Source: S&P Capital IQ

From the Desk of Deborah Weinswig

Reviewing WeChat, a Communication, Connection and Commerce Ecosystem with Almost a Billion Users

We recently attended the Rise 2017 Conference in Hong Kong, which is one of the largest technology conferences in Asia. The event featured a talk by Stephen Wang from Tencent, which owns the WeChat mobile app. Wang gave an overview of the “WeChat lifestyle,” or how people in China use WeChat to perform daily tasks “more conveniently and more elegantly.” We expect WeChat to hit 1 billion users this year, and in this week’s note, we reflect on some of Wang’s comments and share our own observations on the company.

The scale of WeChat is remarkable for a brand that was founded less than seven years ago. WeChat has grown to become one of the largest communication platforms in the world, with 938 million monthly users as of the first quarter of 2017 (latest reported), a 23% year-over-year increase, according to company filings. According to Wang, WeChat accounts for fully 30% of all time spent on cell phones in China.

WeChat has achieved this by creating an ecosystem consisting of several elements:

- Social media: WeChat’s Moments feature allows users to share photos, videos and other content in real time. Meanwhile, Official Accounts allow organizations to distribute news subscriptions, provide customer service and communicate internally with colleagues.

- Mobile payments: WeChat Pay enables in-person payment via cell phone for business-to-consumer and consumer-to-consumer transactions.

- Replacing native apps: Mini Programs are “apps within the app” that allow consumers to access services without having to leave WeChat.

Wang noted that WeChat’s product development philosophy centers on communication, connection and commerce and that its features allow users to engage with the app multiple times a day for purposes as diverse as renting a bike, reading an article or calling a friend via video call.

Commerce is a major focus for WeChat, and Wang noted that the company’s development team has launched two products to help businesses engage with WeChat users: social ads, which allow businesses to target users to build awareness and acquire customers, and cross-border pay, which is a service that the company is launching in international markets.

