FROM THE DESK OF DEBORAH WEINSWIG

The surge of fast-fashion retailers such as Zara, H&M and Forever 21 has created a culture of faster apparel consumption, especially among the women who are these retailers’ core customers. With apparel prices flat, the online channel making purchasing convenient, and social media representing an easy way to learn about and share new trends, fashion is likely to become even faster as women are inspired to make more purchases more often.

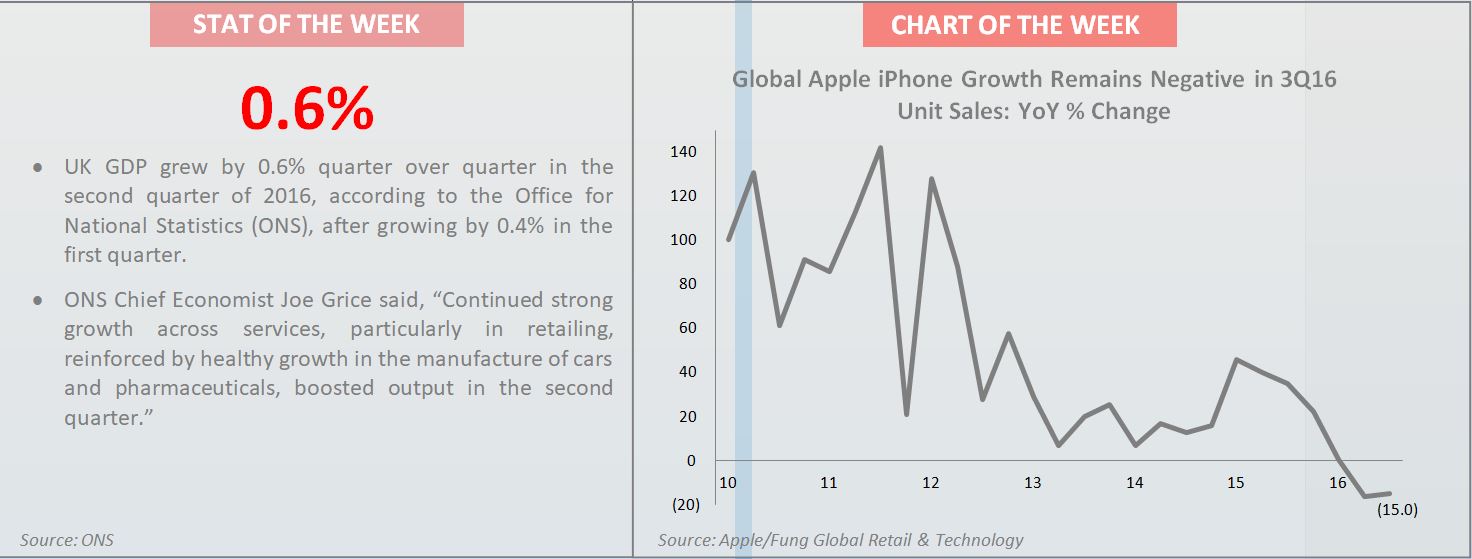

In Western markets, women are purchasing apparel at an accelerating pace. Over the past decade, apparel retailers in the US have benefited from a steady climb in women’s clothing expenditure. Women’s clothing store sales in the US increased by $4.6 billion between 2005 and 2014. Against a backdrop of flat apparel prices in the US, this suggests that women are shopping more and owning more clothes than they did in previous decades.

In the UK, a survey conducted by British charity Barnardo’s in 2015 indicated that women wear clothes only seven times on average, which suggests they are making new clothing purchases on a regular basis.

We believe there are three factors that are contributing to the faster-fashion phenomenon: the influence of social media, the affordability of apparel and the convenience of purchase.

Social Media Is Creating Demand for Faster Fashion

Social media is affecting consumption of personal items such as clothing in two major ways: it allows brands and retailers to communicate with their customers in real time and it has created the “selfie culture,” which puts more emphasis on being fashionable.

According to market research firm Mintel, 35% of American women ages 18–34 point to social media as a key influencer that impacts their purchasing decisions. Not surprisingly, fast-fashion brands have come to dominate the channel. As of July, H&M, Zara and Forever 21 had some of the most-followed brand accounts on Instagram, with 15.3 million, 12.0 million and 10.9 million followers, respectively. With such huge followings, these brands can communicate and advertise new trends quickly, building up demand for newly released and soon-to-be-released items.

