From the Desk of Deborah Weinswig

A Visit to the New Amazon Books Store in New York City

The Fung Global Retail & Technology team recently visited the newly opened Amazon Books location at The Shops at Columbus Circle in New York City. This is Amazon’s seventh bookstore, and follows store openings in California, Illinois, Massachusetts, Oregon and its home state of Washington. The bookstore was fairly busy when we visited, with a healthy mix of local office workers and visitors.

Although the store looks like most traditional bookstores, it differs in several key ways. First, there are no prices listed. To find out the price of a book, the customer must scan a barcode with the Amazon app using a smartphone camera. Each book includes a rating of zero to five stars and a quote from a review, similar to how books are presented on Amazon.com. The store also has collections of highly rated books (with ratings greater than 4.8 stars, as shown in the photo), local favorites and the most highly anticipated books (again, as on Amazon.com).

Source: Fung Global Retail & Technology

The store features only a curated selection of books and does not attempt to offer the same broad selection as traditional bookstores. There are other product displays taken from the website, such as a display of “If you like [this], then you’ll like [this]” recommendations.

Although one might think that the store is just a showcase for ordering books online for shipment, this is not the case: shoppers can buy books in the store and take them home. Customers who are Amazon Prime members automatically receive discounts (the GeekWire tech website reported that these discounts range from 6% to 40%). To check out, the customer swipes a credit card or scans a barcode. For Prime members, the register recognizes a known credit card and applies the discount automatically. All non-Prime members pay retail prices.

The bookstore is similar to chain bookstores in that it carries items such as coffee makers, cellphone cases and consumer electronics, which naturally focus on Amazon’s devices. Shoppers can try out the various Amazon products on display, including Kindle e-readers, Fire tablets and TV set-top boxes, and the full spectrum of Alexa-enabled devices. The store also offers a variety of smart-home gadgets that work with Alexa, including connected thermostats, electrical plugs, door locks and light bulbs from a variety of vendors. In addition, the store has a wall of AmazonBasics accessories, such as smartphone and video cables and batteries. There were of plenty of helpful staff members around to explain how to scan and purchase items.

Lurking beneath the surface of all things Amazon is the mountain of data that the company is able to collect and leverage. Amazon can use the data from customer purchases and preferences on its website to curate and fine-tune the store’s inventory and, of course, it can collect data from the bookstore. Moreover, the store serves as a showroom for all of Amazon’s electronic gadgets that were previously only available online.

The Fung Global Retail & Technology team will continue to provide updates on Amazon Books and other interesting retail happenings.

