FROM THE DESK OF DEBORAH WEINSWIG

Social Selling

This week, we found ourselves once again discussing the prospects for social commerce, which simply refers to buying and selling through social media websites. In this note, we distill our thoughts on why social commerce—which has gone through so many iterations already—has so far failed to take flight in Western markets.

False Dawns

The history of social commerce is one of false dawns. Major US and European retailers began opening transactional storefronts on Facebook back in 2010; ASOS, Gap, JCPenney and Nordstrom were among those to (briefly) sell on Facebook. Yet who remembers “F-commerce” now? Subsequently, Twitter launched “Buy” buttons in 2014—but the company abandoned them in 2016.

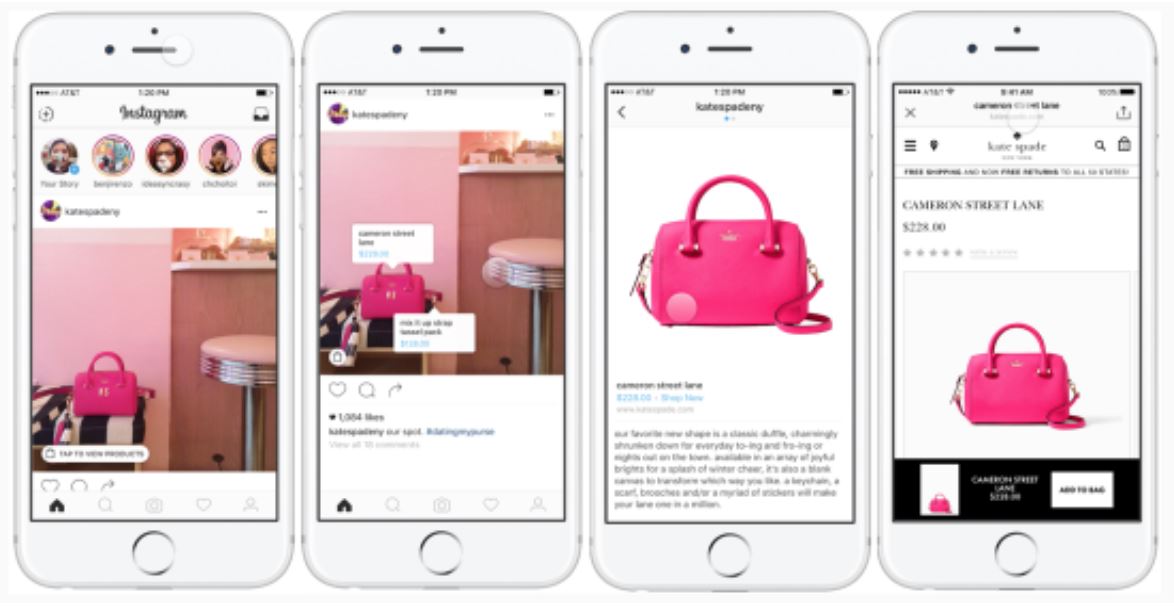

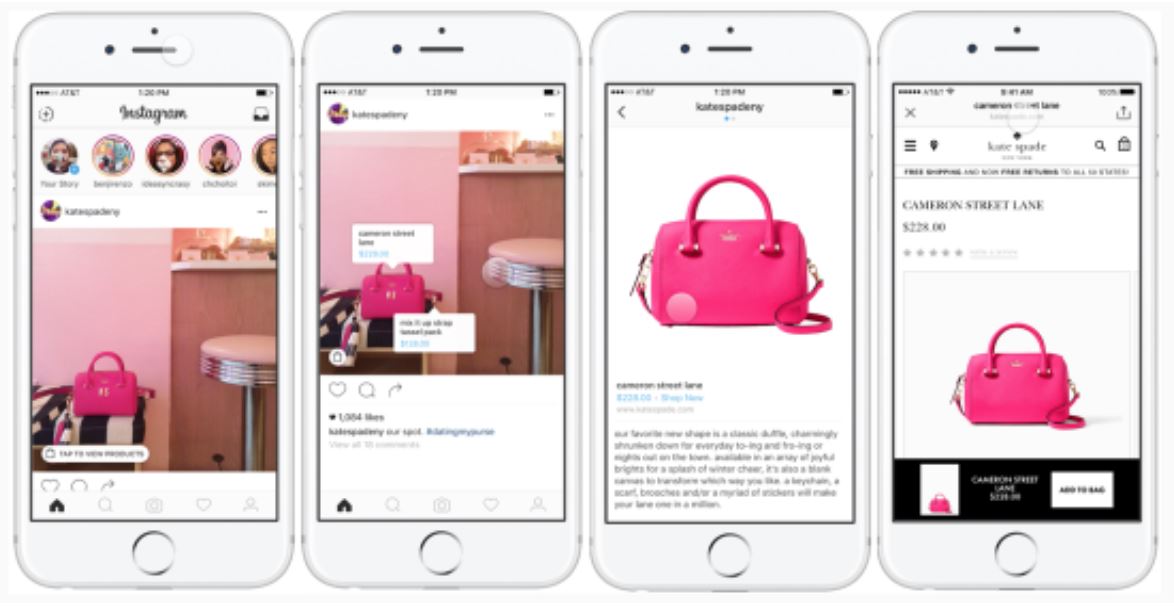

Still, social media companies continue to roll out new social commerce initiatives. Last year, Facebook opened up its Messenger app to retailers to use as a selling channel. And now, Instagram is testing new ways for users to click on an image in order to see more information about—and buy—an item that is pictured. Brands such as Kate Spade and J.Crew are trialing the service on Instagram.

Source: Instagram

What Is Social Commerce’s Value to Consumers?

The question should not be “Is social selling possible?” (yes, it is), but “What convenience does it deliver to shoppers?” Too often, the kinds of innovations listed above appear to originate from social media companies’ desire to monetize their platforms, rather than from them looking to solve a problem or make consumers’ lives easier. In the process, these companies are shoehorning commerce into sites that were not designed for shopping and into environments where many users are not looking to buy.

We think social commerce’s principal weakness is that it is typically not set up for comparison shopping. “Buy” buttons on social sites work on the assumption that consumers already have all the information they need and that they do not want to compare the product they are viewing with other products or check prices elsewhere. We think that is a long shot, and one that runs counter to the trend of more informed consumers: smartphone ubiquity and total connectivity mean that shoppers are constantly researching their purchases, comparing specifications between products and comparing prices between retailers.

Social Media’s Value to Retailers and Consumers

Two recent surveys indicate that social media has much more value as tool for brand engagement than as a retail channel. A survey conducted by the Pew Research Center found that 39% of US adults polled had shared their views on companies on social media, but that only 15% had ever bought something through a link on a social media site. And a survey by digital commerce firm Sumo Heavy Industries found that 45% of US consumers polled said that social media sites had had some influence on their purchasing decisions—yet only 18% said that they had ever purchased something directly through social media.

So long as social commerce remains focused on simply putting a single product in front of a consumer and adding a “Buy” button, we think companies will find it tough to push up participation rates.

