FROM THE DESK OF DEBORAH WEINSWIG

Fashions Change

If there is one subject close to our hearts at Fung Global Retail & Technology, it is fashion retailing. Over the last few years, we have established ourselves as a leading global think tank on apparel. Our coverage continues with our

On Trend series of thematic fashion reports, which are published on FungGlobalRetailTech.com. In this week’s note, we distill some thoughts on the underlying trends driving changes in fashion retail.

Consumers Demand Newness and Value

The shifts in the US apparel market are about more than just a battle between e-commerce and department stores—even though they often seem to be characterized that way by the media and commentators. Faced with a profusion of choice and information, consumers are more demanding than in the past, and we perceive them wanting more newness but not wanting to compromise on genuine value for money. These two elements are driving various innovations, some of which are at the heart of the mass market and some of which are—for now, at least—more peripheral.

Apparel rental is resonating with millennials who want new looks and premium brands, but who do not want to pay a fortune for them or even necessarily hold on to a particular look for any period of time. This model is a near perfect answer to the demand for short-term fashions at affordable prices, as it does not require that renters compromise on style or brand. Rental company Rent the Runway has attracted 6 million customers in the US, and the rental format is growing in other markets, too, such as the UK and Australia. We discuss the apparel rental trend in our recent report

Deep Dive: Millennial Lifestyles Drive Growth in Apparel Rental, which can be found here:

bit.ly/ApparelRent

Fashion resale marketplaces have attracted millions of members looking to buy and sell clothing, footwear and accessories, often high-end items. Like rental services, resale marketplaces combine demand for new products and brands with affordability. Major firms in the space include The RealReal and Tradesy, which each say they have 5 million members, and Vestiare Collective, which claims 6 million customers. Our forthcoming report

Fashion Re-Commerce Evolution covers this segment in detail.

The option to

buy straight from the runway is making up-to-the-minute trends available to shoppers (although it does not meet their demand for value). This model’s immediacy is a big break from the traditional industry model in which designer brands and luxury houses present two seasonal collections per year and the showcased items appear in stores some six months later. The see-now, buy-now trend is being adopted by more and more designer names, from Alexander Wang to Burberry to Tom Ford to Tommy Hilfiger, as we discuss in our recent report

From Runway to Checkout: The See-Now, Buy-Now Trend in Fashion, which can be found here:

bit.ly/InstantFashion

Meanwhile, in the store-based mass-market segment, the demand for newness and value is driving the growth of fast-fashion retailers and off-price stores. Midmarket rivals are being compelled to adopt fast-fashion techniques in order to bring more newness into their ranges, and major names such as Macy’s are rolling out off-price formats. We cover the American mass-market apparel segment in detail in our forthcoming report

Retail Revolution—US Apparel Shifts in 20 Charts.

Several of the segments noted above—such as apparel rental—remain niche oriented and pose little threat to mass-market giants in the near term. Yet they reflect consumers’ demand for getting genuine value without having to trade down to the lowest tier. In fashion, shopper frugality is about more than just getting ultralow prices from discount retailers, and demand for newness is about more than the growth of big fast-fashion names.

