Source: S&P Capital IQ

From the Desk of Deborah Weinswig

Prime Day’s Importance Lies in Driving Reconsideration, Not Just Sales

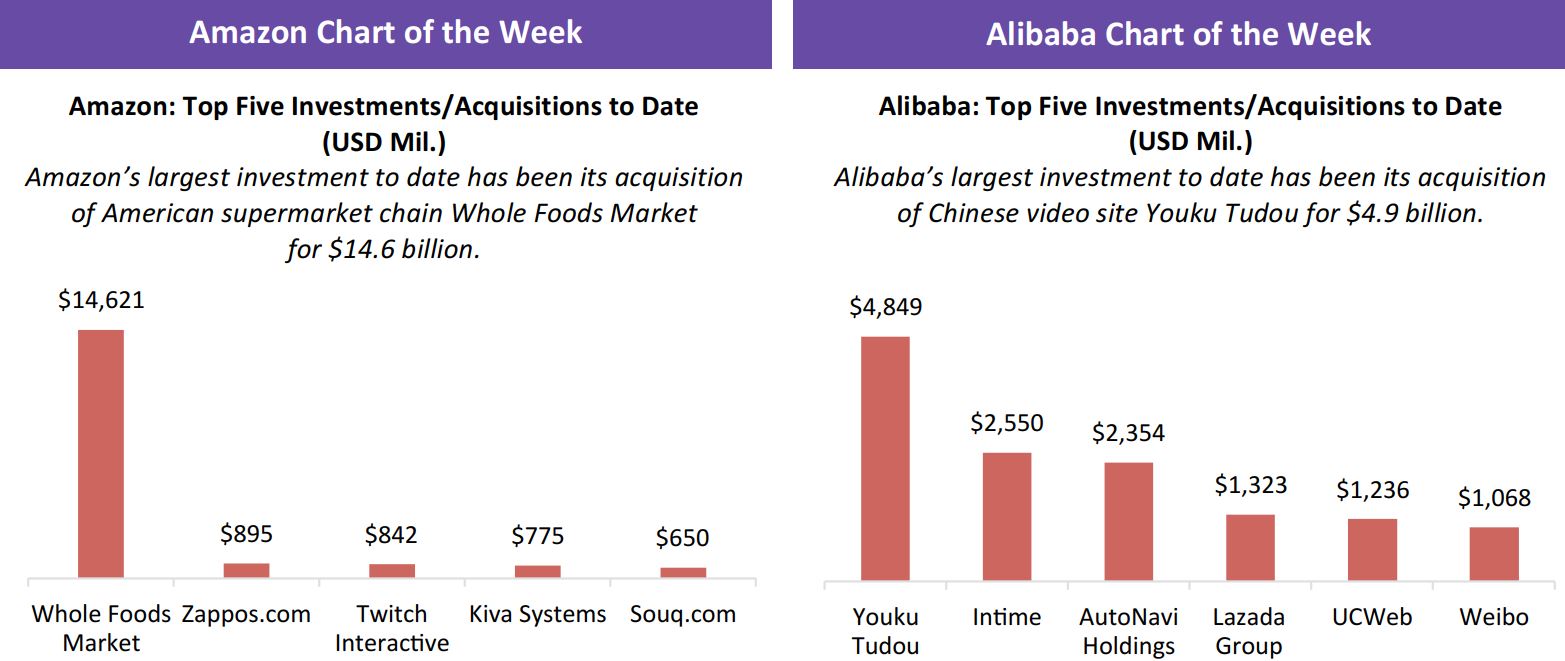

This week saw Amazon offer up its third-annual Prime Day—a feast of special offers available exclusively to Amazon Prime members. By the time this is published, many readers will have seen a slew of statistics on the sales values and visitor numbers that Amazon enjoyed as a result of the event.

We think, however, that the event’s value lies beyond any one-off spike in sales. Rather, Prime Day drives awareness of categories that shoppers may not traditionally have associated with Amazon, and it encourages trial purchasing of Amazon’s private labels. It is a marketing event that knocks shoppers from their routines and, in doing so, supports Amazon’s ongoing migration from a value-focused reseller of hardline brands to a convenience-driven seller of everything from snacks to socks.

1. Boosting Awareness of Fashion, Beauty and Grocery Ranges

As Amazon’s proposition has developed, Prime Day has evolved. The event remains skewed toward electronics and entertainment goods, but this year the range of featured categories encompassed those in which Amazon has recently strengthened its offering, such as fashion and food. Prime Day 2017 featured apparel and beauty products prominently, with shoppers offered 30% off selected items across both categories. The company highlighted groceries, too, offering Prime members multibuy deals, coupons, subscription savings and selected discounts.

