FROM THE DESK OF DEBORAH WEINSWIG

Brexit: The View from This Side of the Pond

On June 23, British citizens cast a historic vote for the UK to exit the European Union (EU), with the “leave” votes outnumbering the “stay” votes by a margin of 52% to 48%.

The US has a “special relationship” with the UK and strong, long-lasting ties with Europe as well, through NATO and other transatlantic links, and US President Barack Obama issued strongly worded remarks urging the UK to remain in the EU.

By exiting the EU, the UK will be able to increase its control over its borders and economy, and it will have greater freedom to trade with the rest of the world without tariffs, but both the UK and the EU will pay a price for Brexit, as will other countries, including the US.

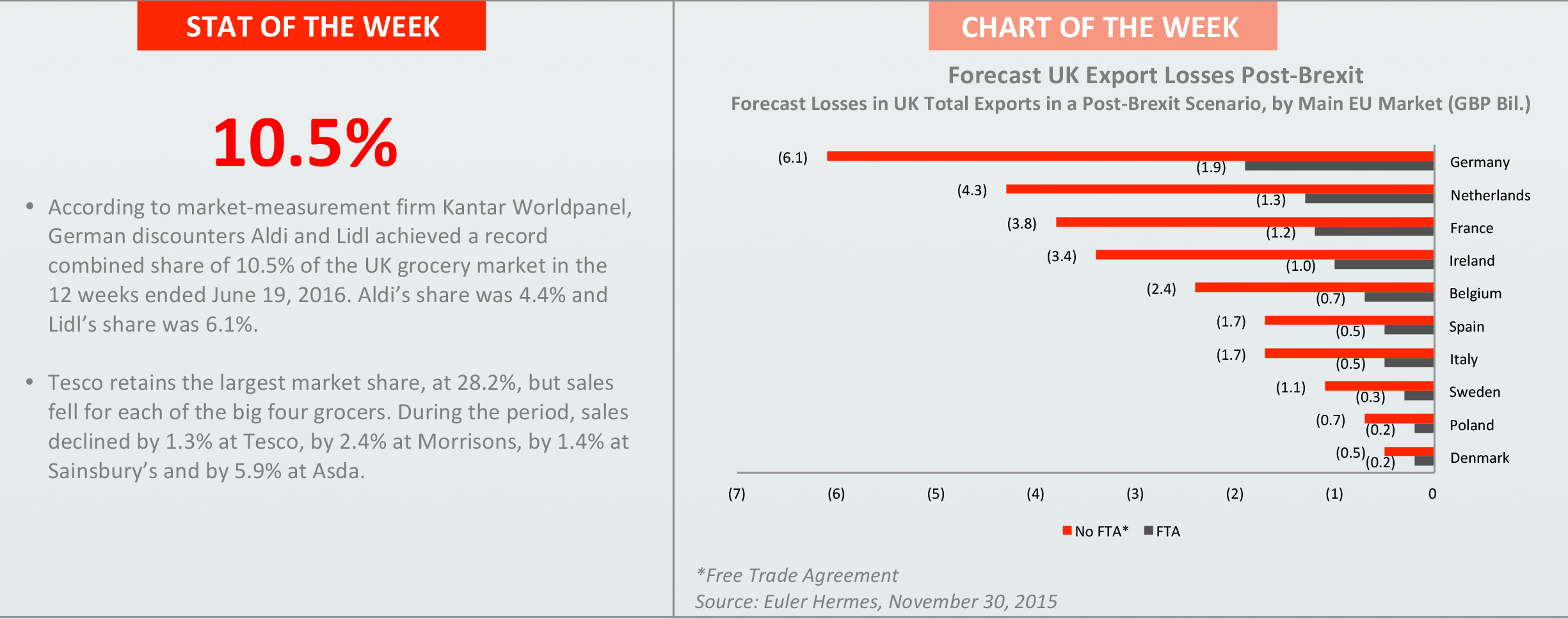

Challenges for the UK: Uncertainty regarding the timing and process of withdrawal from the EU is likely to take an immediate toll on the UK’s economy, currency and markets. Some economists are predicting that the decision to exit the EU could throw the UK’s economy into recession in the second half of this year, and there is consensus that the fall in the pound will raise input costs and, so, consumer prices in the coming years. However, we think some sectors will struggle to pass on higher costs to consumers, meaning that retailers will have to bear some or all of them. Weak consumer demand for apparel and price wars in grocery mean that these sectors’ margins are likely to take a hit. On the positive side, a falling pound should boost UK exports, and the attractiveness of the currency already appears to be driving up global interest in UK tourism.

