Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

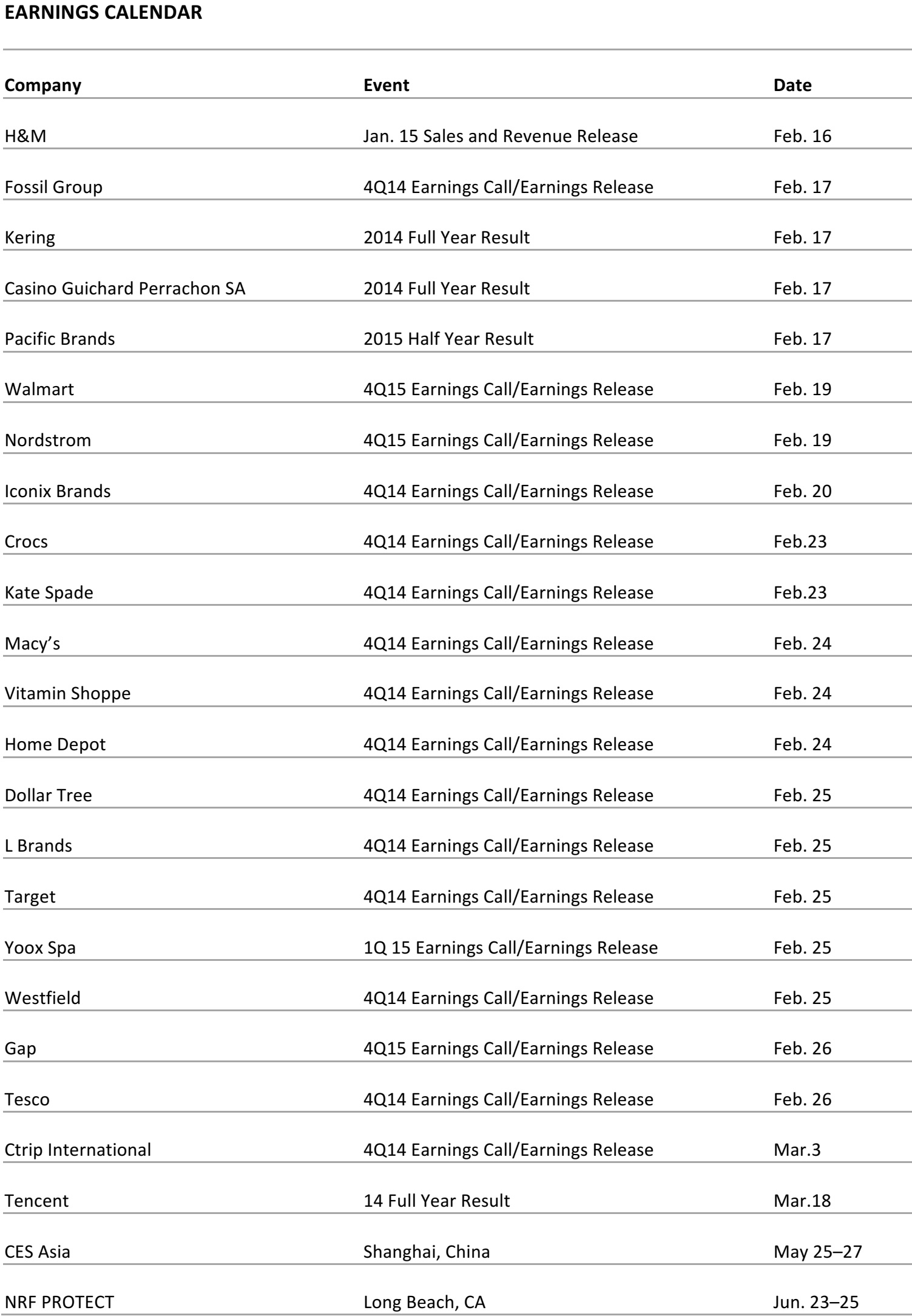

Remember when, not that long ago, traditional retailers were fretting that the physical store was headed for obsolescence, to be viewed merely as a place where tech-savvy shoppers would try on or test merchandise, only to make the purchase at Amazon.com or a competitor’s ecommerce site? Well, what’s actually evolved is more complex, but also more hopeful. Yes, “showrooming” is a growing trend. However, several recent studies indicate that it is far less common than its opposite—“webrooming,” whereby shoppers do their research online, then make the purchase at a store. In its just-released annual survey of US consumers, PricewaterhouseCoopers (PwC) found that the amount of research performed online before buying in a store has increased dramatically across all product categories since 2013 (Figure 1). It also showed that Web-to-store sales made up a significant share of the total purchases for household appliances (36%), consumer electronics (35%) and home-improvement products (32%). The smallest Web-to-store conversion was for grocery, at 15%. Webrooming poses new challenges for retailers: it means fewer impulse buys and fewer opportunities to upsell. But cross-channel shopping is here to stay, so retailers need to figure out how to work this trend to their advantage. Keep in mind that when a webroomer walks into your store, she has compared prices and read reviews, and has decided that your store meets her purchase criteria. That’s a golden opportunity to enroll this shopper in your customer relationship management (CRM) program. A seamless omnichannel strategy works best with this customer, because webroomers often also showroom. Offer coupons or discounts to shoppers who visit your website if they make a purchase in your store. Integrate social media engagement into the store experience. Provide the click-and-collect option, make it possible to check product availability online and make sure that in-store inventory matches what your website says. Webroomers also like the option of being able to easily return items to the store if they need to. The good news for traditional retailers is that stores retain a critical role in the consumer’s path to purchase, even in this digital era.Source: PricewaterhouseCooper US Retail Survey, published February 2015

