FROM THE DESK OF DEBORAH WEINSWIG

Introducing the Four-Quadrant Disruptors Framework

This week, we introduced our new concept regarding opportunities in the retail industry: the Four-Quadrant Disruptors Framework. This model identifies four areas of opportunity for innovative retailers and startups that serve the retail industry, and was formulated as a response to the “retail destruction” seen in the US very recently, when a number of major retail names reported disappointing results. In the context of this quickly shifting retail landscape, we identify four areas of opportunity: new retail models, all-channel, experiential retail and customer engagement.

We summarize these quadrants of opportunity below, and direct readers to our

full report on fbicgroup.com for complete details of the framework, including greater context and profiles of companies operating within each space.

New Retail

New retail models identify “white spaces” in how consumers shop in the evolving retail world, whether that is through an online barter community such as reKindness, or through a marketplace such as Ideally that lets them name their own price for goods. This quadrant also includes some more common emerging retail models, including marketplaces such as Etsy, sharing economy businesses such as Rent the Runway and caring economy businesses such as TOMS.

All-Channel

The all-channel model offers significant opportunities for retailers and startups to merge shopping channels, so consumers can shop seamlessly when and where they want to. The all-channel startup and innovation ecosystem includes e-commerce platform solutions, “click and arrive” reordering shopping buttons, next-generation store locations that broadcast in-store inventory online, and in-store smart displays designed to provide consumers with information on products.

Experiential Retail

Experiential retail encompasses retailers and technology startups that work to repurpose existing store space to make the shopping experience frictionless and more fun; stores thus become a natural complement to the functionality offered by online shopping. This quadrant is important because, even though the online channel has been driving significant sales growth, over 90% of US retail sales still take place in-store. Technologies that fall under this category include virtual fitting rooms, self-checkout solutions and augmented reality applications.

Customer Engagement

Startups and innovators that fit into the customer engagement quadrant explore ways in which retailers can convert consumers to customers and enhance interactions with their customers on different platforms. This area includes gamification, recommendation engines powered by artificial intelligence, influencer marketing and social shopping “evangelize and thrive” apps.

In short, the Four-Quadrant Disruptors Framework emphasizes the fact that retailers need to provide total convenience, and that they must develop deeper connections with their customers. We see those retailers that adopt new retail models and provide cross-channel convenience, improved experiences and greater engagement as being well positioned to gain share—and this will likely be at the expense of those generalist retailers whose catchall propositions appear to be resonating less and less with shoppers.

- For a complete discussion of our Four-Quadrant Disruptors Framework concept, together with profiles of selected key companies in each quadrant, please see our full report on fbicgroup.com.

