From the Desk of Deborah Weinswig

Alibaba Enters the Intelligent Digital Assistant Fray

This week, Alibaba threw its hat into the intelligent digital assistant ring, joining Amazon, Google, Apple, Microsoft, Baidu and several others that are already fighting for share in the space.

The company announced the Tmall Genie X1 (named after its Tmall e-commerce platform), which uses artificial intelligence (AI) and Internet connectivity to perform tasks such as reporting the user’s daily calendar, providing weather updates, playing music and controlling smart home devices. In a demo, the Genie ordered and purchased a Coca-Cola, played music, recharged a prepaid phone, and controlled a TV and a humidifier. Naturally, the device can also make purchases on Alibaba’s Tmall platform.

The appliance is attractively priced at under $75 (¥499), well below the Amazon Echo ($180) and the Google Assistant ($129). Readers should not rush out to buy one right away, though. The Genie currently only understands Mandarin, and is activated by the phrase

Tianmao Jingling (“Tmall Genie”).

In the US and Europe, Amazon’s Echo has established itself as the platform to beat. The Echo is part of a virtuous circle for Amazon: increasing numbers of Prime members receive an increasing number of benefits and exclusive services, which encourage even more consumers to sign up for the service. Amazon recently offered a cheaper Prime membership in the US for those receiving government assistance, which further widens its potential customer base. The number of tasks the Echo can accomplish—called skills—continues to grow dramatically, reaching 15,000 most recently, up from 10,000 in February. To further spur demand, Amazon offers sales on its hardware periodically, and the upcoming Prime Day is likely to feature such discounts as well as deals exclusive to the Echo, which will encourage consumers to subscribe to Prime and purchase an Echo.

The Google Assistant is also a worthy contender. The Assistant easily connects to all the Google services and is the portal to the fruits of Google’s substantial R&D in AI. Like the Echo, it controls smart home devices and can perform tasks such as making restaurant reservations and sending messages. Whereas the Echo executes commands, the Google Assistant uses more layers of AI to be more conversational, and it can also make use of contextual information.

Then there is Apple’s HomePod, to be released in December with a hefty $349 price tag. The HomePod uses Apple’s Siri digital assistant and can control smart home devices that use Apple’s HomeKit and get information on weather, traffic and sports. The HomePod is more focused on music than competing products are, and it includes a microphone array that enables it to make out voice commands from across the room, even while loud music is playing, as well as a woofer and an array of tweeter speakers. Two HomePods placed in a room will automatically detect each other and balance their sound production.

Further crowding the marketplace are Microsoft’s Cortana intelligent assistant, Baidu’s Xiaoyu Zaijia (“little fish”) intelligent assistant and JD.com’s LingLong DingDong (through a joint venture).

Although it appears that Alibaba’s Genie is a late arrival to the market, the company has several huge advantages, particularly in China and other parts of Asia. Primarily, Alibaba dominates e-commerce in China: Tmall had a 56.6% share in 2016, according to iResearch. By comparison, Amazon accounted for 43% of e-commerce in the US in 2016, according to Slice Intelligence. Since Amazon has only a small presence in China and Google not much of a presence at all, Alibaba has little competition from US companies, although it does face substantial competition from domestic rivals such as Baidu and JD.com.

This heightened competition is likely to further heat up the intelligent assistant space, in addition to offering positive benefits (including new services) for consumers, and Fung Global Retail & Technology will continue follow the development of these devices.

