US RETAIL HEADLINES

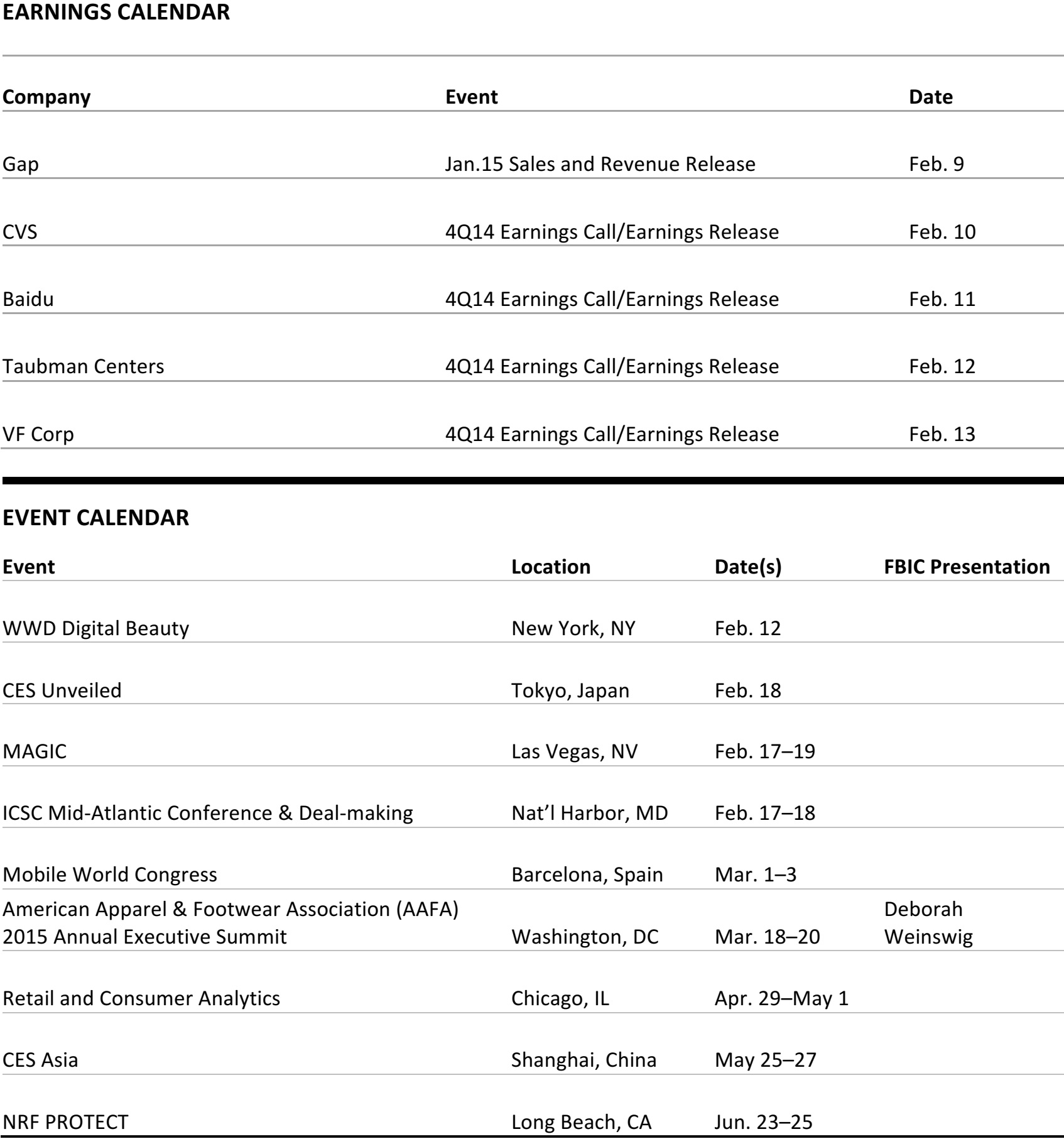

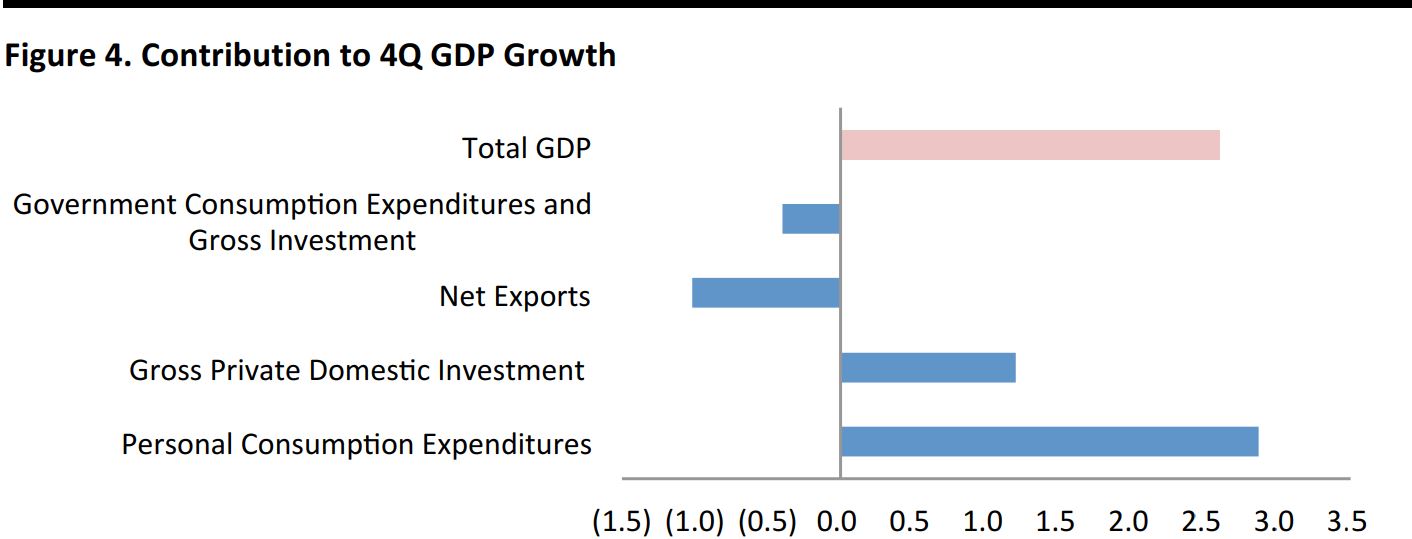

Retail Sales And Traffic Decline 7.7% YOY In January

Through January 31, 2015

Source: RetailNext

- Retail sales and traffic declined 7.7% YOY in January

- The last week of January saw a relatively stronger performance with modest gains in average transaction value (ATV) and sales per shopper (SPS)

- The Saturday before Martin Luther King, Jr. Day (January 17) experienced the highest levels of traffic and transactions for the month, while January 31 saw the highest sales and ATV, as wintry conditions during these periods drove store traffic across much of the US

- The Midwest was the only region with a modest (0.1%) traffic increase. The Northeast experienced the most severe traffic decline, at 12.8%

- The best regional sales performance was in the Midwest, down 4.7%, and the worst performance was in the Northeast, down 10.9%

Despite Record Volume During Holiday 2014, UPS Reports Flat 4Q Adjusted Earnings

(February 3) UPS press release and conference call

Despite Record Volume During Holiday 2014, UPS Reports Flat 4Q Adjusted Earnings

(February 3) UPS press release and conference call

- Delivered 572 million packages worldwide in December

- Experienced a 12% increase in Cyber Monday and peak-day deliveries, with peak-day scheduled deliveries exceeding 35 million packages, 100% greater than on an average day

- CEO David Abner sees e-commerce outpacing global GDP growth fourfold and cross-border e-commerce sevenfold

Target Announces Plans To Add 15 New Stores In 2015

(February 2) Target press release

Target Announces Plans To Add 15 New Stores In 2015

(February 2) Target press release

- Target’s strategy for store growth focuses on urban centers in which TargetExpress and CityTarget’s smaller formats will offer customized assortments and services

- Eight TargetExpress locations are planned for 2015, and Target is exploring additional opportunities beyond 2015 in major US markets. This newest and smallest format (about 20,000 square feet) allows for a quick shopping experience. The first TargetExpress opened in Minneapolis in July 2014 and continues in test mode

- One CityTarget will open near Boston’s Fenway Park for a total of nine CityTargets. This format ranges in size from 80,000 square feet to 160,000 square feet and its stores are among the highest-trafficked locations

- Six general merchandise Target stores are planned as well

Driverless Cars Get Closer To Reality As Uber Invests In A New Research Center

(February 2) Wall Street Journal, Financial Times and Uber Blog

Driverless Cars Get Closer To Reality As Uber Invests In A New Research Center