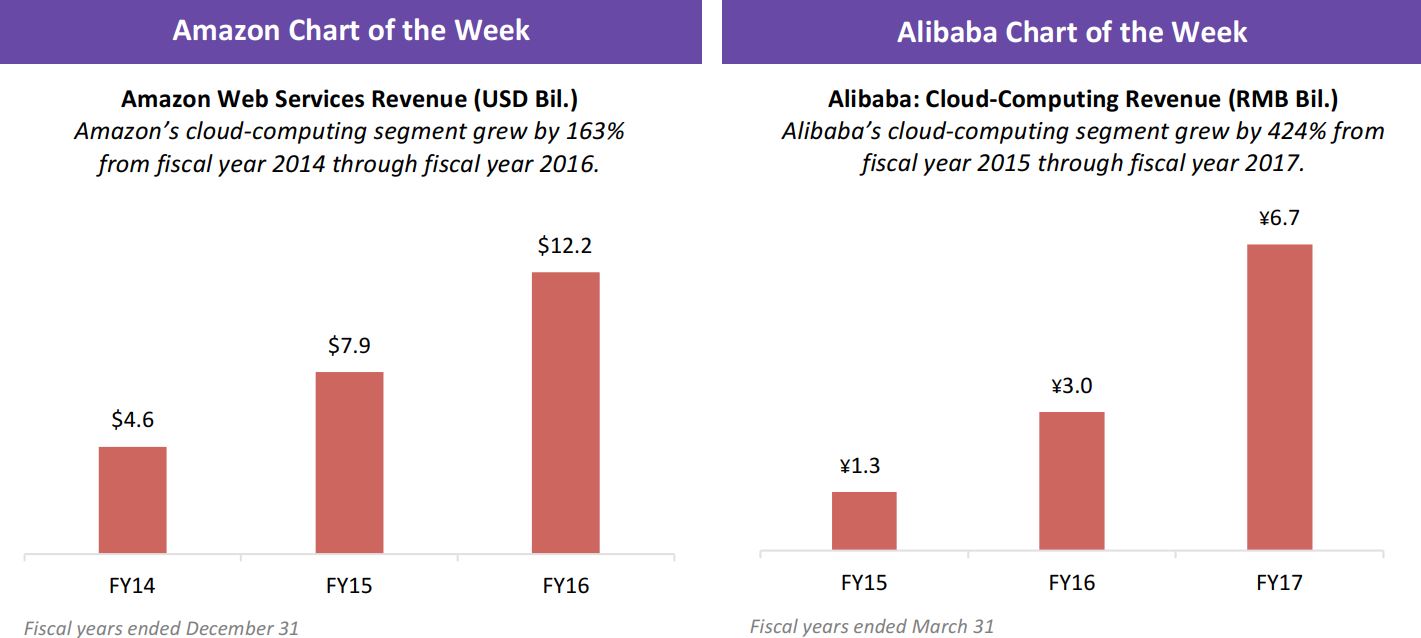

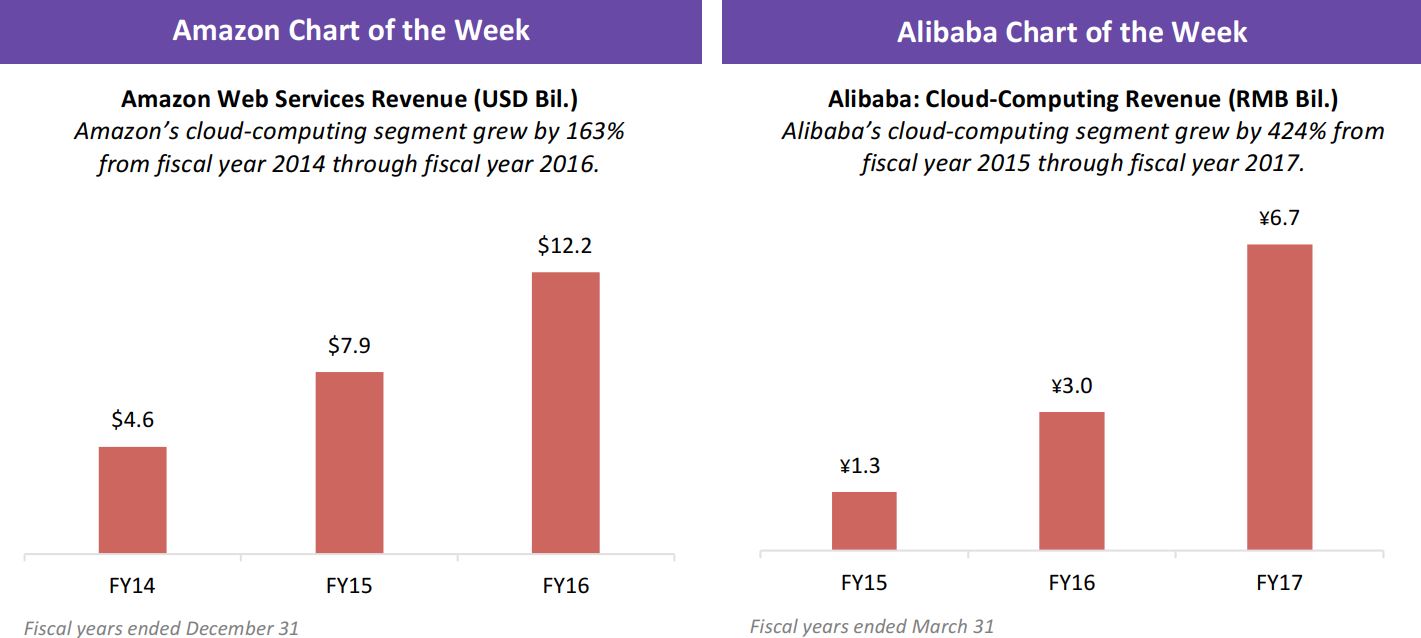

Ecosystem Model Is a Hallmark of the Chinese Internet Sector

Diversification into multiple categories and services is also a hallmark of Tencent rival Alibaba Group, whose offerings encompass payments, commerce, logistics, cloud services, media and entertainment. The dominance of these multisector behemoths gives the e-commerce and tech services sector in China a very different shape than in Western countries, which tend to be marked by a plurality of more specialized companies that range from Amazon to Zalando. We note that in both China and the West, major Internet players are cementing their positions, meaning these regional differences are likely to become even more entrenched over time.

