Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

A lot of exciting events happened in the wearables space last month. In the smart fabrics realm, Google and jeans maker Levi Strauss & Co. launched a collaboration, Project Jacquard, to incorporate touch-sensitive yarns into clothing. The goal is to make garments interactive by allowing the wearer to communicate with an electronic device through simple gestures, such as tapping or swiping over a garment. Doing so will prompt the garment to send a wireless signal to the device and access its functionality. Also, fitness tracker extraordinaire Fitbit IPO’d in June, raising about $732 million for the company and giving it a valuation of $4.1 billion. Finally, at CE Week 2015 in New York, a number of consumer-ready wearables were showcased at a wearables fashion show, and they sparked great enthusiasm from the audience.

The global wearables market is expanding quickly. Some 317 types of wearable products are either already on the market or will be soon. Global shipments of wearable devices will hit 61 million in 2015 and then climb to 134 million by 2018, representing a compound annual growth rate of 30.4%, according to research firm MarketsandMarkets. In terms of value, we project that global wearables sales will rise from $6.6 billion in 2015, up to $16.8 billion

by 2018.

Funding is flowing into the development of wearables on expectations of a sustained market boom. Backers invested more than $613 million in startups in the wearables space between 2009 and the end of 2014, and CB Insights estimates that total investment dollars in wearables were $1.4 billion over the same period. Crowdfunding investors have financed various head-mounted devices, while wristbands have trailed substantially in this funding channel. Traditional venture capital investors are the ones who have tended to favor wristband products, and they’ve also viewed bodywear more favorably than the crowdfunders have.

In this highly dynamic and competitive sector, who will be the ultimate winners and losers? FBIC thinks that wearable devices need to meet the following basic criteria in order to achieve longevity:

A lot of exciting events happened in the wearables space last month. In the smart fabrics realm, Google and jeans maker Levi Strauss & Co. launched a collaboration, Project Jacquard, to incorporate touch-sensitive yarns into clothing. The goal is to make garments interactive by allowing the wearer to communicate with an electronic device through simple gestures, such as tapping or swiping over a garment. Doing so will prompt the garment to send a wireless signal to the device and access its functionality. Also, fitness tracker extraordinaire Fitbit IPO’d in June, raising about $732 million for the company and giving it a valuation of $4.1 billion. Finally, at CE Week 2015 in New York, a number of consumer-ready wearables were showcased at a wearables fashion show, and they sparked great enthusiasm from the audience.

The global wearables market is expanding quickly. Some 317 types of wearable products are either already on the market or will be soon. Global shipments of wearable devices will hit 61 million in 2015 and then climb to 134 million by 2018, representing a compound annual growth rate of 30.4%, according to research firm MarketsandMarkets. In terms of value, we project that global wearables sales will rise from $6.6 billion in 2015, up to $16.8 billion

by 2018.

Funding is flowing into the development of wearables on expectations of a sustained market boom. Backers invested more than $613 million in startups in the wearables space between 2009 and the end of 2014, and CB Insights estimates that total investment dollars in wearables were $1.4 billion over the same period. Crowdfunding investors have financed various head-mounted devices, while wristbands have trailed substantially in this funding channel. Traditional venture capital investors are the ones who have tended to favor wristband products, and they’ve also viewed bodywear more favorably than the crowdfunders have.

In this highly dynamic and competitive sector, who will be the ultimate winners and losers? FBIC thinks that wearable devices need to meet the following basic criteria in order to achieve longevity:

- They must solve a genuine problem or add real convenience—not be built on gimmicks that will struggle to maintain their appeal longer term.

- Devices must be able to sustain demand in the face of heightened competition from both inside and outside the wearables space—for instance, from smartphone apps that can offer similar functionality.