(February 2) Wall Street Journal, Financial Times and Uber Blog

- Uber, in partnership with Carnegie Mellon University, will fund a new research center in Pittsburgh. The Uber Advanced Technologies Center will research autonomous driving technology, mapping and other technologies related to vehicle safety

- Google, one of Uber’s investors, is working closely with Uber and has integrated Uber directly into the Google Maps smartphone app, allowing users seeking directions to jump into Uber’s app to call a car

- In December, the head of Google’s self-driving car project, Chris Urmson, told The Wall Street Journal that Google is looking for auto industry partners to bring the cars to market within the next five years. Urmson, a former adjunct professor at Carnegie Mellon, said Google is currently working with auto suppliers on a fleet of more advanced prototypes than the stripped-down models the company showed off last spring

- According to most experts, fully autonomous vehicles are at least five years away

Macy’s Agrees To Acquire Luxury Beauty Products And Spa Services Retailer Bluemercury

(February 3) Macy's Inc. Press Release

Macy’s Agrees To Acquire Luxury Beauty Products And Spa Services Retailer Bluemercury

(February 3) Macy's Inc. Press Release

- Bluemercury operates about 60 specialty stores in 18 states as well as an online business. It is widely recognized as America’s largest and fastest-growing luxury beauty products and spa services retailer

- Macy's plans to operate and significantly expand Bluemercury as a standalone business with an enhanced omnichannel component for a seamless customer experience across stores, online and mobile. Selected Bluemercury products and boutiques will be added to Macy’s stores nationwide

- The purchase price is $210 million cash. The transaction is expected to be completed in Macy’s 1Q (ending May 2, 2015) and to be accretive in its first full year (FY16)

Under Armour Announces Creation Of World's Largest Digital Health And Fitness Community

(February 4) Under Armour press release

Under Armour Announces Creation Of World's Largest Digital Health And Fitness Community

(February 4) Under Armour press release

- Under Armour agreed to purchase MyFitnessPal, the leading healthy living and nutrition resource with more than 80 million registered users, for $45 million. MyFitnessPal will expand Under Armour Connected Fitness offerings to include comprehensive nutrition tools, allowing users to track calories, nutrition and exercise. The acquisition is expected to close in 1Q15 and will be funded through an expanded-term loan and revolving-credit facility as well as cash on hand

