FROM THE DESK OF DEBORAH WEINSWIG

Brexit Fallout: Retail Winners and Losers

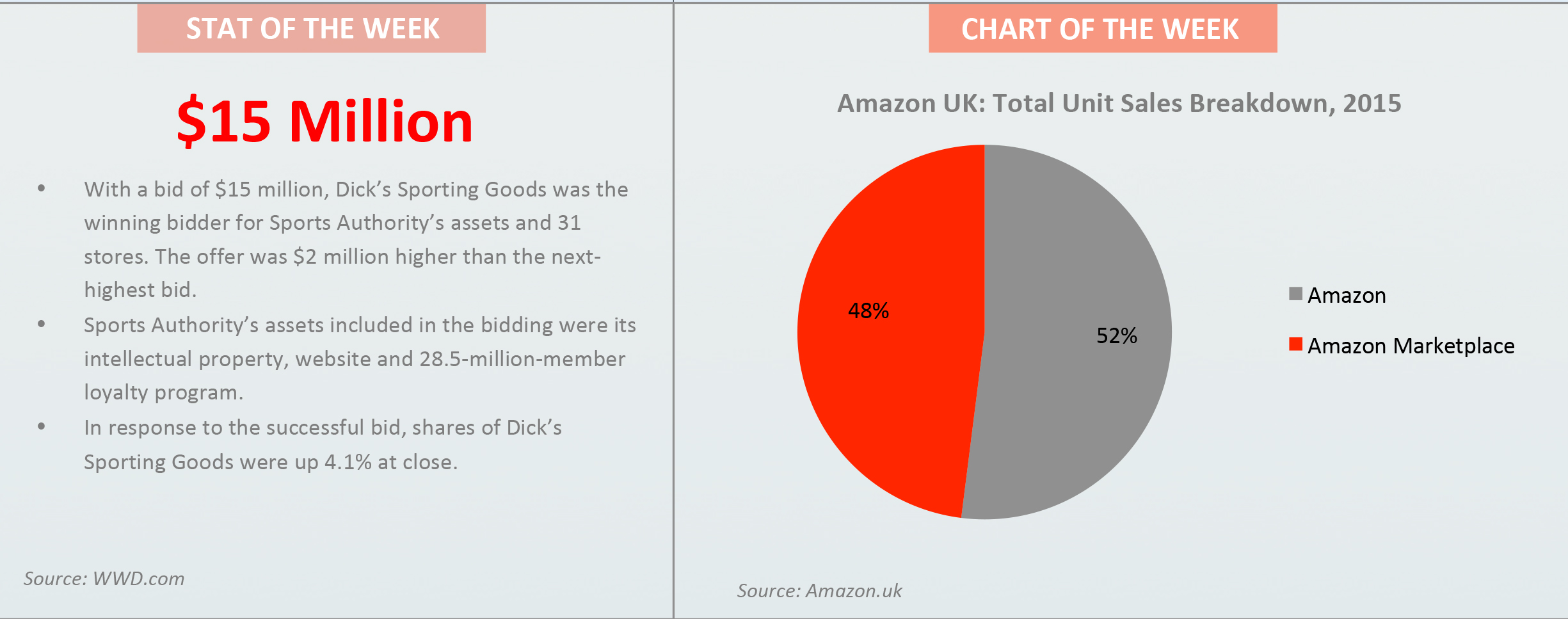

It has been only two weeks since the UK voted to leave the EU. Yet, in that time, Britain has witnessed political upheaval and substantial economic turbulence. As we have digested the fallout from the UK’s Brexit vote, we have crystallized our thinking on which UK sectors and retailers have been left more vulnerable. Our analysis focuses on the near term—the remainder of this year and next year—because visibility into the timing and shape of the UK’s exit beyond that is highly limited.

Near-Term Impacts on Consumers

The effects the Brexit vote will have on economic growth have yet to become clear. But in 2016 and into 2017, we see four principal impacts on UK consumers: house prices could fall; stock prices have declined; interest rates are likely to be cut; and consumer prices could rise. With regard to the latter, we think competitive pressures will force retailers to keep a lid on inflation, especially in the key grocery and apparel categories. Given this, the main negative impacts on consumer sentiment will be the decline in stock prices and any decrease in house prices. Both of these will primarily hit older and more affluent consumers’ willingness to spend, even if they do not dent their actual spending power. Younger and less affluent consumers, who generally have fewer assets, will be more insulated. For mortgage holders, any hit to confidence may be mitigated by lower interest rates.