According to a 2016 survey conducted by Ipsos, 43% of UK respondents said that their main reason for using social media was to share photos. While many pictures are taken to highlight a certain event or experience, the selfie culture leads people to want to look different in every photo, which includes wearing different clothes in every photo.

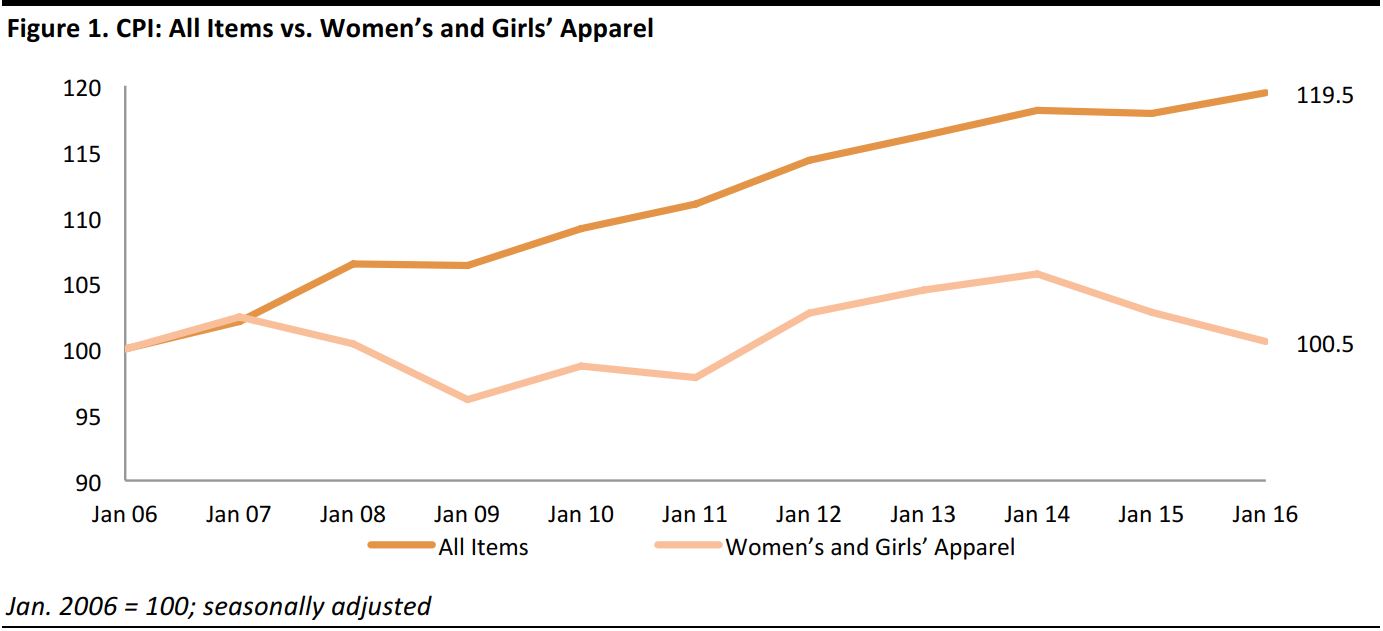

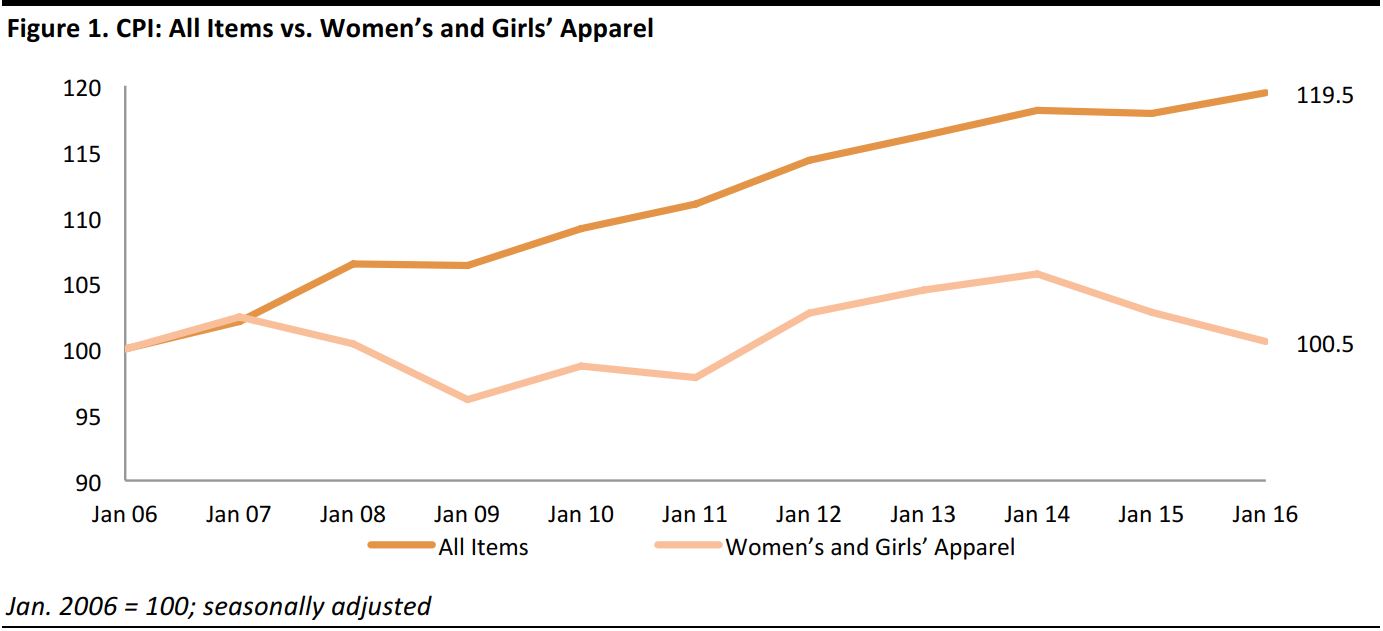

Women’s Apparel Has Gotten Cheaper Relative to Other Categories

Another significant factor in the acceleration of fashion is the affordability of apparel. Compared to other product categories, women’s and girls’ apparel has become increasingly affordable in the US. While prices for all consumer goods and services have appreciated by 19.5% over the past decade, prices for women’s and girls’ apparel have barely increased, rising by only 0.5%. And the consumer price index (CPI) for women’s and girls’ apparel has actually fallen since 2014, widening the gap between the category and other consumer products. The divergence in price points has made clothing cheap relative to other consumer categories, stimulating demand.

