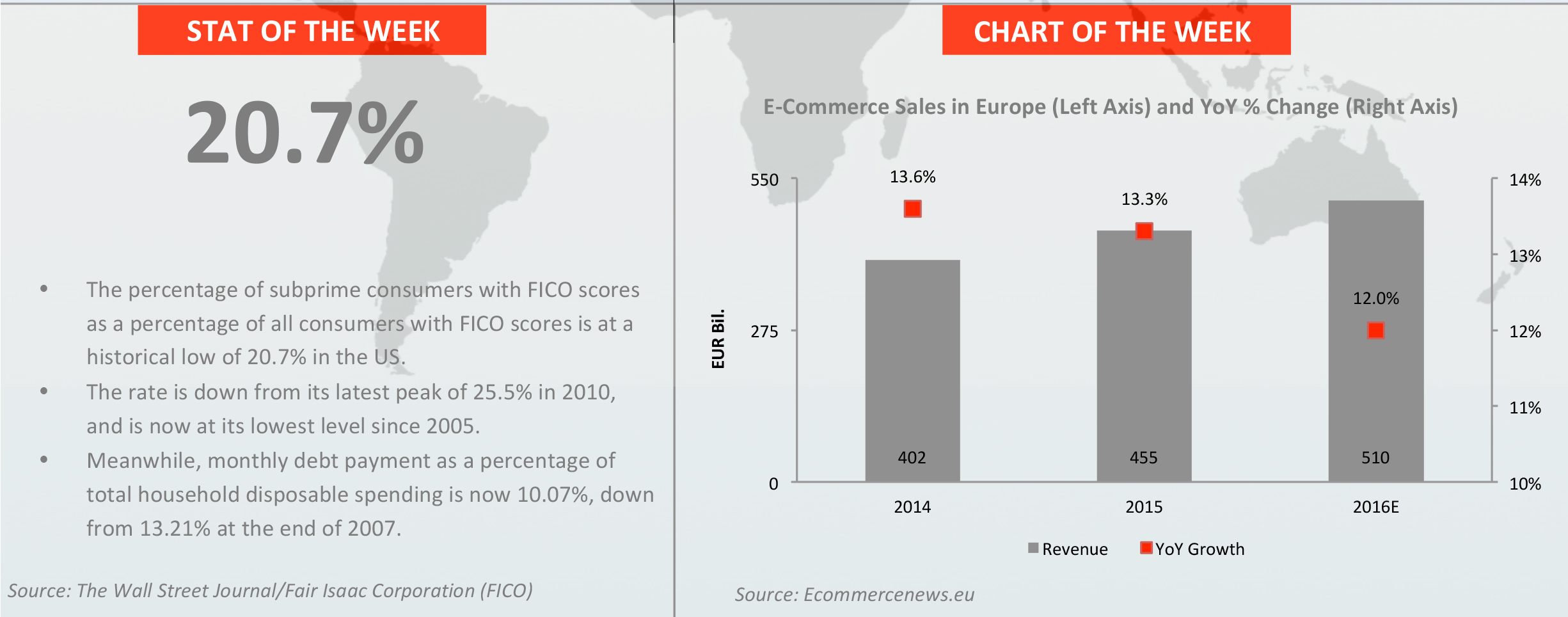

Services Continue to Outpace Retail in the US

The trend among American shoppers to spend more on services continued in May, with new data from the US Census Bureau showing an increase of more than 4% in spending at restaurants and bars; several major nonfood retail sectors, in contrast, saw significant year-over-year declines.

Data are nonseasonally adjusted and are advance estimates.

Source: US Census Bureau/Fung Global Retail & Technology

British shoppers now appear to be following their American counterparts in directing their spending from retail to services: UK data released in the last week show that sales at UK clothing and footwear stores fell for a sixth straight month in May. This is a shift we explore in detail in our new report, UK Apparel Malaise Signals a Shift in Consumer Spending Priorities, which can be found at fbicgroup.com.

What Has Prompted Services Growth?

We see two factors contributing to this shift to leisure spending: the first is a “push” factor and the second is a “pull” factor—and both are relevant across countries.

First, we think the growth of social media—and particularly the shift to photo and video content on sites such as Instagram and Facebook—is pushing consumers to spend on fun, experience-rich services. This is what we call “the Instagram effect.” Younger consumers tend to enthusiastically document their lives on social media, and this arguably puts pressure on them to be seen traveling, attending concerts and sports events, dining out, and enjoying other leisure activities. As a result, many of these consumers are redirecting their discretionary spending away from retail.

