Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

This past week, we were delighted to co-host the second New York Disruptors Breakfast with the Entrepreneurs Roundtable Accelerator (ERA) at the newly renovated Li & Fung Hive. Over 100 LF North America and Global Brands Group employees attended the breakfast. This marked the fourth Disruptors Breakfast series that FBIC team has organized in Hong Kong and New York since April. A total of seven emerging startups in fashion and consumer space presented at the breakfast. Our long-time partner ERA handpicked six startups for this occasion; FBIC invited a personal video startup recommended by Israel’s New York Trade and Economic Mission. We are excited to see that Li & Fung has started to substantiate partnerships with the startup community: one of the presenting companies Trendalytics was initially mentored by Global Brands Group and now provides subscriptions of analytics-based fashion trend insights to several divisions of our business. ERA had just announced their Summer 2015 class in early June, which consisted of ten startups from real estate, online jewelry marketplace, to virtual in-person shopping assistant. This program is designed to grow early-stage companies by providing them with collaboration opportunities, and access and exposure to a wide range of mentors and companies in the New York area. ERA selects 10 lucky companies from 1,000 applicants three times a year; participants receive a $40,000 investment, free coworking space in the Chelsea neighborhood and access to more than 200 mentors. So far ERA have produced 80 companies with a combined market capitalization of over $500 million After a brief introduction by Rick Darling, Executive Director of Government & Public Affairs at Li & Fung, seven startups gave their four-minute elevator pitch followed by Q&As. The audience was extremely engaged and asked questions about their business models, origins of ideas, and synergies with Li & Fung. The startups included (in alphabetical order):- Four Mine, an online jewelry store that lets shoppers experience their favorite engagement ring styles at home through a “try before you buy” replica service, which eliminates the uncertainty of buying online. The company’s smart shopping tools identify the customer’s preferences and pinpoint the ideal ring.

- Grsp, is a mobile tool that helps people make better, faster decisions when shopping in a store. Users are advised to buy something or walk away based on comprehensive analysis of prices, deals, coupons, and product reviews.

- idomoo, a personalized engagement video platform that delivers 1:1 communication to the right target audience, meeting each customer's preferences and needs, creating long-lasting memorable customer experiences and tightening the brand-consumer connection.

- Muse Find, is a self-serve platform that matches brands to their ideal social media influencers, so that brands can reach and engage their audience more effectively, delivering a greater reach with a lower cost.

- RetSKU, is a business intelligence and analytics platform for retail brands selling via traditional brick-and-mortar merchants. The platform collects in-store competitive placement data in real-time, analyzes it to provide actionable insights, and helps to improve promotional effectiveness and new product launches.

- Rockerbox brings efficiency and effectiveness to digital advertising by analyzing the sites a user visits to determine their real-time browsing intent. It enables momentum-based advertising that drives better performance with smaller budgets.

- Trendalytics, provides decision support software for merchandise trends. It marries online search behavior and consumer engagement with products across the social web, so that brands and retailers are empowered with data-driven insights to make informed merchandising and creative marketing decisions.