Auto Sales Charge Ahead

Through January 31, 2015

Seasonally adjusted

Source: US Census Bureau

Through January 31, 2015

Seasonally adjusted

Source: US Census Bureau

Retail Sales Growth

Through January 2015

Seasonally adjusted

Source: US Census Bureau

Through January 2015

Seasonally adjusted

Source: US Census Bureau

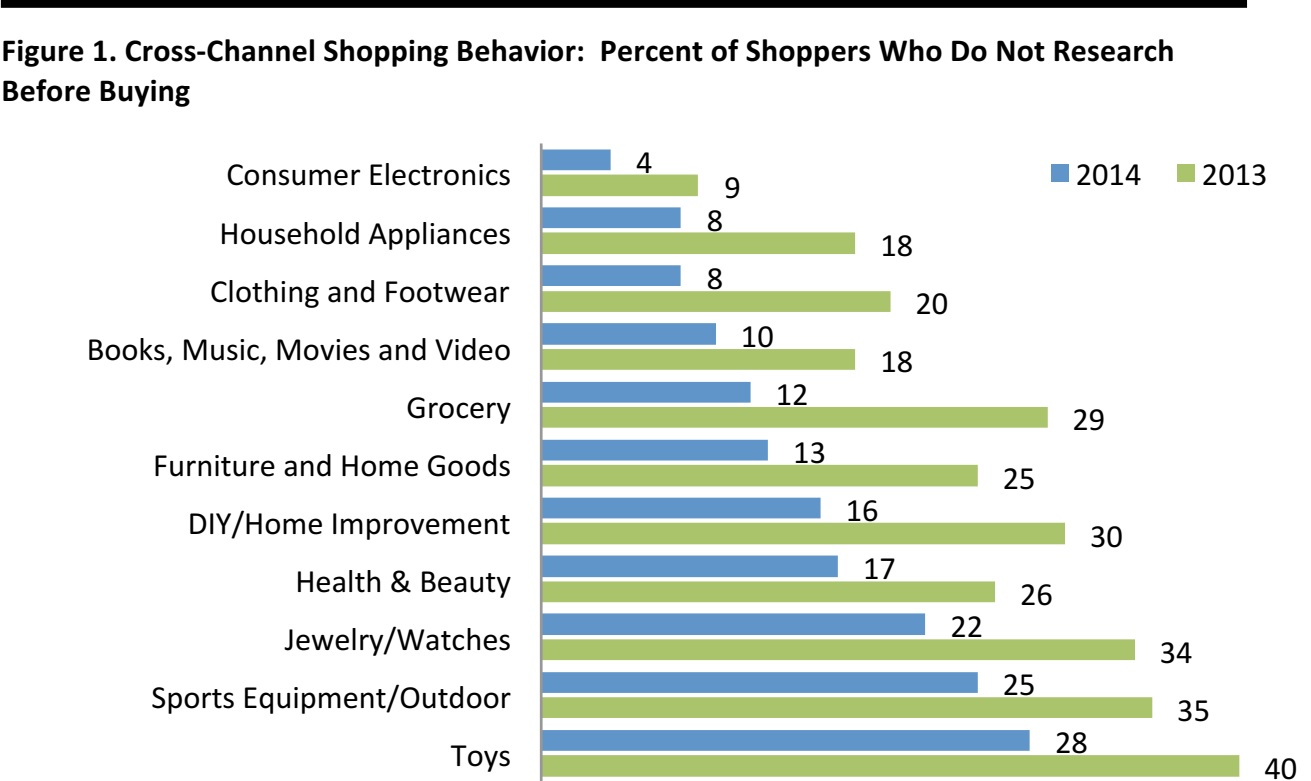

- Another month of a disappointing retail sales report from the US Census Bureau as gains in discretionary income were likely diverted into spending on services. January retail sales fell 0.8% from December and ex-autos declined 0.9%. The consensus forecast was for a 0.4% decline