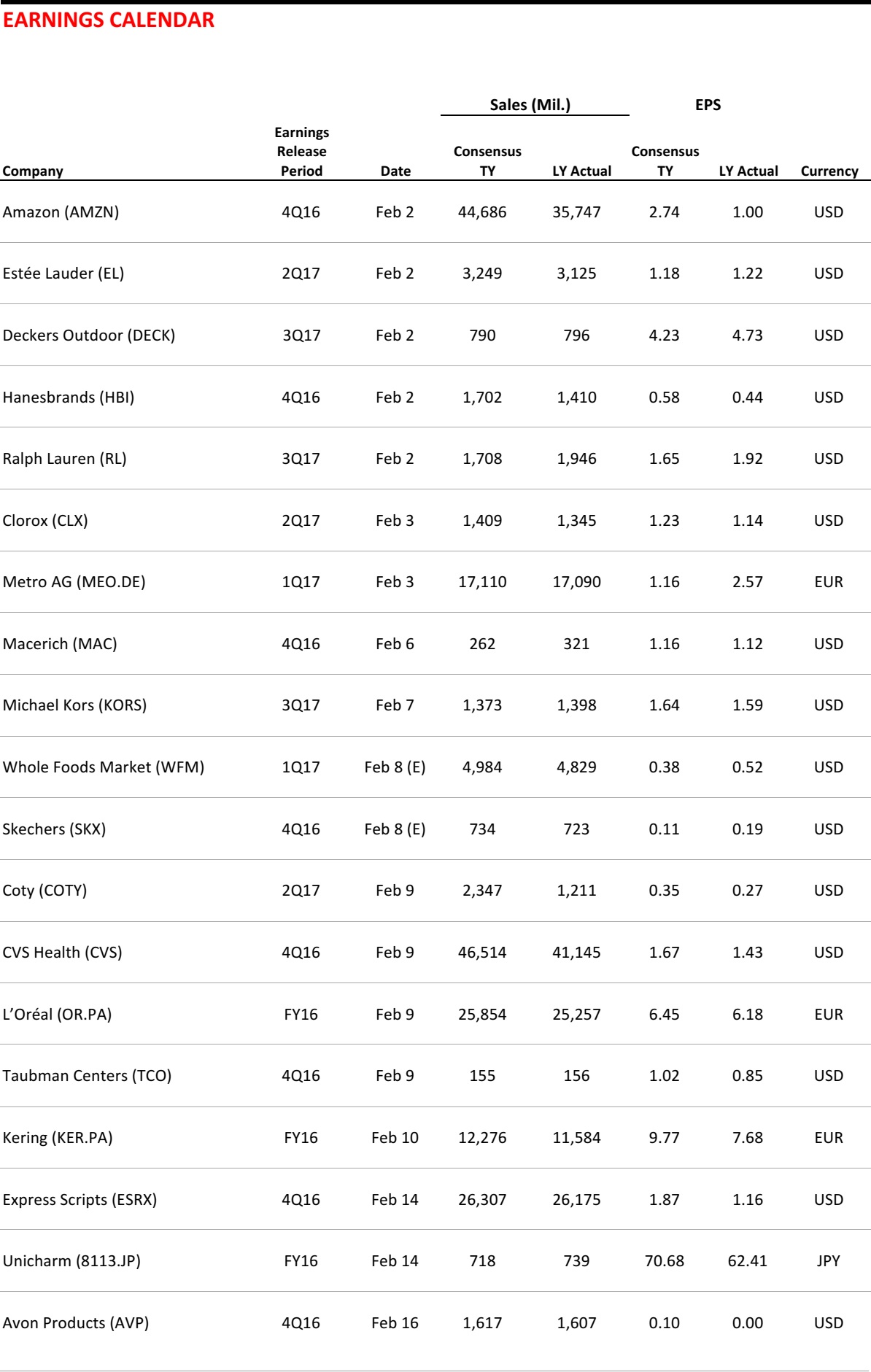

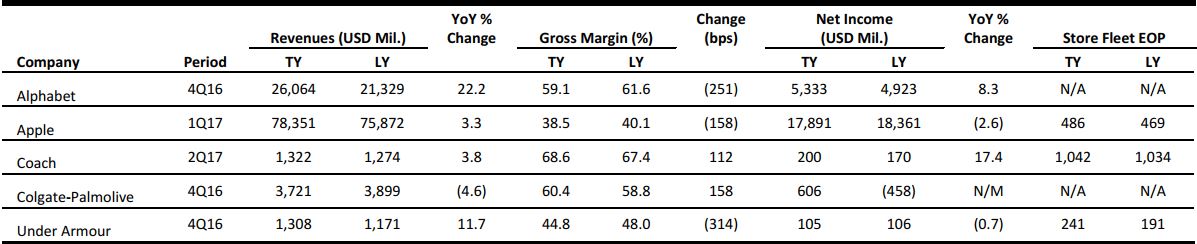

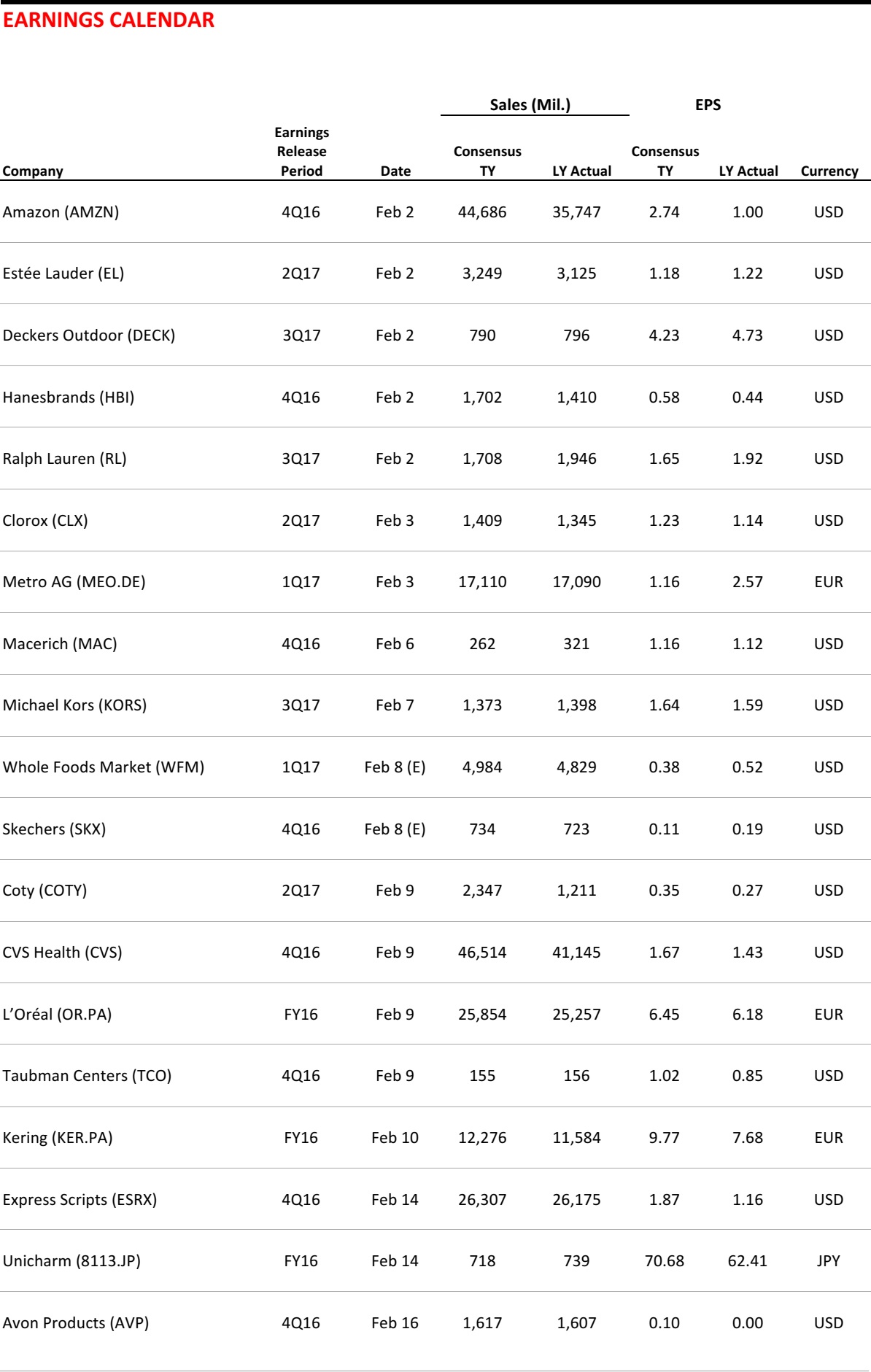

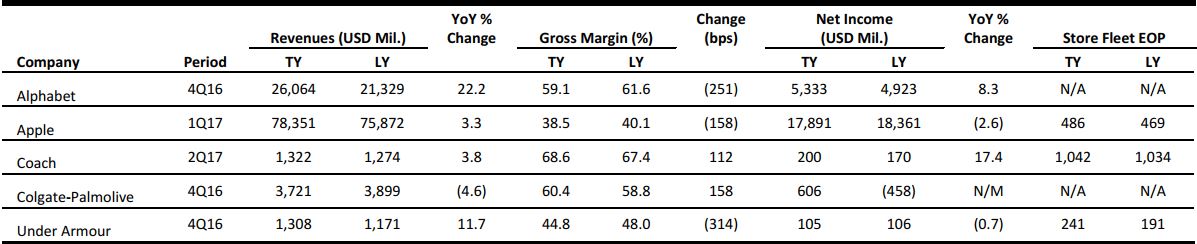

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

NRF/Forrester Study Finds Mobile Investments Pay Off in Evolving Retail Landscape

(January 31) Press release

NRF/Forrester Study Finds Mobile Investments Pay Off in Evolving Retail Landscape

(January 31) Press release

- Amid a seismic shift in how US consumers shop, retailers are vying for time on their customers’ screens across all their devices—before, during and after a purchase—according to a recent report from the National Retail Federation and Forrester. In 2016, direct online sales accounted for 11.6% of total US retail sales ($394 billion), but digital touchpoints actually impacted an estimated 49% of total US retail sales, Forrester estimated.

- In response, retailers are focusing on several key areas to enhance customer experiences across all touchpoints. For example, 54% of retailers note that mobile is one of their top three initiatives in 2017; others include marketing (46%), site merchandising (42%) and omnichannel efforts (22%).

Under Armour Debuts “Made in the US” Gear