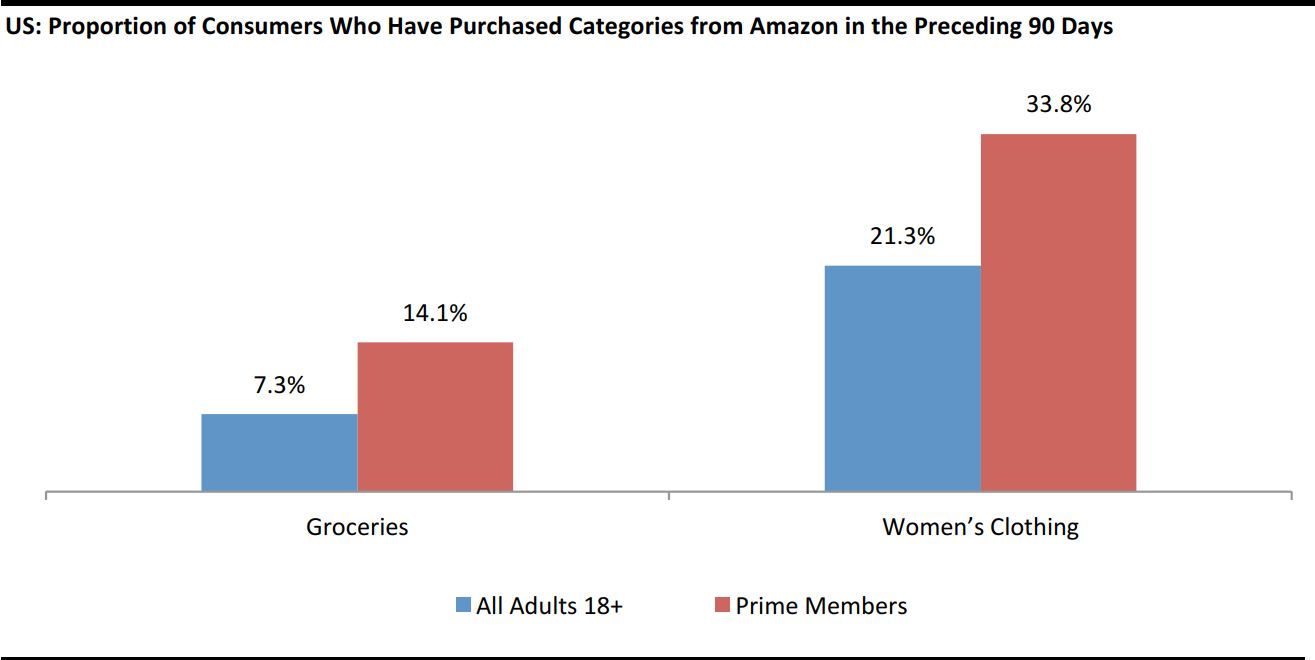

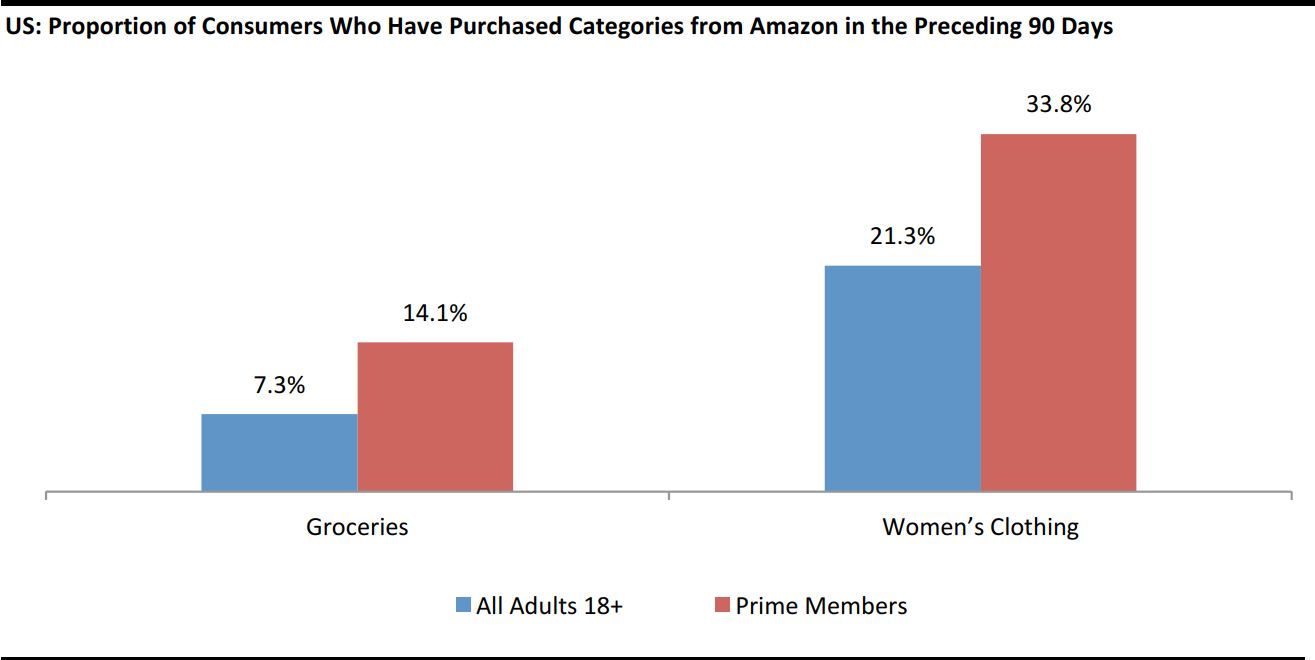

The prominence of these categories almost certainly encouraged Prime members to try Amazon for types of purchases they may not otherwise have considered—indeed, for types of purchases they may not have been making online at all. The reward for Amazon is that once shoppers have “discovered” it as a source for such categories, the Prime membership scheme encourages them to lock in their purchasing. As charted below, Prime members are much more likely than nonmembers to buy categories such as groceries and women’s clothing from Amazon.

Base: 6,915 Internet users in August 2016 (groceries); 7,406 Internet users in April 2017 (women’s clothing)

Source: Prosper Insights & Analytics

2. Encouraging Customers to Try Amazon’s Private Labels

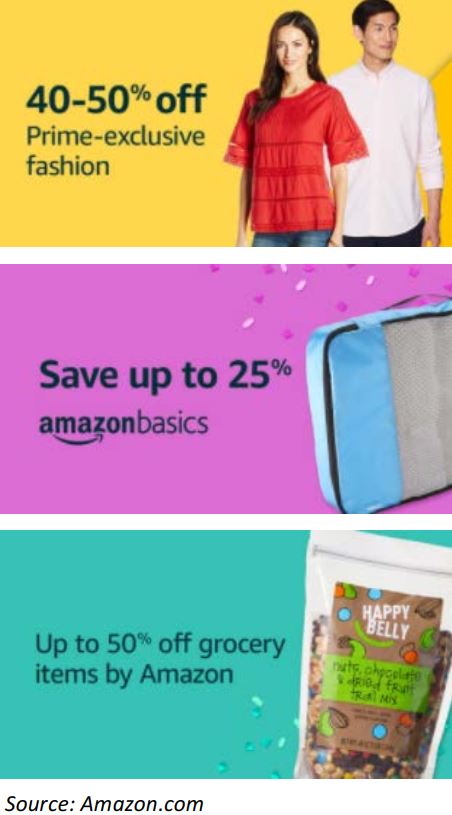

In a similar vein, we observed a stronger emphasis on Amazon’s private labels on Prime Day this year. Prime Day deals continued to feature many third-party brands, but Amazon promoted its private labels across a number of categories, perhaps most noticeably apparel.

- As in previous years, some of Amazon’s biggest and most prominently Weekly Insights July 14_2017 featured discounts were on its own ranges of hardware, including its Kindle e-readers and Kindle Fire tablets. This year, Amazon slashed prices on its Echo and Echo Dot devices, too.

In apparel, Amazon’s still-new private labels—such as Buttoned Down (men’s shirts), Lark & Ro (womenswear) and Mae (lingerie)—dominated the offerings presented to shoppers who clicked through to the Fashion section from the Prime Day homepage.