- Endomondo, purchased in early January 2015 for $85 million, has one of the largest global connected fitness communities, with approximately 20 million registered users concentrated in Europe and about 20% located in the US. Endomondo provides users with the ability to map, record and share their workouts

- The acquisitions of Endomondo and MyFitnessPal, combined with Under Armour’s existing MapMyFitness community, creates the world's largest digital health and fitness community, with more than 120 million unique registered users

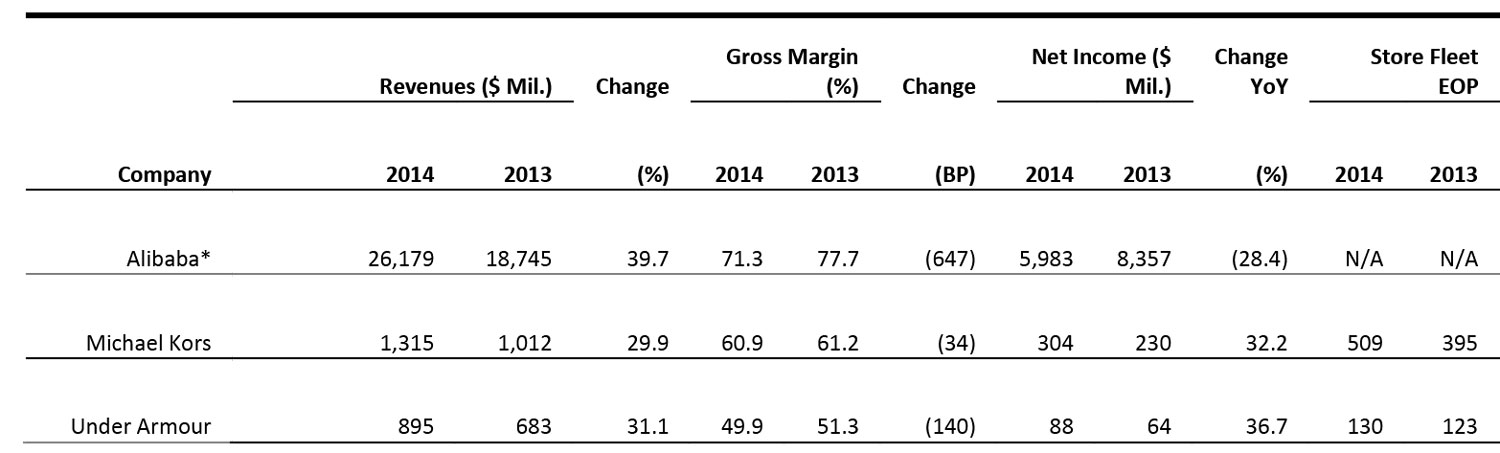

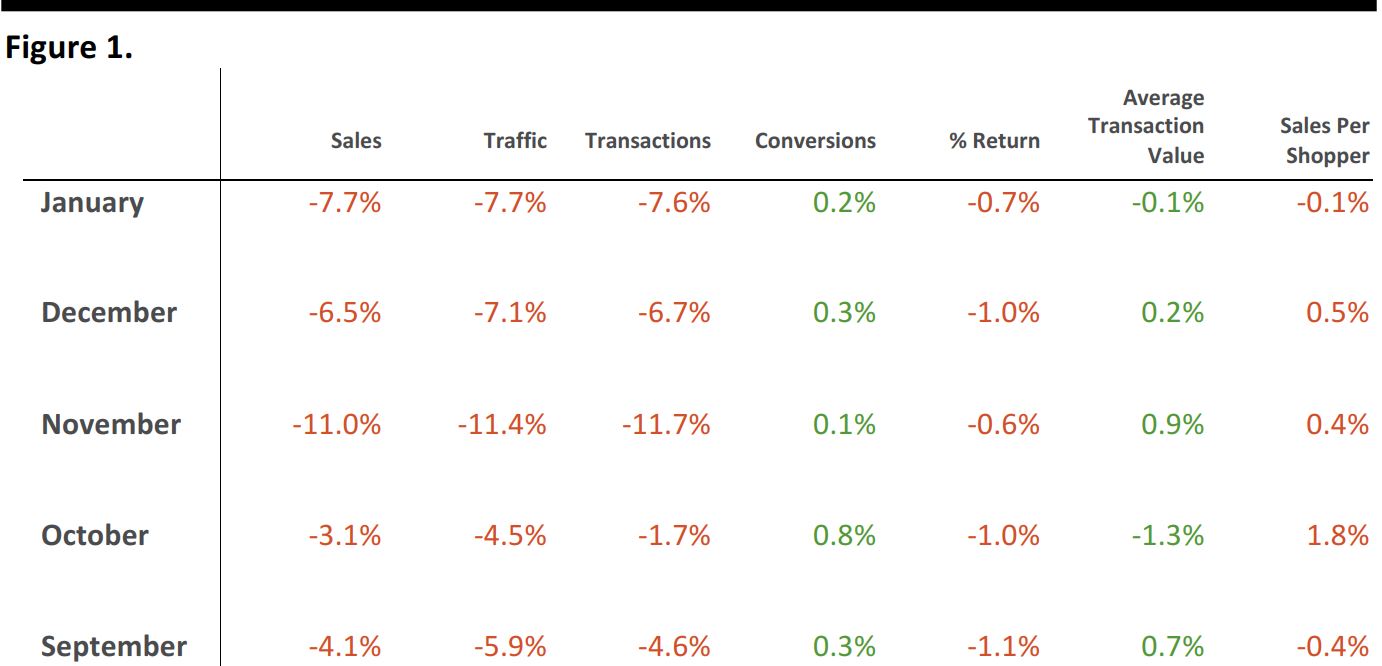

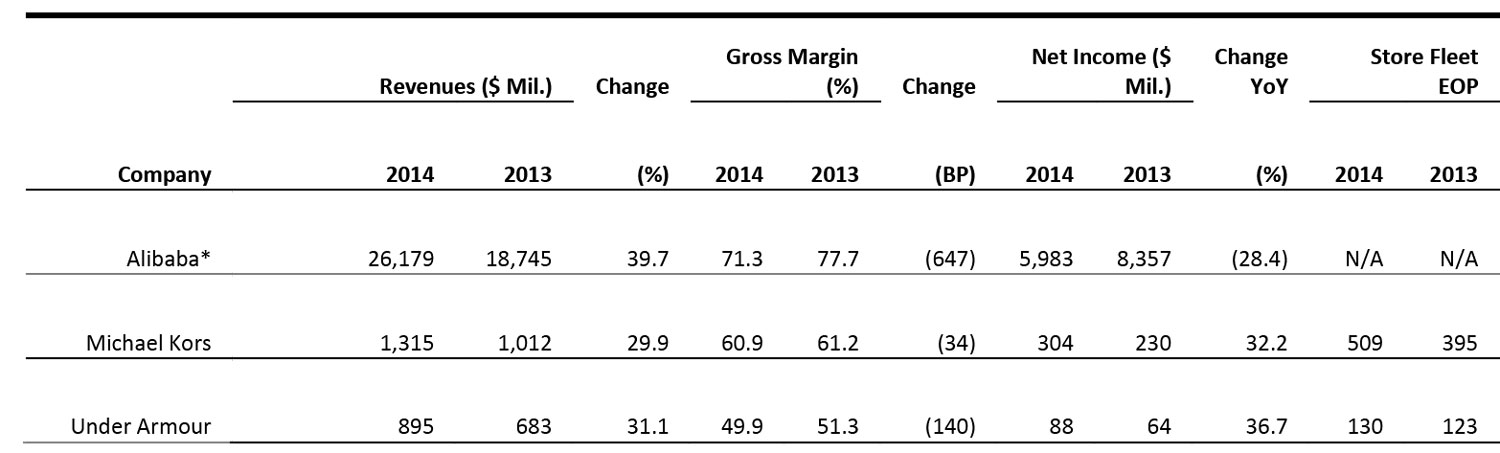

Select Company Earnings

Source: Company reports *Alibaba earnings are reported in RMB

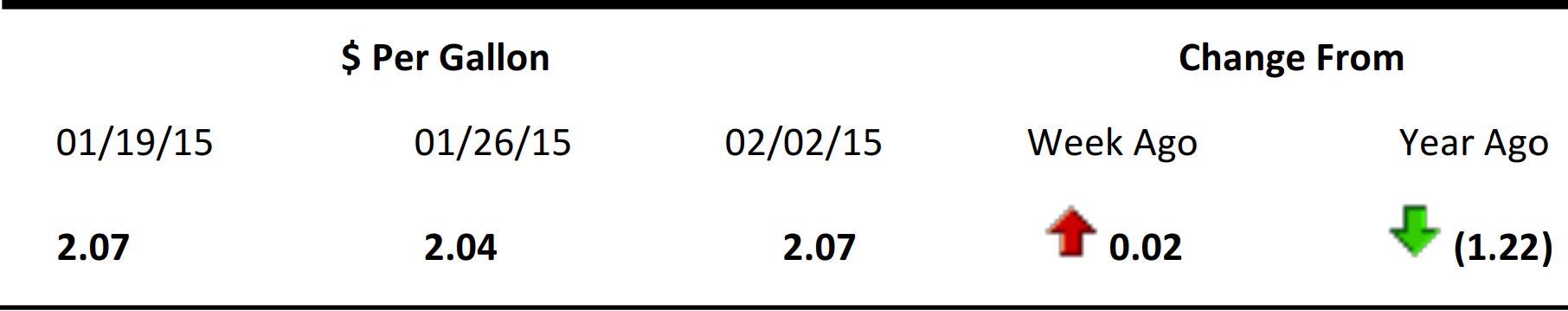

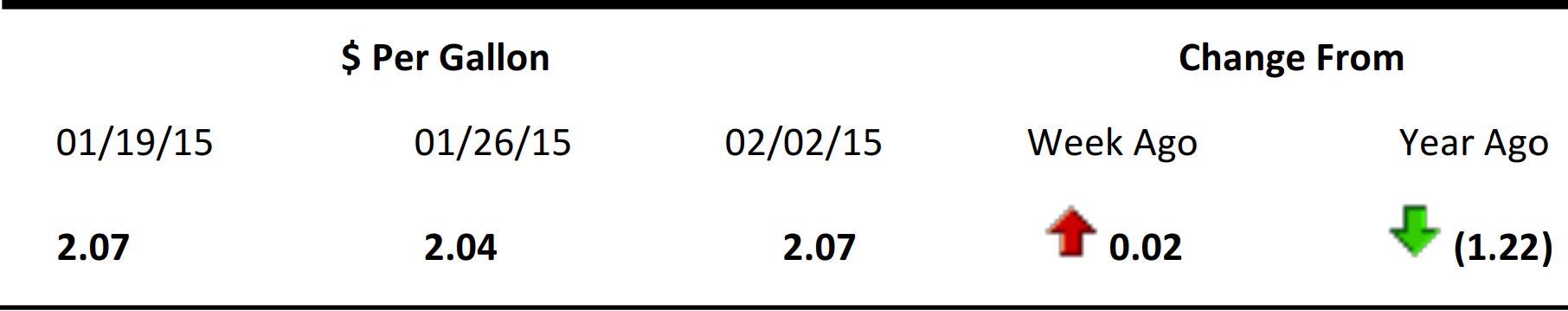

US Regular Gasoline Prices

Source: US Energy Information Administration

LA Port Labor Dispute Approaching A “Total Meltdown”