Source: US Bureau of Labor Statistics/Fung Global Retail & Technology

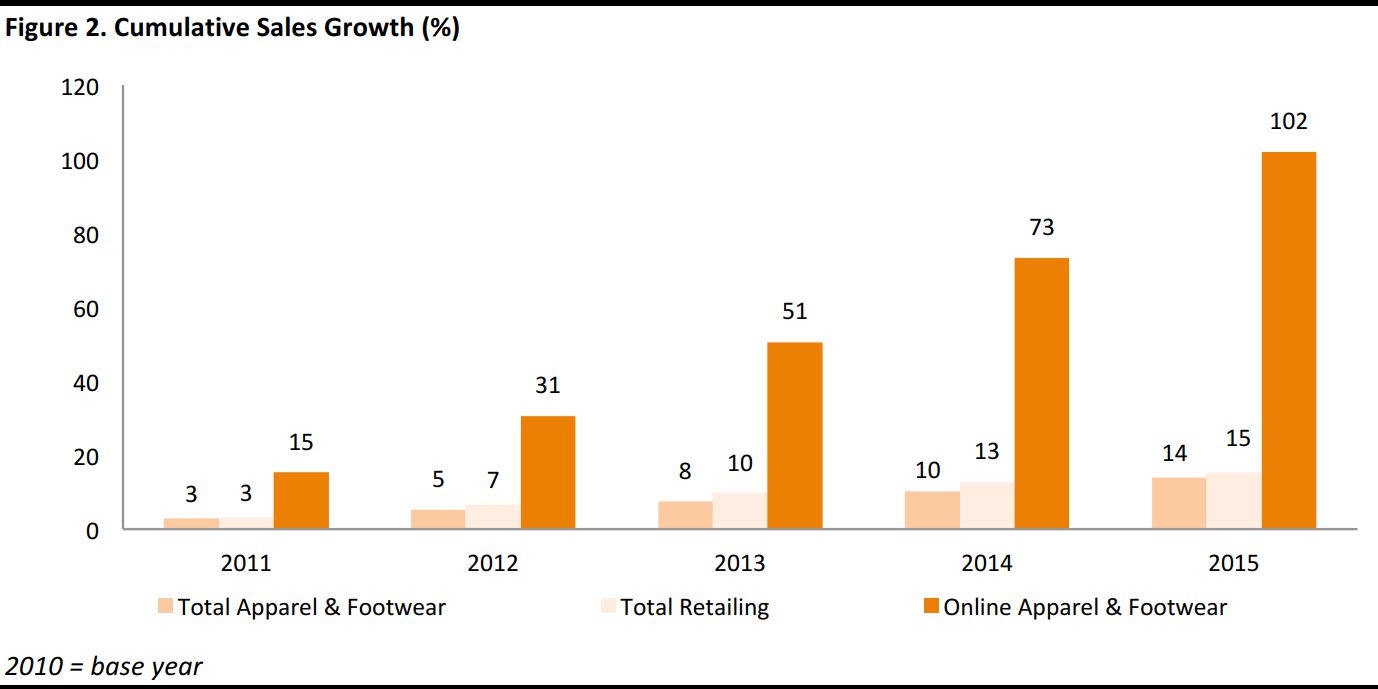

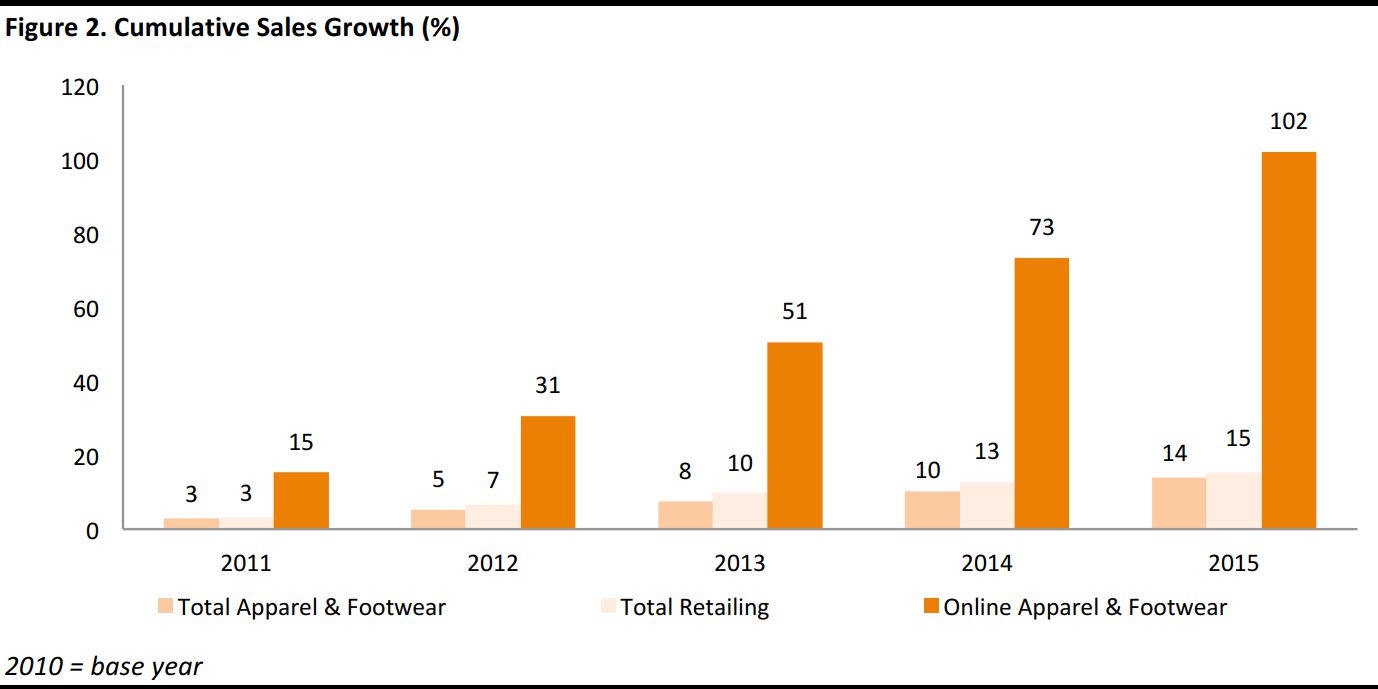

Purchasing Apparel Is Becoming More Convenient

A third factor that is contributing to the speedup of fashion is the convenience of making apparel purchases. Consumers can now browse and order apparel anytime and anywhere they want by using their smart devices. Moreover, they can compare prices instantaneously and get products delivered and returned for free. These conveniences have contributed to online shopping’s rapid growth in the past decade. Online sales of apparel and footwear in the US totaled $45.5 billion in 2015, up from $22.5 billion in 2010, according to data from Euromonitor International. This represents cumulative sales growth of 102.0% over the period, compared to 13.9% for the total apparel and footwear category and 15.5% for total retailing in the US.