In apparel, Amazon’s still-new private labels—such as Buttoned Down (men’s shirts), Lark & Ro (womenswear) and Mae (lingerie)—dominated the offerings presented to shoppers who clicked through to the Fashion section from the Prime Day homepage.- Amazon also pushed its private-label ranges in grocery, offering up to 50% off some private-label food items in its Wickedly Prime range.

- A focus on private labels was evident in home textiles, too, where Amazon featured deals on its Pinzon brand. The company also offered up to 25% off across its range of AmazonBasics office supplies.

Our reading of Prime Day in the US is therefore that its real value lies in prompting Prime members to consider Amazon for categories and brands they may not otherwise have thought to purchase from the company. Two things underscore our thinking: First, Amazon has evolved Prime Day to support its push into newer categories such as fashion and grocery. Second, Amazon used Prime Day as a showcase for its private labels—so, it forms part of Amazon’s incremental move from being simply a reseller of other parties’ brands to an owner of brands that cultivate shopper loyalty.

US RETAIL & TECH HEADLINES

Amazon’s Prime Day Sets Company Sales Record

(July 12) CNN.com

Amazon’s Prime Day Sets Company Sales Record

(July 12) CNN.com

- On July 12, Amazon reported record sales for its third-annual Prime Day, beating its numbers for previous Black Friday and Cyber Monday shopping periods. In fact, Prime Day sales were higher than sales for both shopping holidays combined in 2016. Prime Day 2017, which kicked off on Monday and offered 30 hours of deals, saw a sales uptick of more than 60% compared with last year.

