From the Desk of Deborah Weinswig

Amazon Is Playing Its Part in Changing the Back-to-School Shopping Season

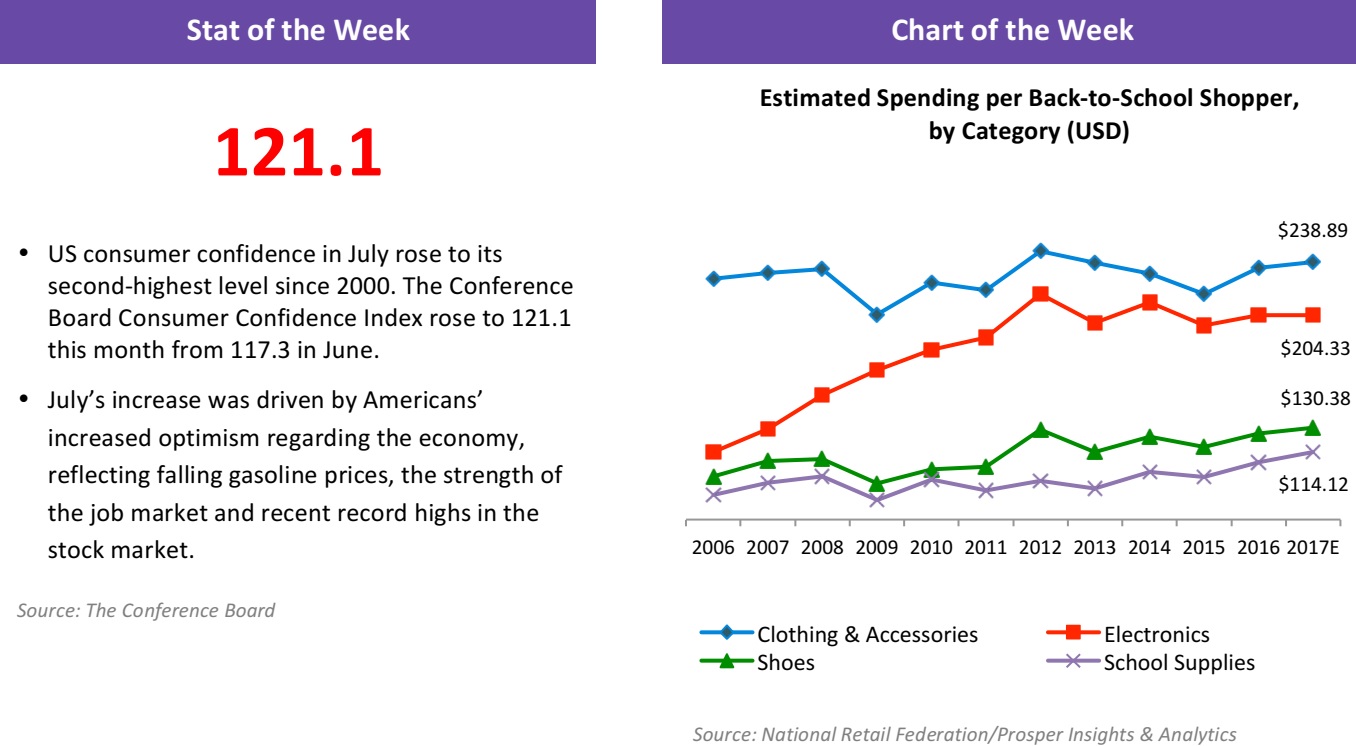

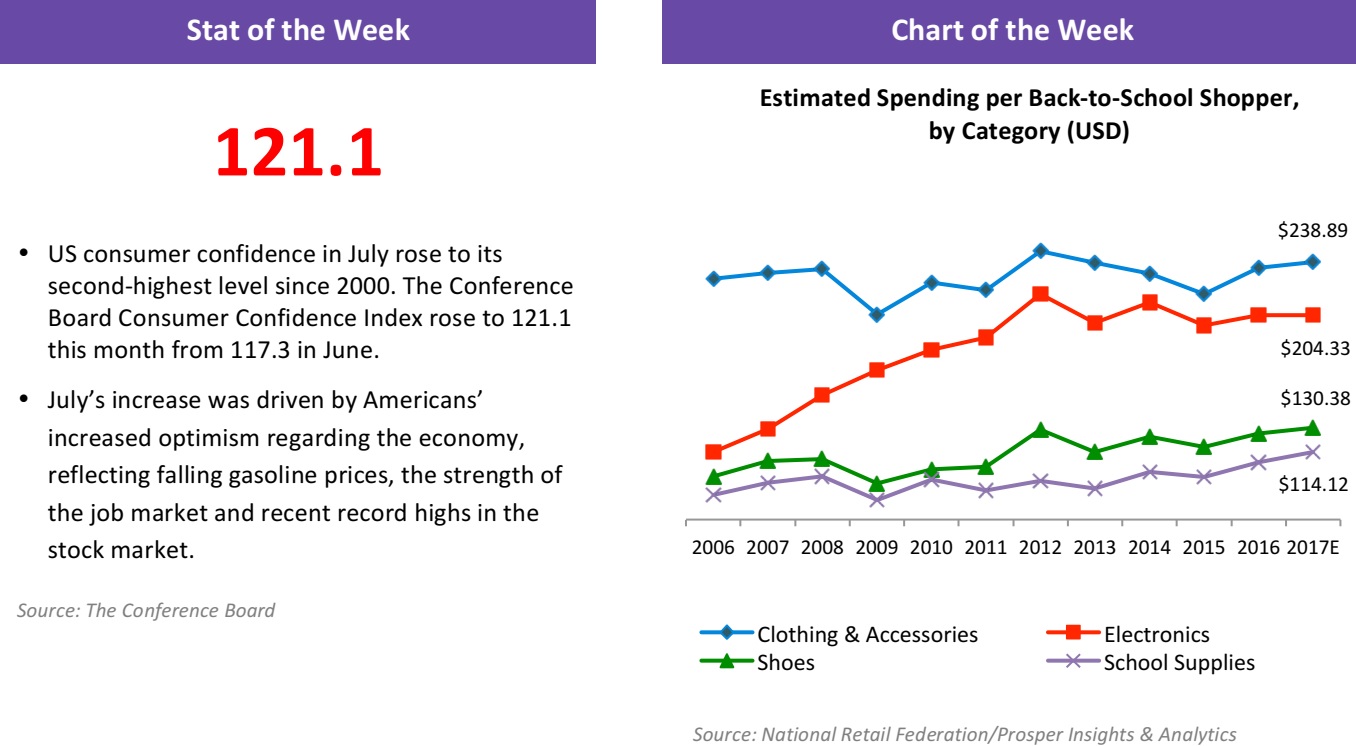

Economic conditions look good for back-to-school spending this year—unemployment is low, consumer confidence is at a 16-year high, housing prices have risen and gas prices remain low—leading to healthy forecasts for shopping this season. Fung Global Retail & Technology expects US back-to-school sales to increase by a solid 3%–4% this year, which would result in sales of $28.1–$28.3 billion, an increase over the National Retail Federation’s $27.3 billion spending figure for last year.

Yet the nature of back-to-school shopping has changed, owing to the power and convenience of the Internet and the efforts of a variety of retailers. Consumers no longer have to wait for back-to-school sales to fill up their shopping carts with all their kids’ school supplies and apparel (sometimes a tiring struggle through a series of stores with the kids). The popularity of e-commerce means that parents can now compare prices and order goods from a variety of vendors and then have them delivered to their doorsteps.

There have long been summer shopping holidays such as “Christmas in July” that are designed to stave off the summer doldrums and build shoppers’ anticipation of the back-to-school season. Some of these events preceded Amazon Prime Day, which has rocked the boat the last three years. Now, Amazon Prime Day offers a plethora of deals every July (it fell on the 11th this year), encouraging savvy shoppers to stock up well ahead of the traditional back-to-school season. Amazon-branded, educational-oriented electronics such as Kindle tablets/e-readers were heavily discounted on Prime Day this year. And, as of late July, Amazon already has “Back to School Essentials” web pages on its site featuring school supplies and office products.