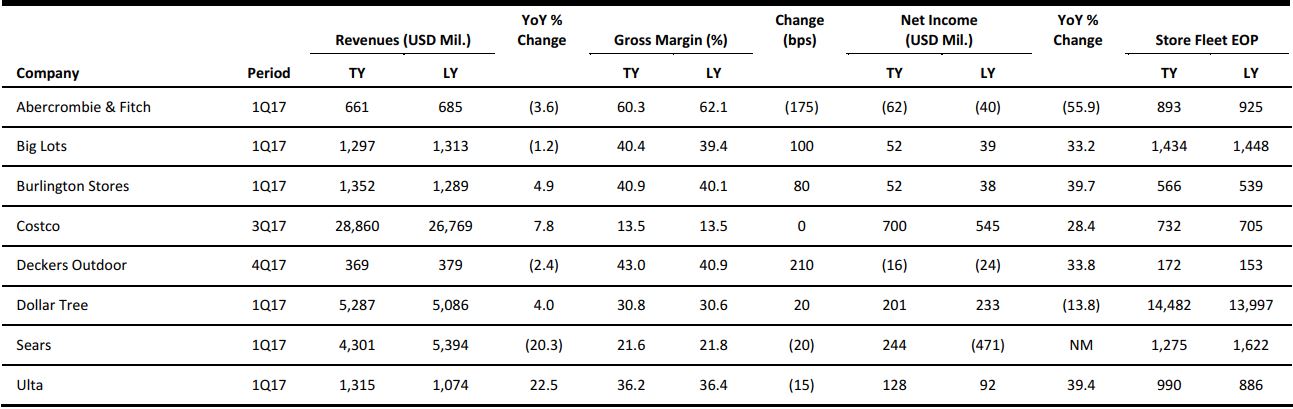

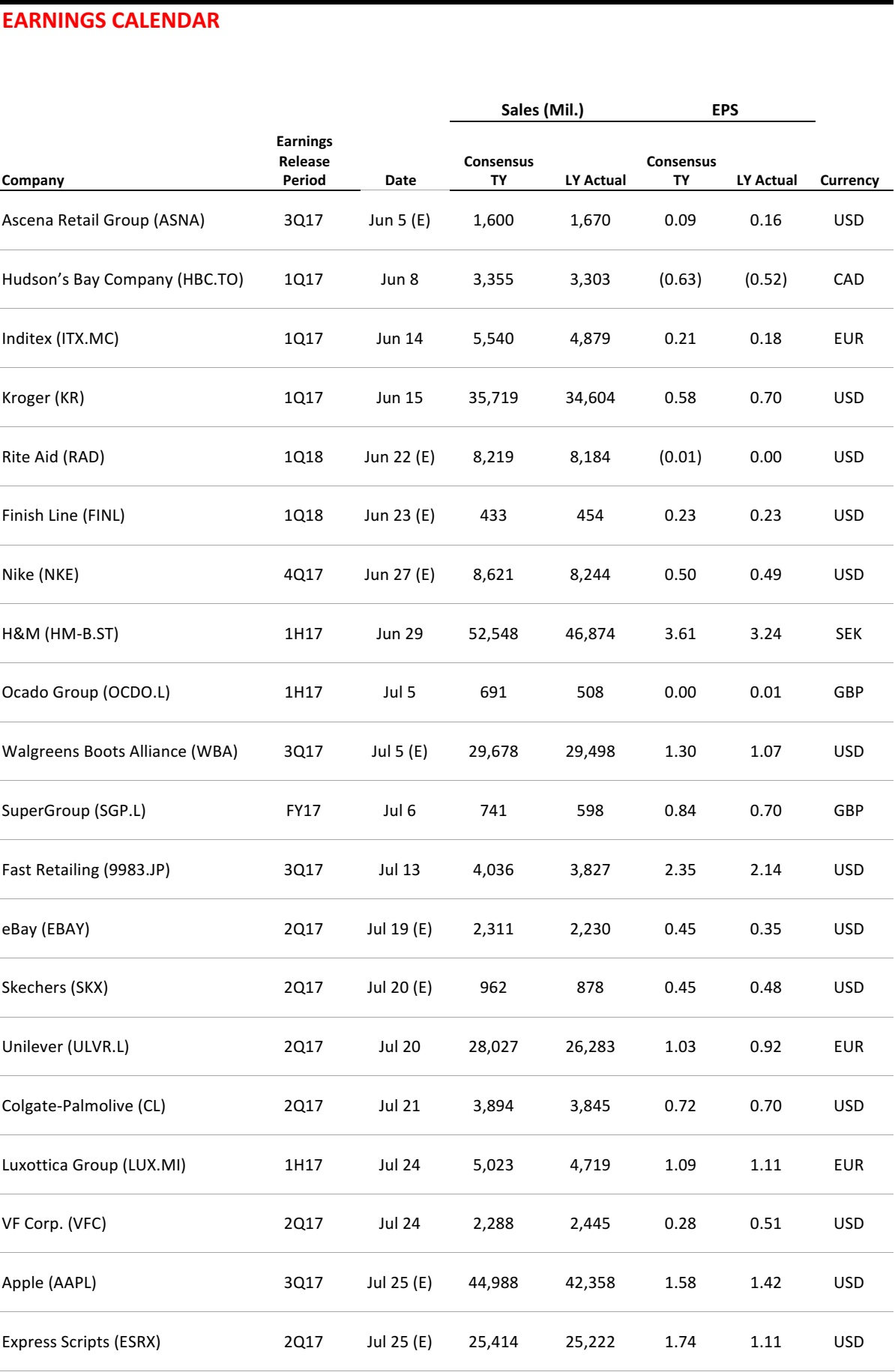

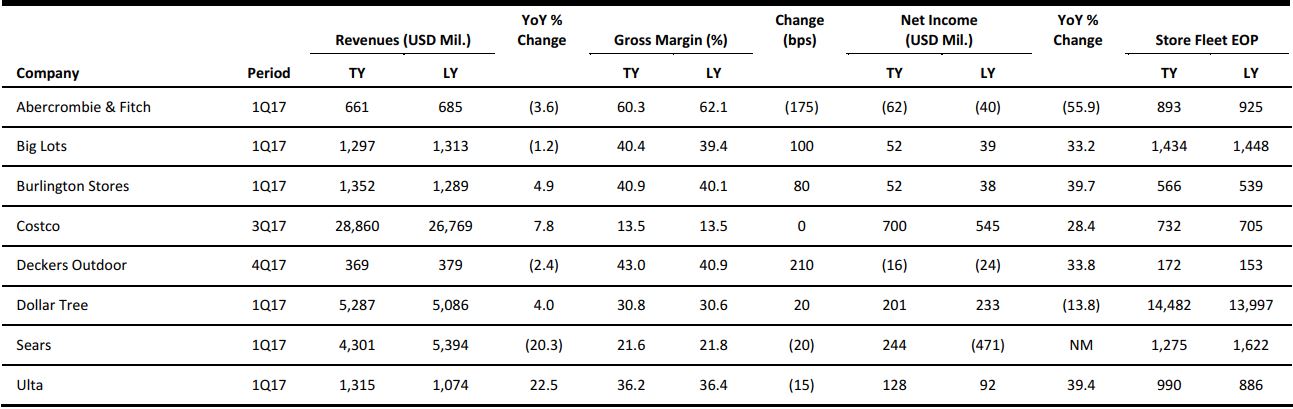

US RETAIL EARNINGS

US RETAIL & TECH HEADLINES

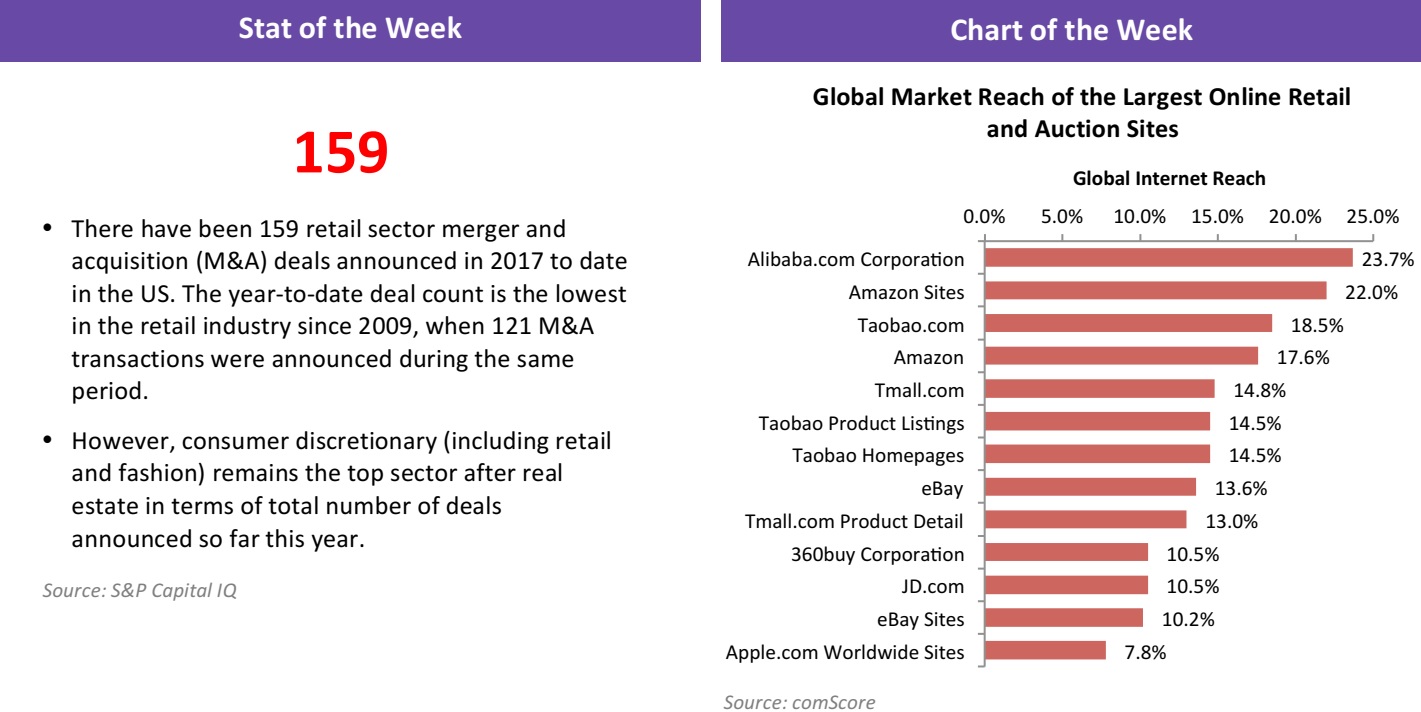

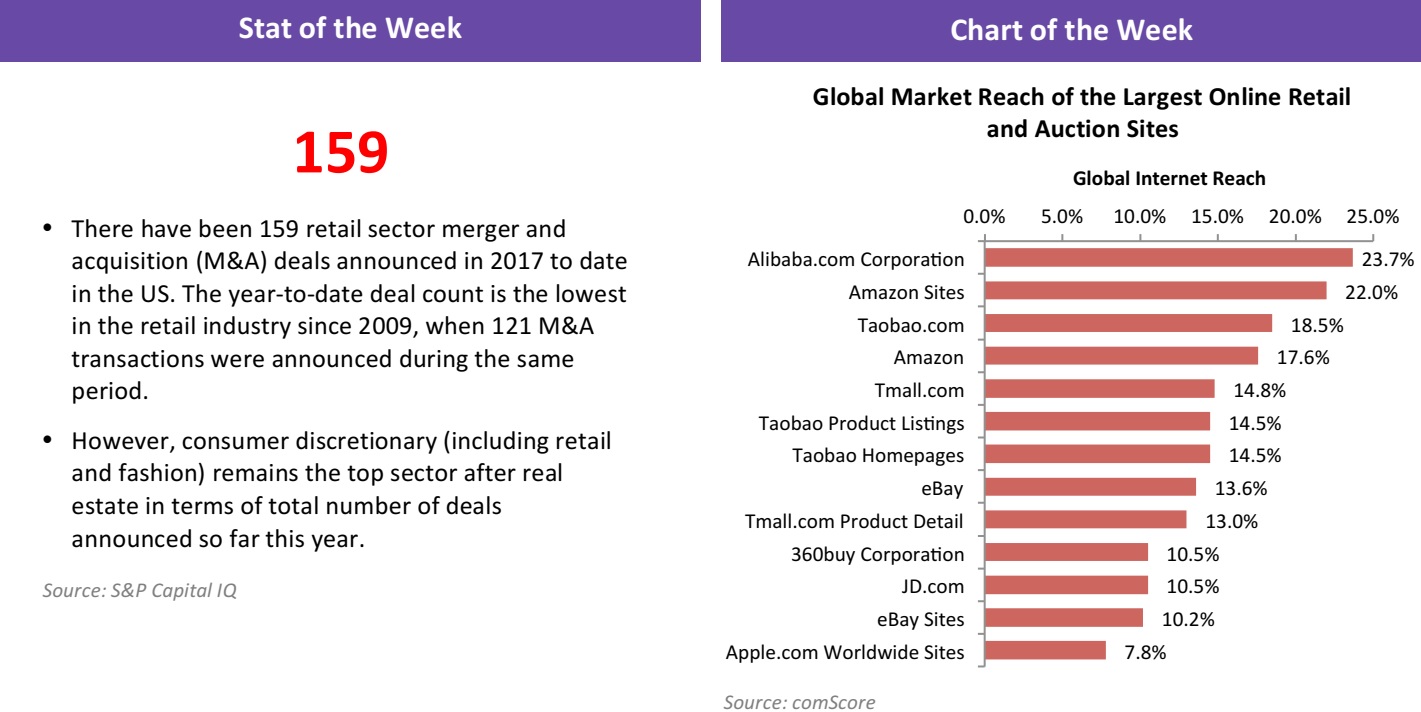

Year to Date, M&A Activity Slows

(May 31) WWD.com

Year to Date, M&A Activity Slows

(May 31) WWD.com

- According to the latest year-to-date data from S&P Capital IQ, merger and acquisition (M&A) activity in the US has decelerated, with both the number of deals and total transaction value lower than in the same period last year. To date in 2017, there have been just over 6,400 total transactions in the 11 sectors covered by the S&P, which reflects a 4.3% decline in deal volume from the same period last year. Transaction values are off by double digits, the firm said in its report.

