FROM THE DESK OF DEBORAH WEINSWIG

Amazon Prime Day and the Disruption of Retail

This week, Amazon celebrated its 21st birthday and its second annual Prime Day, on which the company recorded its biggest daily sales total since its founding. According to Amazon, orders increased by 60% worldwide and by 50% in the US, and other records were set for sales of Amazon devices.

Prime Day has another purpose beyond just driving sales—it is a mechanism for increasing the number of Prime members, which were up 43% year over year, to 63 million, as of June 30, according to an estimate by Consumer Intelligence Research Partners (CIRP). Prime members are important, as they spend an average of $1,200 per year on Amazon products, more than twice the $500 that non-Prime members spend, according to CIRP. Amazon uses a combination of hot deals (many of which were on Amazon hardware this year) and a 30-day free membership to entice consumers to purchase Prime memberships, which lock them in for the following 12 months.

While Prime products come with free shipping, their prices are not necessarily the lowest available among all e-tailers. However, human psychology makes Prime members want to place orders with Amazon in order to get their money’s worth once they have signed up for the program. It is a virtuous circle: the more Prime members Amazon signs up, the better the prices and services it can offer them…which increases the value of a Prime membership and creates a higher entry barrier for competitors.

Amazon Prime is disrupting and affecting retail in several ways. It is accelerating shipping times and forcing competitors to drop shipping fees. Prime’s free two-day shipping (and its one-hour shipping via Prime Now in selected cities) prompted many retailers to accelerate and cut the price of shipping last holiday season, and the pressure is still on for them to continue to do so. For example, Target has partnered with Instacart for same-day grocery delivery and Macy’s has partnered with Deliv.

Another way that Prime is disrupting retail is through its ability to promote products, particularly Amazon’s own products, by making them Prime eligible. Naturally, all of Amazon’s devices for consuming digital content are Prime eligible, as are the private-label apparel lines that Amazon stealthily launched in February. In addition to their low prices, the Prime-ness of the Amazon apparel lines represents a competitive advantage for the company–and a disruption to everyone else.

In just two years, Prime Day has become a phenomenon in the retail industry. Many retailers have run “Black Friday in July” promotions to spur retail activity in the sluggish summer months just ahead of the back-to-school season, and Amazon’s Prime Day has served to enhance this phenomenon. Seemingly as a response to Prime Day, Walmart offered free shipping with no minimum order this week in addition to “rollbacks” (i.e., discounts) on a large number of items, and Target, Toys “R” Us and at least a dozen other retailers offered various combinations of discounts and free shipping. While Amazon Prime Day may serve to put Prime members in a shopping mood, other retailers are enthusiastically welcoming non-Prime members and their purchase dollars.

Then there is the 800-pound gorilla in the room: Alibaba. Alibaba created Singles’ Day on November 11 (the date, 11/11, was chosen as one that well represents single people), and the most recent Singles’ Day handled $14.3 billion in goods. The idea for Singles’ Day began with Chinese college students commiserating about being single, and it has become a global shopping phenomenon. The made-up shopping holiday has served Alibaba well by creating global visibility and driving sales, and Prime Day appears to be Amazon’s adaptation of that concept. There seems to be no letup in sight in the momentum of Singles’ Day; its gross merchandise volume grew by 54% last year. Like Alibaba’s first Singles’ Day, Amazon’s first Prime Day last year was an experiment. The event turned out to be so successful that, at the conclusion of Prime Day both last year and this year, Amazon commented, “After yesterday’s results, we’ll definitely be doing this again.”

Prime Day has served to energize US shoppers during the dog days of summer, leading to short-term retailer happiness. Although Amazon’s competitors still face the rapid international expansion of Alibaba on one side and the rapid, mostly domestic, expansion of Amazon on the other, Amazon’s e-commerce business accounted for less than 20% of US e-commerce sales in 2015—which leaves plenty of room in the e-commerce arena for other innovative retailers.