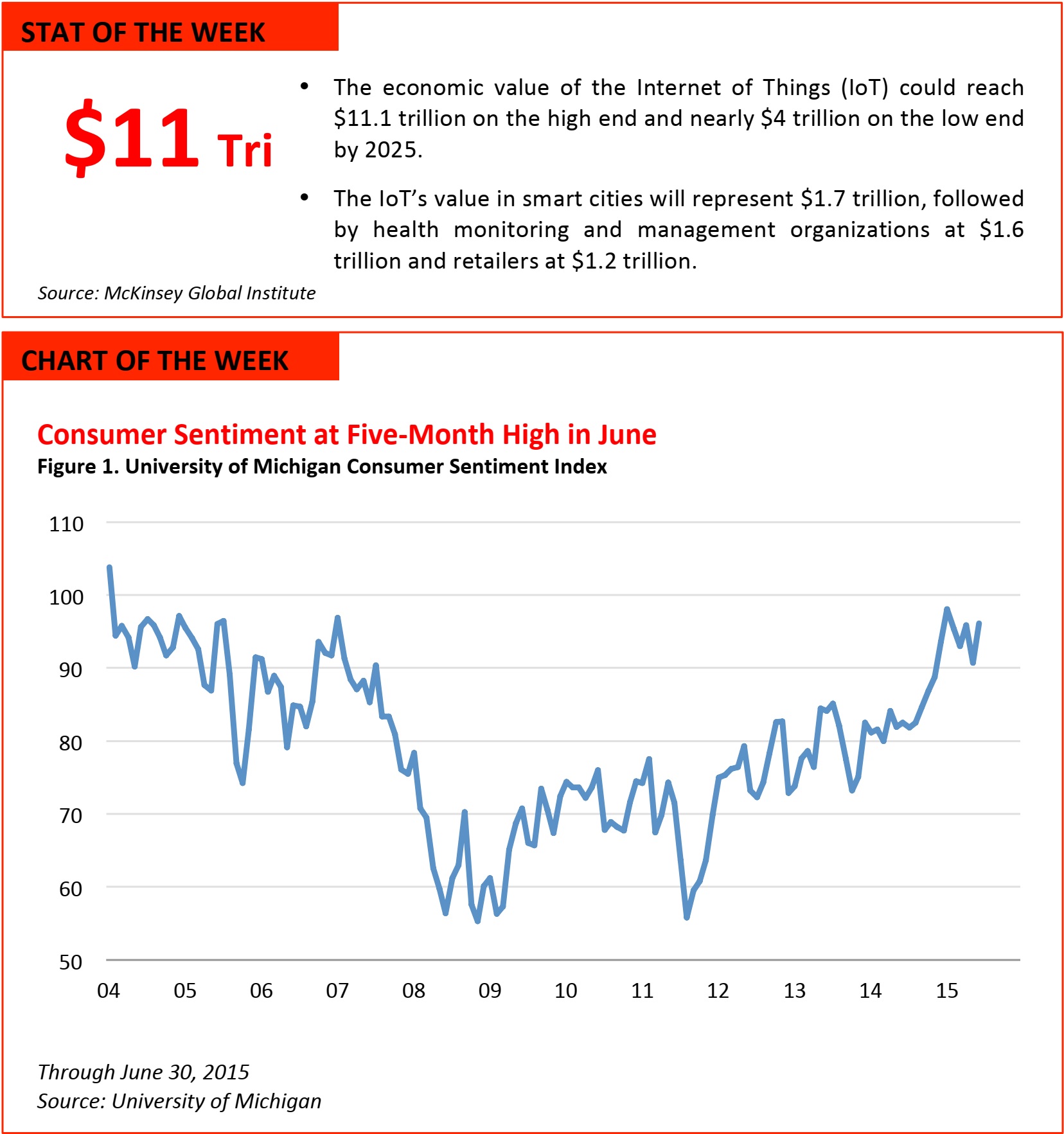

- The final reading of the University of Michigan’s Consumer Sentiment Index rose to 96.1 in June, beating economists’ consensus of 94.6.

