From the Desk of Deborah Weinswig

Loyalty Programs Are About More than Just Loyalty (Hint: It Is the Data!)

Retail loyalty programs have a long history in the US. According to rewards program solutions company Smile.io, these programs started in the 18th century, when retailers would give customers copper tokens that could be redeemed for future purchases. Starting in the 19th century, US consumers began receiving green stamps for purchases; shoppers collected the stamps and redeemed them for products. The first airline frequent-flyer program was created for United Airlines in 1972. And today, we all likely have a card in our wallet from a neighborhood coffee or sandwich shop that promises “buy 10, get one free.” Many of us also have probably bought an unnecessary flight or an unnecessary sandwich at some point just to maintain or raise our rewards status.

Although there are a variety of credit cards that offer cash back, airline miles or hotel points, and numerous restaurant and retailer rewards schemes, a few of these programs go much deeper, offering personalized services adapted to individual consumers based on an analysis of their data.

For example, grocery chain Kroger leverages its data-analysis subsidiary, 84.51°, to analyze customer data in order to generate discounts on commonly purchased items as well as provide personalized product recommendations. It does this through its loyalty program card, which is the conduit for online and click-and-collect purchases.

Then there is Starbucks, which has redefined the concept of loyalty. Through a combination of digital payments and rewards, Starbucks has created a “digital flywheel” comprising rewards, personalization, payments and mobile ordering—and the company has seen lifts in spending of 20%–70% after customers join its rewards program. In its most recent quarterly report, Starbucks’ management commented that 44% of all transactions in the quarter were made using the company’s payment platform and that average spending increased by 8% over the period (quarterly net revenues were $5.3 billion). Following the launch of a spending-based rewards system, the company has used its “real-time personalization engine” to increase its number of personalized email variants from 30 to 400,000 offers and selling recommendations.

Finally, Amazon has taken the concept of loyalty to a whole new level with its Prime program. Amazon Prime members receive a basket of services—including two-day free shipping, unlimited streaming of TV shows and movies, the ability to borrow books from the Kindle Lending Library, and many other offerings—in exchange for a $99 annual or a $10.99 monthly fee. There are also several Prime-only features available to members, including Prime Now one- or two-hour shipping and the ability to use the Amazon Echo intelligent assistant. As Amazon has long targeted revenue growth ahead of profitability, it is likely that the value of these services exceeds the annual or monthly fee, providing significant value for the customer.

But there is even more going on behind the scenes with an Amazon Prime account. For starters, members are likely to direct more of their shopping to Amazon so as to offset the membership fee and get their money’s worth. Although Amazon was an early price leader in e-commerce, the company no longer offers the lowest prices all the time: in some cases, it now offers convenience at the expense of savings. Given its value and exclusivity, the Prime package of services is addictive and “sticky.”

Consumer Intelligence Research Partners has estimated that Prime renewal rates are 91% after one year and 96% after two years. Although it may seem that there is little room left for Prime to grow, as about 60% of all US households already subscribe, according to Piper Jaffray, that membership figure is even higher among higher-income households, at 82%. Amazon is also targeting lower-income households: the company recently announced a discounted monthly Prime membership fee of $5.99 for those receiving government benefits. To further lock in loyalty, the company launched a rewards Visa card in January that offers Prime members 5% back on purchases made at Amazon.com (non-Prime customers get 3% back) and 1%–2% back on other purchases and purchases made at restaurants, gas stations and drugstores.

In the end, it is all about the data. The three companies mentioned—Kroger, Starbucks and Amazon—have cleverly interwoven loyalty and payment functions so as to be able to collect a mountain of customer data that can be used to extend their customers increasingly relevant and personalized offers.