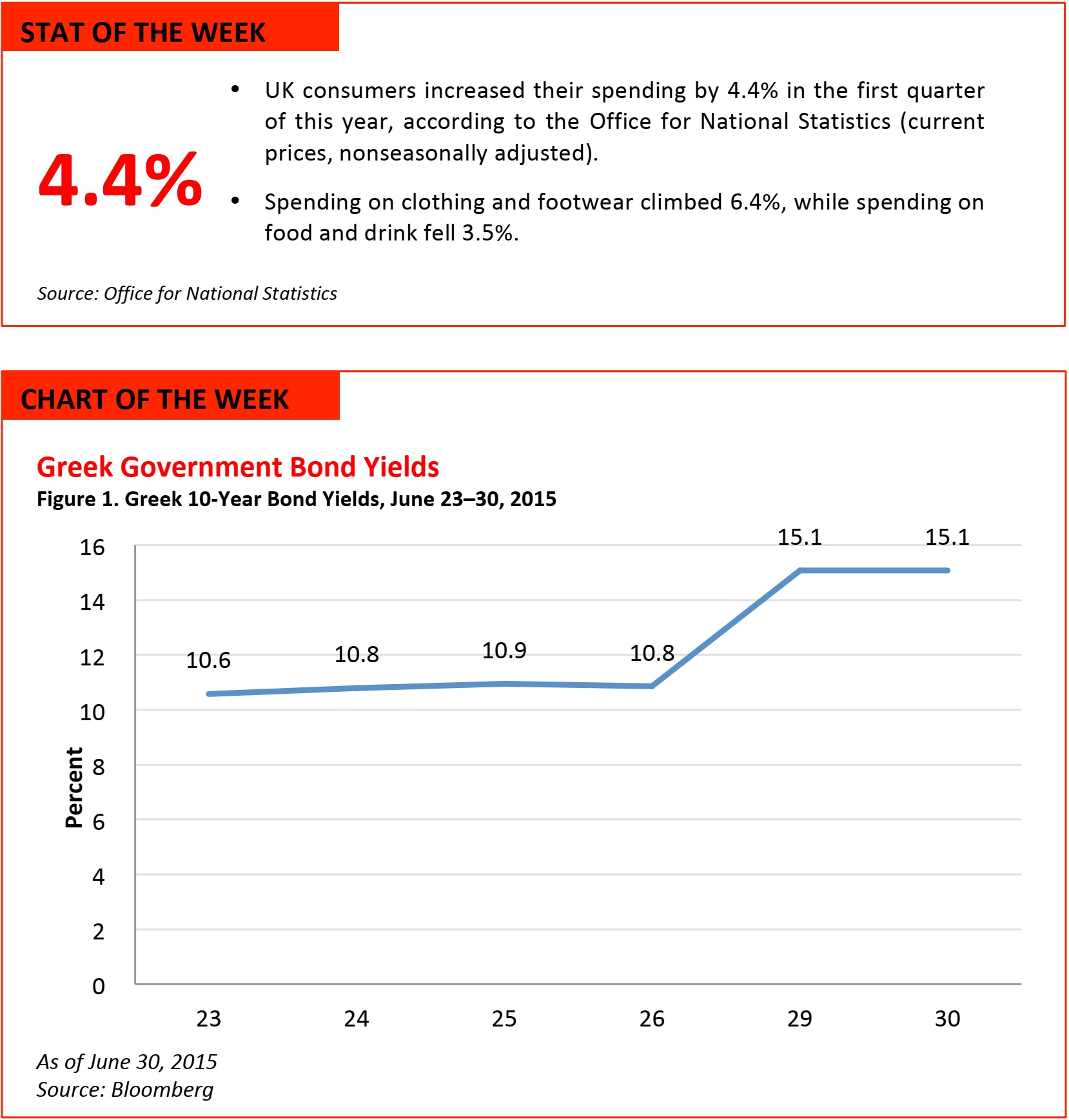

- Greek 10-year bond yields jumped this week as a default on obligations and a consequent exit from the eurozone started to look like it would become a reality.

- Europe waits while Greece holds a referendum, scheduled for this Sunday, on whether to accept further austerity measures in return for continuing to receive bailout funds.

- A “no” vote to austerity would almost certainly precipitate the country’s departure from the currency bloc.

