FROM THE DESK OF DEBORAH WEINSWIG

Is Experience Enough?

Two events from the past week have led us to reflect on the future of the retail landscape. First, our US team attended the National Retail Federation (NRF) Retail’s Big Show 2017, where there was much discussion of the reshaping of retail, including opportunities to improve the customer experience. Second, US fashion retailer The Limited announced the closure of all 250 of its stores as it moves to online-only operations, prompting further consideration of the role of the physical store.

In-Store Experience in Retail

At the NRF Retail’s Big Show 2017, we heard a number of speakers and other attendees emphasize the opportunity to improve the in-store experience, including through the use of new technologies. Few can doubt that a high-quality, unique in-store experience offers a complement to the functionality of e-commerce. Better service offerings, more in-store events and improved store environments are all weapons that brick-and-mortar retailers can wield in the battle against players such as Amazon. And there is significant potential for some retailers—notably, some of America’s major department-store chains—to improve their proposition.

But we must not get carried away with believing that experience alone will save brick-and-mortar stores. If a consumer wants cheap electronics, or urgently needs to buy groceries, or simply wants to collect a purchase she made online, then the store experience may be completely irrelevant to her. Moreover, some retailers may find it difficult to change their focus to the quality of the in-store experience due to their traditional positioning.

Convenience, Collection, Destination to Drive Store Traffic

So, experience is not the only opportunity for stores. In our view of the retail future, three core functions will drive shopper traffic once e-commerce has established a major share:

- Convenience: shoppers will make distress purchases of goods needed quickly, often at stores close to home.

- Collection: shoppers will go to a store to pick up online purchases.

- Destination: leisure shoppers will still make trips to those stores that they like to visit rather than have to visit.

Our vision of the future includes a mix of formats, store sizes and retail propositions. Smaller, more local stores will serve demand for convenience and maybe collection, too; we are already seeing retailers such as Target open these kinds of stores. Meanwhile, high-quality flagship stores will be the ones that focus on the customer experience in order to attract leisure shoppers who are looking to spend some enjoyable time browsing and buying.

Large-store retailers that offer relatively few compelling reasons for shoppers to visit will face the most difficulty in this retail landscape. These include the hard-hit department stores and other retailers whose traditional USPs have been breadth of choice or low prices. These kinds of retailers must consider how their estates will meet shopper needs in the future: this may mean not only fewer stores, but also stores that cater to how consumers shop in a digital age. By focusing on one or more of the themes of convenience, collection and destination, such large-store operators may be able to successfully reposition themselves for the future.

US RETAIL & TECH HEADLINES

Are Online Merchants the Mall’s Unlikely Salvation?

(January 18) PYMNTS.com

Are Online Merchants the Mall’s Unlikely Salvation?

(January 18) PYMNTS.com

- One might imagine that mall operators nationwide take a rather jaundiced view of the Internet, since online shopping has more or less killed the mall. But perhaps online retailers are actually giving back some of what they have taken away.

- Retailers are repurposing physical locations as distribution centers of sorts, and online shopping’s greatest hits are starting to appear more often in the real world via pop-up shops and long-term locations such as Amazon’s bookstores. Some online-focused businesses—Happy Returns, for example—are even thriving in mall locations.

What Walmart’s Higher Wages, Better Training Mean for US Retail

(January 17) The Christian Science Monitor

What Walmart’s Higher Wages, Better Training Mean for US Retail

(January 17) The Christian Science Monitor

- Walmart’s plan to pay higher wages and invest more in training suggests a major shift in its business model. But to succeed, America’s largest private employer may need to overcome steep mistrust from labor unions.

- When large corporations like Walmart need to pay a higher wage, it increases their incentive to make other improvements—and reduce worker turnover. Higher wages at Walmart mean that “now they have to recoup that in higher levels of productivity of their employees,” said Thomas Kochan, a professor at the Massachusetts Institute of Technology’s Sloan School of Management. “That’s where the training should make a contribution.”

US Retail Sales End Year with 0.6% Increase

(January 17) CFO Magazine

US Retail Sales End Year with 0.6% Increase

(January 17) CFO Magazine

- US retail sales posted another strong month to end 2016, powered by strong demand for autos and a jump in spending by online shoppers. The US Commerce Department said retail sales increased by 0.6% last month after rising by 0.2% in November. Sales were up 4.1% from December 2015 and rose by 3.3% for all of 2016, versus 2.3% in 2015.

- “American consumers remain remarkably resilient, and after a slow start to the holiday season, retail sales picked up momentum,” Craig Johnson, president of consulting firm Customer Growth Partners, told The Wall Street Journal.

