FROM THE DESK OF DEBORAH WEINSWIG

Tons of Cool and Innovative Gadgets on Display at This Year’s CES

The Fung Global Retail & Technology team recently attended the 50th annual CES trade show in Las Vegas. Originally a trade show for televisions, radios and phonographs, CES has evolved into the world’s largest consumer electronics showcase, drawing more than 165,000 attendees from more than 150 countries. The size and scope of the show boggle the mind, but we noted several key trends at the event.

Voice control is everywhere. The accuracy of machine voice recognition has improved dramatically over the past several years, leading to the advent of Apple’s Siri, Amazon’s Alexa and other voice-controlled appliances. Alexa seemed to be everywhere at CES 2017, and products ranging from LG refrigerators, Ford cars and Samsung robotic vacuum cleaners to TVs from Westinghouse, Seiki and Element will all support Alexa this year.

Concierge services will be provided by a smart home/automobile/phone combination. German auto-part maker Bosch showed a vision of the future in which a consumer’s smart home, smart vehicle and smartphone will act in concert to provide services. An early version of this technology was demonstrated at CES last year, in the form of a Ford car driver being able to send a message to his or her Amazon Alexa intelligent agent at home, instructing the device to turn on the lights as the driver arrived at home. The Ford driver could also tell Alexa to instruct his or her car to warm up before driving. In the near future, smart handoffs between the three networks will enable users to operate home appliances, schedule appointments and stay connected whether inside or outside their vehicle.

Fully autonomous cars are still far off. There were numerous announcements and demonstrations of driverless car technology at CES, including an all-in-one module offered by ZF that uses a chipset from Nvidia. One researcher from Toyota gave a highly academic presentation that outlined the SAE International standards for autonomous cars, pointing out that levels 2–4 enable a vehicle to operate autonomously under various controlled situations. However, the presenter noted that it is possible that the driver would have to take over if the car could not make sense of its environment. Cars meeting the level 4 requirement are expected to be out by 2020 and, ultimately, they could reduce human error, leading to a reduction in injuries and fatalities.

TVs keep getting thinner and better. Building on the advent of flat-panel TVs with 4K resolution, TVs keep getting better and better, and they now feature high dynamic range (HDR)—meaning a greater difference between bright and dark elements—and quantum dot technology (which modulates the brightness of the backlight), both of which improve picture quality. TVs and monitors featuring 8K resolution were also on display, and Chinese diversified tech company Hisense showed a TV in which the picture was generated by lasers, which offer a color gamut (i.e., palette) with a larger number of colors than offered by traditional LCD TVs. LG displayed TVs featuring Dolby Atmos 3D surround sound, and Hisense commented that it was close to receiving THX certification on its sound systems.

Wearables keep multiplying. The number and variety of wearable devices continues to expand, particularly in the health and fitness area. There were connected toothbrushes and hairbrushes on display at CES, as well as many devices that monitor and improve sleep. Under Armour announced a shirt that enables athletes to recover faster while sleeping as well as an update to its app that analyzes the sleep data generated by many kinds of devices. Other gadgets on display included a watch that reminds kids when to brush their teeth and go to bed in order to enforce good habits and devices that monitor and measure breathing as well as determine the digestibility of certain foods.

Virtual and mixed reality are still expensive. There were many vendors demonstrating virtual reality at the show, including Intel, which displayed a couple of compelling offerings. The company demonstrated a 360-degree view of a live basketball game, a live drone inspection of a solar panel out in the desert, a mixed-reality shooter game that turns room objects into game objects and a 360-degree video transmitted wirelessly by Qualcomm. Today, virtual reality typically requires an expensive headset and a powerful PC, while augmented reality can leverage existing smartphones and tablets.

These products and technologies just skim the surface of what was demonstrated at CES 2017, and the Fung Global Retail & Technology team will continue to follow these and other tech trends throughout the year.