- S&P Principal Analyst Richard Peterson said that “with announced US M&A dollar proceeds in 2017 off 16% from year-ago activity, the slump in several sectors’ deal [counts] represents another cautionary sign for deal making this year.”

Over 45% of US Retailers to Use AI in Next Three Years

(May 28) Fibre2Fashion.com

Over 45% of US Retailers to Use AI in Next Three Years

(May 28) Fibre2Fashion.com

- More than 45% of retailers in the US plan to utilize artificial intelligence (AI) within three years to enhance the customer experience, according to the 2017 Customer Experience/Unified Commerce Benchmark Survey conducted by BRP Consulting. Savvy retailers plan to use innovative technologies to improve customer service, and more than 55% of retailers surveyed are focused on improving the mobile shopping experience to provide a unified experience across channels.

- The survey notes that stores must now encompass both worlds, the sensory experience generally available in the physical world—where shoppers can touch and feel merchandise and personally interact with a knowledgeable associate, whether simply human or a combination of AI and human characteristics—and the unique and personalized shopping experience common in the digital world.

Target Invests $75 Million in Mattress Startup Casper Sleep

(May 26) InvestorPlace.com

Target Invests $75 Million in Mattress Startup Casper Sleep

(May 26) InvestorPlace.com

- Target has a new bedfellow—Casper Sleep—and will invest $75 million in the online mattress seller, according to media reports. Earlier this month, Target announced a partnership with Casper to sell its beds and accessories beginning in June. The San Francisco–based bedding maker typically sells online and ships mattresses directly to shoppers.