- The company also added more Prime members in one day than ever before. Amazon required shoppers to be Prime members to participate in the sale. While it did not give specific figures, Amazon said “tens of millions” of Prime members bought something on Prime Day this year, up more than 50% over last year.

Gymboree to Close About 350 Stores in Restructuring Effort

(July 11) The New York Times

Gymboree to Close About 350 Stores in Restructuring Effort

(July 11) The New York Times

- Children’s retailer Gymboree, which filed for bankruptcy last month, will close about 350 stores as part of its restructuring plan, the company said on July 11. The San Francisco–based retailer said it would begin winding down operations on July 18 at stores slated to close.

- Gymboree is using Chapter 11 bankruptcy proceedings to pare down its debt load, much of which stems from private equity firm Bain Capital’s $1.8 billion 2010 leveraged buyout of the retailer. The company is faced with more than $800 million in debt that is due in less than a year.

Talks Between Abercrombie & Fitch and Potential Buyers Stall

(July 10) The Wall Street Journal

Talks Between Abercrombie & Fitch and Potential Buyers Stall

(July 10) The Wall Street Journal

- Abercrombie & Fitch’s efforts to sell itself have stalled, leaving the apparel retailer to continue trying to right its business on its own. In May, the company said it was in “preliminary discussions with several parties,” though it warned the talks might not result in a transaction. On July 10, Abercrombie said the deal talks were off, confirming an earlier report in the day by The Wall Street Journal.

- The sales process had attracted a number of interested parties, including rivals Express and American Eagle Outfitters, which teamed up with private equity firm Cerberus Capital Management, people familiar with the matter said. Sycamore Partners was also involved in the process, but the buyout firm just last month struck a $6.9 billion deal to buy office-supply retailer Staples.

QVC to Merge with Home Shopping Network in $2.1 Billion Deal

(July 6) The New York Times

QVC to Merge with Home Shopping Network in $2.1 Billion Deal

(July 6) The New York Times

- John C. Malone is solidifying his hold on home-shopping channels—in his own particular way. His Liberty Interactive, which owns QVC, said that it would combine with its longtime rival, Home Shopping Network, in a $2.1 billion deal.

- The deal will put together the two home-shopping television networks at a time of upheaval in the retail world. Amazon’s dominance in selling online has grown seemingly nonstop, while Walmart has made e-commerce a big priority with the purchase of startups such as Jet and the clothing brand Bonobos.

Walmart Is Building Giant Towers to Solve the Most Annoying Thing About Online Ordering

(July 5) BusinessInsider.com

Walmart Is Building Giant Towers to Solve the Most Annoying Thing About Online Ordering

(July 5) BusinessInsider.com

- Walmart is building giant self-service kiosks in its stores that retrieve customers’ online orders. The kiosks, which Walmart calls Pickup Towers, are massive—standing at least 16 feet tall and about 8 feet wide—and are typically near store entrances. To use the tower, customers scan a barcode on their purchase receipt. Within 45 seconds, a door on the machine opens, and the items appear on a conveyer belt.

- The first kiosk appeared in a Walmart store in Bentonville, Arkansas, last year. The company is now rolling them out to more than a dozen stores in cities including Gilbert, Arizona; Glenpool, Oklahoma; Enterprise and Auburn, Alabama; and Midlothian, Virginia.

