FROM THE DESK OF DEBORAH WEINSWIG

Do Pure Plays Need Physical Stores?

Do Pure Plays Need Physical Stores?

We’ve seen a slew of Internet-only retailers open physical shops in recent years, and this trend seems to have accelerated recently. The move into brick and mortar (B&M) is particularly prominent in fashion, as top names from Europe, Asia, and the US have recently opened stores. Bonobos, Rent the Runway, Zalando, Missguided, Simply Be and Zalora are among the names that are no longer pure plays in the purest sense.

Given this trend, it’s now common to hear about “the death of the pure play”—how Internet-only retailers will be compelled to open physical stores in order to compete with multichannel competitors. Some commentators argue that pure plays will need to open stores in the same way that stores had to begin selling online.

We disagree, and we point to three counter-indicators:

- Many of the retailers that have pushed into B&M have done so with only a limited number of stores or with short-term pop-ups, whose contribution to the top line is likely to be minimal and whose functions are more about garnering press coverage or serving other marketing purposes.

- Big names such as Amazon and ASOS have been holdouts against the move to stores.

- Not all ventures into physical stores prove suitable. British baby products pure play Kiddicare is one name that tried B&M and decided it wasn’t right for the company. After pushing into B&M with 10 stores, Kiddicare pulled out of all but one of its stores to once again focus on online retailing.

We think it’s far from certain that B&M shops are necessary or suitable for all pure plays, and that it’s too simplistic to forecast a wave of mass store openings by pure play retailers.

There is, however, a case for arguing that Internet-only retailers lose out on some of the marketing benefits enjoyed by their store-based counterparts. We see physical shops as a means by which Internet retailers can build value in their brands. In turn, this brand building can help pure plays move their positioning beyond a low-price focus.

Moreover, stores offer retailers the opportunity to reduce shipping costs by providing a lower-cost, in-store collection option. There’s also strong evidence that multichannel players tend to see lower return rates in apparel. In-store shoppers have an opportunity to try on products, which results in fewer returns due to ill fit, and so lowers costs borne by the retailer. (For more, see our new Quick Take, Fit for Purpose? Online Fitting Tech and the Boom in Internet Apparel

.)

A major caveat here is that online retailers would need a very substantial network of stores to reach a majority of their customers. So, a convincing push into B&M could prove very costly. We see two ways of gaining the benefits of stores while keeping a cap on investment:

- For collection, we think third-party collection locations are a possible solution. Amazon Lockers are an established format here, but there are others, too. In the UK, the CollectPlus network allows shoppers to pick up or return purchases from one of thousands of local stores such as newsagents and convenience stores. We think these kinds of third-party collection points will become familiar elsewhere.

- Yet picking up an order from a local convenience store doesn’t build a brand; it’s simply a functional, if convenient, experience. So there’s a case for complementing these kinds of collection services with glossy, brand-building flagship stores in big cities.

In short, we think there are benefits to operating physical stores, but given the costs/benefits balance, the prospect of pure plays opening networks of shops is far from an inevitability.