- The June reading was up from a final reading of 90.7 in May.

- The survey’s chief economist, Richard Curtin, said, “Consumers voiced in the first half of 2015 the largest and most sustained increase in economic optimism since 2004.”

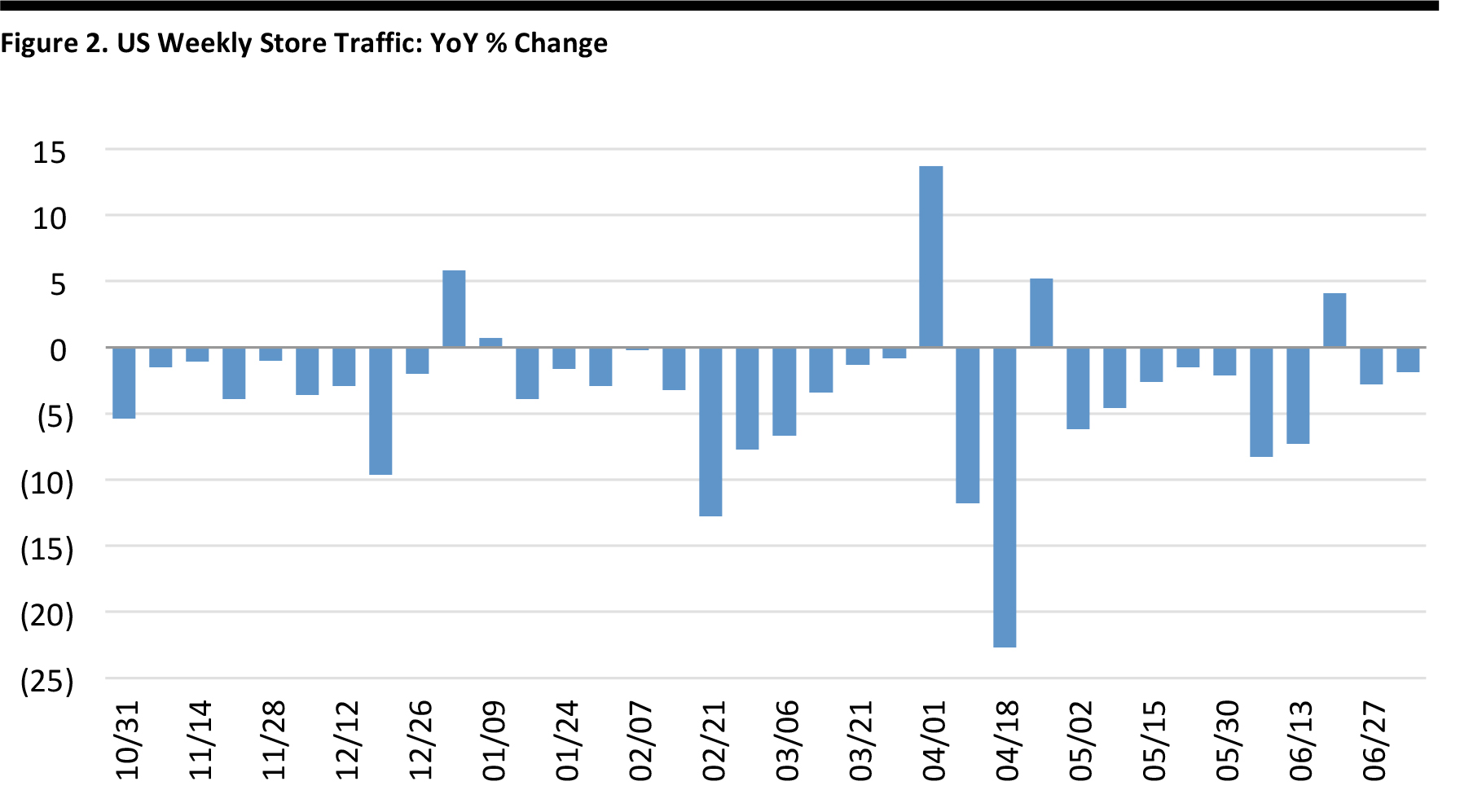

US RETAIL TRAFFIC

Through July 4, 2015 Source: ShopperTrak

- Overall store traffic was down 1.9% for the week ended July 4.

