Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

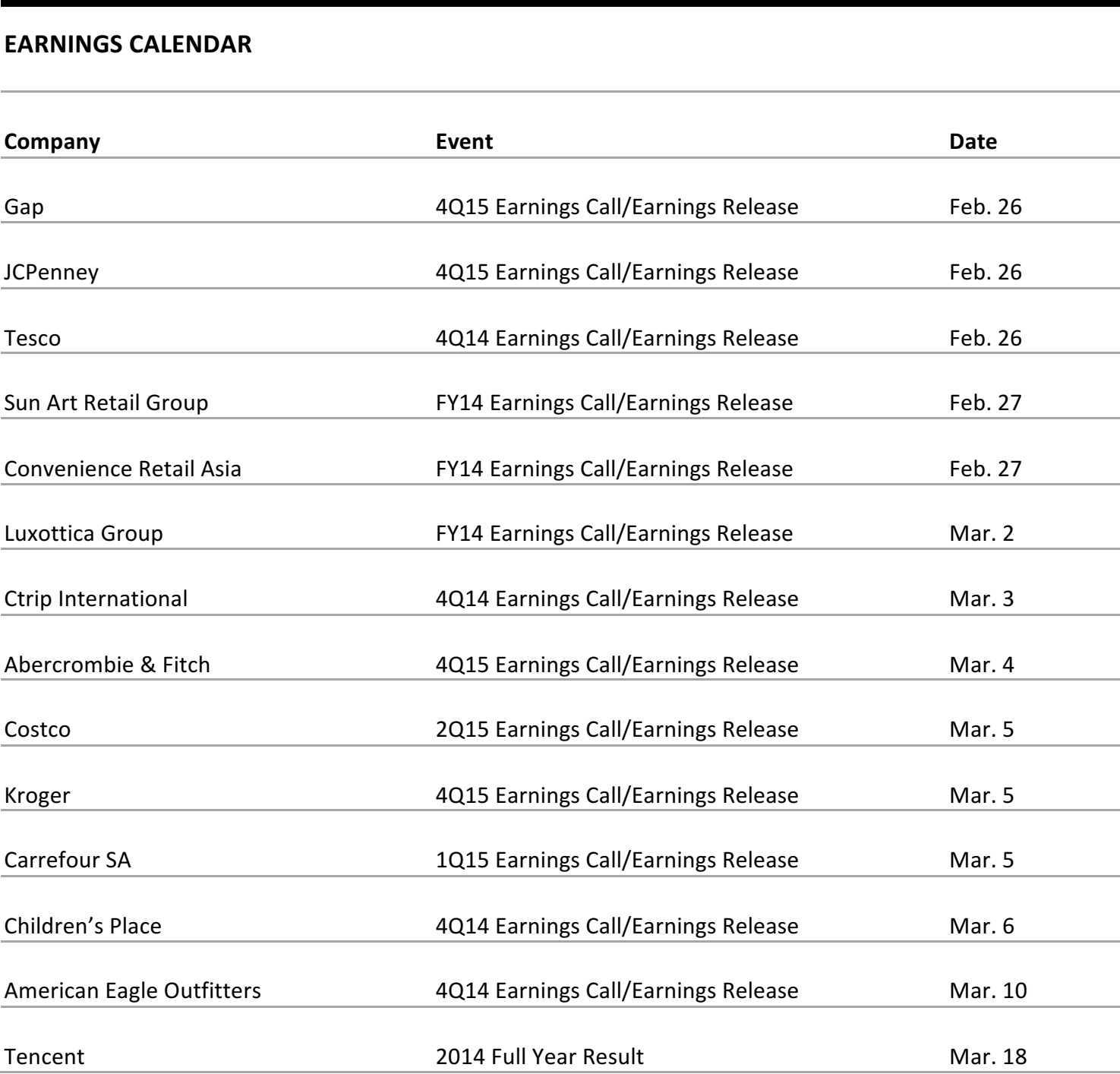

As has become abundantly clear, the future of retailing is fast evolving into an “anywhere, anyplace and anytime” (omnichannel) model, with the consumer calling the shots. Last week, we wrote about the preponderance of webrooming—the practice of researching online to find just the right item and then buying that item in a store. Shoppers still want to get physical when it comes to buying things, though they are armed with a lot more price and product information than was possible even just a few years ago. The explosion in mobile apps has also been a major change agent. As a just released Harvard Business Review study put it, the next billion shoppers to move online will be making their digital decisions on mobile devices. That’s very different from how the first billion ecommerce consumers shopped. Indeed, according to a recent Flurry survey, overall mobile app usage—based on usage “sessions,” which are defined as instances of a user launching and actually using an app—climbed 76% in 2014. By far the biggest growth spurt came from using apps for retail, with the “lifestyle and shopping” category rising 174% YoY on iOS and Android. On Android alone, sessions more than tripled, for a gain of 220%. Retailers have been spurred to action. Success requires the merging of online and offline into a single retail organization. However, with some notable exceptions (Macy’s and Nordstrom come to mind), the industry is still lagging behind in setting up even the most basic mobile-commerce capabilities. At least that was the upshot of the December 2014 study from Boston Retail Partners (Figure 1), which found that only 24% of retailers surveyed had a system that worked well for a “buy online, pick up in the store” offering, while just 29% said they had successful systems for accepting returns across channels. Inventory visibility across channels, and various combinations of buying or reserving an item in one channel and picking up or shipping from another, were areas that retailers said needed the most improvement. Mobile coupons, smartphone apps, personalization and a mobile wallet were on the long list of features that retailers plan to add within the next three years. It’s time to get moving.