On February 4, the Pacific Maritime Association (PMA—representing the port employers) held a conference call with reporters, making public its offer of a new five-year contract, which includes 3% average wage increases, a comprehensive employer-paid health plan, and an 11% increase to the maximum annual pension benefit.

- The International Longshore and Warehouse Union (ILWU) had no immediate comment

- If an agreement is not reached within the timeframe of 10 days to two weeks, PMA members will cease sending workers to the docks

- If a lockout is imposed, President Obama could order both sides to return to work during an 80-day cooling-off period, and if no agreement is reached by the end of that period, Congress could impose a settlement

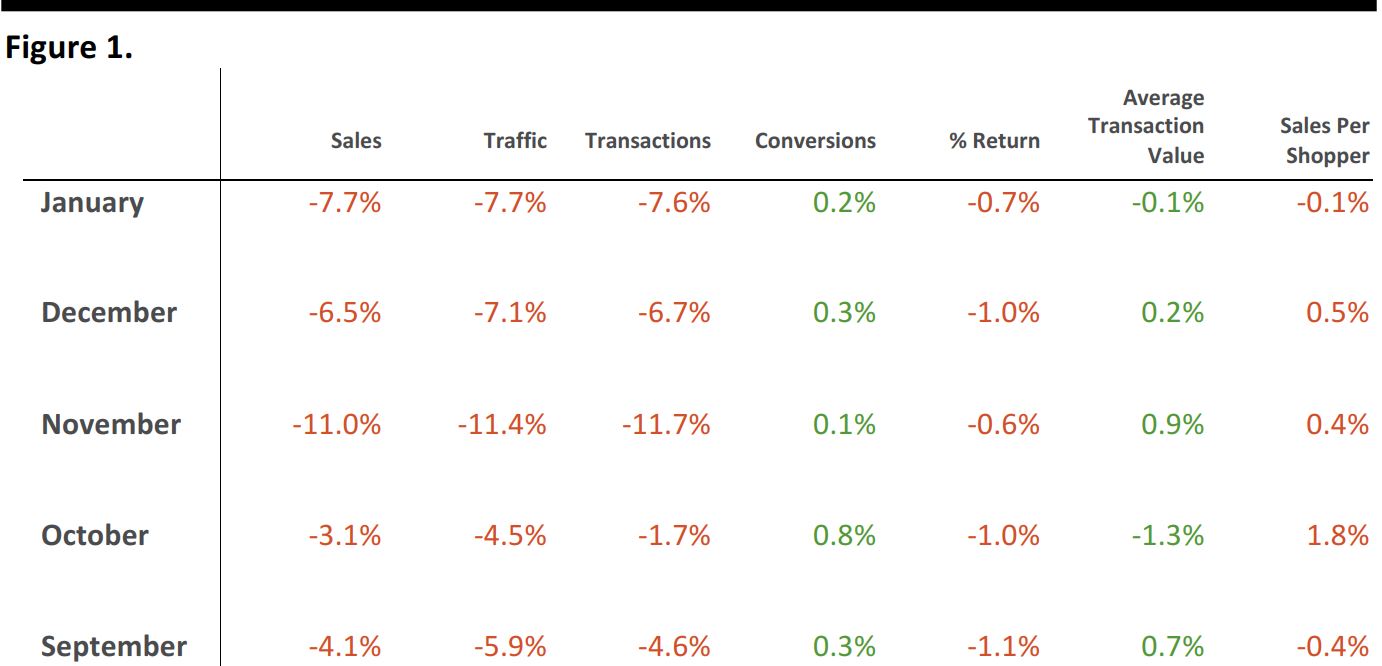

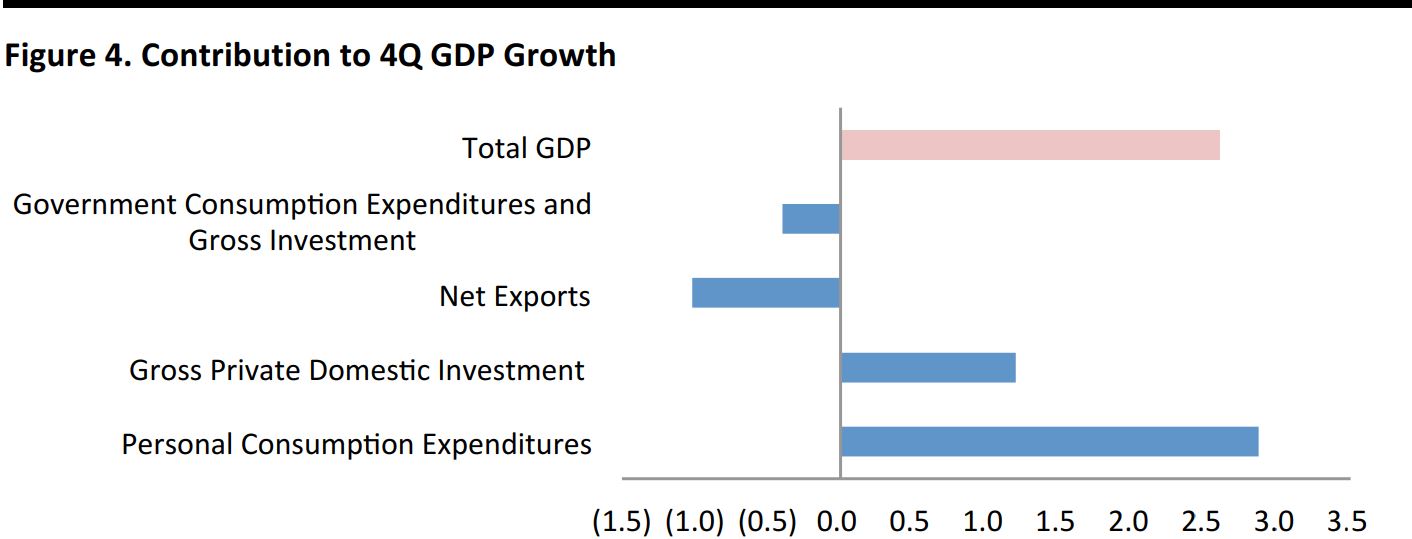

4Q GDP Growth Driven By Consumer Spending

Through December 31, 2014

Seasonally adjusted

Source: Bureau of Economic Analysis

- Personal consumption expenditures (PCE) grew at their fastest pace since 2006, up 4.3% in the final quarter, and accounted for 110% of the 4Q 2.6% GDP growth. Spending on durable goods rose 7.4%

- Government spending decreased 2.2%, reflecting a 12.5% drop in expenditures on national defense. Spending at the state and local levels increased modestly

- Net exports reduced GDP growth as the US dollar appreciated and the global economy weakened