There will be other, unspecified costs and benefits, too. London is the financial hub of Europe and draws talent from across the continent. Financial services firms could have to move resources to other European capitals, and a brain drain of talent could result. After the exit, which is a couple of years away, UK companies could benefit from no longer needing to invest the time and expense necessary to comply with EU regulations as well as from the UK resetting its own tariffs at a more competitive level.

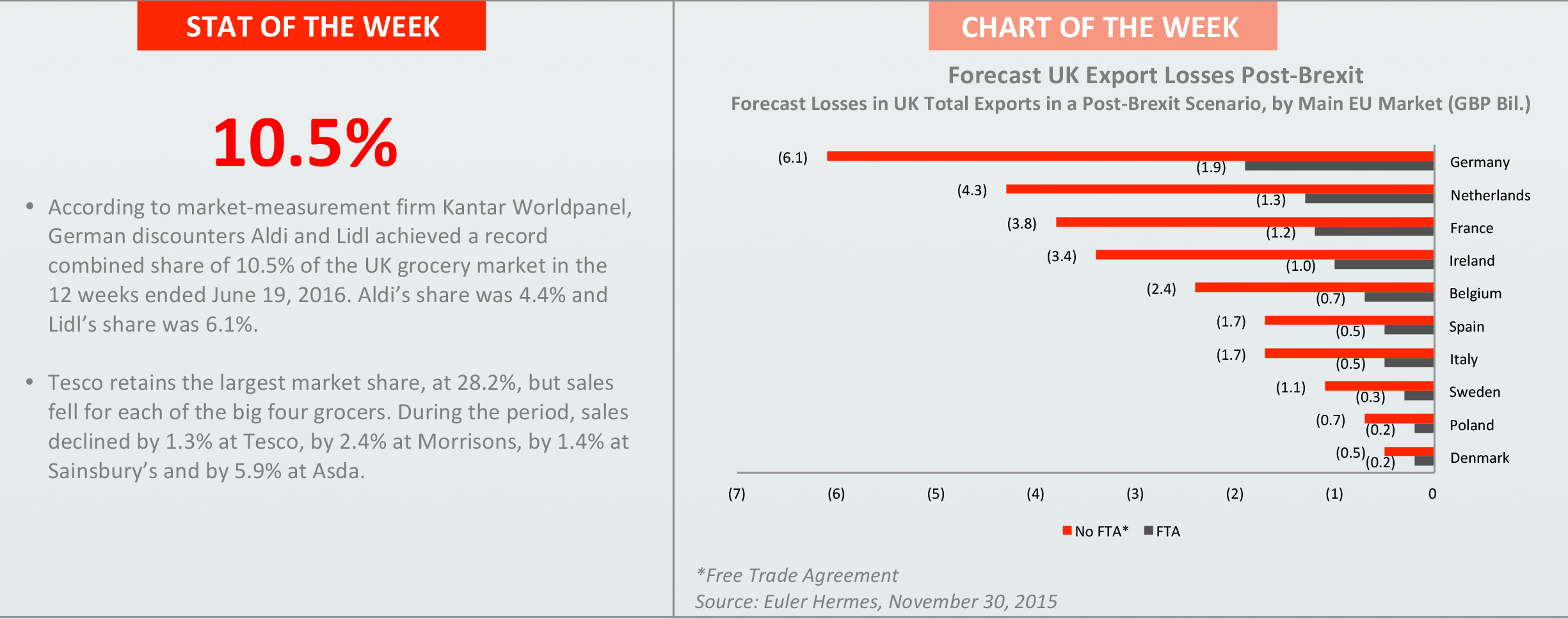

Challenges for the rest of Europe: Economists also predict that the UK’s decision is likely to create a drag on European GDP growth, though they cannot agree on how much it will be affected. Citi expects EU and eurozone GDP to take a hit of 100–150 basis points over the next three years, but Barclays sees eurozone GDP being impacted by 140 basis points in 2017 alone. Ireland, Germany, the Netherlands and Belgium are likely to be hit the hardest, given the closeness of their trading ties with the UK. The fall in the pound will make exports from the UK cheaper, which means they could take share from continental suppliers. Further ahead, after the exit, both the EU and the UK may face additional costs due to the reintroduction of taxes and tariffs on the transfer of goods and services across borders, and consumers may lose the ability to compare prices for goods across countries.

