FROM THE DESK OF DEBORAH WEINSWIG

Free Two-Day Shipping Is the New “Table Stakes” for E-Commerce

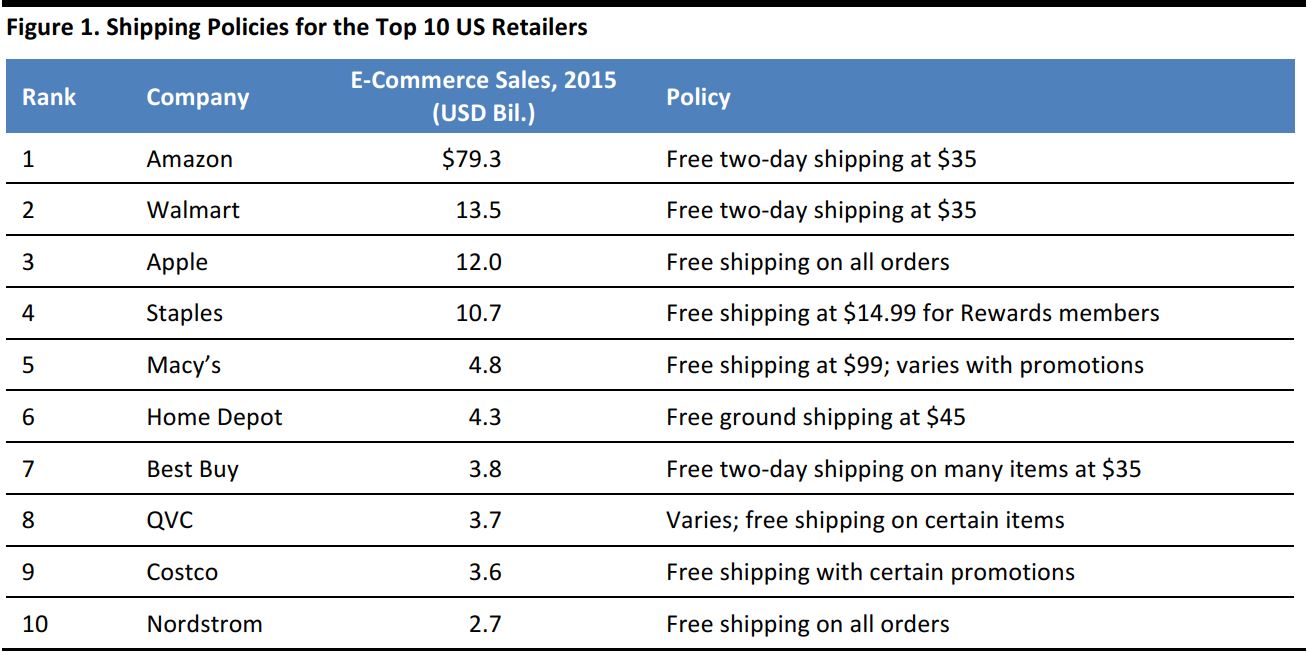

In late January, Amazon reduced its minimum purchase requirement for free two-day shipping to $35 ($25 for books) from $50 previously. In an interview with Recode, Marc Lore—who is Walmart’s e-commerce chief and the former CEO of Jet.com, which Walmart acquired last September—made a poker reference when talking about shipping. He commented that “in today’s world of e-commerce, two-day free shipping is table stakes,” referring to the minimum bet required to get in on a poker game.

Amazon’s reduction in its shipping minimum generated a response from Walmart. After having recently eliminated its ShippingPass program offering free two-day shipping in exchange for a $49 annual fee, Walmart, too, began offering free two-day shipping on orders of $35 or more. Due to the timing, Walmart’s move seemed to echo Amazon’s—but perhaps it was Amazon that anticipated Walmart’s move. Interestingly, $35 is also the minimum for free two-day shipping at Jet.com.

While Amazon has offered free two-day shipping to its Prime members, it has largely restricted the benefit otherwise, using it mostly to entice consumers to spend during the holiday season. With giants Amazon and Walmart now both offering free two-day shipping at $35, it appears that other serious e-tailers need to quickly follow suit.