*Includes price, location, availability and research Source: Boston Retail Partners, 16th Annual Point-of-Sale/ Customer Engagement Survey, January 10, 2015

US MACROECONOMIC UPDATE

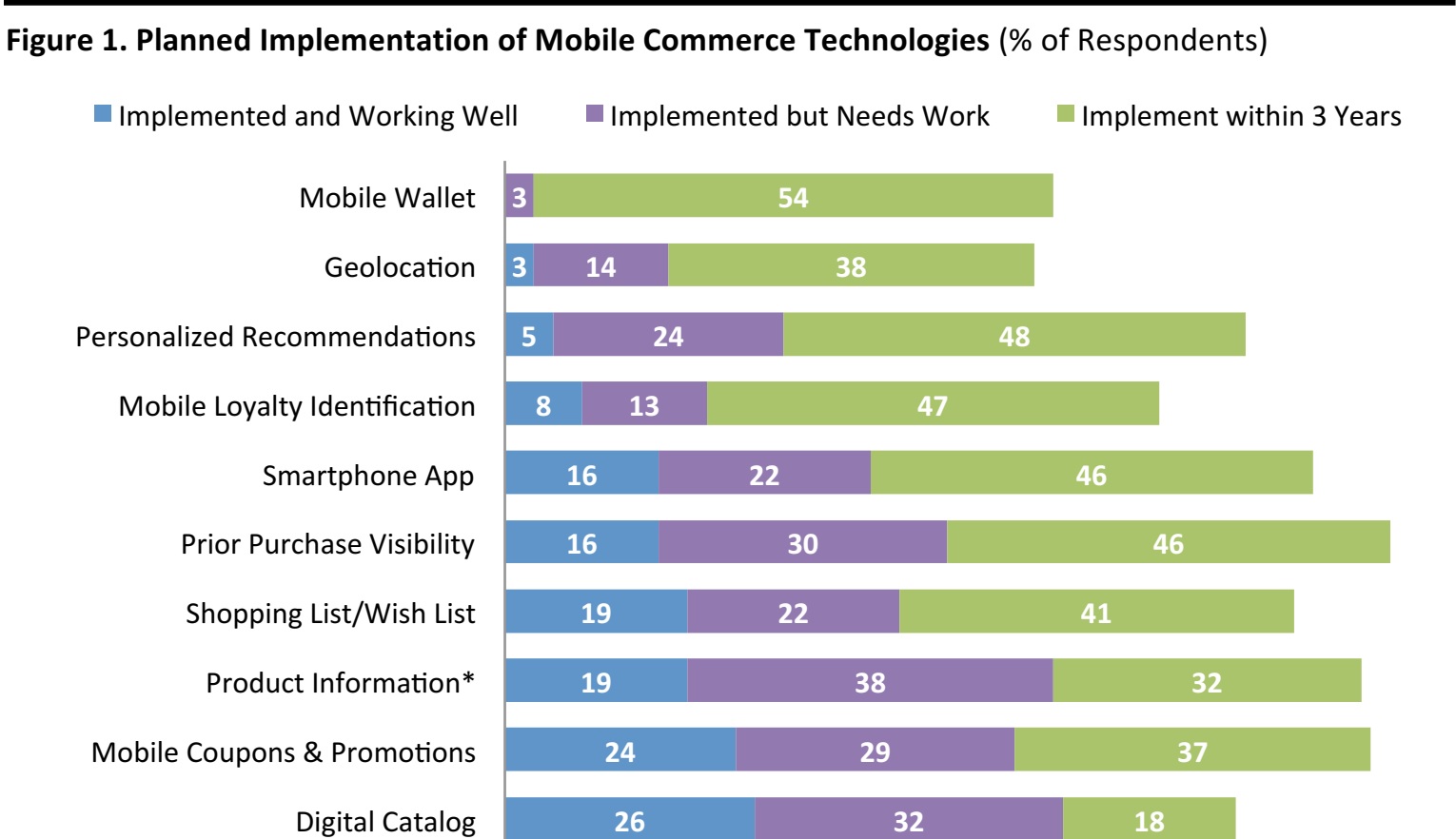

Existing-Home Sales Declined in January to Their Lowest Rate in Nine Months

Through January 31, 2015

Seasonally adjusted

Source: National Association of Realtors

Through January 31, 2015

Seasonally adjusted

Source: National Association of Realtors

- Existing-home sales fell 4.9% to a seasonally adjusted annual rate of 4.82 million in January (the lowest since last April’s 75 million annual rate) from an upwardly revised 5.07 million in December. Despite January’s decline, sales are higher by 3.2% than a year ago.

