Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

As they say, every cloud has a silver lining. Although two events this week—Amazon’s inaugural Prime Day and the NRF (The National Retail Federation)’s outlook for back-to-school spending—appear disappointing on the surface, the final Prime Day figures say otherwise. The event also sparked a wave of competition among retailers that is good for consumers and could perhaps mitigate the NRF’s gloomy expectations.

Prime Day deals received mixed reviews. Reviews said that the product mix was somewhat esoteric, deals were too mundane, and the Prime Day page was difficult to navigate. But the good news is consumers still like to shop and enjoyed the occasion as a social event. Even if social media sentiment was not entirely supportive, Amazon still sold 34.4 million items globally, enjoyed a 266% daily sales boost from last year and beat 2014 Black Friday’s order growth by 18%.

As they say, every cloud has a silver lining. Although two events this week—Amazon’s inaugural Prime Day and the NRF (The National Retail Federation)’s outlook for back-to-school spending—appear disappointing on the surface, the final Prime Day figures say otherwise. The event also sparked a wave of competition among retailers that is good for consumers and could perhaps mitigate the NRF’s gloomy expectations.

Prime Day deals received mixed reviews. Reviews said that the product mix was somewhat esoteric, deals were too mundane, and the Prime Day page was difficult to navigate. But the good news is consumers still like to shop and enjoyed the occasion as a social event. Even if social media sentiment was not entirely supportive, Amazon still sold 34.4 million items globally, enjoyed a 266% daily sales boost from last year and beat 2014 Black Friday’s order growth by 18%.

Moreover, the social element of Prime Day was also applauded by consumers. Thousands of Prime customers shared their “Prime moments” for a chance to win $10,000 in Amazon gift cards. The photo contest on Prime Day picked up a lot of positive responses from social media. Most of them expressed appreciation towards the convenience Prime membership has provided. Some Tweets with the hashtag #PrimeLiving included:

“PrimeLiving allows to live rurally, but buy nationally”

“PrimeLiving with @HailMerry Snacks! Love Amazon!”

“#PrimeLiving means time and money to take my kids swimming while I write!”

“We use it everyday!”

Consider Amazon’s recent efforts to provide value for its customers: it took its Prime Now service (in-city,one-hour delivery) to London; It launched full retail operations in Mexico; and this week it offered numerous deals to celebrate its 20th anniversary on Prime Day.

When a retailer like Amazon offers new services, its competitors often follow suit. Consumers are the ultimate beneficiary of the increasingly competitive retail landscape. They are becoming accustomed to a highly promotional retail environment and first-class customer experiences at low prices. Prime Day just escalated the competition again. Following a strongly worded press release earlier this week, Walmart featured “Low Prices Every Day for Everyone” and “Dare to Compare” on its homepage on Prime Day, promoting over 2,000 online exclusive “rollbacks” in addition to lowering the free shipping requirement to $35 from $50. On the same day, Target also extended its “Black Friday in July” through July 18. Last but not least, the emerging e-tailer jet.com will open up its membership to everyone in a week. Jet.com aims to challenge Amazon by combining low prices of warehouse clubs and the ease of e-commerce.

Where is the next battlefield for retailers? A fiercely competitive back-to-school season is on the horizon. The NRF released its annual Back-to-School and Back-to-College (BTS/BTC) outlook this week, and projected a combined total spending on these categories of $67.95 billion, a 9.3% decrease from the $74.94 billion projected season’s spending in 2014.

Still, value is timeless. We think that fashion at value prices will be a real winner in the second half of 2015, beginning with BTS shopping. Consumers’ quests for value will benefit outlets and off-price retailers alike. Macy’s Backstage will open in time to capture some BTS sales, and we expect sales this new format (along with its attractive pricing) to outperform other retailers. A projected increase in dorm furnishing sales by NRF should also benefit a handful of home and e-commerce retailers.