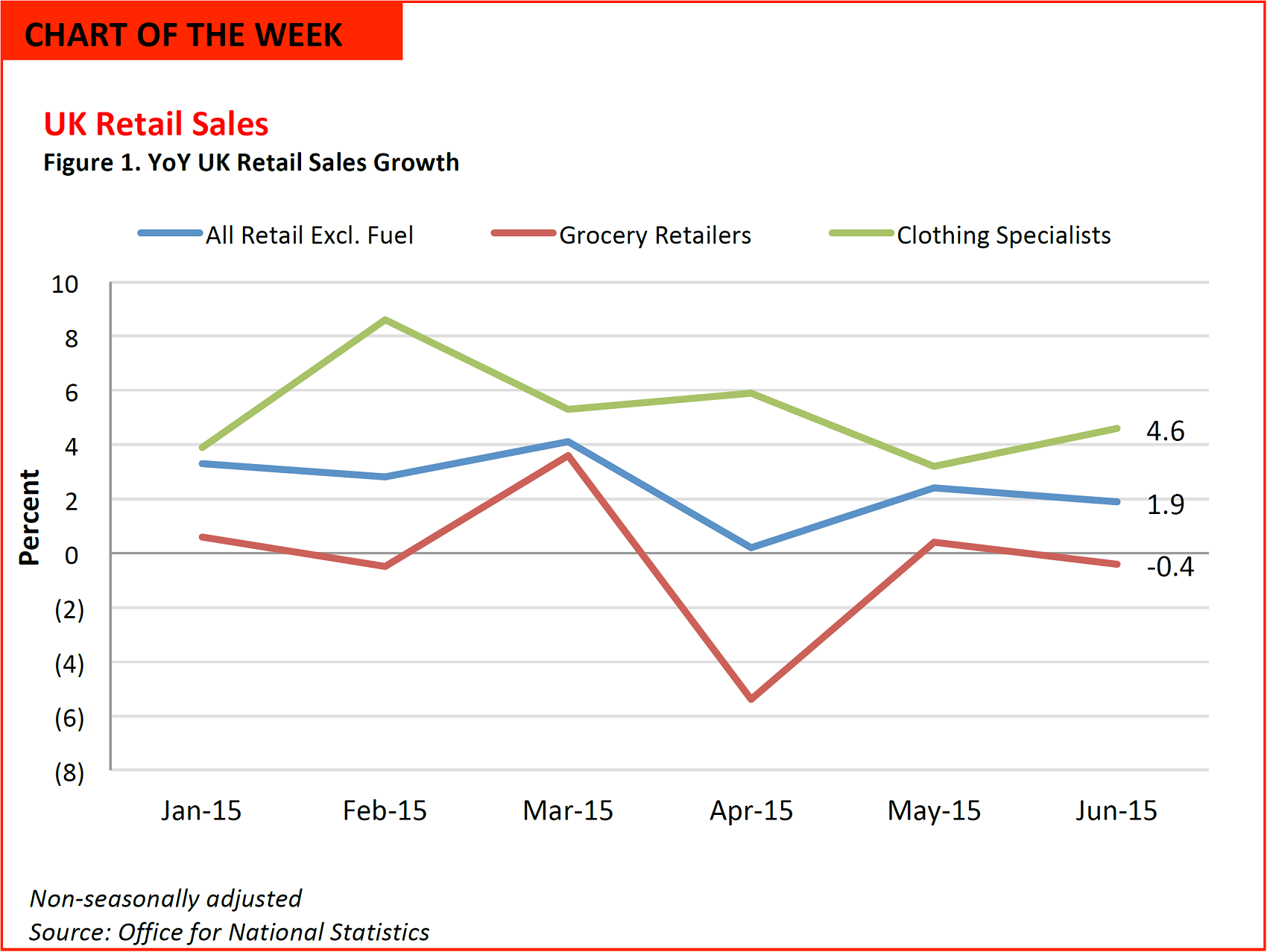

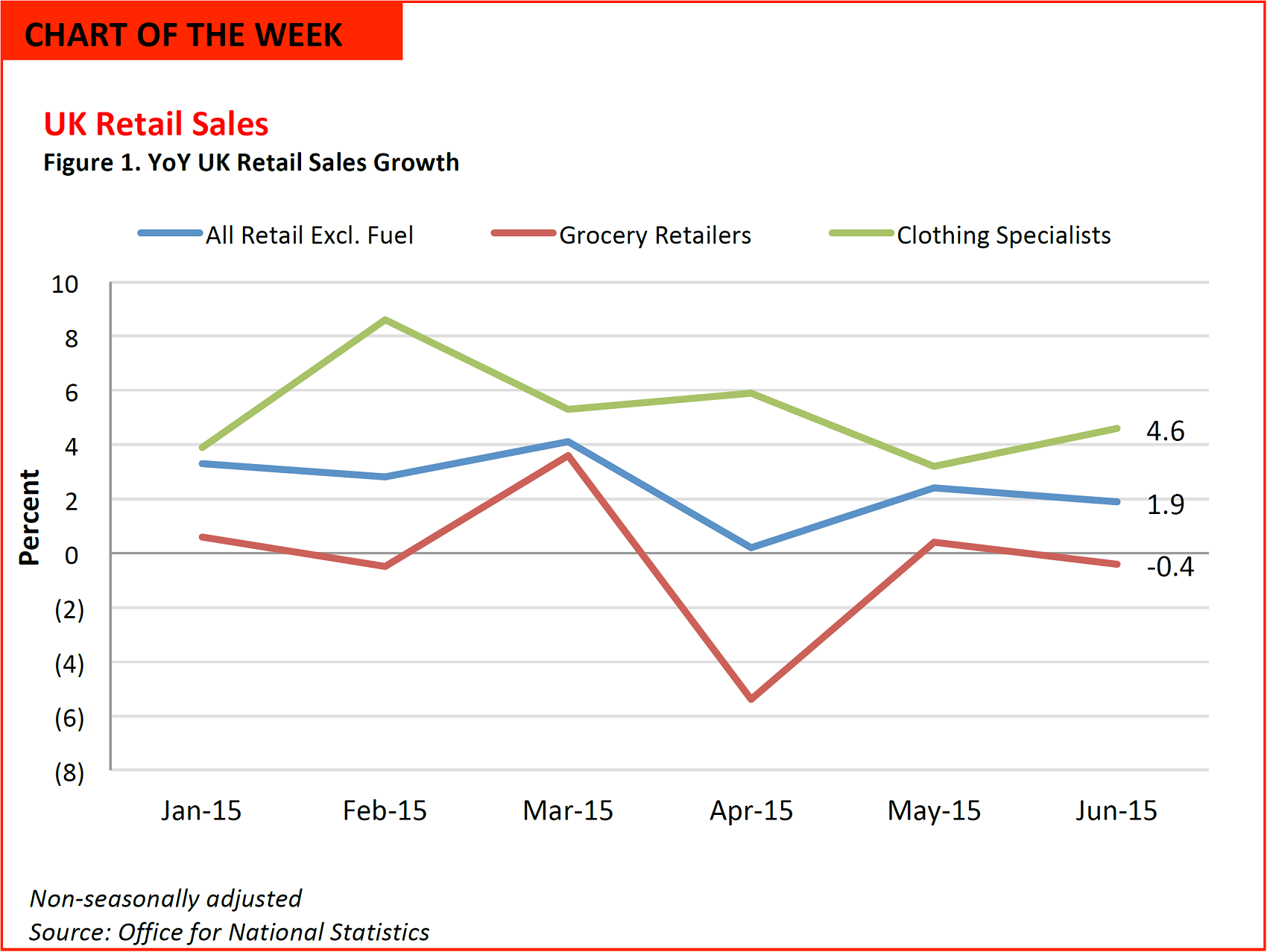

- The UK grocery price war continued to exert downward pressure on food retailers’ sales in June.

- Clothing specialists are among the winners from rising disposable incomes, as lower food and automotive fuel prices allow shoppers to spend more on discretionary categories.

- Halfway through 2015, our retail forecasts are proving accurate: back in February, we forecast total UK retail sales growth of 2.6% for 2015. So far, total growth has averaged 2.5%. And in our Global Grocery Retailing report, we forecast a decline of 0.3% for the UK grocery sector this year; sector growth so far has averaged -0.3%.

US RETAIL HEADLINES

VF Beats Q2 Estimates as Outdoor Sports Unit Excels

(July 27) Women’s Wear Daily

VF Beats Q2 Estimates as Outdoor Sports Unit Excels

(July 27) Women’s Wear Daily

- VF beat its own year-ago performance and analysts’ expectations with an 8.3% increase in second-quarter profits. VF has taken a proactive stance with Wrangler and Lee with its channels of distribution in the US and globally. Wrangler’s business is up 4%, and is strongest in the Americas, while Lee’s sales have declined at a mid-single-digit pace.

- The Outdoor & Action Sports coalition, which accounts for over 55% of VF’s sales, delivered a 9.2% advance in revenues, to $1.4 billion. Net income rose to $170.8 million, or 40 cents a diluted share, exceeding analysts’ expectations for EPS of 36 cents. Revenue rose 4.7% in the quarter, to $2.51 billion, from $2.4 billion in the same quarter in 2014.

Instagram Ad Revenue to Top Google’s

(July 27) Women’s Wear Daily

Instagram Ad Revenue to Top Google’s

(July 27) Women’s Wear Daily

- eMarketer projects that photo and video sharing platform Instagram will take in $2.81 billion from mobile advertising revenues, more than four times the $595 million the company is expected to generate this year. By 2017, it’s estimated that Instagram will make up 14% of Facebook’s overall ad sales, nearly triple the current percentage.

