FROM THE DESK OF DEBORAH WEINSWIG

The 45th President of the United States Gets to Work

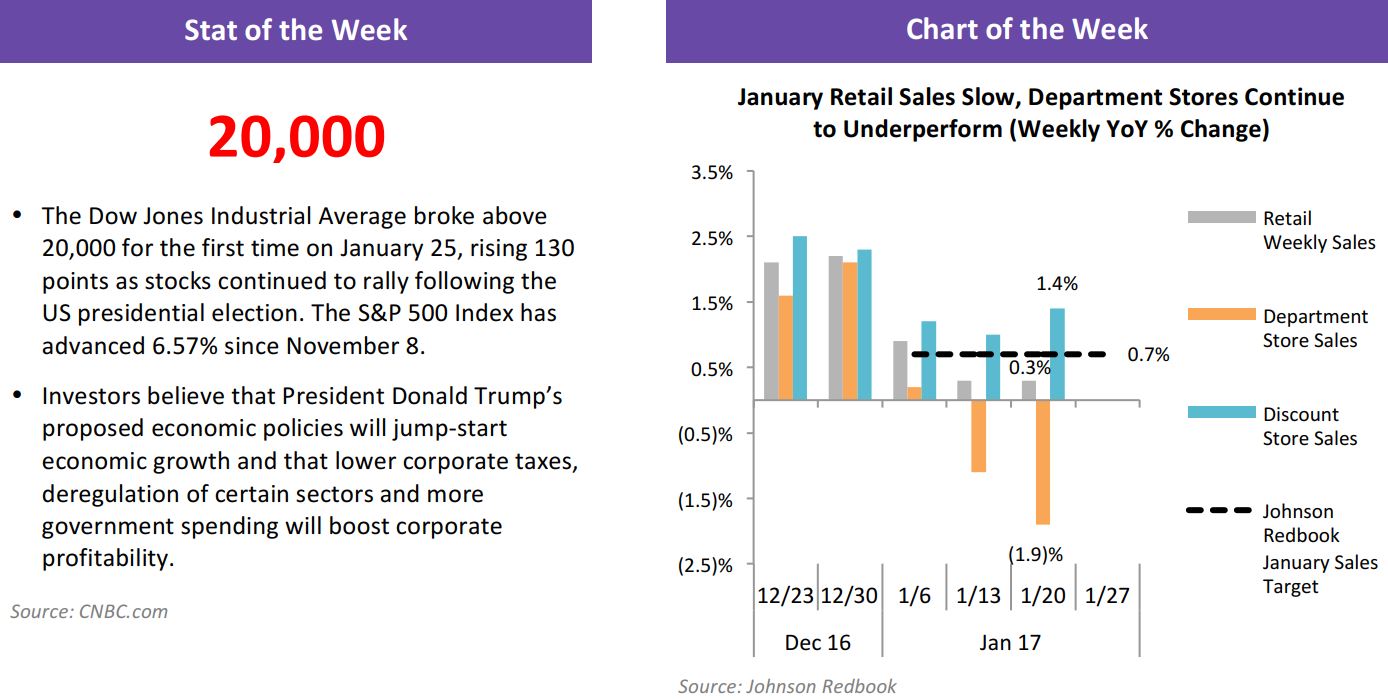

At noon on Friday, January 20, 2017, Donald J. Trump took the oath of office, becoming the 45th President of the United States, succeeding Barack Obama. Since then, Trump has launched a whirlwind of policies and executive orders.

Just planning and executing the transition and inauguration presents a Herculean task for every new president. Behind the pomp and circumstance of the inauguration, the incoming and outgoing teams had just a few hours to move the Obamas out of the White House and move the Trumps in on the morning of the 20th. The two families met for a traditional tea gathering at the White House prior to the swearing in.

Trump has wasted little time in making good on his campaign promises to roll back many of Obama’s initiatives. On his first day in office, Trump signed an executive order directing government agencies to reduce the burdens of the Affordable Care Act (aka “Obamacare”). In addition, White House Chief of Staff Reince Priebus directed government agencies to impose an “immediate regulatory freeze.”

Trump’s team also took over the WhiteHouse.gov website on January 20, which articulates the new administration’s key issues as creating “America First” energy and foreign policy plans, bringing back jobs and growth to the US, strengthening the country’s military, standing up for the law enforcement community, and creating trade deals that work for all Americans.