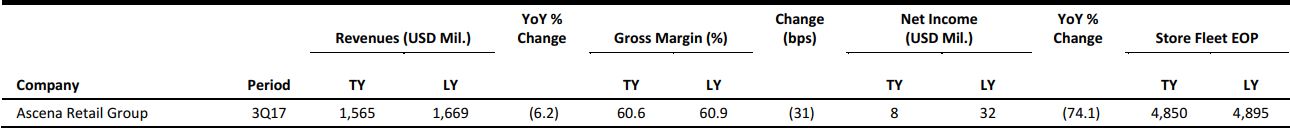

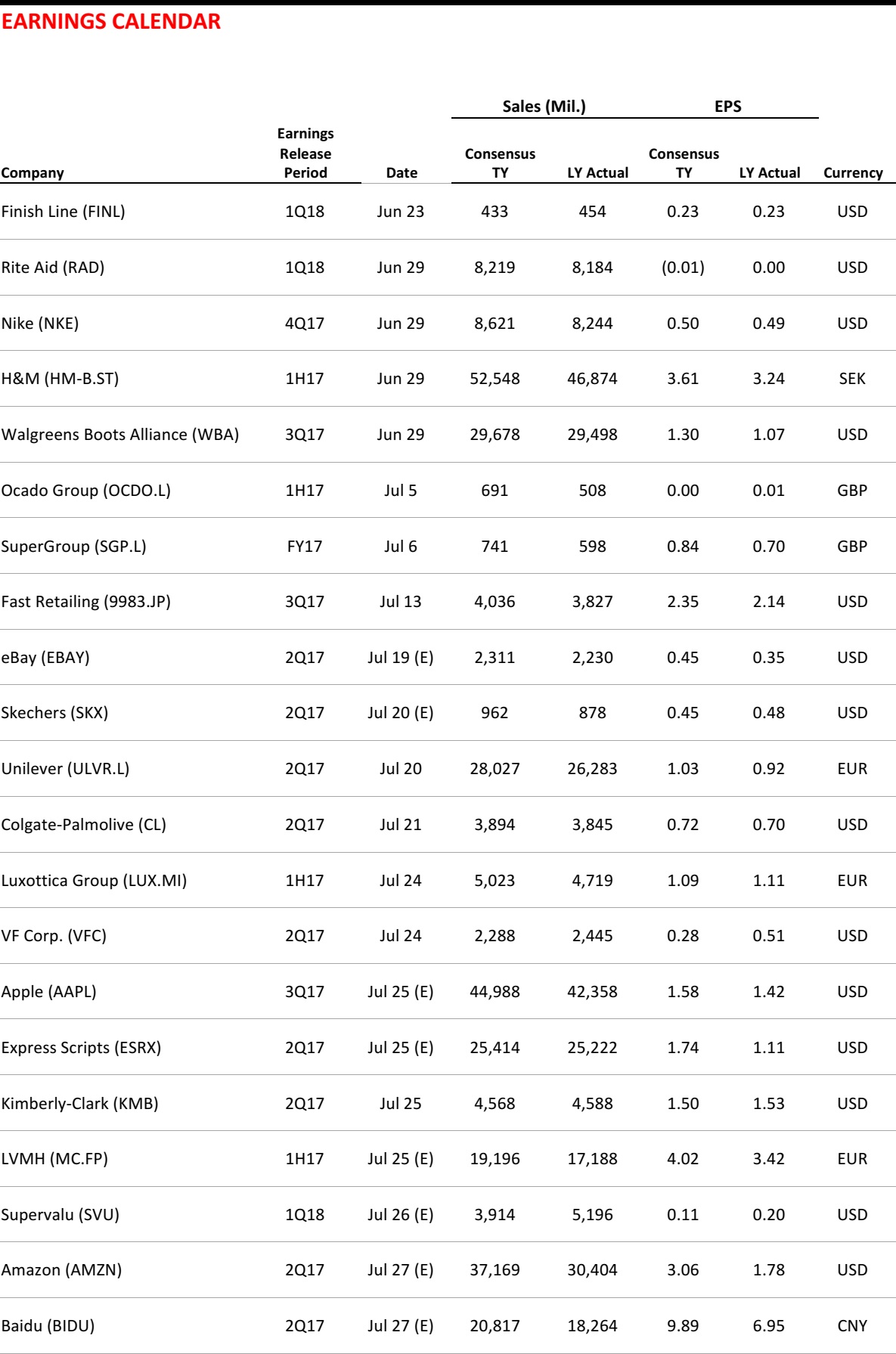

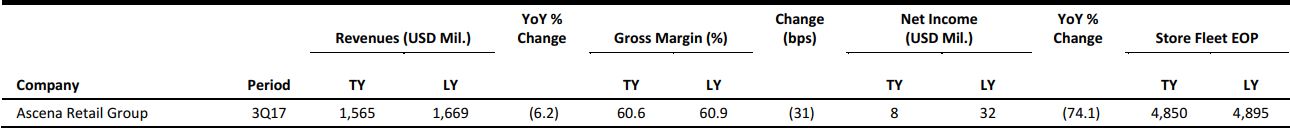

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Gymboree Files Bankruptcy, Closing Up to 450 Stores

(June 12) USAToday.com

Gymboree Files Bankruptcy, Closing Up to 450 Stores

(June 12) USAToday.com

- Children’s clothing chain Gymboree has filed for Chapter 11 bankruptcy protection, aiming to slash its debt and close hundreds of stores amid crushing pressure on retailers. Gymboree said it plans to remain in business but will close 375–450 of its 1,281 stores. The company employs more than 11,000 people, including 10,500 hourly workers.

- The bankruptcy was widely expected after the company refused to pay some of its bills in recent months, placing it on a collision course with creditors. Gymboree said in its filing late Sunday that it hopes to slash $1 billion of its $1.4 billion in debt and win approval for its plan by September 24.