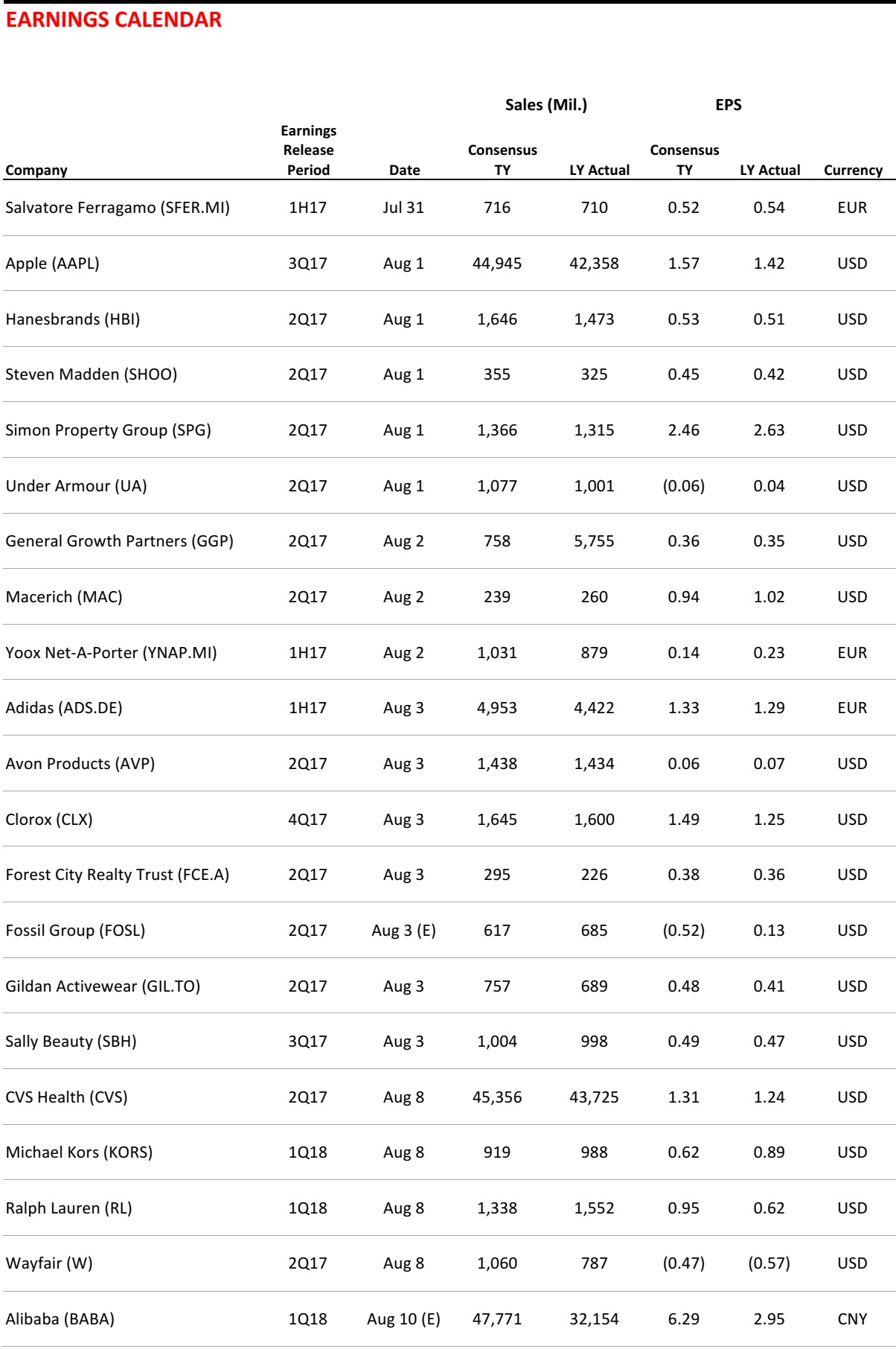

Many other retailers, not wanting to be left out and seeking to ride Amazon’s coattails, offer their own shopping events, such as “Black Friday in July” sales, to compete with Amazon Prime Day. Although less relevant for US consumers, there are new and emerging international shopping holidays, too, such as JD.com’s shopping festival on June 18 and Alibaba’s mammoth Singles’ Day shopping event every November 11. This week, Walmart announced the expansion of its cooperation with JD.com and said the two companies are launching yet another shopping event, to be held on August 8 (eight is a lucky number in China, so 8/8 is twice as lucky).

Still, back-to-school is not a complete shoo-in for Amazon. Results from a recent survey by the International Council of Shopping Centers (ICSC) show that a great many back-to-school shoppers still like to visit physical stores for a variety of reasons, as shown below.

Source: ICSC, Back-to-School 2017 Spending Survey

Other recent surveys show that although Amazon no longer offers the cheapest prices on certain items, the company still excels at convenience and ease of use. Online publication Retail Dive conducted a comparison study of back-to-school items using the Wikibuy extension for Google’s Chrome browser and found that other vendors offered prices that were 15% lower.

Back-to-school shopping, like most things in retail, continues to evolve, and Fung Global Retail & Technology will cover this year’s US back-to-school season in detail in a forthcoming series of reports.