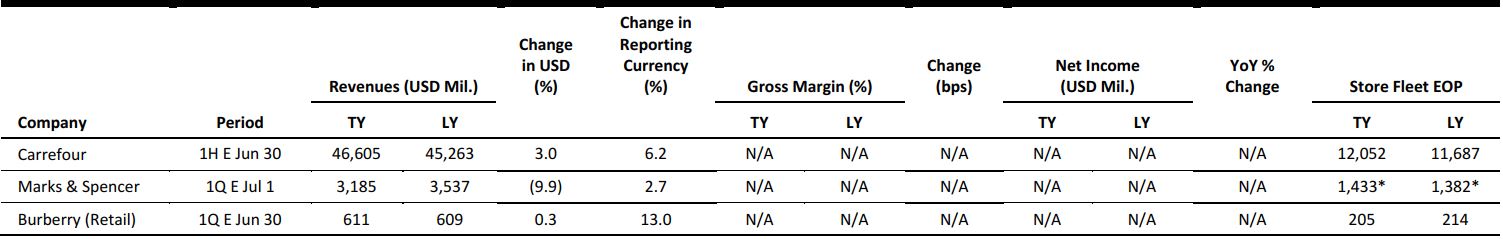

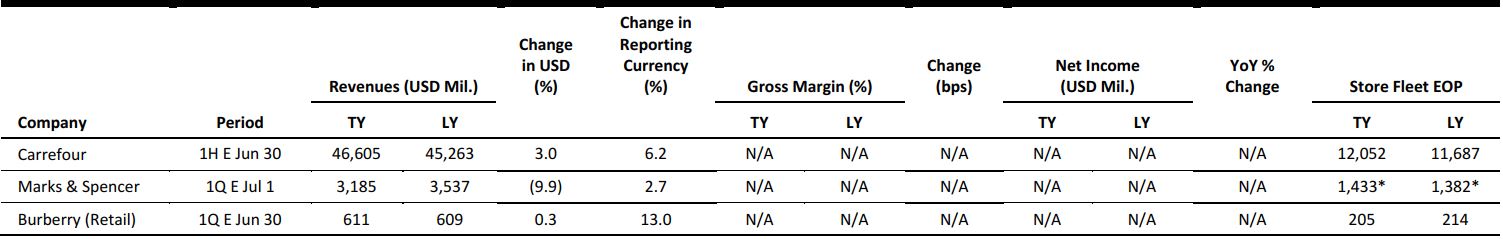

EUROPE RETAIL EARNINGS

*Marks & Spencer store numbers are as of closest year-end, due to absence of reported store numbers in latest quarter.

Source: Company reports/Fung Global Retail & Technology

EUROPE RETAIL HEADLINES

UK Retail Sales in June Boosted by Warm Weather

(July 11) BRC press release

UK Retail Sales in June Boosted by Warm Weather

(July 11) BRC press release

- The UK’s retail performance rebounded in June as total comparable retail sales rose by 1.2% year over year, up from 0.4% in May. The British Retail Consortium (BRC) noted that warm weather had a positive effect, as did rising inflation. Total retail sales rose by 2.0% in June, up from a 0.2% increase in May.

- However, BRC Chief Executive Helen Dickinson warned that “there’s a question mark over whether this spending momentum will last, as household expenditure is increasingly squeezed from rising inflation and slowing wage growth.”

Lidl to Double UK Store Openings over Two Years

(July 10) Retail-Week.com

Lidl to Double UK Store Openings over Two Years

(July 10) Retail-Week.com

- Discount supermarket chain Lidl aims to open “at least one shop a week” in the UK for the next two years, according to CEO Christian Härtnagel.

- The supermarket chain opened 30 stores last year, bringing its UK total to 670, and it has already agreed to locations for 50 to 60 shops a year for the next two years.

Ahold Delhaize to Open First Register-Free Store Next Year

(July 6) RetailDetail.eu

Ahold Delhaize to Open First Register-Free Store Next Year

(July 6) RetailDetail.eu

- Dutch-Belgian supermarket group Ahold Delhaize has announced that it hopes to launch its first store with no cash registers next year, in its Albert Heijn supermarket group in the Netherlands.

- The store, which will be in the AH to Go chain, was first announced in February this year by CEO Wouter Kolk, as payment speed is becoming an increasingly important factor in retailing.

AS Watson Looks to Open 92 Stores

(July 9) BBC.co.uk

AS Watson Looks to Open 92 Stores

(July 9) BBC.co.uk

- AS Watson, the owner of British high-street chains Superdrug, Savers and The Perfume Shop, is set to open 92 stores across the UK, creating more than 1,000 jobs.

- Health and beauty retailer Superdrug plans to open 30 new stores, while discount chain Savers will open 45 stores and The Perfume Shop will open 17 stores.

Dixons Carphone Launches Its Own Prime Day Event

(July 10) Retail-Week.com

Dixons Carphone Launches Its Own Prime Day Event

(July 10) Retail-Week.com

- British electrical-goods retailer Currys PC World, owned by Dixons Carphone, has gone toe-to-toe with online rival Amazon by launching its own version of Prime Day, which started one hour before Amazon’s Prime Day event.

- Last year, Dixons Carphone responded to Amazon Prime Day with a 10-day super sale, which resulted in a 47% jump in online traffic to Carphone Warehouse’s website on the same day as Prime Day.

ASIA TECH HEADLINES

Stripe Partners with Alipay and WeChat to Access Customers in China

(July 10) Bloomberg.com

Stripe Partners with Alipay and WeChat to Access Customers in China

(July 10) Bloomberg.com

- San Francisco–based Stripe unveiled a partnership deal with two of China’s biggest digital payment services, giving the startup access to hundreds of millions of Chinese customers. Businesses that use Stripe can now accept Alipay and WeChat as payment methods on their websites.

- Stripe’s software lets businesses accept payments online, and offers tools to help with data security, fraud prevention, accounting and billing. “By deepening our existing partnership with Alipay, we’re enabling businesses around the world to instantly access the once-impenetrable Chinese consumer market,” said John Collison, President and Cofounder of Stripe.