US RETAIL & TECH HEADLINES

Your Car Has Been Studying You Closely and Everyone Wants the Data

(July 12) Bloomberg

Your Car Has Been Studying You Closely and Everyone Wants the Data

(July 12) Bloomberg

- New model cars have more than 100,000 data points that are constantly updating to track everything from the weight of the front passenger to your route to work. Opinions on connected cars are mixed, with some seeing a wonderful convenience and others an intrusive nightmare.

- As tech companies are increasingly involved in the dashboard, car companies are putting in place systems that can host and supervise apps from outsiders without sharing vehicle and driver information. However, some companies will share anonymous user data with insurers, allowing a consumer to contact the carrier if their driving habits will cut premiums.

Olay Built a Skin Evaluation Tool to Help Drugstore Shoppers

(July 13) Glossy

Olay Built a Skin Evaluation Tool to Help Drugstore Shoppers

(July 13) Glossy

- P&G beauty brand Olay has built a skin evaluation tool to determine customers’ “skin age,” identify problem areas and offer a regimen of products meant to address those issues. The tool uses a series of questions, artificial intelligence and “deep learning” modeled on the algorithm-based data reading used by Google and Facebook.

- The goal of the web tool is to educate customers about Olay products, so they do not rely on just customer reviews and impersonal web searches. To be released August 15, the skin evaluation tool is not an app, as Olay wanted to avoid asking customers to download something.

Surveys Peer into Consumer Preferences, Reveal Low Buy Button Adoption

(July 12) Women’s Wear Daily

Surveys Peer into Consumer Preferences, Reveal Low Buy Button Adoption

(July 12) Women’s Wear Daily

- As consumers increasingly turn to e-commerce—and use mobile devices to do so—data from social messaging apps are revealing interesting consumer behaviors. For instance, while all consumers polled in one survey used Facebook Messenger on their phone, Snapchat was used frequently by the greatest number of participants.

- Also, many consumers (73% of those surveyed) are aware of buy buttons, but few (10%) are using them. When it comes to notifications, though, consumers seem more open, with 66% of those surveyed saying they would be open to receiving coupons when entering a store.

Retailers Lease Warehouse Space at Record Pace

(July 12) The Wall Street Journal

Retailers Lease Warehouse Space at Record Pace

(July 12) The Wall Street Journal

- As e-commerce continues to grow, retailers are leasing warehouse space at record-setting rates. In the second quarter of 2016, companies leased 70.1 million square feet of industrial space, up 6% from the year-ago quarter.

- Developers are racing to build more warehouses to meet demand, but, in the meantime, rents have been increasing. Cushman & Wakefield estimates that 68 out of 79 major US markets have experienced increased industrial rents.