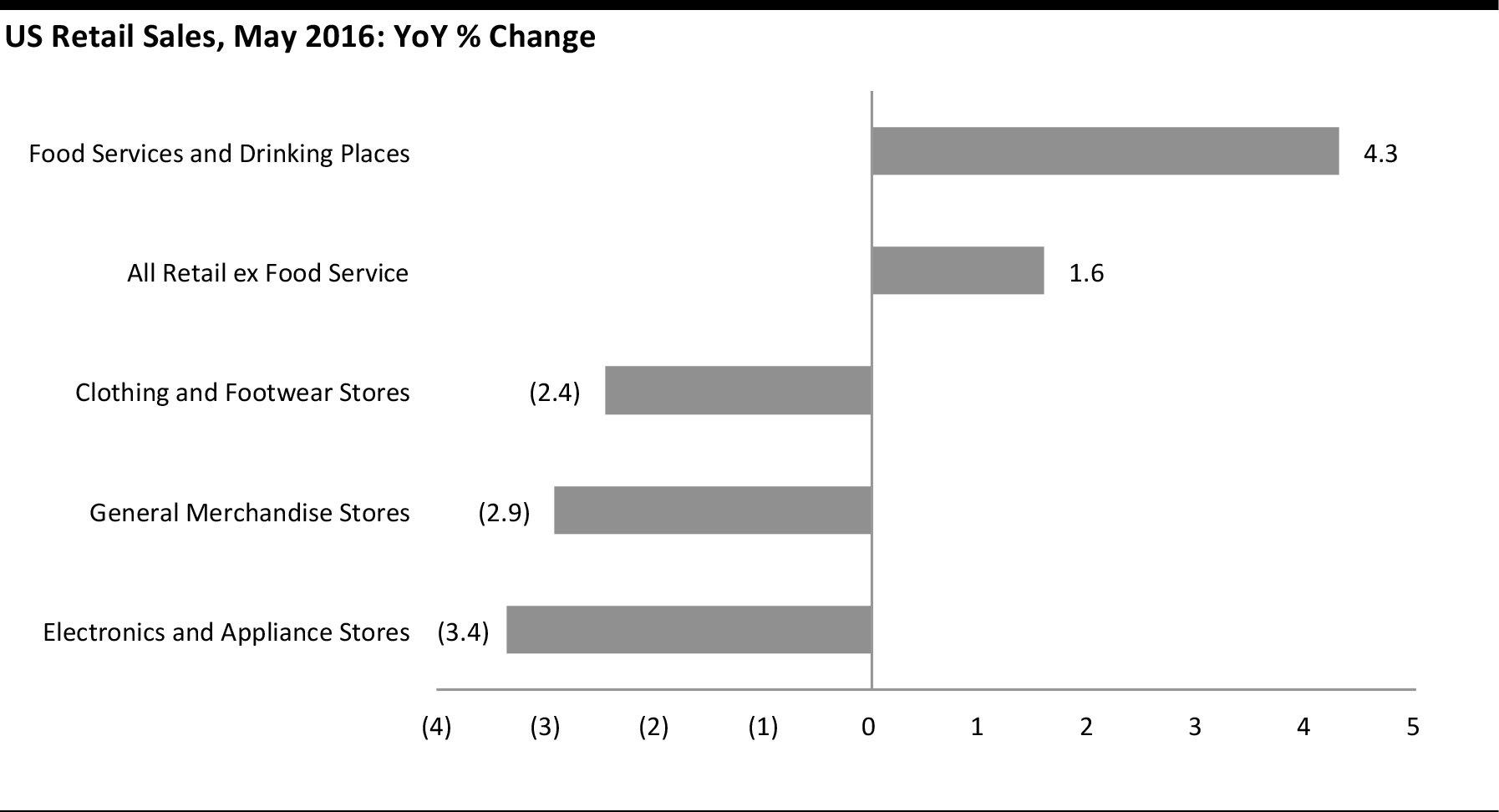

Second, mobile connectivity is making it easier to find and book leisure services, including weekend getaways, salon treatments and last-minute dinner reservations. Apps such as YPlan allow consumers to discover leisure events and activities in their city, and online and app-based booking intermediaries—such as Just Eat and Deliveroo in food service—are making it easier to spend on services.