- Instagram Cofounder Kevin Systrom told Women’s Wear Daily that fashion and retail brands—including Ralph Lauren, Victoria’s Secret, Banana Republic, Hollister, and Abercrombie & Fitch—accounted for about a third of the network’s advertising revenue.

David Taylor Named President and CEO of P&G

(July 29) Women’s Wear Daily

David Taylor Named President and CEO of P&G

(July 29) Women’s Wear Daily

- The world’s largest household products company, Procter & Gamble, announced on Thursday that veteran David Taylor will replace A.G. Lafley as chief executive.

- Taylor is taking the position at a time when the company is undergoing a major transition. P&G has been streamlining its business: earlier this month, it sold more than 43 beauty brands to perfume maker Coty for $12.5 billion in order to focus on its faster-growing brands, such as Tide and Gillette. The company is now organized into four industry-based sectors.

Under Armour’s Game Plan: Faster Retail Expansion

(July 23) Women’s Wear Daily

Under Armour’s Game Plan: Faster Retail Expansion

(July 23) Women’s Wear Daily

- Investors appear optimistic about Under Armour in the wake of the company’s earnings report. Shares were up 7.3%, even though net income fell 16.5%, to $14.8 million, from $17.7 million in the same period a year ago. CEO Kevin Plank announced that the company plans to add 100 Brand House retail units to its store portfolio this year; three-quarters of those stores will be in Asia.

- The athletic and fitness apparel firm reaped considerable exposure from its association with PGA golf sensation Jordan Spieth and NBA star Stephen Curry, whose one sneaker model helped lift footwear revenues by 40.2%. Under Armour has also developed an online fitness community, Connected Fitness, which has more than 140 million athlete participants. The company’s new organizational structure, focused on sport rather than product category, is expected to remain a strong growth factor.

Back-to-School Spending Expected to Be Flat

(July 27)Women’s Wear Daily

Back-to-School Spending Expected to Be Flat

(July 27)Women’s Wear Daily

- Households with school-age children (preschool through 12th grade) plan to spend an average of $650 on back-to-school items,$2 less than last year even though consumer confidence has been rising. The largest increases will be seen in specialty apparel retailers (plus 21%) and department stores (plus 20%).

- 50% of consumers said they had bought and stockpiled supplies for the first day of school before August, up 15% from a year ago. Parents will spend the most on apparel and footwear, which are expected to account for approximately one-third of total back-to-school spending, followed by electronics.

ASIA HEADLINES

Baidu Issues Disappointing Q3 Forecast as It Invests Heavily in O2O Services

(July 28) TechCrunch

Baidu Issues Disappointing Q3 Forecast as It Invests Heavily in O2O Services

(July 28) TechCrunch

- Baidu is focusing aggressively on online-to-offline (O2O) sales, one of the hottest forms of e-commerce in China, but its near-term earnings growth is still under pressure. As investors reacted to a disappointing third-quarter 2015 forecast, the company’s shares dropped about 9.5% in after-hours trading before recovering slightly.

- Baidu disclosed that its second-quarter selling, general and administrative expenses rose by 81%, to ¥2.7 billion (US$437.5 million), due to increased promotional spending for O2O. Its gross merchandise volume for O2O services, which include food delivery and ticket ordering, was ¥40.5 billion (US$6.5 billion), a jump of 109% year over year.

Cambly, an English-Learning App Focused on Actual Conversation, Is Spreading Like Wildfire in Asia

(July 28) TechinAsia

Cambly, an English-Learning App Focused on Actual Conversation, Is Spreading Like Wildfire in Asia

(July 28) TechinAsia

- Fire up Cambly and you’ll see just one big red button that says, “Practice English.” Push it, and you’ll be connected via video chat to a native English speaker. Then, you talk. There’s no curriculum, no tests and no vocabulary—just a real conversation with the native speaker on the other end of the line.

- Cambly is not free. Users buy time on the app to connect them to English speakers, who are paid for the time they spend chatting. The company has grown by a factor of 10 in several Asian markets over the past year, including South Korea, Japan and China. Cambly’s business in South Korea has grown by “almost 100 [times] in the past year,” according to Sameer Shariff, one of the app’s founders.