- In announcing the partnership, Jill Sando, Target’s SVP of Merchandising, Home, said, “At Target, we strive to bring guests amazing new products and exciting partnerships. We love Casper’s brand and innovative products—and we really love the idea of giving our guests a simple way to get a better night’s sleep, with everything they need in one convenient place.”

US Retail and Wholesale Inventories Fall in April

(May 25) DigitalLook.com

US Retail and Wholesale Inventories Fall in April

(May 25) DigitalLook.com

- Retail and wholesale inventories in the US fell in April amid downward revisions to estimates for the prior month. Retail inventories slipped 0.3% month over month, to $613.5 billion, and were 3.0% higher versus the year-ago level, according to the US Census Bureau. Furthermore, a preliminary estimate for March was revised down to show a gain of 0.3% month over month, instead of the 0.5% initially thought.

- In parallel, April wholesale inventories declined by 0.3% against March, hitting $592.0 billion, and were up by 1.8% year over year. The preliminary March estimate was revised lower, too, from the initially estimated rise of 0.2% to 0.1%

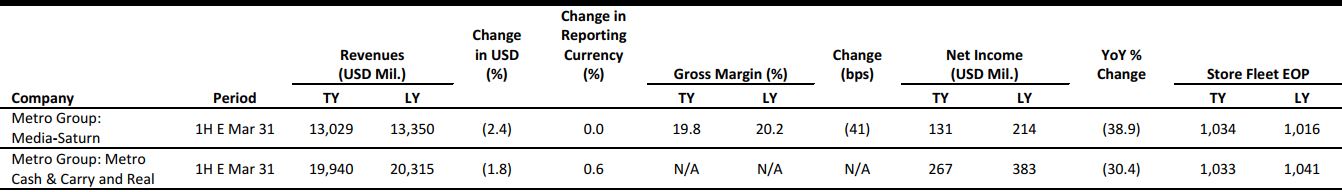

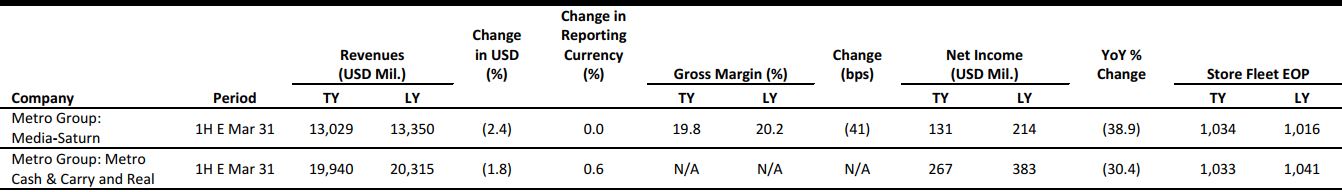

EUROPE RETAIL EARNINGS

Metro Group has demerged into two entities, its consumer electronics retailing business (Media-Saturn) and its food wholesale/retail division (Metro Cash & Carry and Real). Gross profit was not stated for the food wholesale/retail division, which is classified as a discontinued operation.

Source: Company reports/Fung Global Retail & Technology

EUROPE RETAIL HEADLINES

UK GDP Growth Slows Due to Weak Consumer Spending

(May 25) BRC press release

UK GDP Growth Slows Due to Weak Consumer Spending

(May 25) BRC press release

- The UK economy grew more slowly than first thought in the first quarter. GDP grew by 0.2% quarter over quarter versus a first estimate of 0.3%. The UK Office for National Statistics noted a slowdown in household expenditure growth, which decelerated to its slowest rate since the end of the first quarter of 2014.

- The British Retail Consortium (BRC) said that this aligned with what it had seen in retail, where nonfood sales growth has been sluggish in recent months. The BRC said that with inflation likely to increase, the conditions for UK retailers are “set to become more difficult.”

IKEA Appoints New President & CEO

(May 24) Company press release

IKEA Appoints New President & CEO

(May 24) Company press release

- IKEA, the world’s largest furniture retailer, announced that Jesper Brodin will become the company’s new President and CEO as of September 1, 2017. He has been with the company for 22 years.

- Brodin, who is currently the company’s head in Sweden, will succeed Peter Agnefjall, who has served as CEO for four years and has decided leave the firm after 22 years.

Jack Wills Opens New Store in Germany

(May 30) Retail-Week.com

Jack Wills Opens New Store in Germany

(May 30) Retail-Week.com

- British fashion retailer Jack Wills is opening a new store in Germany and plans to open 11 more international stores over the coming months.

- Founder and CEO Peter Williams said, “Our increasingly international store portfolio provides a natural hedge as we look to reap the benefits of a diversified currency base in the face of a prolonged weakening of sterling.”