- Apparel store traffic declined 2.4% and electronics store sales were flat for the second consecutive week.

- Consumers chose to shop online and participate in Independence Day festivities rather than go to stores. Retailers are now offering deep discounts on summer merchandise to make room for back-to-school products.

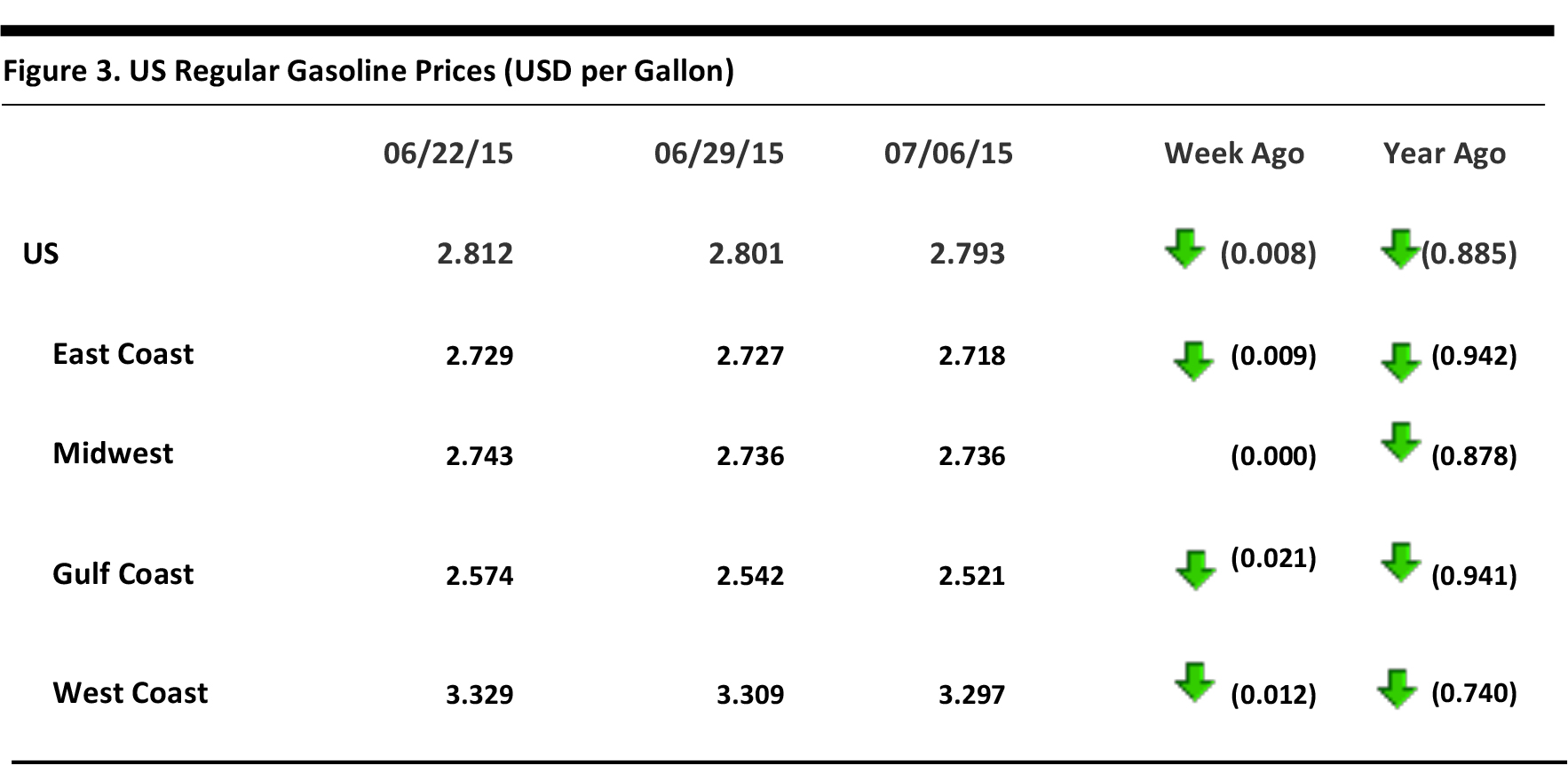

US REGULAR GASOLINE PRICES

Source: US Energy Information Administration

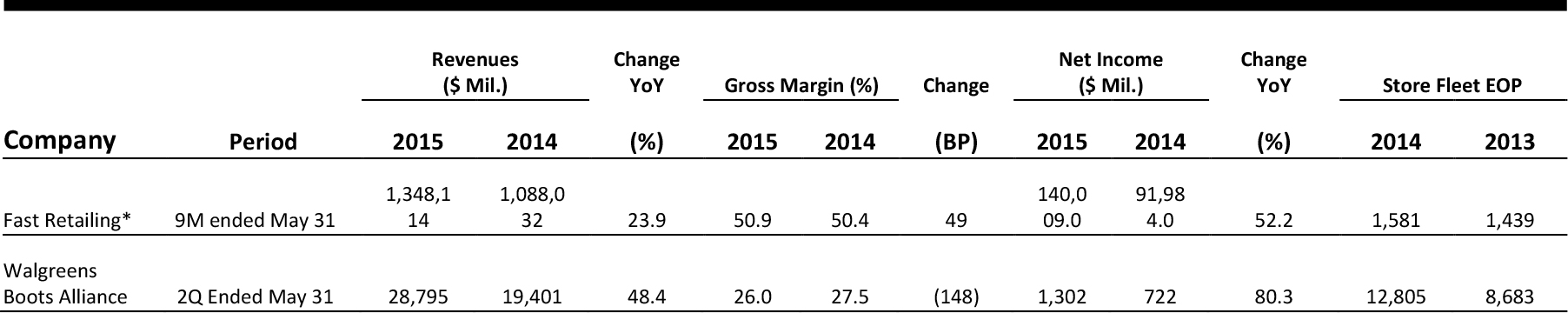

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

- On July 2, Unilever announced an agreement to acquire clinical skincare brand Murad for an undisclosed figure.

- Murad’s products include cleansers, treatments, moisturizers, eye-care products, bodycare products, regimens, masks, suncare products, supplements and toners. The Murad brand had total revenues of $115 million in 2014, and its products are sold across the US in professional salons and spas, at retailers such as Sephora, Ulta and Nordstrom, and through direct sales. The transaction is subject to customary approvals.

- On the eve of its 20th birthday, Amazon introduced “Prime Day,” an exclusive shopping event offering Prime members more deals than Black Friday.

- Starting at midnight on July 15, Prime members will have access to thousands of deals from a dozen categories.

- Tory Burch unveiled a new Paris flagship store at 412 Rue Saint-Honoré, which represents the latest effort of the brand’s European expansion.

- Tory Burch generates about 10% of its revenue in Europe. The company began wholesaling in France in 2008. Burch also created an exclusive capsule collection for the Paris store that’s safer for the coming September.

- Dollar Tree has completed its acquisition of Family Dollar Stores two years after the announcement. Gary Philbin was formerly president and chief operating officer of Dollar Tree, and he’ll assume the same role at Family Dollar.

- Family Dollar shareholders will receive $59.60, plus just under 0.25% of a share of Dollar Tree common stock for each Family Dollar share they own. The combined entity will have more than 13,600 stores, annual sales of $19 billion and more than 145,000 store associates.