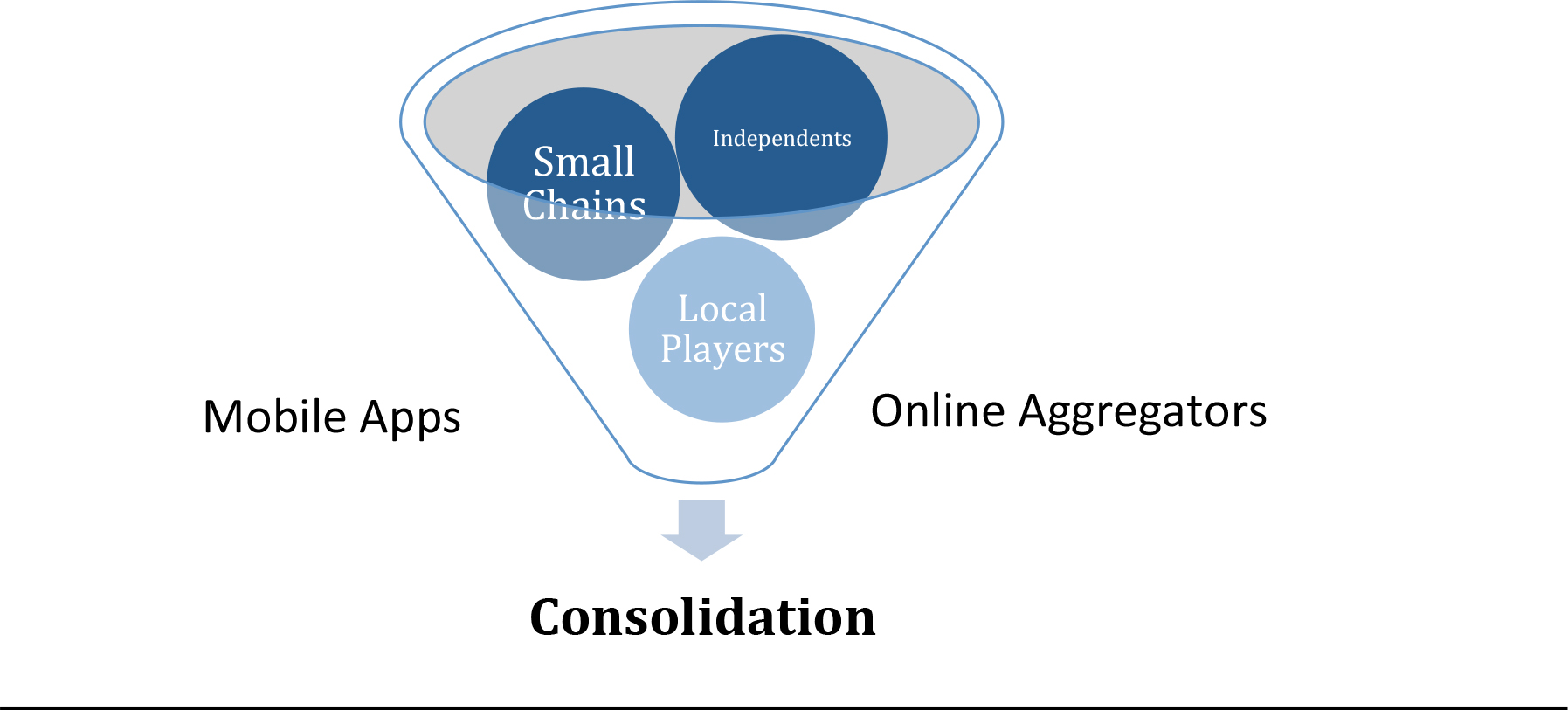

The pull effect of these apps is especially notable in service sectors such as restaurants and beauty, where fragmentation has traditionally created barriers to finding and booking services.

Apps’ and Online Services’ Consolidating Effect on Service Sectors

Source: Fung Global Retail & Technology

Neither of these trends is likely to abate anytime soon, although the effects of both should gradually diminish as changing behaviors become entrenched. In the meantime, we think these factors will underpin robust medium-term growth for spending on leisure services—and, unfortunately for stores, this is likely to come at the expense of discretionary retail categories.

- Please also see our reports May 2016 US Retail Sales and Traffic, UK May 2016 Retail Sales Briefing and UK Apparel Malaise Signals a Shift in Consumer Spending Priorities. These can be found on fbicgroup.com.