H&M Launches Loyalty Scheme in the UK

(May 26) TheRetailBulletin.com

H&M Launches Loyalty Scheme in the UK

(May 26) TheRetailBulletin.com

- Swedish fashion retailer H&M has launched its loyalty scheme, H&M Club, in the UK. For a limited time, new members who sign up will receive a 20% discount.

- The program, which is available on the HM app, will reward customers with one point for every pound spent both in-store and online and provide members with exclusive offers and brand experiences.

Edinburgh Woollen Mill Opens Its First Department Store

(May 30) Retail-Week.com

Edinburgh Woollen Mill Opens Its First Department Store

(May 30) Retail-Week.com

- British retailer Edinburgh Woollen Mill opened its first department store, called Days, in Wales this week.

- Phillip Day, the owner of the group, unveiled his ambition to open at least 50 new Days department stores across the UK. The stores will offer brands owned by Edinburgh Woollen Mill, such as Austin Reed, Peacocks, Jane Norman and Country Casuals.

ASIA TECH HEADLINES

Spotify Steps Up Asia Expansion with Plans to Launch in Vietnam and Thailand

(May 31) TechCrunch.com

Spotify Steps Up Asia Expansion with Plans to Launch in Vietnam and Thailand

(May 31) TechCrunch.com

- Spotify is working to launch its music-streaming business in Vietnam and Thailand, two countries with a combined population of more than 160 million. The company is also getting more serious about an expansion into India, which could potentially happen this year.

- The Spotify service claims upwards of 100 million registered users and more than 50 million paying subscribers. While it is available in more than 60 countries worldwide, there are still pockets in Asia where it has yet to enter the market.

Payment Firm Soft Space Raises $5 Million to Expand in Southeast Asia and Japan

(May 26) TechCrunch.com

Payment Firm Soft Space Raises $5 Million to Expand in Southeast Asia and Japan

(May 26) TechCrunch.com

- Soft Space, a payment provider in Southeast Asia, has closed its $5 million series A funding round as it looks to expand across the region, and potentially into Japan. It is also working closely with Japanese firms that are eying the market in Southeast Asia to help them expand and adapt to local payment behaviors.

- Malaysia-based Soft Space works with large enterprise customers, typically banks, to offer customized solutions for mobile payment at the point of sale and at other points in the process. The startup is currently active in its home market in Thailand, Indonesia and Taiwan.

Goldman-Backed Games Startup Aims for Vietnam’s First IPO Abroad

(May 30) Bloomberg.com

Goldman-Backed Games Startup Aims for Vietnam’s First IPO Abroad

(May 30) Bloomberg.com

- VNG Corp., a game developer whose investors include Goldman Sachs and GIC, signed a memorandum of understanding to list on the Nasdaq stock exchange after regulatory approval from the Vietnam government. It would become the first Vietnamese company that has ever filed for an IPO overseas.

- VNG, founded in 2004 and based in Ho Chi Minh City, forecasts 2017 revenue of $180 million, an increase of as much as 70% from last year. The company’s games, including Sky Garden: Farm in Paradise and Dead Target, have shipped to more than 230 countries.

Japan’s BITPoint to Add Bitcoin Payments to Retail Outlets

(May 29) Bloomberg.com

Japan’s BITPoint to Add Bitcoin Payments to Retail Outlets

(May 29) Bloomberg.com

- BITPoint Japan, the company behind Peach Aviation’s move to let travelers use bitcoin to pay for tickets, is planning to give hundreds of thousands of Japanese retail outlets the ability to accept the digital currency.

- BITPoint is joining a flurry of companies embracing regulations enacted in Japan last month that recognize digital currencies as a form of payment. That has helped to make yen trades one of the world’s largest transaction pools, exceeding China’s pole position at the end of 2016.

LATAM RETAIL AND TECH HEADLINES

Retailer Carrefour’s Brazil Arm Files Prospectus for Possible IPO

(May 24) Reuters.com

Retailer Carrefour’s Brazil Arm Files Prospectus for Possible IPO

(May 24) Reuters.com

- Carrefour, the world’s second-largest retailer, said it has taken a preliminary step toward a possible stock market listing for its Brazilian arm via the publication of a prospectus for that market flotation.

- Atacadão, the parent company of Carrefour’s Brazilian business, filed a draft preliminary prospectus with the Brazilian Securities Commission in the context of its previously announced plan to list its shares on the Novo Mercado market.

General Atlantic to Invest in Mexico Retailer Grupo Axo

(May 30) Company press release

General Atlantic to Invest in Mexico Retailer Grupo Axo

(May 30) Company press release

- Grupo Axo, a leading multibrand retailer in Mexico, announced that global growth equity firm General Atlantic has agreed to make a strategic investment in the company. As part of this transaction, Alsea, a leading Mexican multibrand restaurant operator, will be fully exiting its position in Grupo Axo.