- Seritage Growth Properties, the real estate spin-off of Sears Holdings, raised about $1.6 billion on the New York Stock Exchange from an offering on July 6.

- Sears plans to sell and lease back about 235 properties to the REIT. Sears expects to raise $2.6 billion in proceeds from the REIT buying those properties. In April, Sears reached several real estate deals with Macerich, General Growth Properties and Simon Property Group.

ASIA HEADLINES

- Didi Kuaidi confirmed that it had raised $2 billion in a funding deal, following weeks of speculation. This is the first financing following the merger of rival services Didi Dache and Kuaidi Dache, and it has been left open for additional input from strategic investors. The company said it will officially close at the end of this month.

- Didi Kuaidi didn’t disclose its full investor list, but those made public include new backers Capital International Private Equity Fund and Ping An Ventures, in addition to existing investors Alibaba, Tencent, Temasek and Coatue Management.

- Alibaba will invest an additional S$187.1 million (US$138 million) in SingpPost, Singapore’s national postal and logistics company, increasing its previous 10.23% stake in the company to 14.51%.

- Alibaba will also acquire a 34% stake in Quantium Solutions International (QSI) by investing up to S$92 million (US$67.9 million). QSI, a wholly owned subsidiary of SingPost, handles end-to-end e-commerce logistics and fulfillment services.

- According to a new market research report by Slice Intelligence, US-based sales of the Apple Watch have fallen from 200,000 per day during launch week to around 5,000 per day for the first few days of July.

- Digging deeper into the data, Slice Intelligence claims that two-thirds of Apple Watches sold to date have been the entry-level Sport model. Apple may have sold fewer than 2,000 of the 18-karat gold Edition watches in the US over the past two months.

- Beating giants such as Flipkart and Snapdeal, Ahmedabad-based Infibeam, an online shopping portal, has filed for an IPO to raise US$71 million, becoming the first Indian e-commerce company to list shares on the domestic market.

- Started in 2007, Infibeam runs several e-commerce services, including Infibeam.com, Indent, BuildaBazaar, Incept and Picsquare. Last year, Sony Music bought a 26% stake in Indent, the company’s digital entertainment arm.

- Hiroki Totoki, Sony Mobile’s CEO, said in an interview that Sony will stay in the mobile business. “Smartphones are completely connected to other devices, also connected to people’s lives. And the opportunity for diversification is huge. We’re heading to the IoT era and have to produce a number of new categories of products in this world,” Totoki said.

- “We’ve got a good feel for the technology and we’re not limited to the smartwatch. We include smartwear, smart products, and smart devices, and there are many more things now being made for the IoT era. We will never ever sell or exit from the current mobile business,” Totoki further commented.

- Founded in the UK in 2010, Quipper began with Quipper Quiz, a mobile-based quiz platform that helped learners study language and math subjects. The company then pivoted in 2014, with the launch of Quipper School, an online learning platform for K–12 that features content aligned with government-approved curriculum.

- Known for its acquisition of the world’s largest job recruitment website, Indeed.com, in 2012, Recruit has a strong interest in the education vertical, as the company also provides educational services through Benkyo Sapuri (Japanese for “study supplement”), and grade 12 university entrance exam test prep through Jyuken Sapuri (Japanese for “entrance exam supplement”).

- Japan’s largest television network, FujiTV, is to stream 4K content commercially. This marks the first regular 4K broadcast in Japan, and it may signal more to come.