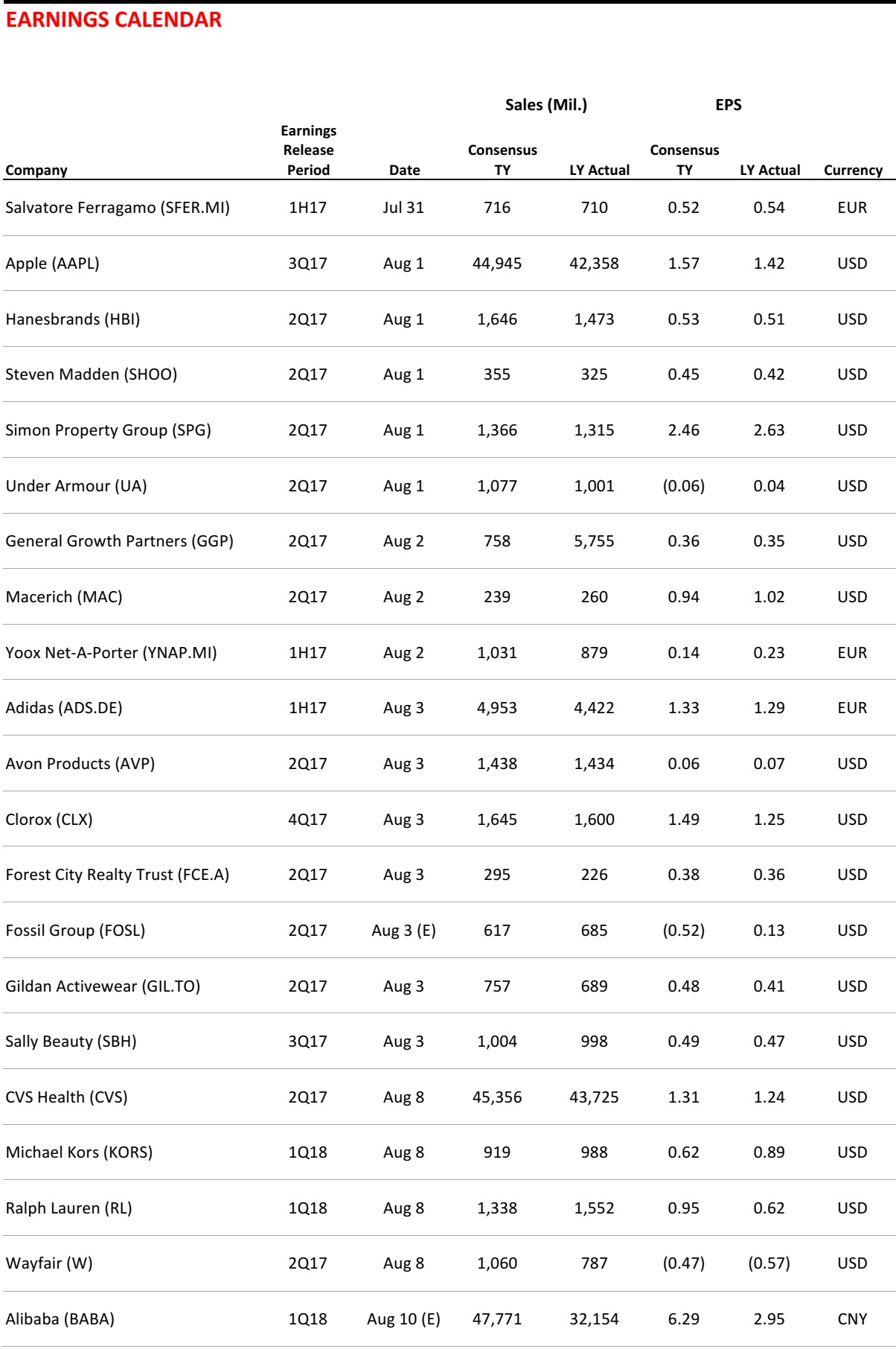

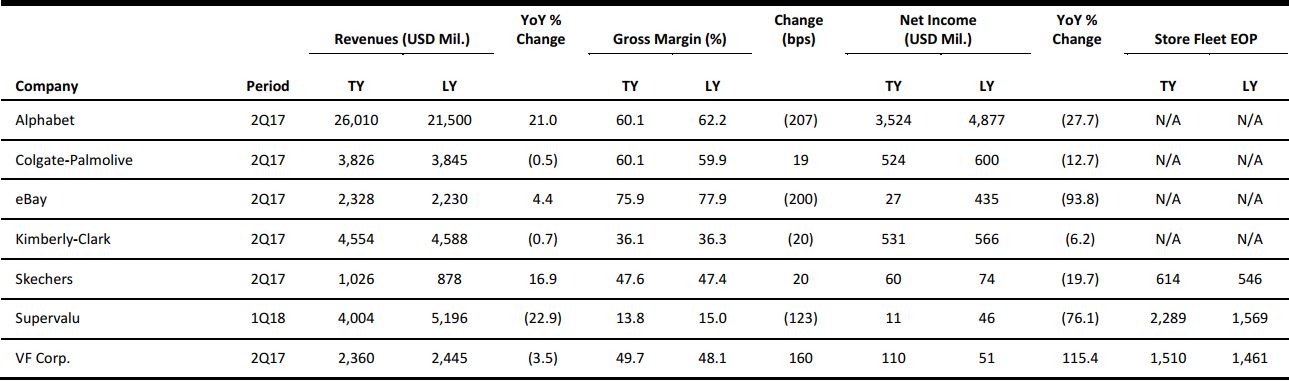

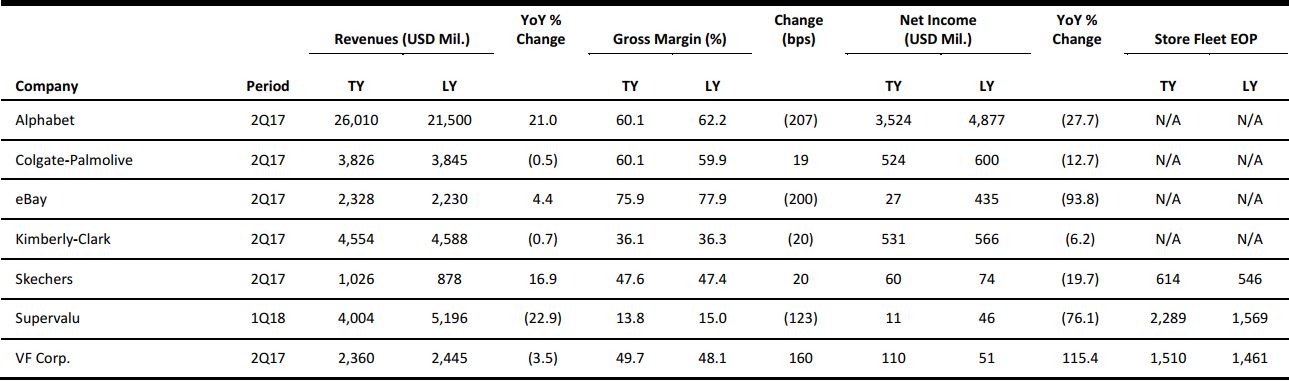

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

14 Million US Businesses Are at Risk of a Hacker Threat

(July 25) CNBC.com

14 Million US Businesses Are at Risk of a Hacker Threat

(July 25) CNBC.com

- Large corporations spend hundreds of thousands, often millions, of dollars on cybersecurity, but when it comes to small businesses, many owners are not spending enough. Only 2% of the small-business owners surveyed in the CNBC/SurveyMonkey Small Business Survey said they view the threat of a cyberattack as the most critical issue they face.

- That, in some ways, makes sense. Taxes and the cost of employee healthcare were two of the highest-ranking items and certainly are more front-of-mind on a day-to-day basis. But online security experts say that very lack of focus makes small businesses a lot more vulnerable.

JCPenney Begins Offering Full Support for Apple Pay Across US

(July 24) AppleInsider.com

JCPenney Begins Offering Full Support for Apple Pay Across US

(July 24) AppleInsider.com

- JCPenney is now accepting Apple Pay across all of its US locations, including as support for store-branded credit cards and associated rewards points. Compatibility within the JCPenney app for iPhones and iPads is “coming soon,” the company added. In-store transactions require an iPhone 6 or later or an Apple Watch.