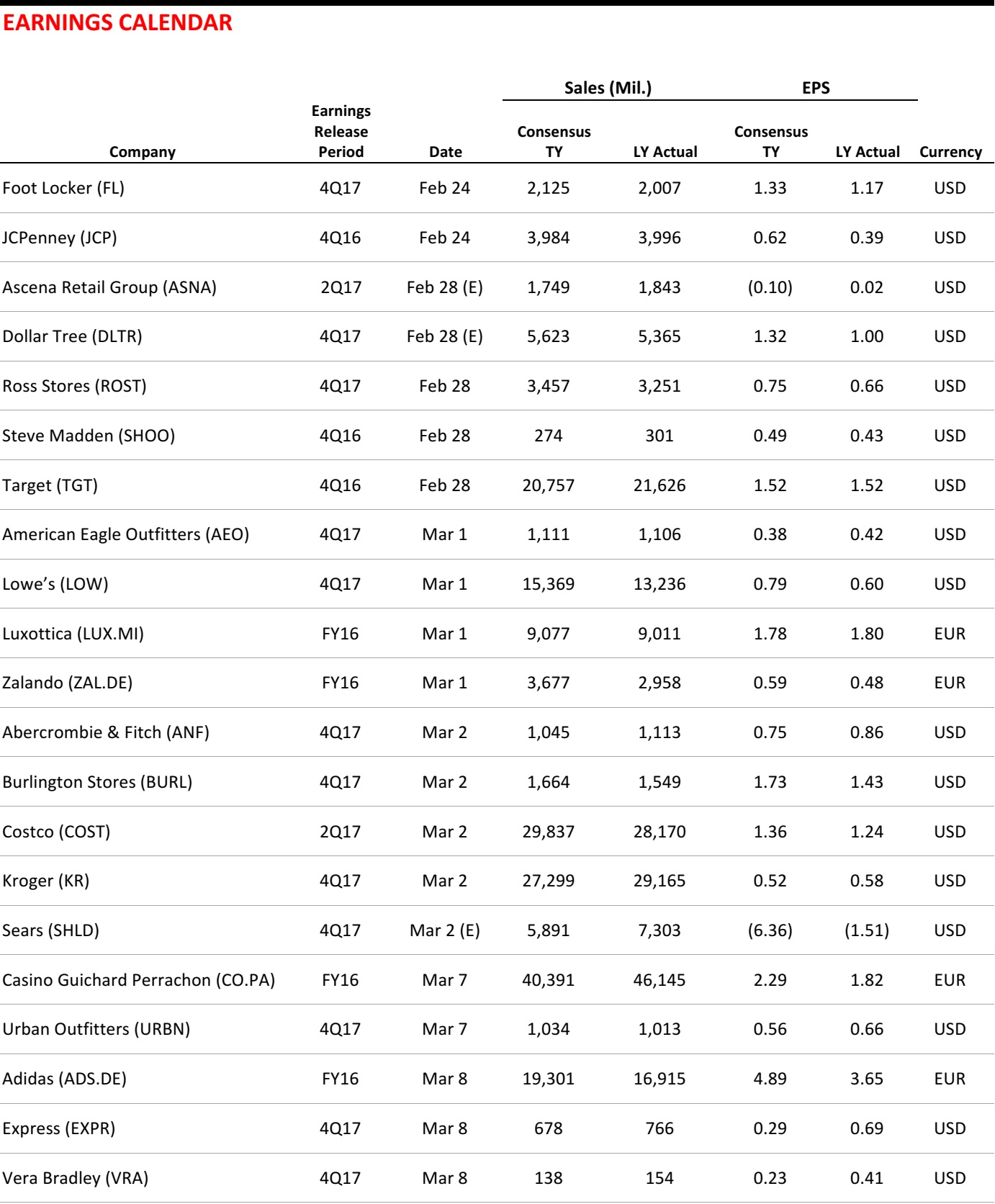

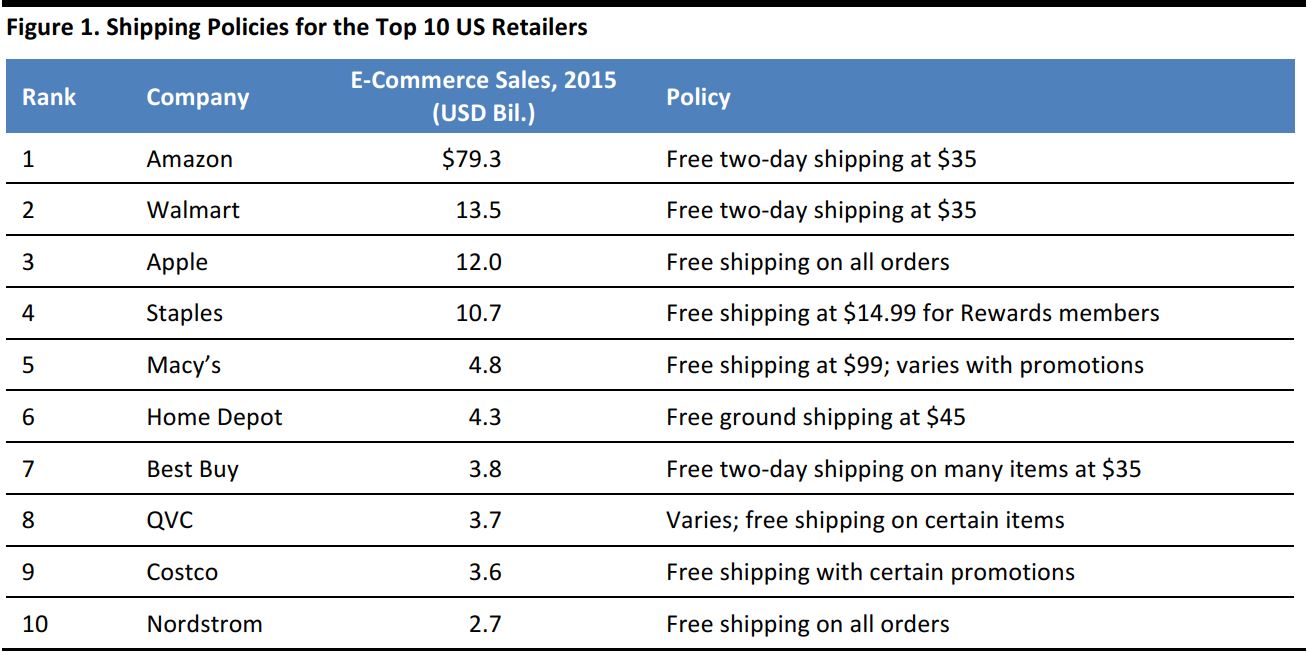

The recent actions of Amazon and Walmart prompt the question “What are other large retailers doing?” To answer that, we have listed the shipping policies for the 10 largest US retailers in the table below.

