Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

This week, we held our third monthly Disruptors’ Breakfast with top startups at our Hong Kong headquarters, in conjunction with entrepreneurship community CoCoon. CoCoon offers a coworking space where entrepreneurs, creative talent and investors can meet, collaborate and deliver results together. The organization has been around for three years and has worked with 100 startups. These startups have raised a total of US$16.4 million (HK$127 million). Although this figure is not large by US standards, it’s highly significant because CoCoon started from zero just three years ago. Moreover, it maintains a network of more than 7,400 individuals, including more than 850 entrepreneurs, industry leaders, investors and students, and has held more than 300 entrepreneurship events. The companies that CoCoon showcased this week included four in the e-commerce and e-payment space and one online education startup: Around started as a neighborhood network, winning the Google EYE (Empowering Young Entrepreneurs) program in 2014, which came with a $100,000 stipend and use of Google’s infrastructure. Today, the company is installing a citywide network of Bluetooth beacons at small shops in Hong Kong, and consumers who “like” a particular shop on Facebook can receive points for their initial and repeat visits, which they can redeem for gifts or offers. The retailers hosting the beacons receive an increase in customer traffic to both their physical stores and their Facebook pages. Around is collecting valuable data, such as dwell analytics, location analytics and traffic synergies between stores. Cashyou solves the vexing problem of making small payments to friends or businesses that lack sufficient change(for example, when splitting the check at lunch). Bank transfers are relatively expensive and are uneconomical for small payments. Cashyou offers a mobile wallet that enables a transfer based on a barcode or e-mail address, and the company has accounts at all major local banks to enable local bank transfers and withdrawals free of charge. Transfers are generally completed in one business day, which is faster than nearly all traditional transfer methods. There’s an additional fee structure for companies, large enterprises and large transfers. At present, the platform only works locally in Hong Kong using Hong Kong dollars. However, Cashyou is exploring offering its platform internationally. Outwhiz is a three-month-old company taking on math and English education in the $4 trillion global education market. Although the space appears crowded with test-prep companies and for-profit schools, Outwhiz’s founder believes that the industry is still in its early stages in terms of operating and business models as well as models of student engagement. Outwhiz offers a free subscription service through which students can study and practice math and English on mobile devices. Subscribing kids can earn real-life awards (prizes) for achieving goals, and there is a suite of analytics and statistics for parents. Though math and English are the first major subjects offered, the platform can be expanded for other subjects, such as Mandarin Chinese. Shopline offers a do-it-yourself e-commerce platform for retailers in Asia. Its e-commerce sites are designed to work equally well on a PC, tablet or mobile phone. Initial clients include a Taiwanese jewelry company, a South Korean beauty and cosmetics brand, and an accessories company with hundreds of products and hundreds of thousands of dollars in sales. The platform offers a comprehensive, localized dashboard and supports many kinds of local payment methods. Moreover, shipping can be selected according to local options. Merchants have the ability to communicate directly with customers, and the retailer can use its own domain name and/or create an instant online shop on Facebook. The platform receives 70% of its traffic from mobile devices and more than 32,000 shops have launched on it. TofuPay calls itself a localized online payment solution. The Tofu network sits between a merchant and a credit-card network and provides clear and simple payment forms, which can be customized to use the merchant’s design, for either desktop or mobile devices. The platform also offers advanced analytics and multicurrency management. A major source of appeal is its transparent pricing, with a fixed percentage and fee (one for domestic credit cards and one for foreign cards) per transaction, with no setup or monthly fees. This transparent fee structure and the fixed percentage rates contrast with other platforms, which have a myriad of fees and progressive fee structures. Although some advanced payment systems already exist in Hong Kong, such as the ubiquitous RFID-based Octopus card payment network, there are numerous opportunities for improvement, as evidenced by these dynamic founders’ ideas and startups. Hong Kong seems an ideal environment for startups to test and perfect their concepts and business models, which can later be expanded throughout Asia and globally. We’re particularly excited about Around’s deployment of a citywide beacon network, which can fully demonstrate the power and elegance of beacon technology—this is currently possible only in a small, manageable, shopping-mad city such as Hong Kong.