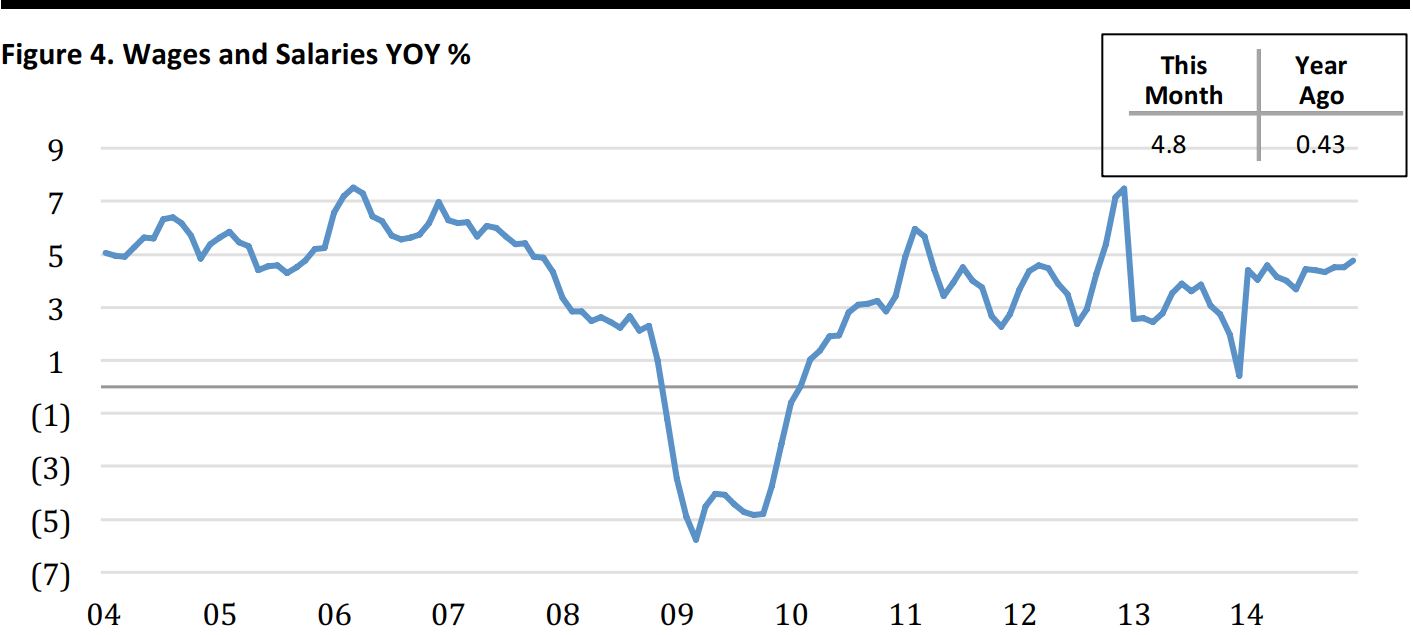

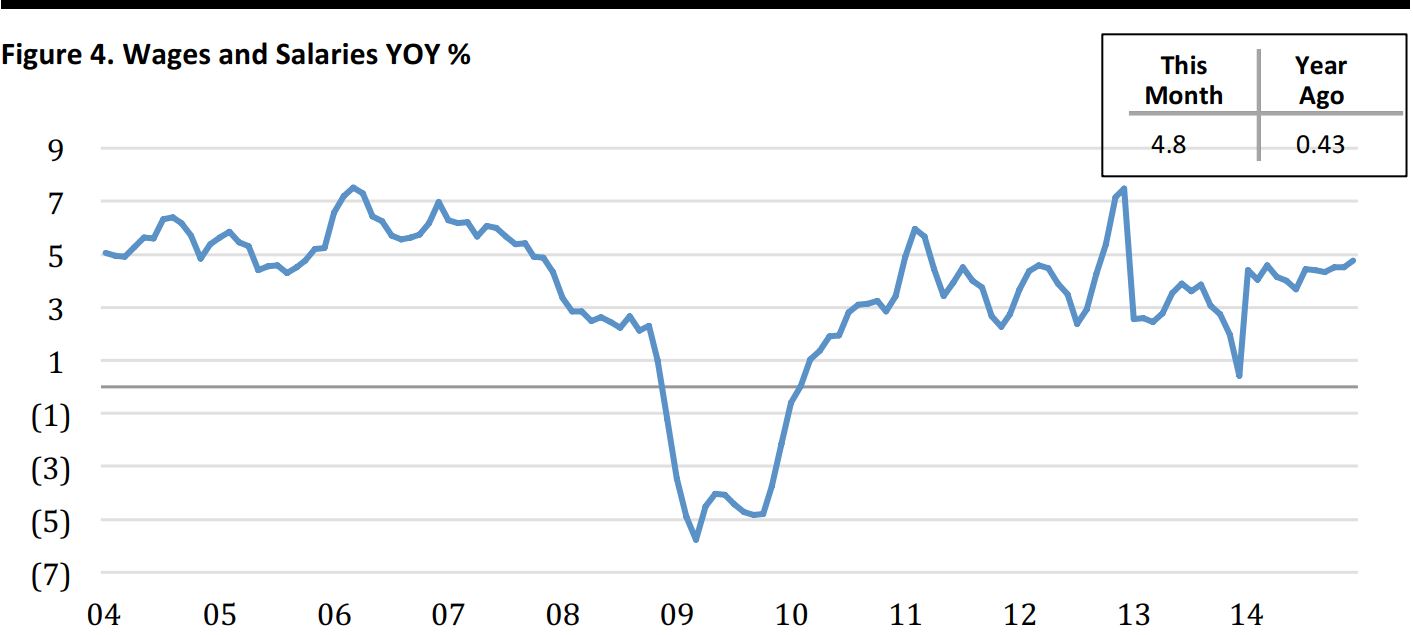

Growth In Wages And Salaries Accelerates In December

Through December 31, 2014

Source: Bureau of Economic Analysis

- Wages and Salaries expanded at a 4.8% YOY rate in December, the fastest pace in 2014

- Moreover, the increase beat the 4.6% YOY increase in Personal Income, laying the foundation for increased consumer spending in 2015

- In 2014 Wages and Salaries increased 4.3%, again beating the 3.9% gain in Personal Income. (Wages and Salaries