Source: National Retail Federation/company websites

Source: National Retail Federation/company websites

“Free” Shipping Is Not Free

While shipping may not appear as an added fee to the consumer, it clearly costs money, and that cost is borne by the retailer. Ross McCullough, UPS’s President of Asia Pacific, recently commented to CNBC, “Free shipping has been around, again, since 1996. I used to run an e-commerce team and…there’s no such thing as free shipping.”

The impact of “free” shipping is increasingly showing up on e-tailers’ bottom lines. Indeed, Amazon reported fulfillment costs of $7.1 billion in 2016, up 43% over the prior year, with the growth rate exceeding a 27% revenue increase in the year. Although Walmart reported a substantial, 29% increase in e-commerce sales in its fiscal fourth quarter earnings this week (which includes the benefit from the acquisition of Jet.com last fall), GAAP EPS declined by 14.7% and adjusted EPS declined by 9.2% in the quarter.

The Fung Global Retail & Technology team will continue to monitor and report on the “shipping wars” among major e-tailers as they continue to heat up.

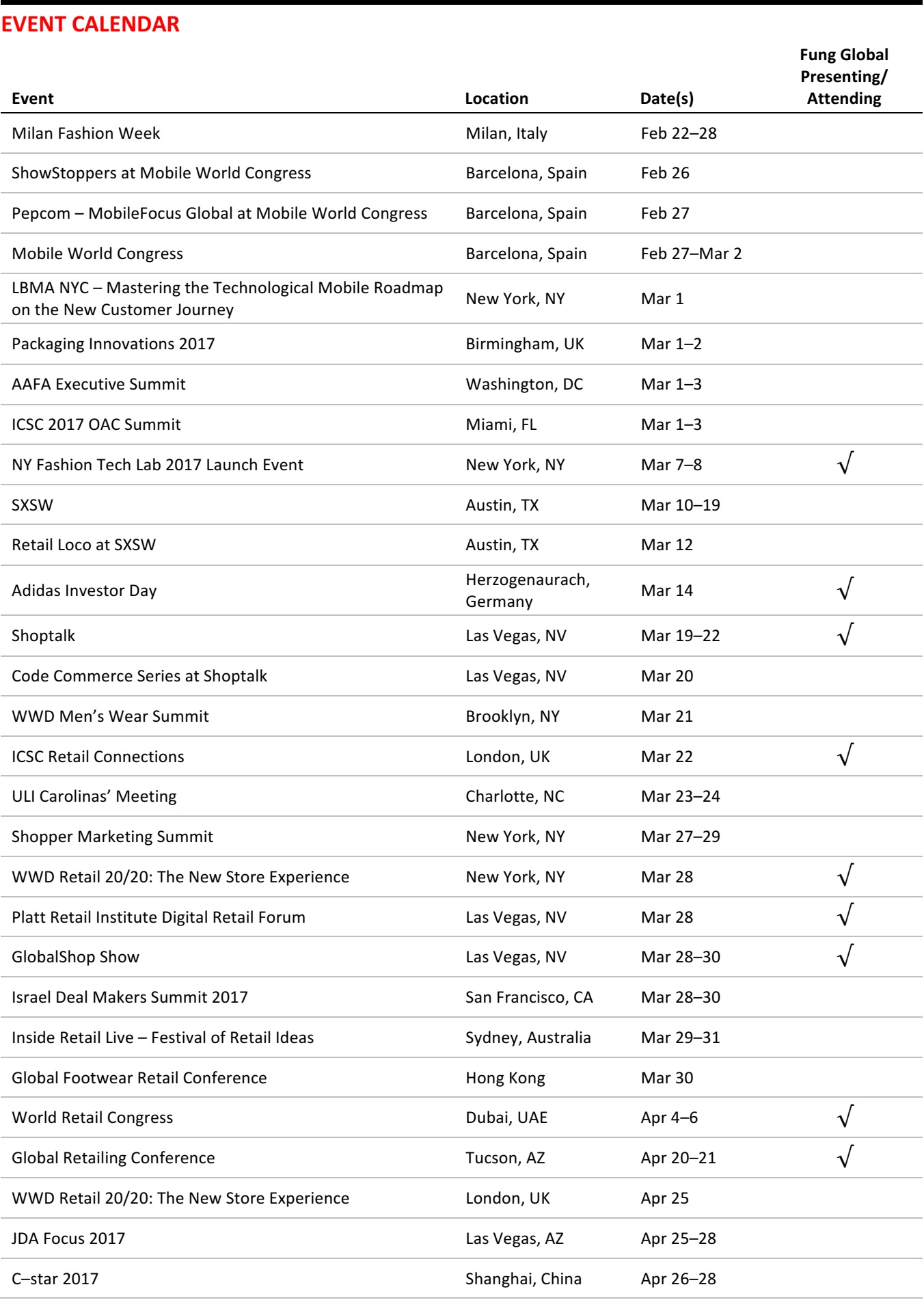

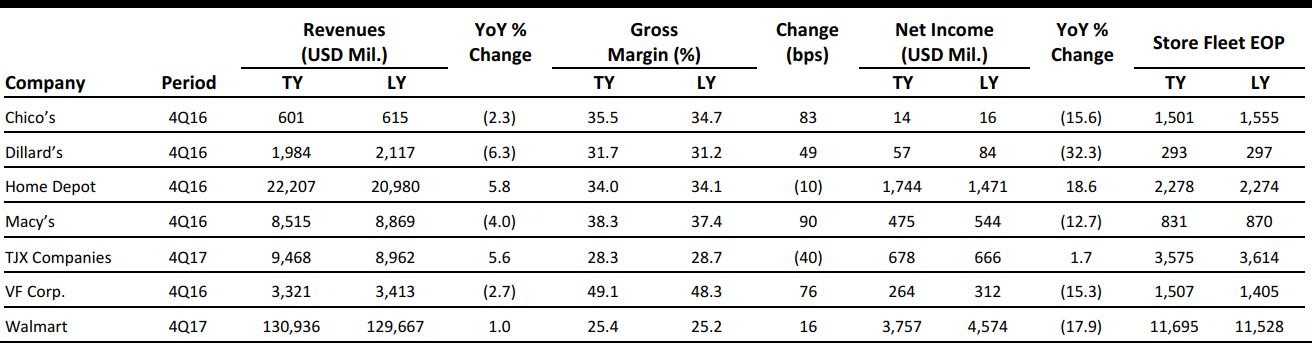

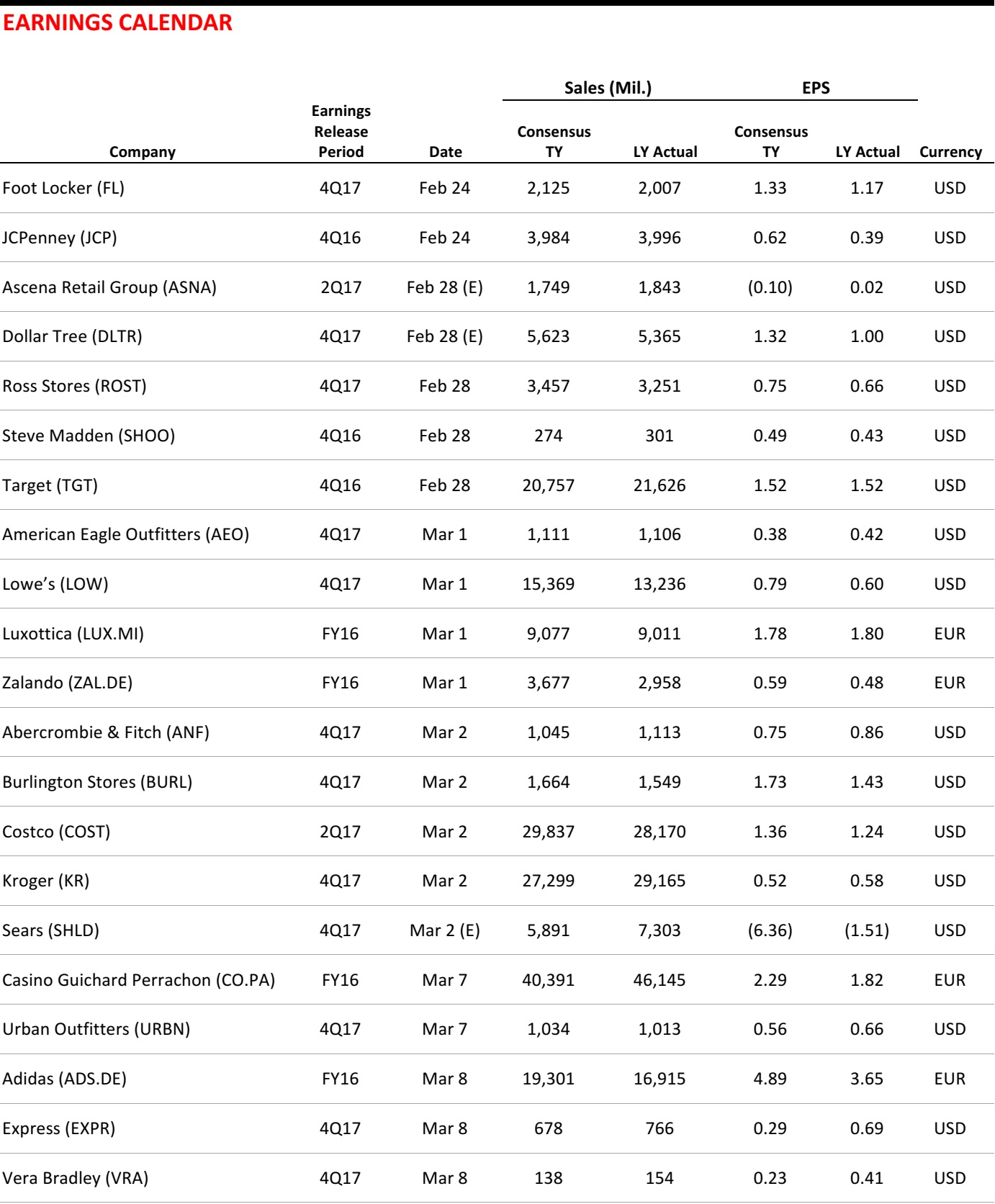

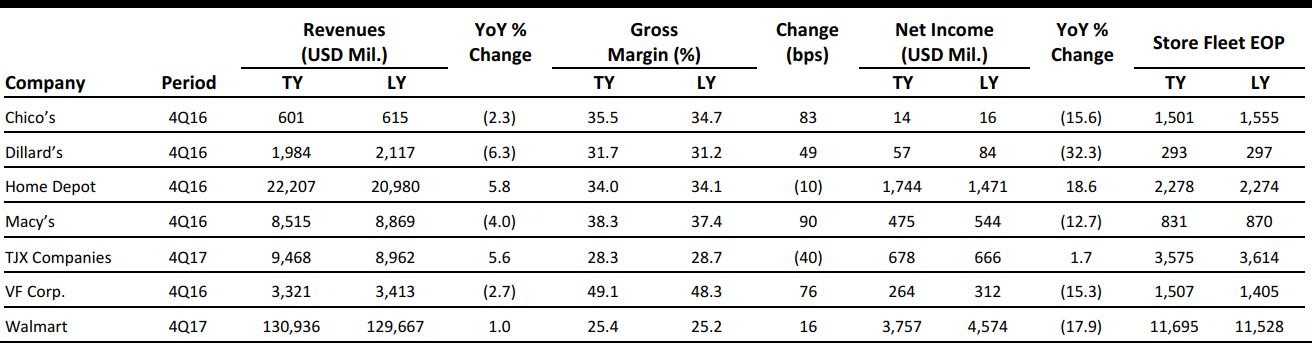

US RETAIL EARNINGS

Source: Company reports

Source: Company reports

US RETAIL & TECH HEADLINES

What Walmart, Macy’s and Home Depot Are Saying About Retail

(February 22) eMarketer.com

What Walmart, Macy’s and Home Depot Are Saying About Retail

(February 22) eMarketer.com

- Walmart, Macy’s and Home Depot reported fourth-quarter earnings on Tuesday that painted a mixed picture, but they highlighted one common theme: physical stores are still important, and online sales and digital strategies are key to bringing traffic and sales to stores.

- Walmart’s US stores reported a better-than-expected 1.8% increase in same-store sales during the quarter, sending its stock 3% higher at market close on Tuesday. Online sales at Walmart US jumped 29% in the fourth quarter, driven partly by the company’s acquisition of Jet.com last year and partly by online grocery sales.