Accelerating Existing Trends in UK Retail

Even prior to the Brexit vote, UK retail was in a state of flux. Discount channels have been growing fast, especially in grocery; Internet pure plays have been making headway, notably in young fashion; and long-standing middle-ground retailers across food and nonfood have been retrenching as customers have splintered away to more targeted retailers, including those in the discount and e-commerce channels.

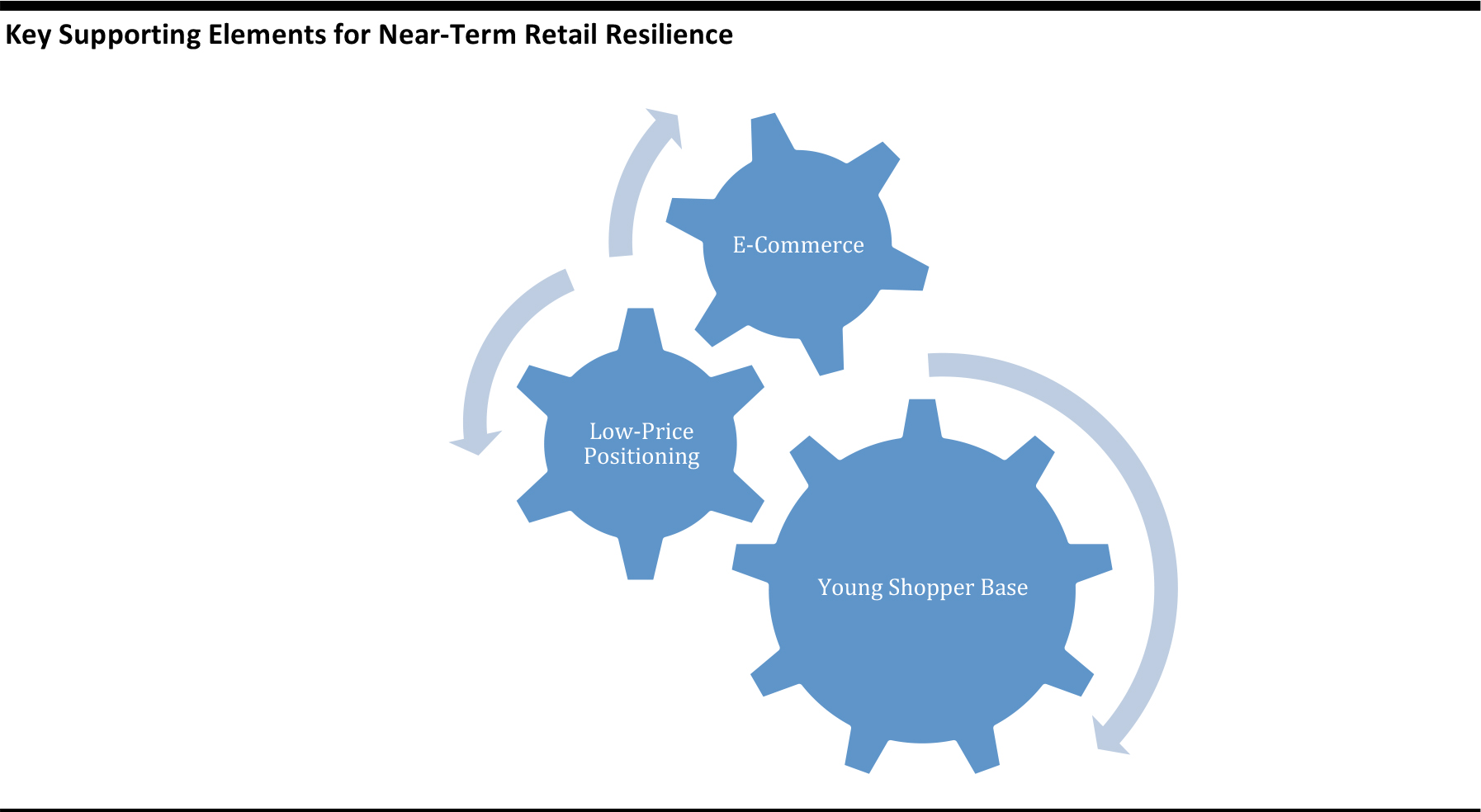

We expect the Brits’ decision to leave the EU to accelerate these existing retail trends, and that resulting tailwinds will include:

- Mass adoption of discount formats, which may be accelerated by some middle-class shoppers trading down.