Moreover, the social element of Prime Day was also applauded by consumers. Thousands of Prime customers shared their “Prime moments” for a chance to win $10,000 in Amazon gift cards. The photo contest on Prime Day picked up a lot of positive responses from social media. Most of them expressed appreciation towards the convenience Prime membership has provided. Some Tweets with the hashtag #PrimeLiving included:

“PrimeLiving allows to live rurally, but buy nationally”

“PrimeLiving with @HailMerry Snacks! Love Amazon!”

“#PrimeLiving means time and money to take my kids swimming while I write!”

“We use it everyday!”

Consider Amazon’s recent efforts to provide value for its customers: it took its Prime Now service (in-city,one-hour delivery) to London; It launched full retail operations in Mexico; and this week it offered numerous deals to celebrate its 20th anniversary on Prime Day.

When a retailer like Amazon offers new services, its competitors often follow suit. Consumers are the ultimate beneficiary of the increasingly competitive retail landscape. They are becoming accustomed to a highly promotional retail environment and first-class customer experiences at low prices. Prime Day just escalated the competition again. Following a strongly worded press release earlier this week, Walmart featured “Low Prices Every Day for Everyone” and “Dare to Compare” on its homepage on Prime Day, promoting over 2,000 online exclusive “rollbacks” in addition to lowering the free shipping requirement to $35 from $50. On the same day, Target also extended its “Black Friday in July” through July 18. Last but not least, the emerging e-tailer jet.com will open up its membership to everyone in a week. Jet.com aims to challenge Amazon by combining low prices of warehouse clubs and the ease of e-commerce.

Where is the next battlefield for retailers? A fiercely competitive back-to-school season is on the horizon. The NRF released its annual Back-to-School and Back-to-College (BTS/BTC) outlook this week, and projected a combined total spending on these categories of $67.95 billion, a 9.3% decrease from the $74.94 billion projected season’s spending in 2014.

Still, value is timeless. We think that fashion at value prices will be a real winner in the second half of 2015, beginning with BTS shopping. Consumers’ quests for value will benefit outlets and off-price retailers alike. Macy’s Backstage will open in time to capture some BTS sales, and we expect sales this new format (along with its attractive pricing) to outperform other retailers. A projected increase in dorm furnishing sales by NRF should also benefit a handful of home and e-commerce retailers.

