Web Developers

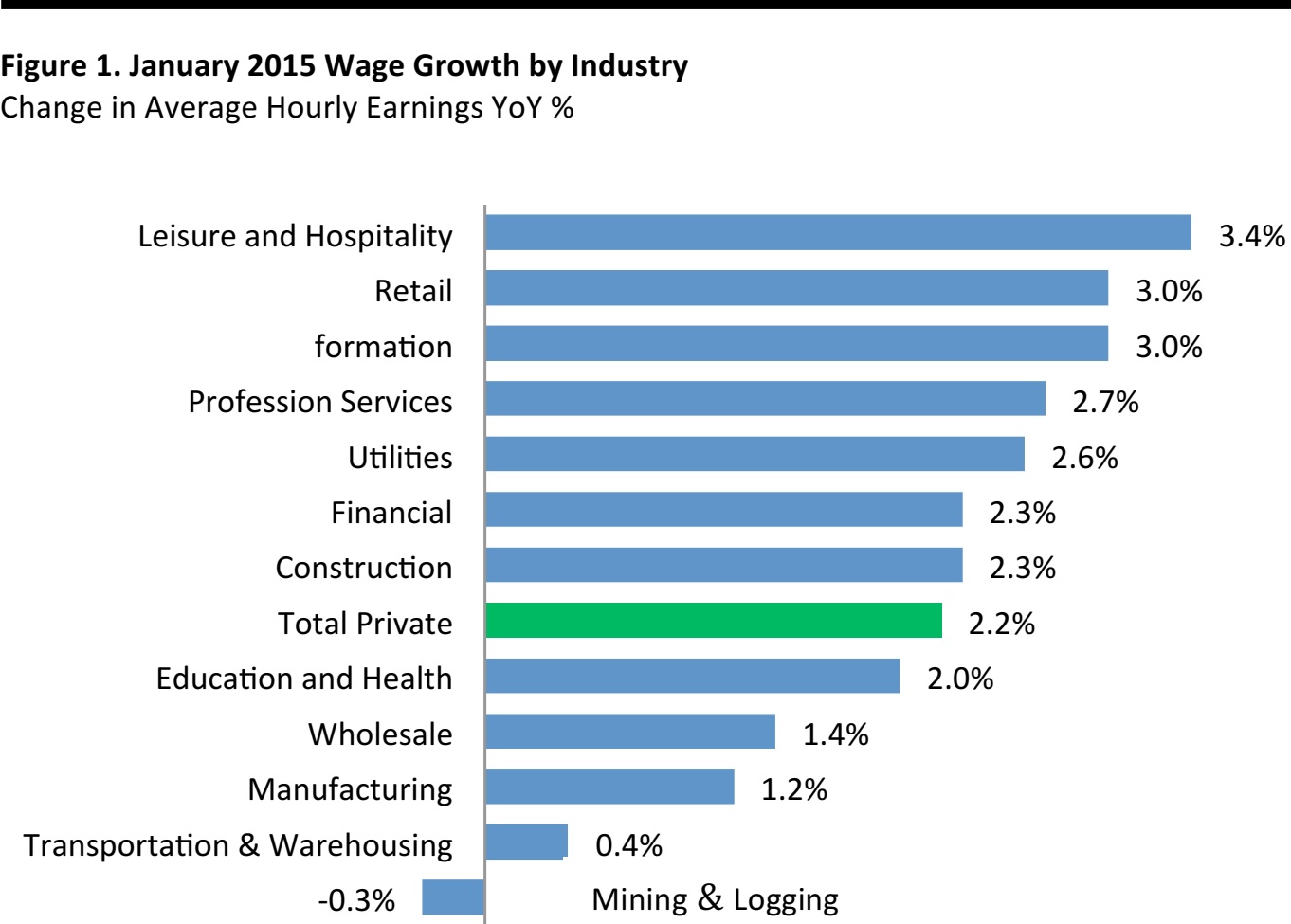

FROM THE DESK OF DEBORAH WEINSWIG

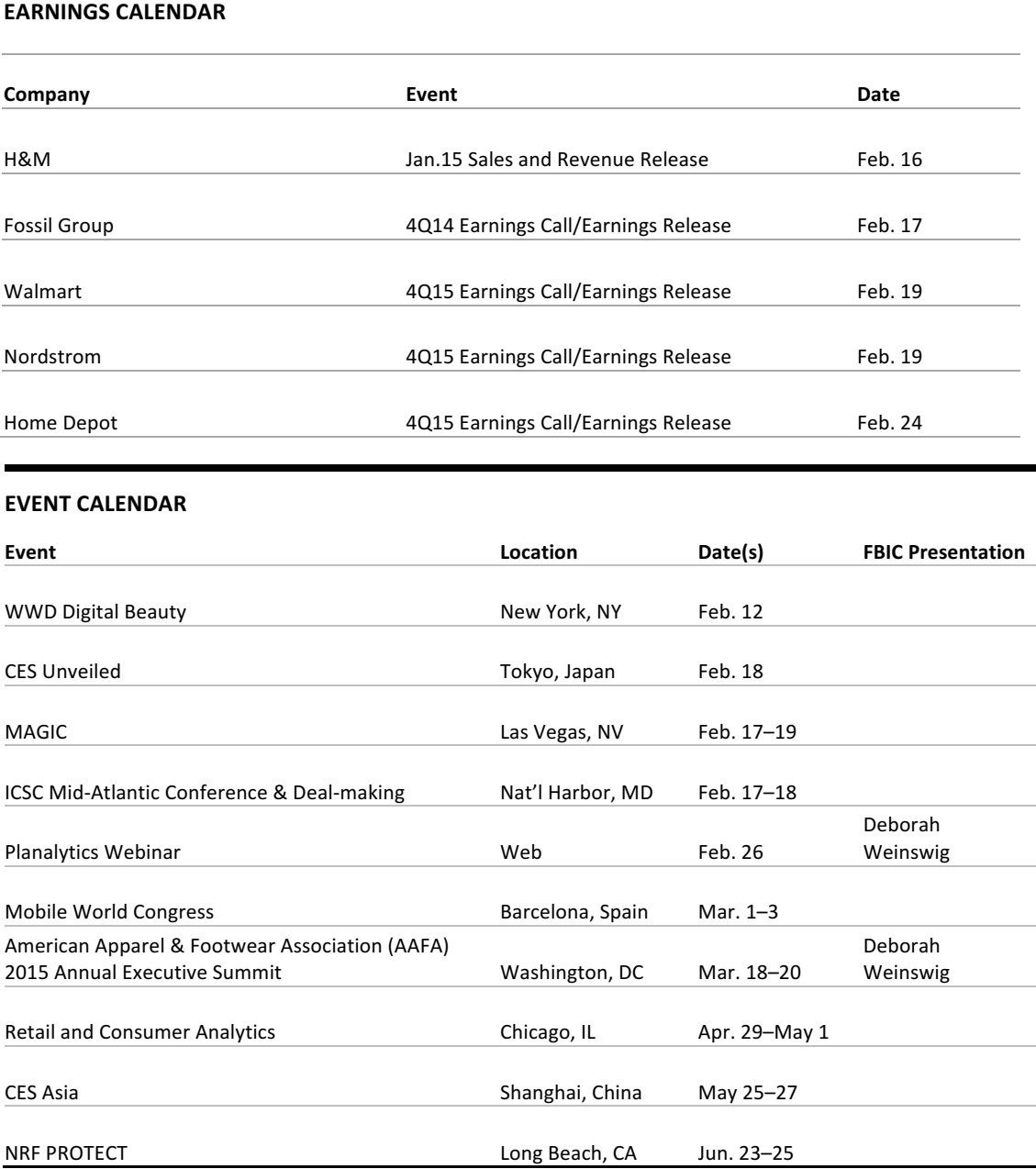

Last Friday’s US jobs report for January handed us fresh evidence of something we’ve long been waiting for: a “self-sustaining” recovery. That news was followed by the release this week of December job openings data, which showed a 28% YoY gain to the highest level in more than a decade. After a prolonged period of lethargy, the economy finally appears to have achieved escape velocity and can continue to gain traction. Not only did the job gains in January beat expectations, but they were also revised upward for November and December—making this the best three-month stretch of hiring since 1997. The unemployment rate ticked back up to 