Weathernews Partners with Moji, Maker of China’s Largest Crowdsourced Weather App

(July 27) TechCrunch

Weathernews Partners with Moji, Maker of China’s Largest Crowdsourced Weather App

(July 27) TechCrunch

- Weathernews, one of Japan’s biggest weather forecast providers and the owner of the Sunnycomb and Weathermob apps, announced that it had signed an agreement with Moji, the maker of China’s largest social weather app, to share data.

- The benefit of using crowdsourced apps instead of services like Accuweather or the Weather Channel is that you see real-time updates about the weather along with user comments about how it makes them feel, which is useful for sufferers of migraines, allergies and seasonal affective disorder.

South Korea–Based Smartphone Producer Sees Potential in Indonesia

(July 27) e27.co

South Korea–Based Smartphone Producer Sees Potential in Indonesia

(July 27) e27.co

- A South Korean tech consortium led by Optis plans to join the smartphone competition in Indonesia. The local telecom industry is currently on the verge of transitioning from 3G to 4G/LTE, and is seen as a potential gold mine.

- Optis plans to work with Pantech, which has had difficulty in the South Korean market. “At the moment, our priority is to dominate the smartphone market in [Indonesia] using Pantech’s technology,” an Optis representative said.

Samsung’s Newest Computer Monitor Can Wirelessly Charge Your Phone

(July 27) ZDNet

Samsung’s Newest Computer Monitor Can Wirelessly Charge Your Phone

(July 27) ZDNet

- Samsung introduced its new SE370 computer display in two sizes on Monday (23.5" and 27"); both sizes include a wireless charging port. The design is smart because the charging pad is built into the base of the monitor, so a user can simply place a mobile device on the monitor stand to recharge the battery.

- Samsung chose to use the Qi standard, which has become fairly commonplace, for its wireless charging monitor. Samsung phones use it, as do devices from Nokia, Motorola, LG, HTC, and others. The Apple Watch also works with Qi charging pads.

Are Digital Wallets the Future of the Asian Economy?

(July 25) e27.co

Are Digital Wallets the Future of the Asian Economy?

(July 25) e27.co

- Banks have started to integrate digital payment platforms into their banking services. These have been very well received in certain Asian countries, most notably Singapore. MasterPass, a global digital payment platform launched by MasterCard, was first launched in Singapore in June 2014.

- High barriers to cross-border remittances in the region complicate the electronic payments. Discrepancies in legalities and currency exchange (especially in and out of China) make it difficult to regulate electronic payments accurately and efficiently.

KFit to Use Newly Raised Funds to Focus on Its Mobile Strategy

(July 24) e27.co

KFit to Use Newly Raised Funds to Focus on Its Mobile Strategy

(July 24) e27.co

- KFit has partnered with more than 1,000 fitness studios and gyms across Asia, which is five times the number since its launch. It also claims to have generated a fourfold increase in reservations. In the month of July, the number of reservations doubled, the company said.

- KFit is now refocusing all its efforts (tech, marketing, etc.) on mobile. The KFit app will be available on both iOS and Android by the end of July.

