From the Desk of Deborah Weinswig

New Year’s Resolutions

Happy New Year! If you made a New Year’s resolution to lose weight or exercise more, you are one of many millions: some 10% of Americans recently told Marist Poll that one of these was their top resolution for 2017. The aspiration to look and feel better generates big business, and this week, we take a look at the scale of the fast-growing US healthy-living industry.

Limbering Up

The first item on the list for most of those with good intentions will be a gym membership, and this kind of demand means the industry is growing at a healthy pace. Americans spent some $25.8 billion on fitness center and health club memberships in 2015 (latest), according to the International Health, Racquet & Sportsclub Association. The total represented 6.1% year-over-year growth.

The next stop for many will be shopping for suitable apparel to wear at the gym. Sports apparel and footwear burned up another $105 billion of US consumer spending last year, and Euromonitor International predicts such spending will jump by 7%, to $112 billion, in 2017. Some $64 billion of this total will be spent on products in the “performance” segment, which are actually designed for sporting activities rather than for lounging at home.

Fueling Up

Essential for virtuous consumers is a switch to healthier foods. In 2015 (latest), Americans spent some $8.6 billion on the kinds of functional foods that boast added health benefits or ingredients, according to Transparency Market Research. And they spent $6.7 billion on sports nutrition products in the same year, according to Euromonitor. Also in 2015, US shoppers bought $39.7 billion worth of organic food, up 11% from the previous year, according to the Organic Trade Association. The United Fresh Produce Association says that the double-digit growth in organic fruit and vegetable sales continued into 2016.