Source: Euromonitor International/Fung Global Retail & Technology

With the rapid and continuous development of online retailers, consumers now have more options to choose from and new ways to conduct online transactions. Yet more online apparel sales may not necessarily lead to bottom-line growth for e-commerce companies, because more online sales also mean more returns—and the increasing intensity of these forward and reverse supply chains can impact the profitability of companies operating in the space.

CONCLUSION

Over the past decade, social media has stimulated apparel consumption. The channel represents a key influencer in many consumers’ buying decisions and an outlet for displaying new fashions and trends. At the same time, apparel prices have barely increased, making clothing relatively more affordable for women to purchase. And the development of online apparel retailers has made it more convenient for consumers to purchase, receive and return goods. Considering the convergence of these trends, we expect apparel consumption to continue to speed up and fast fashion to become even faster.

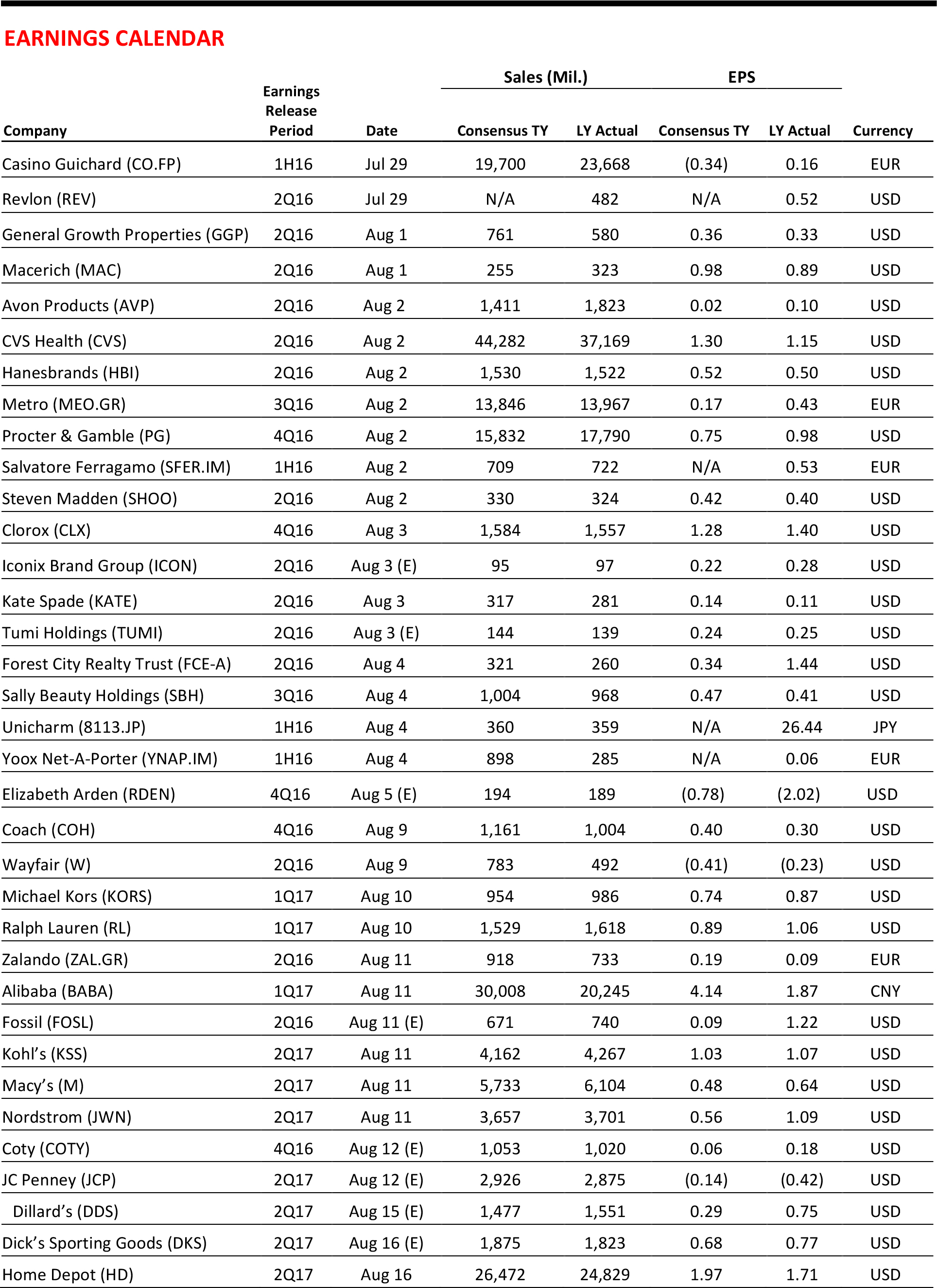

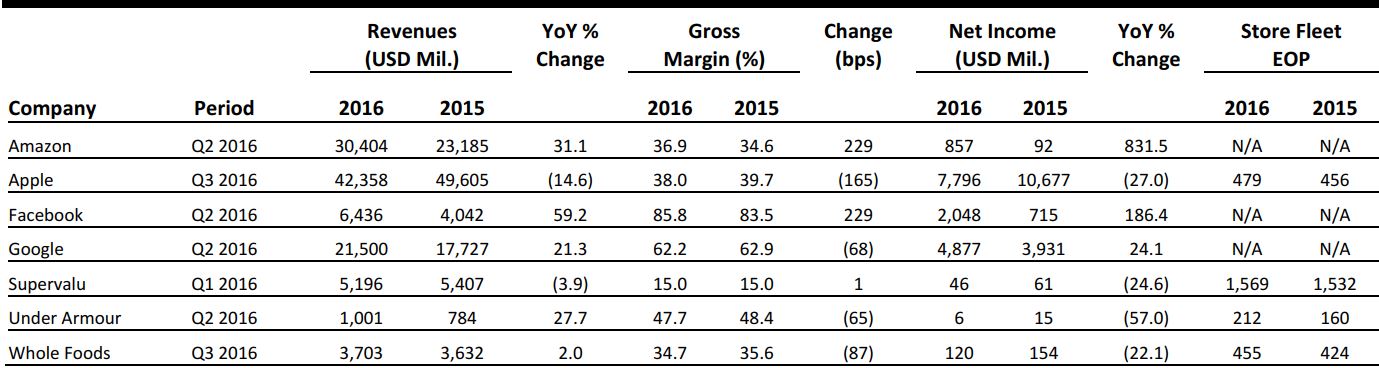

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

What 3D Printing Means for Fashion

(July 27) Business of Fashion

What 3D Printing Means for Fashion

(July 27) Business of Fashion

- 3D printing technology is accelerating exponentially to create finished products for fashion and luxury goods through additive manufacturing. The three main technologies used are fused deposition modeling (FDM), stereolithography (SLA), and the sintering of powders (SLS).

- The promising future of 3D printing features emerging technologies, which create the possibility of printing bags and buckles, but go far beyond this and include seamless garments or mix materials and custom athletic shoe soles. This new industrial revolution must factor in innovation for sustainability and reduced printing time.