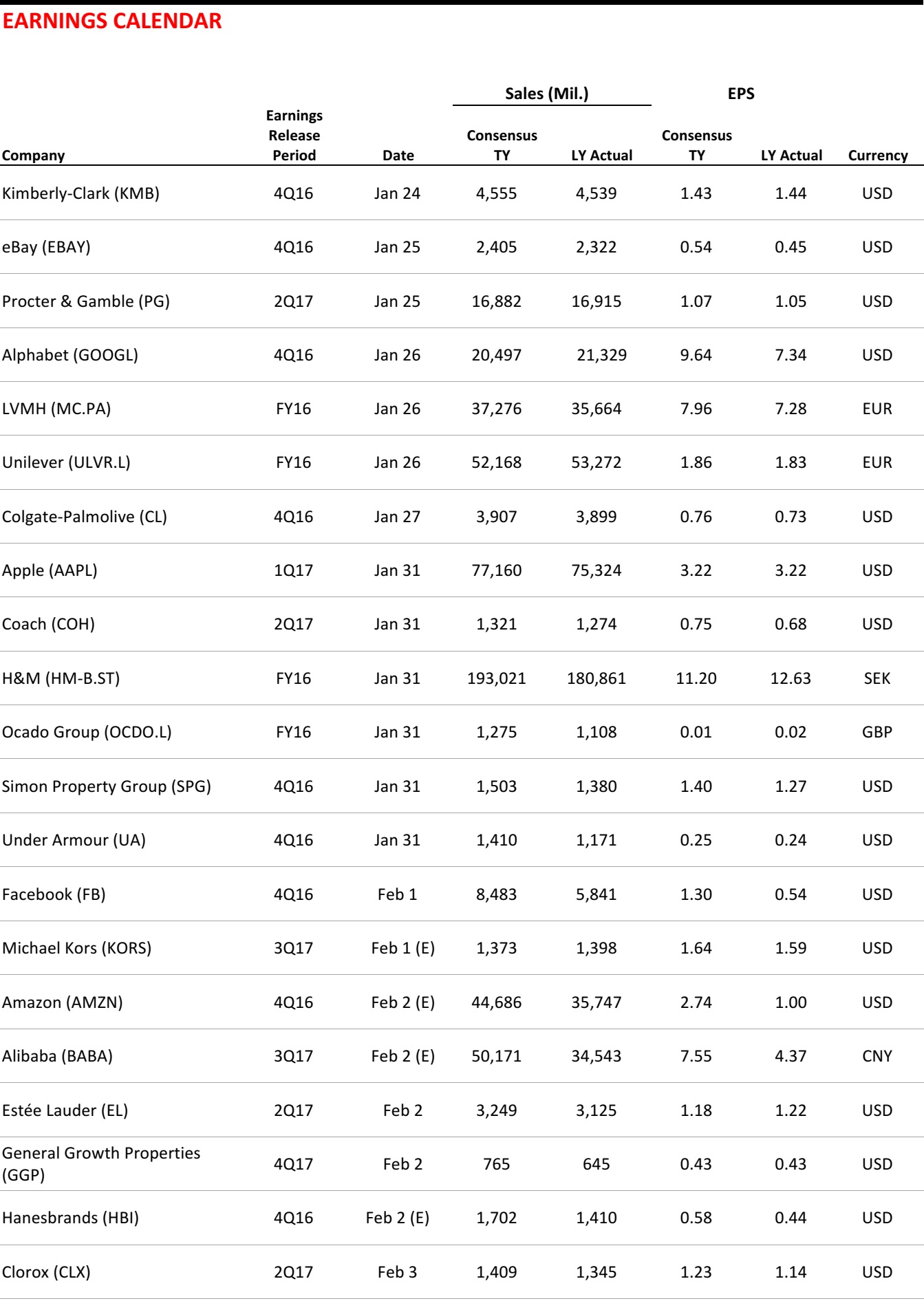

US RETAIL EARNINGS

US RETAIL & TECH HEADLINES

US-Bound Retail Container Volumes See Gains Despite Mixed Signals, Says Global Port Tracker

(January 10) Logistics Management

US-Bound Retail Container Volumes See Gains Despite Mixed Signals, Says Global Port Tracker

(January 10) Logistics Management

- Retail container volumes saw an atypical, late-in-the-year holiday season bump, based on data in the most recent edition of the Global Port Tracker report issued by the National Retail Federation and maritime consultancy Hackett Associates.

- Authors of the report explained that cargo import numbers do not correlate directly with retail sales or employment because they count only the number of cargo containers brought into the country, not the value of the merchandise inside them. The authors added that the amount of merchandise imported provides a rough barometer of retailers’ expectations.