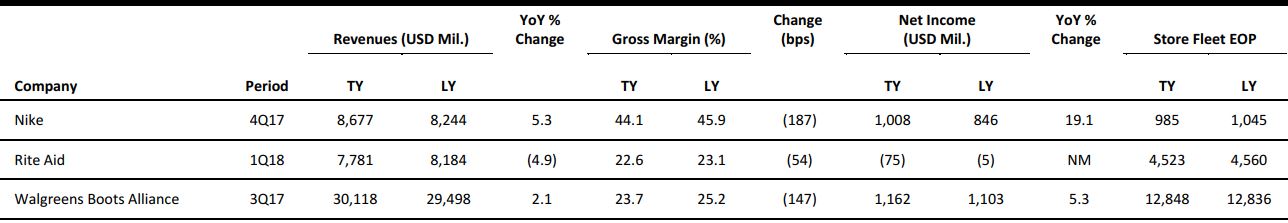

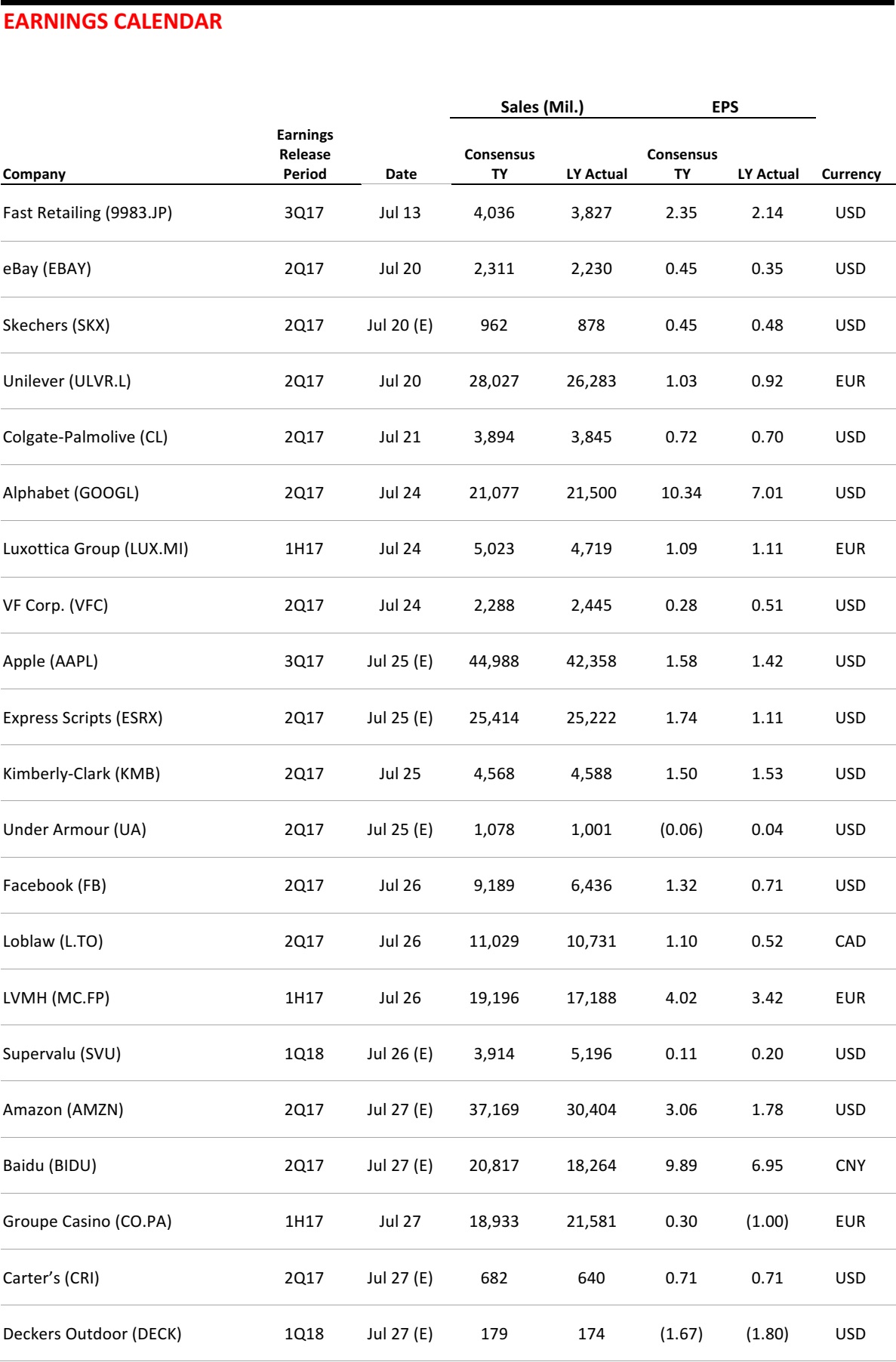

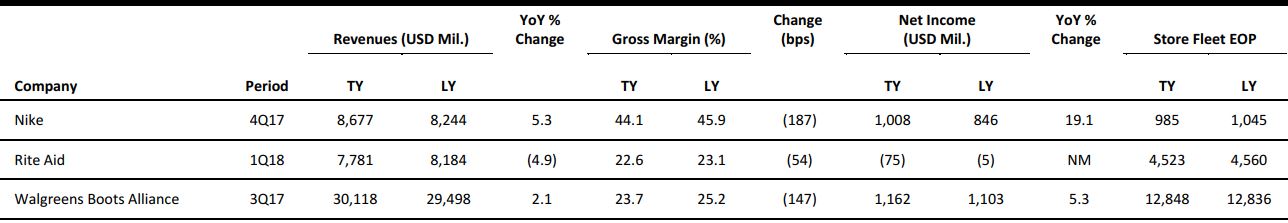

US RETAIL EARNINGS

Source:Company reports

US RETAIL & TECH HEADLINES

US Denim Retailer True Religion Files for Bankruptcy Protection

(July 5) Reuters.com

US Denim Retailer True Religion Files for Bankruptcy Protection

(July 5) Reuters.com

- US denim retailer True Religion Apparel filed for bankruptcy protection and signed a restructuring agreement with a majority of its lenders. True Religion, a company whose denims have gradually fallen out of style, filed for creditor protection under Chapter 11 in the US bankruptcy court in the District of Delaware, and listed assets and liabilities in the range of $100–$500 million.

- The restructuring agreement with lenders, including TowerBrook Capital Partners, will slash the company’s debt by over $350 million, it said in a statement.

Americans Spend Big on Booze, Beef on July 4

(July 4) USA Today

Americans Spend Big on Booze, Beef on July 4

(July 4) USA Today

- This July 4, holiday revelers are expected to dole out $7.1 billion for food for Independence Day barbeques and picnics, up from $6.8 billion in 2016, the National Retail Federation forecast. US meat consumption is on the rise year-round, but beef enthusiasts certainly live it up on July 4, the apex of the grilling season.

- Last year, Americans bought close to $804 million worth of beef in the two weeks around the holiday, according to Nielsen, which tracks consumer data. They also purchased more than $371 million worth of chicken and more than $217 million worth of pork.

Nike Makes It Official: It Will Sell on Amazon and Instagram

(June 30) Fortune.com

Nike Makes It Official: It Will Sell on Amazon and Instagram

(June 30) Fortune.com