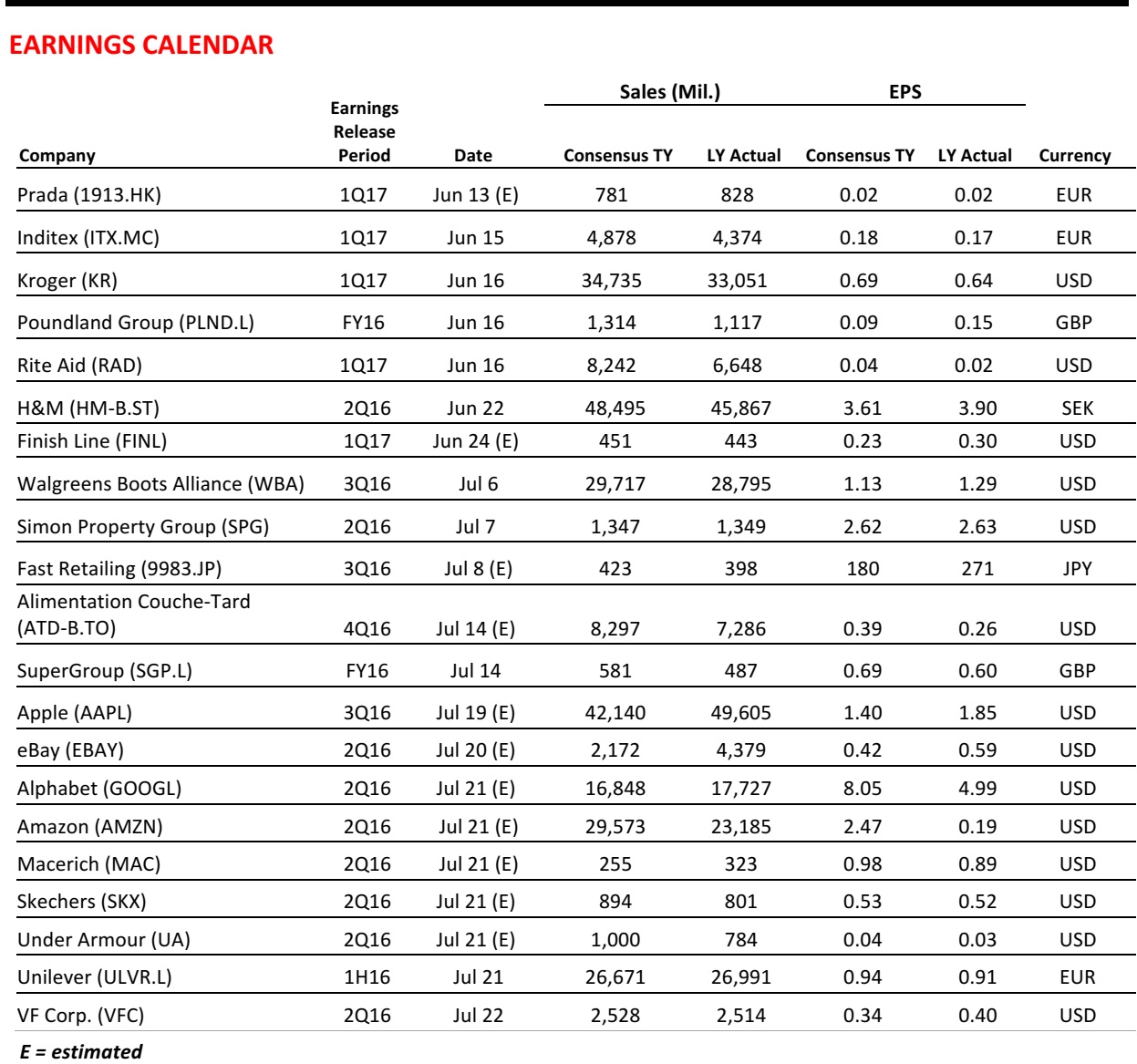

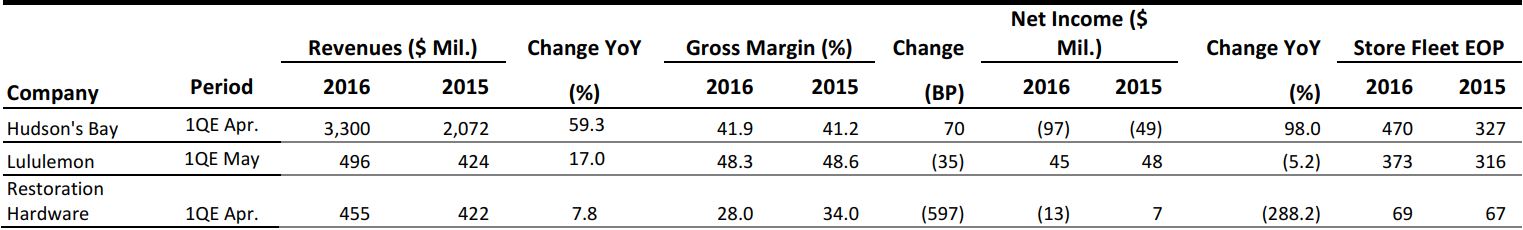

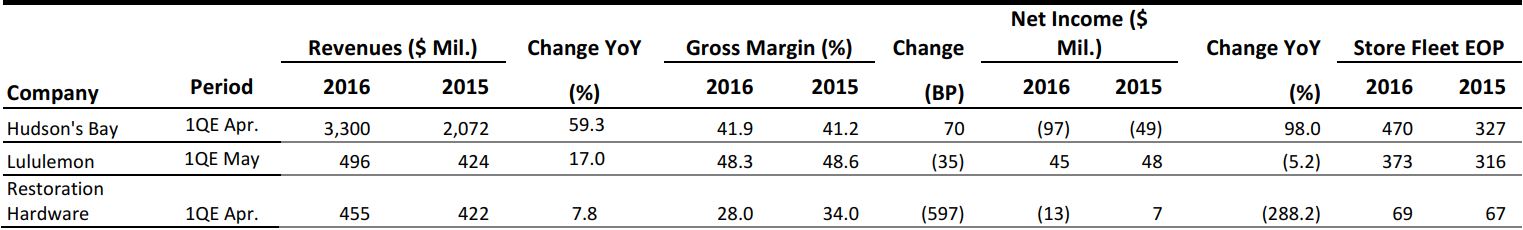

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Athleisure Is Paving the Way for Technical Apparel

(June 8) Glossy

Athleisure Is Paving the Way for Technical Apparel

(June 8) Glossy

- As the athleisure market approaches saturation, Lululemon Athletica founder Chip Wilson says that “streetnic” apparel—made with engineered fabrics that apply the stretch and performance of athleticwear to everyday clothing—is the next big trend.

- Consumers have come to expect the comfort of athleisure. Now, retailers are working to create fashionable clothing that has the functionalities of athletic apparel. For example, Kit and Ace invented a machine washable “technical cashmere.”

Cultivating Brand Loyalty in Even the Toughest Customer

(June 5) The New York Times

Cultivating Brand Loyalty in Even the Toughest Customer

(June 5) The New York Times

- According to a report by Colloquy, loyalty programs have grown by 26% since 2013, and totaled 3.3 billion memberships nationwide in 2015. However, while the average household has memberships with 29 loyalty programs, only 12 of them are typically used, which means the number of memberships used has actually decreased by 4.5% since 2013.

- Loyalty programs are effective at attracting customers, but they cannot just offer a discount or free dessert. Companies need to adjust to effectively use the important data they receive from customers in order to persuade them to buy more.

Mall Landlords Embrace High-Tech to Entice Shoppers

(June 7) Retailing Today

Mall Landlords Embrace High-Tech to Entice Shoppers

(June 7) Retailing Today

- Retailers have typically been the ones investing in technology to improve the customer experience. But as store closures have increased pressure on landlords, they, too, are beginning to pour money into technology, investing in mapping functions to help shoppers find parking spaces, navigate mall corridors or find a flash sale at a store one floor above.

- Landlords hope to better connect with shoppers, sparking more activity and possibly giving themselves an edge in lease negotiations with retailers.

Weak Productivity, Rising Wages Putting Pressure on US Companies

(June 6) Mobile Commerce Daily

Weak Productivity, Rising Wages Putting Pressure on US Companies

(June 6) Mobile Commerce Daily

- Weak productivity growth, rising wages and sluggish demand are putting pressure on US companies and increasing the likelihood that they will slow hiring, cut spending and further weaken the economy.

- Labor productivity fell at a 0.6% annual rate in the first quarter, according to the US Department of Labor. Strong productivity increases corporate profits, giving more money to workers in turn. Productivity has grown by 2.2% on average annually since World War II, but has grown by only 0.5% over the last five years.