were 50.5% of total Personal Income in 2014, up 30 basis points from 2013.)

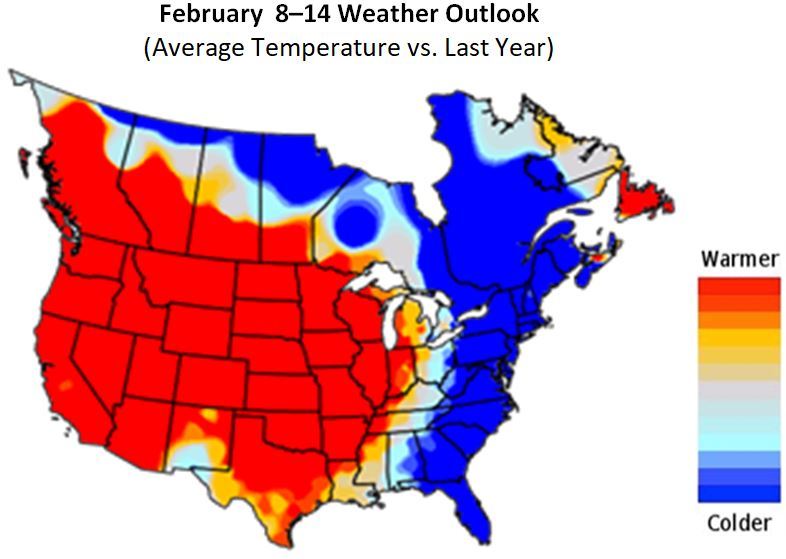

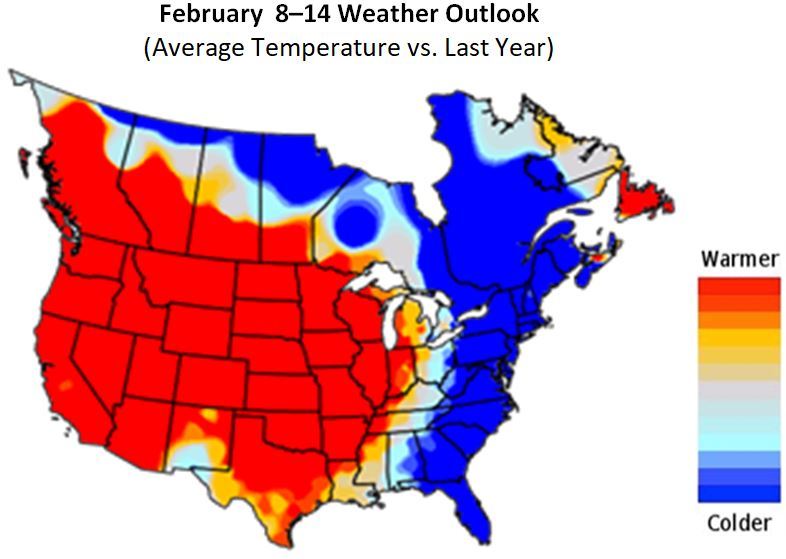

US WEATHER ANALYTICS: WEEK OF FEB. 8–14

Warm In The Western And Central States, Snowy In The Northeast

- As the Heart Warms, So Does the West. In the week leading up to Valentine’s Day, temperatures from the West Coast to the Midwest will remain warmer than both last year and normal. Merchants will enjoy healthy demand for early spring merchandise in these markets