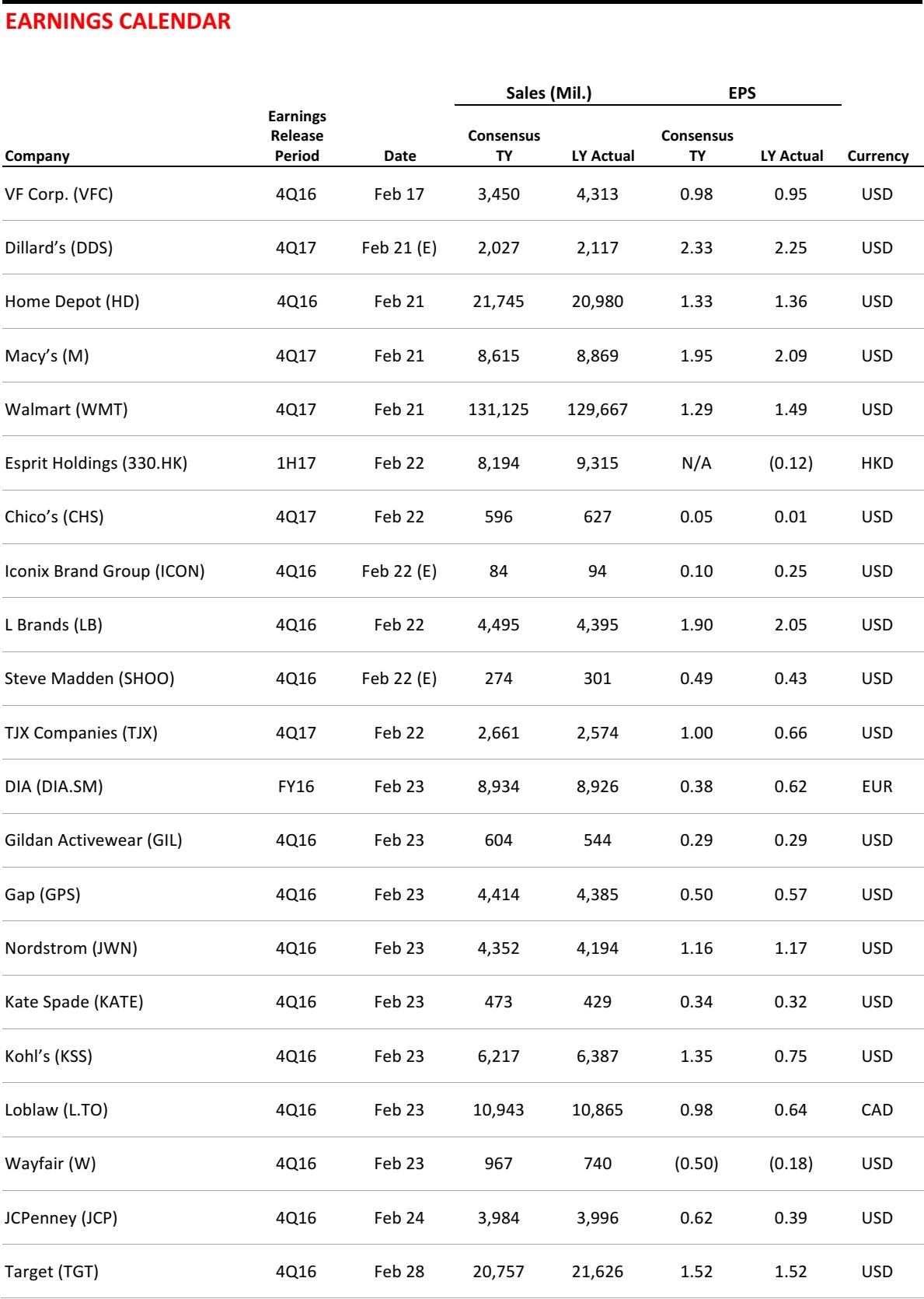

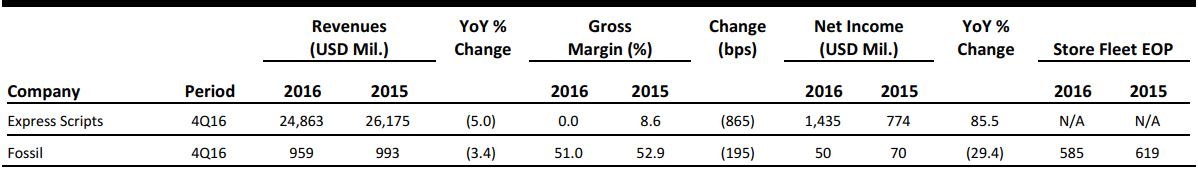

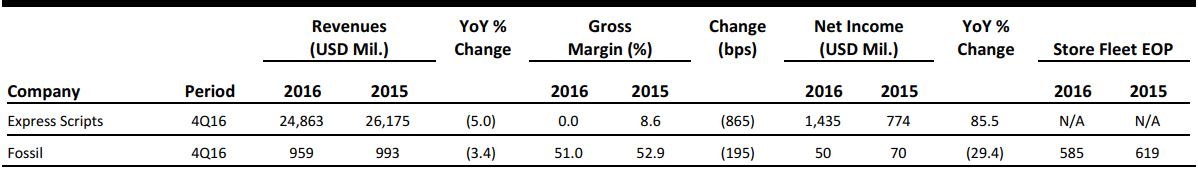

US RETAIL EARNINGS

US RETAIL & TECH HEADLINES

The Cost of Convenience: Amazon’s Shipping Losses Top $7 Billion for First Time

(February 9) GeekWire.com

The Cost of Convenience: Amazon’s Shipping Losses Top $7 Billion for First Time

(February 9) GeekWire.com

- The amount of money that Amazon lost on shipping—the net cost of landing all those boxes on doorsteps in record time—reached an all-time high of nearly $7.2 billion in 2016, according to an analysis by GeekWire.

- The number reflects the difference between what Amazon charges customers for shipping and what it spends to get those items to customers. Amazon traditionally takes a net loss on shipping, due in part to the flagship Amazon Prime benefit of free two-day shipping. But with the company selling more and more items and promising faster and faster shipping, that net cost is getting bigger and bigger.

Walmart to Tear Down Walls Between Store and Online Buying Operations

(February 14) Reuters.com

Walmart to Tear Down Walls Between Store and Online Buying Operations

(February 14) Reuters.com

- As it looks to consolidate buying operations in order to better fight Amazon, Walmart will combine its own buying for products sold at its stores with purchases it makes for its website. Vendors contacted by Walmart about the change told Reuters the store and online buying teams currently operate independently.

- Walmart has told some vendors it is seeking to make the buying process more efficient for itself and vendors, and to improve coordination between its buying teams. The company also wants to apply its brick-and-mortar expertise in securing the lowest possible prices to its e-commerce business, according to the vendors, who declined to be identified for fear of disrupting business relations with Walmart.