Challenges for the US: The UK was the US’s seventh-largest trading partner in 2013, according to the most recent data provided by the US Census Bureau, with total imports and exports amounting to 2.6% of total trade. Looking at other large EU trading partners, Germany was fifth, with 4.2% of total trade; France was eighth, with 2.0%; the Netherlands was 13th, with 1.6%; and Italy was 15th, with 1.4%. If the pound falls, the US will benefit from cheaper imports from the UK. The most exposed US retailers, based on UK sales as a percentage of total sales, are Walmart (11.1% of sales), Walgreens Boots Alliance (8.9%), Amazon (8.4%) and Apple (5.0%). In the near term, these retailers face the challenge of currency fluctuations. And, once the UK has left the EU, they may face additional costs, as they will have to reallocate resources to serve the new, separate UK market. Exposure to the EU outside the UK is also a risk, given that “Brexit contagion” threatens the cohesiveness of the EU.

The upshot: Despite recent market gyrations, the separation process will occur slowly over several years. This means that, despite the euphoria among the “leave” voters, there will be little immediate, tangible change to trade rules, and companies and consumers will have ample time to adjust and position themselves for a UK-free EU. It is still possible that the EU and the UK will arrive at some kind of business-friendly political and economic arrangement that minimizes the effects of the exit on international trade. The near-term impact primarily depends on the extent to which the decision will hit economic growth and how businesses will be affected by a sharply devalued pound. With economists divided, it is largely a case of wait and see.

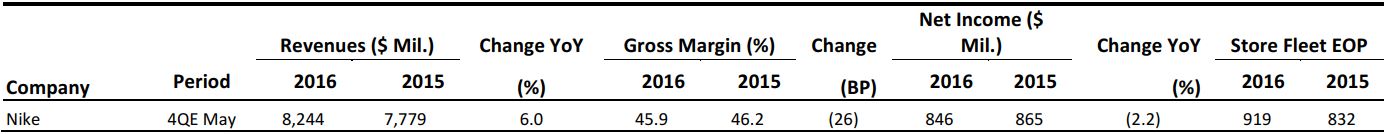

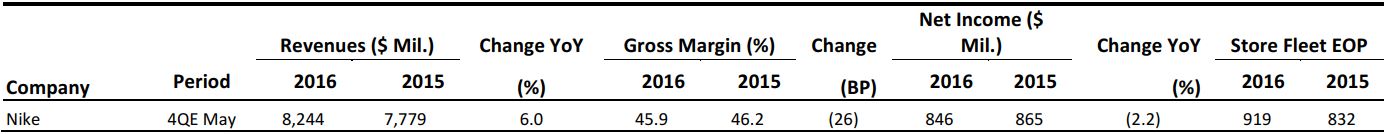

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

How Fashion Brands Are Starting to Design Like Tech Companies

(June 24) Fast Company

How Fashion Brands Are Starting to Design Like Tech Companies

(June 24) Fast Company

- Lululemon and Ministry of Supply are among the retail names that are embracing the lab concept to test designs and fabrics before they officially enter the market. This method allows retailers to stay more in touch with consumers and continue the design process after a product hits stores.

- In this process of testing and prototyping, consumer feedback is key, especially for smaller companies that can swiftly adjust to meet their customers’ needs. Social media and direct-to-consumer models have also changed how retailers interact with consumers.

The Snapchat Effect: Fashion Designers Are Making the Ephemeral Fab

(June 29) Glossy

The Snapchat Effect: Fashion Designers Are Making the Ephemeral Fab

(June 29) Glossy

- In the fashion industry, designers and brands are using Snapchat as they compete to win over customers with behind-the-scenes looks at collections and events. A favored platform among teens, Snapchat has seen its number of views increase fourfold since May 2015; it now garners up to 8 billion views per day.