Gearing Up

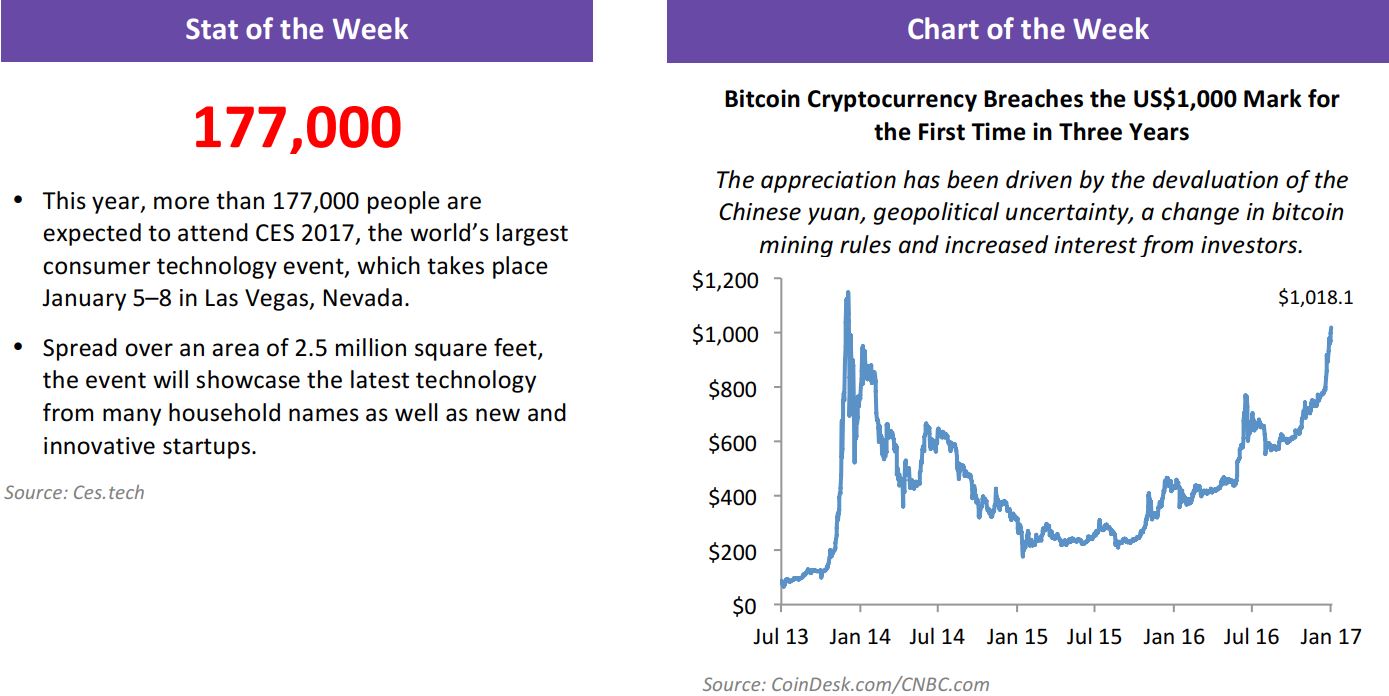

For those taking their fitness goals seriously (or who want to be seen as taking them seriously), a fitness wristband or other wearable device may be the next item to check off the list. This year, American consumers will spend $940 million on fitness wearables such as wristbands and smart clothing, excluding smartwatches, according to Statista. They will fork out a further $526 million on fitness apps. That $1.5 billion total marks a 23% year-over-year leap in spending on fitness tech.

Shaping Up

Finally, for those who could not stick to their resolutions—or who were unwilling to make them in the first place—there are more straightforward routes. Around 350,000 Americans get liposuction or tummy tucks each year, according to the American Society of Plastic Surgeons. These consumers spent a total of $668 million on liposuction and $704 million on tummy tucks in 2015 (latest), the society says—collectively adding another $1.4 billion to the spending on the industries noted above.

January is likely to be a bumper month across these sectors, as US consumers are set to splash out billions on the perennial search to look and feel better.

US RETAIL HEADLINES

Coach Appoints Kevin G. Wills as CFO

(January 5) WSJ.com

Coach Appoints Kevin G. Wills as CFO

(January 5) WSJ.com

- Coach announced the appointment of Kevin G. Wills as CFO, effective no later than March 2017. Wills joins Coach from AlixPartners, a global business advisory firm, where he has served as Managing Director and CFO since March 2014.

- The move comes as Coach is working to rebrand itself. In the past three years, the company has faced sales declines and store closings as a result of competition from affordable luxury rival Michael Kors.

Amazon Doubles Deliveries in 2016 for Third-Party Sellers

(January 4) Reuters.com

Amazon Doubles Deliveries in 2016 for Third-Party Sellers

(January 4) Reuters.com

- Amazon said it shipped 50% more items for third-party vendors this holiday season than it did last holiday season and that it doubled the number of items shipped in 2016 overall.

- The company’s statement offers new data points for investors who are hoping Amazon will post a profit for the fourth quarter when it announces results in coming weeks. Seattle-based Amazon, known for its roller-coaster results in years past, has forecast that operating income would range from zero to $1.25 billion.

Revlon Restructures Following Elizabeth Arden Acquisition

(January 3) WWD.com

Revlon Restructures Following Elizabeth Arden Acquisition

(January 3) WWD.com

- As part of its acquisition of Elizabeth Arden, which closed in September 2016, Revlon expects to cut 350 positions globally and projects that integration-related restructuring activities will cost $65–$75 million by 2020.

- Revlon said the restructuring should help the business realize “significantly” more than the previously announced $140 million in annualized synergies and cost reductions.

JCPenney Announces Sale of Home Office Campus for $353 Million

(January 3) Company website

JCPenney Announces Sale of Home Office Campus for $353 Million

(January 3) Company website

- JCPenney announced that it has completed the sale of its home office building and surrounding 45 acres of land in Plano, Texas, to Dreien Opportunity Partners, general partner of Silos Opportunity Partners, for a gross sale price of $353 million before closing and transaction costs.

- JCPenney previously announced that, upon transfer of ownership, it would lease back approximately 65% of the building, leaving the remaining square footage available for new tenants. The building lease expense would be offset by a reduction in maintenance costs, property taxes and interest expense as a result of paying down debt with proceeds from the transaction.

Kate Spade to Kick Off Formal Sale Process in January

(December 29) BusinessofFashion.com

Kate Spade to Kick Off Formal Sale Process in January

(December 29) BusinessofFashion.com

- Kate Spade, which is exploring a sale, plans to kick off a formal auction process in January and has six possible bidders in mind, according to a person familiar with the situation.