Designers Are Using Instagram Live to Offer an Unfiltered Look at NYFW

(February 14) Glossy.co

Designers Are Using Instagram Live to Offer an Unfiltered Look at NYFW

(February 14) Glossy.co

- Instagram Live is becoming a breakout star at New York Fashion Week. Fashion designers and brands have been increasingly turning to the platform since it launched in December 2016, using it either as an addendum to platforms such as Facebook Live or as a means to connect with different demographics of social media users.

- Thakoon was among the brands that dabbled with Instagram Live early in the week, sharing several behind-the-scenes moments leading up to its spring 2017 collection debut. It also posted backstage preparation and moments from the runway show itself to its nearly 100,000 followers.

Retail CEOs Head to Washington to Try to Kill US Border Tax

(February 14) Reuters.com

Retail CEOs Head to Washington to Try to Kill US Border Tax

(February 14) Reuters.com

- Chief executives of some of America’s largest retailers, including Target, Best Buy, Gap and AutoZone, headed to Washington this week to make their case that a controversial tax on imports would raise consumer prices and hurt their businesses. The group of eight retail bosses was to meet on Wednesday with Kevin Brady, Chairman of the House Ways and Means Committee, and with members of the Senate.

- This is the first time well-known retail CEOs descended on Washington as a group to try to kill the import tax proposal. Their input has more urgency, as US President Donald Trump is finalizing his own tax plan, which he plans to unveil in the coming weeks.