Amazon to Accept Food Stamps, Taking on Walmart

(January 16) CBS MoneyWatch

Amazon to Accept Food Stamps, Taking on Walmart

(January 16) CBS MoneyWatch

- The US Department of Agriculture (USDA) is testing a pilot program this summer that will allow seven online grocery stores, including online-retailing giant Amazon.com, to accept food stamps. Expanding food stamps to online grocery services may help eliminate so-called food deserts, or neighborhoods that lack grocery stores offering fresh, healthy food.

- Walmart said it wants to work with the USDA’s Food and Nutrition Service (FNS), which administers the food stamp program. “We look forward to working with FNS as they continue to explore this opportunity,” the company said. “We’ve expanded our highly popular online grocery service from five markets to more than 100 markets over the past 18 months in both large and small communities across the country.”

Despite Living a Digital Life, 98% of Generation Z Still Shop In-Store

(January 12) National Retail Federation press release

Despite Living a Digital Life, 98% of Generation Z Still Shop In-Store

(January 12) National Retail Federation press release

- Despite expectations that the first “digitally native” generation would want to shop online, a new study released by IBM and the National Retail Federation found that almost all members of Generation Z prefer to shop in brick-and-mortar stores.

- With the global Gen Z population set to reach 2.6 billion by 2020, retailers need to create more interactive engagement around their brands in order to serve the “always on,” mobile-focused, high-spending demographic, according to the study.

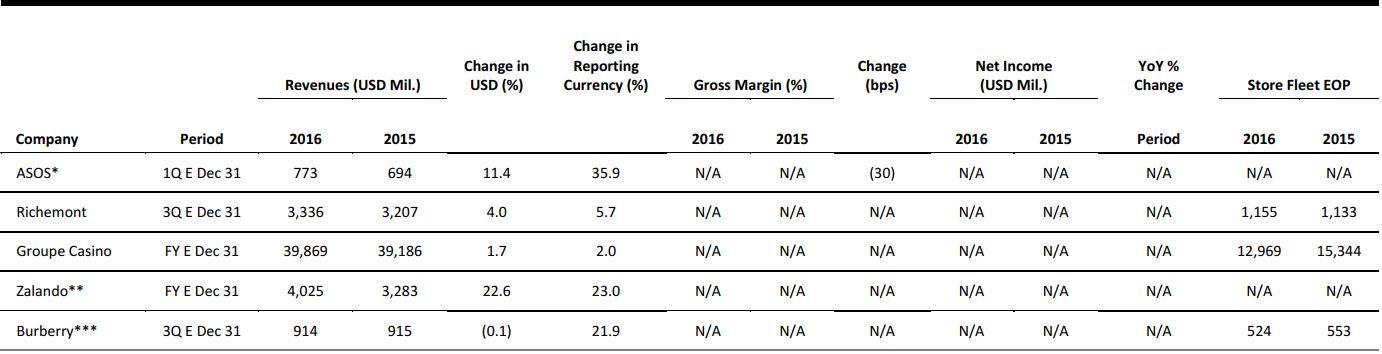

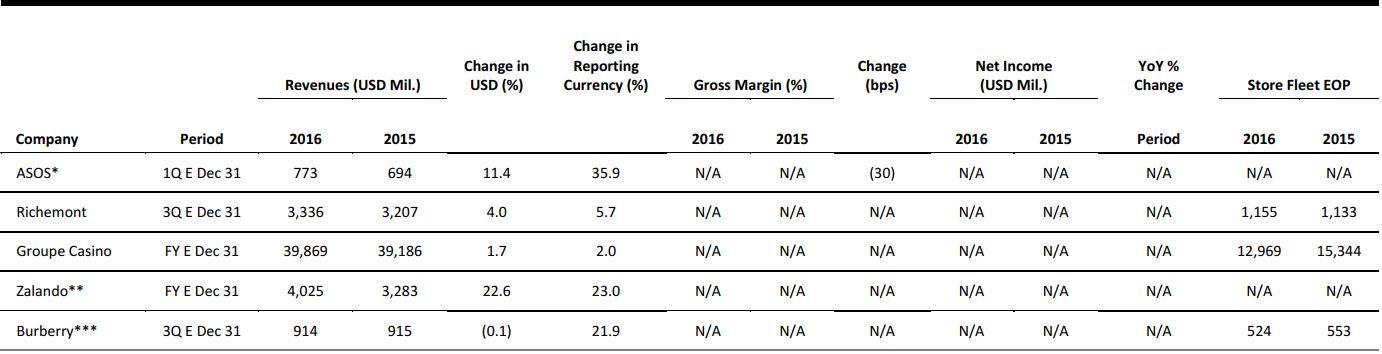

EUROPE RETAIL EARNINGS

*ASOS revenues are for the group, but the gross margin change is for the retail business only; the company did not provide actual gross margin or gross profit figures.