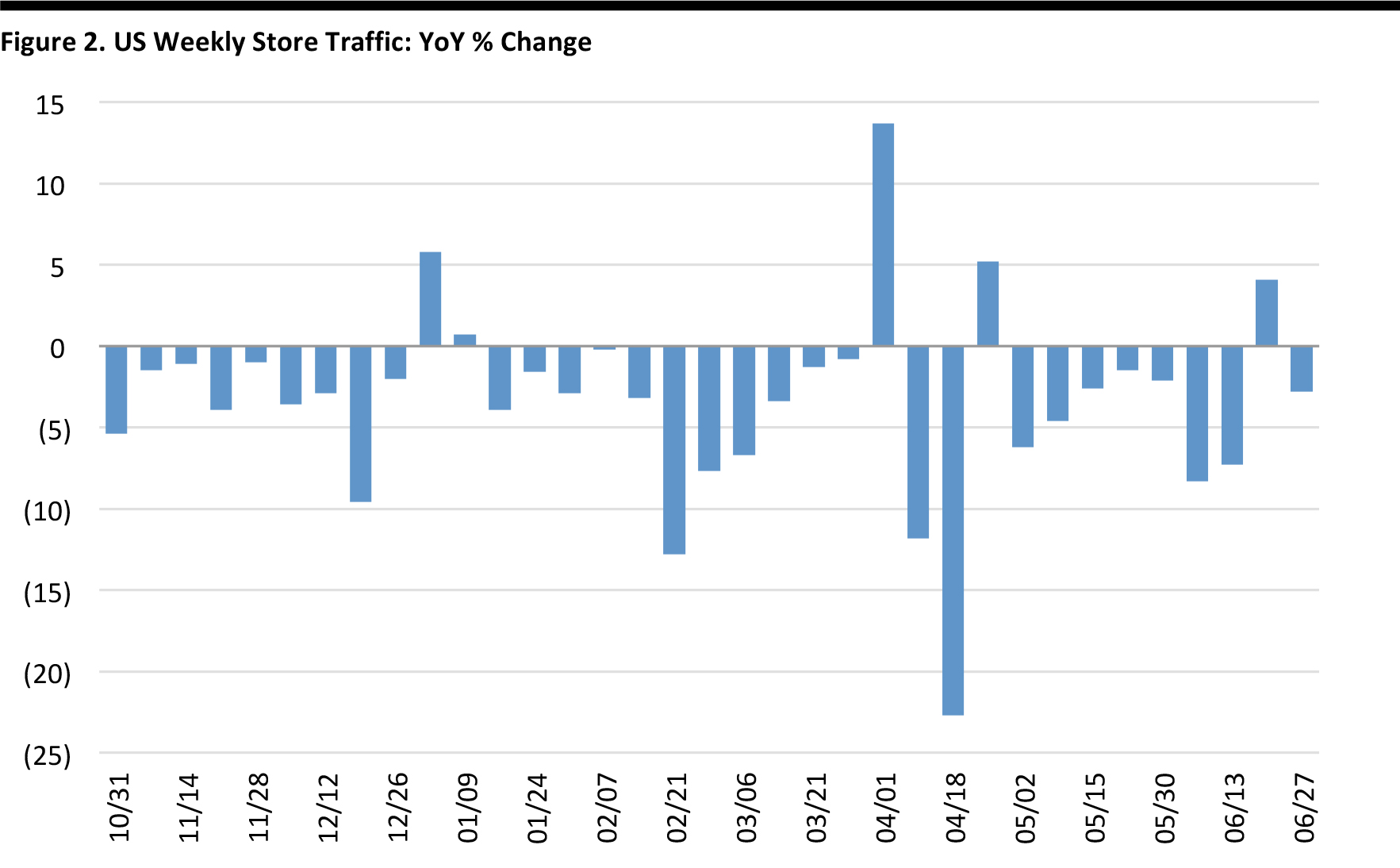

US RETAIL TRAFFIC

Through June 27, 2015 Source: ShopperTrak

- Overall store traffic were down 2.8% for the week following Father’s Day shopping.

- Apparel store traffic declined 4.1% % and. electronics store traffic sales were flat

- The upcoming July 4th is expected to lift store traffic this week.