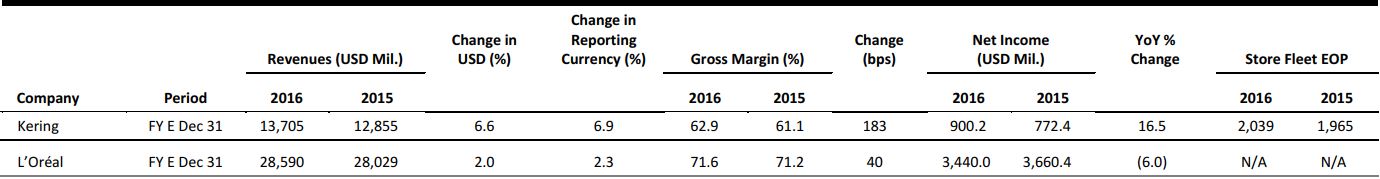

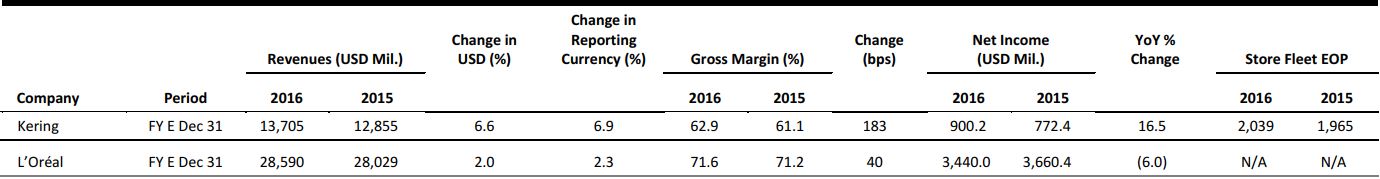

EUROPE RETAIL EARNINGS

EUROPE RETAIL HEADLINES

UK Retail Footfall Falls Further in January

(February 13) Retail-Week.com

UK Retail Footfall Falls Further in January

(February 13) Retail-Week.com

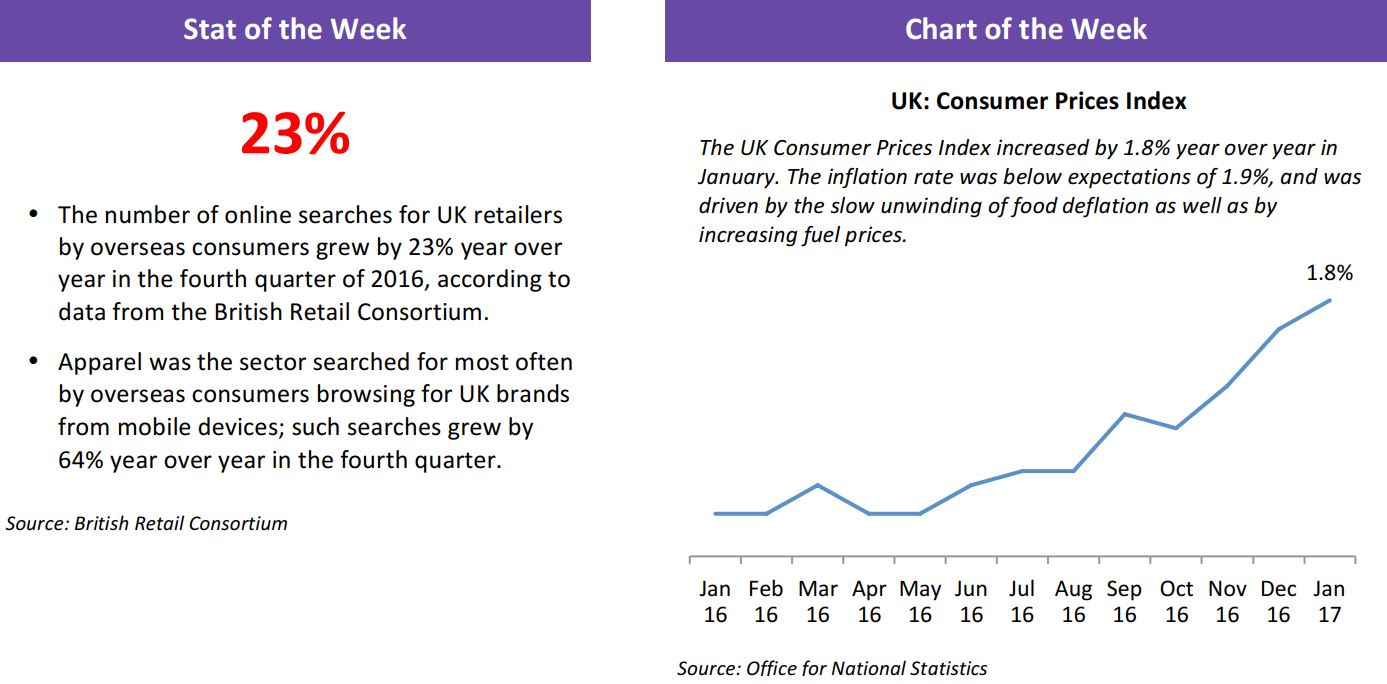

- Total retail footfall in the UK fell by 1.3% in the four weeks ended January 28, 2017, according to data from the British Retail Consortium and Springboard. The figure was below the three-month average of 0.8% and was the sharpest decline since the 2.8% drop seen in June 2016.