**Zalando provided a range of €3,633–€3,642 million for its FY16 revenues; the midpoint has been used to calculate the changes shown in this table.

***Retail revenues only.

Source: Company reports

EUROPE RETAIL HEADLINES

Foreign Visitors to the UK Boost Christmas Retail Sales

(January 13) Company press release

Foreign Visitors to the UK Boost Christmas Retail Sales

(January 13) Company press release

- Bargain-hunting foreign visitors to the UK spent an estimated £725 million (US$878 million) on high-street shopping in December 2016, according to data on spending through non-UK cards from Worldpay, a payments-processing company. The total was up 22% year over year.

- The biggest beneficiaries were luxury boutiques and department stores in London’s West End. Tourists spent 35% more at these stores than they did in December 2015. Manchester and Edinburgh were the other top gainers in the UK; year-over-year tourist spending on retail increased by 19% and 24%, respectively, in the two cities.

UK Retail Footfall Declines by 0.2% in December

(January 16) Springboard press release

UK Retail Footfall Declines by 0.2% in December

(January 16) Springboard press release

- Retail footfall in the UK declined by 0.2% year over year in the five weeks ended December 31, 2016, according to the British Retail Consortium-Springboard Footfall and Vacancies Monitor. The figure represented the fourth consecutive month of decline, but the fall was less than the 2.2% drop seen in December 2015.

- In retail parks, footfall dropped by 0.7% year over year and in shopping centers, it fell by 1.9%, but high-street stores exhibited positive performance during the period, posting an increase of 0.8%.

Shop Direct’s Christmas Sales Rise by 9% Year over Year

(January 16) Company press release

Shop Direct’s Christmas Sales Rise by 9% Year over Year

(January 16) Company press release

- UK retail group Shop Direct, which operates pure-play stores Very.co.uk, Littlewoods.com and VeryExclusive.co.uk, reported a 9% year-over-year increase in group sales in the seven weeks ended December 23, 2016. Some 68% of total sales were made through mobile devices, Shop Direct said.

- Among the banners, Very.co.uk saw the highest sales growth, of 19%. In terms of product categories, fashion sales grew by 16% year over year, with ladies sportswear growing by a substantial 83%. Shop Direct noted that more than a quarter of all orders placed were picked up by customers at collection points throughout the UK, representing a 20% year-over-year increase in the service.

Eyewear Giants Essilor and Luxottica Announce Merger

(January 16) Company press release

Eyewear Giants Essilor and Luxottica Announce Merger

(January 16) Company press release

- France-based lens maker Essilor and Italian eyewear group Luxottica announced a merger worth €46 billion (US$49 billion) that will form the world’s largest player in the eyewear space. The combined revenue of the new company is estimated to be in excess of €15 billion (US$16 billion).

- According to the terms of the deal, Delfin, Luxottica’s majority shareholder, will contribute its stake entirely to Essilor in exchange for its new shares. The exchange ratio is 0.461 Essilor shares for each Luxottica share. The deal is expected to close in the second half of 2017, subject to approval by the shareholders of both companies and clearance by antitrust authorities.

Puig Signs Joint Venture Deal with Luxasia

(January 17) WWD.com

Puig Signs Joint Venture Deal with Luxasia

(January 17) WWD.com

- Barcelona-based fashion and fragrance group Puig signed a joint venture deal with Singapore-based omnichannel beauty distribution and retail firm Luxasia to expand Puig’s international network. Details of the deal were not revealed.

- Puig, which owns brands such as Nina Ricci, Carolina Herrera, Paco Rabanne and Jean Paul Gaultier, said that the joint venture will begin February 1 and will involve selected Southeast Asian markets, including Singapore and Malaysia.

ASIA TECH HEADLINES

Nintendo Launches Its New Game Console, Nintendo Switch

(January 13) The Wall Street Journal

Nintendo Launches Its New Game Console, Nintendo Switch

(January 13) The Wall Street Journal

- The new Nintendo Switch game console, which comes with two controllers, will go on sale worldwide on March 3. Priced at $299.99, the handheld hybrid design enables two players to look straight at each other, rather than at a screen.

- The Switch is partly a reaction to the poor performance of Nintendo’s most recent console, the Wii U. Introduced in 2012, sales of the Wii U lagged those of the PlayStation console.