Former Walmart US CEO: Technology Is Changing the Retail Platform

(January 6) FoxBusiness.com

Former Walmart US CEO: Technology Is Changing the Retail Platform

(January 6) FoxBusiness.com

- Despite reports of a strong holiday season, some retailers are not feeling so jolly. The “Amazon effect” is taking its toll on brick-and-mortar stores, including major brands such as Macy’s and Kohl’s. Both retailers reported a decline in comparable store sales of more than 2% during November and December versus the same period the prior year.

- “Retail is in a transition clearly. There’s a lot of things that have been changing, but that has been the dynamic of retail really since the beginning,” said former Walmart US CEO and President Bill Simon. “Our lives have been impacted by technology in just ways we couldn’t have imagined over the last 10 years. I think the winners in retail will be the ones who find a way to take this fantastic technology that we’re dealing with and bring it to the retail store.”

Struggling Upscale US Retailer Neiman Marcus Pulls IPO

(January 6) Reuters.com

Struggling Upscale US Retailer Neiman Marcus Pulls IPO

(January 6) Reuters.com

- Nearly two years after Neiman Marcus filed its intent with US regulators to go public, the upscale department store chain said it would withdraw its IPO.

- The company’s abandoned IPO underscores the challenges it faces as it grapples with weaker customer demand and as the broader industry struggles under the weight of competitive pressure from off-price stores and online retailers such as Amazon.com.

US Retail Mall Vacancies Flat in Fourth Quarter: Reis

(January 5) Reuters.com

US Retail Mall Vacancies Flat in Fourth Quarter: Reis

(January 5) Reuters.com

- US retail mall vacancies in the fourth quarter were flat versus the third quarter’s 7.8%, indicating that the retail real estate market is finally showing signs of a correction, real estate research firm Reis said in a report.

- “In short, the fourth-quarter statistics show that the growth in e-commerce that has led to scores of store closures across the US is truly starting to impact many retail property markets in a meaningful way,” said Barbara Denham, a senior economist at Reis.

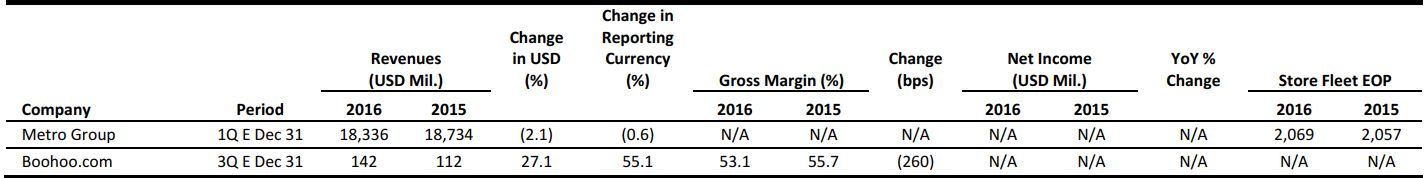

EUROPE RETAIL EARNINGS

EUROPE RETAIL HEADLINES

UK Retail Sales Finish Strong with 1.7% Year-over-Year Rise in December

(January 10) Press release

UK Retail Sales Finish Strong with 1.7% Year-over-Year Rise in December

(January 10) Press release

- UK retail sales rose by 1.7% year over year in the five weeks from November 27 through December 31, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comps grew by 1.0% year over year during the period, compared with 0.1% in December 2015. BRC CEO Helen Dickinson said the week before Christmas “was a bumper one and exceeded expectations.”

- Over the three months ended December 31, food sales grew by 2.4% year over year and food comps increased by 1.1%, while nonfood sales grew by 1.3% and nonfood comps rose by 1.1%. During the period, online sales grew by 7.2%, while in-store sales fell by 1.2% and in-store comps fell by 1.4%.

Tesco the Christmas Grocery Winner: Kantar Worldpanel

(January 10) Press release

Tesco the Christmas Grocery Winner: Kantar Worldpanel

(January 10) Press release

- Tesco was the strongest performer of the big four UK supermarket chains over the Christmas period, according to new Kantar Worldpanel market-share data. In the 12 weeks ended January 1, Tesco grew sales by 1.3%, compared with 1.2% growth at Morrisons, a 0.1% decline at Sainsbury’s and a 2.4% decline at Asda.