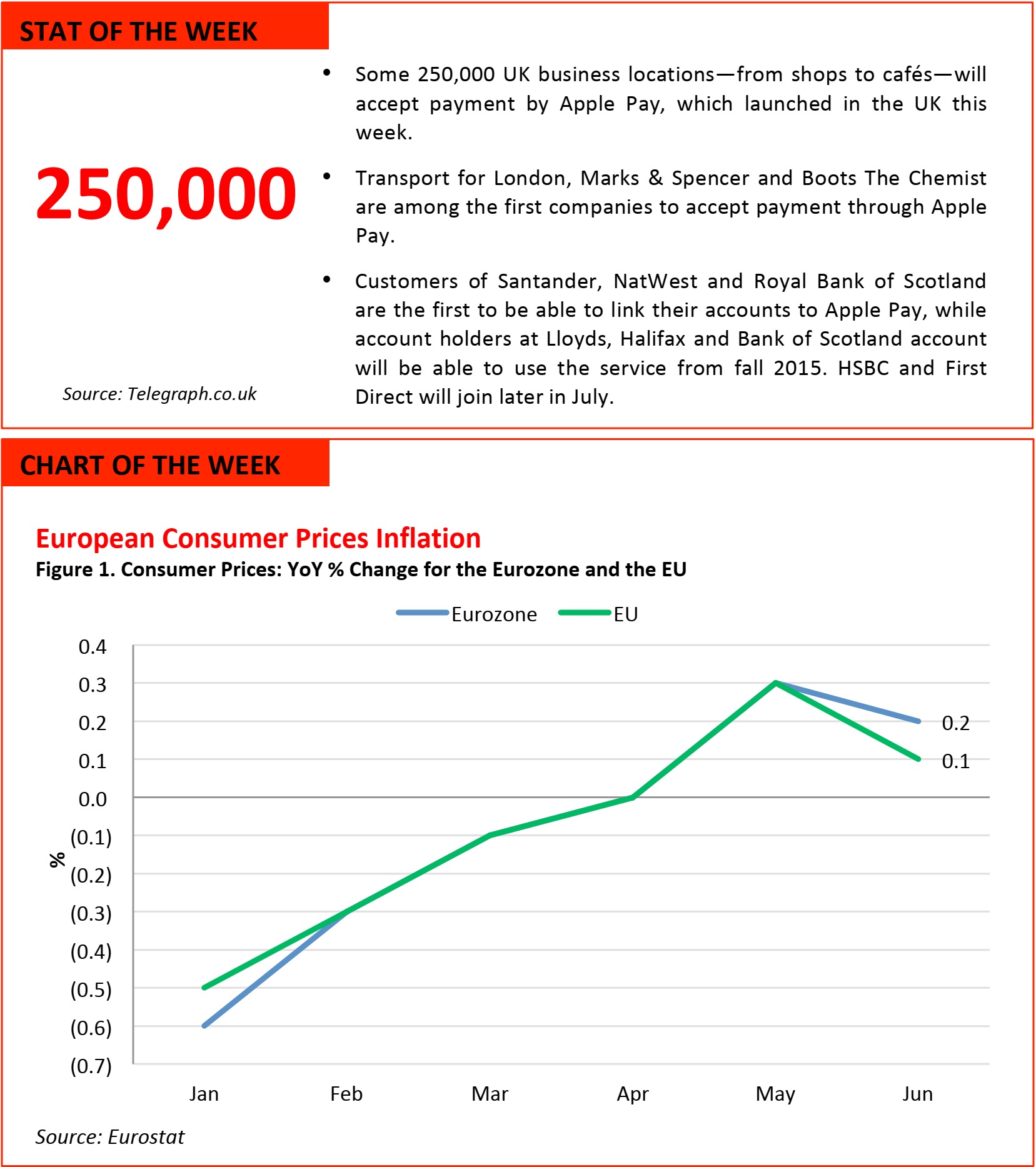

- European consumer prices inflation slowed a little in June, according to Eurostat.

- Food prices roses 1.1% YoY in the euro area in June.

- Energy prices fell 5.1% YoY in June across the Eurozone.