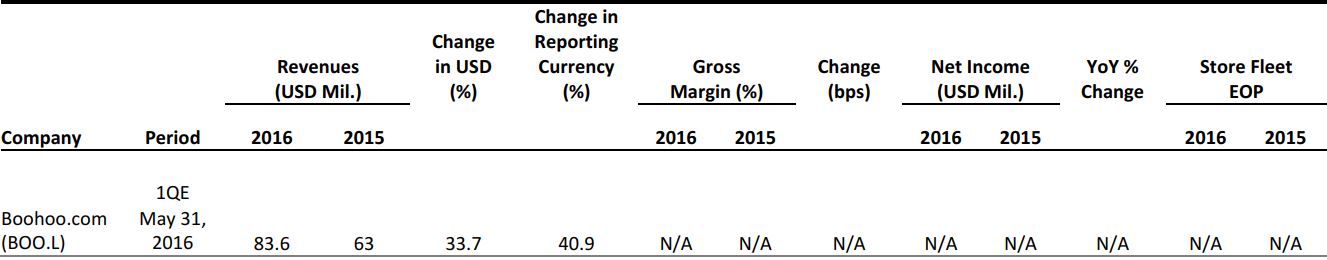

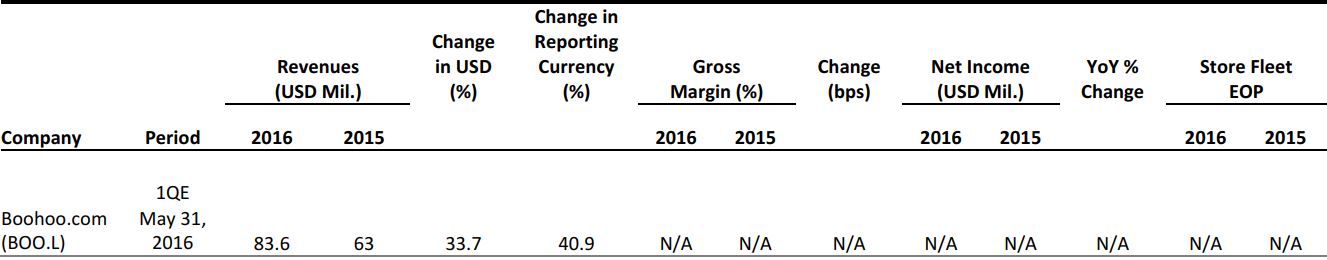

EUROPE RETAIL EARNINGS

EUROPE RETAIL HEADLINES

UK Retail Sales Rise in May

(June 7) Brc.org.uk

UK Retail Sales Rise in May

(June 7) Brc.org.uk

- In the UK, retail sales in the four weeks from May 1–28 grew by 1.4% year over year, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. BRC CEO Helen Dickinson noted that though this growth is “not spectacular, it is in line with the 12-month average of 1.5%.”

- During the same period, online sales in the UK grew by 13.7% year over year, as tracked by the BRC-KPMG Online Retail Sales Monitor.

New Look Reports Solid Sales Increase for FY16

(June 7) Company press release

New Look Reports Solid Sales Increase for FY16

(June 7) Company press release

- British fashion retailer New Look has reported revenue growth of 5.4%, to £1,490.6 million (US$2,249.2 million) for the year ended March 26, 2016. UK comps were up 3.4% and New Look brand comps were up 3.6%. Sales on the company’s own website grew by 27.9% and sales through third-party e-commerce sites grew by 41.8%.

- While adjusted pretax profit rose by 16.8%, to £59.1 million (US$89.2 million), New Look reported a pretax loss of £34.4 million (US$51.9 million) due to the one-off costs of its May 2015 acquisition by South African investment group Brait.

Norwegian Rain to Open First International Store

(June 7) Theretailbulletin.com

Norwegian Rain to Open First International Store

(June 7) Theretailbulletin.com

- Outerwear brand Norwegian Rain is set to open its first store outside Norway, in London. The new shop will be located on Piccadilly, in close proximity to the traditional sartorial quarters of Savile Row, Bond Street and Jermyn Street.

- The new store will sell Norwegian Rain’s full collection of clothing, suits and shoes; leather items from the T-Michael label; and Scandinavian furniture.

El Corte Inglés Opens Store Dedicated to Women’s Products

(June 6) Wgsn.com

El Corte Inglés Opens Store Dedicated to Women’s Products

(June 6) Wgsn.com

- Spanish retail chain El Corte Inglés has opened a store dedicated entirely to women’s products in Madrid’s Calle de Serrano, the preferred location for some of Europe’s best-known brands in the city. This move follows the success of its Serrano 52 MAN store, which opened on the same street last year, catering exclusively to men.

- The new store has six floors of womenswear and accessories, and includes several brands that are new to the retailer’s offering.

Matalan’s Performance in FY16 Drops on Warehouse Challenges

(June 6) Company press release

Matalan’s Performance in FY16 Drops on Warehouse Challenges

(June 6) Company press release

- British clothing retailer Matalan announced that revenues fell by 3%, to £1,061.4 million (US$1,608.3 million) for the year ended February 27, 2016. EBITDA fell by 44%, to £56.2 million (US$85.2 million).