- The initial 4K content release includes a documentary on Hashima, the deserted island near Nagasaki that was chosen as a modern industrial heritage site just one day before the announcement. The 4K streaming content comes from a Tokyo-based startup called Mist Technologies, which launched in 2013 and received funding from Japanese telco KDDI

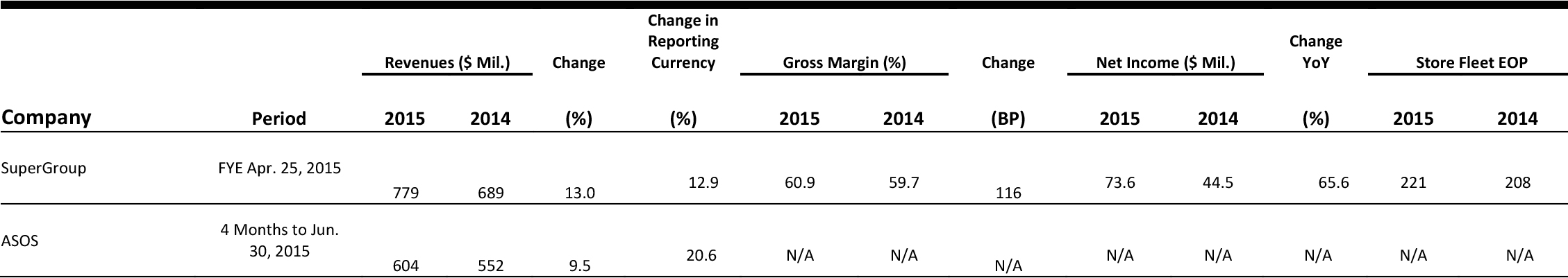

EUROPEAN RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

- UK designer Bruce Oldfield has created an 80-piece capsule collection for UK department store John Lewis. The range will debut in selected stores and online on September 4, with prices starting from around £60 (US$92).

- Inspired by over 40 years of Oldfield’s creations, the womenswear line will include coats trimmed with faux fur, skinny trousers and velvet coats.

- In the four months through June 30, ASOS saw a 20% rise in retail sales, in line with analysts’ expectations. UK sales were up 27% and international sales, which constitute 60% of ASOS’s business, were up 16%, despite currency movements being unfavorable to the pound.

- Total year-over-year revenue was up 17%, to £947.1 million (US$1,456.8 million) over 10 months (ASOS’s fiscal year ends August 31). The retailer said that expected annual sales growth would be between 15% and 20%; the full-year gross margin is expected to remain flat compared to the previous year, as strict stock control and strong full-price sales have been offset by price cuts. ASOS is also expecting an increase of 15% to 20% in sales volumes and estimates that EBIT will be about 4% of sales.

- An increasing number of Greek citizens are turning to online stores and card payments, as withdrawing money from the banks has become impossible for most. This is a stark turnaround for a country where most people still visit brick-and-mortar stores and pay with cash.

- According to the Greek organization for entrepreneurs, ESEE, the average turnover drop in the past week was around 70%, with only food rising by 30%. The ESEE commented, “It is remarkable to see that the Greek population has used its card for payments in supermarkets, something that only happened on occasion in the past.”

- German sports brand Puma will create a bespoke shoe collection for Amazon. It will be available in September 2015 on every European Amazon website. The range has been designed exclusively for the online retailer and is based on Puma’s best-selling sneakers.

- There will be six designs in total and they will retail for €80 (US$88).

- Coty is close to completing a deal worth €11 billion (US$12 billion) to acquire Procter & Gamble’s perfume and cosmetics companies. Coty will double in size once the deal is completed.

- This deal will make Coty a leader in the perfume category and will push it to fifth position in the haircare products market as it adds the Wella and Clairol brands to its product range. The deal also gives Coty access to the emerging markets, where it has had little presence; Wella’s largest market is Latin America, which contributed to 38% of its 2014 turnover.

- This quarter, like-for-like sales were down 0.4% in the clothing and housewares business of M&S. However, total general merchandise sales were up 0.2%, and gross margin for the year is expected to rise by 150 to 200 basis points. Online sales also increased, by 38.7%, during the quarter, thanks to new website and distribution center improvements.