- A structural shift to the online channel; this will be strengthened by digitally savvy younger consumers proving a resilient segment and by other age groups switching channels in pursuit of value.

- Younger consumers’ relative insulation from Brexit’s near-term economic impacts.

Retailers that can capitalize on one or more of these trends look to be best positioned to weather the effects of the vote in the short term. For instance, we see Internet pure plays such as boohoo.com, which cater to young consumers with budget fashion, as one standout segment.

Source: Fung Global Retail & Technology

Which Names Will Prove Most Resilient?

The following are the major retailers that we see ticking one or more of the boxes noted above, and that we therefore expect to prove among the most resilient in UK retail: Aldi and Lidl, which will benefit from their low-price positioning as well as from structural shifts to smaller-store formats; Amazon, which will be helped by its strong price-competitive positioning, its push into apparel and its new grocery offering; ASOS, which will be bolstered by its young customer base and price-competitive positioning; and boohoo.com, which, like ASOS, targets young shoppers, but which has a stronger focus on low prices.

Elsewhere, we see trading down by middle-class shoppers and older shoppers as a risk for some retailers, which means that premium mass-market names with a more affluent customer base look somewhat vulnerable. Grocery retailers such as Sainsbury’s and Ocado are among the names that could be impacted if shoppers start cutting back. Big-ticket retailers such as do-it-yourself stores are likely to see subdued demand if house prices decline. Finally, in fashion, we expect any weakening of sentiment among middle-class, middle-aged and older shoppers to make life even tougher for well-established midmarket brick-and-mortar retailers.