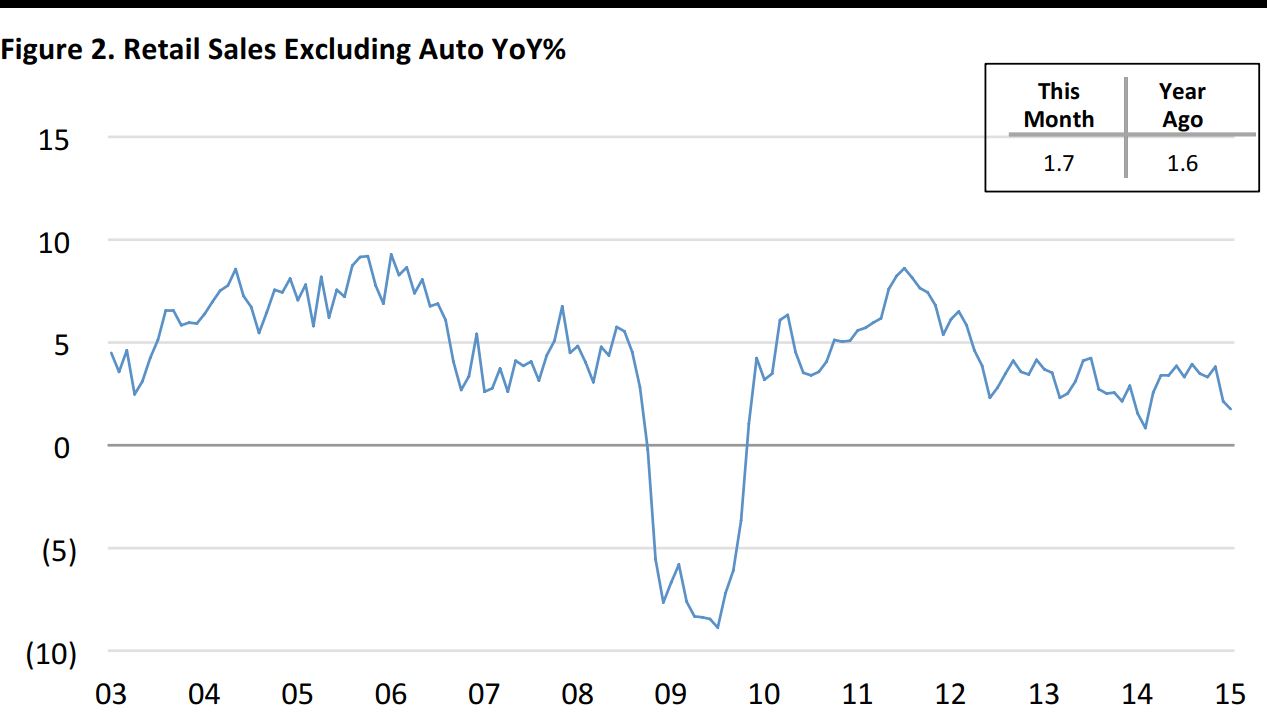

- On a YoY basis, the sales gain was 3.3% (or up 1.7% ex-autos). The strongest categories were restaurants, autos and sporting goods, with autos up 10% YoY

- Sales at home furnishing stores moderated from the 5.8% YoY pace in December to 5.5%, but remained significantly above the 2.9% growth the channel achieved in 2014