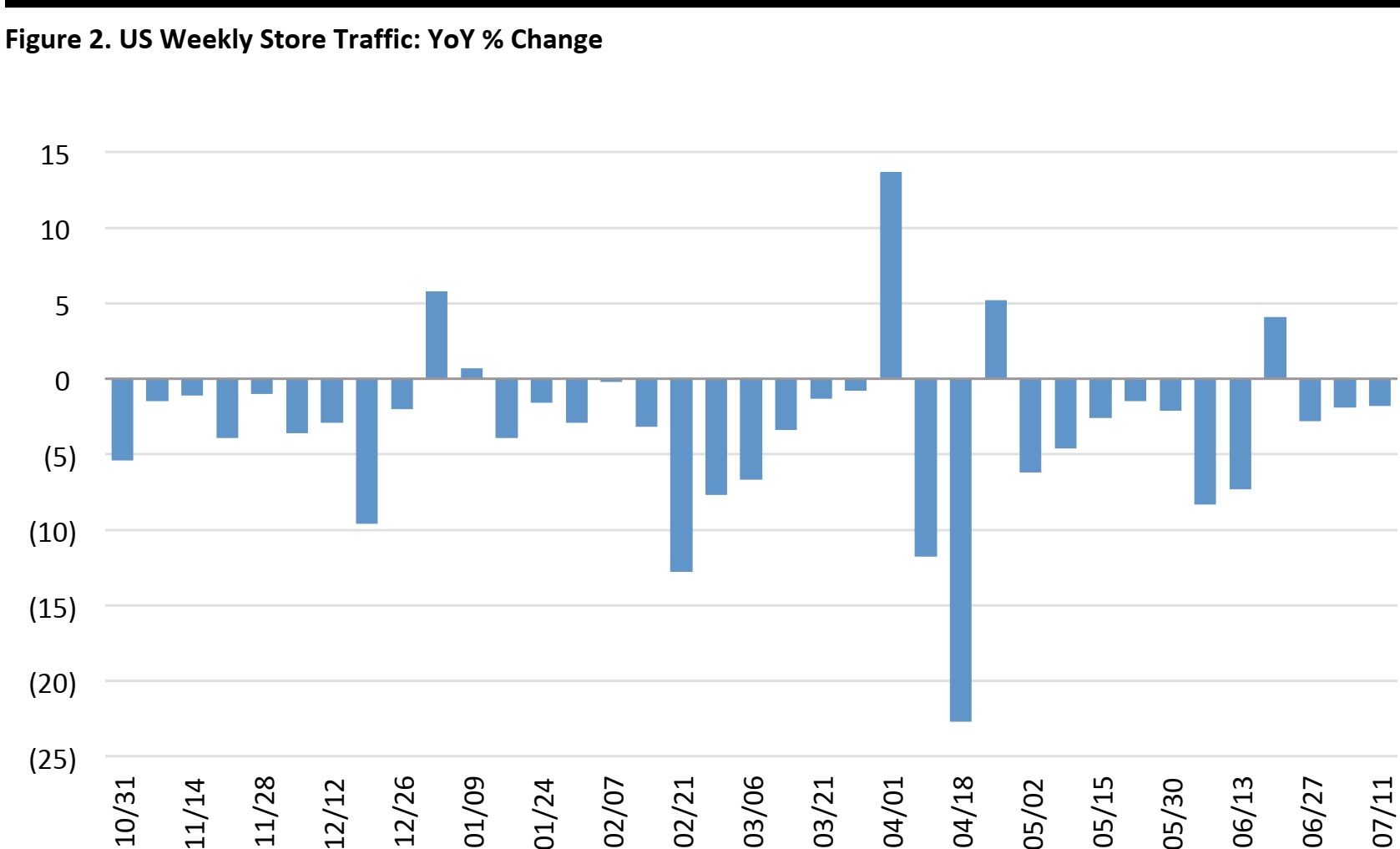

US RETAIL TRAFFIC

Through July 11, 2015 Source: ShopperTrak

- Overall store traffic was down 1.8% for the week ended July 11.

- Apparel store traffic rose by 0.8% and electronics store traffic declined by 2.4%.

- Retailers are now offering deep discounts on summer merchandise to make room for back-to-school products.