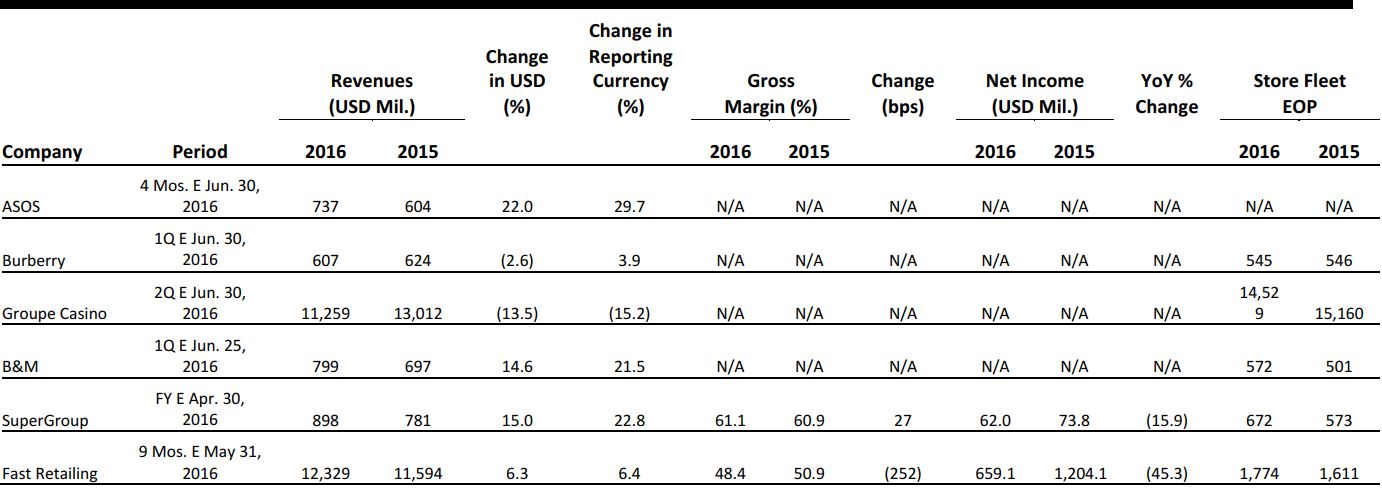

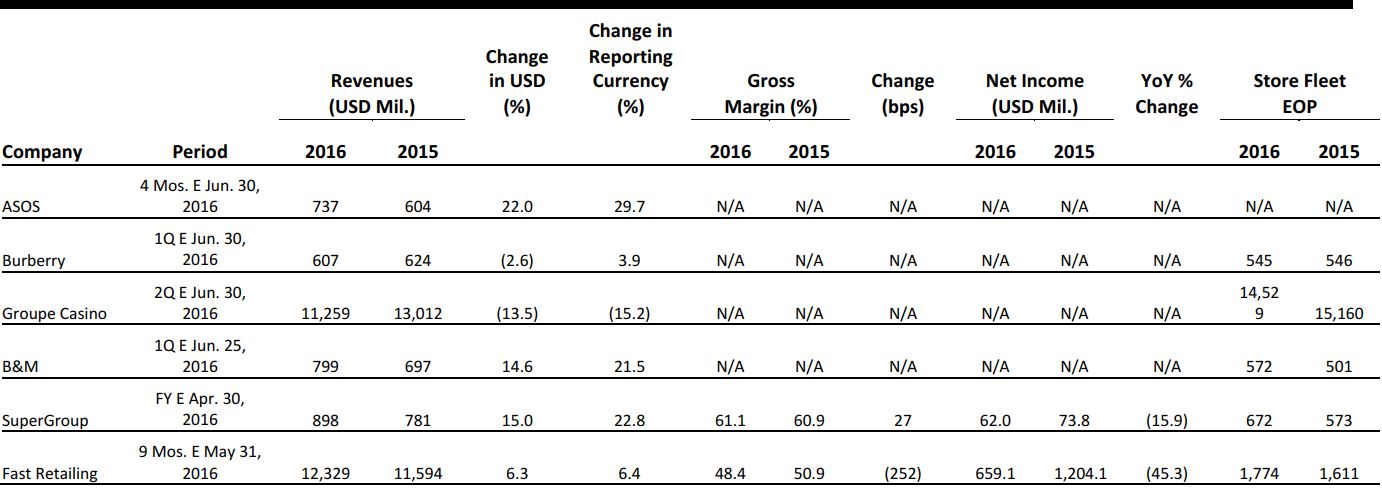

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Hotel Chocolat Maiden Results Beat Expectations

(July 12) Company press release

Hotel Chocolat Maiden Results Beat Expectations

(July 12) Company press release

- In its inaugural trading update since floating on the London Stock Exchange’s AIM submarket in May, British chocolatier Hotel Chocolat posted a 12% increase in sales, to £92.6 million, for the 52 weeks ended June 26.

- The company said online sales rose by 20% and that overall growth was “slightly above expectations.” Hotel Chocolat’s share price surged 28%, from 148 pence to 190 pence, on its first day of trading.

John Lewis Sets £1 Billion Revenue Goal for Own-Brand Home Products

(July 8) Retailgazette.co.uk

John Lewis Sets £1 Billion Revenue Goal for Own-Brand Home Products

(July 8) Retailgazette.co.uk

- British department store chain John Lewis has set a target of generating £1 billion in annual revenues from its own-brand home products by 2020. The retailer’s ambitious growth plan includes the launch of its new Design Project collection this autumn. The 250-piece collection was designed in-house and targets customers who want contemporary pieces in their homes.