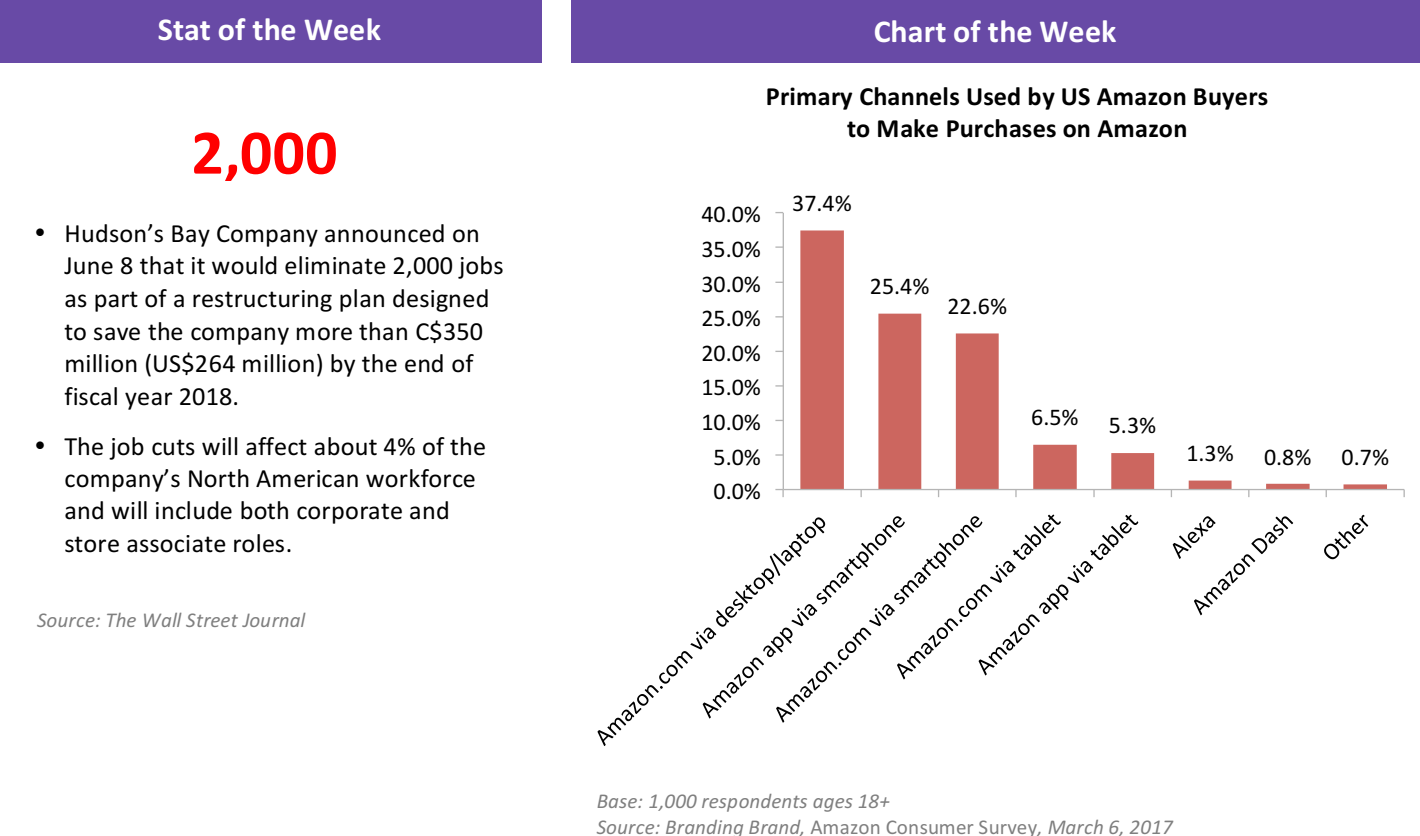

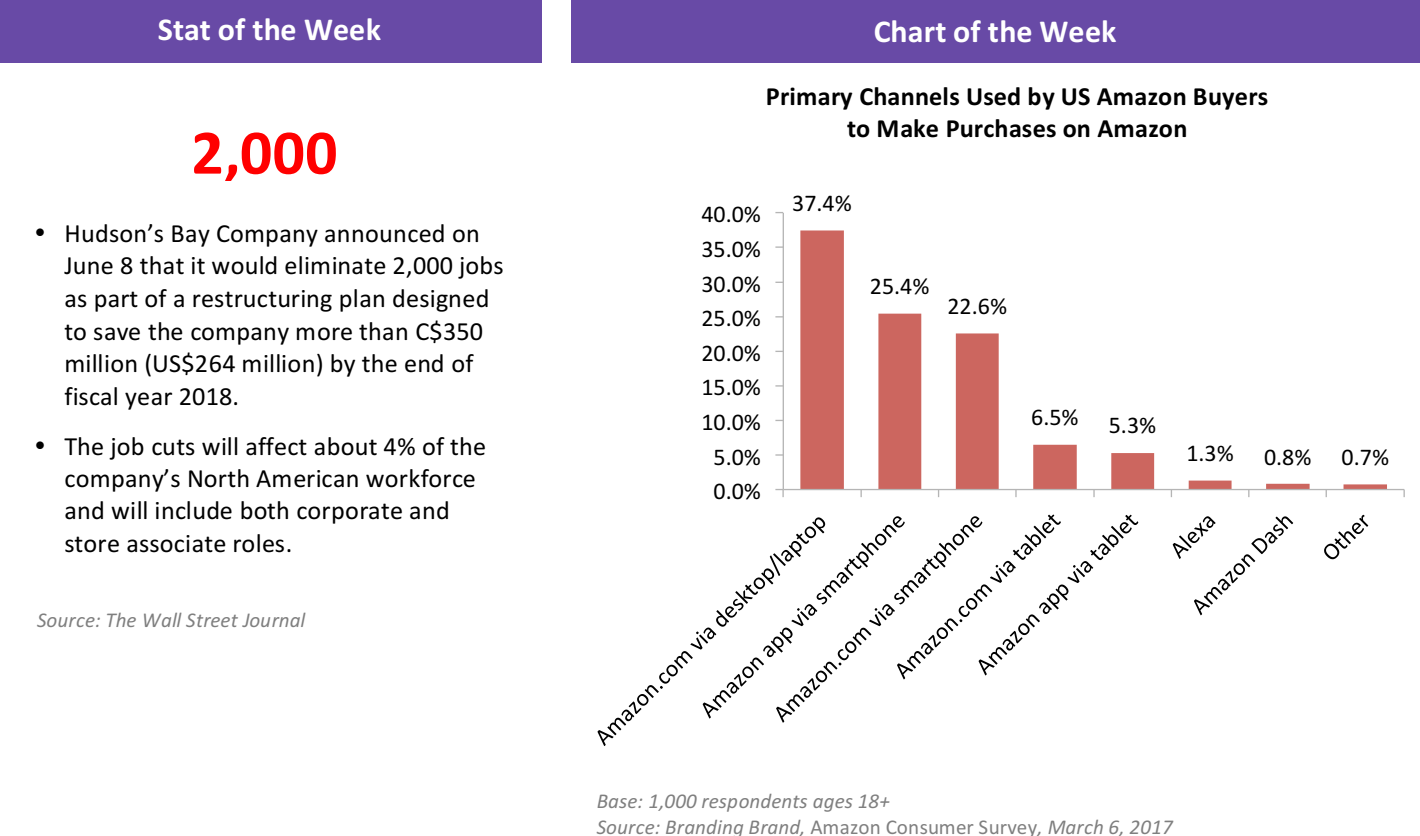

Hudson’s Bay Company Details Restructuring Plans to Tackle “Brutal” Retail Market

(June 9) Aol.com

Hudson’s Bay Company Details Restructuring Plans to Tackle “Brutal” Retail Market

(June 9) Aol.com

- Canadian department store operator Hudson’s Bay Company said it would streamline its structure across its various store chains to compete in what it called a “brutal” retail environment, while its shares plunged to record lows.

- The company, which operates Hudson’s Bay, Lord & Taylor, Saks Fifth Avenue and other chains, plans to decrease its number of vendors, centralize store operations and move toward a “shared services” structure to standardize processes across department stores.

Talks to Combine Neiman Marcus and Saks Have Stalled

(June 9) The Wall Street Journal

Talks to Combine Neiman Marcus and Saks Have Stalled

(June 9) The Wall Street Journal

- Takeover talks between Neiman Marcus and the parent of Saks Fifth Avenue have stalled, according to people familiar with the matter, leaving the department store owners to chart their own paths through a difficult retail landscape.

- Hudson’s Bay Company, which owns Saks and Lord & Taylor, had approached Neiman Marcus about a potential combination earlier this year. The two sides have been unable to reach an agreement on price and are no longer actively working on a deal, one of the people said, adding that the talks could resume.

Nordstrom Could Go Private as Department Stores Struggle

(June 8) USAToday.com

Nordstrom Could Go Private as Department Stores Struggle

(June 8) USAToday.com

- The Nordstrom family is exploring a bid to acquire the department store chain that bears the family name in a deal that would turn the publicly traded company into a private venture in order to help it navigate the turmoil that has engulfed the retail industry.

- The luxury department store retailer said that several members of the Nordstrom family, including multiple company executives, had formed a group to weigh the potential deal.

Expectations Slip as Abercrombie Auction Looms

(June 8) WWD.com

Expectations Slip as Abercrombie Auction Looms

(June 8) WWD.com

- Abercrombie & Fitch, which acknowledged last month that it was in talks to sell itself, was set to accept bids in an auction on June 8, and the specialty chain might just go at a discount.