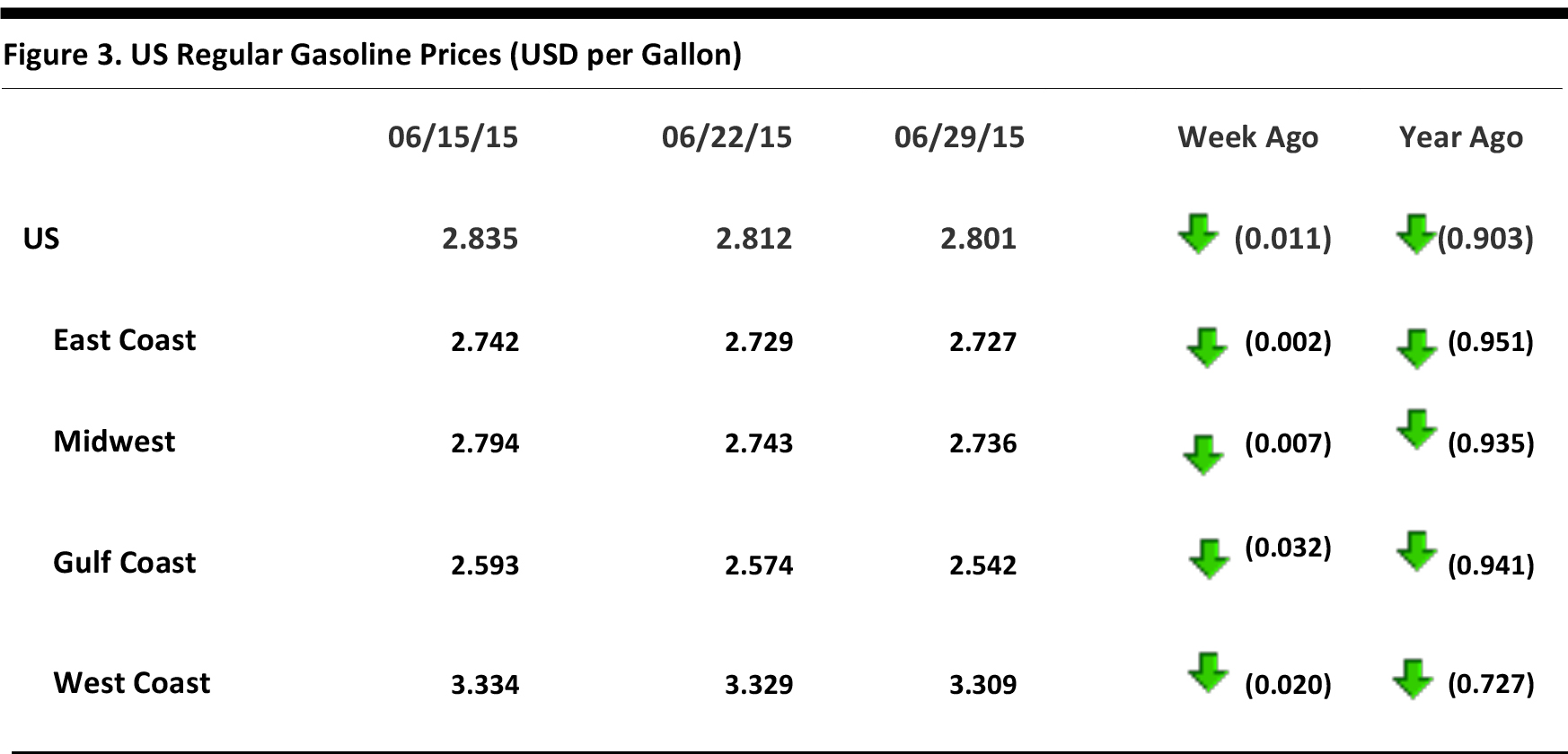

US REGULAR GASOLINE PRICES

Source: US Energy Information Administration

US RETAIL HEADLINES

- Vince Holding named Mark Brody as interim CFO. He will replace Lisa Klinger, who resigned from the post.

- Brody most recently was Managing Director and Group CFO at Sun Capital Partners. The company’s portfolio included Vince.

- Amazon has expanded its one-hour delivery service for Prime members to parts of central London. This is the first location where such service is available outside the US.

- Amazon launched the one-hour delivery service in Manhattan last December. The London Prime Now app offers 27 categories of products.

- Juicy Couture Black Label set off in a new direction with its fall campaign, “Couture Nouveau.” Different from previous location-based campaigns, the new collection is shown against a white, seamless background to represent the brand’s rock ’n’ roll vibe.

- The campaign will be augmented by a socially driven initiative, “Couture Confessions,” which will launch in September.

- Heinz’s leadership is shaking up senior management at Kraft before the companies’ planned merger. Kraft CFO James Kehoe and General Counsel Kim Rucker are among the departing executives.

- As Heinz’s CFO, Paulo Basilio, takes the same role at the new Kraft Heinz, more senior executives will assume new positions from the Heinz side, with the exception of Kraft’s COO, George Zoghbi, who will be COO of the US commercial business.