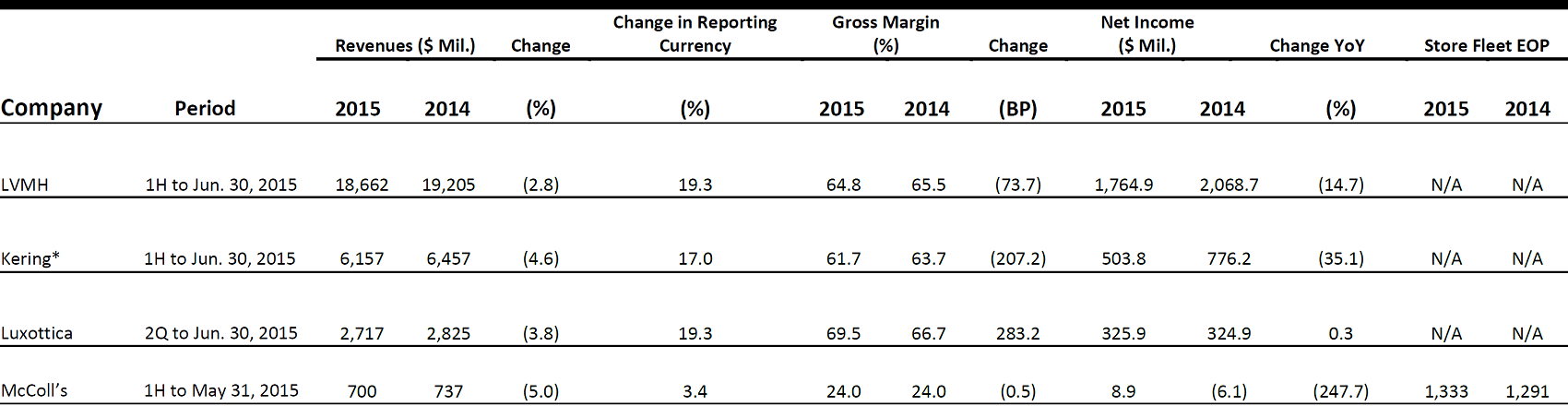

EUROPEAN RETAIL EARNINGS

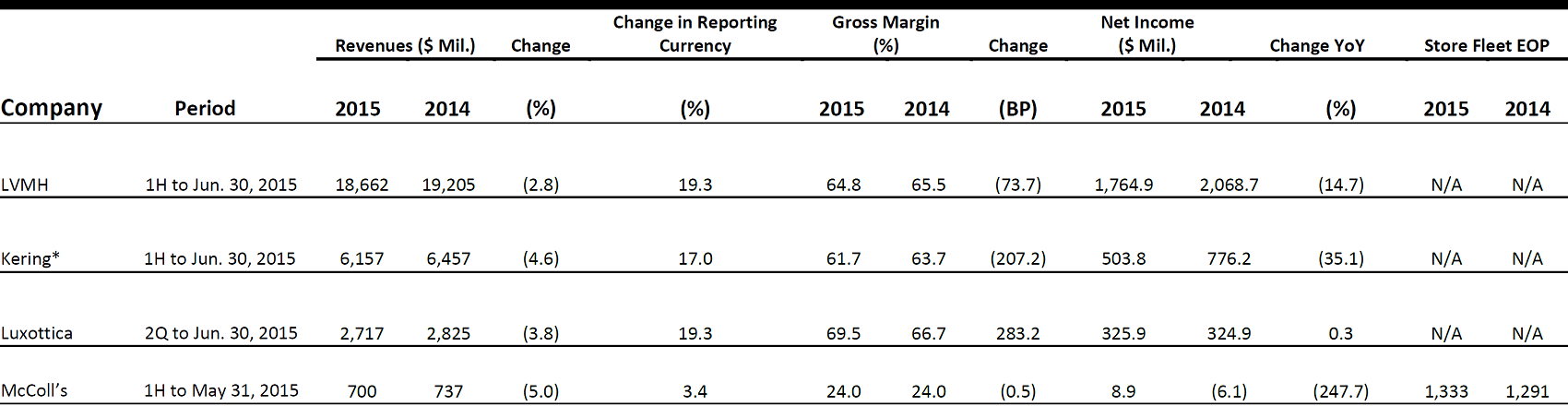

*Net income is from continuing operations.

Source: Company reports

EUROPEAN RETAIL HEADLINES

Moulin Family Increases Ownership Stake in Carrefour

(July 23) RetailDetail.eu

Moulin Family Increases Ownership Stake in Carrefour

(July 23) RetailDetail.eu

- The founding family of French retail giant Galeries Lafayette announced that it currently controls more than 10% of Carrefour’s capital, and confirmed that it may increase its stake in the future. The family also stated in a press conference that it doesn’t intend to take over control of Carrefour in the future.

- The family now has two seats on the board of Carrefour, as it is the largest shareholder. The great-grandson and great-granddaughter of Galeries Lafayette’s founder have taken the seats. The Moulin family has a controlling stake in Galeries Lafayette as well.

Amazon Opens Multibillion-Pound Photo Studio in London

(July 23) TechCrunch.com

Amazon Opens Multibillion-Pound Photo Studio in London

(July 23) TechCrunch.com

- Amazon has opened a new photography studio in Shoreditch, London. It spans 46,000 square feet and has 22 photography bays. The studio is the largest of its kind in Europe and the company stated that nearly 500,000 images of clothes can now be added to its sites every year.