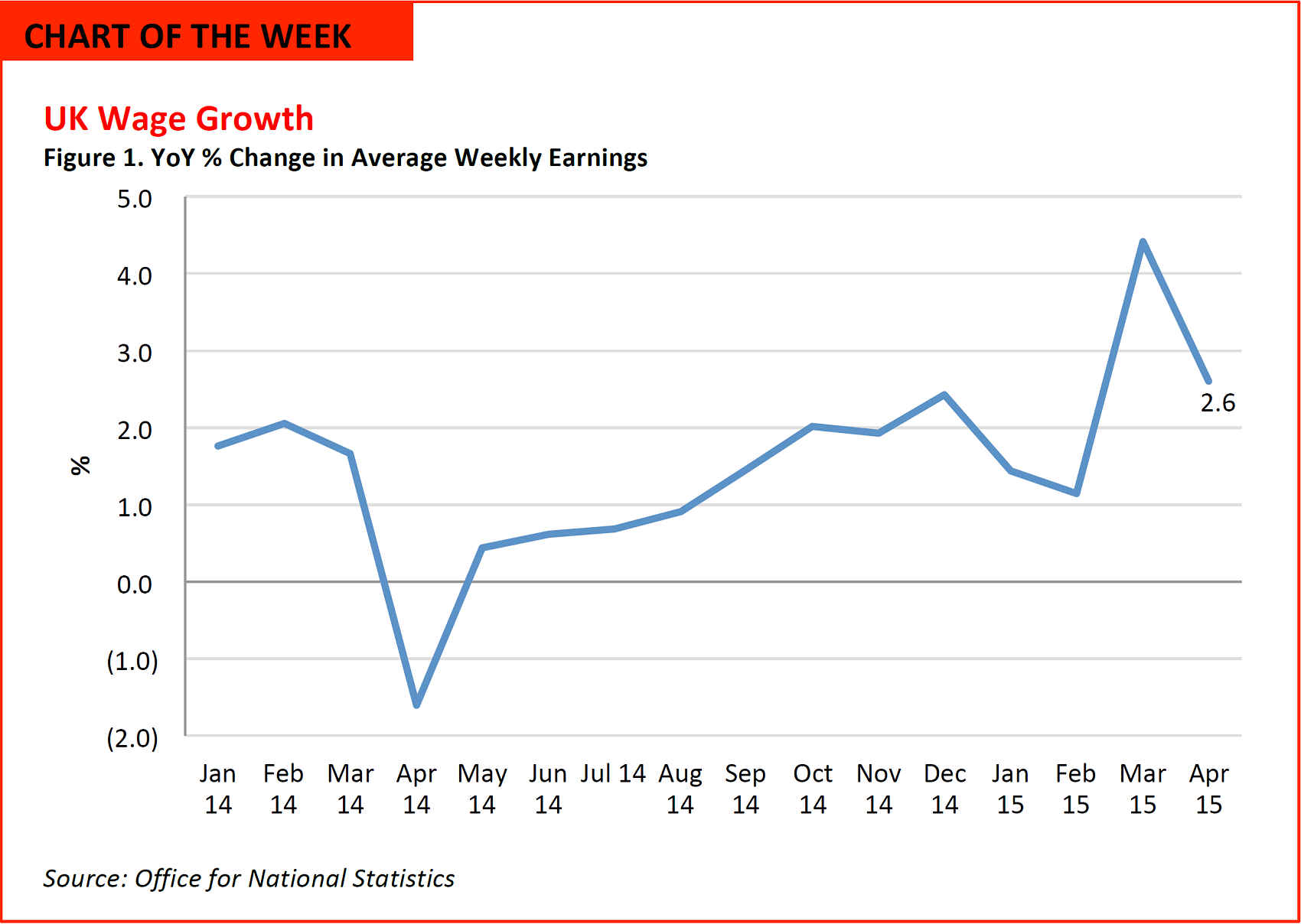

- British workers are seeing strengthening earnings growth.

- Coupled with ultra-low deflation, including deflation in the non-discretionary food and automotive fuel categories, this is giving a boost to shoppers’ spending power.

- At the same time, a fresh round of austerity measures is imminent, which will likely hit in-work state benefits.