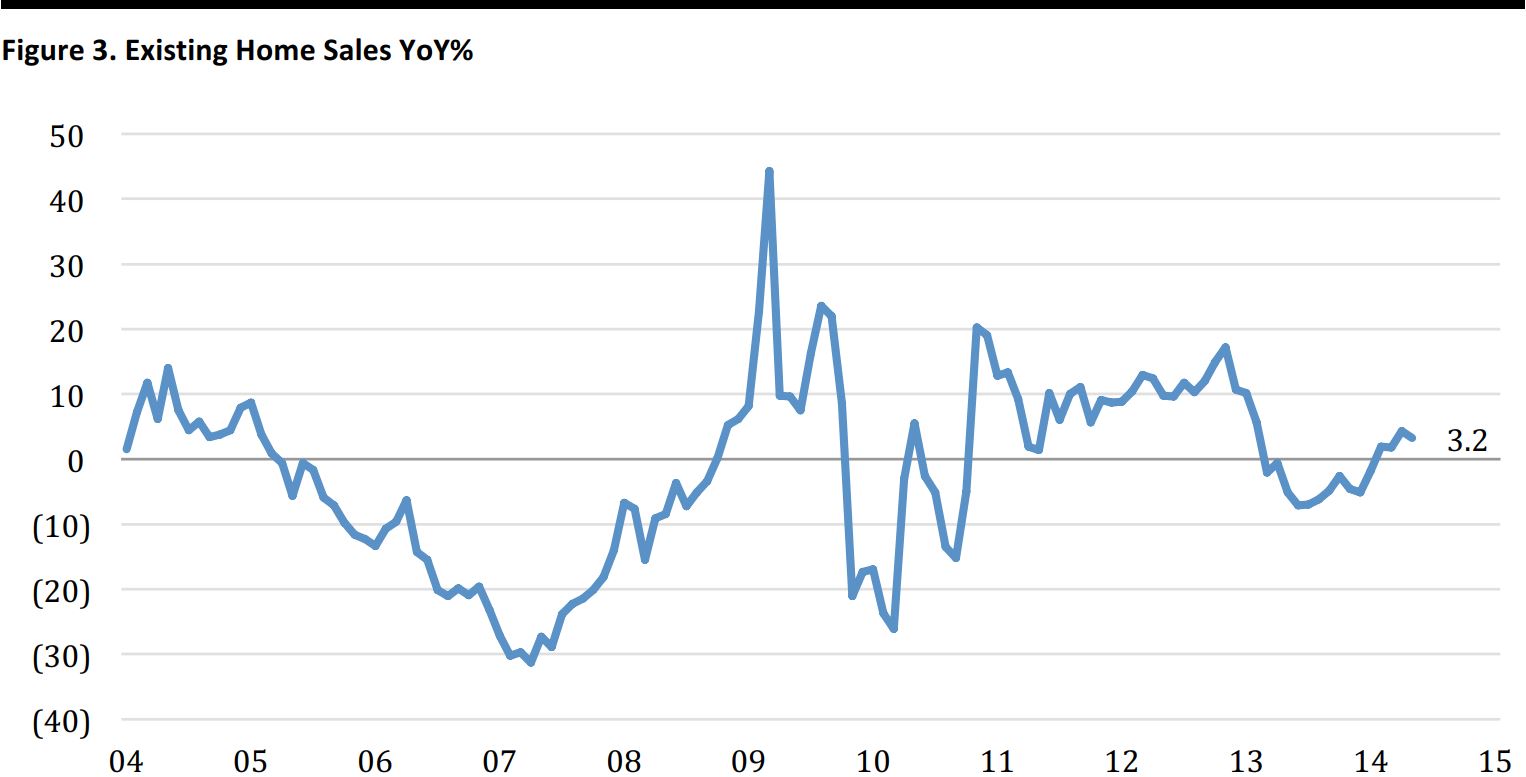

S&P/Case-Shiller 20-City Home Price Index Closes 2014 With a 4.5% YoY Increase

Through January 31, 2015

Sources: S&P Dow Jones and CoreLogic

Through January 31, 2015

Sources: S&P Dow Jones and CoreLogic

- San Francisco and Miami, where prices rose 9.3% and 8.4% respectively over the last 12 months, reported the strongest gains in December, while Las Vegas led the declining annual returns with a 6.9% slump. Month-on-month, December’s comparisons were mixed, and the 20-city index reported a 0.1% increase.