- Grupo Axo is one of the largest and fastest-growing retailers in Mexico, operating more than 500 retail points of sale and more than 3,100 wholesale points of sale in department stores. The company owns the exclusive rights to commercialize more than 20 leading international brands in Mexico under licensing agreements and joint ventures.

SoftBank Invests $100 Million in Brazilian Ride-Hailing App 99

(May 25) DealStreetAsia.com

SoftBank Invests $100 Million in Brazilian Ride-Hailing App 99

(May 25) DealStreetAsia.com

- Japan’s SoftBank agreed to invest $100 million in Brazilian ride-hailing app 99, capping off a fundraising round totaling more than $200 million. The transaction is subject to approval by Brazil’s antitrust regulator.

- Didi Chuxing, China’s largest ride-hailing company, spearheaded an initial investment of more than $100 million in the Brazilian firm. The capital injection underscores strong investor demand for the fast-growing ride-hailing market in Latin America’s largest economy despite ongoing legal battles that could sharply increase operating costs.

A $200 Million Bet on Brazilian Tech Startups amid Political Upheaval

(May 30) NYTimes.com

A $200 Million Bet on Brazilian Tech Startups amid Political Upheaval

(May 30) NYTimes.com

- Latin American venture capital firm Kaszek Ventures has raised a $200 million fund, its largest, in what represents a major vote of confidence for Internet startups in Brazil amid the political upheaval in the country.

- The new fund, which the firm is expected to announce this week, is about 48% larger than the firm’s second and most recent fund, which totaled $135 million and was marketed in late 2013. Kaszek is based in Buenos Aires, but it made about two-thirds of its investments in startups in Brazil in its first two funds, and that is expected to continue.