US RETAIL & TECH HEADLINES

Anxiety Among Hispanics Is Taking a Bite Out of US Retail Sales

(July 18) Quartz

Anxiety Among Hispanics Is Taking a Bite Out of US Retail Sales

(July 18) Quartz

- It is not just their numbers that make Hispanics a hugely important consumer group in the US. In addition to making up roughly 18% of the US population, at about 57 million people—and counting—Hispanics also spend more money on a daily basis than other groups, and their buying power is growing faster than that of the rest of the US.

- Shifts in the group’s spending habits can have a large ripple effect on retailers, and right now, signs are pointing to a spending slowdown following the election of President Donald Trump, who has caused a wave of uncertainty and anxiety among Latino undocumented workers, legal residents and US citizens alike after blaming a host of national ills on Mexican immigrants during his 2016 campaign.

It’s Back-to-School Season All Year

(July 17) Marketplace.org

It’s Back-to-School Season All Year

(July 17) Marketplace.org

- Back-to-school shopping counts for nearly half of all school-related spending in the year for families in the US. Retail analysts predict a strong back-to-school season this year, and most retailers and brands will be offering more deals this year than last and increasing their spending on marketing.

- But it does not feel quite like it used to, as more shoppers are going online for their deals and parents and kids are buying goods year-round. Just 15 or 20 years ago, retailers would create powerful, all-encompassing promotions for all things “kids.” So, it felt as if there was a holiday during the summer or early fall that mirrored the actual Christmas season for kids’ products.

US Retail Sales Drop 0.2% in June vs. 0.1% Increase Expected

(July 14) Reuters.com

US Retail Sales Drop 0.2% in June vs. 0.1% Increase Expected

(July 14) Reuters.com

- US retail sales unexpectedly fell in June for a second straight month, which could temper expectations of strong acceleration in economic growth in the second quarter. The Commerce Department said that retail sales fell by 0.2% last month, weighed down by declines in receipts at service stations, clothing stores and supermarkets. Americans also cut back on spending at restaurants and bars, as well as on hobbies.

- May’s retail sales were revised to show a 0.1% dip versus the previously reported 0.3% drop. Retail sales rose by 2.8% year over year in June. Excluding automobiles, gasoline, building materials and food services, retail sales slipped 0.1% last month after being unchanged in May.

Walmart Launches Online Tools for Back-to-School Shoppers

(July 13) Fortune.com

Walmart Launches Online Tools for Back-to-School Shoppers

(July 13) Fortune.com

- As autumn approaches and families prepare to send their kids to school, Walmart’s new services will be put to the test. Back-to-school season is the second-busiest time of year for the retailer (behind only Christmas). The National Retail Federation is forecasting a particularly strong season, with total spending expected to reach $83.6 billion, up 10% from last year.

- To prepare for the onslaught, Walmart unveiled new tools, including the integration of TeacherLists, an online resource with more than 500,000 classroom lists, so customers can directly look up the school supplies they need to buy. The retailer will also add extra in-store employees to assist customers at checkout, a strategy it said was successful in cutting down on wait times during the holiday season.

Target Counters US Retail Gloom with Upbeat Outlook

(July 13) Financial Times

Target Counters US Retail Gloom with Upbeat Outlook

(July 13) Financial Times

- Target became one of the few US retailers to raise—rather than cut—its guidance to investors. Target said that like-for-like sales, a key industry metric, were expected to increase modestly in the second quarter following a strong performance in May and June. The forecast is an upgrade on the low-single-digit decline that the retailer was forecasting just two months ago when it issued its first-quarter earnings.