Wal-Mart offers new mobile cross-channel features for Chinese shoppers

(July 28) Internet Retailer

Wal-Mart offers new mobile cross-channel features for Chinese shoppers

(July 28) Internet Retailer

- Wal-Mart partners with WeChat, a popular mobile-based social network, to deliver an expedited check-out process when consumers show a bar code within the app to the cashier. Additionally, a digital gift card feature allows users to send and receive virtual gift cards.

- The new omni-channel feature creates increased shopper interaction. Wal-Mart does not sell products on its company site in China, it relies on its Chinese e-commerce subsidiary, Yihaodian, to compete in e-retail.

How Companies Like Dollar Shave Club Are Reshaping the Retail Landscape

(July 27) The New York Times

How Companies Like Dollar Shave Club Are Reshaping the Retail Landscape

(July 27) The New York Times

- Technology made a consumer products revolution possible for online shaving start-up, Dollar Shave Club; higher quality shaving products are cheaper and more convenient than ever before.

- Customers are exposed to an elevated level of experience through online start-ups in various industries including shaving, mattresses and apparel. Competition with traditional consumer product companies is not based on price alone, rather, it is based on building deep, lifelong connections with audiences whose influences, thanks to social networks, can now be tapped.

Tiger Global is Now the Biggest Investor in Online Fashion Retail in India

(July 26) Quartz India

Tiger Global is Now the Biggest Investor in Online Fashion Retail in India

(July 26) Quartz India

- Tiger Global, headquartered in New York, made early investments in Indian online fashion retailers, which positioned it for success.

- The most active startup investor in India in the last decade, Tiger Global invests in e-commerce, content creation and news.