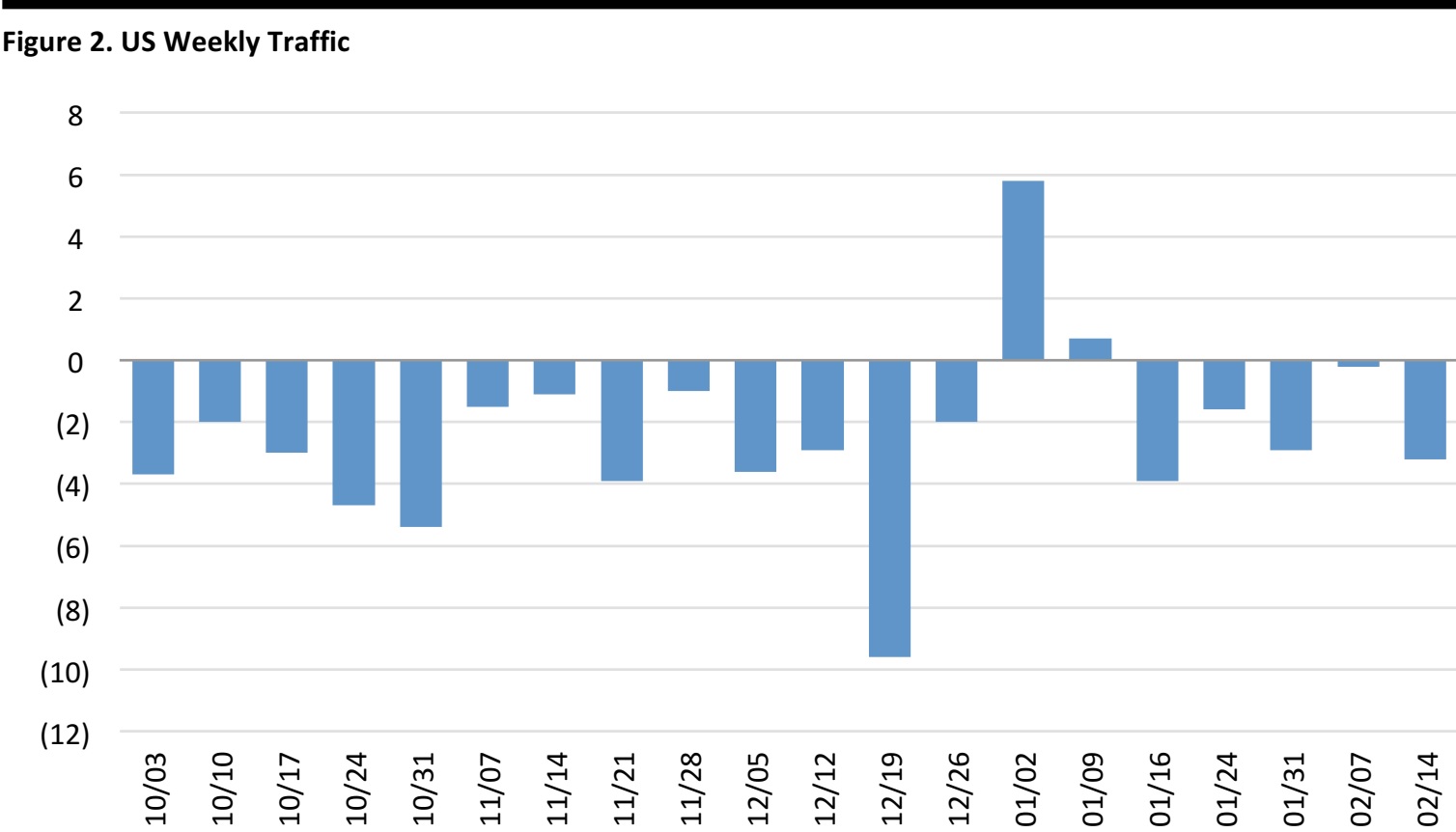

US RETAIL TRAFFIC

US Store Traffic Falls, Led by Declines at Electronics Retailers

Through February 14

Source: ShopperTrak

Through February 14

Source: ShopperTrak

- US store traffic decline worsened, with a 3.2% drop YoY for the week ended February 24, a 220 basis point drop from the prior week.

- Traffic at electronics retailers declined 10%.

- Apparel stores continued to enjoy YoY traffic growth, rising 2% from year ago levels when severe winter weather and snowstorms likely deterred shoppers.