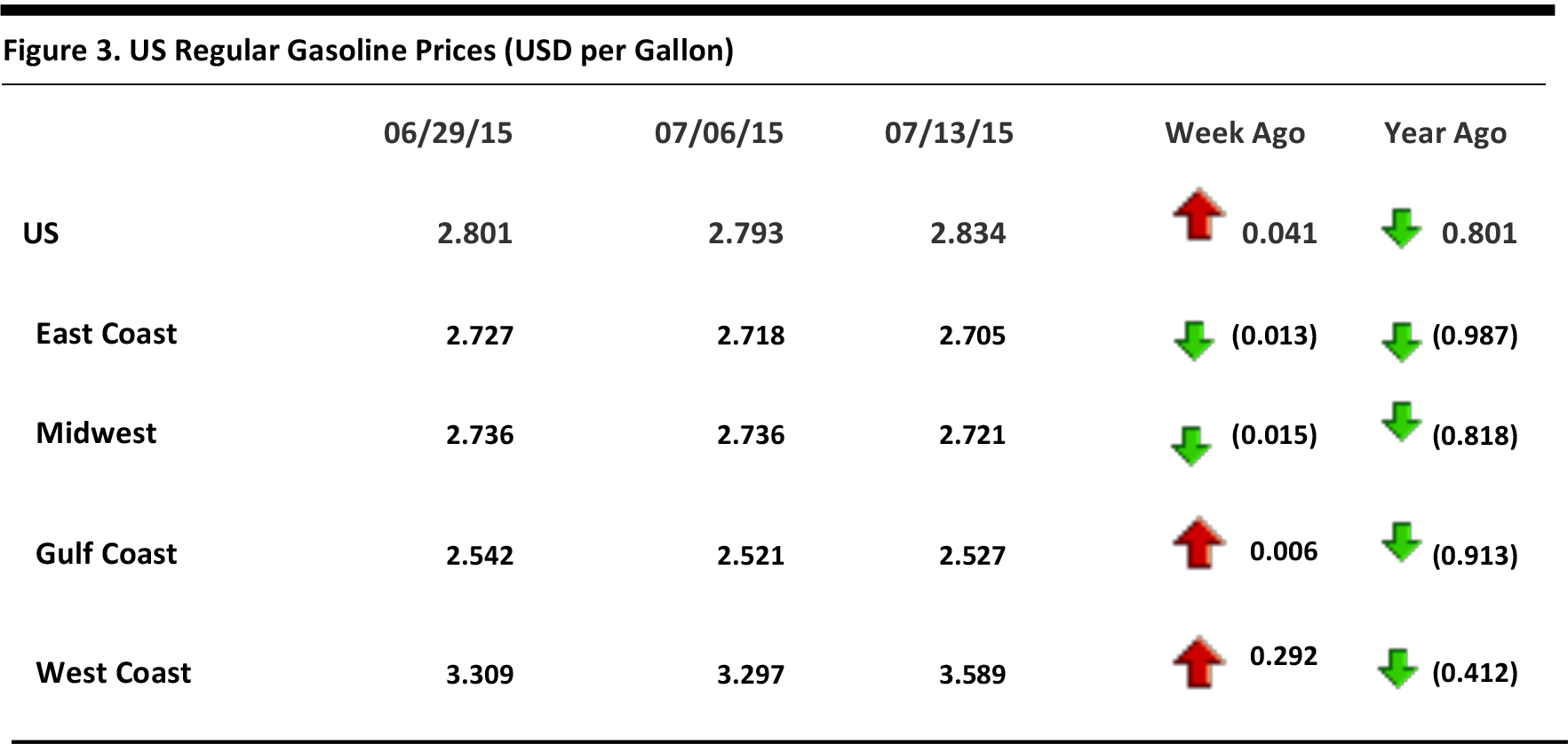

US REGULAR GASOLINE PRICES

Source: US Energy Information Administration

US RETAIL HEADLINES

- Vince’s shares dropped by 18.7% Tuesday, one day after its CEO, Jill Granoff, announced her resignation. Granoff will remain in her role for a “transition period to ensure an orderly and effective” changeover.

- Granoff joined Kellwood Co. in 2012 and was tasked with accelerating the Vince brand’s growth. She took Vince public in November 2013. Company Chairman Marc Leder will help lead the search for Granoff’s successor.

- Victor Herrero, former head of Asia-Pacific for Inditex and of greater China for Zara, has been named CEO of Guess, effective August 1. Current CEO Paul Marciano, who has held the role for eight years, will become Executive Chairman and Chief Creative Officer.

- Herrero was chosen for his understanding of global retail markets and supply chain management. As CEO, he said he plans to continue to focus on the domestic market while actively expanding in South America, Latin America, Northern Europe, China, Russia and Southeast Asia.

- According to The Social Intelligence Report, created by Adobe Digital Index each quarter, Google’s display ad strategy has not been as successful as Facebook’s. Google’s click-through rate for display ads grew at a rate of 24%, which was 75% lower than Facebook’s rate.

- Facebook’s revenue per visit was 30 cents higher than its competitors’. Google has recently refocused on mobile, which is hurting sites that are not mobile friendly.

- After spending more in 2014, parents are evaluating their children’s real needs before opening their wallets this year.