Following coordinated protest marches led by women over the weekend and disputes about the number of attendees at the inauguration, on his first full day in office, Trump signed an order executing the US’s withdrawal from the Trans-Pacific Partnership (TPP), as he had promised to do, thereby freeing the US to sign unilateral trade deals with the Asian signatory countries. In addition, Trump signed an order blocking federal funds from being used by NGOs that perform or provide information about abortions overseas, as well as one instituting a federal hiring freeze for all positions except military and national-security roles. Trump also met with various CEOs and union and congressional leaders, and banned registered lobbyists from serving in his administration.

In his first 72 hours, Trump delivered on several of his campaign promises, including ordering government agencies to freeze new regulations in order to have time to review them properly. He also stopped a reduction to the annual mortgage insurance premiums paid on government-backed home loans. In addition, Trump addressed employees of the Central Intelligence Agency.

On the foreign policy front, the new administration is discussing moving the US embassy in Israel from Tel Aviv to Jerusalem. Trump has announced meetings with the leaders of Mexico and Canada to begin to renegotiate the North American Free Trade Agreement (NAFTA) and he will meet with the prime minister of the UK this week. Trump also ordered the construction of a wall along the US-Mexico border, which was a key part of his campaign, and said the US will initially foot the bill.

Announcements and appointments regarding positions in Trump’s cabinet and staff continue, and Trump announced that he would present his candidate to fill the vacancy on the US Supreme Court this week.