US RETAIL & TECH HEADLINES

Study: Millennial Shoppers Can Be Selfish, Too

(June 21) Retailing Today

Study: Millennial Shoppers Can Be Selfish, Too

(June 21) Retailing Today

- In a recent Daymon Worldwide survey of 7,000 global consumers ages 18–55, 35% of millennial and Gen X consumers polled said they prefer to buy sustainable products. However, the millennials surveyed were more likely than the Gen Xers to prefer buying products that directly benefit them, such as those that help them save money or impress people.

- Gen Xers were more likely than millennials to prefer to buy from companies that support their community or give to charities, while millennials were more likely to prefer products with sustainable packaging and those that are not tested on animals.

US Home Prices Increased by 5.9% in April from a Year Earlier

(June 22) Bloomberg

US Home Prices Increased by 5.9% in April from a Year Earlier

(June 22) Bloomberg

- In April, US home prices rose by 5.9% year over year. According to the Federal Housing Finance Agency, the April figure represented a 0.2% increase from March, which was below economists’ expectations of a 0.6% increase.

- This growth has been fueled by an improving labor market, easing mortgage standards and tight supply in the housing market. At the end of April, inventory was down 3.6% from a year ago, according to the National Association of Realtors.

US Releases Drone Rules, but E-Commerce Deliveries Stay Grounded for Now

(June 21) Internet Retailer

US Releases Drone Rules, but E-Commerce Deliveries Stay Grounded for Now

(June 21) Internet Retailer

- On Tuesday, the Federal Aviation Administration announced new regulations for commercial drones. Under the new rules, drones must be under 55 pounds, fly at speeds below 100 miles per hour and remain within sight of the operator.

- These regulations do now allow for the type of drone package deliveries that Amazon, Google and other companies have proposed. The new regulations will become effective in two months.

Under Armour Sees Retail as a Game

(June 22) Women’s Wear Daily

Under Armour Sees Retail as a Game

(June 22) Women’s Wear Daily

- Under Armour makes shopping a richer experience by providing shoppers with exciting offerings such as a golf simulator and an Optojump machine that measures how high a person can leap. With each store, Under Armour seeks to connect with customers through a high-energy design, motivational videos, eye-catching graphics and star-studded events that have drawn in more than 1,200 new customers who spend 20% more than average.

- The company’s efforts to connect with shoppers do not end with the stores. Under Armour continues to connect with customers digitally via its collection of fitness apps, including MapMyFitness and MyFitnessPal.

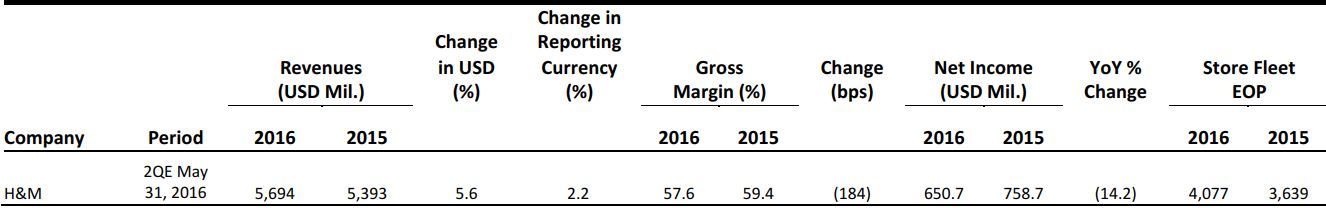

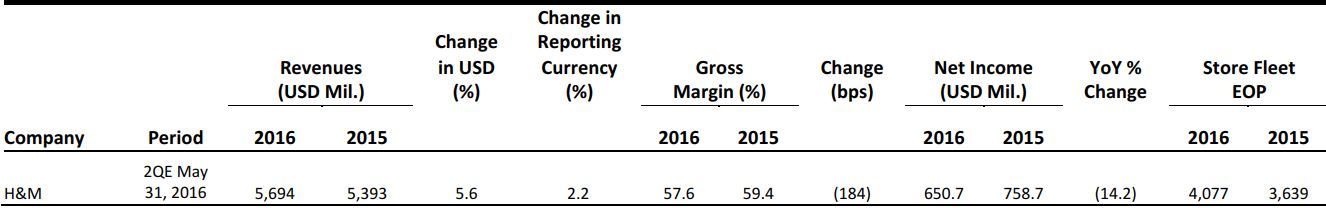

EUROPE RETAIL EARNINGS

Source: Company Reports

EUROPE RETAIL HEADLINES

Inditex Net Sales Rise by 12% in 1Q16

(June 15) Company press release

Inditex Net Sales Rise by 12% in 1Q16

(June 15) Company press release

- Apparel giant Inditex reported net sales growth of 12%, to €4.9 billion (US$5.5 billion), in its first quarter ended April 30. In constant-currency terms, revenue growth was 17%. Net income for the period grew by 6%, to €554 million (US$620 million).