- A source close to the situation said that Abercrombie’s board had started the process of looking to sell for $14.50–$15 a share, but that it is resigned to accepting something closer to $13.50, given the deepening secular shifts and weakness in retail.

Walmart Is Testing a Giant Grocery Vending Machine

(June 8) Money.com

Walmart Is Testing a Giant Grocery Vending Machine

(June 8) Money.com

- Not to be outdone by Amazon, Walmart is now piloting a new version of its grocery pickup service. The retail giant has started testing a fully automated, self-service kiosk stationed in the parking lot of one of its stores in Oklahoma. Customers order groceries online and, after entering a special five-digit code, pick them up at the kiosk.

- While there is no extra cost to use the service, customers must purchase at least $30 worth of groceries in order to use it. More than 30,000 products are available for purchase through the self-service option, and freezers and fridges are used in the kiosk.

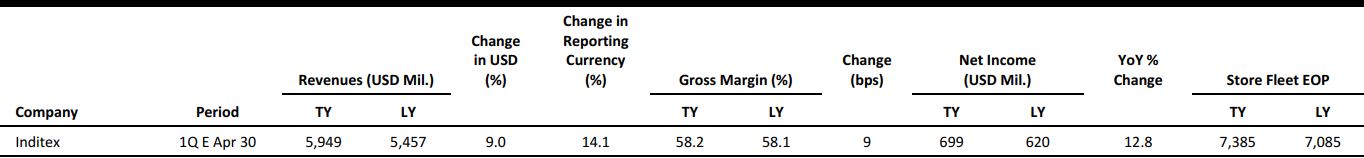

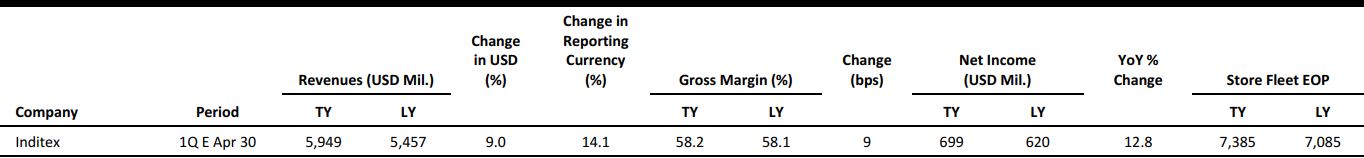

EUROPE RETAIL EARNINGS

Source: Company reports/Fung Global Retail & Technology

EUROPE RETAIL HEADLINES

IKEA to Start Selling on Third-Party Websites

(June 8) RetailGazette.com

IKEA to Start Selling on Third-Party Websites

(June 8) RetailGazette.com

- In a bid to increase its online presence, Swedish furniture retailer IKEA plans to trial the use of third-party websites to sell its furniture.

- Torbjörn Lööf, head of brand and strategy at Inter IKEA Group, stated that the company plans to start testing the concept in 2018.

Carrefour Announces New CEO

(June 9) Company press release

Carrefour Announces New CEO

(June 9) Company press release

- French retailer Carrefour has confirmed that Alexandre Bompard will join the group as Chairman and CEO.

- The company announced that it has unanimously chosen Bompard, CEO of French retailer Fnac Darty, to succeed Georges Plassat as of July 18, 2017.

Amazon Makes a Move on UK Car Websites

(June 12) Bloomberg.com

Amazon Makes a Move on UK Car Websites

(June 12) Bloomberg.com

- Seattle-based com could soon expand its car offering to the UK, according to German trade magazine Automobilwoche.

- The company has already been trialing car sales in Italy, with a limited offer of Fiat Chrysler Automobiles’ BV models, but the tech giant is reportedly considering starting sales in the UK before extending the offering to other European countries.

Saks OFF 5TH Opens First Store in Europe

(June 12) RetailDetail.eu

Saks OFF 5TH Opens First Store in Europe

(June 12) RetailDetail.eu

- US off-price fashion retailer Saks OFF 5TH has opened its first European store, in Düsseldorf, Germany. The company also plans to open a store in the Netherlands later this year.

- Saks OFF 5TH will open about 40 stores in Germany over the next three to five years, each spanning at least 3,000 square meters.

New Look Directors Leave Retailer

(June 12) Retail-Week.com

New Look Directors Leave Retailer

(June 12) Retail-Week.com

- Two directors from global fast-fashion retailer New Look have left the company just days after it posted results for the 52 weeks ended March 25. The company reported a 44% slump in underlying operating profit, to £97.6 million (US$124.1 million), for the period.

- New Look’s menswear director Christopher Englinde and women’s footwear, accessories and beauty director Amanda Wain both departed following the results announcement.