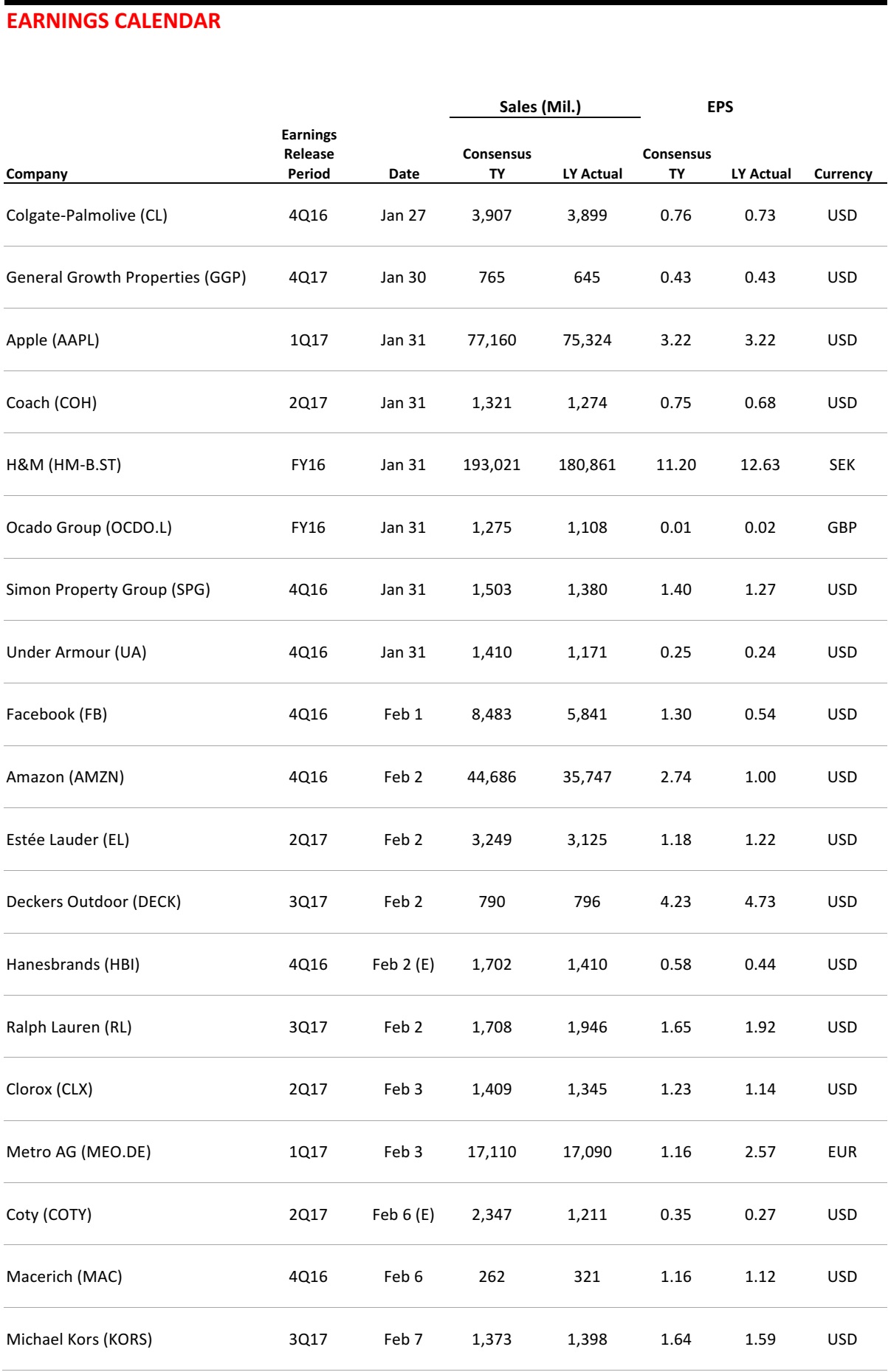

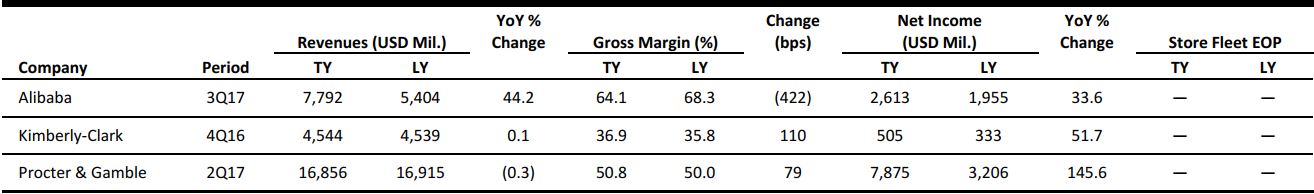

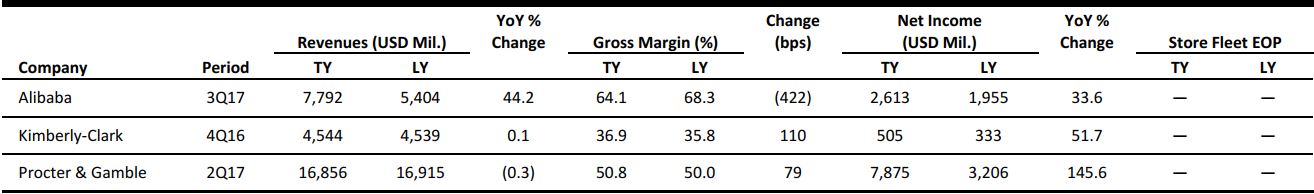

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Warby Parker Plans to Open 25 Retail Stores in the US This Year

(January 24) Inc.com

Warby Parker Plans to Open 25 Retail Stores in the US This Year

(January 24) Inc.com

- Three weeks after retail giant Macy’s announced it was closing 68 stores and cutting more than 10,000 jobs, the retail forecast for 2017 got much gloomier. But Neil Blumenthal, CEO of Warby Parker, announced that the eyewear company plans to open at least 25 brick-and-mortar locations this year.

- “I don’t think retail is dead. Mediocre retail experiences are dead,” Blumenthal said in an interview with The Wall Street Journal. Warby Parker, which is now worth more than $1 billion, currently has 46 retail locations in the US. The company’s new stores will expand its footprint in major cities such as Miami, Los Angeles and Philadelphia

Target Plans to Introduce Its Own Smartphone Payment Service in Stores Later This Year

(January 24) Recode.net

Target Plans to Introduce Its Own Smartphone Payment Service in Stores Later This Year

(January 24) Recode.net

- Shoppers will be able to use their phones to pay in Target stores later this year, but it will not necessarily be with Apple Pay or Android Pay. Instead, Target plans to introduce mobile payment features to one or more of its own apps, the retailer’s Chief Information and Digital Officer, Michael McNamara, told Recode last week at a National Retail Federation conference in New York City.