5.7%, but that was only because of an increase in the labor participation rate, suggesting that more people are confident enough to begin looking for jobs again. Meanwhile, annual wage growth came in at 2.2%, still below the annual growth of 3% or more seen before the recession, but up significantly from the 1.9% YoY increase in 2013, and definitely headed in the right direction. Economists and market watchers see this as a hopeful sign that wage growth may finally be breaking out of the 2% area it has been stuck in since 2008. The positive ripple effects of more people working, wages rising and energy costs reaching multiyear lows cannot be underestimated. This wealth of good news suggests that the initial estimate for the country’s GDP, which showed the economy grew at an annualized rate of just 2.6% in 4Q 2014, may be headed for its own upward revision. The stars remain in alignment for what we expect to be the strongest year for consumer spending in a long time. Cheers!Change in Average Hourly Earnings YoY %

As of January 31, 2015 Source: US Department of Labor

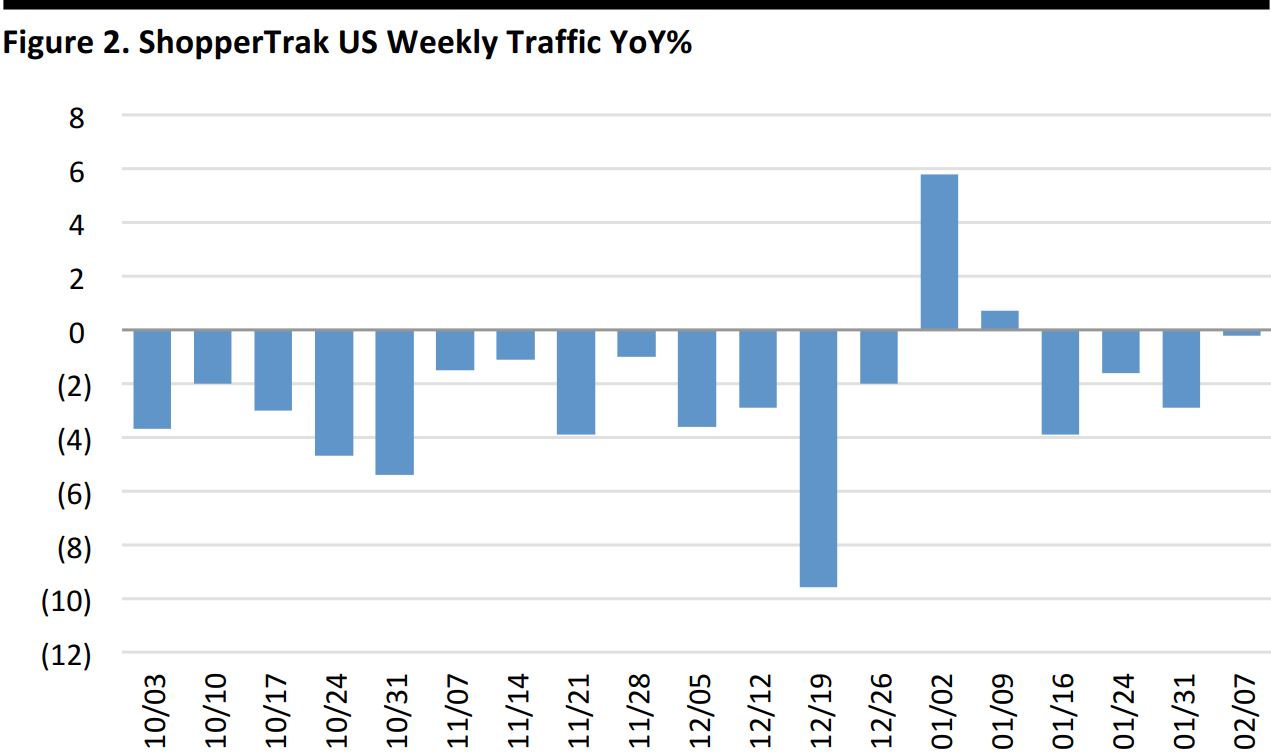

US Store Traffic Improves, Driven by a Lift in Footfall at Apparel Stores

Through February 7, 2015 Source: ShopperTrak

- US store traffic dropped 20 basis points, or 0.2% YoY, a significant improvement from the 2.9% decrease ShopperTrak recorded in the final week of January

- Apparel stores continue to experience traffic gains, with a 5.9% lift, the sixth rise in the last seven weeks and the second- largest gain in the past 12 months