- The company will also continue building its other own brands, including House and Croft, and expand its exclusive relationships with external brands such as Loaf and West Elm.

International Sales Boost ASOS

(July 12) Company press release

International Sales Boost ASOS

(July 12) Company press release

- Online fashion retailer ASOS reported a 30% increase in group revenues for the four months ended June 30, despite the shock effects of the June 23 Brexit vote and uncertainty regarding the UK’s eventual exit from the EU.

- ASOS grew UK retail sales by 28% and international retail sales by 31% (or 25% in constant currency), boosted by a jump of 53% in US sales (45% in constant currency). International sales contributed nearly two-thirds (59%) of the e-tailer’s total sales for the period.

London’s Oxford Street Anticipates £1 Billion Annual Boost from Crossrail

(July 11) Retailgazette.co.uk

London’s Oxford Street Anticipates £1 Billion Annual Boost from Crossrail

(July 11) Retailgazette.co.uk

- London’s iconic Oxford Street expects to see a £1 billion lift in annual sales from the Crossrail Elizabeth line, the new London rail line that will provide direct commutes for counties such as Berkshire, Buckinghamshire and Essex.

- Oxford Street already generates £5 billion per year in sales and The New West End Company hopes it will hit an annual target of £6 billion by 2020—two years after the Elizabeth line is expected to be completed. In addition, 2,000 new retail jobs are expected to be created, and nearby Bird Street will transform into a new shopping precinct, thanks to private donations and £200,000 from program developed by Transport for London’s Future Streets Incubator.

Sports Direct Reports Poor Full-Year Performance

(July 7) Company press release

Sports Direct Reports Poor Full-Year Performance

(July 7) Company press release

- UK sportswear retailer Sports Direct posted an 8.4% decline in pretax profit for its fiscal 2016 year. CEO Dave Forsey described it as “a disappointing full-year financial performance.” In the year ended April 24, the company’s EBITDA edged down 0.5%, to £381.4 million, while group revenue increased by 2.5%, to £2.9 billion.

- Sports Direct said trading since the start of May and leading up to the EU referendum on June 23 was broadly in line with management’s expectations, albeit with the continued volatility seen in the wider retail sector.

ASIA TECH HEADLINES

China Shows Off “World’s First Graphene Battery”

(July 11) TechinAsia

China Shows Off “World’s First Graphene Battery”

(July 11) TechinAsia

- Dongxu Optoelectronic Technology, a Chinese battery and screens manufacturer, invented “the world’s first graphene battery.” The battery is claimed to have a recharging time of only 13–15 minutes, which is 10–20 times faster than a lithium-ion battery’s charging time.

- Because graphene batteries have the advantage of short charge times, they can be adopted for use in electric vehicles, huge drones and lots of other applications.

Lenovo Might Sell Bendable Smartphones in 2020

(July 12) The Star Online

Lenovo Might Sell Bendable Smartphones in 2020

(July 12) The Star Online

- At the Lenovo Tech World event in June, Lenovo demonstrated two prototype handsets that are flexible and bendable.

- The company might end up selling the bendable smartphones—which are capable of rolling up around the owner’s wrist—in five years’ time, according to Aymar de Lencquesaing, Co-President of the company’s Mobile Business Group.

India Becomes the Destination for Google’s Android Program

(July 11) Bloomberg

India Becomes the Destination for Google’s Android Program

(July 11) Bloomberg

- Google launched the Android Skilling program to offer training to developers in India. The country is expected to have the world’s largest developer population, of 4 million people, by 2018.

- The program will cover hundreds of public and private universities and training schools and is aimed at improving the developers’ skills in creating innovative mobile apps.