(January 30) The Washington Post

Under Armour Debuts “Made in the US” Gear

(January 30) The Washington Post

- The black sports bra and matching leggings that Under Armour began selling Monday do not look much different from the rest of the workout attire on its website. But, in fact, the garments were made in the US, marking a key milestone in the company’s ambitious bid to significantly rethink its manufacturing strategy.

- Just 2,000 of the garments are available for sale—1,000 each of the bras and leggings—representing a small-scale start. But the process of creating them offers a look at what the future of Under Armour, and the wider apparel industry, might hold.

Online Grocery Sales Set to Surge, Grabbing 20% of Market by 2025

(January 30) CNBC.com

Online Grocery Sales Set to Surge, Grabbing 20% of Market by 2025

(January 30) CNBC.com

- Online grocery shopping could grow fivefold over the next decade, with American consumers spending upwards of $100 billion on food-at-home items by 2025, according to a recent report from the Food Marketing Institute and Nielsen. Around a quarter of American households currently buy some groceries online, up from 19% in 2014, and more than 70% will engage with online food shopping within 10 years, according to the report.

- The report also found that, of those who will buy digitally, 60% expect to spend about a quarter of their food dollars online in 10 years. Millennial shoppers surveyed indicated that they were more willing to buy groceries online in the future than did other demographic groups surveyed.

Selfie Generation Turns Makeup Chain Ulta into Rare Retail Star

(January 27) Bloomberg.com

Selfie Generation Turns Makeup Chain Ulta into Rare Retail Star

(January 27) Bloomberg.com

- In the Instagram era, one retailer has found a way to capitalize on the selfie craze. Ulta Salon, Cosmetics & Fragrance, where women can buy a broad range of cosmetics and get their hair styled on-site, was a rare bright spot in what was otherwise a disastrous 2016 for US retailers.

- Ulta’s mobile app has a feature called Glam Lab that allows shoppers to take selfies and apply virtual makeup before they make a purchase. At Ulta’s 950 stores, customers can also visit a professional skin therapist for “face mapping,” and get their eyebrows groomed. Because Ulta sells brands at all price points, it has the ability to capture market share from drugstore chains and high-end department stores such as Bloomingdale’s.