- While the fashion industry has historically been a step behind in terms of adopting the latest tech trends, digitally native brands have found particular success with Snapchat. These younger, more digitally savvy brands, such as Rebecca Minkoff and Kate Spade, are helping pave the way for more established heritage brands on the disappearing-message app.

Retailers Rethink Inventory Strategies

(June 27) The Wall Street Journal

Retailers Rethink Inventory Strategies

(June 27) The Wall Street Journal

- Retailers are shifting to hold less inventory in stores, aiming to increase sales by 15% while keeping inventory levels flat or even decreasing them slightly. As consumers increasingly shop online, retailers are working to figure out how to profitably allocate inventory to meet consumers’ needs.

- Since inventory is one of retailers’ highest costs, holding less of it can free up capital for building online operations or covering wage increases. Additionally, by putting more inventory on display, retailers can avoid frustrating consumers, who do not like to be presented with bare shelves.

How E-Commerce Shoppers Actually Shop

(June 28) Women’s Wear Daily

How E-Commerce Shoppers Actually Shop

(June 28) Women’s Wear Daily

- Less than half of customer purchases are made within the first hour of browsing, so retailers are turning to “cross-device reconciliation” to make the sale. According to experience-marketing platform Monetate, more than half of online shoppers spend time shopping on different devices before making their purchase.

- Cross-device reconciliation allows customers to pick up where they left off, even if they switch devices. And while consumers are increasingly shopping on mobile devices, Monetate advises retailers to continue focusing on desktops, as the average order value is 46% higher on desktops than on mobile devices.

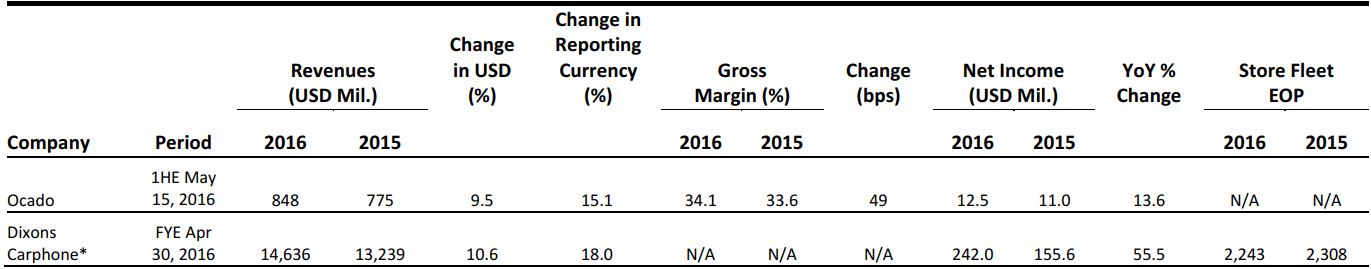

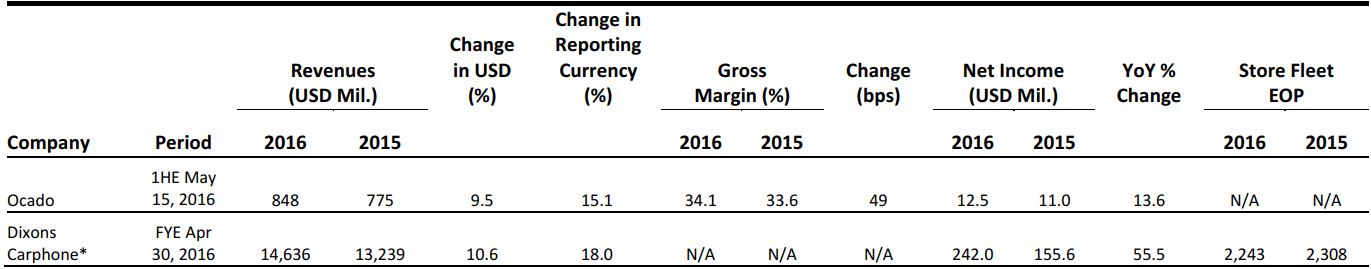

EUROPE RETAIL EARNINGS

*FY16 was the 12 months ended April 30, 2016; FY15 was the 13 months ended May 2, 2015. Carphone Warehouse and Dixons Retail merged on August 6, 2014, so the FY15 results are pro forma.