- JCPenney is believed to have been running a pilot program for Apple Pay as far back as November 2015 and preparing to launch chainwide support by spring 2016. If so, it is not clear what might have caused the year-plus delay.

Drop in Manhattan Retail Rents Has Retailers Looking

(July 22) The Wall Street Journal

Drop in Manhattan Retail Rents Has Retailers Looking

(July 22) The Wall Street Journal

- Lower rents and generous tenant incentives persuaded more Manhattan retailers to check out potential shop space in the second quarter, but leasing remained slow as merchants wait to see just how good a deal they can secure, brokers and analysts said.

- Asking rents for ground-floor spaces dropped in 11 of 16 prime Manhattan shopping corridors from a year ago, with some falling as much as 22%. Overall, asking rents fell 8.6% from the same period last year, as the number of available retail spaces rose by 34%, to 203, in the 16 prime corridors, CBRE data showed.

Amazon Is Buying Products from Some US Retailers at Full Price to Build Global Inventory

(July 20) CNBC.com

Amazon Is Buying Products from Some US Retailers at Full Price to Build Global Inventory

(July 20) CNBC.com

- Amazon is trying to boost its catalog by telling tens of thousands of marketplace sellers in the US that it will buy their inventory at full retail price. The Fulfillment by Amazon team said that a new program is being rolled out where Amazon will buy products at full price from third-party merchants, then sell them to consumers across the globe.

- The new program, which follows a similar rollout in Europe, is the latest move by Jeff Bezos to build up a complete catalog, even if Amazon cannot make much money on the products in question.

Walmart and JD.com to Launch Aug. 8 Shopping Festival

(July 25) WWD.com

Walmart and JD.com to Launch Aug. 8 Shopping Festival

(July 25) WWD.com

- Deepening their strategic alliance, Walmart and JD.com have revealed a new omnichannel shopping festival set for August 8 and a set of initiatives to integrate their supply chains and other operations as the battle for the Chinese consumer intensifies.

- “The festival will help Walmart extend its reach to the 99% of the country’s population that JD.com’s delivery network covers, bringing high-quality Walmart products to more Chinese customers nationwide,” the announcement said.

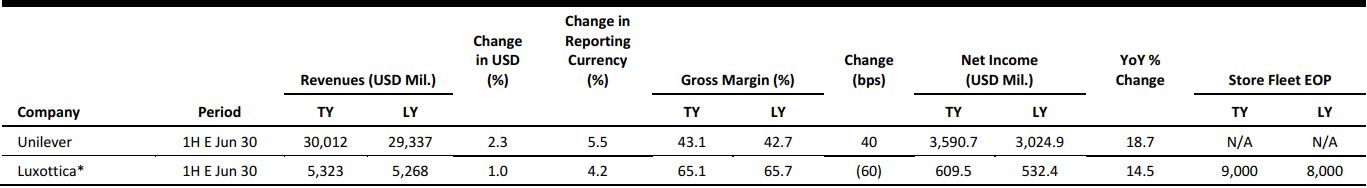

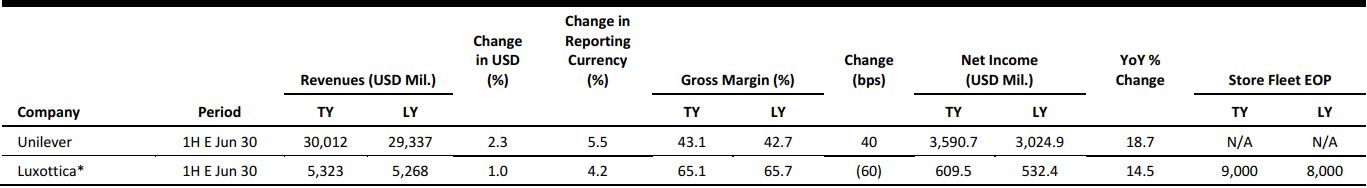

EUROPE RETAIL EARNINGS

*Luxottica store numbers are approximate and as of closest year-end, due to the absence of reported store numbers in the company’s latest statement.

Source: Company reports/FGRT

EUROPE RETAIL HEADLINES

Tesco Expands Same-Day Delivery Across UK

(July 24) Company press release

Tesco Expands Same-Day Delivery Across UK

(July 24) Company press release

- British supermarket chain Tesco announced that it will extend its same-day online grocery delivery service to more than 300 stores across the UK, covering 99% of UK households—making it the first retailer to offer nationwide same-day grocery delivery.

- The retailer launched same-day grocery delivery in London and the Southeast in 2014, enabling customers to order an unlimited number of items by 1 p.m. to have them delivered from 7 p.m. onward.

Hot Weather Boosts UK Retail Sales

(July 20) Press release

Hot Weather Boosts UK Retail Sales

(July 20) Press release

- The UK’s Office for National Statistics has reported that total UK retail sales grew by a robust 5.4% year over year in June, helped by warm weather in the month. This marked a strengthening from 3.4% growth in May, despite inflation moderating between May and June.

- The strong performance was boosted by department stores and mixed-goods retailers, clothing stores, and Internet pure plays. Grocery stores registered solid year-over-year growth of 2.5%.

John Lewis Eyes Coworking Office Space in Stores

(July 18) Retail-Week.com

John Lewis Eyes Coworking Office Space in Stores

(July 18) Retail-Week.com

- British department store chain John Lewis is assessing the idea of introducing coworking or serviced office areas into its larger stores as it seeks a better use of excess space prior to deciding on whether to go ahead with the plan next year.