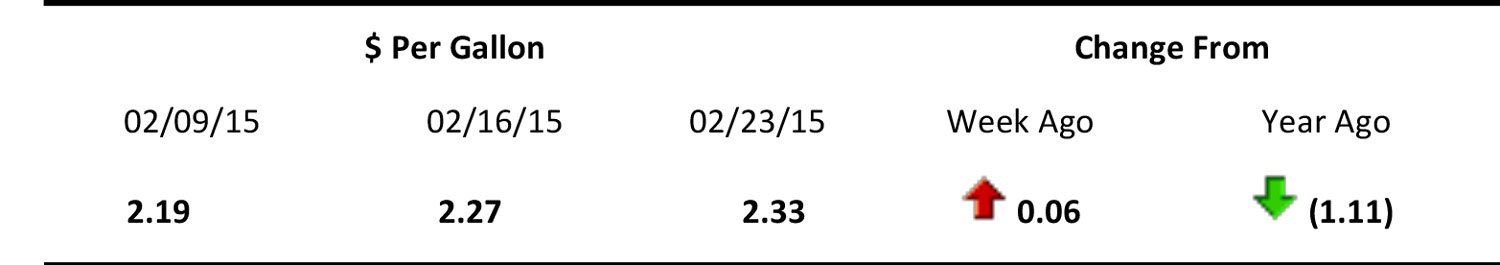

US REGULAR GASOLINE PRICES

Source: US Energy Information Administration

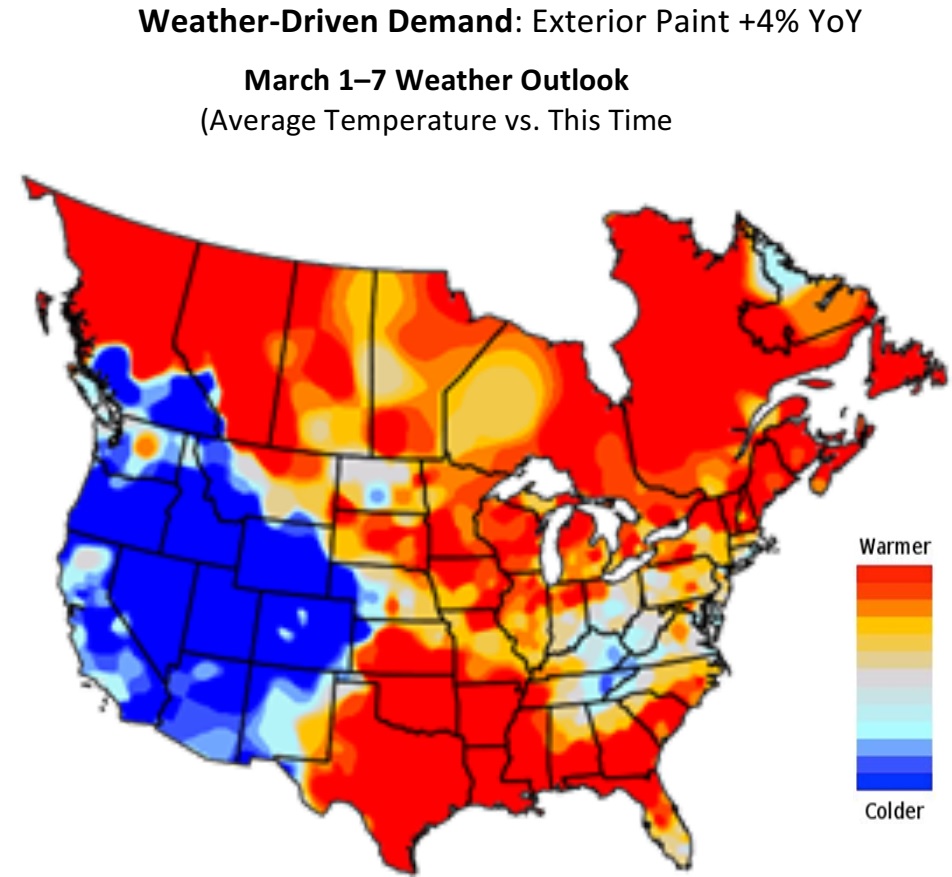

US WEATHER ANALYTICS: WEEK OF March 1–7

March Will Start on a Warmer Note than It Did Last Year

- Warmer Start to March Last year we experienced the coldest first week of March since 1996, with near normal rain and snow fall. This year, the eastern two-thirds of the continent will start the week warmer than at this time last year, but cooler than is normal in many markets. Arctic temperatures will creep back in late week across the Mid-Atlantic and Northeast.

- The West Remains Cool The western US will experience another week of temperatures averaging below those of temperatures this time last year, although near normal. The West will also become unsettled as low pressure systems dive southeastward across the region, bringing rain and snow showers.

- Warmth Focused in the South The central south, Gulf Coast, and parts of the Southeast will trend warmer than both last year and normal. These regions will provide the strongest opportunity for spring apparel and outdoor categories.

- Active Storm Pattern Continues Wintry precipitation will continue to cause travel headaches as a series of storm systems move across the continent, bringing periods of rain, ice and snow. We are also entering severe weather season across the Deep South. A late week storm may impact the Southeast with severe weather.