- It is not clear if Target will add the payment feature to its main Target app, its popular Cartwheel coupon app or both. Target will be following in the footsteps of other big retailers, such as Walmart and Kohl’s, that have added mobile payment features to their own apps over the last year in the wake of offerings from Apple, Google and Samsung. All three of the big-box stores had originally backed a separate payment app, CurrentC, but it never launched widely.

With Millennials Picking Cash over Cards, Cash Gains Steam

(January 24) PYMNTS.com

With Millennials Picking Cash over Cards, Cash Gains Steam

(January 24) PYMNTS.com

- According to new PYMNTS.com research, cash usage in the Americas is on track to hit $3.5 trillion by 2020. For its recently published Global Cash Index Americas Analysis, PYMNTS tracked the factors powering cash usage in Brazil, Mexico and the US.

- As of 2015, cash usage represented 13.1% of overall US GDP, the latest PYMNTS Global Cash Index found. The recently published study, which analyzed the spending behavior and payment experiences of 2,500 Americans, found that consumers aged 35–44 are increasingly using card- and mobile-based payments. Younger millennials, on the other hand, showed a higher propensity for using cash.

Walmart Enters Car-Selling Business

(January 23) AdAge.com

Walmart Enters Car-Selling Business

(January 23) AdAge.com

- Walmart is jumping into car sales through partnerships with dealership groups, including AutoNation, the nation’s largest new-vehicle retailer. CarSaver, an online auto retail platform, will launch the program April 1 at about 25 Walmart Supercenters in four markets: Houston, Dallas, Phoenix and Oklahoma City. Ally Financial is the program’s preferred lender.

- CarSaver’s digital platform allows car shoppers to select, finance and insure a vehicle through its website or a touch-screen kiosk. The service is backed by bilingual auto advisers who are available by phone. Staffers at CarSaver Centers—set up inside Walmart stores across from checkout lanes and alongside other services, such as vision centers and nail salons—will explain the car-buying program to Walmart customers.

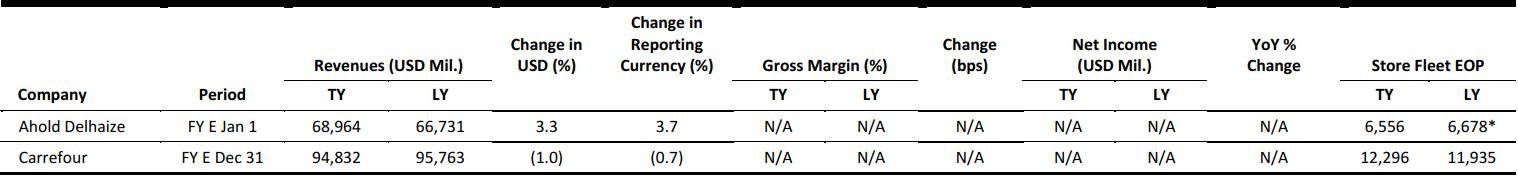

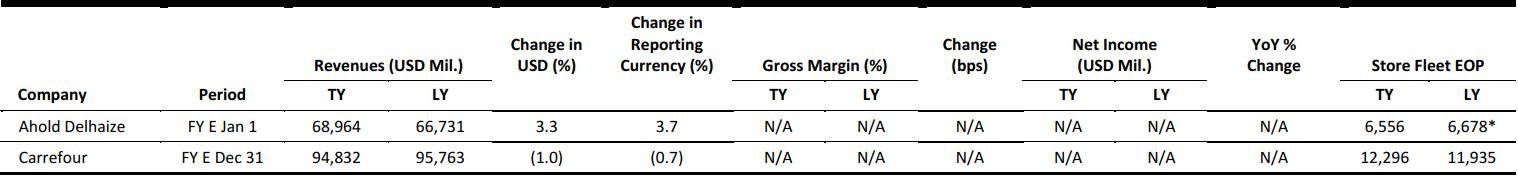

EUROPE RETAIL EARNINGS

*At date of merger, July 24, 2016

Source: Company reports

EUROPE RETAIL HEADLINES

Dixons Carphone Reports Strong Christmas Trading

(January 24) Company press release

Dixons Carphone Reports Strong Christmas Trading

(January 24) Company press release

- The UK’s largest electricals retailer, Dixons Carphone, reported that its third-quarter 2017 group sales grew by 8% at constant currency in the 10 weeks ended January 7, 2017. Group comps increased by 4%.