ASIA TECH HEADLINES

Intudo Ventures Launches $10 Million Fund for Indonesia’s Fast-Growing Startup Ecosystem

(June 13) TechCrunch.com

Intudo Ventures Launches $10 Million Fund for Indonesia’s Fast-Growing Startup Ecosystem

(June 13) TechCrunch.com

- The Indonesian startup market gained a new investor with the launch of Intudo Ventures’ debut fund, which has more than $10 million to invest in 12–16 early-stage startups as well as in joint ventures with overseas companies that want to break into the Indonesian market.

- Indonesia is one of Southeast Asia’s most promising startup markets. It is the world’s fourth-largest country by population, with about 260 million people, and it is also one of the fastest-growing Internet markets by penetration. The number of Internet users in the country (most of whom are mobile-first) is expected to jump from 92 million currently to 215 million in 2020.

Mobike Will Launch Dockless Bike-Sharing in the UK

(June 12) TechCrunch.com

Mobike Will Launch Dockless Bike-Sharing in the UK

(June 12) TechCrunch.com

- Beijing-based Mobike, one of China’s largest bike-sharing companies, will launch in the UK cities of Manchester and Salford, its first foray outside Asia. The service is slated to arrive on June 29, the company said, and will start with 1,000 bikes.

- Mobike’s launch outside Asia (it expanded into Singapore in March) heightens the competition with Ofo, another well-funded Chinese bike-sharing startup that is keen to expand internationally. Ofo actually beat Mobike to England when it launched a pilot two months ago in Cambridge, but that was on a much smaller scale, with just 20 bikes.

South Korean E-Book Platform Ridibooks Raises $20 Million in Fresh Funds

(June 13) TechinAsia.com

South Korean E-Book Platform Ridibooks Raises $20 Million in Fresh Funds

(June 13) TechinAsia.com

- South Korean e-book provider Ridibooks announced it has raised $20 million in series C funding from Praxis Capital Partners, ShinHan Finance Investment and Company K Partners. The company has more than 2.5 million users, and says that 175 million e-books have been downloaded through its platform.

- The startup’s main competitors include Kyobo Book Center and Yes24, which are among the biggest bookstore chains in South Korea, selling printed books as well as e-books on their sites. Ridibooks previously said it sets itself apart by focusing on digital content distribution.

Alibaba to Open Data Center in Indonesia amid Tighter Controls on Local Storage

(June 10) TechinAsia.com

Alibaba to Open Data Center in Indonesia amid Tighter Controls on Local Storage

(June 10) TechinAsia.com

- Alibaba Cloud, the cloud-computing arm of Alibaba Group, announced that it plans to establish a new data center in Jakarta, Indonesia, that will open before the end of the first quarter of 2018. Alibaba Cloud operates globally, and other Asian countries, including China, Japan and Singapore, already have similar facilities.

- In Indonesia, Alibaba Cloud and other international giants are answering the growing demand for reliable, scalable data storage. Amazon Web Services is popular with Indonesian companies, even though the firm does not operate data centers in the archipelago.

LATAM RETAIL AND TECH HEADLINES

Brazil’s Natura Set to Buy The Body Shop in $1.1 Billion Deal

(June 11) TaipeiTimes.com

Brazil’s Natura Set to Buy The Body Shop in $1.1 Billion Deal

(June 11) TaipeiTimes.com

- Natura Cosmeticos entered exclusive talks to acquire British brand The Body Shop from L’Oréal with an offer that values the UK chain at €1 billion (US$1.1 billion). The deal would give Natura new sales channels and more exposure to developed markets, although The Body Shop is in “great need of a turnaround” and would require a lot of work, according to Eleven Financial Research Analyst Giovana Scottini.

- An acquisition would represent a major expansion for Natura, which originated as a direct-sales business and expanded its retail operations with its US$70 million purchase of Australia’s Aesop in 2013.

Brazil Signs Agreement with China and Others to Obtain 5G Technology

(June 9) ChinaDaily.com.cn

Brazil Signs Agreement with China and Others to Obtain 5G Technology

(June 9) ChinaDaily.com.cn

- The Brazilian government has signed an agreement with China, the EU, the US, Japan and South Korea to bring 5G cellphone technology to the country. The Ministry of Science and Technology said the agreement had been signed by Project 5G Brazil, made up of 18 government entities, companies and research centers, with the participation of the Ministry.

- With the new agreement, Brazil joins the select group that is leading the development of fifth-generation mobile technology. Theoretically, 5G networks will allow users to download hundreds of hours of video within minutes.

Kaszek Ventures Raises $200 Million for LatAm Tech Stimulation

(June 6) NearshoreAmericas.com

Kaszek Ventures Raises $200 Million for LatAm Tech Stimulation

(June 6) NearshoreAmericas.com

- Latin American venture capital fund Kaszek Ventures has raised $200 million in its third round of fundraising, with plans to accelerate the stimulation of technology startups across the region. Buenos Aires–based Kaszek has backed more than 40 startups so far, with reports saying that this is the largest fund the company has raised since its founding in 2011.