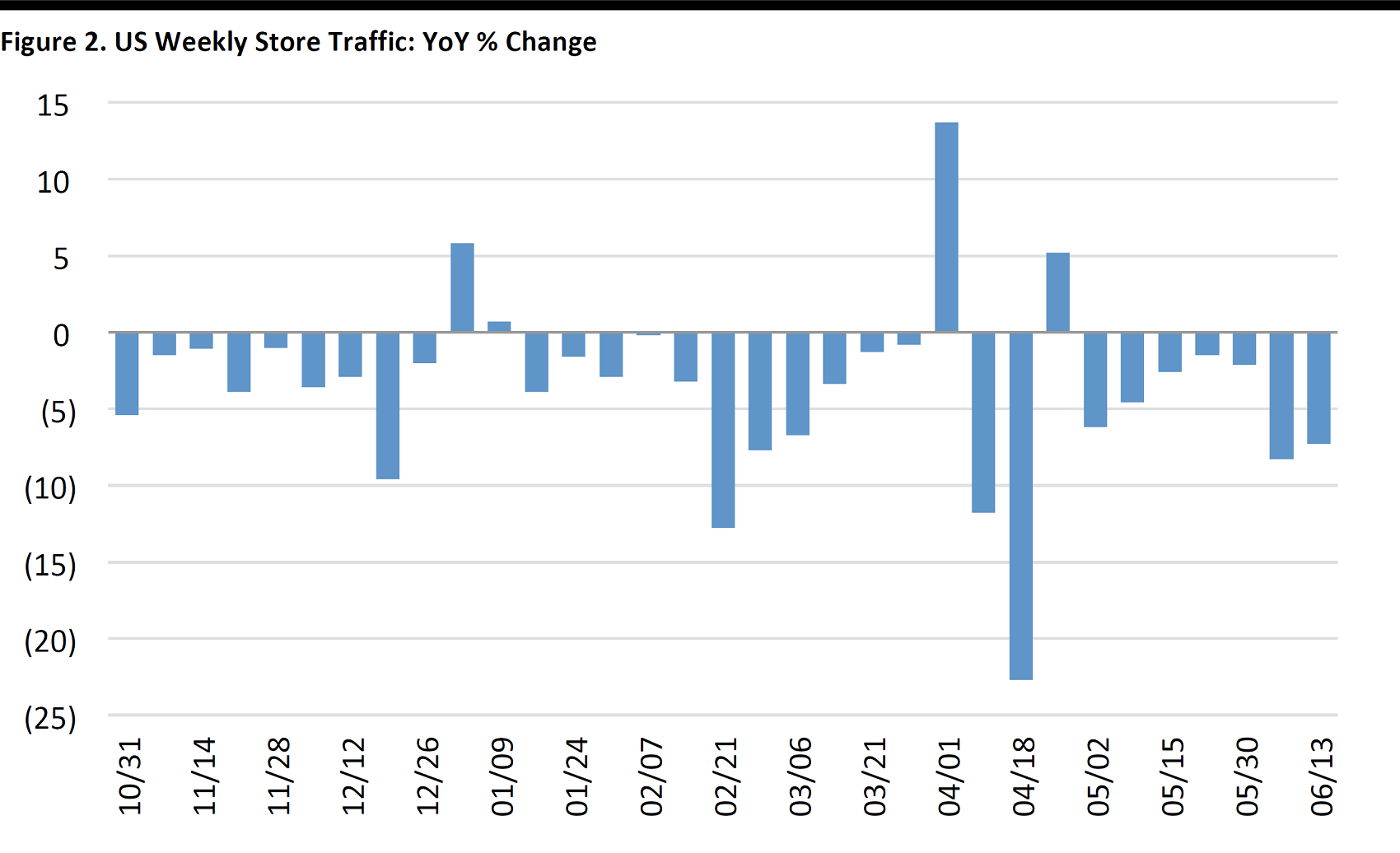

US RETAIL TRAFFIC

Through June 13, 2015 Source: ShopperTrak

- Overall store traffic for the week ended June 13 declined by 7.7%, its seventh consecutive weekly decline.

- Apparel and electronics store traffic decreased by 3.7% and 3.9%, respectively.

- Men’s apparel and electronics store traffic should be lifted by the late Father’s Day in the coming week.