- John Lewis is initially looking at including such spaces in its older, larger stores, including its store at Newcastle’s Intu Eldon Square shopping center.

Marks & Spencer Hires New Supply Chain Director

Marks & Spencer Hires New Supply Chain Director

- British retailer Marks & Spencer has hired former Morrisons group property director Gordon Mowat for the newly created role of Director of Clothing and Home Supply Chain, Logistics and Planning.

- Mowat will take up his new role at Marks & Spencer in August, and will report to Jill McDonald, incoming Managing Director of Clothing, Home and Beauty.

Michael Kors Acquires Jimmy Choo

(July 25) RetailDetail.eu

Michael Kors Acquires Jimmy Choo

(July 25) RetailDetail.eu

- Fashion brand Michael Kors has acquired luxury shoe brand Jimmy Choo for €1 billion (US$1.2 billion).

- Jimmy Choo owner JAB Luxury put the footwear brand up for sale in April. While Chinese private equity firm Hony Capital also expressed an interest in Jimmy Choo, Michael Kors won the acquisition battle.

ASIA TECH HEADLINES

SoftBank, Didi Hand $2 Billion to Uber’s Biggest Asian Rival

(July 24) Bloomberg.com

SoftBank, Didi Hand $2 Billion to Uber’s Biggest Asian Rival

(July 24) Bloomberg.com

- Singapore-based ride-hailing company grab has raised $2 billion from Didi Chuxing and SoftBank in the largest-ever venture fundraising in Southeast Asia as it joins forces with the Chinese company that drove Uber out of China.

- The deal cements a loose alliance between Didi and Grab, which competes against Uber in markets from Malaysia to Thailand. Grab said it expects to close another $500 million from unspecified new and existing backers. That will take its valuation north of $6 billion, making it the most valuable startup in Southeast Asia, a person familiar with the matter said.

China’s Got a Huge Artificial Intelligence Plan

(July 21) Bloomberg.com

China’s Got a Huge Artificial Intelligence Plan

(July 21) Bloomberg.com

- China aims to make the artificial intelligence (AI) industry a “new, important” driver of economic expansion by 2020, according to a development plan issued by the State Council. Policy makers want to be global leaders, with the AI industry generating more than ¥400 billion (US$59 billion) of output per year by 2025, according to an announcement from the cabinet.

- “Artificial intelligence has become the new focus of international competition,” the report said. “We must take the initiative to firmly grasp the next stage of AI development to create a new competitive advantage, open the development of new industries and improve the protection of national security.”

Alibaba Said to Lead $500 Million Funding Round for Indonesia’s Tokopedia

(July 25) TechinAsia.com

Alibaba Said to Lead $500 Million Funding Round for Indonesia’s Tokopedia

(July 25) TechinAsia.com

- Alibaba is supposedly in talks to make an investment in Tokopedia, according to Bloomberg. The Chinese firm is expected to take the lead in a $500 million funding round for the Indonesian e-commerce marketplace. Existing investors SoftBank and Sequoia Capital are also slated to join the round.

- Earlier this year, Bloomberg reported that Tokopedia has been in investment talks with JD.com, Alibaba’s Chinese rival. The rumor was never confirmed by JD.com or Tokopedia. A source with direct knowledge of the discussion told Tech in Asia that JD.com was in talks to fund many companies in Indonesia, including Tokopedia, but that it did not hold talks with Tokopedia in the past few weeks.

Amazon Prepares to Enter Southeast Asia via Singapore Launch

(July 26) TechCrunch.com

Amazon Prepares to Enter Southeast Asia via Singapore Launch

(July 26) TechCrunch.com

- Amazon is continuing its international expansion push with the launch of its services in Singapore coming imminently. The arrival could happen as soon as this week, according to a source with knowledge of the plans, and it will mark Amazon’s entry into Southeast Asia.

- The launch will see Amazon Prime, Amazon Prime Now fast delivery and Amazon’s regular e-commerce services become available to Singapore’s population of more than 5 million people, the source said. Pricing is unclear at this point.

LATAM RETAIL AND TECH HEADLINES

IBM Watson Gains Traction in Brazil

(July 24) ZDNet.com

IBM Watson Gains Traction in Brazil

(July 24) ZDNet.com

- IBM is moving forward with its plans to promote its cognitive-computing platform Watson in Brazil, one of the main target markets for the company. The company expects that by next year, 1 billion people worldwide will have had contact with the platform. In Brazil, a current priority is to educate prospective buyers about how the technology can improve their processes.

- IBM has not disclosed how many local clients are using Watson so far, but it is demonstrating what the platform can do through some of its largest clients, which have been showcasing their recent experiments based on the system.

Brazil Retailer GPA Swings to Profit, Eyes Better EBITDA Margin

(July 26) Reuters.com

Brazil Retailer GPA Swings to Profit, Eyes Better EBITDA Margin

(July 26) Reuters.com

- Brazilian retailer GPA posted a second-quarter profit of R$165 million (US$52 million) on Tuesday, compared with a net loss of R$277 million (US$87 million) a year earlier, according to a securities filing.

- Earnings before interest, taxes, depreciation and amortization, a gauge of operating profit known as EBITDA, doubled from a year ago to R$659 million (US$208 million). GPA forecast that EBITDA would equal 5.5% of revenue from its food business this year, up from 5.3% in 2016.