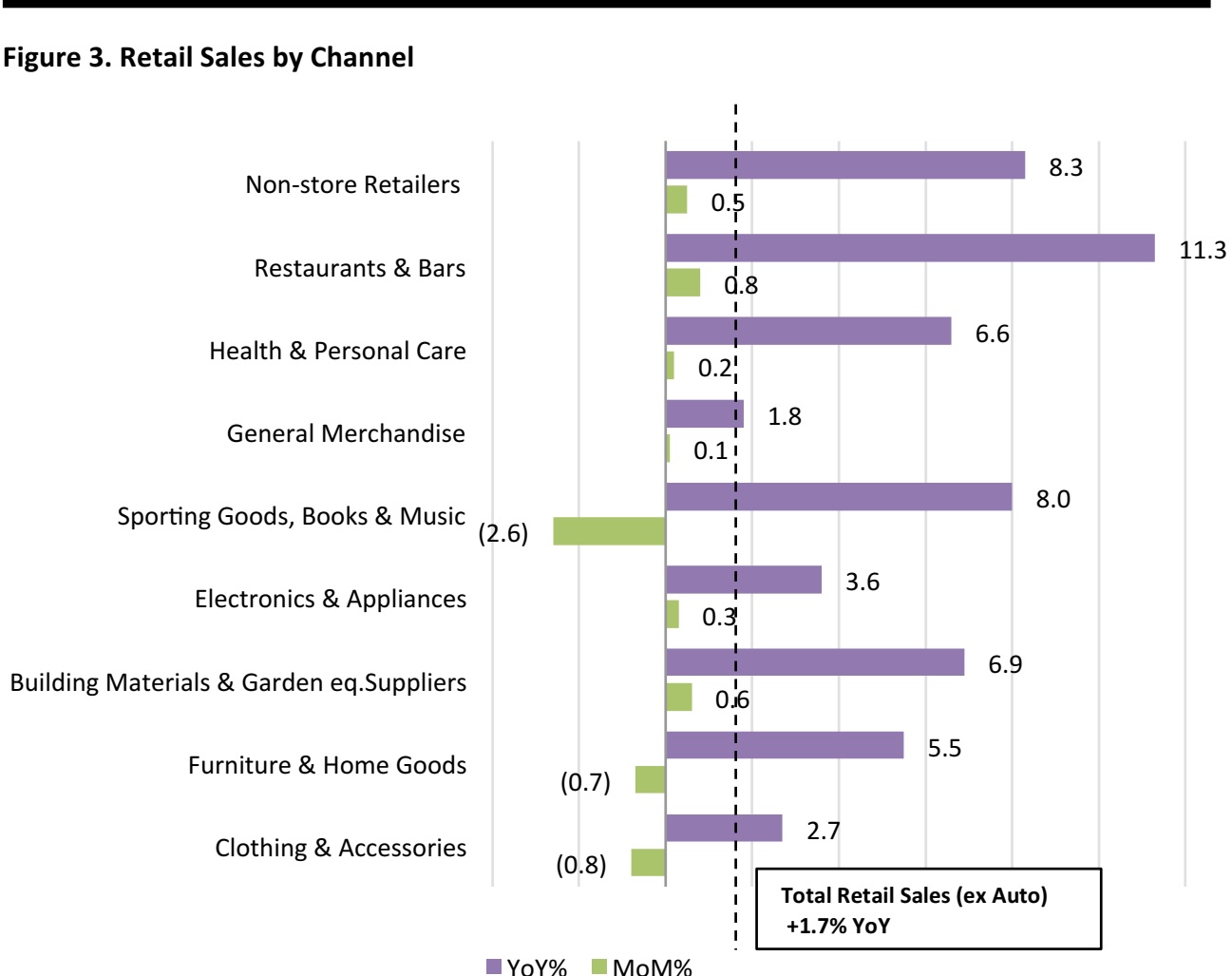

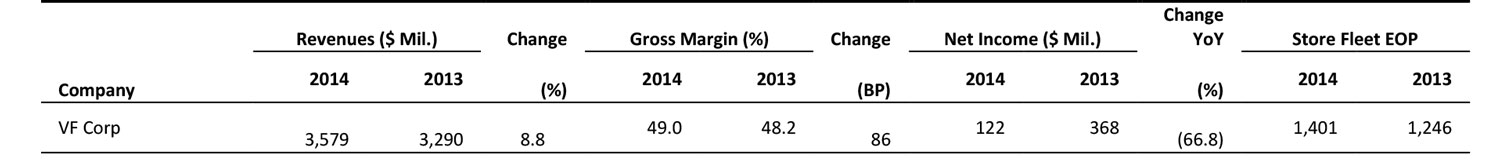

Selected Company Earnings

US RETAIL HEADLINES

Banana Republic and J.Crew Invade Fashion Week in Search of Cachet

(February 13) Bloomberg

Banana Republic and J.Crew Invade Fashion Week in Search of Cachet

(February 13) Bloomberg

- Banana Republic (a division of Gap), J.Crew and other mainstream brands are increasing their presence at Fashion Week this year, shifting the tone of an event known for experimental clothing that few ordinary consumers could afford to buy—or would even want to—to something that is more accessible in both silhouette and cost

- Specialty-apparel chains face pressure to be hip. Ecommerce sites and fast-fashion chains, popular with millennial shoppers, can embrace the latest fads much faster than traditional retailers

- An even broader challenge for both: many Americans are wearing more sports clothing as street wear—a clothing category known as “athleisure”

- Chico's (NYSE: CHS) was a big mover last week. The company saw its shares rise 7.4%, during the week—and 8.1% in the past one-month time frame

- The gain can be attributed to talk of a possible buyout by private equity firm Sycamore Partners. The Wall Street Journal reported late Tuesday afternoon (February 10) that Sycamore was seeking financing from anonymous sources to buy Chico’s

- Sycamore Partners specializes in consumer and retail investments and has more than $3.5 billion in capital under management. Its investments include Aéropostale, Coldwater Creek, Hot Topic, Jones New York, Kasper, Kurt Geiger, MGF Sourcing, Nine West, Stuart Weitzman and Talbots

- Tommy Hilfiger celebrates its thirtieth anniversary with a collection inspired by one of the most iconic and inclusive American pastimes: football. Limited-edition products that premiere on the runway Monday, February 16 will be available in real time at tommy.com

- The brand will continue to introduce innovative digital technology that democratizes New York Fashion Week and invites everyone to view the show in expanded, engaging ways

- Tommy Hilfiger uses digital initiatives to reach new consumers, improve service and efficiencies and support sustainability. This year the company opened a digital showroom in Amsterdam, and in 2013 it opened its first “digital flagship” retail store in Düsseldorf, Germany

CHINA TECH HEADLINES

- Alibaba-backed Kuaidi Dache and Tencent-backed Didi Dache announced a merger. The two hold a nearly 100% market share of taxi apps in China