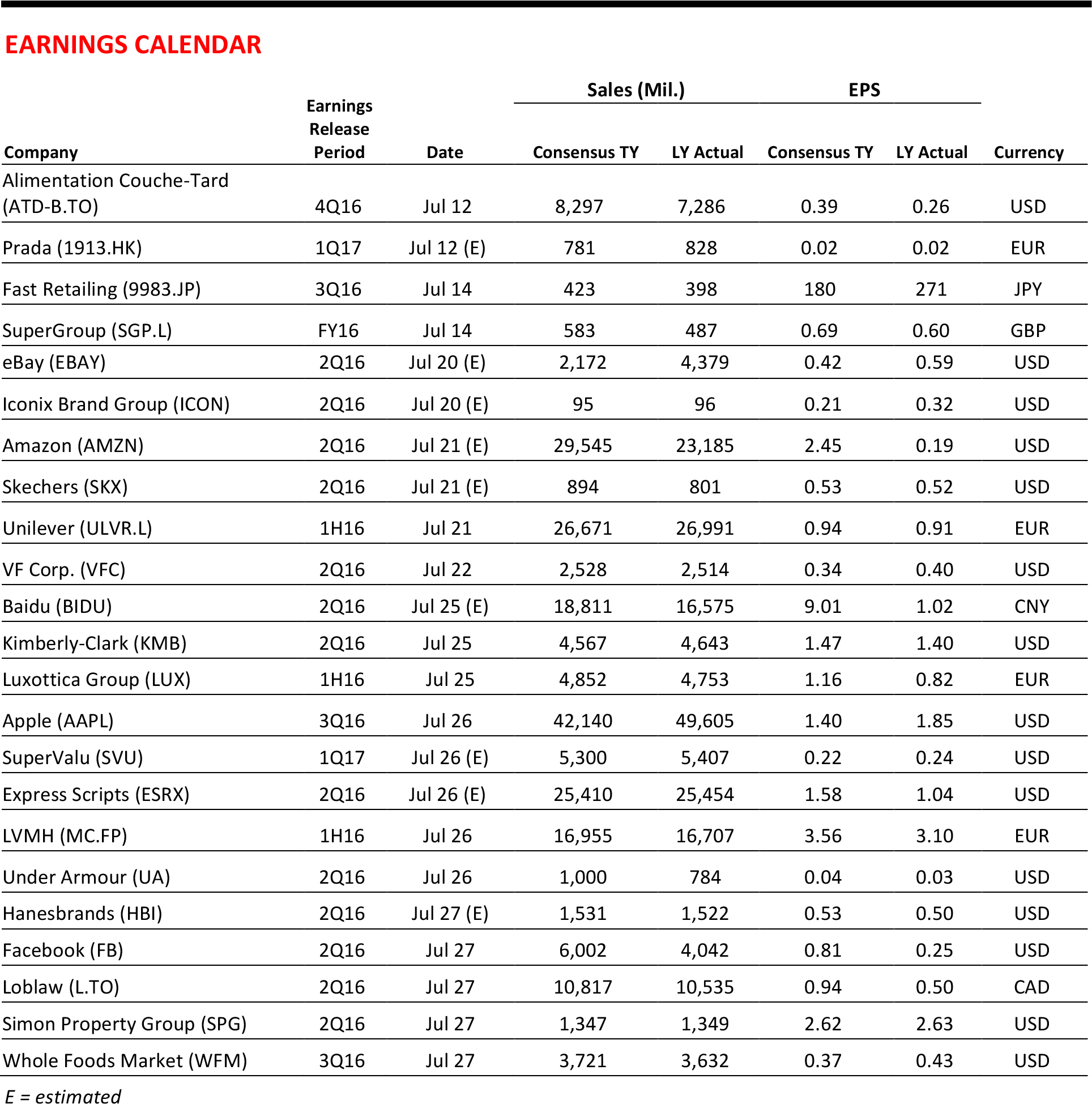

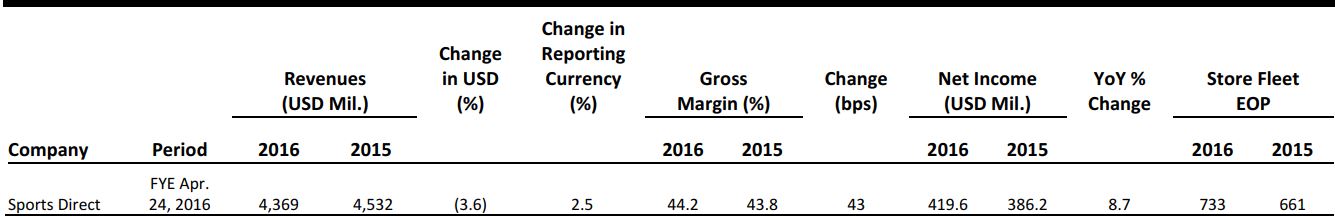

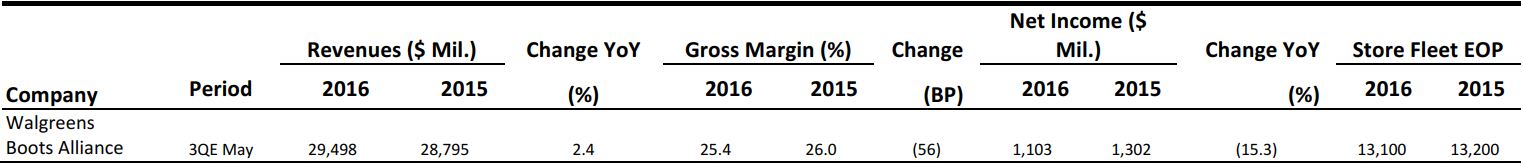

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Retailers’ Fourth of July Weekend: No Firecracker