- Managing Director Jason Hargreaves cited “operational challenges encountered with last year’s warehouse transition” as the cause of the performance decline. He added that the warehouse is now operationally stable and that the company has a cautious recovery plan in place for the coming year.

ASIA TECH HEADLINES

Chinese Consumers Lead the World in Paying with Their Phones

(June 7) TechinAsia

Chinese Consumers Lead the World in Paying with Their Phones

(June 7) TechinAsia

- According to eMarketer, 195 million people in China will be using their phone as a wallet by the end of 2016. That represents 38% of all smartphones users in the country, and is double the rate of smartphone store payments in the US.

- There are three main mobile wallet options in China, WeChat, Alipay and newcomer Apple Pay. While WeChat and Alipay generate a QR code for scanning, Apple Pay ties up with China’s biggest card network, UnionPay, which means Apple Pay works at every store that has UnionPay’s PIN-input keypad.

Believe the Hype? How Virtual Reality Could Change Your Life

(June 6) The Star Online

Believe the Hype? How Virtual Reality Could Change Your Life

(June 6) The Star Online

- Virtual reality (VR) was the buzz industry at Asia’s largest tech fair, Computex, held in Taiwan’s capital of Taipei last week. The island is hoping to become a development hub for VR technology.

- HTC is among the major tech firms, including Facebook and Samsung, that have latched on to the immersive experience platform of VR, and HTC has already branched out into the medical sector. Last year, the company invested in a US startup that uses VR to help surgeons plan complicated brain operations. E-commerce is another industry that holds much potential for VR utilization.

LINE App Looks to Build on Asian Popularity with One of the Year’s Biggest Tech IPOs

(June 6) Asian Correspondent

LINE App Looks to Build on Asian Popularity with One of the Year’s Biggest Tech IPOs

(June 6) Asian Correspondent

- LINE, a Japanese subsidiary of South Korean Internet search giant Naver and one of Asia’s most popular messaging services, plans to open its shares to the public in Tokyo and New York this July. The company aims to raise US$1–US$2 billion at a valuation of US$5–US$6 billion.

- The firm’s total reported revenue in 2015 was more than US$1 billion (¥120 billion), up 40% from the previous year. The firm is getting 35% of its revenue from advertisers, while “stickers,” which count as communications-related products, are contributing 22% of its revenue.

Malaysian Fitness Startup KFit Acquires Groupon Indonesia

(June 6) TechinAsia

Malaysian Fitness Startup KFit Acquires Groupon Indonesia

(June 6) TechinAsia

- Malaysian fitness startup KFit issued a statement that it has signed a deal to acquire Groupon Indonesia for an undisclosed amount. Groupon Indonesia will become a wholly owned subsidiary of KFit, while Groupon Inc. will become a strategic shareholder of KFit.

- KFit has already made other strategic moves in 2016. In February, it added more categories, such as massages and beauty salons, to its offering, an indication that it needed to add more revenue streams to its core product. In March, KFit tweaked its model by limiting membership to 10 activities per month for the same rate.

China’s Bitauto Raises US$300 Million; Baidu, JD.com and Tencent Each Chip in US$50 Million

(June 6) TechCrunch

China’s Bitauto Raises US$300 Million; Baidu, JD.com and Tencent Each Chip in US$50 Million

(June 6) TechCrunch

- Bitauto, which operates a giant car marketplace that is described as Cars.com, Consumer Reports and Autotrader.com rolled into one and also invests in transportation startups, has announced a fundraising round of $300 million.

- The publicly traded company is valued at around US$1.4 billion, and is profitable, with revenues from advertising, subscriptions, transactions and marketing.

LATAM RETAIL HEADLINES

New Mexican Textile, Apparel Import Rules Hit US Brands

(June 7) WWD.com

New Mexican Textile, Apparel Import Rules Hit US Brands

(June 7) WWD.com

- Mexico launched an expanded list of reference prices for textiles and garments, causing concerns among US apparel manufacturers, who claim the new scheme hampers trade. The rules could prompt American producers to source elsewhere. The current import system is under review.

- Mexico’s textile and apparel industry is expected to grow by 5% in 2016, while the US’s market share continues to decline as Central American and Asian rivals win new orders.