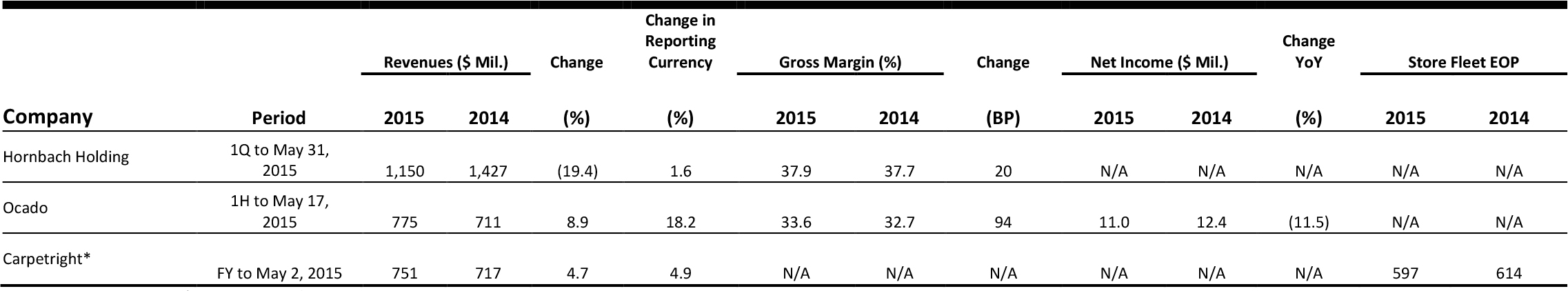

EUROPEAN RETAIL EARNINGS

Source: Company reports * 2015 is 53 weeks

EUROPEAN RETAIL HEADLINES

- British online grocer Ocado posted first-half revenues that were up 18.2%, to £508 million. Operating profit before share from joint ventures climbed 8.2%, to £10.6 million. Pretax profits for the first half stood at £7.2 million, down from £7.5 million in the corresponding period of 2014.

- Ocado said it had broadened its range, grown private-label sales, increased active customers by 19% and improved order accuracy in the first half.

- Carpetright, a UK floor coverings specialist, reported that full-year revenues were up 3.3%, to £463 million. Comparable UK sales climbed 7.3%, or 5.4% in total. Comparable rest-of-Europe sales rose 0.3%, but fell 7.4% in total as the group culled stores.

- Underlying operating profit grew by 112%, to £15.8 million, while underlying profit before tax rose 183%, to £14.2 million, for the year.

- An American private equity company is in talks to back a £100 million management buyout of shirtmaker TM Lewin. The retailer has around 100 UK stores and 60 overseas stores.

- Sankaty Advisors is reported to be close to a deal to help management acquire the 20% stake currently held by Coller Capital, which was inherited when it took over the private equity portfolio of Lloyds Banking Group.

- German retail sales volumes fell 0.4% year over year in May 2015, according to provisional results from Germany’s statistics office. In current prices, year-over-year growth was flat.

- Adjusted for calendar and seasonal variations, retail sales in May were up 0.5% in real terms (volumes) and up 0.4% in current prices.

- German DIY chain Hornbach reported that first-quarter revenues were up 1.9%, to €995 million. Parent company Hornbach Holding saw revenues climb 1.6%, to €1,052 million, in the first quarter.

- EBIT for Hornbach DIY in the first quarter was down 11%, to €65.2 million. EBIT for Hornbach Holding was down 13%, to €76.8 million.

- London department store retailer Liberty is to sell its own-label products through department stores in the US and Italy. Starting in July, US chain Nordstrom will feature pop-up shops for Liberty housewares, while Italy’s La Rinascente will host a pop-up for the Liberty London accessories range.

- The overseas venture underpins a planned float on the London Stock Exchange in 2018. The retailer is currently owned by private equity firm BlueGem Capital Partners.

- Grocery giant Tesco posted an improving performance for its core UK division last week, reporting a comparable UK sales decline of 1.3%. In a deflationary environment, UK sales volumes were up 1.4% and transactions were up 1.3%, the company said.

- International comps were down 1.0%, and groupwide comps were down 1.3% in the first quarter. Total group sales (excluding automotive fuel) were down 1.0% in the quarter, with UK sales down 1.0% and international sales down by the same figure.

ASIA HEADLINES

- Chinese tech news site Techweb recently conducted a survey of 1,607 businesses on a busy pedestrian street in Wuhan to check the acceptance rate of mobile payments among offline shops and restaurants. Just 617 of the shops—38% of the total surveyed—accept mobile payments.

- Among 1,047 clothing shops, 28.2% accept Alipay, and 18.6% accept Tenpay.

- Of the 310 restaurant surveyed, 4.5% accept Alipay, and 1.2% accept Tenpay.

- Chope, a Singapore-headquartered startup, raised S$11 million (US$8 million) in a series-C round led by F&H Fund Management, a fund chaired by pioneering Alibaba CTO John Wu.

- According to Tech in Asia, the startup generated revenues of about S$519,000 (US$385,000) in 2013, a fiftyfold increase over the previous year. Cofounder Arrif Ziaudeen says the startup’s annual revenue doubled from 2013 to 2014.