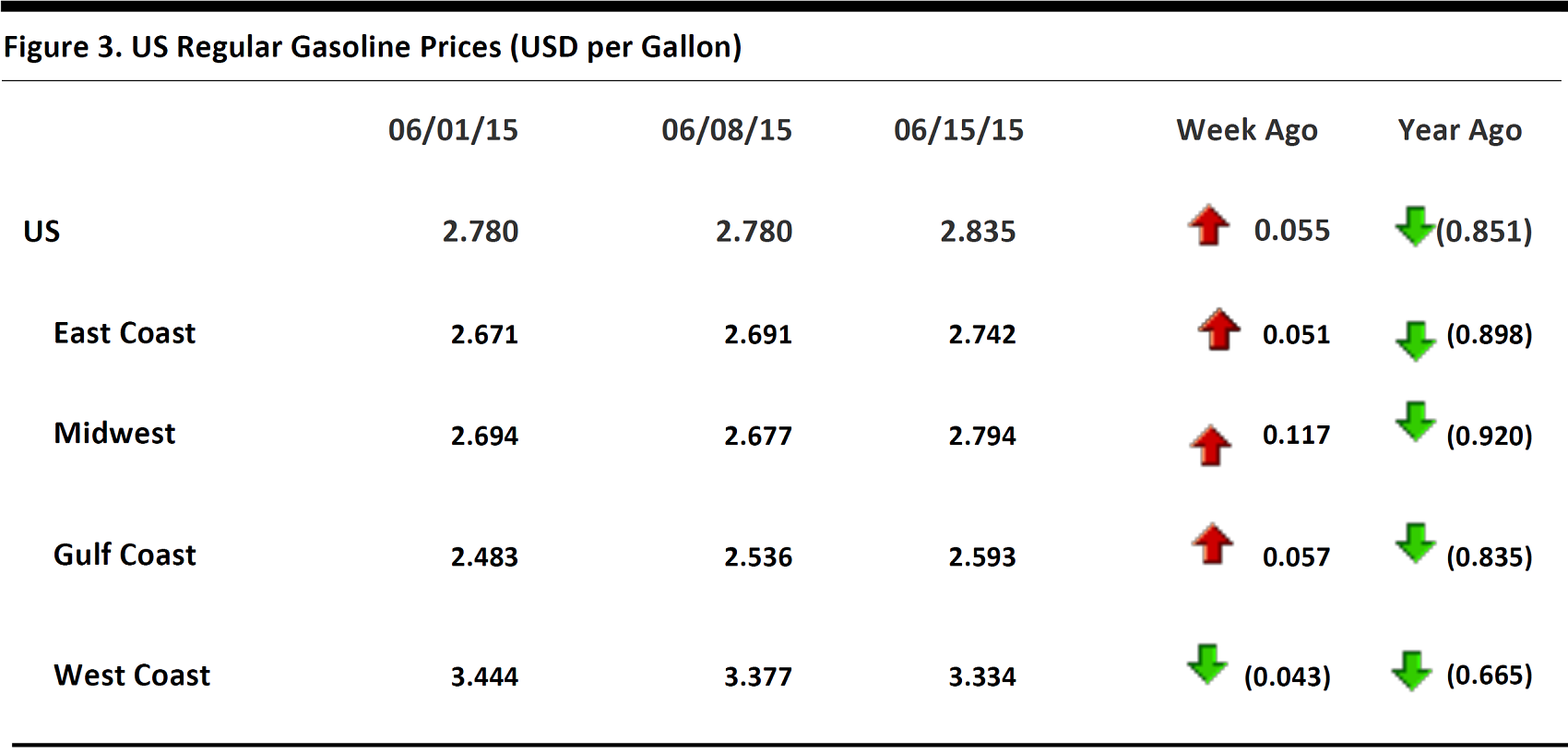

US REGULAR GASOLINE PRICES

Source: US Energy Information Administration

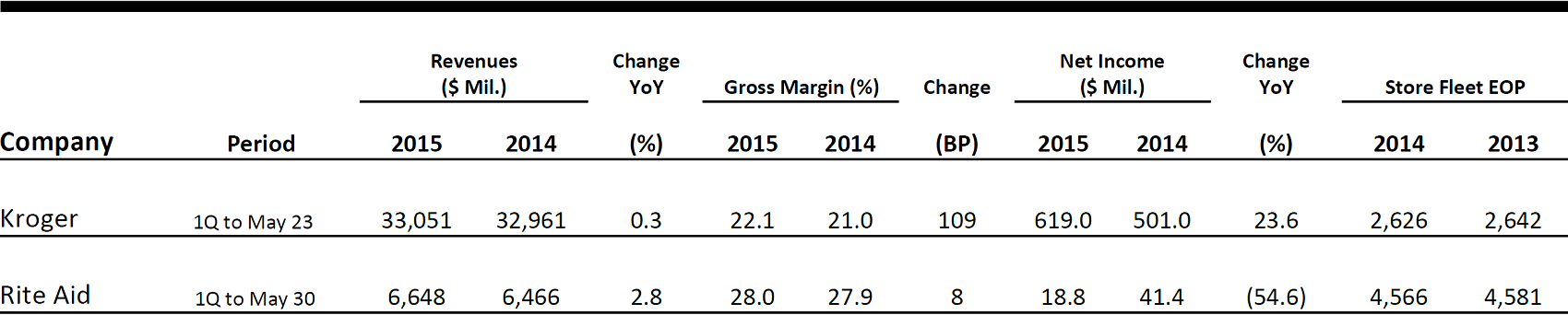

US RETAIL EARNINGS

Source: Company reports * Hudson's Bay reported in CAD

US RETAIL HEADLINES

- Forever 21 opened a three-story, 30,100-square-foot store at Sydney’s popular Pitt Street Mall, where average retail rent is $1,016 a square foot; it ranks as the fifth-most-expensive retail neighborhood.

- The Pitt Street Mall unit is Forever 21’s third, and largest, store in Australia. The Sydney flagship is one of 150 stores the retailer plans to open around the world. The company aims to reach 1,200 stores and $8 billion in annual revenue by 2017.

Gap to Close 175 North American Stores and Cut 250 Jobs

(June 15) Women’s Wear Daily

Gap to Close 175 North American Stores and Cut 250 Jobs

(June 15) Women’s Wear Daily

- Gap announced plans to close 175 specialty stores in North America over the next few years, including 140 in this fiscal year. Gap Outlet and Gap Factory stores will not be affected. The intention is to cut total store count to 800, comprising 500 specialty stores and 300 outlets.

- The company anticipates the store closure plan will result in $300 million in sales and $140 million–$160 million in onetime closing costs.

- Under the $1.9 billion purchase deal, CVS will rebrand 1,660 drugstores and 80 medical clinics inside Target.

- This deal will allow Target to focus on its core businesses, including baby, kids’ and style, while expanding healthcare services offerings inside Target stores. The partnership was praised by investors of both companies: Target’s shares were up 1.3% and CVS’s were up 0.4% on the day of the announcement, when overall trading was down.

- Amazon is developing a mobile app that will pay regular people rather than professional carriers to drop off packages on the way to their destinations. Meanwhile, Amazon would also recruit brick-mortar-stores to store packages instead of renting warehouse space.