- Most of the enterprises it has supported are early-stage technology companies, and they have collectively raised more than $1.4 billion in capital from other investors. Much of the funding went to startups in Brazil, with the remainder shared by entrepreneurs in Argentina, Mexico, Chile, Colombia and Uruguay.

IDB Grants $5 Million to NXTP Labs to Accelerate LatAm Tech Startups

(June 8) NearshoreAmericas.com

IDB Grants $5 Million to NXTP Labs to Accelerate LatAm Tech Startups

(June 8) NearshoreAmericas.com

- The Inter-American Development Bank’s (IDB’s) venture capital arm has agreed to inject another $5 million into NXTP Labs, urging the business accelerator to stimulate the growth of more technology startups in Latin America.

- NXTP Labs stated in a press release that it will use the capital to fund about 30-40 companies operating in technology verticals, including fintech, agtech, edutech, cleantech, e-commerce and software-as-a-service.

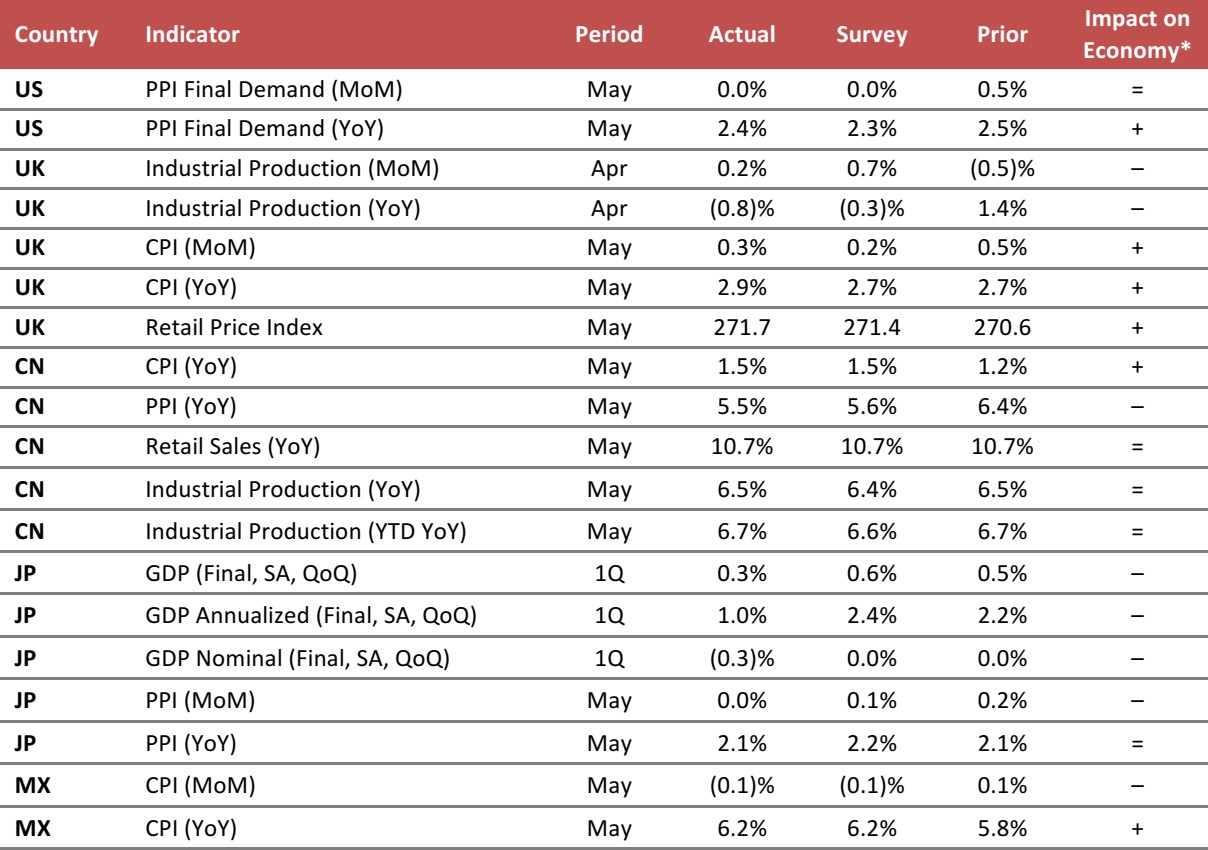

MACRO UPDATE

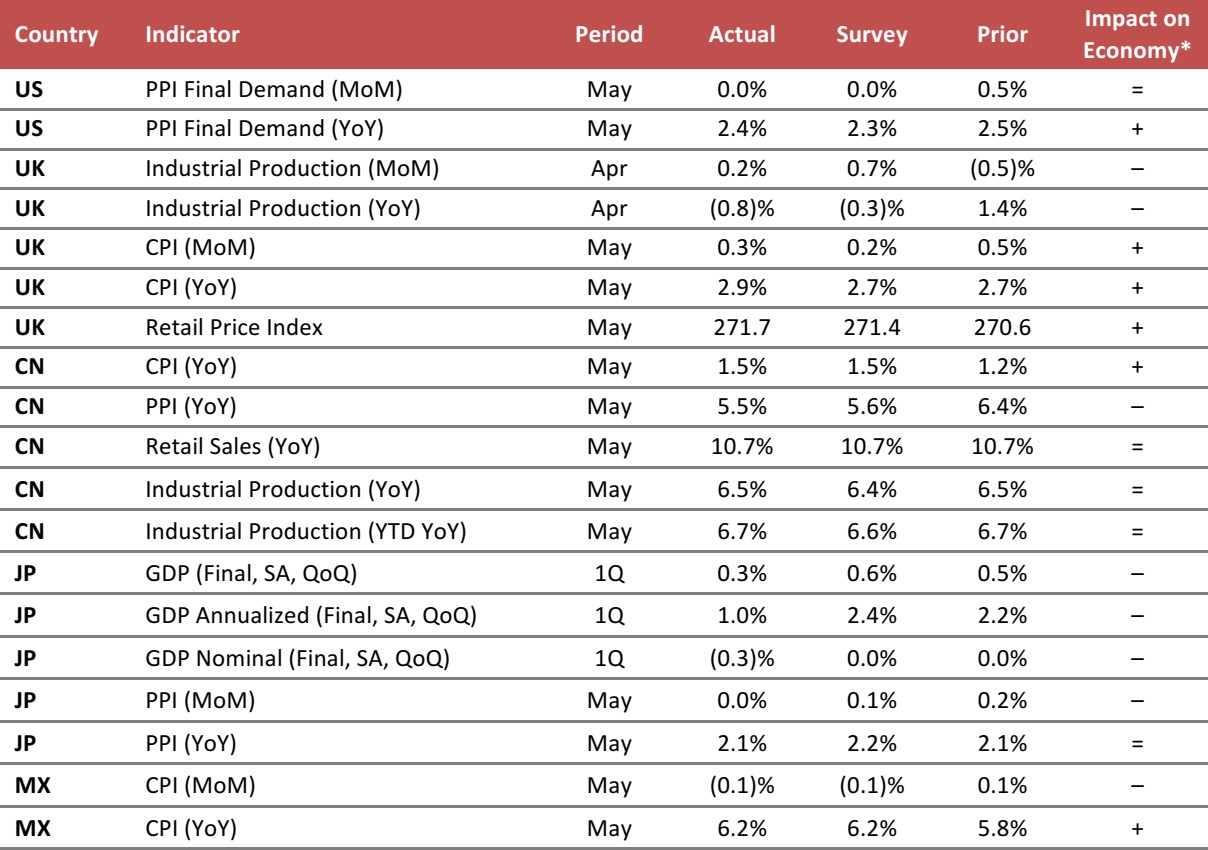

Key points from global macro indicators released June 7–14, 2017:

- US: The Producer Price Index (PPI) for final demand was unchanged month over month in May and grew by 2.4% year over year, a rate slightly slower than in April.