Interactive Pinterest Pins Let Shoppers in Brazil Bring Offline Items Online

(June 4) Digital Trends

Interactive Pinterest Pins Let Shoppers in Brazil Bring Offline Items Online

(June 4) Digital Trends

- Pinterest has partnered with Brazilian designer furniture retailer Tok&Stok to create a system called Pinlist that allows shoppers to save in-store items to their Pinterest boards. The Pinlist app turns the in-store buying experience into something social by integrating the virtual world.

- Tok&Stok has equipped hundreds of in-store items with physical Pinterest “Pins” that customers can push in order to send a Bluetooth signal to their phones and “pin” the item to their Pinterest boards.

Apple Begins Hiring for “Several” Mexican Apple Stores

(June 7) AppleInsider

Apple Begins Hiring for “Several” Mexican Apple Stores

(June 7) AppleInsider

- Apple listed a plethora of job openings for several stores in Mexico, despite having yet to launch its first store in the country. The company is searching to fill positions at multiple undisclosed locations.

- In January, Apple confirmed plans for a store in Mexico City’s Centro Santa Fe Mall, but has not commented on any rumors of additional stores. It is rumored that Apple is planning a second Mexico City location as a stand-alone store in a luxury shopping district, along with stores in Guadalajara and Monterrey.

FEMSA Comercio Enters Convenience Store Space in Chile

(June 6) Marketwired

FEMSA Comercio Enters Convenience Store Space in Chile

(June 6) Marketwired

- FEMSA Comercio announced that it has acquired Big John, a leading convenience store operator based in Santiago, Chile. There are currently 49 Big John retail locations, mostly in the Santiago metropolitan area.

- FEMSA already operates several small-format retail chains in Mexico, Chile and Colombia, including OXXO convenience stores; YZA, Farmacon, Moderna and Cruz Verde drugstores; and Maicao beauty stores.

Brazil’s Inflation Accelerates More than Forecast in May

(June 8) Bloomberg

Brazil’s Inflation Accelerates More than Forecast in May

(June 8) Bloomberg

- Brazil’s consumer inflation accelerated more than analysts had forecasted in May, as the market expects the central bank to keep interest rates at the same level for a seventh consecutive meeting.

- The Consumer Price Index climbed 0.78% after a 0.61% increase in April; the forecasted median was 0.75%. The 12-month cumulative inflation rate was 9.32%.

This week, we introduced our new concept regarding opportunities in the retail industry: the Four-Quadrant Disruptors Framework. This model identifies four areas of opportunity for innovative retailers and startups that serve the retail industry, and was formulated as a response to the “retail destruction” seen in the US very recently, when a number of major retail names reported disappointing results. In the context of this quickly shifting retail landscape, we identify four areas of opportunity: new retail models, all-channel, experiential retail and customer engagement.

We summarize these quadrants of opportunity below, and direct readers to our full report on fbicgroup.com for complete details of the framework, including greater context and profiles of companies operating within each space.

This week, we introduced our new concept regarding opportunities in the retail industry: the Four-Quadrant Disruptors Framework. This model identifies four areas of opportunity for innovative retailers and startups that serve the retail industry, and was formulated as a response to the “retail destruction” seen in the US very recently, when a number of major retail names reported disappointing results. In the context of this quickly shifting retail landscape, we identify four areas of opportunity: new retail models, all-channel, experiential retail and customer engagement.

We summarize these quadrants of opportunity below, and direct readers to our full report on fbicgroup.com for complete details of the framework, including greater context and profiles of companies operating within each space.

Mall Landlords Embrace High-Tech to Entice Shoppers

(June 7) Retailing Today

Mall Landlords Embrace High-Tech to Entice Shoppers

(June 7) Retailing Today

Norwegian Rain to Open First International Store

(June 7) Theretailbulletin.com

Norwegian Rain to Open First International Store

(June 7) Theretailbulletin.com

LINE App Looks to Build on Asian Popularity with One of the Year’s Biggest Tech IPOs

(June 6) Asian Correspondent

LINE App Looks to Build on Asian Popularity with One of the Year’s Biggest Tech IPOs

(June 6) Asian Correspondent