- Earnings per share are also expected to come in above the high end of the company’s previously stated range of $0.95–$1.15. The retailer’s share price rose by more than 5%, to $53.56, by lunchtime trading in New York on the news. Brian Cornell, Target’s Chairman and CEO, said, “Following better-than-expected results in the first quarter, we’ve seen additional, broad-based improvement in traffic and category sales trends in the second quarter, despite continued challenges in the competitive environment.”

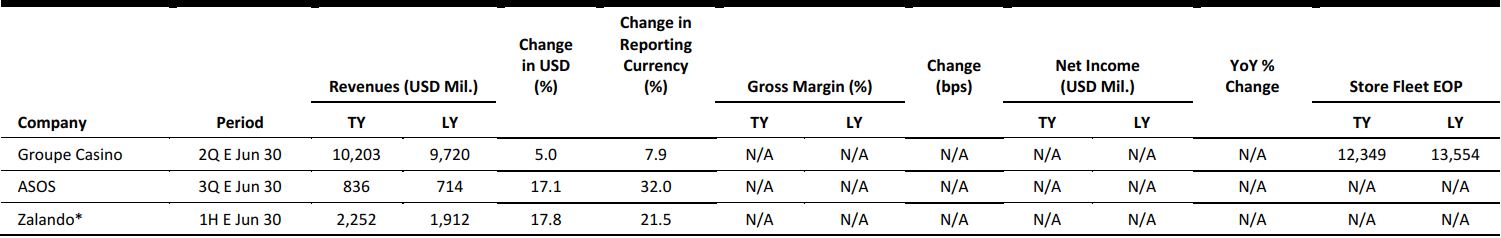

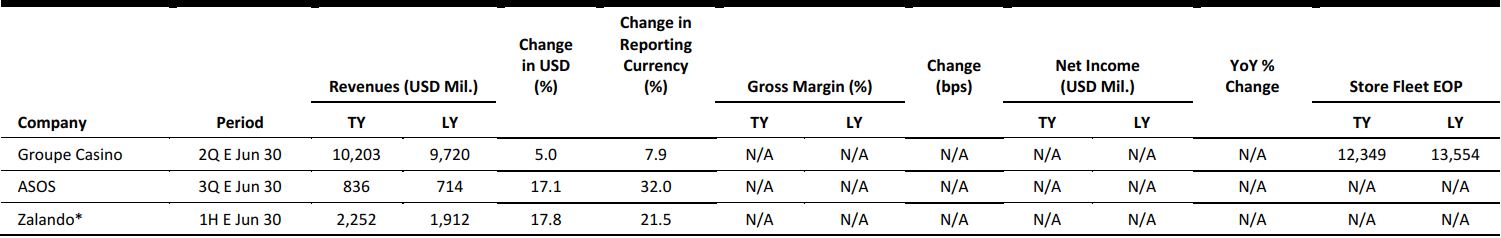

EUROPE RETAIL EARNINGS

*Zalando provided a range of €2,071–€2,089 million for its 1H17 revenues; the midpoint (in US dollars) has been used to calculate the changes shown in this table.

Source: Company reports/Fung Global Retail & Technology

EUROPE RETAIL HEADLINES

Metro Group Splits into Two Companies

(July 12) RetailDetail.eu

Metro Group Splits into Two Companies

(July 12) RetailDetail.eu

- German retailer Metro Group has demerged into two separate companies, Metro and Ceconomy, a move that was decided in February.

- The split will cost about €100 million (US$116 million) and Metro Group’s current shareholders will get the shares in the two new companies. A Metro Group share is worth one share in the new Metro and one share in Ceconomy.