- This initiative could help bring down Amazon’s growing shipping costs. On average, UPS charges $8 per package and Amazon ships 3.5 million packages a day. Last year, shipping costs amounted to $8.7 billion, or 9.8%, of its total sales.

ASIA HEADLINES

- A MasterCard Mobile Shopping Survey of the Asia-Pacific region showed that close to half of respondents made a purchase using their smartphone in the three months preceding the survey, which was conducted between October and December 2014.

- 1% of respondents from China said they had made such a purchase, while 62.9%of respondents from India, 62.6%of respondents from Taiwan and 19.6% of respondents from Australia said they had done so.

- Chinese e-commerce giant Alibaba and Taiwanese electronics contract manufacturing company Foxconn are reportedly in talks to jointly invest about US$500 million in Snapdeal, a deal that could value the Indian e-commerce company at about US$5 billion.

- Last year, Snapdeal was valued at roughly US$2 billion when it raised US$627 million from Japan’s SoftBank. eBay and BlackRock are its other major investors. Alibaba gave up an earlier deal over differences in Snapdeal’s valuation.

- Mobile security company NowSecure reported that the SwiftKey keyboard on millions of phones check for updates over an unencrypted, plain-text connection. This allows access to device sensors, apps and more.

- This security issue allows access to a phone’s camera and microphone, installation of malicious apps without the user knowing, eavesdropping on incoming/outgoing messages or voice calls, and attempts to access sensitive personal data such as pictures and text messages.

- Sony will once again tout the ability to stream and remotely play PlayStation 4 games as a key selling point as it looks to break into the US smartphone market through it newest smartphone, the Xperia Z4v.

- Sony’s mobile prospects were so dim that some speculated it would shed the business altogether. In the fiscal year ended March 31, the unit lost $184 billion despite an 11% increase in revenue.