Source: Planalytics

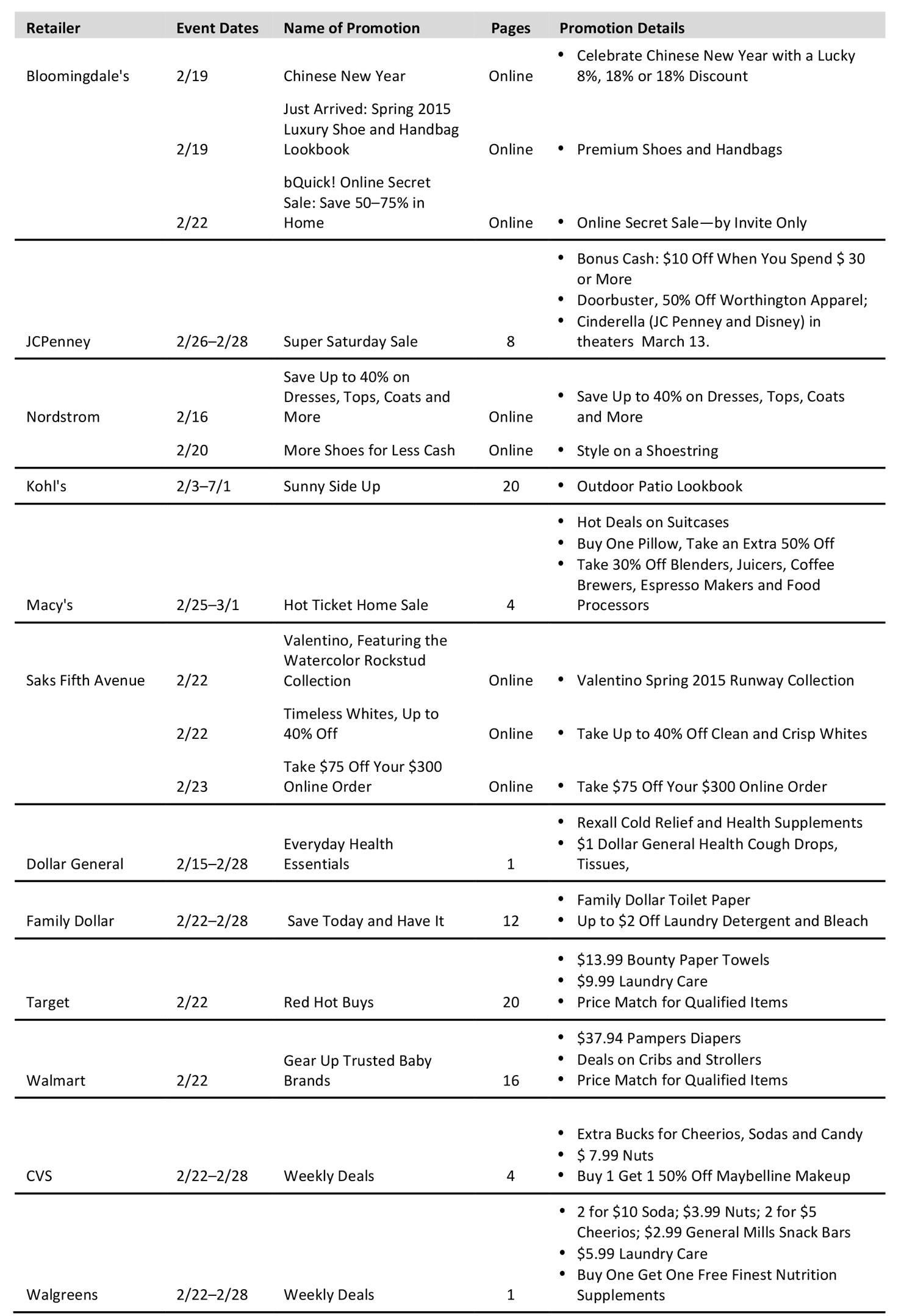

US PROMO HIGHLIGHTS

- JCPenney featured exclusive Disney Collection Cinderella offerings online and in stores as a tie-in with the movie Cinderella, in theatres March 13.

- Bloomingdale’s and Macy’s offered clearance discounts for home categories .

- Target cut its free-shipping minimum to $25 .

- On a YoY basis, Target offered a $5 gift card on select items in 2014 versus a $10 gift card this year; The 10% off perk for using the Cartwheel app was no longer offered this year.