- Cold Temperatures Persist in the East. Another shot of cold air will push into the eastern US through the middle of February. The colder conditions will help retailers move through winter inventory

- Twin Storm Tracks Continue into February. A series of weak storm systems will bring snow across Canada to the northeastern US while the southern stream will cause rain from southern California to the Gulf Coast. Areas in between will experience mostly dry conditions

- Weather-Driven Demand: Firewood -7%

Source: Planalytics

CHINA TECH HEADLINES

China’s Ctrip To Speed Up Expansion

(Feburary 4) South China Morning Post

China’s Ctrip To Speed Up Expansion

(Feburary 4) South China Morning Post

- com announced plans to accelerate international expansion on the heels of “blowout” growth in China’s domestic travel industry

- In January, the company acquired a majority stake in TravelFusion, a London-based website that facilitates airline and hotel bookings

- Chairman James Liang Jianzhang recently told the South China Morning Post that he still sees an enormous opportunity in China, where average tourism spending is one-tenth that of the US, and online tourism only accounts for one-tenth of the 180 billion Yuan ($28.8 billion) overall tourism market

- Moreover, Ctrip will focus on developing mobile apps to cater to the increasing number of Chinese who prefer to use smartphones, rather than PCs, to book travel

Alibaba Partners With LendingClub To Finance Purchases of Chinese Goods

(February 3) South China Morning Post

Alibaba Partners With LendingClub To Finance Purchases of Chinese Goods

(February 3) South China Morning Post

- Alibaba Group has partnered with San Francisco-based LendingClub, which matches small-business borrowers with lenders, to ease US consumer purchases of Chinese goods on alibaba.com

- According to the exclusive agreement, LendingClub will become the leading source of financing on alibaba.com, offering loans of up to $300,000 at annual rates of 0.5%–2.4%

- Analysts believe that Alibaba is building goodwill by aiding small businesses and merchants, which should create a foundation for a longer-term expansion. Alibaba is said to have selected LendingClub due to the greater speed and ease-of-use of its platform

EUROPE/UK RETAIL HEADLINES

Europe: Retail Sales Up 2.2% In December

Europe: Retail Sales Up 2.2% In December

(

Feburary 4) Eurostat

- Retail sales grew a robust 2.2% YOY across the European Union as a whole in December 2014 (excluding automotive fuel), a step up from the growth rates seen in preceding months. Across the euro currency bloc, growth was weaker, at 1.8% YOY

- German retail sales were up 3.7% YOY in December, and Spanish retail recorded a 5.3% surge in sales. Retail sales in recession-hit France were down 0.8% YoY

- All figures above are for all-retail, excluding automotive fuel, at current prices and adjusted for the number of working days

Grocery Pure Play Ocado Reports Its First Annual Profit

(February 3) Ocado

Grocery Pure Play Ocado Reports Its First Annual Profit

(February 3) Ocado

- The UK’s only major internet-only grocer, Ocado, this week reported a move from annual loss to profit before tax. In the year to November 2014, the company turned a profit before tax of £7.2 million, with total revenues up 19.8% to £949 million

- Ocado’s own retail sales grew 15.3% YOY. An agreement to service Morrisons grocery website contributed £45 million of revenue in 2014

- The company said average shopper numbers grew 18% YOY, but average basket sizes fell 1% 2014

Amazon’s European Sales Growth Slows

(January 30) Amazon

Amazon’s European Sales Growth Slows

(January 30) Amazon

- In its annual results, Amazon posted slowing sales growth in its core European markets, the UK and Germany

- In euro terms, German revenue growth slowed to 13.2% in 2014, from 16.8% in 2013

- In GB£ terms, UK sales growth fell to 8.6% in 2013, from 14.1% in 2013

- Sales through Amazon Germany totaled $11.9 billion in 2014 while revenues from Amazon UK reached $8.3 billion

Tesco Finally Pays Out To Its Former Execs

(February 3) Tesco

Tesco Finally Pays Out To Its Former Execs

(February 3) Tesco

- Tesco this week confirmed it had paid damages contractually due to its former CEO, Philip Clarke, and its former CFO, Laurie McIlwee. The payments totaled nearly £2.2 million

- The payments had been suspended following the revelation of accounting irregularities around commercial income, discovered in 2014

- The company said it was contractually obliged to make the payments unless it can legally establish a case of gross misconduct, and that it will seek to recover the payments if new information comes to light following an investigation underway by the Serious Fraud Office

Target Announces Plans To Add 15 New Stores In 2015

(February 2) Target press release

Target Announces Plans To Add 15 New Stores In 2015

(February 2) Target press release

Driverless Cars Get Closer To Reality As Uber Invests In A New Research Center

(February 2) Wall Street Journal, Financial Times and Uber Blog

Driverless Cars Get Closer To Reality As Uber Invests In A New Research Center

(February 2) Wall Street Journal, Financial Times and Uber Blog