CompareAsia Sees $50 Million in New Funding from Alibaba and Other Investors

(July 11) TechinAsia.com

CompareAsia Sees $50 Million in New Funding from Alibaba and Other Investors

(July 11) TechinAsia.com

- Financial comparison site CompareAsiaGroup has raised $50 million in a funding round led by the World Bank’s International Finance Corporation. Other backers in the series B round included Alibaba Entrepreneurs Fund (Alibaba’s nonprofit startup support program), SBI Group and H&Q Utrust. Some existing investors also participated, including Goldman Sachs Investment Partners, Nova Founders Capital, ACE & Company and Route 66 Ventures.

- CompareAsia, which lets people search for and compare things such as credit cards, loans and insurance products, operates sites under different brand names in several Southeast Asian countries and its home base of Hong Kong. In Indonesia, it is known as HaloMoney, while in the Philippines, it is known as MoneyMax.

China Sees Tech Funding Drop amid “Crazy” Valuations

(July 10) TechinAsia.com

China Sees Tech Funding Drop amid “Crazy” Valuations

(July 10) TechinAsia.com

- Tech in Asia’s database showed that $27.8 billion was invested in Chinese tech firms in the first six months of 2017, down from $35.2 billion the same period last year. In 2016, we saw a record total of $56.1 billion in funding for China’s booming tech sector, though the latter half of the year already indicated that 2017 would see a slowdown, as investors began to balk at sky-high valuations.

- “There will always be ups and downs for everything,” said Edith Yeung, Partner at Silicon Valley–based 500 Startups and boss of its Greater China wing. Yeung said that Mainland China tech valuations are “still crazy” right now.

Amazon Puts an Additional $260 Million into Its Indian Business

(July 5) TechCrunch.com

Amazon Puts an Additional $260 Million into Its Indian Business

(July 5) TechCrunch.com

- Amazon has topped up its investment in its India business with another $260 million. The funding was disclosed in regulatory documents filed last month and first reported by Indian financial publication Mint.

- The infusion of capital comes in time to prepare Amazon India for the holiday shopping season, which centers on the Dussehra and Diwali festivals in the fall. Amazon India’s chief rival for the attention of online shoppers will be Flipkart, which raised $1.5 billion at a valuation of $11.6 billion three months ago from a noteworthy roster of investors that include Amazon rival eBay as well as Microsoft and Tencent.

LATAM RETAIL AND TECH HEADLINES

Brazilian Firm Presses Ahead with Antitrust Case Against Google

(July 7) ZDNet.com

Brazilian Firm Presses Ahead with Antitrust Case Against Google

(July 7) ZDNet.com

- A Brazilian online giant is planning to use arguments from the EU’s $2.7 billion antitrust ruling as part of its own lawsuit against Google. Buscapé, a price comparison engine, is also suing Google for using its prevalence in Internet searches to favor its Google Shopping engine.

- Buscapé’s lawyers are planning to submit details on the EU ruling to the local antitrust regulator and to argue that the cases are very similar. The antitrust case between Buscapé and Google was filed in 2011, when the latter’s comparison-shopping service was launched in Brazil.

MercadoLibre to Debut Lending, Logistics Services in Brazil

(July 12) Reuters.com

MercadoLibre to Debut Lending, Logistics Services in Brazil

(July 12) Reuters.com

- Argentine online marketplace MercadoLibre is diving into areas such as lending and logistics management, which once belonged exclusively to large financial and retail groups, in order to increase its market share in Brazil, according to a top executive.

- The company’s Brazil operations account for about half its business, COO Stelleo Tolda said in an interview last week. He expects revenue at MercadoLibre to surpass that of B2W, Brazil’s largest e-commerce company, this year.

Google Picks Four Brazilian Startups for Accelerator Program

(July 5) ZDNet.com

Google Picks Four Brazilian Startups for Accelerator Program

(July 5) ZDNet.com

- Google has chosen four Brazilian startups to take part in its Launchpad Accelerator program. The four ventures will be among 33 startups hailing from 16 countries chosen to participate in the program, which includes a two-week intensive mentoring period at Google’s offices in Mountain View, California.

- Of the 3,000 submissions received, the web giant picked Contratado.me, which focuses on recruitment of people with up-and-coming skills in areas such as business intelligence; Guichê Virtual, which offers a bus ticketing app; online accounting resources provider Contabilizei; and Arquivei, which provides archiving management services for tax documentation.

Fintechs Seek Slice of Brazil’s Small Business Loan Market

(July 4) Reuters.com

Fintechs Seek Slice of Brazil’s Small Business Loan Market

(July 4) Reuters.com

- Financial technology firms in Brazil such as Banco Inter are targeting lending to small and midsized companies to fill a gap in the credit market left by large lenders deterred by rising delinquencies and narrow margins.