- Aldi grew sales by 11.8% and Lidl by 7.5%. Total sector sales increased by 1.8% and inflation was 0.2%, versus deflation in preceding months..

Tesco to Overhaul Its Distribution Network Management and Shut Two Warehouses

(January 9) Press release

Tesco to Overhaul Its Distribution Network Management and Shut Two Warehouses

(January 9) Press release

- British grocer Tesco plans to close two of its UK warehouses, located in Hertfordshire and Derbyshire, as part of its strategy to simplify its distribution network. The move will bring its total number of UK warehouses to 23.

- The closures will also result in more than 1,000 roles being cut, but Tesco plans to create some 500 jobs elsewhere in the company, including some at its other warehouses.

US Bankruptcy Court Approves Sale Process of Nasty Gal Intellectual Property to Boohoo.com

(January 9) Press release

US Bankruptcy Court Approves Sale Process of Nasty Gal Intellectual Property to Boohoo.com

(January 9) Press release

- UK fashion pure play Boohoo.com is a step closer to acquiring certain intellectual property assets from US retailer Nasty Gal, as the US Bankruptcy Court has approved the sale process.

- Nasty Gal will receive bids until February 2, and if any are higher or more favorable, Boohoo.com’s bid may not result in a transaction. However, if Boohoo.com is successful, the transaction will be subject to final court approval around February 8.

Ahold Delhaize Begins €1 Billion Share Buyback Program

(January 9) Press release

Ahold Delhaize Begins €1 Billion Share Buyback Program

(January 9) Press release

- Dutch-Belgian supermarket group Ahold Delhaize has embarked on a €1 billion (US$1.1 billion) share buyback program that it expects to complete before the end of 2017. The program is aimed at reducing Ahold Delhaize’s capital by canceling all or part of the common shares acquired through the exercise.

- The company stated that “maintaining a balanced approach between funding growth in key channels and returning excess liquidity to shareholders” is part of its financial framework. Ahold and Delhaize merged on July 24, 2016, to form Ahold Delhaize.

Asda Launches New Private-Label Brand for Diet-Conscious Customers

(January 9) ESMmagazine.com

Asda Launches New Private-Label Brand for Diet-Conscious Customers

(January 9) ESMmagazine.com

- British grocery e-tailer Asda has introduced a new private-label brand called Slimzone that features healthier options in frozen meals and meat products. The product range includes chicken and prawn paella, vegetable arrabiata and cottage pie and it uses ingredients such as turkey mince with only 5% fat, beef mince, dried pasta and vegetables.

- The Slimzone range is free for members of the UK weight-loss plan and community Slimming World. While group membership to Slimming World costs £4.95 (US$5.25) per week, nonmembers can buy the meals for £2.50 (US$3.50) each from the frozen aisle.

ASIA TECH HEADLINES

Alibaba Takes Another Step Offline with $2.6 Billion Intime Deal

(January 10) Bloomberg.com

Alibaba Takes Another Step Offline with $2.6 Billion Intime Deal

(January 10) Bloomberg.com

- As it deepens its integration with brick-and-mortar stores, Alibaba Group is leading a bid to privatize department store operator Intime Retail for about HK$19.8 billion (US$2.55 billion). Alibaba and the founder of Intime, Shen Guojun, will pay HK$10 (US$1.29) for each Intime share, representing a 42% premium over the last closing price.

- Alibaba originally took a stake in the retailer in 2014 and Alibaba CEO Daniel Zhang became Intime’s chairman the next year. The partnership has already given Alibaba access to Intime’s inventory and allows its online customers to pick up orders from Intime’s physical stores.

China’s Tencent Takes on the App Store with Launch of “Mini Programs” for WeChat

(January 10) TechCrunch.com

China’s Tencent Takes on the App Store with Launch of “Mini Programs” for WeChat

(January 10) TechCrunch.com

- Tencent has launched “mini programs,” which are essentially stripped-down versions of iOS and Android apps that can be downloaded instantly and stored within WeChat. The platform has 768 million daily users, half of whom use it for 90 minutes each day. The mini programs are found by searching inside WeChat or scanning a QR code, such as those printed on subway ads. Cinema booking is one of the activities made possible via WeChat mini programs.