Retailers May Dominate Bankruptcy Headlines in 2017

(January 31) TheDeal.com

Retailers May Dominate Bankruptcy Headlines in 2017

(January 31) TheDeal.com

- The number of bankruptcy filings by US retailers with at least $250 million in liabilities nearly doubled in 2016. Of the seven big retail filings in 2016, three chains suffered through large-scale closures. A fourth, clothing retailer Pacific Sunwear of California, closed hundreds of stores in the months before its bankruptcy, but only shuttered 10 while in Chapter 11.

- An oversupply of retail space in the US and changing demographics could lead to some major retail filings in 2017. The market for clothing retailers seems particularly soft, as teenagers are concentrating their discretionary spending on experiences instead of fashion labels.

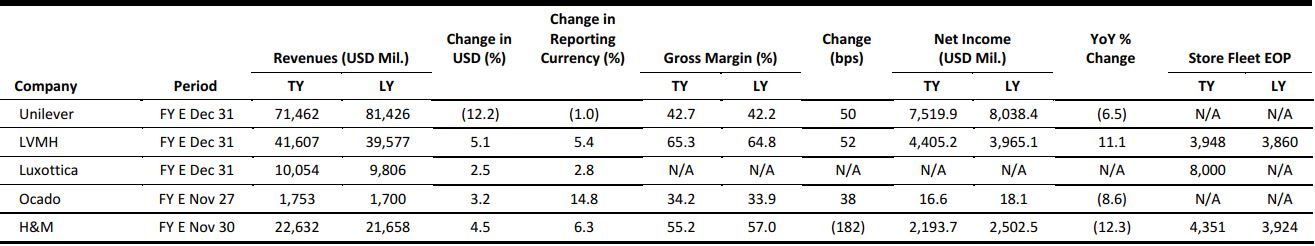

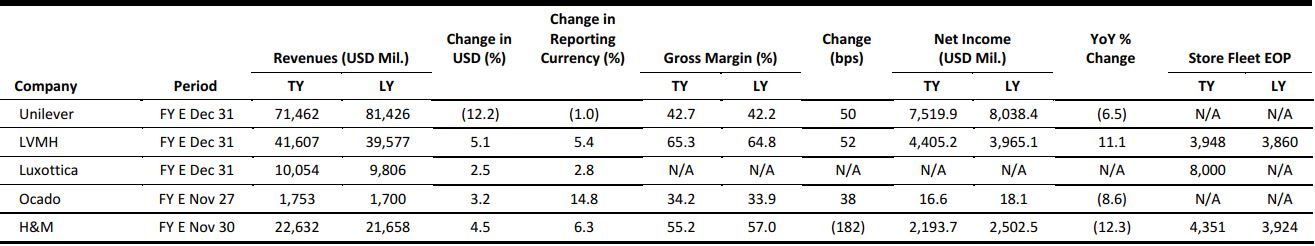

US RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Tesco and Booker Group Announce Agreement to Merge

(January 27) Company press release

Tesco and Booker Group Announce Agreement to Merge

(January 27) Company press release

- The UK’s biggest grocery retailer, Tesco, and the UK’s largest cash-and-carry wholesaler, Booker Group, have announced an agreement to merge. As of market close on January 26, Tesco’s capitalization was about £15.3 billion (US$19.3 billion), while Booker Group’s was some £3.2 billion (US$4.0 billion), making the deal an acquisition, in practice.

- Per the agreement, Booker is valued at £3.7 billion (US$4.6 billion), and Booker shareholders will receive 0.861 new Tesco shares and 42.6 pence (US$0.53) in cash for every Booker share. If the merger is approved by the Competition and Markets Authority, it will give Booker shareholders ownership of 16% of Tesco.

British Business and Consumer Confidence Resilient at Start of 2017

(January 29) Press release

British Business and Consumer Confidence Resilient at Start of 2017

(January 29) Press release

- The Confederation of British Industry (CBI) announced that growth in both private sector and consumer confidence was 10% in the three months ended January 2017. Though the rate slowed from 17% in December, it was similar to November’s 9% and October’s 8%. CBI surveyed 753 businesses in the manufacturing, distribution and service sectors to arrive at the figure.