- The new studio will add 35 jobs and 75 more during peak season. The VP of Amazon Fashion EU said that the company aims to be the best place to buy fashion online. The company has also made several strategic moves to increase fashion sales online and in Europe.

John Lewis Sales Were up by 6.9% Last Week

(July 25) TheRetailBulletin.com

John Lewis Sales Were up by 6.9% Last Week

(July 25) TheRetailBulletin.com

- John Lewis saw an increase of 6.9% in its year-over-year online and shop sales last week. Online sales rose 22.6% thanks to availability of products and robust trade over the clearance section. Shop sales increased by 0.7% compared to last year, with 19 branches showing year-over-year growth.

- In terms of product mix, fashion sales led the growth with a 10.5% increase, home sales grew by 2% and electronics sales rose by 9.4%. As the company’s sale season is over, the director of retail services stated that the focus will now be on new collections.

UK Consumer Confidence Index Overtakes Global Average

(July 27) ft.com

UK Consumer Confidence Index Overtakes Global Average

(July 27) ft.com

- Nielsen, a market research company, found that the UK Consumer Confidence Index (CCI) outstripped the global average for the first time in nine years. The last time the CCI surged past the global average was in the first quarter of 2006. The company also found that British consumers were more confident than their German counterparts for the first time in five years.

- Nielsen noted that consumers are switching grocery brands to save money less frequently, which could be a good sign for retailers. Nielsen’s managing director stated that wage inflation had surged past price inflation for the first time in several years, and that unemployment had been declining.

Media-Saturn Now Has 1,000 Stores in Europe

(July 27) RetailDetail.eu

Media-Saturn Now Has 1,000 Stores in Europe

(July 27) RetailDetail.eu

- The Media-Saturn Group, owner of Media Markt and Saturn stores and Europe’s number one consumer electronics retailer, has opened its 1,000th outlet in Europe. The group expressed that its focus will be on a fully omnichannel future.

- Speaking at the opening of the 1,000th store, CEO Pieter Haas said that the stores will have digitized points of sale linking them to online branches. As part of the digitization process, store employees will receive tablets, free Wi-Fi will be made available to customers and online kiosks will be put in place to help customers who seek additional information.

Luxottica Reports 25% Increase in Profits

(July 27) wsj.com

Luxottica Reports 25% Increase in Profits

(July 27) wsj.com

- Eyewear leader Luxottica reported an increase of 25% in net profits, as the weak euro against the dollar improved the company’s sales in the second quarter. Luxottica reported net profit of €295 million (US$326 million) and operating profit of €500 million (US$552 million). Sales grew by 19.3% compared to the same period last year, with a distinct increase of 23.4% in the retail division.

- The group also stated that sales in North America grew by 29% at current rates compared to the same period last year; the region accounts for 57% of total sales. European sales saw an increase of 9% and sales were up 18% at current rates in the Asia-Pacific region.

Next Reports Sales Increase of 3.5%

(July 28) bbc.co.uk

Next Reports Sales Increase of 3.5%

(July 28) bbc.co.uk

- Next, one of the UK’s biggest clothing retailers, reported a sales increase of 3.5% in the six months ending July 25. The company raised the midpoint of its full-year profit forecast by 1.9%, from £810 million (US$1,263 million) to £825 million (US$1,287 million), and raised its full-year sales growth guidance to 3.5%–6% (it was previously 1.5%–5%).

- Full-price sales at Next stores were up 0.8% and its online/catalog sales were up 7.5%. A company statement said that the increase in performance at the end of the season was mainly due to warm weather.

Former Tesco Executive to Join Morrisons as Group Retail Director

(July 28) Retail-Week.com

Former Tesco Executive to Join Morrisons as Group Retail Director

(July 28) Retail-Week.com

- Gary Mills, a former Tesco executive who was in charge of the company’s business in Northern Ireland, has been appointed Group Retail Director for Morrisons. He replaces Martyn Fletcher, who is the fifth director to leave Morrisons following the appointment of CEO David Potts in March.

- Mills has 30 years of experience in the industry, and has held several senior positions at Tesco, including Retail Director for Convenience and Retail Director for Northern Ireland. He will begin his new role on August 1.