Zalando Reveals Subscription Service

(July 18) Company press release

Zalando Reveals Subscription Service

(July 18) Company press release

- In its second-quarter results, e-commerce retailer Zalando announced the launch of its membership program, Zalando Zet. The program will be tested in four German cities for three months, after which it will be open to annual membership.

- The new program will cost €19 (US$22) per year and offer premium services such as faster same-day delivery, pickup of returns on demand, personal fashion advice and early access to sales.

C&A to Exit Russia

(July 18) RetailDetail.eu

C&A to Exit Russia

(July 18) RetailDetail.eu

- Dutch fashion retailer C&A announced it will exit fully from Russia following the end of its collaboration with franchise partner Russian Trade Group. The Russian Trade Group deal started in 2004 and consisted of 11 stores.

- The last Russian store will soon shut down and there are no new plans to continue operations in Russia. C&A reportedly no longer wants to have franchised operations.

Dixons Carphone Disposes of The Phone House Spain

(July 14) Company press release

Dixons Carphone Disposes of The Phone House Spain

(July 14) Company press release

- British electrical-goods giant Dixons Carphone has entered into an agreement to dispose of its entire holdings in The Phone House Spain. The operation will be acquired by Global Dominion Access, a Spanish provider of technical services.

- Completion of the deal is expected by the end of the second quarter and will see Dixons Carphone receive a consideration of €55 million (US$64 million).

Waitrose Appoints First Director of Food Service

(July 14) Company press release

Waitrose Appoints First Director of Food Service

(July 14) Company press release

- British supermarket chain Waitrose announced the appointment of Simon Burdess as its first Director of Food Service, effective beginning in September.

- The newly created role will see Burdess lead the development of the chain’s food service offering in stores as it looks to evolve the offering.

ASIA TECH HEADLINES

WeWork Will Launch in Japan with the Help of SoftBank

(July 18) TechCrunch.com

WeWork Will Launch in Japan with the Help of SoftBank

(July 18) TechCrunch.com

- WeWork is gearing up to launch its coworking spaces in Japan, thanks to a joint venture with SoftBank. As part of the arrangement, SoftBank and WeWork will each own 50% of the joint venture, which will be called WeWork Japan.

- WeWork Japan’s first location will launch early next year in Tokyo. WeWork operates coworking spaces in the US and 16 other countries, including Argentina, China, Israel, India and Germany. The company has appointed Chris Hill, WeWork’s first-ever COO, as CEO of WeWork Japan.

Spring Singapore Commits $73 Million to Coinvest in “Deep Tech” Startups

(July 14) TechinAsia.com

Spring Singapore Commits $73 Million to Coinvest in “Deep Tech” Startups

(July 14) TechinAsia.com

- Spring Singapore, a government agency that provides assistance to local small and medium-sized enterprises, is seeking coinvestment partners for its newly launched, $72.8 million venture capital fund.

- Spring’s investment arm, Spring Seeds Capital, said in a statement that the funds will be committed to investments in “deep tech” startups. The firm defines such businesses as being built around proprietary technologies that require significant developmental and commercialization efforts—such as product design, prototyping, product testing and clinical trials—before they are ready for market.

Uber Exits Russia After a Deal with Local Ride Hailer Yandex

(July 14) TechinAsia.com

Uber Exits Russia After a Deal with Local Ride Hailer Yandex

(July 14) TechinAsia.com

- Uber famously quit China in 2016, after selling its business unit there to incumbent Didi. On July 13, it exited Russia after a deal with local ride hailer Yandex. As Uber stares down controversies and competition at home and abroad, investors are reportedly making the case for the company to cut deals with other local competitors, including in Southeast Asia.

- Uber counterparts Here, Grab and Go-Jek have diversified, moving from ride hailing into payments and commerce, in an effort to capture more high-frequency transactions and revenue. Uber has not gone down that route. Additional services such as UberEats food delivery have not been widely introduced in Southeast Asia. While Grab and Go-Jek have gained traction in their respective markets, Uber has trailed behind by most measures.