- According to NRF’s Back-to-School Spending Survey, conducted by Prosper Insights & Analytics, the average family with children in grades K–12 plans to spend $630.36 on electronics, apparel and other school needs this year, down from $669.28 last year. Total spending is expected to reach $24.9 billion.

ASIA HEADLINES

- Japan is facing a labor shortage as its population ages: the jobless rate is at its lowest since the late 1990s, and is projected to fall further. In response, Prime Minister Shinzo Abe wants to more than double productivity growth in the service sector by 2020.

- “While omotenashi raises the quality of services, it requires a lot of time and effort,” said Yasuhiro Kiuchi, a senior researcher at the Japan Productivity Center in Tokyo. “It’ll be hard to change this culture, but Japan has the inventiveness to make use of IT or improve efficiencies without customers noticing.”

- On Tuesday, a report on Chinese tech news site Sina Tech cited a “source close to Uber” as saying that the company has had trouble finding first-tier Chinese investors.

- Uber reportedly expects to do US$1.1 billion in total sales in China in 2015, but it also expects to post losses of US$1.1 billion there this year. Over the next three years, the company apparently expects its China business to lose US$3 billion.

- Hong Kong’s blueprint, an accelerator and coworking space backed by Swire Properties, provides a soft landing for London-based startups looking to benefit from Hong Kong’s startup-friendly environment. With London-based accelerator fund Seedcamp’s former investment manager Hilary Szymujko leading the charge, blueprint has housed 34 founders in its first B2B accelerator batch, 11 of which were from Europe.

- Carlos Eduardo Espinal, Partner at Seedcamp, is optimistic about Asia. “With the amount of ecosystems that are popping up in Asia, the time is now. So not only is it a big market, it is one that is likely to yield great ideas because the maturity of the ecosystem is now enabling people to work together the way that they are in other startup hubs.”

- Tsinghua Unigroup reportedly wants to buy Micron Technology for $23 billion in a deal that would garner intense regulatory scrutiny in the US and likely rattle the memory market.

- In a report released Tuesday, analyst firm Credit Suisse said a deal would be “highly unlikely to get past US regulators who are increasingly viewing semiconductors as a strategic industry.”

- Earlier this year, Samsung Electronics’ fourth-quarter results showed that its mobile business had continued to drag down the rest of the company’s yearly profit, by nearly one-third. These results followed the company’s third-quarter report showing that net profit had tumbled by 49%, again impacted by the mobile business.

- Todd Lynton, Samsung Electronics Australia’s business solutions director, said the company’s continued push of its mobility business falls under its broader strategy of focusing on the Internet of Things, activity-based working and having its devices work on an open architecture.

- Nintendo CEO Satoru Iwata died of cancer on Saturday, months after he led Nintendo’s belated entry into mobile gaming following years of declining sales. He was 55.

- Iwata’s main legacy was broadening the appeal of video games with the best-selling Wii, which included fitness titles and fantasy battles. Gaming fans took to Twitter to mourn his death, and even rival Sony PlayStation’s Twitter account said, “Thank you for everything, Mr. Iwata.”

- Last month, Coursera, an American online education startup, announced that it has a million registered users in China, making it the company’s second-biggest market. Today, Coursera announced that those million users can now use Alipay.

- Previously, to get a verified certificate of course completion, Chinese users needed access to an international credit card such as a Visa or MasterCard. Very few Chinese people have international cards, so Coursera was probably missing out on quite a bit of revenue.