(July 5) Women’s Wear Daily

Retailers’ Fourth of July Weekend: No Firecracker

(July 5) Women’s Wear Daily

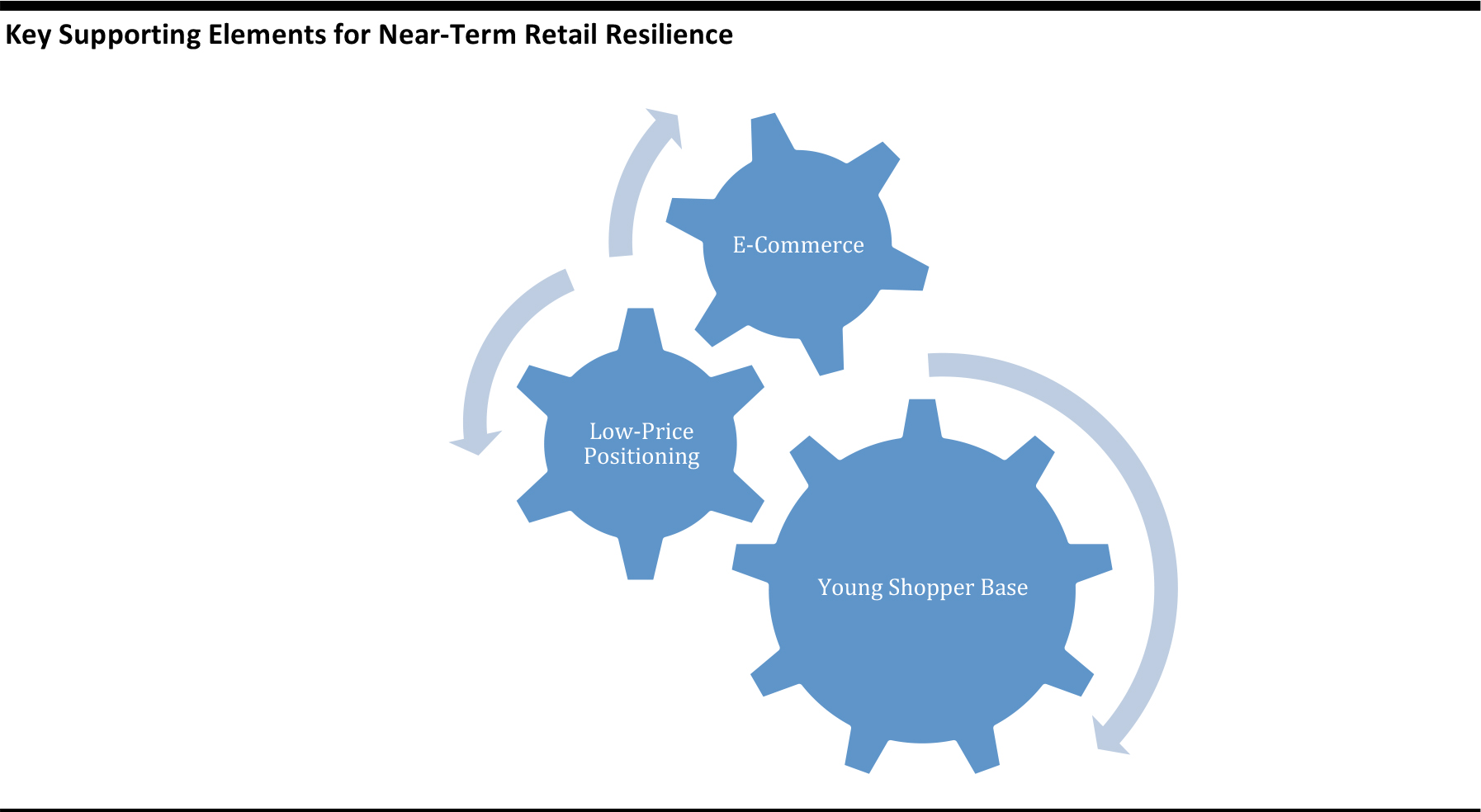

- Chaotic world events seem to have deterred consumer spending recently. In response, retailers are stepping up promotions in order to clear excess inventories, and a number of new promotions and extensions of old ones popped up after the Independence Day holiday weekend.

- Senior retail executives say they have seen low store traffic, strength in the off-price sector and thin inventories. Consumers continue to avoid paying full price for goods, with full-price units sold down 9.5% and orders using a promotion up 38% during the week leading up to the Fourth of July.