- M&S saw an increase of 3.2% in total food sales and 0.3% in like-for-like food sales. It launched 700 new lines, including the new Taste of the British Isles range. M&S is expected to open 90 new food stores, as planned, and the ones that are already open have been performing well so far. Overall, sales in the UK climbed 1.9%, but were unchanged like-for-like, and international sales grew moderately, by 0.7%, though international turnover decreased by 3.9%.

- In a bid to achieve its objective of generating £1 billion in sales through its fashion operations by 2020, UK supermarket Sainsbury’s has announced a relaunch of vintage sports brand Admiral. The brand will launch as a premium fashion label, and its first menswear collection will be released on July 14.

- In June, Sainsbury’s reported a 10% increase in clothing sales, and it has chosen to focus on this by picking up on the current athleisure fashion trend. The new collection will be available in its larger stores and online.

- According to the British Retail Consortium (BRC), consumer sentiment improved in June as high street stores in the UK saw a slower deflation in their prices. The BRC-Nielsen Shop Price Index fell 1.3% in June, which was the smallest decrease since January. It had fallen 1.9% in May.

- The Consumer Price Index showed its first year-over-year decline in April, but rose back above zero in May. Consumer spending, a key driver of economic recovery, is expected to remain strong through the summer, and the Bank of England expects the Consumer Price Index to start bouncing back to the targeted level of 2% later in the year, once the steep fall in 2014’s oil prices is left out of the year-over-year comparisons.

LATAM HEADLINES

- Perry Ellis International announced a license agreement with Manufacturas Kaltex for Original Penguin brand home textile products for customers in Mexico.

- Licensed products include coordinated sheets, pillow cases, comforter duvets, bed skirts, decorative pillows, throws, shams, blankets, quilts and window treatments, as well as bath products, including coordinated towels, shower curtains, bath rugs, waste baskets, soap dishes, soap dispensers, tissue box covers and other bath accessories.

- Major department and upscale stores, including both online and physical stores, are among the targeted retailers. The launch is planned for spring 2016.

- On July 6, Priceline Group announced the formation of a strategic partnership with, as well as a US$60 million investment in, Brazil’s Hotel Urbano.

- Hotel Urbano was founded in 2011 and offers travel packages, hotel rooms, spaces for rent, cruises and other products. It has more than 8,000 Brazilian hotel partners.

- In the partnership, Hotel Urbano will be able to use Priceline’s Booking.com for non-LatAm retail hotels, and Priceline will become the preferred provider for Hotel Urbano’s global packages.

- Xiaomi is selling its Redmi 2 phone online for US$160 in Brazil, according to Bloomberg.

- This model marks the first phone Xiaomi has manufactured outside China, suggesting that the company has global expansion plans.

- Xiaomi Global Vice President Hugo Barra said the company is planning to expand into other emerging markets, such as Thailand, Vietnam and Russia, and that it plans to start selling phones in those countries during the next 12 months.

- Weak same-store sales and heavy promotions have pressured revenues and operating margins for Brazilian retailers.

- The Brazilian Institute of Geography and Statistics reported that Brazilian retail sales contracted by 0.8% in the first quarter of 2015, the worst performance of the past 12 years, putting an end to an 11-year period of growth.

- Fitch believes that retailers need to renegotiate rent contracts, postpone store openings and reposition brands to reduce costs.

- Over the past few weeks, Brazilian retailers have cut their workforces by 4,200 employees, which is likely to hurt financial results in the second half of the year.

- According to a recent report by Nielsen, Hispanic women will constitute about 30% of the total US female population by 2060.

- The Hispanic market was worth $1.3 trillion in 2014, up 155% from 2000.

- The Selig Center for Economic Growth estimates that by 2019, Hispanics will account for 10.6% of total US buying power.

- From June 2012 to May 2013, Latina women spent an estimated $3.3 billion on footwear, accounting for almost 20% of the total women’s fashion footwear market.