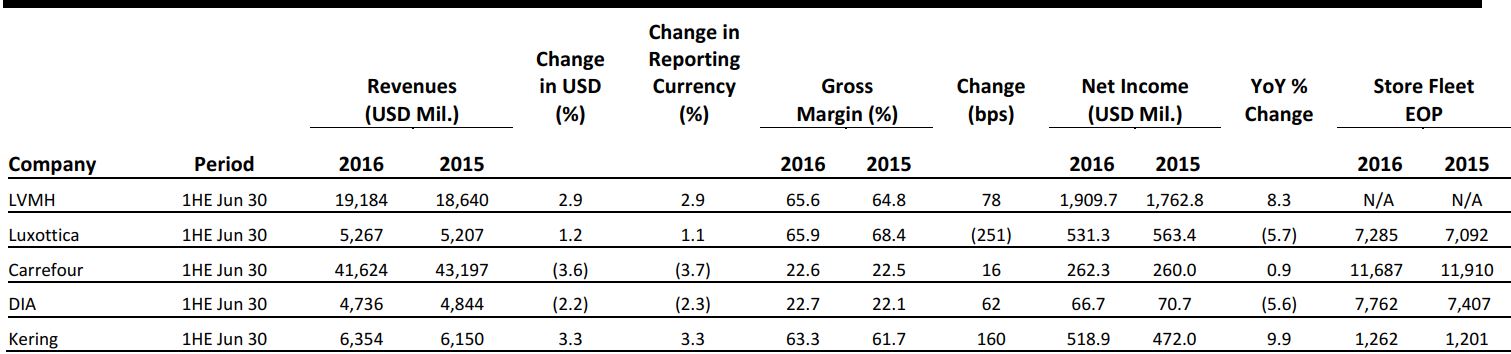

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Amazon Invests Heavily in Italy

(July 25) Retaildetail.eu

Amazon Invests Heavily in Italy

(July 25) Retaildetail.eu

- Online giant Amazon has announced plans to invest €500 million in the construction of a major logistics center near Rome, Italy.

- This comes after the Italian government passed a new policy to aid the promotion of e-commerce in Italy in order to bring it closer to the level of other major European economies.

Tesco Launches Shop-in-Shop Partnership with Holland & Barrett

(July 26) Retail-week.com

Tesco Launches Shop-in-Shop Partnership with Holland & Barrett

(July 26) Retail-week.com

- UK supermarket chain Tesco has agreed to a tie-up with health foods retailer Holland & Barrett in a move to make better use of space in larger Tesco stores. The supermarket retailer said it is “confident the brands and propositions will work successfully together.”

- This follows other, similar deals among supermarkets. Sainsbury’s is already starting to integrate Jessops and Argos, and Asda is piloting a partnership with French sports giant Decathlon.

Hobbs Reports International Success

(July 25) Retail-week.com

Hobbs Reports International Success

(July 25) Retail-week.com

- Fashion retailer Hobbs reported an 18% increase in EBITDA for the year ended January 30, despite a total sales decline of 5.7%, to £109.9 million.

- CEO Meg Lustman stated that the “strong performance this year against an uncertain economic backdrop is an indication of the success of our investments and our growing international footprint.”

BHS Set to Cease Trading

(July 25) Retailgazette.co.uk

BHS Set to Cease Trading

(July 25) Retailgazette.co.uk

- The administrators of BHS have made the decision to shut down the chain’s remaining 114 stores by August 20, as no buyer has come forward since it entered administration in April.

- It is expected that some of the stores will shut before the deadline date and that around 5,000 shop-floor staff will lose their jobs.

Discounters Continue to Impact Major UK Supermarkets

(July 26) UK.kantar.com

Discounters Continue to Impact Major UK Supermarkets

(July 26) UK.kantar.com

- The UK grocery sector grew sales by 0.1% year over year in the 12 weeks ended July 17, according to market measurement company Kantar Worldpanel. Discounters Aldi and Lidl continued to lead growth, with sales up 11% and 12.5%, respectively.

- Each of the big four nondiscount grocery retailers saw sales fall, according to Kantar Worldpanel. At market leader Tesco, sales fell by 0.7%; sales were down 1.1% at Sainsbury’s, 1.8% at Morrisons and fully 5.6% at Asda.

ASIA TECH HEADLINES

China’s Huawei Reports 40% Revenue Surge

(July 25) BBC

China’s Huawei Reports 40% Revenue Surge

(July 25) BBC

- Chinese technology and smartphone giant Huawei saw a 40% surge in revenue for the first half of 2016. The company reported ¥245.5 billion (US$37 billion) in revenue, a ¥69.9 billion year-over-year increase.