- Research from various firms indicates that fewer than a dozen apps get the bulk of consumers’ attention, that getting consumers to download an app is tough in the first place and that one in four people abandon news apps after just one session.

Chinese Spend More than Ever on Alipay amid Mobile Payments Boom

(January 10) TechinAsia.com

Chinese Spend More than Ever on Alipay amid Mobile Payments Boom

(January 10) TechinAsia.com

- Users of Alipay, China’s top mobile wallet app, spent record amounts online and in stores in 2016. Some 71% of Alipay transactions were conducted on mobile devices, up from 65% in 2015. People in Shanghai are the app’s biggest spenders; they spent an average of US$20,400 last year and spent 1.5 times more than in 2015.

- Alipay has 450 million users and can be used on China’s top online shopping sites, including all of Alibaba’s marketplaces and at stores of all sizes. The app is also used for transferring money to friends, and features a number of financial services, including a personal savings fund and small loans.

Jack Ma Meets with Trump to Talk About How to Create 1 Million US Jobs over Five Years

(January 10) CNBC.com

Jack Ma Meets with Trump to Talk About How to Create 1 Million US Jobs over Five Years

(January 10) CNBC.com

- President-elect Donald Trump had a meeting with Alibaba Chairman Jack Ma to discuss job creation, trade issues and the China-US relationship. The meeting came amid tensions between China and the incoming Trump administration. Trump has proposed steep tariffs on Chinese goods and has needled China over the US’s relationship with Taiwan.

- Ma said that the business community will help the US and China understand their political situation better and that Alibaba will create 1 million US jobs over five years by enabling a million small businesses, especially in the Midwest, to sell American goods and services to China and Asia.

LATAM RETAIL HEADLINES

Mexican Retailers Lose More than $1.3 Billion from Theft, Inventory Losses

(January 11) WWD.com

Mexican Retailers Lose More than $1.3 Billion from Theft, Inventory Losses

(January 11) WWD.com

- As Mexican stores continue to recover from last week’s heavy protests and lootings, the president of the country’s retail lobby, Vicente Yáñez, said retailers have lost more than $1.3 billion to shoplifting and inventory shrinkage since 2014.

- He confirmed that Walmart, Coppel, and hypermarket chains Soriana and Chedraui were the worst-hit companies last week, when furious Mexicans ransacked roughly 2,000 retailers to protest a 15%–20% fuel-price hike dubbed the “gasolinazo.”

Brazil Sees Record Number of International Visitors in 2016

(January 4) WSJ.com

Brazil Sees Record Number of International Visitors in 2016

(January 4) WSJ.com

- Brazil received a record 6.6 million foreign tourists in 2016, boosted by visitors attending the Summer Olympics and Paralympics, according to figures released by the country´s tourism ministry.

- The figure was 4.8% higher than the 2015 total. Foreign visitors spent $6.2 billion in the country last year, up from $5.84 billion in 2015.

Black Friday Gives One-Off Boost to Retail Sales in Brazil

(January 10) Reuters.com

Black Friday Gives One-Off Boost to Retail Sales in Brazil

(January 10) Reuters.com

- In November, retail sales in Brazil rose by more than had been forecast, as early holiday discounts boosted demand for electronics and home appliances, offering temporary relief amid expectations of a weaker December. Retail sales volumes excluding cars and building materials rose by 2.0% in November month over month after having fallen for four consecutive months.

- The increase, the sharpest since July 2013, far exceeded the 0.4% rise that economists polled by Reuters expected. The November surprise reinforces the growing popularity of Black Friday discounts in Brazil.

Karla Martinez’s 2017: Latin American Fashion Will Come into Its Own

(January 6) BusinessofFashion.com

Karla Martinez’s 2017: Latin American Fashion Will Come into Its Own

(January 6) BusinessofFashion.com

- More Latin American retailers are beginning to accent their international product offering with items from local designers scouted at growing South American fashion weeks held in Buenos Aires, Argentina; Santiago, Chile; and Lima, Peru.

- Some regional retailers have also recently begun to source hard-to-find merchandise from smaller Central American fashion weeks in Guatemala, Honduras and Panama.