Source: Company reports

EUROPE RETAIL HEADLINES

H&M’s Net Sales Rise by Less than Planned in the Second Quarter of 2016

(June 22) Company press release

H&M’s Net Sales Rise by Less than Planned in the Second Quarter of 2016

(June 22) Company press release

- H&M reported that group sales including VAT grew by 5% in local currencies during the second quarter ended May 31, 2016. In reporting currency, sales including VAT increased by 2%, to SEK54.3 billion (US$6.6 billion). The group’s profit after tax for the period was SEK5.4 million (US$0.65 million).

- The company commented that cold spring weather in many of its markets weighed on sales—which were below the company’s plan—while profit was affected by higher purchasing costs due to the strength of the US dollar, increased markdowns and the cost of the company’s long-term investments.

Tesco Reports Its Second Straight Quarter of UK Comparable Sales Growth

(June 23) Company press release

Tesco Reports Its Second Straight Quarter of UK Comparable Sales Growth

(June 23) Company press release

- Tesco reported group comparable sales growth of 0.9% for the first quarter of its fiscal year 2017. UK comps increased by 0.3%, while international comps were up 3.0%. This is the second successive quarter of UK comparable sales growth for the retailer, signaling that its recovery is making steady progress.

- Tesco is refocusing its business on its core grocery operations. The retailer announced the sale of the Harris + Hoole coffee shop chain on June 23, 2016. Earlier in June, it announced the sale of the Giraffe restaurant chain, Dobbies Garden Centres and its controlling stake in Kipa in Turkey.

Schwarz Group to Invest in Store Revamp in Germany

(June 23) Retail Week

Schwarz Group to Invest in Store Revamp in Germany

(June 23) Retail Week

- Schwarz Group, the owner of Lidl and Kaufland, announced a plan to invest €6.5 billion (US$7.4 billion) in store revamps for the two chains in Germany in order to regain some of the market share it has lost to rivals.

- More than €3.0 billion (US$3.4 billion) of the total will be used to refurbish 3,200 Lidl stores in Germany in an effort to improve the shopping experience.

Poundland Rejects Takeover Offer from Steinhoff

(June 24) Company press release

Poundland Rejects Takeover Offer from Steinhoff

(June 24) Company press release

- According to a statement released by Steinhoff on June 24, Poundland has rejected Steinhoff’s proposal regarding a cash takeover offer.

- Steinhoff commented that it is considering its position following Poundland’s rejection of the proposal. Earlier this year, Steinhoff attempted, unsuccessfully, to acquire Home Retail Group and Darty.

Ocado Gains Market Share Despite Increasing Competition

(June 28) Company press release

Ocado Gains Market Share Despite Increasing Competition

(June 28) Company press release

- Ocado reported an increase in revenue of 15.1%, to £584.2 million (US$844.9 million), for the first half of fiscal year 2016. Profit before tax increased to £8.5 million (US$12.3 million) for the period, compared with £7.2 million (US$10.4 million) in the first half of 2015.

- Ocado commented that its increasing scale and operational efficiencies will enable it to grow profit—albeit at a slower rate—and gain share in online grocery, despite the market remaining competitive.

ASIA TECH HEADLINES

Uber China Repositions Itself as an All-in-One Solutions Provider

(June 27) TechCrunch

Uber China Repositions Itself as an All-in-One Solutions Provider

(June 27) TechCrunch

- This year, Uber China will promote two new offerings throughout China, UberLIFE and Uber + Travel. UberLIFE provides users with a digital magazine that covers sports, arts, plays and other local events. Uber + Travel aims to improve users’ travel experience.

- Uber China is repositioning itself, moving from car-hailing app to all-in-one solutions provider, a service for which there is high demand in the Chinese market. The company’s vision is to provide comprehensive solutions for transportation, food and entertainment.

China to See 1.4 Billion Smartphones in Use by 2020

(June 28) ZDNet

China to See 1.4 Billion Smartphones in Use by 2020

(June 28) ZDNet

- The total number of smartphones in China is expected to reach 1.4 billion by 2020, with an increase of 34 million mobile phone users, according to research firm Canalys.