- In the UK and Ireland, sales grew by 4% and comps grew by 6%; comps included a four-percentage-point benefit from sales transference from closed stores. In the Nordic countries, sales jumped by 15% (1% in constant currency), but comps declined by 1%. Southern Europe reported the strongest sales increase, of 24% (6% in constant currency), while comps in the region grew by 5%. The company confirmed its guidance for full-year profit before tax of £475–£495 million (US$593–US$618 million), which is in line with the consensus estimate.

Tesco’s PayQwiq Mobile Payment App Now Available Across the UK

(January 23) Retail-week.com

Tesco’s PayQwiq Mobile Payment App Now Available Across the UK

(January 23) Retail-week.com

- Tesco rolled out its mobile payment app, PayQwiq, across its store estate in the UK after it received “positive feedback” from customers during the pilot phase. The app is available for download on both Android and iOS smartphones.

- Shoppers are able to store their debit and credit card details on the PayQwiq app and pay for baskets worth up to £250 (US$312) by simply scanning their phone at checkout. The app also allows shoppers to view their transaction history and collect Tesco Clubcard points as they shop.

L’Oréal and Founders Factory Unveil First Five Startups for Accelerator

(January 23) WWD.com

L’Oréal and Founders Factory Unveil First Five Startups for Accelerator

(January 23) WWD.com

- L’Oréal and startup incubator Founders Factory revealed the first five startups they have selected to participate in the accelerator program they jointly run. Personalization is the common feature among the five companies, which include a brand that creates unique, natural skincare solutions and the maker of a device that customizes and prints nail designs.

- Over the six-month program, Founders Factory will provide the selected startups with digital and business support and product guidance, while L’Oréal will provide them with access to its laboratories and marketing and research departments.

Bumper Christmas Retail Sales in the UK

(January 20) Office for National Statistics (ONS)

Bumper Christmas Retail Sales in the UK

(January 20) Office for National Statistics (ONS)

- The ONS reported that total UK retail sales (excluding automotive fuel) surged by 7.1% year over year in December. The result comes on top of robust, 5.9% year-over-year growth in November and 6.0% growth in October.

- The month was also the strongest December for retail since the current run of ONS data began in 1989. The 7.1% increase was mainly driven by the strong performance of grocery retailers (whose sales grew by 4.3%), department stores (up 6.8%) and Internet pure plays (up 30.9%).

Media Markt Trials Electronics Rental Service

(January 20) Reuters.com

Media Markt Trials Electronics Rental Service

(January 20) Reuters.com

- In a bid to lure customers, Metro Group’s consumer electronics division, Media Markt, is trialing a new service that allows customers to rent devices for a month or more. The selection includes more than 500 different devices. Customers can try out drones, virtual reality (VR) headsets, floor-mopping robots and smartphones through the service.

- Media Markt is working with Berlin-based startup Grover to offer the service, which is currently only available online. The company said that it will extend the service and expand the range depending on the results of the test phase.

ASIA TECH HEADLINES

Samsung Electronics Profit Growth Driven by Component Sales

(January 24) The Wall Street Journal

Samsung Electronics Profit Growth Driven by Component Sales

(January 24) The Wall Street Journal

- Samsung Electronics recorded its highest operating profit in more than three years, as booming sales of components helped the company shrug off last year’s recall of 3 million Galaxy Note 7 smartphones.

- Growth was driven in large part by strong sales of the company’s memory chips and display panels, which contributed about 68% of Samsung’s overall operating profit.

Chinese Bike-Sharing Startup Mobike Snags Strategic Investment from Foxconn

(January 23) TechCrunch.com

Chinese Bike-Sharing Startup Mobike Snags Strategic Investment from Foxconn

(January 23) TechCrunch.com

- Targeting an international expansion this year, one-year-old Chinese bike-sharing service Mobike has secured a strategic investment from manufacturing giant Foxconn, the firm that helps Apple and others produce electronic devices.

- Mobike believes that by working with Foxconn, it can more than double its output, to 10 million new bikes per year. It also said the partnership will enable it to reduce its overall production costs and lower the distribution costs of placing bikes worldwide by locating production hubs in strategic areas.