- The potential bidders for the company, which has a market value of about $2.2 billion, are mostly other retailers, the person said. Hedge fund Caerus Investors pushed the company last month to find an acquirer that could help it improve its profit margins.

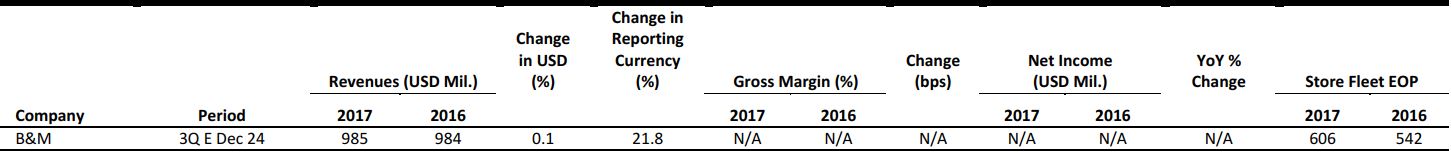

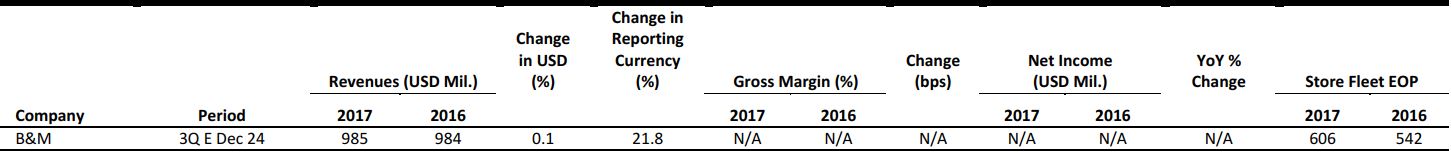

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Sports Direct to Sell Dunlop Brand to Japan’s Sumitomo Rubber Industries

(December 28) Press release

Sports Direct to Sell Dunlop Brand to Japan’s Sumitomo Rubber Industries

(December 28) Press release

- British retailer Sports Direct has entered into an agreement to sell its rights to the Dunlop brand and the related wholesale and licensing operations to Japanese firm Sumitomo Rubber Industries for a cash consideration of $137.5 million.

- The sale of the brand is subject to regulatory clearance in Germany and the Philippines, and is expected to be completed before May 31, 2017.

Boohoo.com Bids to Acquire Intellectual Property from Nasty Gal

(December 28) Press release

Boohoo.com Bids to Acquire Intellectual Property from Nasty Gal

(December 28) Press release

- UK fashion pure play Boohoo.com has proposed acquiring certain intellectual property assets from US online fashion retailer Nasty Gal for $20 million. Nasty Gal filed for bankruptcy protection on November 8, 2016.

- com’s US subsidiary, Boohoo F I Limited, will be appointed as the “stalking horse” bidder to acquire Nasty Gal’s brand and customer databases, subject to US court approval on January 5, 2017.

Footfall Declines Across the UK Post-Christmas

(December 30) TheRetailBulletin.com

Footfall Declines Across the UK Post-Christmas

(December 30) TheRetailBulletin.com

- British retail insights firm Springboard revealed that footfall across stores in the UK declined by 5.8% year over year during the three days after Christmas. Traffic fell the most on Boxing Day, by 7.3% year over year. Online transactions, however, rose by 5.7% year over year during the three-day period.

- Footfall declined across all shopping destination types. Shopping centers performed best, posting an increase of 15.5% on December 28 following a decline of 5.0% on December 27 and a decline of 20.7% on December 26.

Sparkling Wine Sales from the UK See Record Growth

(December 31) ESMmagazine.com

Sparkling Wine Sales from the UK See Record Growth

(December 31) ESMmagazine.com

- The UK exported sparkling wine to a record 27 countries in 2016, up from 19 in 2015, according to the Department for Environment, Food and Rural Affairs (DEFRA). Wine sales in the UK also jumped: Marks & Spencer observed a doubling of sales in its stores and sales at Waitrose grew by as much as 50%.