LATAM HEADLINES

Rising Poverty Rate in Mexico Threatens Retailers

(July 28) Bloomberg

Rising Poverty Rate in Mexico Threatens Retailers

(July 28) Bloomberg

- An additional 2 million Mexicans have fallen below the poverty line in Mexico since 2012, pushing one poverty metric to a 14-year high.

- Average household income in Mexico declined by 3.5% in real terms from2012 through 2014, and the government is considering raising the minimum wage, which has fallen 70% during the past 40 years when adjusted for inflation.

- Moreover, according to an economist at the Dallas Federal Reserve, reverse migration to Mexico from the US is crowding the Mexican labor market, which is reducing remittances from the US to relatives in Mexico.

Brazilian Retailer Magazine Luiza Getting a Boost from E-Commerce

(July 28) InternetRetailer.com

Brazilian Retailer Magazine Luiza Getting a Boost from E-Commerce

(July 28) InternetRetailer.com

- E-commerce is approaching 20% of sales at Brazilian electronics retailer Magazine Luiza.

- Brazilian Internet research firm eBit estimates that Brazilian e-commerce sales grew by 25.3%, to an estimated R$35.9 billion (US$14.0 billion), in 2014 and could hit R$67.1 billion (US$20 billion) within five years.

- To continue to grow e-commerce sales, Magazine Luiza is leveraging social media. For example, it launched a program on Facebook in 2013 that enables consumers to open a virtual storefront and sell products they recommend to friends and family.

Brazil Likely to Raise Benchmark Rate Next Week

(July 26) The Wall Street Journal

Brazil Likely to Raise Benchmark Rate Next Week

(July 26) The Wall Street Journal

- Brazil’s central bank is likely to raise its Selic benchmark interest rate to at least 14% next week to combat rising inflation.

- Brazil’s inflation rate recently hit 9.25%, more than twice the 4.5% target rate and up from the 6.5% rate when the central bank began raising rates in April 2013.

- A central bank official said recently in a speech that rising unemployment and slow growth are working together to weaken inflation in 2016, which could precede a new, more sustainable period of growth.

Starbucks and PepsiCo Sign Agreement for Marketing, Sale and Distribution of Beverages in Latin America

(July 23) Company press release

Starbucks and PepsiCo Sign Agreement for Marketing, Sale and Distribution of Beverages in Latin America

(July 23) Company press release

- Starbucks and PepsiCo entered into an agreement for the marketing, sale and distribution of several Starbucks ready-to-drink coffee and energy beverages.

- The Latin American ready-to-drink beverage category is estimated to be worth US$4 billion and is expected to grow by 22% over the next five years.

- Beverages specified in the agreement include Starbucks Frappuccino chilled coffee drinks, Starbucks Doubleshot Espresso and Cream, and Starbucks Refreshers beverages.

Desigual Plans to Open 450 Stores in Latin America by 2017

(July 21) WWD.com

Desigual Plans to Open 450 Stores in Latin America by 2017

(July 21) WWD.com

- Desigual plans to open 450 new stores in Latin America over the next two years, many of them in Mexico.

- This year, the company plans to open five new stores and five store-in-a-stores in Mexico, boosting the country’s total to 29 stand-alone stores and 27 store-in-a-stores.

- The remaining total will include of 45 stand-alone stores, 53 corners, and 27 store-in-a-stores, and the company will own about 80% of its stores; the remaining 20% will be franchised.

Do Pure Plays Need Physical Stores?

Do Pure Plays Need Physical Stores?

Instagram Ad Revenue to Top Google’s

(July 27) Women’s Wear Daily

Instagram Ad Revenue to Top Google’s

(July 27) Women’s Wear Daily

Cambly, an English-Learning App Focused on Actual Conversation, Is Spreading Like Wildfire in Asia

(July 28) TechinAsia

Cambly, an English-Learning App Focused on Actual Conversation, Is Spreading Like Wildfire in Asia

(July 28) TechinAsia

South Korea–Based Smartphone Producer Sees Potential in Indonesia

(July 27) e27.co

South Korea–Based Smartphone Producer Sees Potential in Indonesia

(July 27) e27.co

Starbucks and PepsiCo Sign Agreement for Marketing, Sale and Distribution of Beverages in Latin America

(July 23) Company press release

Starbucks and PepsiCo Sign Agreement for Marketing, Sale and Distribution of Beverages in Latin America

(July 23) Company press release