- High-street footfall declined by 0.8% year over year, behind the three-month average of 0.1%. Footfall at retail parks fell for the third consecutive month, by 0.4%, and footfall at shopping centers fell for the 12th consecutive month, by 3.0%.

Visa’s UK Consumer Spending Index Shows Clothing Expenditure at Five-Year Low in January

(February 13) Press release

Visa’s UK Consumer Spending Index Shows Clothing Expenditure at Five-Year Low in January

(February 13) Press release

- Year-over-year UK consumer spending growth slowed from 2.5% in December to a five-month low of 0.4% in January, according to financial services firm Visa. The company added that clothing spending “saw the biggest drop in nearly five years” as it fell by 3.8%.

- Visa noted that consumer spending on experiences rose, however, as spending on dining out grew by 5.7% and spending on recreation and culture grew by 3.1% during the period.

Aldi to Invest an Additional $1.6 Billion to Boost US Expansion

(February 9) FT.com

Aldi to Invest an Additional $1.6 Billion to Boost US Expansion

(February 9) FT.com

- German supermarket group Aldi has said that it will invest an additional $1.6 billion in its US operations as the competition among its American rivals intensifies. The group is already in the process of growing its store number to 2,000 by 2018, an expansion worth more than $3 billion.

- Aldi operates more than 1,600 stores in the US. German rival Lidl will enter the US market in 2017 or 2018. Aldi’s extra investment will fund the expansion and refurbishing of about 1,300 stores, the company said.

L’Oréal Considers Sale of The Body Shop Business

(February 9) Company press release

L’Oréal Considers Sale of The Body Shop Business

(February 9) Company press release

- French beauty company L’Oréal is considering offloading The Body Shop business, as L’Oréal failed to grow the skincare brand as much as it had hoped to. The company’s statement said that it will “explore all strategic options regarding The Body Shop’s ownership.”

- Last week, The Body Shop reported comparable store sales growth of 0.6% and a total sales decline of 4.8% for full-year 2016. L’Oréal bought the brand from environmental activist Anita Roddick over a decade ago.

H&M’s Weekday Banner Chooses Regent Street for UK Debut

(February 8) Retailgazette.co.uk

H&M’s Weekday Banner Chooses Regent Street for UK Debut

(February 8) Retailgazette.co.uk

- Swedish fast-fashion group H&M has chosen London’s Regent Street as the location of the first store under its Weekday label in the UK. The company did not reveal the exact date for the store opening, but said that it will happen this summer.

- Fashion and denim brand Weekday was acquired by H&M in 2008 and currently operates in seven countries

ASIA TECH HEADLINES

Alibaba’s Ant Financial Is Raising $3 Billion in Debt to Finance a Global M&A Spree

(February 8) TechCrunch.com

Alibaba’s Ant Financial Is Raising $3 Billion in Debt to Finance a Global M&A Spree

(February 8) TechCrunch.com

- Alibaba affiliate Ant Financial announced a surprise deal to acquire international payment service MoneyGram for $880 million last month, but that looks like just the start of its M&A activities. It is now reportedly close to raising nearly $3 billion in debt financing in order to bankroll further acquisitions.

- Ant Financial’s businesses includes Chinese digital banking service MyBank and Alipay, China’s dominant digital payment service, which has 450 million users. However, the company also has stakes in India’s Paytm and Southeast Asia–based Ascend Money.

Grab Is Buying Indonesian Payment Firm Kudo in Its First Major Acquisition

(February 14) TechCrunch.com

Grab Is Buying Indonesian Payment Firm Kudo in Its First Major Acquisition

(February 14) TechCrunch.com

- Singapore-based Grab, Uber’s rival in Southeast Asia, raised $750 million in September and is now making a play for Indonesia, which is Southeast Asia’s largest economy, with a population of more than 250 million. Grab is reportedly in the process of buying Indonesia-based online payment startup Kudo in its first major acquisition.

- Payments are a central focus in Grab’s push as it looks to differentiate itself from Uber and local rival Go-Jek, which raised $550 million last year. Offering payment services can also help Grab win business from millions of unbanked citizens and provide a solution in the market.