500 Tuk Tuks Increases Investment Fund by US$3 Million

(July 12) e27.co

500 Tuk Tuks Increases Investment Fund by US$3 Million

(July 12) e27.co

- Thailand’s 500 Tuk Tuks, one of the funds for global venture capital firm 500 Startups, announced that it will add a US$3 million fund and bring its current fund size to US$15 million.

- In Asia, there are other funds supporting 500 Startups, including Malaysia’ 500 Durians, South Korea’s 500 Kimchi, Japan’s 500 Startups JP, Vietnam’s 500 Startups Vietnam and India’s 500 Kulfi.

Singapore Government Develops Chatbots

(July 12) TechinAsia

Singapore Government Develops Chatbots

(July 12) TechinAsia

- The Singapore government will cooperate with Microsoft to build prototype chatbots to improve public services.

- The government will carry out the project in three steps. First, it will build bots capable of answering simple factual questions. Next, it will focus on bots that help citizens finish transactions within government websites. Finally, it will customize the chatbots to better serve each user’s needs.

LATAM RETAIL HEADLINES

Guatemala Rejects US Forced Labor Claims

(July 12) WWD.com

Guatemala Rejects US Forced Labor Claims

(July 12) WWD.com

- Guatemala has denied claims made by the US that it employs minors and promotes forced labor within the apparel industry. A June report by the US State Department said that Guatemala, Vietnam, Jordan, Russia and Chile had all fallen short in combating forced labor and human trafficking.

- Guatemala claims that its factories, mills and producers meet the UN’s International Labour Organization standards and do not employ minors, although child labor may be present in the informal market, which is said to account for 85% of Guatemala’s economy.

Brazil’s Retail Sales Unexpectedly Fall in May

(July 12) Bloomberg

Brazil’s Retail Sales Unexpectedly Fall in May

(July 12) Bloomberg

- Brazil’s retail sales fell unexpectedly in May as the country struggled to emerge from recession. Sales fell by 1% in May, month over month, after increasing by 0.3% in April. Sales were expected to rise by 0.4% in May.

- Year over year, retail sales fell by 9% in May. Brazil’s 12-month consumer inflation is currently 8.8%, and interest rates remain at a 10-year high, cutting into Brazilians’ purchasing power.

Mexico’s Liverpool Paying High Price for Chile’s Ripley

(July 7) FashionMag.us

Mexico’s Liverpool Paying High Price for Chile’s Ripley

(July 7) FashionMag.us

- Mexico’s Liverpool department store chain is paying a high price to acquire a majority stake in Chilean retailer Ripley, according to analysts. Liverpool agreed to acquire a majority stake in Ripley for CLP813 billion (US$1.2 billion).

- Ripley was an appealing acquisition for Liverpool, as it is a highly diversified retailer. Analysts also agreed that there was room for improvement in how Ripley was managed, leaving an opportunity for Liverpool to improve business.

Grupo Axo Forecasts Revenue Boost from PVH Deal

(July 7) WWD.com

Grupo Axo Forecasts Revenue Boost from PVH Deal

(July 7) WWD.com

- Grupo Axo, a fast-growing Mexican apparel licensor, expects to see a 25%–30% increase in revenues from a joint venture with PVH to sell the Calvin Klein, Warner and Arrow brands in Latin America’s second-largest market.

- Synergies from the venture will begin to appear in the fourth quarter, when Axo will start distributing Calvin Klein, Speedo, Warner and Olga in Mexico. This year, Axo expects revenues to increase by approximately 15%.

Rio 2016 Signs Insect Repellent Sponsor amid Zika Concerns

(July 6) Bloomberg

Rio 2016 Signs Insect Repellent Sponsor amid Zika Concerns

(July 6) Bloomberg

- Rio de Janeiro has faced difficulties convincing tourists and athletes that the 2016 Olympics will be safe from Zika-carrying mosquitoes. Thus, Rio 2016 has partnered with SC Johnson’s OFF! Brand. The insect repellent brand will have an official role at the games, and thousands of bottles will be distributed to athletes, staff and volunteers.

- OFF! began working around the clock last November to ensure supply would meet demand amid the Zika scare, and it is boosting distribution, especially in Rio, where it plans to have products available at every supermarket and pharmacy.