- Europe: In the UK, industrial production grew by 0.2% month over month in April, missing the consensus estimate of 0.7%. In May, the UK Consumer Price Index (CPI) increased by 0.3% month over month and by 2.9% year over year, while the Retail Price Index increased slightly, to 271.7.

- Asia-Pacific: In China, the CPI increased by 1.5% year over year in May, indicating higher inflation than in the same period last year. In Japan, real GDP growth slowed to 0.3% in the first quarter of 2017.

- Latin America: In Mexico, the CPI decreased by 0.1% month over month in May, representing continuing strong domestic price levels. Year over year, the CPI grew by 6.2%.

*Fung Global Retail & Technology’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/UK Office for National Statistics/National Bureau of Statistics of China/Economic and Social Research Institute of Japan/Bank of Japan/Instituto Nacional de Estadística y Geografía (INEGI)/ Fung Global Retail & Technology

New Look Directors Leave Retailer

(June 12) Retail-Week.com

New Look Directors Leave Retailer

(June 12) Retail-Week.com

Brazil’s Natura Set to Buy The Body Shop in $1.1 Billion Deal

(June 11) TaipeiTimes.com

Brazil’s Natura Set to Buy The Body Shop in $1.1 Billion Deal

(June 11) TaipeiTimes.com

IDB Grants $5 Million to NXTP Labs to Accelerate LatAm Tech Startups

(June 8) NearshoreAmericas.com

IDB Grants $5 Million to NXTP Labs to Accelerate LatAm Tech Startups

(June 8) NearshoreAmericas.com