- Singapore-based new venture capital firm KK Fund has just invested US$250,000 in Malaysia’s Be Malas, a “chatty commerce” startup, and US$200,000 in Malaysian service marketplace Koadim.

- Koichi Saito, the head of KK Fund and a former director of IMJ Investment Partners, said that “the timing of the exit is much more important than finding good startups. Maybe that’s slightly different than other investors.”

In Wake of Hacking Scandals, Japan’s NTT Partners with Box for Enterprise Security

(June 16) TechinAsia

In Wake of Hacking Scandals, Japan’s NTT Partners with Box for Enterprise Security

(June 16) TechinAsia

- The CEOs of NTT Communications and Silicon Valley–based Box jointly unveiled Box over VPN, a new service that will combine NTT’s secure enterprise network and Box’s cloud-based collaboration and content management platform.

- Box over VPN promises to increase digital security for enterprise customers by sending data through its proprietary Arcstar Universal One private network, thus avoiding the public Internet.

Video Streaming Site in China Says It’s Finally Getting People to Pay Up, Hits 5Million Subscribers

(June 16) TechinAsia

Video Streaming Site in China Says It’s Finally Getting People to Pay Up, Hits 5Million Subscribers

(June 16) TechinAsia

- iQiyi, owned by search engine giant Baidu, revealed that it just topped 5 million paid subscribers. iQiyi Senior VP Yang Xianghua says iQiyi is now the industry leader in China in terms of number of premium subscribers.

- iQiyi’s numbers came days after Alibaba announced an upcoming HBO/Netflix-style service called Tmall Box Office. The service would be accessible only to paying users, in contrast to the free access of all of China’s other video sites.

- According to research firm CB Insights, SoftBank has made more first-time investments in US companies than in Indian or Chinese tech firms since 2010, but its deals have been far more sizable in India and China, averaging US$125 million per deal in India and US$323 million per deal in China.

- The massive investments in Coupang (US$1 billion), Snapdeal (US$627 million) and Indonesia’s online marketplace, Tokopedia (US$100 million), are believed to be SoftBank’s attempt to replicate the success of its investment in Chinese giant Alibaba.

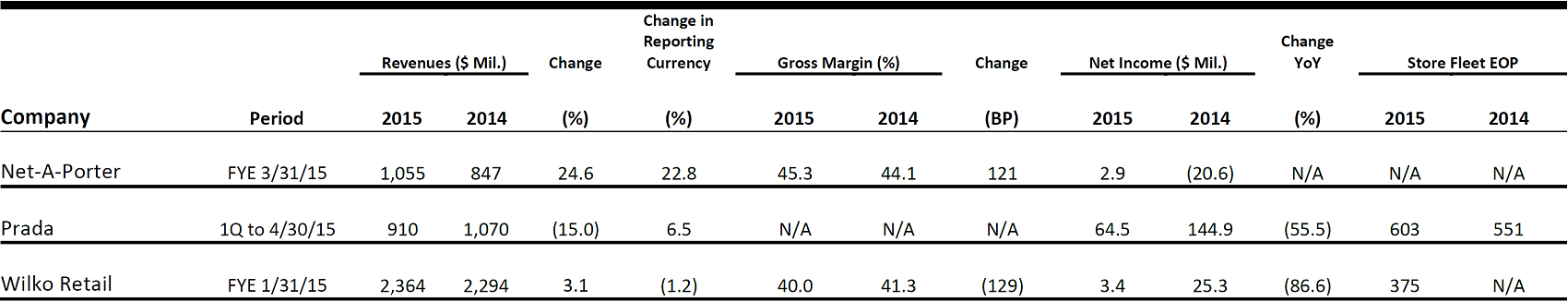

EUROPEAN RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

- Swedish fashion retailer H&M’s sales rose 10% year over year, in local currencies, in May 2015. In the second quarter (March–May), sales also rose 10% year over year, in local currencies.

- Store count increased from 3,285 in May 2014 to 3,639 in May 2015.

- Online luxury fashion retailer Net-A-Porter has posted its first pretax profit in five years, at £11 million (US$17 million) for the year through March, up from a pretax loss of £10 million (US$16 million) in the previous year. Sales grew by more than one-fifth, to £654 million (US$1,019).

- Active customer numbers increased by more than one-quarter, to 887,000 in the year, and order numbers rose to 2.6 million.