- The group’s results were driven by positive comparable sales growth in all the geographies in which the company operates. By the end of the quarter, Inditex had operations in 90 markets, 7,085 physical stores and an e-commerce presence in 39 markets.

Poundland Comps and Profit Decline in FY16

(June 16) Company press release

Poundland Comps and Profit Decline in FY16

(June 16) Company press release

- British discount retailer Poundland reported a revenue increase of 18.7%, to £1.3 billion (US$2.0 billion), but a 3.9% decrease in comps for its fiscal year ended March 27. Earnings before tax fell by 83.7%, to £5.9 million (US$8.9 million).

- Poundland’s acquisition of 99p Stores at the end of September 2015 weighed on profits. On June 15, South African group Steinhoff announced the acquisition of 22.8% of Poundland shares as part of a possible—but still unconfirmed—takeover offer. If it proceeds, it will be finalized in cash.

Darty Revenue and Earnings Rise in FY16

(June 16) Company press release

Darty Revenue and Earnings Rise in FY16

(June 16) Company press release

- Electronics chain Darty reported group revenue growth of 4.1%, to €3.7 billion (US$4.1 billion). Comps grew by 3.9%, e-commerce revenue grew by 13% and retail earnings grew by 24%, to €93.1 million (US$103.32 million), in its fiscal year ended April 30.

- Darty’s positive results reflected its exit from loss-making markets (Italy, Spain, Turkey, the Czech Republic and Slovakia) and its focus on both its core market of France and its multichannel offering. France-based retailer Fnac made a final takeover offer for Darty on April 25, 2016.

Mulberry Earnings More than Triple in FY16

(June 16) Company press release

Mulberry Earnings More than Triple in FY16

(June 16) Company press release

- Leather-goods brand Mulberry reported fiscal year 2016 earnings before tax of £6.2 million (US$9.4 million). The result was more than three times higher than the £1.9 million (US$3.1 million) achieved in 2015. Retail sales increased by 8.0%, to £118.7 million (US$179.0 million), while comps also grew by 8.0%.

- Mulberry’s increase in earnings follows the appointment of a new Creative Director, Johnny Coca, who revived the company’s product range and implemented a lower-price strategy aimed at attracting consumers looking for affordable luxury.

Tesco Sells Dobbies Garden Centres

(June 17) Company press release

Tesco Sells Dobbies Garden Centres

(June 17) Company press release

- UK grocery giant Tesco confirmed the sale of Dobbies Garden Centres to an investor group led by Midlothian Capital Partners and Hattington Capital. Tesco will receive £217 million (US$307 million) from the sale, which will be used for general corporate purposes.

- The sale is part of Tesco’s effort to refocus on its core grocery operations. On June 10, Tesco announced the sale of two other noncore operations, the Giraffe restaurant chain and its controlling stake in the Kipa grocery chain in Turkey.

ASIA TECH HEADLINES

Alibaba’s Ant Financial Plans to Purchase a 20% Stake in Thailand’s Ascend Money

(June 18) Bloomberg

Alibaba’s Ant Financial Plans to Purchase a 20% Stake in Thailand’s Ascend Money

(June 18) Bloomberg

- Alibaba affiliate Ant Financial plans to expand its online payments and small loans business in Southeast Asia by purchasing a 20% stake in Ascend Money, a microfinance provider based in Thailand.

- At the same time, Alibaba is also entering countries such as South Korea and India to fulfill Executive Chairman Jack Ma’s plan for global expansion.

Indonesian Startup Loket Gets Series A Round

(June 21) e27.co

Indonesian Startup Loket Gets Series A Round

(June 21) e27.co

- Indonesian startup Loket, an event management and analytics firm, has secured a series A round of funding led by Sovereign’s Capital, with participation from East Ventures. Sovereign’s Capital Managing Principal Luke Roush said that his firm believes the ticketing and event management business in Indonesia will experience rapid growth.

- Loket provides services such as ticketing, gate access control and crew-monitoring systems, and its technology helps improve the customer experience and prevent fraud.

India Is Becoming More Open in Foreign Direct Investment (FDI)

(June 20) TechinAsia

India Is Becoming More Open in Foreign Direct Investment (FDI)

(June 20) TechinAsia

- India has loosened restrictions on FDI, making the country the most open economy for FDI, according to Indian Prime Minister Narendra Modi. The country allows for automatic FDI approval for companies in the aviation sector and some other sectors, while defense, broadcasting, phamaceutical and single-brand retail companies can increase their FDI with government approval.