Telegram Agrees to Delete Terrorist Content in Indonesia Following Partial Block

(July 18) TechCrunch.com

Telegram Agrees to Delete Terrorist Content in Indonesia Following Partial Block

(July 18) TechCrunch.com

- Messaging app Telegram has agreed to block terrorist-related content in Indonesia after the government threatened to block the service over fears it was enabling terrorist communication. The country’s Ministry of Communication and Information Technology blocked the web-based version of the messaging service and has threatened to do more.

- ISIS has heightened its attacks in Indonesia and the Philippines this year, and the chat app has long been seen as a key communication tool for the group. In response to the partial block, Telegram CEO Pavel Durov said the company would remove ISIS-related channels flagged by the government and develop better systems.

LATAM RETAIL AND TECH HEADLINES

Brazil’s Retail Sales Slip Unexpectedly in May

(July 12) Reuters.com

Brazil’s Retail Sales Slip Unexpectedly in May

(July 12) Reuters.com

- Retail sales in Brazil fell slightly in May, government data showed, dashing expectations for a moderate increase as the economy slowly emerges from a deep recession.

- Sales volumes excluding cars and building materials fell 0.1% from April after seasonal adjustments. That followed a revised increase of 0.9% in the previous month, government statistics agency IBGE said. Analysts in a Reuters poll expected a rise of 0.35%.

Mobile Phone Sales Bounce Back in Brazil

(July 14) ZDNet.com

Mobile Phone Sales Bounce Back in Brazil

(July 14) ZDNet.com

- Mobile phone sales in Brazil showed signs of recovery over the first three months of 2017, according to data from IDC. Some 12.4 million mobile phones were sold in the country between January and March, 25.4% more than in the same period in 2016.

- “The worst moment of the mobile phone market in Brazil, seen in early 2016, was left behind. Over the last 10 months, we have seen an increase in sales over nine months,” IDC Brazil analyst Leonardo Munin said.

Lenovo Chases Data Center Business in Brazil

(July 12) ZDNet.com

Lenovo Chases Data Center Business in Brazil

(July 12) ZDNet.com

- Lenovo will strengthen its channel presence in Brazil with a specific focus on servers and data center equipment. The company currently has 200 channel partners in the country, about 35% of which are focused on the data center market.

- The goal is to ramp up the channel to 300 partners by the end of the year, with an equal split of representatives selling PCs and servers. The decision follows the introduction of the company’s new channel program, Lenovo Partner Engage, introduced in Brazil this month.

WeWork Plans “Aggressive” Expansion in Latin America Push

(July 13) Bloomberg.com

WeWork Plans “Aggressive” Expansion in Latin America Push

(July 13) Bloomberg.com

- WeWork, the world’s largest coworking space startup, is embarking on an ambitious expansion in Latin America, following recent forays into China and India. A week after opening its first office space in Brazil, WeWork is planning to boost the number of people working in its facilities tenfold, to 20,000, by the beginning of 2018, said WeWork Cofounder Miguel McKelvey.

- “Right now, we think of Latin America as one of our most important regions and a place where we’re going to continue to aggressively pursue new locations throughout the year and continue to grow very quickly,” McKelvey said in an interview.