Synthetic Spider Silk Could Be the Biggest Technological Advance in Clothing Since Nylon

(July 3) Quartz

Synthetic Spider Silk Could Be the Biggest Technological Advance in Clothing Since Nylon

(July 3) Quartz

- Spider silk’s tensile strength is comparable to steel’s, yet it is lighter and can be as stretchy as a rubber band. Because of these mystical qualities, several companies are racing to create a synthetic version of the thread.

- Bolt Threads, for example, is a California-based startup that makes protein microfibers from modified yeast, water and sugar. The material could be used for everything from car parts to medical devices to performance outdoor gear.

Shoppers Prefer Retailers’ Payment Apps to Apple Pay, Android Pay

(July 5) Luxury Daily

Shoppers Prefer Retailers’ Payment Apps to Apple Pay, Android Pay

(July 5) Luxury Daily

- A report from Parks Associates shows that more than 25% of smartphone owners in the US are using mobile payment applications at least once a month. Retailers are embracing the technology, and more than 3 million of them now accept Apple Pay and Android Pay.

- Despite the growth of these two mobile payment platforms, consumers are using retailer-specific apps more frequently. For example, the Starbucks app accepts 5 million transactions per month. Retailer-specific apps allow retailers to control all aspects of the payment app experience within their stores.

Pinterest for Fashion Brands: “It’s Not There Yet”

(July 5) Glossy

Pinterest for Fashion Brands: “It’s Not There Yet”

(July 5) Glossy

- Fashion is a top category on Pinterest and an estimated 55% of users shop via the platform, according to the company. However, it is unclear if the platform’s latest efforts will succeed in the fashion realm.

- As a social media platform for shopping, Pinterest is unique because it allows brands to unabashedly share promoted content—unlike Instagram and Facebook, which foster dialog among users and promote commenting. However, Pinterest still lacks typically critical fashion information, such as sizing charts and reviews.

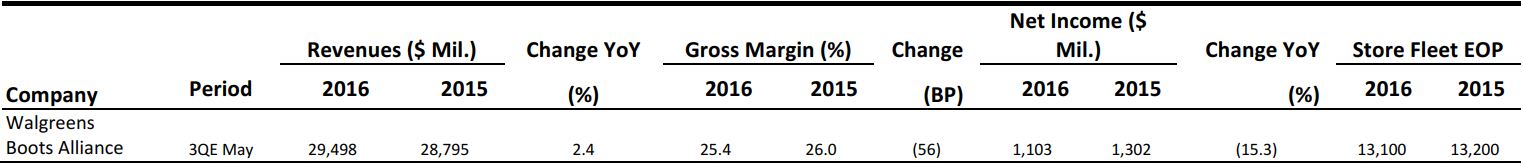

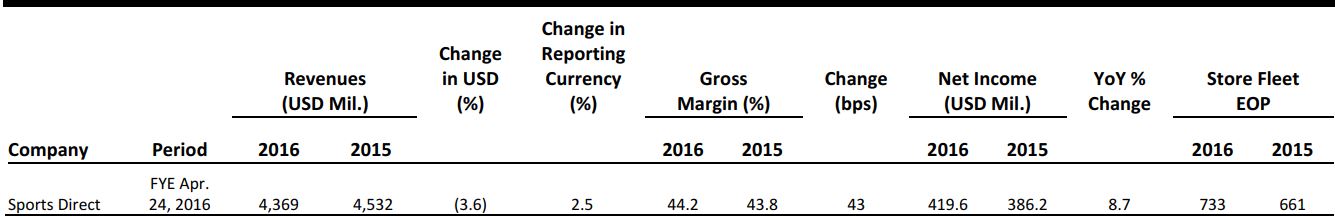

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Marks & Spencer Reports 1Q17 Slump in Clothing and Home Sales

(July 7) Company press release

Marks & Spencer Reports 1Q17 Slump in Clothing and Home Sales

(July 7) Company press release

- British food, clothing and home retailer Marks & Spencer (M&S) reported that group sales fell by 0.4% in the first quarter of fiscal 2017. However, UK sales were down 1.1% in total and down 4.3% on a comparable basis.

- The disappointing UK performance was driven by an 8.9% slump in comparable sales in the clothing and home segment; the result was below the consensus estimate, which called for a decline of approximately 4%. Comps for the UK food segment were down 0.9%. The company attributed the fall in clothing and home sales to weaker consumer confidence, fewer promotions and lower prices.