Walmart’s Sales Got Off to a Slow Start in 2017 Due to Tax Refund Delays

(February 22) CNBC.com

Walmart’s Sales Got Off to a Slow Start in 2017 Due to Tax Refund Delays

(February 22) CNBC.com

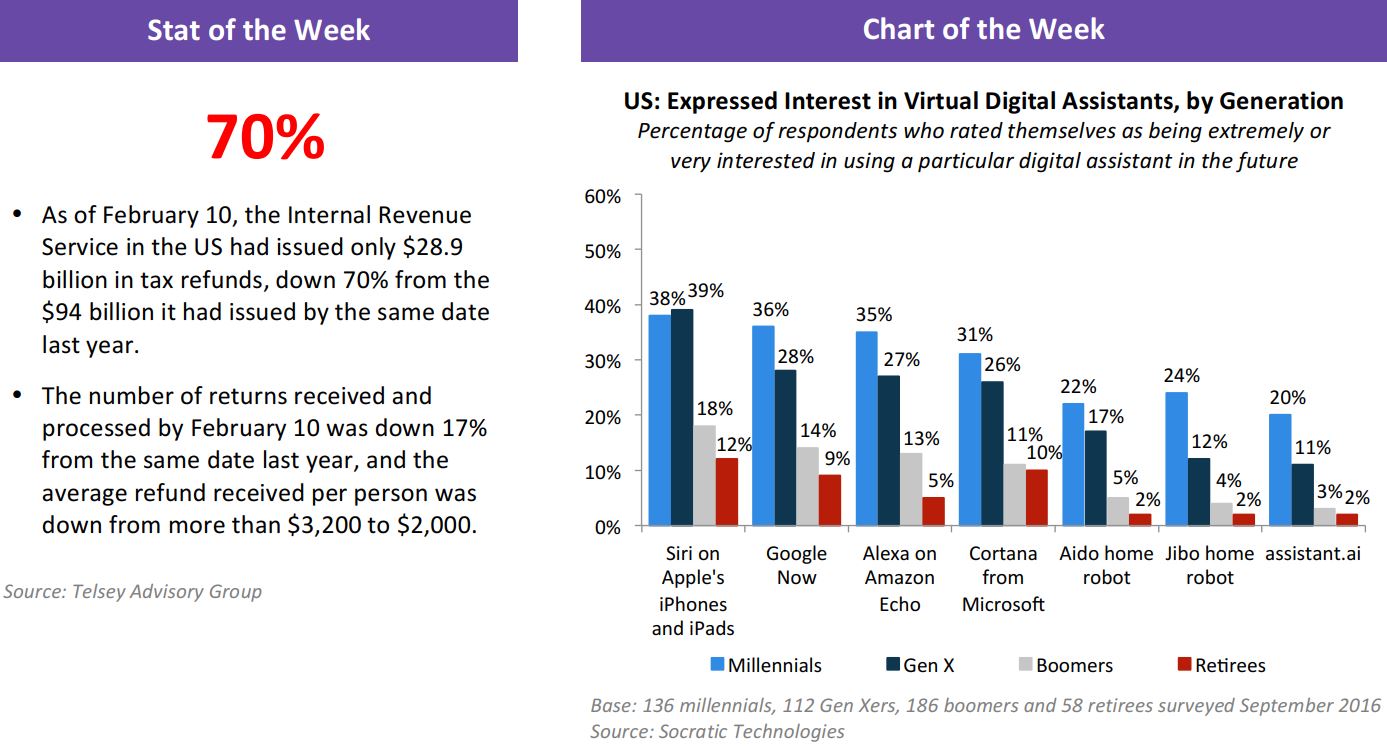

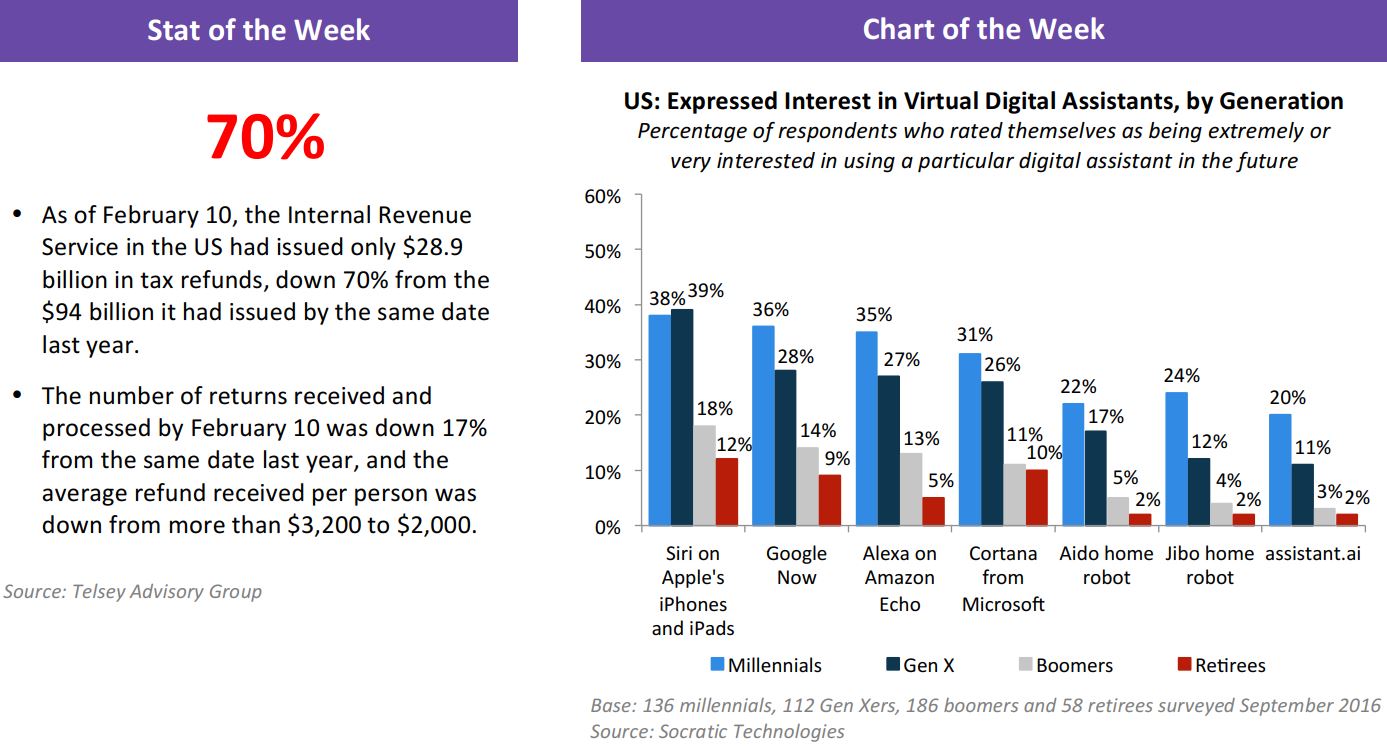

- A planned delay in the delivery of two tax refunds could be taking a bite out of Walmart’s revenue. After reporting another quarter of top-line growth during the holiday period, the world’s largest retailer said sales have gotten off to a slow start in its new fiscal year.