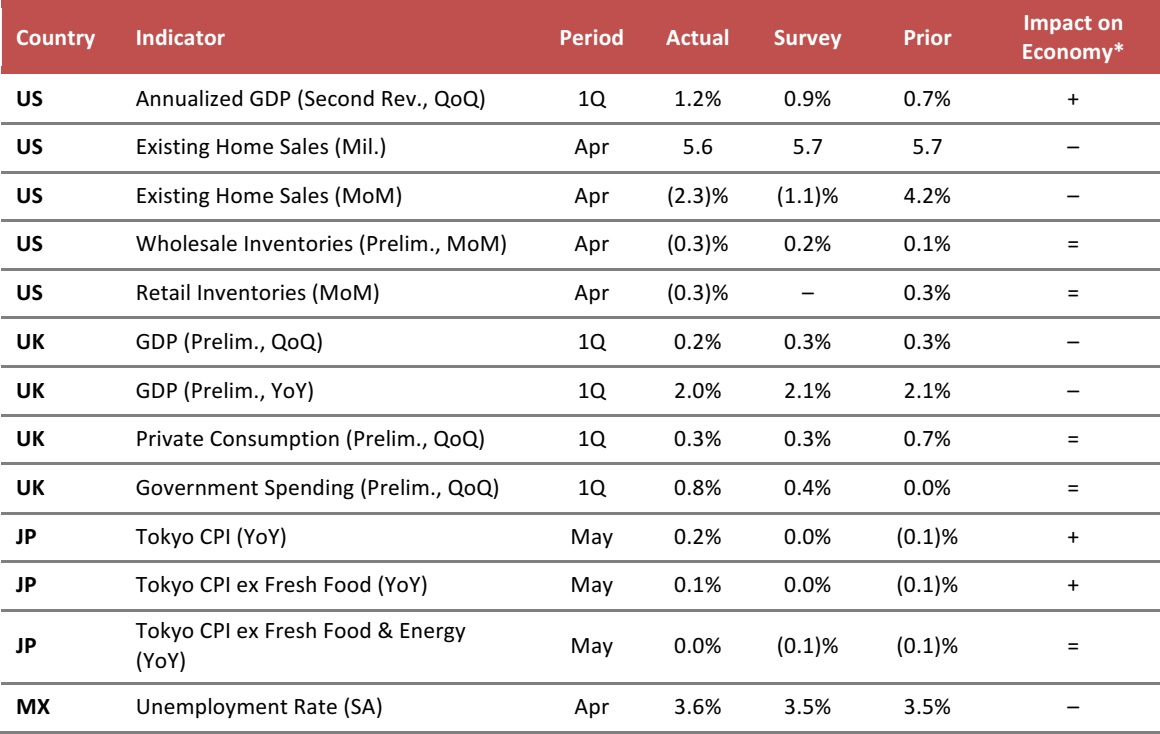

MACRO UPDATE

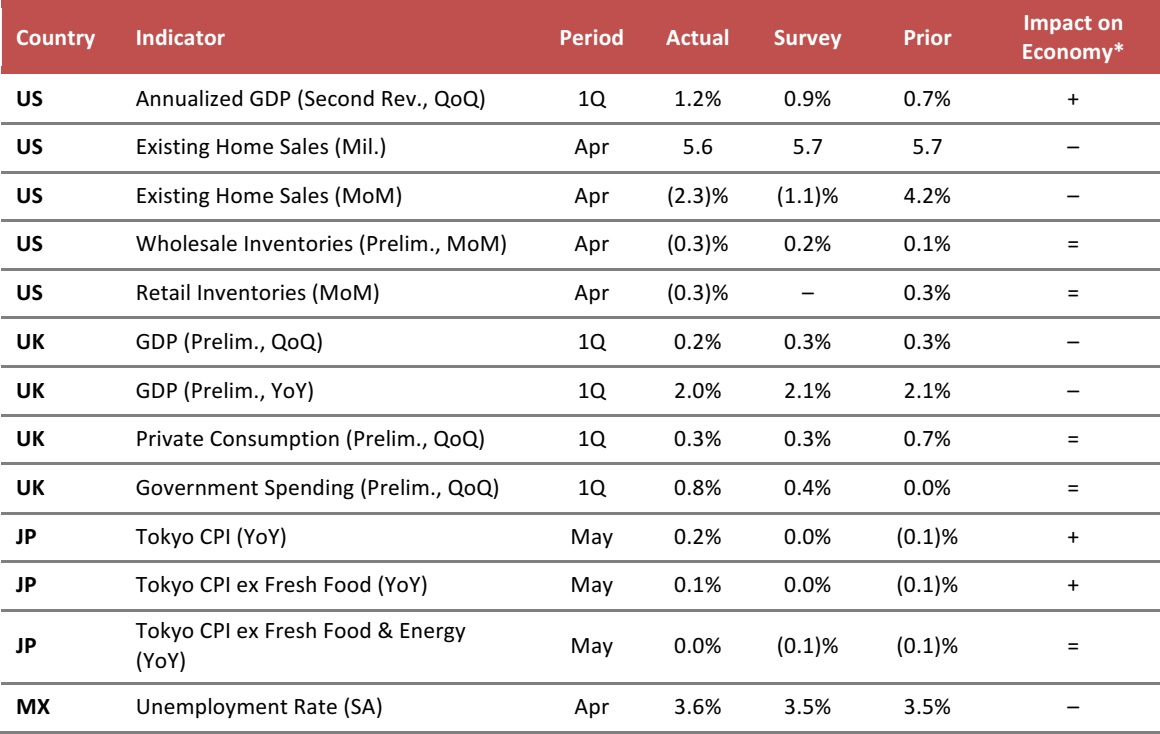

Key points from global macro indicators released May 24–31, 2017:

- US: GDP for the first quarter was revised upward to 1.2%. Existing home sales dropped by 2.3% month over month in April. Wholesale and retail inventories both saw a slight drop of 0.3% month over month in April.

- Europe: UK GDP in the first quarter edged up 0.2% quarter over quarter, which was weaker than the consensus estimate. Consumption showed modest growth, while government spending ticked up 0.8%.

- Asia-Pacific: In Japan, consumer prices in Tokyo edged up in May. The headline Consumer Price Index (CPI) edged up 0.2% year over year, compared with a 0.1% drop in the previous reading. The CPI excluding fresh food ticked up 0.1% year over year in May.

- Latin America: In Mexico, the unemployment rate edged up to 3.6% in April. The reading was higher than the consensus estimate and the previous reading of 3.5%.

*Fung Global Retail & Technology’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/US Bureau of Economic Analysis/US Census Bureau/UK Office for National Statistics/Ministry of Internal Affairs and Communications of Japan/Ministry of Economy, Trade and Industry of Japan/Instituto Nacional de Estadística y Geografía (INEGI)/Fung Global Retail & Technology

Spotify Steps Up Asia Expansion with Plans to Launch in Vietnam and Thailand

(May 31) TechCrunch.com

Spotify Steps Up Asia Expansion with Plans to Launch in Vietnam and Thailand

(May 31) TechCrunch.com

Payment Firm Soft Space Raises $5 Million to Expand in Southeast Asia and Japan

(May 26) TechCrunch.com

Payment Firm Soft Space Raises $5 Million to Expand in Southeast Asia and Japan

(May 26) TechCrunch.com

Goldman-Backed Games Startup Aims for Vietnam’s First IPO Abroad

(May 30) Bloomberg.com

Goldman-Backed Games Startup Aims for Vietnam’s First IPO Abroad

(May 30) Bloomberg.com

General Atlantic to Invest in Mexico Retailer Grupo Axo

(May 30) Company press release

General Atlantic to Invest in Mexico Retailer Grupo Axo

(May 30) Company press release