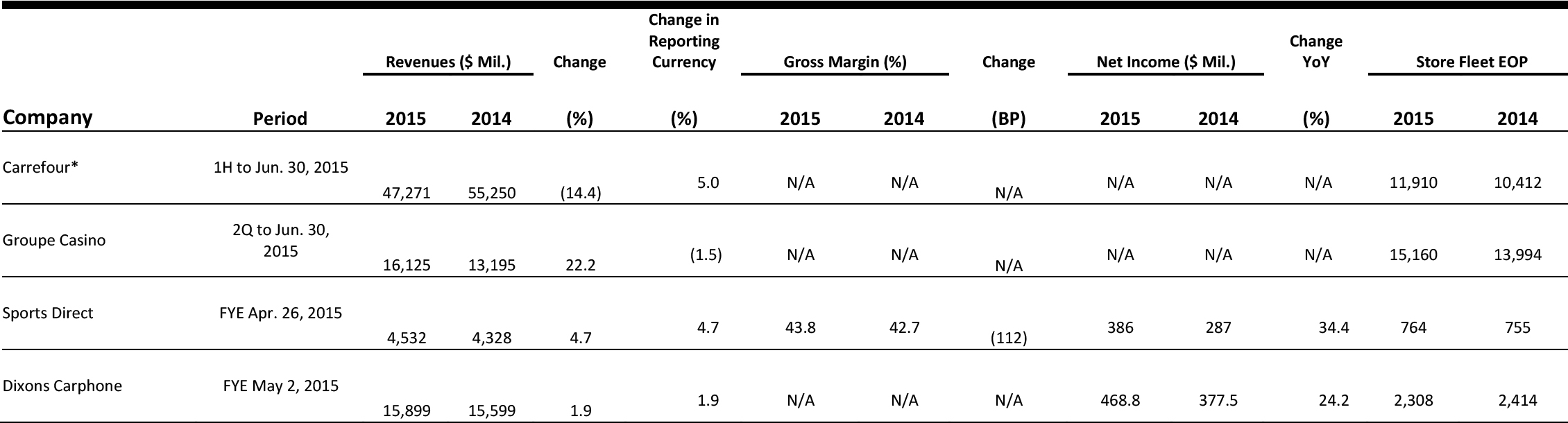

EUROPEAN RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

Aldi’s New School Uniform Collection to Be 62% Cheaper than Rival Retailers’

(July 15) wgsn.com

Aldi’s New School Uniform Collection to Be 62% Cheaper than Rival Retailers’

(July 15) wgsn.com

- Discount supermarket Aldi is about to launch the UK’s lowest-priced school uniform. Set for release on July 23, the offer includes two polo shirts, a jumper and a skirt or pair of trousers for £4 (US$6.26).

- The move is expected to start a price war between retailers as they aim to target parents looking to buy new uniforms before the start of the school term.

- Luxury department store Harvey Nichols has used footage of shoplifters from its London flagship store in its new advertising campaign. The unlikely stars have their faces covered by drawings from animation artists the Layzell Bros. to protect their identities.

- The campaign will promote the retailer’s loyalty program, Rewards by Harvey Nichols, and features the tagline “Love freebies? Get them legally.”

- For the 40 weeks ended June 20, ABF reported that sales at the group were 2% ahead of last year’s levels, and that sales at Primark were up 13%, with an 8% increase in selling space.

- Primark shops in Spain, Portugal and Ireland performed strongly, and the like-for-like sales in the UK showed positive progress. Shops in France also performed well, though they’re excluded from the like-for-like measure. ABF also announced that it will enter its 10th European market next year, when it opens its first Primark store in Italy.

- UK-based virtual fit technology site Fits.me has been bought by Japanese e-commerce company Rakuten for an undisclosed amount.

- Fits.me counts Hugo Boss, Thomas Pink and QVC as its customers. It enables online shoppers to get a better idea of how a garment might look and fit. Rakuten said it expects the acquisition to strengthen its e-commerce and marketing activities by offering a more personalized experience.

- Lindt & Sprüngli reported sales growth of 17.4%, to CHF1.409 billion (US$1.47 billion), for the first six months of the year, thanks to its earlier acquisition of US rival confectionery maker Russell Stover. Without this acquisition, sales growth would have been only 9.4%.

- This sales increase is slightly below analysts’ expectations of 18.5%, or CHF1.422 billion (US$1.49 billion). The turnover on a like-for-like basis grew by 9.4%, and is predicted to grow between 6% and 8% overall this year.