BHS International Stores Sold to Qatari Group

(June 30) Retail-week.com

BHS International Stores Sold to Qatari Group

(June 30) Retail-week.com

- The administrators of UK department store chain BHS have struck a deal to sell the group’s international stores and website to Al Mana, a Qatari group that already runs some overseas stores under a franchise agreement.

- Outside the UK, BHS has 15 franchise partners operating 72 stores in 19 countries. The deal emerged less than a month after it was revealed that BHS would be wound down because administrators were unable to find a buyer.

Sainsbury’s Set to Double Its Number of Click-and-Collect Sites

(July 4) Retailgazette.co.uk

Sainsbury’s Set to Double Its Number of Click-and-Collect Sites

(July 4) Retailgazette.co.uk

- Sainsbury’s, the UK’s second-biggest grocery retailer, plans to double its number of click-and-collect grocery collection sites over the next 12 months. The company launched its click-and-collect service for groceries in March 2015.

- The company’s Online Director, Robbie Feather, said most customers using its drive-through collection points do so for big, weekly shops.

Sainsbury’s and Dansk Supermarked Group to End Netto UK Joint Venture

(July 4) Company press release

Sainsbury’s and Dansk Supermarked Group to End Netto UK Joint Venture

(July 4) Company press release

- Sainsbury’s and Dansk Supermarked Group announced that they are ending their joint venture to operate Netto discount stores in the UK. The venture was launched in June 2014 and had reached a total of 16 stores.

- Announcing the ending of the venture, Sainsbury’s CEO Mike Coupe noted that the “need to grow at pace and scale” would have required “significant investment and the rapid expansion of the [Netto] store estate.”

Dreams Set for £400 Million Sale Three Years After Administration

(July 4) Retail-week.com

Dreams Set for £400 Million Sale Three Years After Administration

(July 4) Retail-week.com

- UK bed retailer Dreams is poised for a £400 million (~US$518 million) sale by its owner, Sun European Partners. The sale of the 180-store chain is reported to be planned for later this year, though it is unclear who is in the running to acquire it.

- Dreams was bought out of administration by Sun European Partners in 2013. The company posted pretax profits of £13.1 million (~US$17 million) in the year ended December 23, 2015, after shutting declining stores and revamping profitable ones.

Metro Plans to Build Its Largest Logistics Park

(July 5) Company press release

Metro Plans to Build Its Largest Logistics Park

(July 5) Company press release

- Metro is planning to build its largest logistics hub, in Marl, Germany, to service its Metro Cash & Carry stores and Real hypermarkets. With a total area of more than 220,000 square meters, the logistics center will be the largest in Germany and will employ more than 1,000 people.

- Construction should start during the third quarter of fiscal year 2016 and the hub should be up and running in autumn 2017. The park will be a central element of Metro’s new logistics strategy, announced in September 2015, which aims for a radical modernization of the company’s logistics network in Germany.

ASIA TECH HEADLINES

Singapore’s Accuron Acquires Malaysia’s Aurum

(July 4) e27.co

Singapore’s Accuron Acquires Malaysia’s Aurum

(July 4) e27.co

- Accuron Technologies, a Singaporean technology and engineering company owned by Temasek, acquired Aurum Healthcare, a Malaysian medtech company. It was the sixth acquisition that Accuron’s medtech division has made in the past two and a half years.

- According to Accuron Medtech Group CEO Abel Ang, the company will be able to make use of Aurum’s capabilities, networks and expertise to maximize its market and technology reach.

Live-Streaming Is Getting Popular in China

(July 5) Bloomberg

Live-Streaming Is Getting Popular in China

(July 5) Bloomberg

- Live-streaming is becoming increasingly popular in China, with millions broadcasting live videos for rewards and millions more watching them. Top streamers and streaming platforms generate millions in revenues from gifts and gift commissions.

- Live-stream platforms such as Momo and Inke are selling virtual gifts, including flowers, cars and toys, for people who want to reward their favorite live-streamers.