- Retailers reported “decent growth” and output growth among manufacturers was strong, while growth was flat in the service sector, the CBI said. The industry body expects similar growth, of approximately 12%, over the next three months.

Auchan Transforms the First of Its Stores Under the Single Banner Initiative

(January 30) RetailAnalysis.igd.com

Auchan Transforms the First of Its Stores Under the Single Banner Initiative

(January 30) RetailAnalysis.igd.com

- French retail group Auchan has begun converting its Simply Market stores to the Auchan banner as part of an initiative to streamline the group’s identity. A store in Saint Germain lès Corbeil is the first of 14 supermarkets set to be rebranded as Auchan Supermarché in the first half of 2017.

- The transformation includes new flooring, fixtures and fittings, and more focus on fresh and center-store categories. The group has employed additional staff in each store, in particular for the beauty and wine departments.

Austrian Post to Launch Its Own Online Marketplace

(January 30) EcommerceNews.eu

Austrian Post to Launch Its Own Online Marketplace

(January 30) EcommerceNews.eu

- Postal service company Austrian Post announced that it will launch its own online marketplace, Shöpping.at, in April 2017. About 65 Austrian retailers are expected to sell their merchandise on the website.

- Several small retailers are reported to be among those that have signed up to sell on the new marketplace alongside big names such as department store chain Kastner & Öhler, electronics retailer E-tec and sporting goods company GigaSports. The Shöpping.at site aims to be an alternative to Amazon, Zalando and eBay.

Joules Reports 16.2% Increase in 1H17 Revenues

(January 31) Company press release

Joules Reports 16.2% Increase in 1H17 Revenues

(January 31) Company press release

- British fashion retailer Joules reported a 16.2% increase in its first-half 2017 group revenues, which reached £81.4 million (US$101.8 million). Retail revenues grew by 15.8%, with online sales up 30.3% and store sales up 11.2% during the period.

- Wholesale revenues grew by 17.1%, which the company noted was a reflection of “the growing appeal of the Joules brand in the UK and target international markets.” It added that international revenue bounced by 39.3% and represented 10.6% of total group revenues for the period.

ASIA TECH HEADLINES

South Korea’s AIM Raises $1.6 Million for Its Mobile Trading Service

(February 1) TechCrunch.com

South Korea’s AIM Raises $1.6 Million for Its Mobile Trading Service

(February 1) TechCrunch.com

- Seoul-based fintech startup AIM has closed $1.6 million in seed funding to bring its artificial intelligence–powered app for financial investments to market in South Korea and, potentially, other parts of Asia.

- AIM has developed a system that works alongside existing investment institutions to allow users in South Korea to make trades and investments via smartphone. Financial institutions are set to be one of the first industries to be impacted by artificial intelligence, and industry watchers expect to see plenty more venture capital investment in companies such as AIM in the future.

Chinese News Reading App Toutiao Acquires Flipagram

(February 2) TechCrunch.com

Chinese News Reading App Toutiao Acquires Flipagram

(February 2) TechCrunch.com

- Chinese news aggregator Toutiao is acquiring popular video app Flipagram for an undisclosed amount. Flipagram will remain an independent product for the time being and the company’s team will stay in its own office in the US.

- Toutiao’s news reading app recommends articles and videos for users. The company plans to integrate Flipagram videos into those recommendations, which should improve Flipagram’s reach. Toutiao is also likely to expand beyond China in the months to come.

China’s Ant Financial to Buy MoneyGram for $880 Million

(January 27) Financial Times

China’s Ant Financial to Buy MoneyGram for $880 Million

(January 27) Financial Times

- Ant Financial, the digital payments arm of Chinese e-commerce group Alibaba, announced an agreement to acquire US-listed money transfer service MoneyGram for about $880 million in cash.

- The transaction highlights the expansion drive by Ant Financial, which gained about 100 million clients last year, taking its total above 500 million. The purchase of MoneyGram, which competes with Western Union, would give Ant Financial a platform for expanding its services to many other parts of the world.