- Nike confirmed it will finally start selling its products directly on Amazon.com, betting that the extra sales will outweigh any loss of control in how its merchandise is presented. The partnership with Amazon is in its early stages and involves only a limited selection of Nike products for now.

- While Nike is one of the top-selling brands on Amazon, its products previously have only been available via third-party vendors on Amazon’s marketplaces. The proliferation of third-party sellers on the site has weakened many top brands’ control of pricing and distribution, prompting them to take a risk and sell directly on Amazon.

Staples in $6.9 Billion Deal to Be Acquired by Sycamore Partners

(June 29) USA Today

Staples in $6.9 Billion Deal to Be Acquired by Sycamore Partners

(June 29) USA Today

- Staples agreed to be acquired by private equity firm Sycamore Partners for $6.9 billion, a deal that will dramatically restructure the struggling office supply retailer. Staples’ shareholders will receive $10.25 per share in cash, a premium of about 11% before traders learned of the deal last Wednesday afternoon.

- Staples has been in talks with private equity firms for weeks regarding a deal. Investors have been aware of their talks at least since April 3, when news headlines about the talks began to emerge.

Walgreens Scraps Rite Aid Deal and Will Instead Buy 2,200 Stores for $5 Billion

(June 29) Fortune.com

Walgreens Scraps Rite Aid Deal and Will Instead Buy 2,200 Stores for $5 Billion

(June 29) Fortune.com

- Walgreens Boots Alliance will not be buying smaller rival Rite Aid after all. The deadline to win regulatory approval was looming and approval seemed unlikely for the $9.4 billion deal, first announced almost two years ago.

- Walgreens said it was scrapping the planned acquisition of Rite Aid as a whole and would instead simply buy 2,186 Rite Aid stores, or about 45% of its fleet, along with three distribution centers and related Rite Aid inventory, for $5.175 billion.