- Huawei is the third-biggest smartphone vendor in the world after Samsung and Apple. It is known for its low-cost smartphones, but has moved into higher-end models.

South Korea Establishes Fintech Investment Partnership with Britain

(July 25) The Star Online

South Korea Establishes Fintech Investment Partnership with Britain

(July 25) The Star Online

- South Korea has formed a fintech investment partnership with Britain to smooth the financial technology investment process for both countries.

- The agreement will attract South Korean firms and investors to Britain, which has become the global capital for fintech. In turn, British fintech companies and investors will be granted access to the Asian market through this move.

India’s Zoomcar Set to Raise US$25 Million

(July 25) e27.co

India’s Zoomcar Set to Raise US$25 Million

(July 25) e27.co

- India’s rental startup Zoomcar is close to securing a US$25 million series C round of funding led by Ford, which will provide $15 million, with Sequoia Capital and Reliance Venture Asset Management providing US$10 million. This will be Ford’s third investment focusing on autonomous rides, data and connected cars.

- Zoomcar provides services such as rides to and from airports, train station pickups and general commuting. It facilitates more than 2,100 rides a day with over 1,600 cars and 860,000 users.

India’s Qwikcilver Raises a New Round of Funding

(July 26) e27.co

India’s Qwikcilver Raises a New Round of Funding

(July 26) e27.co

- Qwikcilver, an Indian gift card technology and end-to-end prepaid solutions company, has secured an undisclosed amount of funding from Sistema Asia Fund Advisory. The funds will be used for investments in innovations, R&D and market expansion.

- Qwikcilver has established and reinforced the prepaid and gift card network in Indian retail. Its technology has been adopted in more than 500 cities and towns by more than 10,000 premium brand stores, e-commerce portals and mobile apps.

LATAM RETAIL HEADLINES

Most Brazilians See More Losses than Benefits from Rio Olympic Games

(July 27) WSJ.com

Most Brazilians See More Losses than Benefits from Rio Olympic Games

(July 27) WSJ.com

- The Olympic Games in Rio de Janeiro are only a week away, and a new poll has been released indicating that 60% of Brazilians see the sporting event as generating more losses than benefits for Brazil.

- Brazilians are more pessimistic about the Olympics than they were two years ago, when Brazil hosted the FIFA World Cup. Prior to that event, 43% of Brazilians polled said they believed the event would bring benefits for the country.

Fashion Brand Licensors Battle for Turf as Mexico Grows, Brazil Slides

(July 26) WWD.com

Fashion Brand Licensors Battle for Turf as Mexico Grows, Brazil Slides

(July 26) WWD.com

- Latin America’s apparel-licensing market is facing an influx of US and European brands that are rushing to expand in booming Mexico. The market is also working to gain control of the struggling franchises that are sliding amid Brazil’s recession.

- The decline is causing licensing groups to divest assets to help their embattled brands survive the worst recession Brazil has seen since the Great Depression.

Brazil’s Economic Gloom Shows Signs of Lightening

(July 25) WSJ.com

Brazil’s Economic Gloom Shows Signs of Lightening

(July 25) WSJ.com

- Some economic indicators have shown positive signs in Brazil in recent weeks or, at the very least, have stopped deteriorating, raising hopes for a return to growth. The recovery could come as soon as the fourth quarter.

- Brazil’s GDP is projected to grow by about 1% next year, following deep contractions of 3.8% in 2015 and an estimated 3.3% this year.

Brazil Sells 100,000 Olympics Tickets in Less than Five Hours

(July 21) WSJ.com

Brazil Sells 100,000 Olympics Tickets in Less than Five Hours

(July 21) WSJ.com

- When the last batch of 100,000 new tickets for the Olympic Games went on sale last Thursday, they sold out within five hours of their release. The batch included tickets for swimming and tennis events (both of which were previously marked as sold out) as well as tickets for the Opening Ceremony.

- The tickets were held from sale until close to the Games out of concern that some seats might not be ready in time, which would have necessitated ticket refunds.

Apple Preps First Mexican Apple Store Ahead of Push into Latin America

(July 26) AppleInsider.com

Apple Preps First Mexican Apple Store Ahead of Push into Latin America

(July 26) AppleInsider.com

- Apple’s first store in Mexico is beginning to take shape at Mexico City’s Centro Santa Fe mall. The store is roughly three times the size of the regular boutique storefronts in the upscale shopping center.

- The company has yet to release a date for the store’s grand opening, though many speculate that the announcement will arrive within the next two months. Apple began accepting job applications for the store in January.