- Banco Inter and other fintechs are expanding into “bridging loans” for small businesses borrowing against their receivables from supply contracts with major companies, offering lower rates than traditional banks

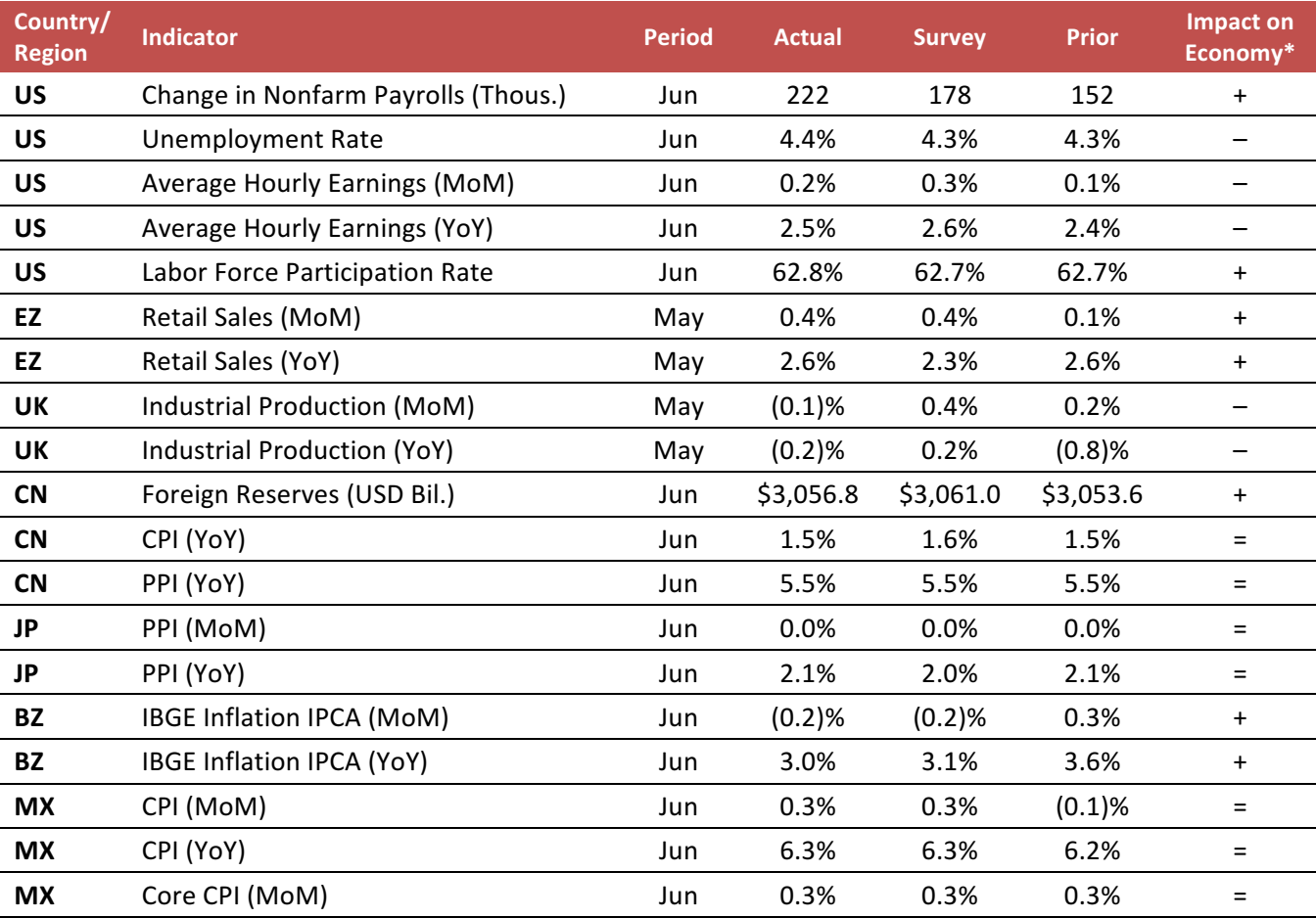

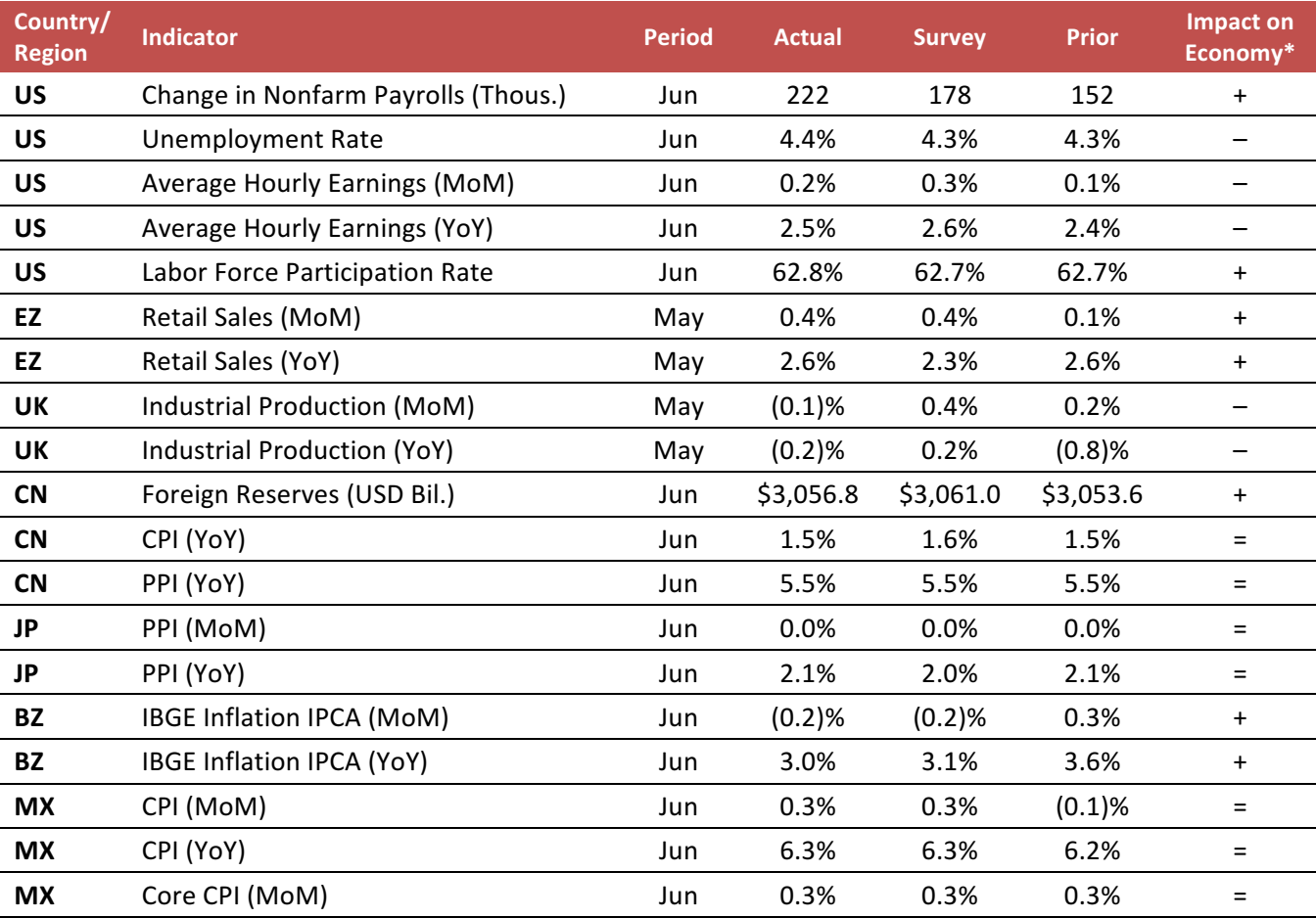

MACRO UPDATE

Key points from global macro indicators released July 5–12, 2017:

- US: In June, nonfarm payrolls increased by 222,000, above the consensus estimate of 178,000. The unemployment rate edged up by 0.1%, to 4.4%, in June, while the labor force participation rate also ticked up by 0.1%, to 62.8%.

- Europe: In the eurozone, retail sales increased by 0.4% month over month and by 2.6% year over year in May. In the UK, industrial production in May decreased by 0.1% month over month and by 0.2% year over year.

- Asia-Pacific: In China, foreign reserves increased to $3,056.8 billion in June. The upward trend in foreign reserves eased concerns about the Chinese economy. Year over year in June, the Consumer Price Index (CPI) in China rose modestly, while the Producer Price Index (PPI) jumped.

- Latin America: In Brazil, the year-over-year inflation rate returned to a more desirable level in June. In Mexico, the CPI edged up modestly month over month in June.

*Fung Global Retail & Technology’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Eurostat/UK Office for National Statistics/The People’s Bank of China/National Bureau of Statistics of China/Bank of Japan/Instituto Brasileiro de Geografia e Estatística (IBGE)/Instituto Nacional de Estadística y Geografía (INEGI)/Fung Global Retail & Technology

In apparel, Amazon’s still-new private labels—such as Buttoned Down (men’s shirts), Lark & Ro (womenswear) and Mae (lingerie)—dominated the offerings presented to shoppers who clicked through to the Fashion section from the Prime Day homepage.

In apparel, Amazon’s still-new private labels—such as Buttoned Down (men’s shirts), Lark & Ro (womenswear) and Mae (lingerie)—dominated the offerings presented to shoppers who clicked through to the Fashion section from the Prime Day homepage.