US RETAIL HEADLINES

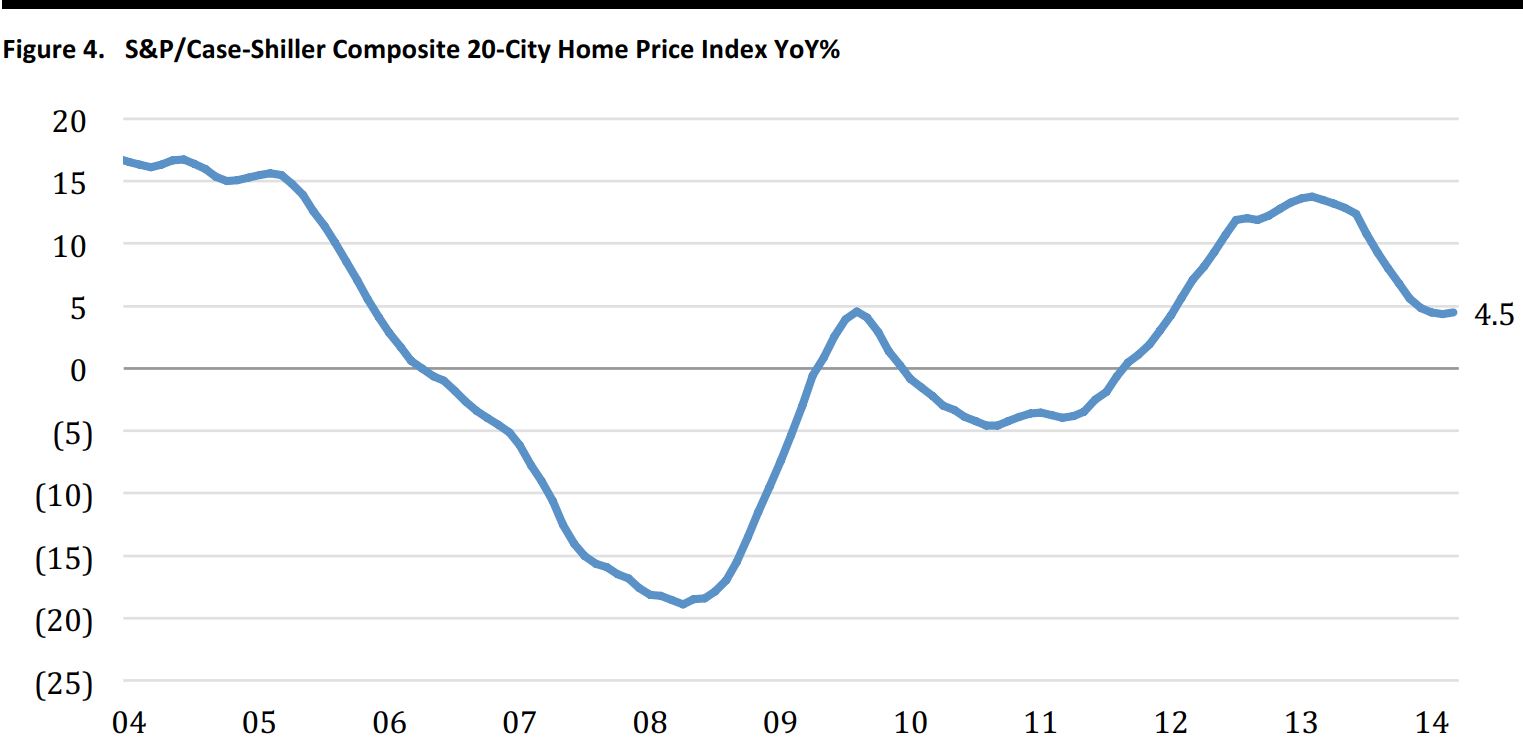

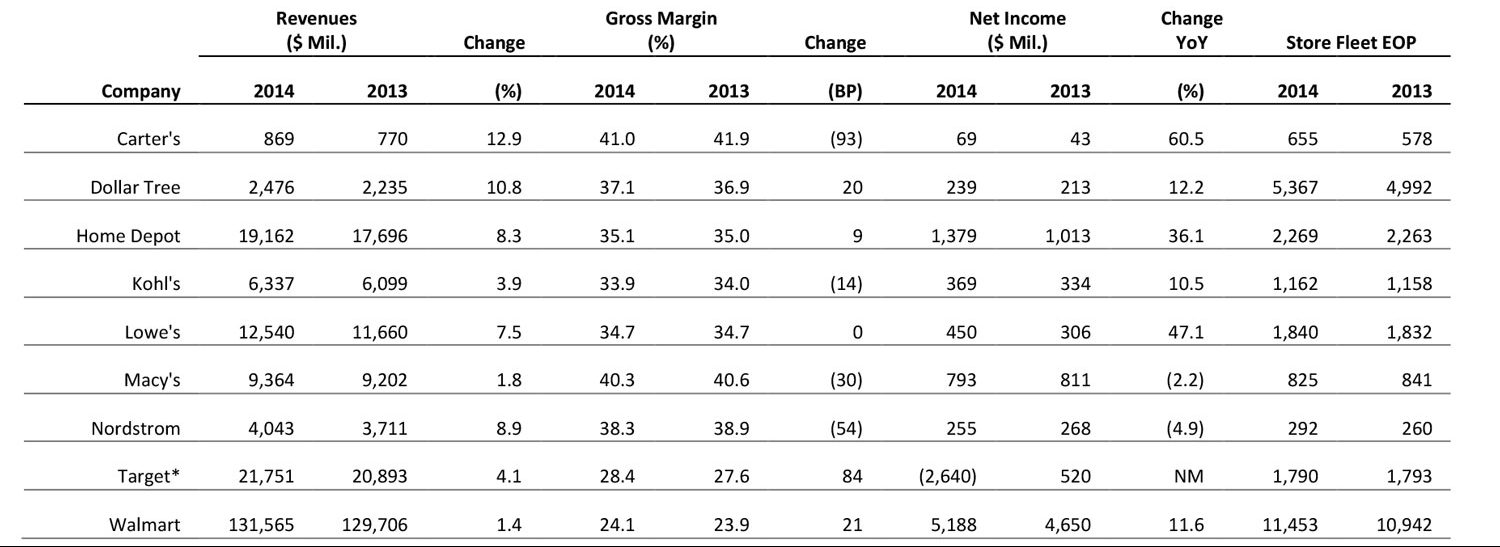

Select Company Earnings

Source: Company reports

- In tandem with Walmart’s 4Q earnings release, the company announced its comprehensive approach to hiring, training, compensation, scheduling programs and a store management structure that is sustainable over the long term. To reward associates for service to Walmart’s customers and give them clearer pathways through which to pursue opportunity, approximately 500,000 full- and part-time associates at Walmart US stores and Sam's Clubs will receive pay raises in H1 2015, ensuring hourly associates earn at least $1.75 above today's federal minimum wage, or $9/hour, in April. By February 1, 2016, current associates will earn at least $10/hour.