- Easton LaChappelle, a 19-year-old, recently joined NASA. He invented a mind-controlled robotic arm when he was just 17, which earned him a meeting with President Obama.

- The brain’s motor cortex controls and executes the body’s voluntary movements, and LaChappelle preprogrammed a commercially available wearable device to sense thoughts occurring in the motor cortex, which in turn become signals that the robotic hand can read and respond to.

- Taxi-hailing app company Didi Kuaidi is raising an investment round of up to US$2 billion, according to Reuters. The deal would value Didi Kuaidi at around US$15 billion, making it the second-most-valuable Chinese tech startup after smartphone maker Xiaomi, which is now valued at US$45 billion.

- China’s three largest tech giants are deeply involved in the country’s taxi app wars. Alibaba and Tencent have backed Didi Kuaidi, while Baidu is an investor in Uber and has provided the company with its maps and integrated it with its electronic wallet.

Asian Investors Jump in on Airbnb’s US$1.5 Billion Funding Round

(June 29) e27.co

Asian Investors Jump in on Airbnb’s US$1.5 Billion Funding Round

(June 29) e27.co

- At least four major Asian investors have entered Airbnb’s latest funding round, according to CrunchBase. The new investors were notably absent from previous rounds; the company has raised US$2.3 billion to date.

- Hong Kong’s Horizon Ventures, Singapore’s Temasek Holdings, China’s Hillhouse Capital Group (which has more than US$20 billion in funds), and China Broadband Capital are the four new Asian investors.

- Getting cash back is the newest trend in the Indian e-commerce market. Big players, emerging players, almost everybody in the e-commerce niche is embracing the cash-back culture, compelled by an enthusiastic audience, surging market competition and recent funding rounds.

- At present, cash-back campaigns are being championed by top Indian mobile wallet firms such as Paytm, MobiKwik and PayU, in addition to food and deal aggregators such as TinyOwl and CashKaro.

- JD.com has become the latest Internet company in China to venture into the consumer credit space, after the NASDAQ-listed online retailer—and Alibaba rival—launched a joint venture with Los Angeles–based financial services company ZestFinance.

- The venture’s aim is to offer new microloan options to Chinese consumers, particularly those who have no credit history and other credentials traditionally required to obtain a credit card or other finance options.

- MYbank, a startup backed by Ant Financial Services—an affiliate of Chinese e-commerce giant Alibaba—has launched a digital-only bank to provide “inclusive and innovative financial solutions” at a lower cost to underbanked urban and rural consumers and small and medium-size businesses.

- As part of Ant Financial, which bills itself as China’s leading online financial services company, MYbank will participate in Alibaba’s e-commerce ecosystem, which offers potential synergies that are unavailable to other banks.

LATAM HEADLINES

- AliExpress.com is one of the top three e-commerce sites in Brazil, receiving 110 million visits per month, according to SimilarWeb, a web analytics company.

- The site is the top e-tail site in Russia and has been growing fast in Brazil, Chile and Mexico. The top purchases in Latin America include wedding products, apparel, electronics and jewelry.

- Customers continue to favor AliExpress despite customs and delivery delays that can reach 40 days.

- AT&T plans to invest about US$3 billion to expand its high-speed mobile Internet network in Mexico.

- The company plans to provide wireless coverage to 40 million people—about one-third of the population—within six months, and to a total of 100 million people by the end of 2018.

- AT&T already owns Mexico’s number three and four wireless carriers, Iusacell and Nextel.

- Brazil’s IBGE statistics bureau reported that the jobless rate in May was 6.7%, as compared to 6.4% in April and 4.9% in May 2014.

- The unemployment rate has been rising since December 2014, when it was 4.3%.

- The number of unemployed in May remained stable at 1.6 million; however, this figure is almost 39% higher than it was a year ago.

- Brazil’s leading credit information companies estimate that as of April, more than 55 million Brazilians were late in making credit-card or loan payments.

- This represents 37% of the adult population, and the list has grown by about 700,000 people since January.

- Interest rates on some Brazilian credit cards are as much as 200% per year, compared to an average of about 12% in the US.

- The company announced on June 30 that it is launching business-to-consumer platform in Mexico on Amazon.com.mx.

- Upon launch, the site will have the largest selection of both local and imported products in the country. Non-Amazon sellers will leverage Amazon’s storage and shipping expertise.