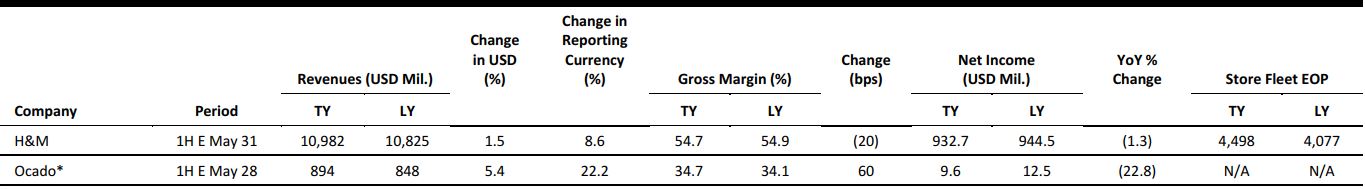

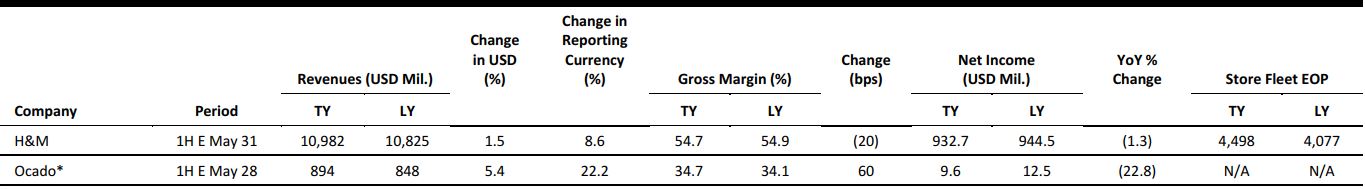

EUROPE RETAIL EARNINGS

*1H16 comprised 24 weeks and 1H17 comprised 26 weeks.

Source: Company reports/Fung Global Retail & Technology

EUROPE RETAIL HEADLINES

Clarks to Bring Shoe Production Back to the UK

(July 3) Retail-Week.com

Clarks to Bring Shoe Production Back to the UK

(July 3) Retail-Week.com

- British footwear retailer Clarks plans to bring shoe production back to the UK, and the company has set up a new manufacturing unit at its headquarters in Somerset for a pilot run. The unit has the capacity to produce 300,000 desert boots per year and will create up to 80 jobs.

- Clarks is trialing onshore manufacturing in a move to get new ranges to market quickly. Should the trial be successful, the company will open additional production centers in the US, Europe and Asia.

Carrefour Prepares IPO for Brazilian Division

(June 29) RetailDetail.eu

Carrefour Prepares IPO for Brazilian Division

(June 29) RetailDetail.eu

- French retailer Carrefour is preparing its Brazilian branch’s IPO. It hopes to attract R$4.5–R$5.6 billion (US$1.3–$1.7 billion).

- Carrefour will still control 71% of its branch following the IPO, and it intends to use the money raised to compete with Groupe Casino’s South American branch.

Aldi to Invest €5 Billion in Stores

(July 2) Reuters.com

Aldi to Invest €5 Billion in Stores

(July 2) Reuters.com

- German discount grocery chain Aldi North is planning to spend more than €5 billion (US$5.7 billion) to revamp its stores worldwide.

- German newspaper Bild am Sonntag reported that Aldi North plans to finance its investment with existing cash rather than by taking on debt, but that the project still needed the approval of one of the three foundations that control the company.

Supergroup Unveils Results Early

(June 30) TheTimes.co.uk

Supergroup Unveils Results Early

(June 30) TheTimes.co.uk

- British brand Supergroup has been forced to publish highlights from its results early after an employee’s handbag containing a draft of its preliminary figures was stolen.

- In the year ended April 29, revenue rose by 27%, to £752 million, and comps were up 12.7% on a comparable 52-week basis.

Ocado Trials Self-Driving Delivery Car

(June 29) RetailDetail.eu

Ocado Trials Self-Driving Delivery Car

(June 29) RetailDetail.eu

- British online supermarket Ocado has trialed its self-driving delivery “milk float” for the first time in London. For safety reasons, two drivers were still present in the car.

- The car has room for eight orders and customers will need to extract their order from the car themselves. Ocado hopes the car will be fully functional by 2019 and it plans to sell the system to other retailers.

ASIA TECH HEADLINES

Chinese Co-Working Unicorn URWork Raises $30 Million from Healthcare Firm Aikang

(July 5) TechCrunch.com

Chinese Co-Working Unicorn URWork Raises $30 Million from Healthcare Firm Aikang

(July 5) TechCrunch.com

- URWork, a Chinese co-working office space with a billion-dollar valuation, announced that it has closed a $30 million investment from Beijing’s Aikang Group. Both sides said the strategic deal will grow the selection of services for URWork customers and help unlock additional revenue.