Retailer Fnac to Sell Brazil Unit to Livraria Cultura

(July 19) Reuters.com

Retailer Fnac to Sell Brazil Unit to Livraria Cultura

(July 19) Reuters.com

- French music and book retailer Fnac Darty has agreed to sell its Brazilian business to local bookstore chain Livraria Cultura. Fnac Darty said it will license the Fnac brand to the new unit and carry out a recapitalization to help the new entity improve its market position.

- Fnac’s Brazil arm is among several Brazilian appliance and consumer electronics retailers up for sale after their traditional setup of brick-and-mortar outlets with lots of floor space and slow inventory turnover became increasingly unsustainable in Brazil’s worst recession on record.

Mexico’s Femsa Q2 Profit Falls, but Sales Jump

(July 25) Reuters.com

Mexico’s Femsa Q2 Profit Falls, but Sales Jump

(July 25) Reuters.com

- Mexican bottler and retailer Femsa said its second-quarter net earnings fell 4.4% year over year, to MXN 4.657 billion (US$257 million). Sales, however, jumped by 21.4% in the quarter, to MXN 114.8 billion (US$6.5 billion) on the back of revenue growth at its Coca-Coca bottler, stores, and health and fuel divisions.

- “Revenue growth was strong during the quarter, not just for our retail formats, but across operations, and reflected a resilient consumer environment in Mexico in spite of rising inflation,” said Femsa Chief Executive Carlos Salazar Lomelin.