- Later delivery of the Earned Income Tax Credit and the Additional Child Tax Credit could be to blame. Back in 2015, Congress passed a measure to delay these refunds, which benefit low- to middle-income households with children. The holdup was designed to give the IRS more time to track down fraudulent claims. Jefferies estimates that this delay has resulted in roughly $45 billion less income than at the same time last year.

Amazon Lowers Free Shipping Minimum to Match Walmart

(February 21) NYPost.com

Amazon Lowers Free Shipping Minimum to Match Walmart

(February 21) NYPost.com

- Jeff Bezos is not usually a follower, but over Presidents’ Day weekend, the founder and CEO of Amazon quietly lowered the minimum purchase amount required to get free shipping from $49 to $35.

- The discounted price just happens to match Walmart’s minimum. And while Amazon in the past has revved its marketing machine to high to get the word out on such moves, there was no press release or announcement to let the world know of the most recent price cut.

Apple Pay Already Accepted at a Third of US Retail Outlets

(February 19) GuruFocus.com

Apple Pay Already Accepted at a Third of US Retail Outlets

(February 19) GuruFocus.com

- The reach of Apple Pay has steadily expanded since it was launched in October 2014. In two short years, Apple has expanded the service to 13 countries, with four of them added last year—Japan, Russia, New Zealand and Spain.

- According to a recent survey conducted by Boston Retail Partners, Apple Pay is now accepted by 36% of the retailers in the US, and another 22% are expected to start accepting it in the next 12 months.

US E-Commerce Sales Grow 15.6% in 2016

(February 17) InternetRetailer.com

US E-Commerce Sales Grow 15.6% in 2016

(February 17) InternetRetailer.com

- The web comprised nearly 42% of the growth in the US retail market last year. E-commerce represented 11.7% of total sales in 2016, but a lot of the gains in e-commerce went to Amazon.

- Online sales reached $394.86 billion last year, a 15.6% increase compared with $341.70 billion in 2015. That is the highest growth rate since 2013, when online sales grew by 16.5% year over year. For comparison purposes, total retail sales were $4.846 trillion in 2016, a 2.9% jump from $4.708 trillion in 2015.

EUROPE RETAIL HEADLINES

UK Retail Growth Softens in January

(February 17) Office for National Statistics

UK Retail Growth Softens in January

(February 17) Office for National Statistics

- Total retail sales growth in the UK slowed sequentially from 7.1% year over year in December to 2.2% in January, according to the UK Office for National Statistics. Grocery retailers posted a 1.1% decline in sales, while department stores/mixed-goods retailers saw robust growth of 3.1%.

- Sales growth at clothing specialists improved, albeit modestly, to 1.4% from 1.2% in December. Sales at pure plays grew by 15.2%, returning to the kind of growth seen prior to their surge in late 2016.

Morrisons Unveils Plans to Appoint More UK Suppliers

(February 17) Company press release

Morrisons Unveils Plans to Appoint More UK Suppliers

(February 17) Company press release

- UK grocer Morrisons announced that it intends to appoint more than 200 new UK suppliers as part of a campaign entitled “The Nation’s Local Foodmakers.” The company is inviting food producers to pitch their proposition through a series of 12 events.

- This move follows the release of a new report commissioned by Morrisons that found UK farmers produce only 52% of the food eaten in the country. Morrisons said that the campaign will address that and other findings by allowing more of its UK customers to buy food “that was grown, made, picked or packaged within 30–60 miles of their local store.”

Kraft Heinz Bids to Acquire Unilever, Then Withdraws Offer

(February 19) Company press release

Kraft Heinz Bids to Acquire Unilever, Then Withdraws Offer

(February 19) Company press release

- Kraft Heinz withdrew its offer to acquire all of Unilever’s shares for around $143 billion. The offer was first announced on February 17. The deal value represented an 18% premium to Unilever’s share price at the close of business on February 16.

- Unilever stated that it saw no “financial or strategic” merit for its shareholders, as the offer price undervalued the firm and, hence, rejected the proposal. On February 19, the companies issued a joint statement noting that Kraft Heinz had “amicably” withdrawn its offer.

Amazon Announces Plans to Create 15,000 Jobs Across Europe

(February 20) RetailDetail.eu

Amazon Announces Plans to Create 15,000 Jobs Across Europe

(February 20) RetailDetail.eu

- Global e-commerce leader Amazon announced that it plans to create more than 15,000 jobs across Europe over the course of 2017 to expand its logistics operations and other functions. This is a record number for Amazon, which is looking to hire specialists for roles ranging from linguists to software developers.

- The expansion includes creating 5,000 jobs in the UK, where Amazon already has a workforce of 19,000. The company will also hire 2,000 employees in Germany, taking its headcount there to 16,500, and 1,500 employees in France, where it already employs 4,000.