- British vintners are aiming to grow wine exports to 2.5 million bottles by 2020 from 250,000 in 2015. The US, Japan, Taiwan and Dubai were among the major buyers of British wine, DEFRA said.

House of Fraser to Invest in App-Only Challenger Bank Tandem

(December 29) Telegraph.co.uk

House of Fraser to Invest in App-Only Challenger Bank Tandem

(December 29) Telegraph.co.uk

- British department store retailer House of Fraser plans to invest about £35 million (US$43 million) in app-only challenger bank Tandem. The retailer intends to offer financial services to its customers through its collaboration with the bank.

- House of Fraser already offers credit and loyalty cards to its customers through financial services firm NewDay. The retailer’s initial investment in Tandem is subject to the fulfillment of unspecified conditions.

Morrisons Launches Latest Wave of Price Cuts

(January 3) RetailGazette.co.uk

Morrisons Launches Latest Wave of Price Cuts

(January 3) RetailGazette.co.uk

- The UK’s fourth-biggest grocer, Morrisons, has slashed the prices of about 800 items in its latest move to compete more aggressively on price. The price cuts include a two-pack of avocados falling from £1.80 to £1.47 (US$2.21 to US$1.80) and the price of a pack of King Edward potatoes falling from £2.00 to £1.67 (US£2.45 to US $2.05).

- Morrisons has also simplified the prices of more than 5,000 items so that they are in “round pounds” to help customers calculate the cost of items in their basket easily.

ASIA TECH HEADLINES

IDG, China Soft Capital Join $22 Million Funding Round in Hsuanzhang

(December 30) ChinaMoneyNetwork.com

IDG, China Soft Capital Join $22 Million Funding Round in Hsuanzhang

(December 30) ChinaMoneyNetwork.com

- IDG Capital, China Soft Capital and two other Chinese funds have invested ¥150 million (US$22 million) in Hsuanzhang, which provides online financial and tax services to small and medium-sized enterprises in China. The company plans to use the funds to improve its products, establish an accounting firm network and enhance profit margin for its partners.

- Hsuanzhang helps companies with bookkeeping, invoicing, tax planning and other financial services via a cloud platform and mobile apps. The company expects to achieve ¥700 million (US$100 million) in revenues in 2017 by serving more than 300,000 enterprises in 150 cities in China

China’s Sogou Targets $5 Billion IPO to Chase Rival Baidu

(January 3) Bloomberg.com

China’s Sogou Targets $5 Billion IPO to Chase Rival Baidu

(January 3) Bloomberg.com

- China’s third-biggest search engine, Sogou, expects to hold a US IPO to sell about 10% of its shares at a valuation of around $5 billion. The move represents a challenge to Chinese search leader Baidu in the mobile market. Baidu has been under siege following a scandal over medical advertising, and there is a chance for Sogou to overtake it as search leader over the next two years.

- Baidu accounted for 44.5% of mobile search queries in the third quarter, while Alibaba-backed Shenma accounted for 20.8% and Sogou for 16.2%, according to iiMedia

IBM’s Watson Replaces 34 White-Collar Employees at Japanese Insurance Company

(January 2) Quartz.com

IBM’s Watson Replaces 34 White-Collar Employees at Japanese Insurance Company

(January 2) Quartz.com

- A Japanese insurance company, Fukoku Mutual Life Insurance, will replace 34 human insurance claims workers with IBM Watson Explorer, starting this month. Watson will scan hospital records and other documents to determine insurance payouts, factoring in injuries, patients’ medical histories and procedures administered.

- Fukoku Mutual will spend $1.7 million to install the artificial intelligence system, and $128,000 per year for maintenance in order to save roughly $1.1 million per year on employee salaries, meaning the payback period of the investment will be less than two years..

Ford and Toyota Launch Consortium to Help Developers Build In-Car Apps

(January 4) TechCrunch.com

Ford and Toyota Launch Consortium to Help Developers Build In-Car Apps

(January 4) TechCrunch.com

- Ford and Toyota have launched the SmartDeviceLink (SDL) Consortium to integrate smartphone apps into infotainment systems in cars. Mazda, PSA Group, Fuji Heavy Industries and Suzuki are also joining the group.