This week, Amazon celebrated its 21st birthday and its second annual Prime Day, on which the company recorded its biggest daily sales total since its founding. According to Amazon, orders increased by 60% worldwide and by 50% in the US, and other records were set for sales of Amazon devices.

Prime Day has another purpose beyond just driving sales—it is a mechanism for increasing the number of Prime members, which were up 43% year over year, to 63 million, as of June 30, according to an estimate by Consumer Intelligence Research Partners (CIRP). Prime members are important, as they spend an average of $1,200 per year on Amazon products, more than twice the $500 that non-Prime members spend, according to CIRP. Amazon uses a combination of hot deals (many of which were on Amazon hardware this year) and a 30-day free membership to entice consumers to purchase Prime memberships, which lock them in for the following 12 months.

While Prime products come with free shipping, their prices are not necessarily the lowest available among all e-tailers. However, human psychology makes Prime members want to place orders with Amazon in order to get their money’s worth once they have signed up for the program. It is a virtuous circle: the more Prime members Amazon signs up, the better the prices and services it can offer them…which increases the value of a Prime membership and creates a higher entry barrier for competitors.

Amazon Prime is disrupting and affecting retail in several ways. It is accelerating shipping times and forcing competitors to drop shipping fees. Prime’s free two-day shipping (and its one-hour shipping via Prime Now in selected cities) prompted many retailers to accelerate and cut the price of shipping last holiday season, and the pressure is still on for them to continue to do so. For example, Target has partnered with Instacart for same-day grocery delivery and Macy’s has partnered with Deliv.

Another way that Prime is disrupting retail is through its ability to promote products, particularly Amazon’s own products, by making them Prime eligible. Naturally, all of Amazon’s devices for consuming digital content are Prime eligible, as are the private-label apparel lines that Amazon stealthily launched in February. In addition to their low prices, the Prime-ness of the Amazon apparel lines represents a competitive advantage for the company–and a disruption to everyone else.

In just two years, Prime Day has become a phenomenon in the retail industry. Many retailers have run “Black Friday in July” promotions to spur retail activity in the sluggish summer months just ahead of the back-to-school season, and Amazon’s Prime Day has served to enhance this phenomenon. Seemingly as a response to Prime Day, Walmart offered free shipping with no minimum order this week in addition to “rollbacks” (i.e., discounts) on a large number of items, and Target, Toys “R” Us and at least a dozen other retailers offered various combinations of discounts and free shipping. While Amazon Prime Day may serve to put Prime members in a shopping mood, other retailers are enthusiastically welcoming non-Prime members and their purchase dollars.

Then there is the 800-pound gorilla in the room: Alibaba. Alibaba created Singles’ Day on November 11 (the date, 11/11, was chosen as one that well represents single people), and the most recent Singles’ Day handled $14.3 billion in goods. The idea for Singles’ Day began with Chinese college students commiserating about being single, and it has become a global shopping phenomenon. The made-up shopping holiday has served Alibaba well by creating global visibility and driving sales, and Prime Day appears to be Amazon’s adaptation of that concept. There seems to be no letup in sight in the momentum of Singles’ Day; its gross merchandise volume grew by 54% last year. Like Alibaba’s first Singles’ Day, Amazon’s first Prime Day last year was an experiment. The event turned out to be so successful that, at the conclusion of Prime Day both last year and this year, Amazon commented, “After yesterday’s results, we’ll definitely be doing this again.”

Prime Day has served to energize US shoppers during the dog days of summer, leading to short-term retailer happiness. Although Amazon’s competitors still face the rapid international expansion of Alibaba on one side and the rapid, mostly domestic, expansion of Amazon on the other, Amazon’s e-commerce business accounted for less than 20% of US e-commerce sales in 2015—which leaves plenty of room in the e-commerce arena for other innovative retailers.

This week, Amazon celebrated its 21st birthday and its second annual Prime Day, on which the company recorded its biggest daily sales total since its founding. According to Amazon, orders increased by 60% worldwide and by 50% in the US, and other records were set for sales of Amazon devices.