- Prada Group this week reported that sales grew by 6.5%, to €828 million (US$909 million) in the first quarter (February–April). At current exchange rates, sales were up 11% in Europe, 6% in Japan, 16% in the Americas and 13% in the Middle East. In the Asia-Pacific region, sales volumes fell “significantly,” although a positive exchange rate effect helped offset the decline.

- Net profit for the quarter fell 44% year over year, to €59 million (US$64 million). The company said its results had been impacted by the “continuing difficult market conditions” in the Asia-Pacific region, especially in Hong Kong and Macau.

- In the UK, consumer price inflation stood at 0.1% in May, ending a short-lived period of deflation.

- Lower deflation in food (-1.8%) and in automotive fuels (-11.0%) contributed, while inflation for clothing turned very slightly positive (0.3%) for the month.

- British variety store chain Wilko posted an 80% slump in pretax profits, to £5.5 million (US$9 million) for the year to January.

- Sales slipped by 1.2% in the year; the company blamed price cuts by supermarkets and discount chains for its weak performance.

- UK grocery giant Tesco needs to raise more than £5 billion (US$8 billion) to strengthen its balance sheet, rating agency Moody’s said this week. Based on current profitability, Tesco needs to raise at least this amount to recover its investment-grade rating.

- Tesco is reported to be exploring a sale of its South Korean business, as part of a raft of changes designed to strengthen its balance sheet.

Saks Fifth Avenue Owner Announces Deal with Germany’s Biggest Department Store

(June 17) RetailBulletin.com

Saks Fifth Avenue Owner Announces Deal with Germany’s Biggest Department Store

(June 17) RetailBulletin.com

- Hudson’s Bay announced it plans to buy Galeria Holding, the parent company of Germany’s biggest department store chain, Kaufhof, in a €2.83 billion deal.

- Kaufhof currently has 103 Galeria Kaufhof stores and 16 Sportarena stores. It also has 16 Galeria INNO stores across Belgium, where it is the country’s only department store.

Karen Millen Campaign Prevents £2.6 Million of Counterfeit Sales

(June 17) RetailBulletin.com

Karen Millen Campaign Prevents £2.6 Million of Counterfeit Sales

(June 17) RetailBulletin.com

- British fashion retailer Karen Millen has managed to prevent the sale of over £2.6 million worth of fake garments traded illegally under the brand’s name. The retailer has been working with companies such as eBay, Amazon, Taobao and Alibaba on this initiative since 2012 and has reportedly removed over 38,000 infringing URLs from search engine results and around 23,000 counterfeit product listings from online marketplaces.

- Karen Millen has also enlisted the support of its customers through a dedicated campaign page on its website called Join Our Fight. Any customer who sees a suspicious site or seller of Karen Millen goods is encouraged to notify the company via this platform.

LATAM HEADLINES

- Guatemala’s apparel industry has improved deliveries and moved into producing more value-added products in order to prevent share loss to Vietnam and other Asian countries.

- Guatemalan mills are currently oversold, with sourcing contracts expected to rise 20% this year, on the heels of a 12% increase in 2014.

- Despite an ongoing corruption scandal, the Guatemalan government is sharply cutting energy prices and extending tax breaks in order to woo foreign investment.

- MosquitNo is a natural mosquito repellent brand that is expanding within the travel markets of Latin America.

- The brand promises no environmental harm and already has a presence in Bolivia, Canada, Panama, Paraguay, Puerto Rico and Saint Barthélemy.

- The family brand is targeting travel retail, border shops and cruise ships in Latin America and the Caribbean as sales outlets.

- Strengthening demand from the US is expected to drive a 15% increase in Mexico’s jeanswear exports, to $2.2 billion this year, according to trade consultant Cedetex.

- The increase would be in addition to a 2% increase (to 124.8 million pairs) last year, amid heightened competition from Vietnam and Bangladesh.

- Mexico sells 90% of its output to the US and is its top supplier in the men’s and children’s jeanswear categories. However, the country has fallen to fifth place worldwide in the women’s category.

- On June 11, the US House of Representatives passed a package that would provide trade benefits to Haiti, sub-Saharan African nations and other developing countries.

- Since the House bill is different from the one that passed the Senate in a 97-to-1 vote last month, the Senate still needs to approve the final legislation.

- The bill aims to create new tariff categories for “recreational performance outerwear” and reduce duties on certain water-resistant performance footwear.