Japan’s Line Raises Price of $1.1 Billion IPO

(July 4) Bloomberg

Japan’s Line Raises Price of $1.1 Billion IPO

(July 4) Bloomberg

- Line, Japan’s most popular messaging service, raised its IPO price, citing strong demand and market conditions. The company increased the price range of shares to ¥2,900–¥3,300 from an earlier target of ¥2,700–¥3,200, which could help it raise up to ¥132.8 billion (US$1.3 billion).

- Line planned to hold an IPO two years ago, but suspended the process in order to get more support from investors. It is estimated that, post-IPO, Line will be valued at about ¥693 billion (US$6.6 billion), which is less than its 2014 target of ¥1 trillion (US$9.5 billion).

SK Telecom Commercializes IoT-Dedicated Network

(July 4) ZDNet

SK Telecom Commercializes IoT-Dedicated Network

(July 4) ZDNet

- SK Telecom, a mobile carrier in South Korea, has commercially launched a nationwide network for IoT services such as remote light control, wireless meter readings, manhole monitoring and wearables.

- Customers can use 100MB of data per month for only US$1.75, while those using the network just for meter reading will pay an even lower price—US$.031 per month.

LATAM RETAIL HEADLINES

Chile’s Falabella Sees Investment Opportunity in Argentina

(July 1) FashionMag.com

Chile’s Falabella Sees Investment Opportunity in Argentina

(July 1) FashionMag.com

- Chilean retailer Falabella first invested internationally in Argentina, and the company plans to continue those investments, encouraged by the inauguration of a business-friendly president, Mauricio Macri, in December 2015.

- Macri cut a deal with holdouts from Argentina’s 2002 default, eliminated capital controls and let the peso float. Falabella is interested in further investment in infrastructure in Argentina, given Macri’s deal with the holdouts and easing inflation.

Mexico’s Liverpool Reaches Deal to Acquire Chile’s Ripley

(July 6) Reuters

Mexico’s Liverpool Reaches Deal to Acquire Chile’s Ripley

(July 6) Reuters

- Mexico’s high-end department store chain Liverpool announced that it would acquire Chilean retailer Ripley for CLP$420 (US$0.63) per share.

- While an agreement has been reached, the deal is still subject to various conditions, including regulatory approval. Liverpool has said that it will consider the deal successful if it is able to acquire at least 25.5% of Ripley’s shares.

Retail Sales Down 10% in Argentina as Consumption Slumps

(July 4) Buenos Aires Herald

Retail Sales Down 10% in Argentina as Consumption Slumps

(July 4) Buenos Aires Herald

- Retail sales in Argentina are plunging as a result of declining consumption. June was the sixth consecutive month in which small retailers reported declines in sales, and the month of steepest decline so far in 2016.

- Reports say that sales fell by 9.8% in June as consumers cut expenses on everything except necessities. All sectors reported declines except for chemists’ shops and pharmacies. Since January 2016, retail sales have fallen by 6.4% per month, on average.

Rio 2016 Signs Insect Repellent Sponsor amid Zika Concerns

(July 4) Bloomberg

Rio 2016 Signs Insect Repellent Sponsor amid Zika Concerns

(July 4) Bloomberg

- The Olympic Games, set to be held in Rio de Janeiro this summer, are battling to convince athletes and tourists that the city will be safe from Zika-carrying mosquitos. Thus, Rio 2016 has signed the Olympics’ first-ever insect repellent partner, SC Johnson’s OFF! brand.

- OFF! will play an official role at the Games starting August 5. Thousands of bottles of the insect repellent will be given to athletes, staff and volunteers. Rio 2016 will distribute 115,000 bottles in total during the event and provide free samples at Olympic venues.

Mexico’s Junk-Food Tax Cuts Purchases by 5.1%

(July 5) Associated Press

Mexico’s Junk-Food Tax Cuts Purchases by 5.1%

(July 5) Associated Press

- Mexico implemented an 8% tax on high-calorie snacks in 2014, and a recent report says that the tax has been successful in reducing junk-food purchases, but only marginally and only among lower-income and middle-class households. The report says there was an average 5.1% reduction in purchases of items subject to the tax.

- The report also indicates that higher-income shoppers have not been impacted at all by the tax, while lower-income households have decreased their junk-food consumption by 10.2%. The study did not indicate whether these families had reduced their calorie intake or simply switched to cheaper, unregulated street foods.