- Chinese consumers are embracing digital devices—including smartphones, smarter vehicles, virtual reality devices and Internet-of-Things connected devices—and adoption rates have been boosted by the government’s “Internet Plus” initiative.

Xiaomi Will Go Public in 2025

(June 28) TechinAsia

Xiaomi Will Go Public in 2025

(June 28) TechinAsia

- Xiaomi will go public in 2025, once its business model has matured and consumers have become loyal to its products, according to Lei Jun, the company’s CEO.

- Xiaomi wants to develop into a retail chain much like Japan’s Muji, which sells a variety of products. Xiaomi has been building its network of retail stores, selling smartphones, smart lamps, drones and scooters, since its establishment in 2010.

Singapore’s Fundnel Cooperates with BANSEA

(June 27) e27.co

Singapore’s Fundnel Cooperates with BANSEA

(June 27) e27.co

- Singapore’s collaborative investment platform, Fundnel, has formed a partnership with the Business Angel Network of Southeast Asia (BANSEA) to build an early-stage investment vehicle.

- BANSEA was established in 2001 to promote the development of the angel-investing community in Southeast Asia and Fundnel is an online fundraising platform that connects investors and private companies, including startups. Under the partnership, Fundnel can tap into BANSEA’s extensive network to find industry experts to lead the funding of deals on the platform.

India’s Government Abolishes the “Angel Investment Tax”

(June 27) ZDNet

India’s Government Abolishes the “Angel Investment Tax”

(June 27) ZDNet

- The Indian government has abolished the “angel investment tax” on investors who fund startups. The move is meant to help startups raise more capital to cover daily operations.

- However, many startups will have a difficult time meeting the terms and conditions of the amended tax law. To become eligible for the benefits, startups must be less than five years old and have an annual turnover of less than 25 crore rupees.

LATAM RETAIL HEADLINES

Elcatex of Honduras to Invest $500 Million in Synthetic Fabrics Plant

(June 27) WWD.com

Elcatex of Honduras to Invest $500 Million in Synthetic Fabrics Plant

(June 27) WWD.com

- Grupo Elcatex, based in San Pedro Sula, Honduras, is set to invest $500 million to build a new synthetics and stretch apparel factory and a new textiles industrial park, and to boost its renewable energy capacity to feed future facilities.

- The firm is an integral part of the Honduras 20/20 development plan, which aims to double the country’s textile exports in the next five years. Construction of the new, $120-million plant will begin in late 2016, and it is planned to open in the second half of 2017.

Panama Inaugurates Expanded Canal

(June 26) WSJ.com

Panama Inaugurates Expanded Canal

(June 26) WSJ.com

- The expanded Panama Canal formally opened on Sunday; the $5.4-billion project doubled the waterway’s capacity and took nine years to complete. The canal now includes new locks on both the Atlantic and Pacific sides that are wider and deeper than the originals.

- Chinese merchant ship Cosco Shipping Panama, named in honor of the project, reached the locks on the Pacific side after entering from the Atlantic side.

High Dollar Drives Gap and Banana Republic to Leave Colombia

(June 24) América Retail

High Dollar Drives Gap and Banana Republic to Leave Colombia

(June 24) América Retail

- Amid liquidations and deep discounts, American brands Gap and Banana Republic are saying good-bye to Colombia due to both the devaluation of the peso against the US dollar and rising inflation.

- Superior Brands Holding owns the brands for Central and South America, and it has made the decision to step back across the region. Stores are also set to close in Costa Rica, as brands such as Forever 21 and Zara scale back as well.

Brazilian Retailer The Beauty Box Plans Further Expansion in 2016

(June 27) Premium Beauty News

Brazilian Retailer The Beauty Box Plans Further Expansion in 2016

(June 27) Premium Beauty News

- The Beauty Box combines its own brands with international cosmetics, fragrance and accessories brands. The company is owned by Brazil’s Boticário Group and is in its fourth year of operation. It currently hass 37 stores across five states.

- The chain has plans to open an additional 15 points of sale in 2016, and to continue investing heavily in its e-commerce platform in order to maintain a sound omni-channel approach.