- The SDL Consortium will host its code on GitHub and will accept and evaluate contributions from anybody, whereas the individual car manufacturers will perform their own tests and manage their own developer programs. The consortium has already worked out a road map of new features that will soon come to SDL, including voice pass-through, improved wireless projection and mobile navigation services

LATAM RETAIL HEADLINES

Brazil Posts Record Trade Surplus as Recession Hurts Imports

(January 2) Bloomberg.com

Brazil Posts Record Trade Surplus as Recession Hurts Imports

(January 2) Bloomberg.com

- Brazil, Latin America’s largest economy, posted its largest yearly trade surplus on record as recession smothered domestic demand in 2016.

- The country’s trade surplus rose to $47.7 billion last year compared with $19.7 billion in 2015, according to trade ministry data released Monday. Imports fell by 19.8% from a year earlier, to $137.6 billion, while exports fell by 3.1% during the same period, to $185.2 billion.

“Selfie Pay” Has Arrived in Latin America

(December 29) BusinessInsider.com

“Selfie Pay” Has Arrived in Latin America

(December 29) BusinessInsider.com

- MasterCard announced that Latin American markets, starting with Brazil and Mexico, will get access to Identity Check Mobile, a payment technology app that uses in-app facial recognition software to confirm a user’s identity in order to authenticate online purchases.

- This rollout follows successful trials in Canada, the Netherlands and the US, as well as a full launch across Europe earlier in 2016. This new feature could be a major success in the region, given its growing e-commerce market and smartphone penetration.

Walmart, Liverpool Seen Hardest Hit by Gas Hikes in Mexico

(January 3) Bloomberg.com

Walmart, Liverpool Seen Hardest Hit by Gas Hikes in Mexico

(January 3) Bloomberg.com

- Mexican consumer companies from Walmart de Mexico to El Puerto de Liverpool may see sales flag when the country raises gasoline prices by as much as 20% in January.

- Retailers may be the most affected by the jump in gas prices, which risks eroding consumer sentiment and purchasing power amid a weakening peso that has already fueled concern about inflation, traders say.

Brazil’s Retailers to Lose R$10.5 Billion Due to 2017 Holidays

(January 4) RioTimesOnline.com

Brazil’s Retailers to Lose R$10.5 Billion Due to 2017 Holidays

(January 4) RioTimesOnline.com

- Retailers in Brazil could lose more than R$10.5 billion (US$3.26 billion) this year due to national holidays, according to estimates from the São Paulo Commerce Federation. The federation says this volume is 2% higher than that forecast in 2016 due to the fact that there will be an extra holiday during the workweek in 2017.

- For establishments wishing to open their doors on holidays in an attempt to reduce these losses, the federation warns of the additional labor costs that they will entail—100% extra for holiday hours and 37% extra in taxes—which may make this option unfeasible.

Chilean Customs Officials Seize Shipment of Fake Shoes Worth $31 Million

(December 29) Hypebeast.com

Chilean Customs Officials Seize Shipment of Fake Shoes Worth $31 Million

(December 29) Hypebeast.com

- The Regional Director of Customs for the Chilean National Customs Office, Ricardo Aceituno, confirmed that a seizure of fake and counterfeit sneakers took place on November 7 in Iquique, Chile.

- Totaling $31 million in value, the shipment originated from China and comprised 16,454 fakes divided into 474 boxes that were hidden beneath packages of napkins. Included in the fakes were the most popular Nike and Adidas models along with pairs of Chalas Zodiac, which mimic the Colombian Zodiak brand.

China’s Sogou Targets $5 Billion IPO to Chase Rival Baidu

(January 3) Bloomberg.com

China’s Sogou Targets $5 Billion IPO to Chase Rival Baidu

(January 3) Bloomberg.com

Walmart, Liverpool Seen Hardest Hit by Gas Hikes in Mexico

(January 3) Bloomberg.com

Walmart, Liverpool Seen Hardest Hit by Gas Hikes in Mexico

(January 3) Bloomberg.com