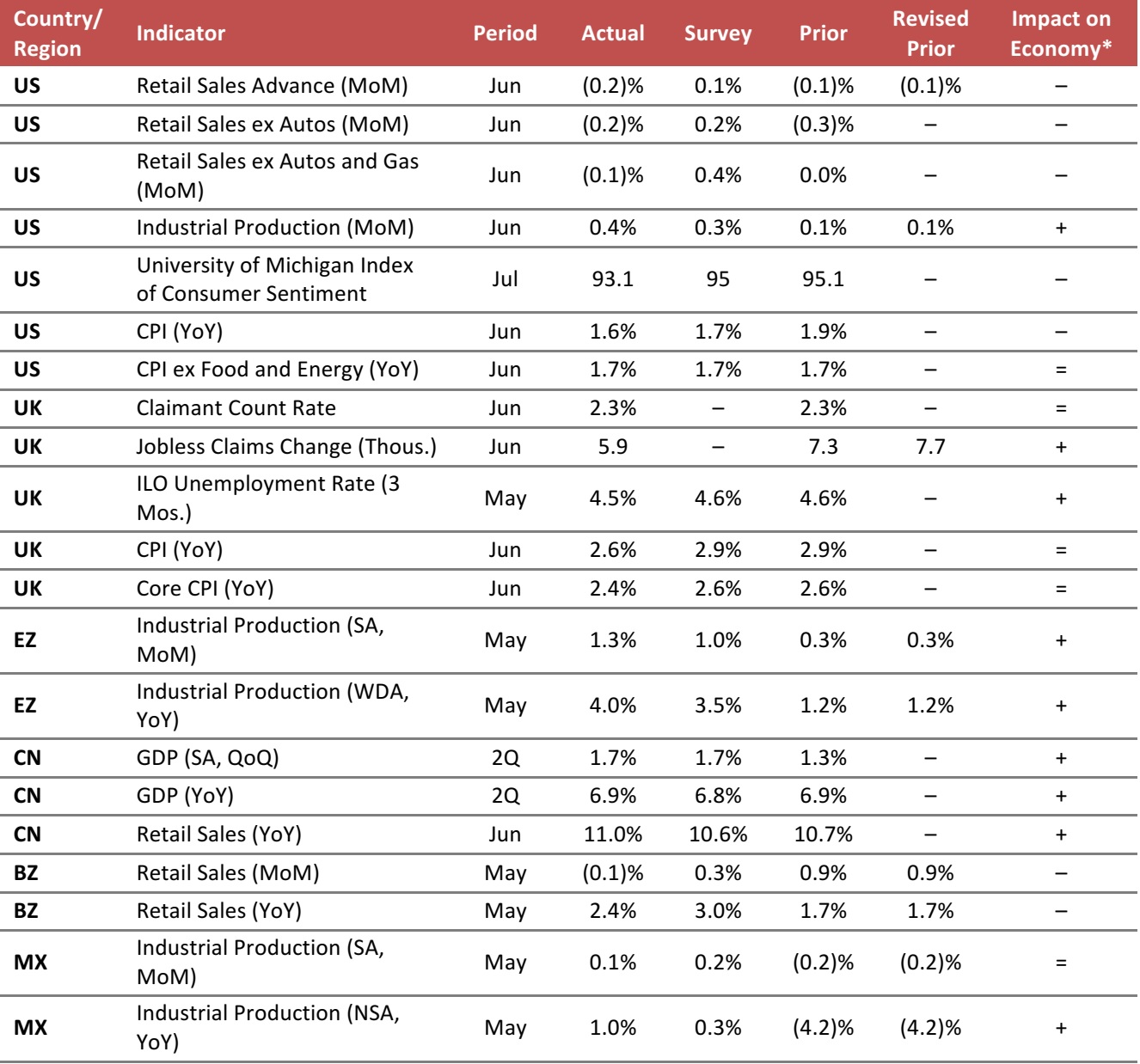

MACRO UPDATE

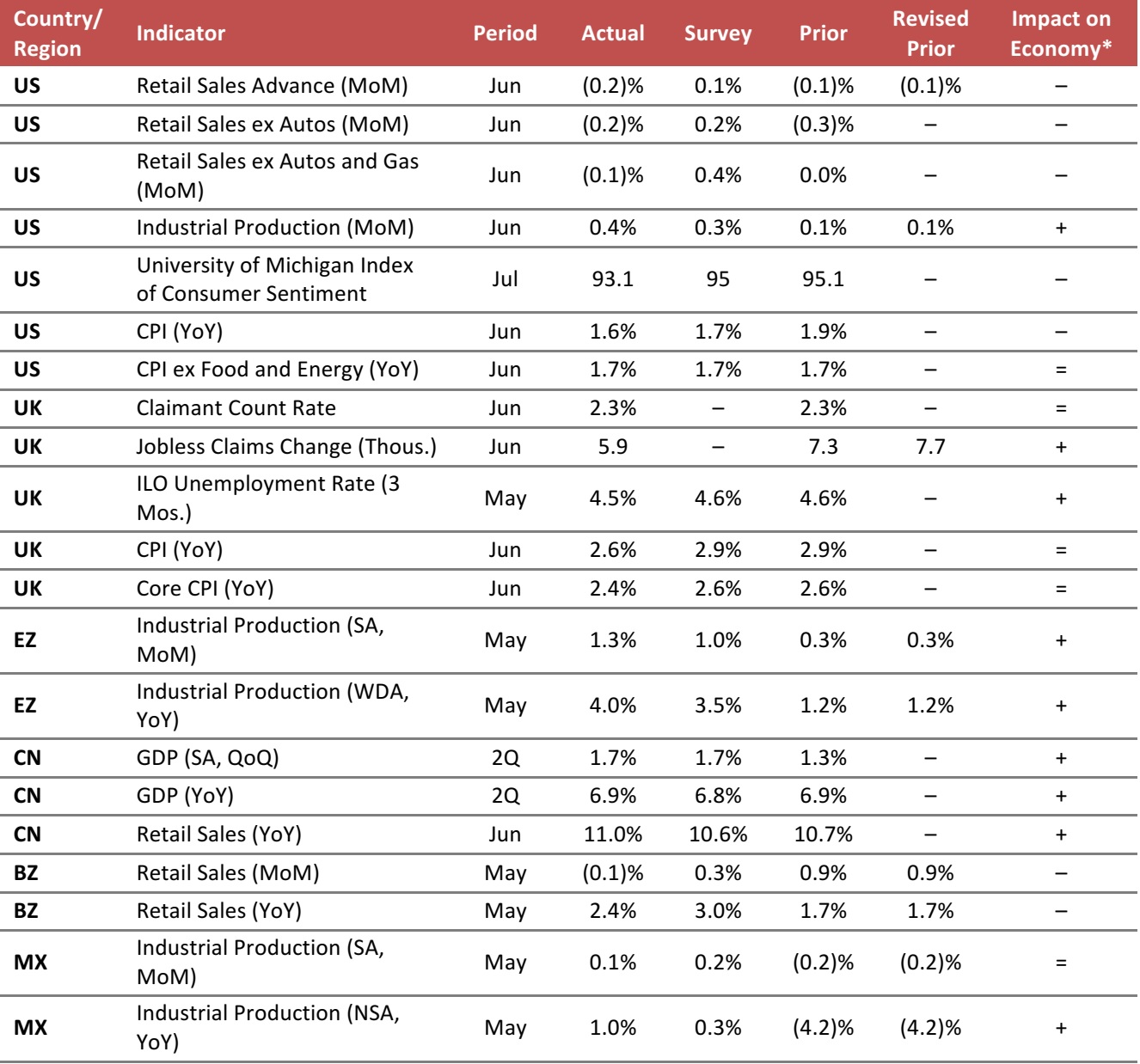

*Fung Global Retail & Technology’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Federal Reserve/University of Michigan/UK Office for National Statistics/Eurostat/National Bureau of Statistics of China/Instituto Brasileiro de Geografia e Estatística (IBGE)/Instituto Nacional de Estadística y Geografía (INEGI)/Fung Global Retail & Technology

It’s Back-to-School Season All Year

(July 17) Marketplace.org

It’s Back-to-School Season All Year

(July 17) Marketplace.org

Brazil’s Retail Sales Slip Unexpectedly in May

(July 12) Reuters.com

Brazil’s Retail Sales Slip Unexpectedly in May

(July 12) Reuters.com