- The new investment adds to URWork’s six rounds of funding, which total $175 million, and one merger since its launch in April 2015. URWork’s annual revenue is approximately $58.5 million, of which 75% comes from its core office space rental business. The investment from Aikang is aimed at generating additional monetization opportunities around its community.

Tencent’s Online Publishing Arm Files for IPO in Hong Kong

(July 4) TechCrunch.com

Tencent’s Online Publishing Arm Files for IPO in Hong Kong

(July 4) TechCrunch.com

- Tencent’s online publishing service, China Literature, is planning for a Hong Kong IPO. The service is akin to Amazon’s Kindle service, and offers 8.4 million pieces of content from more than 5 million writers. Across all services, China Literature counts 175.3 million monthly users, more than 90% of which are on mobile.

- The service is being spun out of Tencent, Asia’s highest-valued tech firm, which currently owns a 65% share of the business. Tencent plans to sell part of its equity for the listing, but it is seeking to retain at least 50% control as China Literature becomes a subsidiary.

Edtech Startup Ruangguru Raises Series B Round Led by UOB’s Venture Arm

(July 4) TechinAsia.com

Edtech Startup Ruangguru Raises Series B Round Led by UOB’s Venture Arm

(July 4) TechinAsia.com

- Indonesian edtech startup Ruangguru announced that it has completed its series B financing round. The lead investor is UOB Venture Management, the private equity arm of Singapore-headquartered United Overseas Bank (UOB). The amount was not disclosed.

- Ruangguru’s main offering is a tutoring marketplace that allows tutors and students to connect and arrange offline, one-on-one classes. The startup raised a seven-digit series A round in December 2015 that was led by Venturra Capital, which focuses on early-stage tech companies in Southeast Asia.

Another Chinese Cycle Sharer Shuts Shop Due to Stolen Bikes

(July 4) TechinAsia.com

Another Chinese Cycle Sharer Shuts Shop Due to Stolen Bikes

(July 4) TechinAsia.com

- 3Vbike has become the latest of China’s bike-sharing services to shut down because most of its bicycles have gone missing. The majority of the Beijing-based startup’s bikes have been lost or stolen. Wu Shenghua, 3Vbike’s founder, said that he had spent over $100,000 of his own money to purchase around 1,000 bikes after a funding round managed to raise just $14,700.

- 3Vbike’s failure follows last month’s closure of Chongqing-based bike sharer Wukong. That company’s founder blamed the shutdown on its inability to secure quality bicycles like those used by its larger competitors.

LATAM RETAIL AND TECH HEADLINES

SA’s Naspers Invests R$393 Million in Brazil’s Movile

(June 30) TechFinancials.co.za

SA’s Naspers Invests R$393 Million in Brazil’s Movile

(June 30) TechFinancials.co.za

- Naspers, Africa’s biggest tech firm, announced that it has invested R$393 million (US$30 million) in Movile, a mobile marketplace based in Brazil. Innova Capital, a private equity fund focused on high-growth, innovative companies in Latin America and the US, also invested US$23 million in Movile.

- The tech firm said the funds will be used to fuel growth in food delivery, tickets and education apps as well as in Rapiddo, an online-to-offline platform recently launched in Latin America that consolidates several popular consumer services in one convenient place.

L’Oréal to Sell The Body Shop for €1 Billion

(July 3) BizCommunity.com

L’Oréal to Sell The Body Shop for €1 Billion

(July 3) BizCommunity.com

- Beauty products giant L’Oréal has signed a contract to sell The Body Shop to Brazilian cosmetics maker Natura Cosméticos for a reported €1 billion (US$1.13 billion). L’Oréal said it has received the nod of approval from its works council, but the proposed sale is subject to clearance by antitrust authorities, notably in Brazil and the US. The deal is expected to close during 2017.

- The acquisition forms part of the group’s plans to grow internationally. Combined with The Body Shop, Natura said it would have annual sales of R$11.5 billion (US$3.5 billion), 3,200 retail outlets and 17,000 employees.

Paraguay/Brazil Border Cell Shop Expansion

(July 3) TRBusiness.com

Paraguay/Brazil Border Cell Shop Expansion

(July 3) TRBusiness.com

- Tax-free retailer Grupo Cell Motion is undertaking a significant refurbishment of its Cell Shop department store at Ciudad del Este’s Ibiza Shopping Mall on the Paraguay/Brazil border. A tranche of exclusive new brands are being procured steadily under distribution agreements.