- Kuaidi’s CEO said that the Internet, especially on mobile, offers the best chance for Chinese companies to expand abroad. They are set on a collision course with Uber in a struggle for global domination

- The merger is a marriage between three camps: Tencent, Alibaba and Softbank (the latter two back Kuaidi), in rivalry with Baidu, which invested in Uber

- Xiaomi, China’s largest smartphone manufacturer, will initially enter the US market by selling headphones, smart wristbands and other accessories online over the next few months

- The company is also seeking a manufacturing partner in Brazil. A December 2014 funding round valued the company at $45 billion

- Xiaomi announced no plans for its phones to enter the US market, most likely due to the fact that Xiaomi doesn’t own many of its patents in the US. Moreover, the US smartphone market is subsidized by carriers, which virtually eliminates the attractiveness of Xiaomi's lower prices

- Samsung announced production of mobile application processor chips with a 14-nanometer (nm) line width

- The company claims its new Exynos 7 Octa chips have 20% more processing power and consume 35% less energy than conventional mobile chips using 20nm processes

- The chips also use 3-D fin-shaped field-effect transistor (FinFET) design

EUROPE/UK HEADLINES

- Zalando posted its first annual positive profit (EBIT), in 2014, the company reported this week. The German-based clothing and footwear pure play said EBIT margins for the full year came in at 3.7%, while in 4Q they reached an all-time high of 9.9%

- The company grew sales 26% to €2.2 billion in the full year, slowing to 21% in the final quarter. Adjusted EBIT for the year reached €82 million

- Zalando serves 15 European markets and says its websites attract more than 100 million visits per month

- Multi-sector retailer Groupement des Mousquetaires posted total retail growth of 0.4% to €36.2 billion for 2014 (1.3% growth excluding automotive fuel)

- Grocery subsidiary ITM reported 1.7% full-year sales growth to €24.4 billion in France (excluding automotive fuel). ITM operates the Intermarché and Netto chains, and according to FBIC analysis is France’s third-largest grocer

- ITM’s performance was in the context of a deflationary environment: French grocery sector sales fell by around 2% in 2014, according to FBIC analysis of Eurostat data

- Tesco is expected to make deeper job cuts than anticipated as it moves to reduce headcount in stores as well as its headquarters

- The company is expected to cut between 4,000 and 6,000 jobs from its head office and from the closure of 43 stores. The company is now expected to remove at least 1,000 store managers as it strips out a layer of in-store management

- Total job cuts could approach 10,000

LATIN AMERICA HEADLINES

- Bank of Nova Scotia, Canada’s third-biggest bank by assets, is hiring 68 bankers in Mexico and is evaluating acquisitions in order to raise its market share there

- Enrique Zorrilla, Scotiabank’s top executive in Mexico, said in an interview that Mexico’s financial industry is poised for “a very significant process of consolidation”

- Scotiabank has invested about $6.8 billion on acquisitions during the past five years, and CEO Brian Porter said last month that the bank plans to make acquisitions in Latin America, particularly in Mexico, Peru, Chile and Colombia

Vivo the Leading Brazilian 4G Wireless Provider in January

(February 16) Telecompaper

Vivo the Leading Brazilian 4G Wireless Provider in January

(February 16) Telecompaper

- According to telecom research firm Teleco, 147 municipalities and 41.8% of Brazil’s population were served by 4G wireless service as of the end of January

- Vivo was the leading carrier, with 140 municipalities and 41.8% of the population covered; Claro was number two, with 95 municipalities and 37.1%

- TIM (45 municipalities and 30.2%) and Oi (45 municipalities and 30.5%) were tied for third place in terms of municipalities served

- Mexico’s rate of consumption of generics is among the highest in the world, according to the head of the Federal Commission for Protection against Health Risks Oversight (Cofepris)

- The number of generic products sold in Mexico has grown from 153 in 2010 to 23,000 in 2014, a growth rate of more than 15,000%

- During the same period, the average expense for Mexicans has dropped from MXP 2,100 to MXP 750 (from $140 to $50)