Brazilian Retailer The Beauty Box Plans Further Expansion in 2016

(June 27) Premium Beauty News

Brazilian Retailer The Beauty Box Plans Further Expansion in 2016

(June 27) Premium Beauty News

- The Beauty Box combines its own brands with international cosmetics, fragrance and accessories brands. The company is owned by Brazil’s Boticário Group and is in its fourth year of operation. It currently hass 37 stores across five states.

- The chain has plans to open an additional 15 points of sale in 2016, and to continue investing heavily in its e-commerce platform in order to maintain a sound omni-channel approach.

On June 23, British citizens cast a historic vote for the UK to exit the European Union (EU), with the “leave” votes outnumbering the “stay” votes by a margin of 52% to 48%.

The US has a “special relationship” with the UK and strong, long-lasting ties with Europe as well, through NATO and other transatlantic links, and US President Barack Obama issued strongly worded remarks urging the UK to remain in the EU.

By exiting the EU, the UK will be able to increase its control over its borders and economy, and it will have greater freedom to trade with the rest of the world without tariffs, but both the UK and the EU will pay a price for Brexit, as will other countries, including the US.

Challenges for the UK: Uncertainty regarding the timing and process of withdrawal from the EU is likely to take an immediate toll on the UK’s economy, currency and markets. Some economists are predicting that the decision to exit the EU could throw the UK’s economy into recession in the second half of this year, and there is consensus that the fall in the pound will raise input costs and, so, consumer prices in the coming years. However, we think some sectors will struggle to pass on higher costs to consumers, meaning that retailers will have to bear some or all of them. Weak consumer demand for apparel and price wars in grocery mean that these sectors’ margins are likely to take a hit. On the positive side, a falling pound should boost UK exports, and the attractiveness of the currency already appears to be driving up global interest in UK tourism.

There will be other, unspecified costs and benefits, too. London is the financial hub of Europe and draws talent from across the continent. Financial services firms could have to move resources to other European capitals, and a brain drain of talent could result. After the exit, which is a couple of years away, UK companies could benefit from no longer needing to invest the time and expense necessary to comply with EU regulations as well as from the UK resetting its own tariffs at a more competitive level.

Challenges for the rest of Europe: Economists also predict that the UK’s decision is likely to create a drag on European GDP growth, though they cannot agree on how much it will be affected. Citi expects EU and eurozone GDP to take a hit of 100–150 basis points over the next three years, but Barclays sees eurozone GDP being impacted by 140 basis points in 2017 alone. Ireland, Germany, the Netherlands and Belgium are likely to be hit the hardest, given the closeness of their trading ties with the UK. The fall in the pound will make exports from the UK cheaper, which means they could take share from continental suppliers. Further ahead, after the exit, both the EU and the UK may face additional costs due to the reintroduction of taxes and tariffs on the transfer of goods and services across borders, and consumers may lose the ability to compare prices for goods across countries.

Challenges for the US: The UK was the US’s seventh-largest trading partner in 2013, according to the most recent data provided by the US Census Bureau, with total imports and exports amounting to 2.6% of total trade. Looking at other large EU trading partners, Germany was fifth, with 4.2% of total trade; France was eighth, with 2.0%; the Netherlands was 13th, with 1.6%; and Italy was 15th, with 1.4%. If the pound falls, the US will benefit from cheaper imports from the UK. The most exposed US retailers, based on UK sales as a percentage of total sales, are Walmart (11.1% of sales), Walgreens Boots Alliance (8.9%), Amazon (8.4%) and Apple (5.0%). In the near term, these retailers face the challenge of currency fluctuations. And, once the UK has left the EU, they may face additional costs, as they will have to reallocate resources to serve the new, separate UK market. Exposure to the EU outside the UK is also a risk, given that “Brexit contagion” threatens the cohesiveness of the EU.

The upshot: Despite recent market gyrations, the separation process will occur slowly over several years. This means that, despite the euphoria among the “leave” voters, there will be little immediate, tangible change to trade rules, and companies and consumers will have ample time to adjust and position themselves for a UK-free EU. It is still possible that the EU and the UK will arrive at some kind of business-friendly political and economic arrangement that minimizes the effects of the exit on international trade. The near-term impact primarily depends on the extent to which the decision will hit economic growth and how businesses will be affected by a sharply devalued pound. With economists divided, it is largely a case of wait and see.