Toshiba Said to Plan to Sell Chip Unit Stake to Multiple Buyers

(January 26) Bloomberg.com

Toshiba Said to Plan to Sell Chip Unit Stake to Multiple Buyers

(January 26) Bloomberg.com

- Toshiba is planning to split the sale of a stake in its chip unit among several investors, including Canon and private equity funds, a person familiar with the matter said. Canon will consider an investment if invited, said Hirotomo Fujimori, a Tokyo-based spokesman for Canon.

- Toshiba has said it is considering spinning off its chip operations to help pay for write-downs at its nuclear unit, which could run into the billions of dollars. The conglomerate aims to retain control of the chip operations after selling a 20%–30% stake, and bringing in multiple investors would help with that goal.

LATAM RETAIL & TECH HEADLINES

Luxottica Buys Brazilian Retailer Óticas Carol in €110 Million Deal

(January 30) Reuters.com

Luxottica Buys Brazilian Retailer Óticas Carol in €110 Million Deal

(January 30) Reuters.com

- Italian eyewear group Luxottica has agreed to buy Brazilian optical chain Óticas Carol for €110 million (US$117 million) to expand its retail footprint in Brazil. Luxottica, which signed a US$50 billion merger deal with top lensmaker Essilor earlier in January, is already present in Brazil through a network of Sunglass Hut shops, a manufacturing plant and its wholesale business.

- Óticas Carol operates around 950 outlets selling both prescription frames and sunglasses, with annual revenue of around €200 million. Its main shareholders are investment funds 3i Group, Neuberger Berman and Siguler Guff & Company.

Dubai’s Abraaj Buys Stake in Chilean Homeware Retailer

(January 28) ArabianBusiness.com

Dubai’s Abraaj Buys Stake in Chilean Homeware Retailer

(January 28) ArabianBusiness.com

- Dubai-based investment firm Abraaj Group announced that it has acquired a majority stake in Casaideas, a leading home design and home decorations business with a growing market presence in Chile, Peru and Bolivia. Founded in Chile in 1993, Casaideas has since expanded its operations to 33 stores in Chile, 16 stores in Peru and seven additional franchise units in Bolivia.

- The transaction represents Abraaj’s first direct investment in Chile, rounding out the group’s investment presence in the Pacific Alliance countries of Mexico, Peru, Colombia and Chile. Homeware and furnishings is the seventh-largest consumer retail category by market share in Latin America and grew at a 6% CAGR between 2010 and 2015.

Carrefour Seeks Brazil Unit IPO in Second Quarter

(January 31) Reuters.com

Carrefour Seeks Brazil Unit IPO in Second Quarter

(January 31) Reuters.com

- France’s Carrefour aims to price the IPO of its fast-growing Brazilian unit as early as the second quarter, signaling that demand for new equity offerings in Latin America’s biggest economy is gaining traction.

- Carrefour expects the IPO to take place in a fresh round of stock offerings slated for late April. The company is confident that investors may value the unit at a 25% premium to larger peer GPA’s R$14.5 billion (US$4.6 billion) market capitalization.

Mexico Says NAFTA Negotiations Should Start in May

(February 1) WSJ.com

Mexico Says NAFTA Negotiations Should Start in May

(February 1) WSJ.com

- President Enrique Peña Nieto of Mexico said that the clock was starting on a remaking of the North American Free Trade Agreement (NAFTA), with the government beginning a 90-day period to consult with the country’s private sector and prepare a negotiating position. The US is expected to launch a parallel process, but Washington has not yet given the necessary 90-day notice to Congress that it intends to seek fast-track consideration of a revamped accord.

- Mexico has shown a willingness to review NAFTA while defending its commitment to free trade and rejecting outright US President Donald Trump’s demands that Mexico pay for a wall the US plans to build along the border to stop illegal immigration.

Auchan Transforms the First of Its Stores Under the Single Banner Initiative

(January 30) RetailAnalysis.igd.com

Auchan Transforms the First of Its Stores Under the Single Banner Initiative

(January 30) RetailAnalysis.igd.com