- The border group, which functions in direct import, distribution, wholesale and retail activities, is in the midst of a sizable expansion initiative to almost double the store’s existing footprint in Paraguay’s tax-free zone from 4,500 square meters to 8,000 square meters.

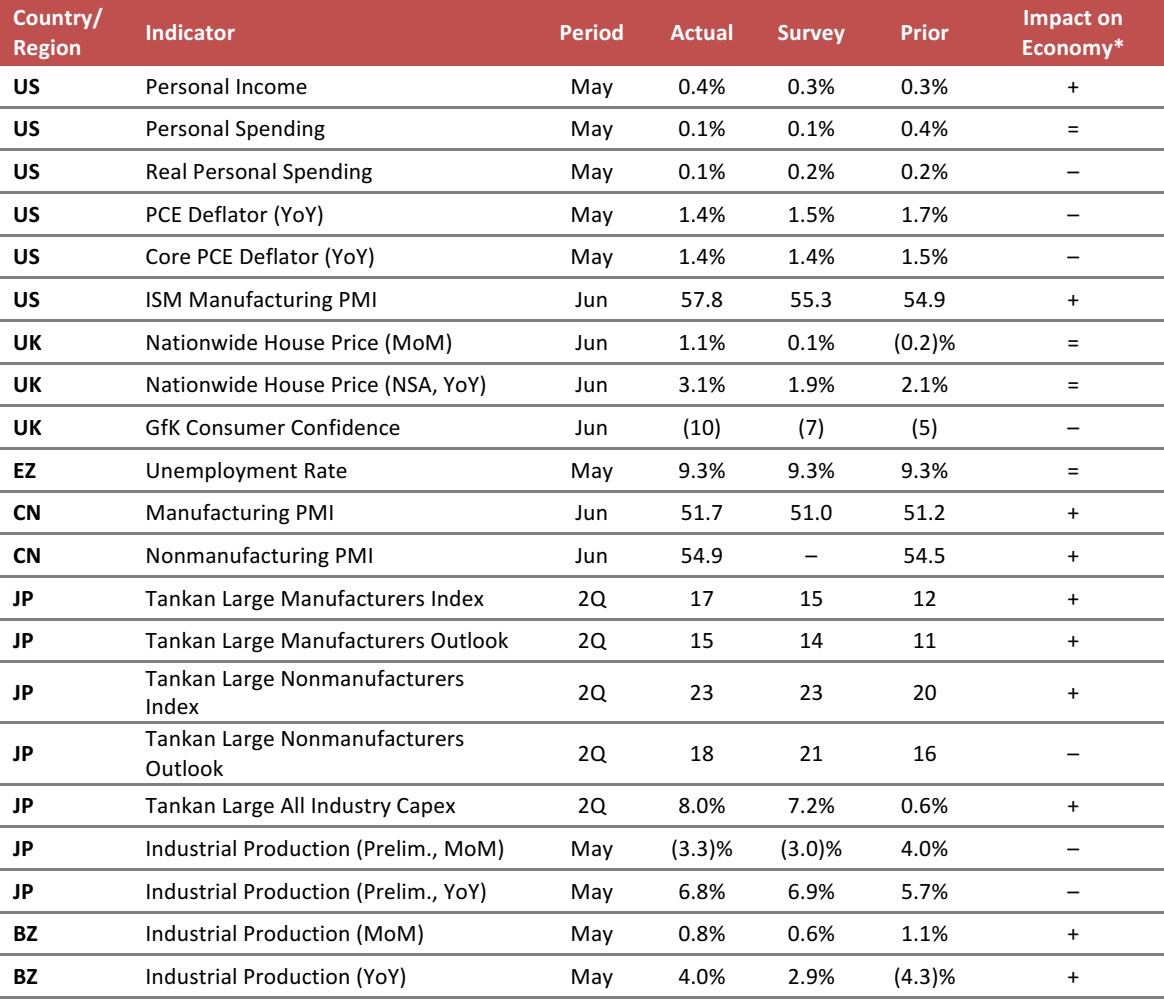

MACRO UPDATE

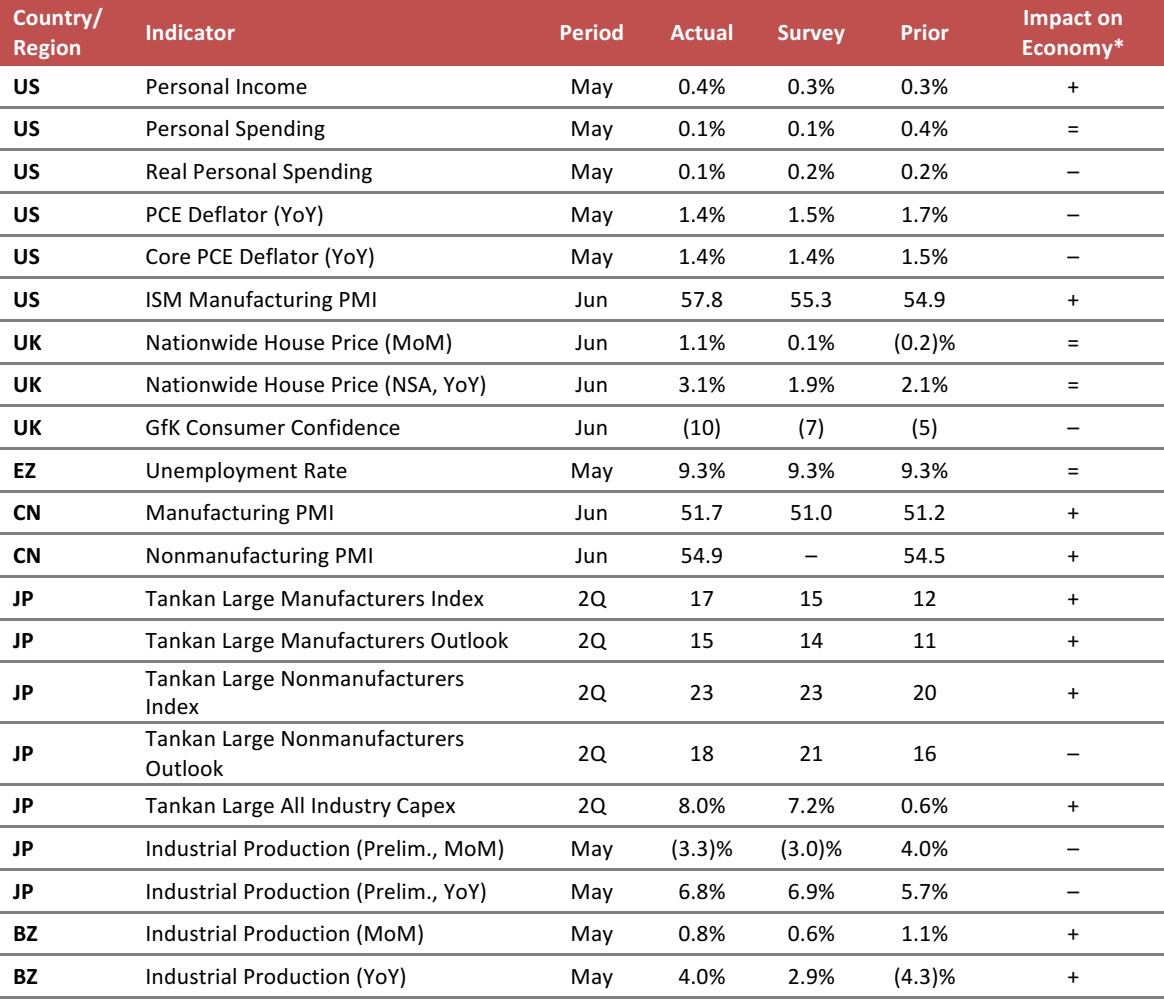

Key points from global macro indicators released June 28–July 5, 2017:

- US: Personal income and spending edged up modestly in May. Year over year in May, the Personal Consumption Expenditure (PCE) deflator increased by 1.4%, which was less than the market had expected. The ISM Manufacturing Purchasing Managers’ Index (PMI) indicated further expansion in the manufacturing sector.