- Companies including Apple, IKEA and Victoria’s Secret can now open stores in India without needing to cooperate with local partners. However, most multibrand retailers, such as Walmart, are still under restriction.

Tesla Invests in a Production Base in Shanghai

(June 21) Bloomberg

Tesla Invests in a Production Base in Shanghai

(June 21) Bloomberg

- Tesla and Jinqiao Group, a government-owned company in Shanghai, have signed a nonbinding agreement to coinvest US$9 billion to develop a production base in Shanghai. The new production facility will likely include a nationwide dealership network, a lithium-ion battery factory and an R&D center.

- The move will allow Tesla to be recognized as a Chinese auto manufacturer, exempt from the 25% import levy, making its vehicles more attractive than those of other foreign carmakers such as BMW and Audi.

Kakao Pay Is Getting More Users in South Korea

(June 21) ZDNet

Kakao Pay Is Getting More Users in South Korea

(June 21) ZDNet

- Kakao Pay, a mobile payment platform, has gained 10 million users in South Korea since its launch 20 months ago. The company operates in a competitive environment, against peers that include Samsung Pay, Naver Pay and L Pay.

- Kakao Pay’s fast expansion is due to its secure and convenient transactions, which do not require digital certifications, according to The Korea Herald.

LATAM RETAIL HEADLINES

Rio de Janeiro State Declares Fiscal Crisis Seven Weeks Before Start of Olympic Games

(June 17) WSJ.com

Rio de Janeiro State Declares Fiscal Crisis Seven Weeks Before Start of Olympic Games

(June 17) WSJ.com

- The governor of Rio de Janeiro decreed a “state of public calamity” and a state of fiscal crisis just seven weeks before Rio is set to host the Olympics. The state said its ability to deliver necessary public services, including healthcare, education, policing and sanitation, is under threat due to soaring Olympic-related costs.

- Rio has spent R$9.8 billion (US$2.8 billion) thus far on infrastructure, including a 10-mile extension of Rio’s subway in order to link certain neighborhoods to the Olympic Park.

Vogue Mexico Names Karla Martinez Editor in Chief

(June 17) WWD.com

Vogue Mexico Names Karla Martinez Editor in Chief

(June 17) WWD.com

- Vogue Mexico and Latin America promoted Karla Martinez to Editor in Chief, succeeding Kelly Talamas, who will become Creative Director. The magazine said that the move comes as a result of a “strategic decision” to strengthen Vogue’s regional presence, particularly in Mexico and Colombia.

- Condé Nast, the owner of Vogue, said it has long-term plans to expand to other Central and South American markets, including Uruguay, Ecuador, Paraguay and Bolivia.

More Brazilians Visit Miami, but Spend 15% Less

(June 21) Miami Today

More Brazilians Visit Miami, but Spend 15% Less

(June 21) Miami Today

- Brazilians still hold the number one spot for total international visits to Miami, despite economic and political turmoil in their home country. However, their spending in Miami is down 15% from previous years. The decline stems from decreased spending on lodging, restaurants and meals, and a further 16% decrease in shopping.

- Despite the decrease in spending, the number of Brazilians visiting Miami is still up 3% from last year—although that growth is slower than in previous years.

A New Contender from Chile Shakes Up Mexico’s Hot Retail Market

(June 16) Bloomberg

A New Contender from Chile Shakes Up Mexico’s Hot Retail Market

(June 16) Bloomberg

- Mexico’s retail market is expecting a jolt as Chile-based retailer Falabella, which is South America’s largest department store chain, moves into Mexico. The company is planning to invest more than half a billion dollars in a partnership with Soriana over the next five years.

- Mexican shoppers have benefitted recently from a slowdown in annual inflation, a weaker peso and boosted remittances from abroad, pushing retail sales growth up 10% in eight of the past 12 months.

H&M Accelerates Expansion in Mexico with a New Store Opening

(June 22) América Retail

H&M Accelerates Expansion in Mexico with a New Store Opening

(June 22) América Retail

- Swedish retail giant H&M continues to bet on Latin America with a new store in Mexico, its 18th in the country. The new store is located in the Plaza Mayor in the city of León, and is H&M’s second store in the city.

- The company plans to open 11 new stores in Mexico during 2016. It opened its first store in the country in 2012.