Baidu Opens Augmented Reality Lab, Begins Integrating AR into Search

(January 17) TechCrunch.com

Baidu Opens Augmented Reality Lab, Begins Integrating AR into Search

(January 17) TechCrunch.com

- Baidu’s new AR Lab is the fourth lab established by the Baidu Research division; it joins the company’s Big Data Lab, Silicon Valley Lab and the Institute of Deep Learning, from which the AR Lab was spun out.

- In August, the company launched an AR platform called DuSee, which allows users to view AR animations overlaid on real-world environments. Baidu is focusing solely on smartphone-based AR, while many companies are focusing their efforts on head-mounted systems such as Microsoft’s HoloLens.

Baidu Hires Former Microsoft Executive and Noted AI Expert Qi Lu as Group President and COO

(January 17) TechCrunch.com

Baidu Hires Former Microsoft Executive and Noted AI Expert Qi Lu as Group President and COO

(January 17) TechCrunch.com

- Former Microsoft executive Qi Lu will join Baidu as Group President and COO, responsible for products, technology, sales, marketing and operations, and will lend his expertise to the company’s artificial intelligence (AI) efforts. Lu left Microsoft in October 2016 and is a leading AI authority. He gained deep management experience at Yahoo and Microsoft.

- Baidu’s CEO has said that AI will be the most important strategic program for the firm for the next decade.

China Tightens Control over Apps

(Januray 16) The Wall Street Journal

China Tightens Control over Apps

(Januray 16) The Wall Street Journal

- China has begun requiring Internet app stores to register with the state and has barred outlawed content, such as pornography, as well as the promotion of illegal activity, including terrorism and the publishing of rumors. However, regulators face challenges in supervising millions of apps, which often serve as platforms for users to exchange information, making them even harder to regulate.

- China is the world’s largest mobile market, and has hundreds of Internet app stores. In contrast, the US market is dominated by only two stores, Google Play and Apple’s App Store.

LATAM RETAIL & TECH HEADLINES

Meltdown of Panama’s Wisa, Argentina Hit Latin American Luxury Sales

(January 17) WWD.com

Meltdown of Panama’s Wisa, Argentina Hit Latin American Luxury Sales

(January 17) WWD.com

- Latin America’s luxury market is suffering from sluggish demand, while the collapse of Panama’s Grupo Wisa is forcing brands to restructure to stem losses. Diego Stecchi, Managing Partner at Luxury Retail Partners, pointed out that Mexico is the only solid market in Latin America, while the rest, including Colombia, Argentina and Brazil, are all suffering and consolidating.

- Argentina is expected to contract sharply due to slowing jewelry, watch and accessories sales and lingering negativity over former President Cristina Fernández de Kirchner’s socialist policies, which require businesses to manufacture in the country in order to sell their products in the market and has prompted many labels to exit the country.

Brazilian Retailers Brace for Weak Fourth Quarter

(January 16) Reuters.com

Brazilian Retailers Brace for Weak Fourth Quarter

(January 16) Reuters.com

- Brazilian retail and consumer goods companies may post weak fourth-quarter results, as the worst recession on record continued to hurt the sales and profitability of the country's largest brick-and-mortar chains during the quarter.

- The pessimistic expectations underscore the challenge retailers face in Latin America’s largest economy, where a decade-long spending boom ended abruptly three years ago, replaced by rising urban unemployment and defaults linked to costly and scarce credit.

Retailer Casino Stays Confident over 2017 as France and Brazil Improve

(January 17) Reuters.com

Retailer Casino Stays Confident over 2017 as France and Brazil Improve

(January 17) Reuters.com

- Retailer Casino is confident that it will further increase revenue and profitability this year, thanks to cost savings and improving sales in France and Brazil, despite the uncertainty and recession hitting the respective countries.

- In Brazil, Casino expects costs to remain under control should the deceleration in inflation continue and should the central bank continue to hold interest rates down. Food retail sales in the country showed signs of robustness, driven by the cash-and-carry Assai stores and promotional activity at hypermarkets.

Uber to Invest More than $60 Million in São Paulo Support Center

(January 17) Reuters.com

Uber to Invest More than $60 Million in São Paulo Support Center

(January 17) Reuters.com

- Ride-hailing service Uber inaugurated a support center in Brazil’s biggest city, São Paulo, on Tuesday. The company plans to invest R$200 million (US$62 million) and create 2,000 jobs, underscoring an aggressive growth strategy in Brazil.

- The new facility in São Paulo may employ up to 7,000 people by the end of the year, providing technical support for around 9 million users in Brazil along with thousands of drivers, the company said in a statement.