- Walmart and the Walmart Foundation also committed $100 million over five years to help increase economic mobility for entry-level workers by focusing on initiatives to better train and advance workers in the retail and other service industries throughout the US.

- Having achieved its 14% adjusted EBITDA margin goal in FY 2014 (ended January 31, 2015) Macy’s is turning its attention to growing its top line. Chief Stores Officer Peter Sachse’s full-time duty is focusing on growth, including piloting an off-price concept with a newly assembled team, as well as studying international opportunities, both store and digital.

- The off-price pilot will be “traditional;” not an outlet, which would compete with the Bloomingdales outlet concept. Macy’s expects to be able to leverage its brand relationships, the Macy’s name, and private label development with this new initiative.

- TJX Companies, corporate parent of TJ Maxx and Marshalls, followed Walmarts lead by announcing all US full- and part-time hourly store associates will earn at least $9.00/hour beginning in June.

- Sometime during 2016, all hourly US store associates who have been employed for six months or more will earn at least $10/hour.

- Hudson’s Bay will contribute 42 owned- or ground-leased properties valued at a total of $1.7 billion to a joint venture with Simon Property Group, and will hold an 80% stake in the venture. The joint venture will then lease back the properties under triple-net operating leases to Hudson’s Bay.

- The agreement represents the latest instance of separating real-estate assets from the operations of retail and restaurant chains. Low interest rates and high yields have driven investors’ attraction to such deals. Commercial real estate, in particular, has posted stronger returns of late as property values have surged.

ASIA TECH HEADLINES

- India’s ecommerce superstar Snapdeal announced its acquisition of luxury fashion estore, Exclusively. The founder of Exclusively commented that with growing disposable incomes, premium and luxury consumption in India demonstrates a significant upward trend.

- Snapdeal also plans to build an online luxury mall. The geographical limitations of the brick-and-mortar model, plus Snapdeal’s distribution network spanning more than 5,000 cities and towns in India, would be a strong draw for top brands.

- After attempting to push the perception that Superfish was not a security concern, Lenovo admitted that Superfish had hijacked SSL/TLS connections.

- Lenova has joined Microsoft in offering a removal tool to fix the Superfish issue. The source code for Lenovo’s Superfish removal is now available on GitHub.

EUROPE/UK RETAIL HEADLINES

- German home-shopping behemoth Otto Group this week announced plans to make a “high double-digit million” investment in startups focused on ecommerce, mobile and software. The company has been active in venture capital since 2008.

- The company also revealed that it expects its online sales to have risen by around 2.5% to €6.3 billion in the year ending February 28, 2015. Otto Group said internet growth in its home market of Germany was pulled down by weak demand for apparel, while online sales of furniture, home accessories and electronics grew strongly.

- Asda, one of the UK’s biggest grocers, posted full-year comps down 1.0% this week, and said that 4Q comps were down 2.6% amid strong price competition.

- Total FY sales growth came in at 0.5%, and the company said it plans to invest £600 million in stores and refreshing its brand in 2015.

- UK retail sales values grew 2.6% YoY in January 2015 (excluding automotive fuel), according to the Office for National Statistics (ONS), with grocery retailers’ sales up just 0.1% and clothing specialists’ sales ahead by 4.9%.

- In a deflationary context, total real (volume) sales growth was 4.3% YoY, the ONS said. Total shop prices (excluding automotive fuel) were down 1.6% YoY in January.

- Fashion chain Primark expects its sales to be up 16% YoY for the year ending February 28, 2015, according to a pre-close trading update from parent company Associated British Foods.

- An 11% increase in selling space and very high sales densities in stores opened during the last year helped underpin annual sales growth, despite the negative impact from unseasonably warm autumn 2014 weather.

LATAM RETAIL HEADLINES

- Heavy rains during the annual Carnaval holiday offered a respite from the nationwide drought, particularly in the Southeast.

- Despite the rain, Brazil’s drought and electricity shortages persist.

- British American Tobacco (BAT) Plc is considering a purchase of the 24.7% of cigarette company Souza Cruz SA that it does not already own.

- Souza Cruz has six of Brazil’s top brands, including Derby, Hollywood, Free and Dunhill.

- Telefónica said in its 2014 earnings report that its competitive position had strengthened in Brazil, especially in higher-value segments.

- Moreover, the company signed up more than half of new mobile contract subscribers and 38% of the LTE wireless market.