On June 23, British citizens cast a historic vote for the UK to exit the European Union (EU), with the “leave” votes outnumbering the “stay” votes by a margin of 52% to 48%.

The US has a “special relationship” with the UK and strong, long-lasting ties with Europe as well, through NATO and other transatlantic links, and US President Barack Obama issued strongly worded remarks urging the UK to remain in the EU.

By exiting the EU, the UK will be able to increase its control over its borders and economy, and it will have greater freedom to trade with the rest of the world without tariffs, but both the UK and the EU will pay a price for Brexit, as will other countries, including the US.

Challenges for the UK: Uncertainty regarding the timing and process of withdrawal from the EU is likely to take an immediate toll on the UK’s economy, currency and markets. Some economists are predicting that the decision to exit the EU could throw the UK’s economy into recession in the second half of this year, and there is consensus that the fall in the pound will raise input costs and, so, consumer prices in the coming years. However, we think some sectors will struggle to pass on higher costs to consumers, meaning that retailers will have to bear some or all of them. Weak consumer demand for apparel and price wars in grocery mean that these sectors’ margins are likely to take a hit. On the positive side, a falling pound should boost UK exports, and the attractiveness of the currency already appears to be driving up global interest in UK tourism.

There will be other, unspecified costs and benefits, too. London is the financial hub of Europe and draws talent from across the continent. Financial services firms could have to move resources to other European capitals, and a brain drain of talent could result. After the exit, which is a couple of years away, UK companies could benefit from no longer needing to invest the time and expense necessary to comply with EU regulations as well as from the UK resetting its own tariffs at a more competitive level.

Challenges for the rest of Europe: Economists also predict that the UK’s decision is likely to create a drag on European GDP growth, though they cannot agree on how much it will be affected. Citi expects EU and eurozone GDP to take a hit of 100–150 basis points over the next three years, but Barclays sees eurozone GDP being impacted by 140 basis points in 2017 alone. Ireland, Germany, the Netherlands and Belgium are likely to be hit the hardest, given the closeness of their trading ties with the UK. The fall in the pound will make exports from the UK cheaper, which means they could take share from continental suppliers. Further ahead, after the exit, both the EU and the UK may face additional costs due to the reintroduction of taxes and tariffs on the transfer of goods and services across borders, and consumers may lose the ability to compare prices for goods across countries.

Challenges for the US: The UK was the US’s seventh-largest trading partner in 2013, according to the most recent data provided by the US Census Bureau, with total imports and exports amounting to 2.6% of total trade. Looking at other large EU trading partners, Germany was fifth, with 4.2% of total trade; France was eighth, with 2.0%; the Netherlands was 13th, with 1.6%; and Italy was 15th, with 1.4%. If the pound falls, the US will benefit from cheaper imports from the UK. The most exposed US retailers, based on UK sales as a percentage of total sales, are Walmart (11.1% of sales), Walgreens Boots Alliance (8.9%), Amazon (8.4%) and Apple (5.0%). In the near term, these retailers face the challenge of currency fluctuations. And, once the UK has left the EU, they may face additional costs, as they will have to reallocate resources to serve the new, separate UK market. Exposure to the EU outside the UK is also a risk, given that “Brexit contagion” threatens the cohesiveness of the EU.

The upshot: Despite recent market gyrations, the separation process will occur slowly over several years. This means that, despite the euphoria among the “leave” voters, there will be little immediate, tangible change to trade rules, and companies and consumers will have ample time to adjust and position themselves for a UK-free EU. It is still possible that the EU and the UK will arrive at some kind of business-friendly political and economic arrangement that minimizes the effects of the exit on international trade. The near-term impact primarily depends on the extent to which the decision will hit economic growth and how businesses will be affected by a sharply devalued pound. With economists divided, it is largely a case of wait and see.

How E-Commerce Shoppers Actually Shop

(June 28) Women’s Wear Daily

How E-Commerce Shoppers Actually Shop

(June 28) Women’s Wear Daily