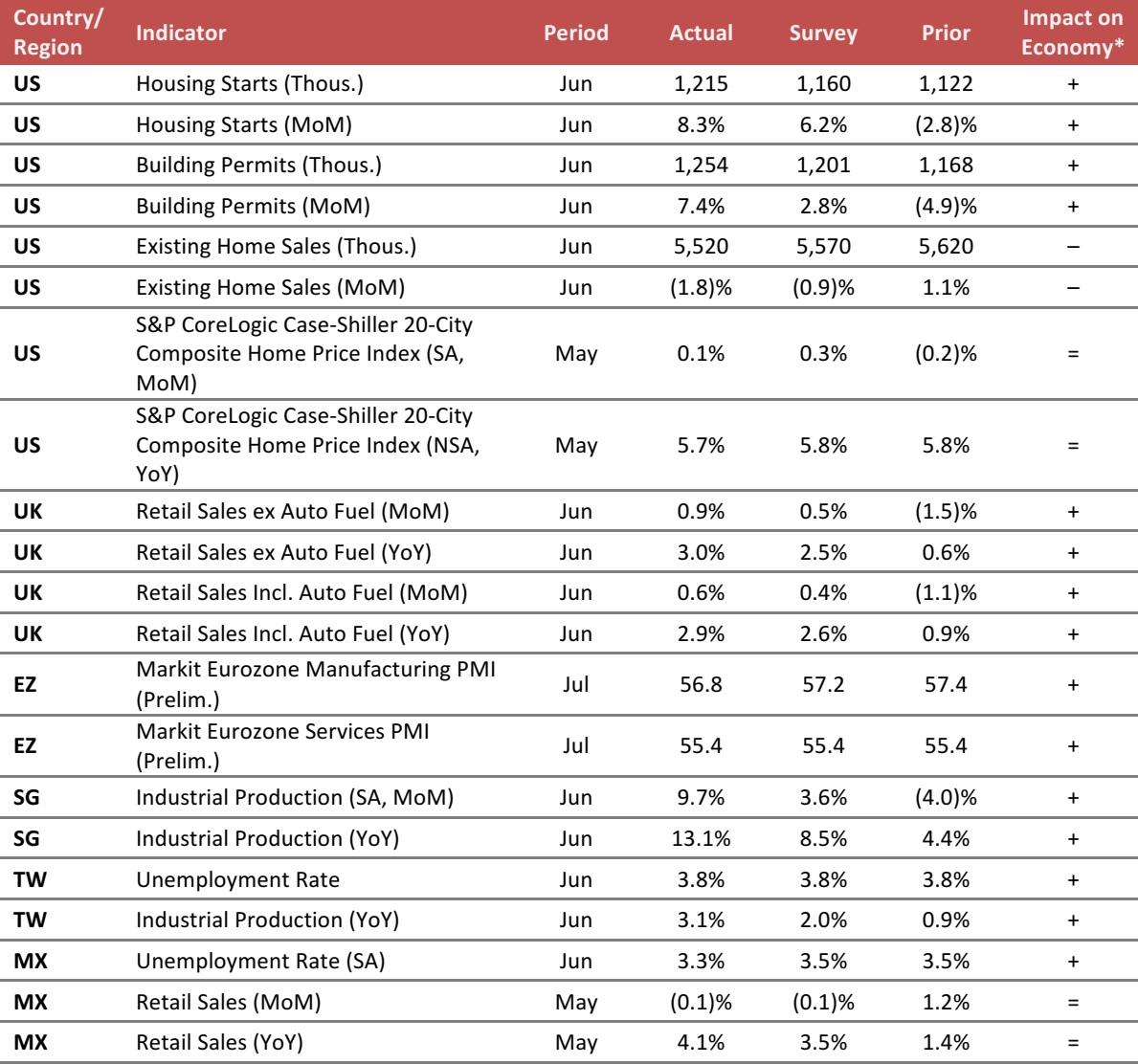

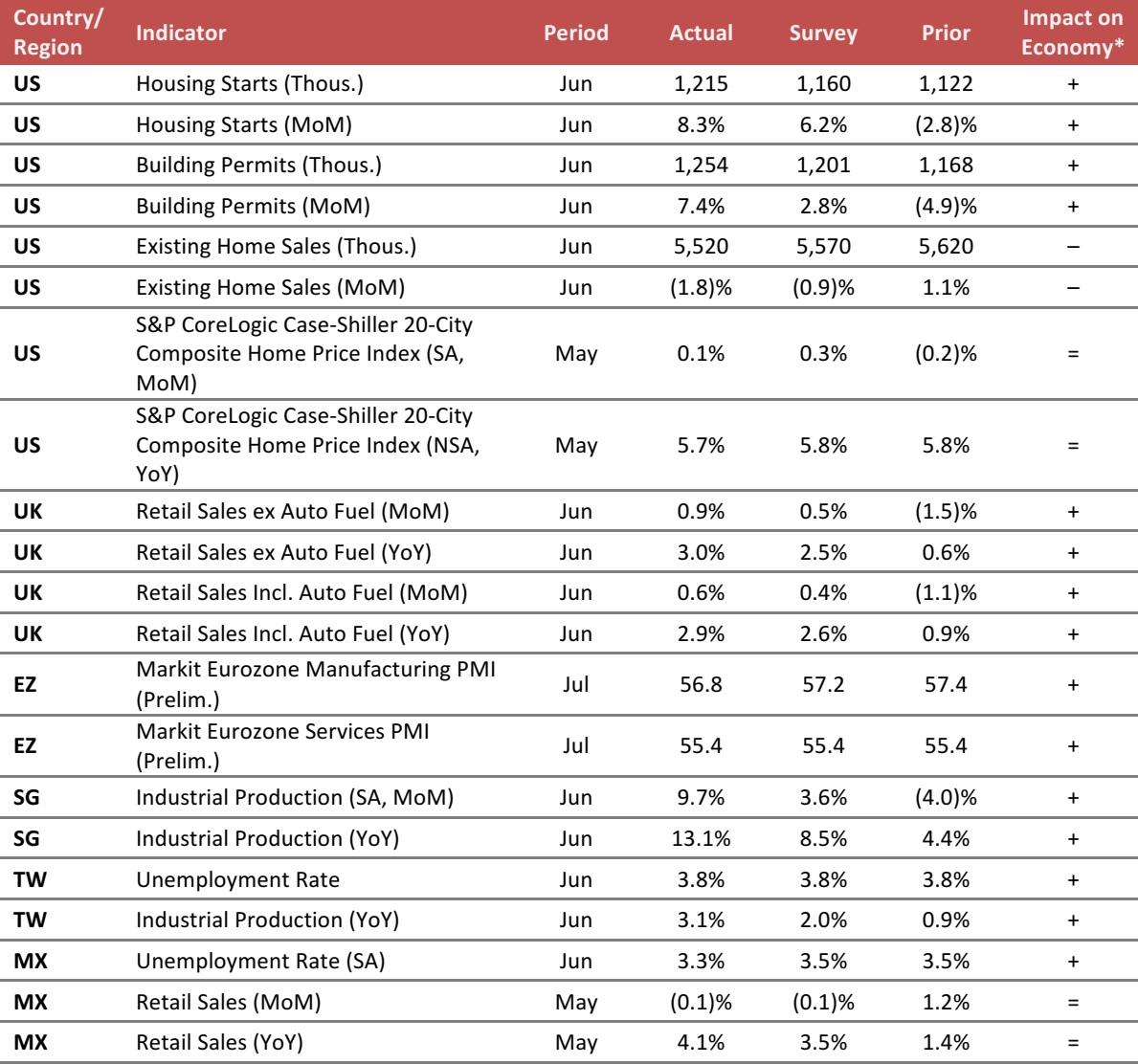

MACRO UPDATE

Key points from global macro indicators released July 19–26, 2017:

- US: Housing starts in June increased by 8.3% month over month and building permits increased by 7.4% month over month, signaling robust home-building activity. However, existing home sales decreased by 1.8% month over month in June, which reflected slower home-buying activity.

- Europe: In the UK, retail sales showed stronger-than-expected growth in June. In the eurozone, the Markit Manufacturing and Services Purchasing Managers’ Indexes (PMIs) remained above the expansion threshold of 50.0 in July, pointing to a stronger economy in the region.

- Asia-Pacific: In Singapore, industrial production in June increased by 9.7% month over month, reflecting the manufacturing sector’s healthy state. In Taiwan, the unemployment rate stayed at a low level in June and industrial production showed healthy year-over-year growth.

- Latin America: In Mexico, the unemployment rate edged down to 3.3% in June. Retail sales in May decreased by 0.1% month over month, but increased by 4.1% year over year.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/National Association of Realtors/S&P Dow Jones Indices/UK Office for National Statistics/Markit/Singapore Economic Development Board/Monetary Authority of Singapore/Singapore Department of Statistics/Taiwan Directorate-General of Personnel Administration/Taiwan Ministry of Economic Affairs/Instituto Nacional de Estadística y Geografía (INEGI)/FGRT

Drop in Manhattan Retail Rents Has Retailers Looking

(July 22) The Wall Street Journal

Drop in Manhattan Retail Rents Has Retailers Looking

(July 22) The Wall Street Journal

SoftBank, Didi Hand $2 Billion to Uber’s Biggest Asian Rival

(July 24) Bloomberg.com

SoftBank, Didi Hand $2 Billion to Uber’s Biggest Asian Rival

(July 24) Bloomberg.com