Prime Day has another purpose beyond just driving sales—it is a mechanism for increasing the number of Prime members, which were up 43% year over year, to 63 million, as of June 30, according to an estimate by Consumer Intelligence Research Partners (CIRP). Prime members are important, as they spend an average of $1,200 per year on Amazon products, more than twice the $500 that non-Prime members spend, according to CIRP. Amazon uses a combination of hot deals (many of which were on Amazon hardware this year) and a 30-day free membership to entice consumers to purchase Prime memberships, which lock them in for the following 12 months.

While Prime products come with free shipping, their prices are not necessarily the lowest available among all e-tailers. However, human psychology makes Prime members want to place orders with Amazon in order to get their money’s worth once they have signed up for the program. It is a virtuous circle: the more Prime members Amazon signs up, the better the prices and services it can offer them…which increases the value of a Prime membership and creates a higher entry barrier for competitors.

Amazon Prime is disrupting and affecting retail in several ways. It is accelerating shipping times and forcing competitors to drop shipping fees. Prime’s free two-day shipping (and its one-hour shipping via Prime Now in selected cities) prompted many retailers to accelerate and cut the price of shipping last holiday season, and the pressure is still on for them to continue to do so. For example, Target has partnered with Instacart for same-day grocery delivery and Macy’s has partnered with Deliv.

Another way that Prime is disrupting retail is through its ability to promote products, particularly Amazon’s own products, by making them Prime eligible. Naturally, all of Amazon’s devices for consuming digital content are Prime eligible, as are the private-label apparel lines that Amazon stealthily launched in February. In addition to their low prices, the Prime-ness of the Amazon apparel lines represents a competitive advantage for the company–and a disruption to everyone else.

In just two years, Prime Day has become a phenomenon in the retail industry. Many retailers have run “Black Friday in July” promotions to spur retail activity in the sluggish summer months just ahead of the back-to-school season, and Amazon’s Prime Day has served to enhance this phenomenon. Seemingly as a response to Prime Day, Walmart offered free shipping with no minimum order this week in addition to “rollbacks” (i.e., discounts) on a large number of items, and Target, Toys “R” Us and at least a dozen other retailers offered various combinations of discounts and free shipping. While Amazon Prime Day may serve to put Prime members in a shopping mood, other retailers are enthusiastically welcoming non-Prime members and their purchase dollars.

Then there is the 800-pound gorilla in the room: Alibaba. Alibaba created Singles’ Day on November 11 (the date, 11/11, was chosen as one that well represents single people), and the most recent Singles’ Day handled $14.3 billion in goods. The idea for Singles’ Day began with Chinese college students commiserating about being single, and it has become a global shopping phenomenon. The made-up shopping holiday has served Alibaba well by creating global visibility and driving sales, and Prime Day appears to be Amazon’s adaptation of that concept. There seems to be no letup in sight in the momentum of Singles’ Day; its gross merchandise volume grew by 54% last year. Like Alibaba’s first Singles’ Day, Amazon’s first Prime Day last year was an experiment. The event turned out to be so successful that, at the conclusion of Prime Day both last year and this year, Amazon commented, “After yesterday’s results, we’ll definitely be doing this again.”

Prime Day has served to energize US shoppers during the dog days of summer, leading to short-term retailer happiness. Although Amazon’s competitors still face the rapid international expansion of Alibaba on one side and the rapid, mostly domestic, expansion of Amazon on the other, Amazon’s e-commerce business accounted for less than 20% of US e-commerce sales in 2015—which leaves plenty of room in the e-commerce arena for other innovative retailers.

Olay Built a Skin Evaluation Tool to Help Drugstore Shoppers

(July 13) Glossy

Olay Built a Skin Evaluation Tool to Help Drugstore Shoppers

(July 13) Glossy

China Shows Off “World’s First Graphene Battery”

(July 11) TechinAsia

China Shows Off “World’s First Graphene Battery”

(July 11) TechinAsia