- In the April–June quarter, year-over-year sales at X5 rose 28.1%, to RUB198.6 billion (US$3.51 billion), after rising 26.5% in the first quarter. This was the company’s highest rate of growth since the third quarter of 2011. The rise was augmented by growth of 15.6% in like-for-like sales, with customer traffic increasing by 2.2% and the average bill by 13%. There was also 23.9% growth in net selling space.

- Pyaterochka, a chain of conveniently located proximity stores run by the group, is the key driver of growth in customer traffic and selling space. The current Russian economic scenario of high inflation resulting from a fall in oil prices and a ban on food imports has driven many consumers to buy from discount stores, benefiting groups such as X5.

- Swiss watch brand Maurice Lacroix is for sale, as it is not able to address the issue of lower demand in Asian markets and the rising value of the Swiss franc, which is up 15% above the euro.

- The brand sells 90,000 watches a year, with a yearly turnover of around €70 million (US$76.7 million). However, the brand’s owner, DKSH, believes the watch business is going down. Maurice Lacroix watches, priced in the range of €1,000 to €5,000 (US$1,096 to US$5,480), are selling at a discount of 20% to 49% on Amazon.

- Comparable store sales in the three months ended June 30 fell by a double-digit percentage in the Hong Kong market, which accounts for 10% of Burberry’s total retail and wholesale sales. The company’s CFO told reporters that there would be no change in strategy, however, as the Hong Kong stores are profitable and the fall is only short term.

- Overall, Burberry posted an 8% increase in first-quarter retail sales, to £407 million (US$635 million), and comparable store sales growth was 6%. These results, however, came in below the 13% growth in retail sales and 9% growth in comparable store sales that were recorded in the second half of Burberry’s 2014/2015 year.

LATAM HEADLINES

- Brazilian retail sales fell 0.9% month over month in May, their fourth consecutive monthly decline, following a revised 0.5% decline in April.

- Driving factors included higher unemployment, accelerating inflation and consumer confidence that was near record lows.

- Sales of food, beverages and tobacco fell 1.1% at supermarkets and hypermarkets due to a decrease in income, and sales of furniture and appliances fell 2.1% due to tighter credit.

- Singapore’s sovereign-wealth fund GIC agreed to pay BRL132.4 million (US$42 million) for a 35% stake in Via Parque Shopping, located in Rio de Janeiro’s Barra da Tijuca neighborhood.

- The mall has 611,400 square feet of shopping space and underwent a major renovation in 2013 and 2014.

- Via Parque is operated by Brazil’s Aliansce Shopping Centers, the country’s number-two mall operator.

- A São Paulo judge refused to grant an injunction that would prohibit retailers from charging a fee for plastic bags.

- The ruling said that since the cost of the bags was not excessive (US$0.05) and that since consumers have the option of bringing their own bags, stores could legally charge for them.

- The city’s mayor filed the injunction request in April following a 2014 law that required retailers to substitute more environmentally friendly bags made from oil derivatives and sugarcane waste for bags made from petroleum derivatives. However, the law did not specify whether retailers could charge for them.

- Mexico’s media industry is expected to grow by 5%, to more than US$6.3 billion, this year due to a digital boom in luxury and women’s lifestyle magazines.

- Digital revenues are also expected to increase, by 10%, to $1.7 billion, owing to a 50% increase in mobile penetration, according to the head of Deloitte’s technology, media and telecom practice.

- Mexican retail is rising to a new level thanks to the opening of flagship stores by brands such as Gucci, Prada and Louis Vuitton in Mexico City.

- Tiffany could join the long list of companies leaving Argentina.

- The company still has two stores in Buenos Aires, one at Patio Bullrich and another on Figueroa Alcorta Avenue, following the closure of a third store in Unicenter.

- Brands that have departed Argentina include Emporio Armani, Fendi, Yves Saint Laurent, Escada, Polo Ralph Lauren and Louis Vuitton.