Half of China’s Population Now Uses the Internet on a Mobile Device

(January 23) TechCrunch.com

Half of China’s Population Now Uses the Internet on a Mobile Device

(January 23) TechCrunch.com

- According to the China Internet Network Information Center, mobile Internet usage in China has reached the notable threshold of 50% for the first time, while the growth of smartphone sales may be declining.

- As of December 2016, China had 731 million Internet users. That figure represents 53.2% of China’s population. Some 95% of Chinese Internet users, or 695 million people, are on mobile.

Tencent Dominates Chinese Mobile App Use as Online Arena Grows

(Januray 22) Bloomberg.com

Tencent Dominates Chinese Mobile App Use as Online Arena Grows

(Januray 22) Bloomberg.com

- Tencent’s messaging services were by far the most popular Chinese mobile apps in 2016, leading steady growth in the world’s largest Internet and smartphone market. Tencent’s QQ took second place after WeChat, while Alibaba’s online bazaar Taobao came in third.

- One of the fastest-growing areas in 2016 was ride hailing, according to the China Internet Network Information Center. That segment is dominated by Didi Chuxing, which drove Uber out of the market last year. From the first half of 2016 to the second half, the number of users of ride-hailing services such as Didi’s leaped by 38%, to 168 million.

LATAM RETAIL & TECH HEADLINES

Perry Ellis Signs Nike Swim Licenses in Latin America

(January 20) WWD.com

Perry Ellis Signs Nike Swim Licenses in Latin America

(January 20) WWD.com

- As Perry Ellis International continues its strategy of extending Nike Swim’s global reach, it has entered into distribution agreements in Latin America with R1 Sports in Brazil; Uldin in Argentina, Uruguay and Paraguay; and Superdeporte Plus Peru in Peru, Bolivia and Ecuador.

- Perry Ellis CEO Oscar Feldenkreis expressed confidence in the ability of the three Latin American companies to bring the Nike Swim line to consumers in the region. He said that Perry Ellis is passionate about performance and supporting the sport of swimming throughout South America.

Brazilian Beermakers Changed Their Advertisement Strategies to Stimulate Sales

(January 19) Bloomberg.com

Brazilian Beermakers Changed Their Advertisement Strategies to Stimulate Sales

(January 19) Bloomberg.com

- Brazil’s top four beer producers are toning down sexual stereotypes in their advertisements, tapping into the “gender friendly” wave that is already commonplace in many markets globally.

- With the country’s long recession taming drinkers’ thirst, production last year retreated to 2010 levels. Appealing to more female drinkers is a key strategy for boosting sales for Ambev, which holds a 60% market share in Brazil, as well as for Heineken and Brasil Kirin, which each have an approximate 8% market share.

Latin America Lifted the Revenue of Carrefour, the World’s Second-Largest Retailer

(January 19) Financial Times

Latin America Lifted the Revenue of Carrefour, the World’s Second-Largest Retailer

(January 19) Financial Times

- French retailer Carrefour has posted its fifth consecutive year of like-for-like sales growth. Revenues rose in its key European and Brazilian markets, offsetting the continuing struggles in its loss-making Asian business.

- In Brazil, Carrefour’s second-largest market, like-for-like sales increased by 9% during the fourth quarter of 2016 and by 11% for the full year, while global sales excluding petrol rose by 2.9%, to €23.4 billion (US$25.1 billion) in the fourth quarter.

Mexico’s Jose Cuervo Planning February IPO

(January 23) CNBC.com

Mexico’s Jose Cuervo Planning February IPO

(January 23) CNBC.com

- Jose Cuervo, the world’s biggest tequila producer, is planning a February 8 pricing for its delayed IPO in a bid to raise up to $1 billion. The company was started by Jose Antonio de Cuervo in the late 1700s and is North America’s oldest continuous producer of spirits.

- Proceeds from the IPO will be used to fund growth as well as broaden the company’s portfolio. The company warned in a prior IPO filing with regulators that the US election could lead to renegotiation of trade deals, which could have a serious impact on its business.

With Millennials Picking Cash over Cards, Cash Gains Steam

(January 24) PYMNTS.com

With Millennials Picking Cash over Cards, Cash Gains Steam

(January 24) PYMNTS.com

L’Oréal and Founders Factory Unveil First Five Startups for Accelerator

(January 23) WWD.com

L’Oréal and Founders Factory Unveil First Five Startups for Accelerator

(January 23) WWD.com