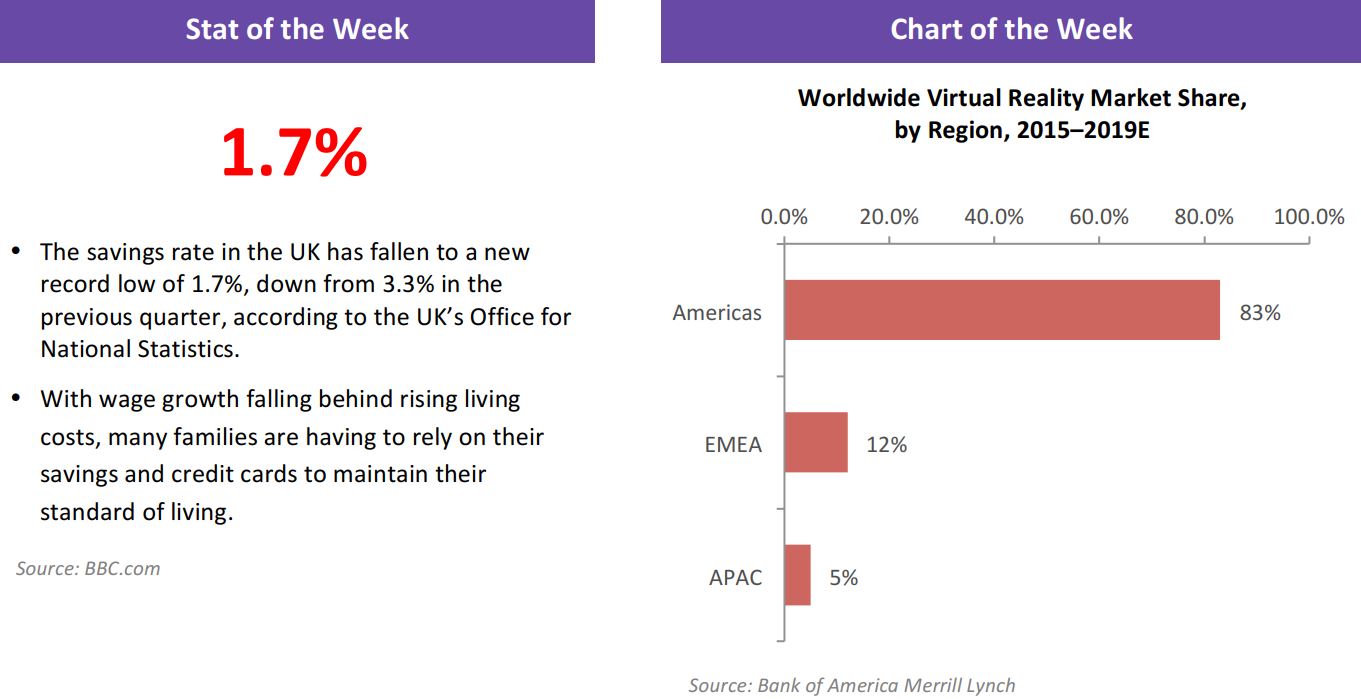

- Europe: In the UK, house prices continued to tick up in June despite increasing unaffordability. The GfK UK Consumer Confidence Index fell to (10) in June. In the eurozone, the unemployment rate stayed at 9.3% in May.

- Asia-Pacific: In China, both the manufacturing and nonmanufacturing PMIs stayed above the threshold of 50.0, indicating that the economy is in an expansionary state. In Japan, the Tankan Large Manufacturers Index and the outlook improved in the second quarter. However, the outlook for large nonmanufacturers deteriorated.

- Latin America: In Brazil, industrial production increased by 0.8% month over month and by 4.0% year over year in May, following an upward revision to April’s figure.

*Fung Global Retail & Technology’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/University of Michigan/Institute for Supply Management (ISM)/Nationwide Building Society/GfK/Eurostat/China Federation of Logistics and Purchasing/Bank of Japan/Japan Ministry of Economy, Trade and Industry/Instituto Brasileiro de Geografia e Estatística (IBGE)/Fung Global Retail & Technology

Clarks to Bring Shoe Production Back to the UK

(July 3) Retail-Week.com

Clarks to Bring Shoe Production Back to the UK

(July 3) Retail-Week.com

Ocado Trials Self-Driving Delivery Car

(June 29) RetailDetail.eu

Ocado Trials Self-Driving Delivery Car

(June 29) RetailDetail.eu

Edtech Startup Ruangguru Raises Series B Round Led by UOB’s Venture Arm

(July 4) TechinAsia.com

Edtech Startup Ruangguru Raises Series B Round Led by UOB’s Venture Arm

(July 4) TechinAsia.com

Another Chinese Cycle Sharer Shuts Shop Due to Stolen Bikes

(July 4) TechinAsia.com

Another Chinese Cycle Sharer Shuts Shop Due to Stolen Bikes

(July 4) TechinAsia.com