Lidl Shelves Plans to Trial Click-and-Collect Format in Germany

(February 20) ESMMagazine.com

Lidl Shelves Plans to Trial Click-and-Collect Format in Germany

(February 20) ESMMagazine.com

- German grocer Lidl has suspended its plans to trial click-and-collect stores in Germany, merely a week after CEO Sven Seidel announced his resignation. The company was set to test the multichannel Lidl Express banner in Berlin this spring.

- Lidl said that it decided not to go ahead with the pilot after carrying out “a comprehensive viability study” and that it will instead focus on international expansion of its e-commerce business.

ASIA TECH HEADLINES

Alibaba’s Ant Financial Expands to South Korea with $200 Million Investment in Kakao Pay

(February 21) TechCrunch.com

Alibaba’s Ant Financial Expands to South Korea with $200 Million Investment in Kakao Pay

(February 21) TechCrunch.com

- Alibaba affiliate Ant Financial is making yet another M&A deal. The firm is investing $200 million into a fintech project belonging to Kakao, the $5 billion firm that runs South Korea’s dominant messaging service.

- Ant Financial will begin to offer its financial services in South Korea through Kakao Pay, a soon-to-launch fintech division, and expand its business from online payments into offline, banking and financing services.

China’s Didi Chuxing Shakes Up Car-Hailing App Business

(February 19) Financial Times

China’s Didi Chuxing Shakes Up Car-Hailing App Business

(February 19) Financial Times

- Didi Chuxing, China’s dominant ride-hailing platform, plans to set up a division that will include the Uber China operations it acquired last year as well as other taxi-booking and ride-sharing services, and it plans to form a “premier mobility” division for high-end services.

- Didi was forced to rethink its business model and cut a majority of its workforce in its largest markets after Shanghai and Beijing introduced new regulations limiting car-sharing services to local drivers.

Chinese Livestreaming Services Provider Said to Seek Funds at $1.2 Billion Valuation

(February 20) Bloomberg.com

Chinese Livestreaming Services Provider Said to Seek Funds at $1.2 Billion Valuation

(February 20) Bloomberg.com

- Douyu, the livestreaming service backed by Tencent that has been compared to Amazon’s Twitch, is in talks to raise a billion yuan ($145 million) in funds at a valuation of about $1.2 billion.

- Douyu built a business by allowing gamers to livestream their online death matches and by hosting discussions about strategies. The three-year-old company, whose name means “fighting fish,” needs capital to expand beyond the streaming of games and to fend off rivals.

Toshiba Seeks at Least $8.8 Billion in Chip Stake Sale

(February 21) Bloomberg.com

Toshiba Seeks at Least $8.8 Billion in Chip Stake Sale

(February 21) Bloomberg.com

- Toshiba is looking to raise at least 1 trillion yen ($8.8 billion) from the sale of its memory chip business and aims to complete the transaction by March 2018. The deal will likely result in Toshiba relinquishing majority control over the unit, which could be valued as high as 2 trillion yen ($17.7 billion).

- Toshiba is grappling with a $6.3 billion write-down at its nuclear division, which is suffering massive cost overruns in the construction of nuclear power plants in the US and China. It may be necessary for the company to sell a majority stake in its highly prized flash memory chip business in order to shore up its balance sheet.

LATAM RETAIL HEADLINES

Brazilian Gaming Startup Cupcake Entertainment Received $1 Million Investment

(February 17) Bloomberg.com

Brazilian Gaming Startup Cupcake Entertainment Received $1 Million Investment

(February 17) Bloomberg.com

- Casual game studio Playlab has invested $1 million into Cupcake Entertainment, a Brazil-based game maker.

- Cupcake has seen consistent growth—increasing its revenue by 45% per month on average over the past 18 months and tripling its revenue since September 2016—but it has struggled with cash flow when it comes to user acquisition.

Brazil’s Creditas Gets $19 Million amid Boom in Local Fintech Financing

(February 21) Reuters.com

Brazil’s Creditas Gets $19 Million amid Boom in Local Fintech Financing

(February 21) Reuters.com

- Creditas, a Brazilian financial technology firm focused on secured consumer loans, has obtained $19 million from investors in a financing round that will allow it to provide borrowers with funds for one-fourth of what they pay to domestic lenders.

- Creditas uses innovative credit-scoring systems and borrowers’ assets to offer loans for 25%–50% less than banks and rival domestic fintechs. Borrowers in Latin America’s biggest country pay an average of 190% a year for unsecured, riskier overdraft, credit card and consumer loans, the highest rate among the world’s 20 major economies.

Atlanta Fintech Startup Enters Chile

(February 16) GlobalAtlanta.com

Atlanta Fintech Startup Enters Chile

(February 16) GlobalAtlanta.com

- Fresh off a $17.5 million funding round that it said would encourage global expansion, Atlanta’s First Performance Global has entered the Chilean market.

- The fintech startup, which provides software that enables card holders to manage security and other preferences via a mobile device, has partnered with Nexus, which provides credit card processing and other services to banks in Chile.

Source: National Retail Federation/company websites

Source: National Retail Federation/company websites

Source: Company reports

Source: Company reports US E-Commerce Sales Grow 15.6% in 2016

(February 17) InternetRetailer.com

US E-Commerce Sales Grow 15.6% in 2016

(February 17) InternetRetailer.com