Eternal Youth Is the Next Big Bet for Singapore Venture Capitalist

(February 10) Bloomberg.com

Eternal Youth Is the Next Big Bet for Singapore Venture Capitalist

(February 10) Bloomberg.com

- A venture capital firm led by Finian Tan began investing in Chinese search engine Baidu in 2000. Following Baidu’s IPO, Tan’s firm ended up with a stake larger than the 22% held by Baidu cofounder Robin Li. Now Tan is making a similar bet on San Diego–based regenerative medicine company Samumed, which is valued at $12 billion.

- What attracted Tan was Samumed’s approach to treating arthritic knees, hair loss, scarring of the lungs and degenerative disc diseases. The company is pursuing novel therapies for those conditions and cancer with drugs targeting a cell-signaling pathway that offers promise in reversing the biological processes of aging.

China’s Weibo Eclipses Rival Twitter’s Market Capitalization

(February 13) Financial Times

China’s Weibo Eclipses Rival Twitter’s Market Capitalization

(February 13) Financial Times

- China’s Weibo is now worth more than US rival Twitter. Following a rally in its share price, Weibo now has a market capitalization of $11.3 billion, versus Twitter’s $11.1 billion. Shares in Weibo, which is part-owned by Alibaba, have been climbing on the back of a rising number of subscribers and its growing ability to wring more cash out of them.

- While Weibo’s usurping of Twitter’s position owes much to the US company’s falling stock, the switchover comes as China’s technology groups are narrowing the gap with their western rivals on various metrics.

LATAM RETAIL HEADLINES

Kirin Ends Brazilian Venture with $700 Million Sale to Heineken

(February 14) Financial Times

Kirin Ends Brazilian Venture with $700 Million Sale to Heineken

(February 14) Financial Times

- As Japanese brewer Kirin shifts its overseas spending to Southeast Asia, it has has ended its ill-fated venture in Brazil, the world’s third-biggest beer market. On Monday, Kirin announced a deal to sell its struggling Brazil business to Heineken for ¥77 billion (US$700 million).

- The sale will make Heineken the second-largest beer company in Brazil, with a 17% market share, and will allow the Dutch brewer to challenge the dominance of rival Anheuser-Busch InBev in its biggest market.

Walmart Continues Downsizing in Brazil, Closes Five Stores

(February 10) ESMMagazine.com

Walmart Continues Downsizing in Brazil, Closes Five Stores

(February 10) ESMMagazine.com

- According to Brazilian newspaper O Estado de São Paulo, Walmart closed five stores in Brazil in recent weeks. Among the banners affected are Nacional (a local network of supermarkets that was acquired by Walmart in 2005) and Todo Dia (a chain of neighborhood stores).

- The company also dismissed employees in the commercial and administrative areas; the total number of dismissals is expected to reach 300, sources told the paper. The latest cuts came despite the fact that Walmart had reported positive data for Brazil in its latest balance sheet.

Mexican Manufacturing Company Giant Motors Is to Build Electric Cars

(February 8) CleanTechnica.com

Mexican Manufacturing Company Giant Motors Is to Build Electric Cars

(February 8) CleanTechnica.com

- Giant Motors, a Mexican manufacturing company, is partnering with Moldex, a subsidiary of Bimbo (the world’s largest bakery), and the Monterrey Institute of Technology to develop a new electric car to serve as a taxi in order to help combat Mexico City’s chronic smog problem.

- Giant Motors also recently announced a tie-in with Chinese automaker JAC Motors to build the JAC S2 and S3 SUVs. Production is scheduled to begin in the second half of 2017.

Brazil Retail Sales Tumble in December Despite Holiday Sales

(February 14) Reuters.com

Brazil Retail Sales Tumble in December Despite Holiday Sales

(February 14) Reuters.com

- Retail sales in Brazil fell sharply in December as Christmas holiday discounts failed to bolster consumption amid a severe recession. Retail sales volumes excluding cars and building materials fell by 2.1% from November, their steepest drop since January 2016.

- Retail sales fell by 6.2% in 2016, their worst year in since 2001, as Brazil weathered the second year of a recession that has left more than 12 million people unemployed.