- Store traffic at electronic stores fell for the fifth consecutive week, down mid-single digits

US RETAIL HEADLINES

- Total 4Q sales rose 12% YoY to $1.01 billion while comparable retail segment net sales, which include ecommerce, increased 6%

- By retail banner, comparable retail segment net sales increased 18% at Free People, 6% at the Anthropologie Group and 4% at Urban Outfitters. Wholesale segment net sales rose 21%

- CEO Richard Hayne commented that promotional activity was higher than planned, but the company enters the spring selling season in a clean inventory position, and Urban Outfitters brand is experiencing steady progress reengaging its core customer

- Based on better than expected sales, margins, and expense management during January, Aeropostale now expects a 4Q operating (loss)/profit in the range of approximately ($2.0) to $2.0 million, or ($0.06) to ($0.01) per diluted share. This compares with previous guidance of operating losses in the range of ($18.0) to ($23.0) million, approximately ($0.25) to ($0.31) per diluted share

- 4Q net sales decreased 11% to $594.5 million, from $670.0 million and 4Q comparable sales, including the ecommerce channel, declined 9%, compared to a 15% decrease last year

- Concurrently, Aeropostale CFO Mark Miller was appointed COO and will be responsible for all aspects of supply chain management, logistics, real estate, construction and human resources, and will continue to lead strategic planning and new business development, including international licensing. David Dick will join Aeropostale February 17 as CFO; most recently he was CFO at Delia’s

Gap Inc. Reports January Sales and Increases FY 14 (ended January 31, 2015) EPS Guidance

(February 9) Gap Inc. press release

Gap Inc. Reports January Sales and Increases FY 14 (ended January 31, 2015) EPS Guidance

(February 9) Gap Inc. press release

- January sales declined 1.2% to $888 million and January comps decreased 3%, driven by a 9% drop in comps at Gap brand. Comps at Old Navy rose 3%, and were up 2% at Banana Republic

- 4Q sales of $4.71 billion rose 3% or 5% on a constant currency basis. 4Q comps were up 2% on a consolidated basis reflecting an 11% comp at Old Navy, 1% at Banana Republic and a 6% comp decline at Gap brand

- FY 14 EPS guidance was lifted to $2.86–$2.87 from $2.73–$2.78 driven by 4Q results and a lower effective tax rate

- In collaboration with Disney's upcoming movie Cinderella, Saks Fifth Avenue is releasing a shoe collection inspired by the fairy tale's iconic glass slipper

- The line—which features heels created by designers Jimmy Choo, Salvatore Ferragamo, Nicholas Kirkwood, Charlotte Olympia, Stuart Weitzman and more—hits stores in March, at the same time as the movie. While there is no midnight deadline, the collection is limited

- These modern day princess pumps are adorned with Swarovski crystals (no glass!)

- JC Penney is launching a line of 40 pieces of exclusive Disney collection merchandise inspired by the new Cinderella film, including role-play dresses and accessories, plush toys, dolls, figurines and a tea set. Apparel includes graphic tees, nightshirts, a tulle dress, a special deluxe ball gown costume and a set of make-believe "glass" slippers reflecting Cinderella's look from the new live-action film

- A fully integrated marketing campaign that includes a dedicated commercial premiering during the Academy Awards is in place and will showcase how JC Penney can inspire today's modern woman and make her fairy-tale dream a reality

- The Disney shop inside JC Penney was launched in October 2013 and offers an enchanting retail destination where some of Disney's most beloved characters are represented by an extensive collection of toys, costumes and children's apparel exclusive to JC Penney. Currently there are Disney shops available at 565 JC Penney locations and online, and the Disney shops will be extended to an additional 116 stores this year

- Walmart Canada plans to complete 29 Supercenter projects in FY ending January 31, 2016, adding 230,000 square feet of retail space. At the same time, the company will expand its distribution network to support its food and ecommerce growth in Canada, and will continue to expand and enhance its ecommerce website, walmart.ca

- Walmart Canada will invest approximately C$340 million for Supercenter, distribution network, and ecommerce projects; C$230 million for Supercenters, including remodeling and expansion to add full grocery departments

- The expansion will bring Walmart Canada’s store count to 396 this FY, with 309 Supercenters and 87 discount stores

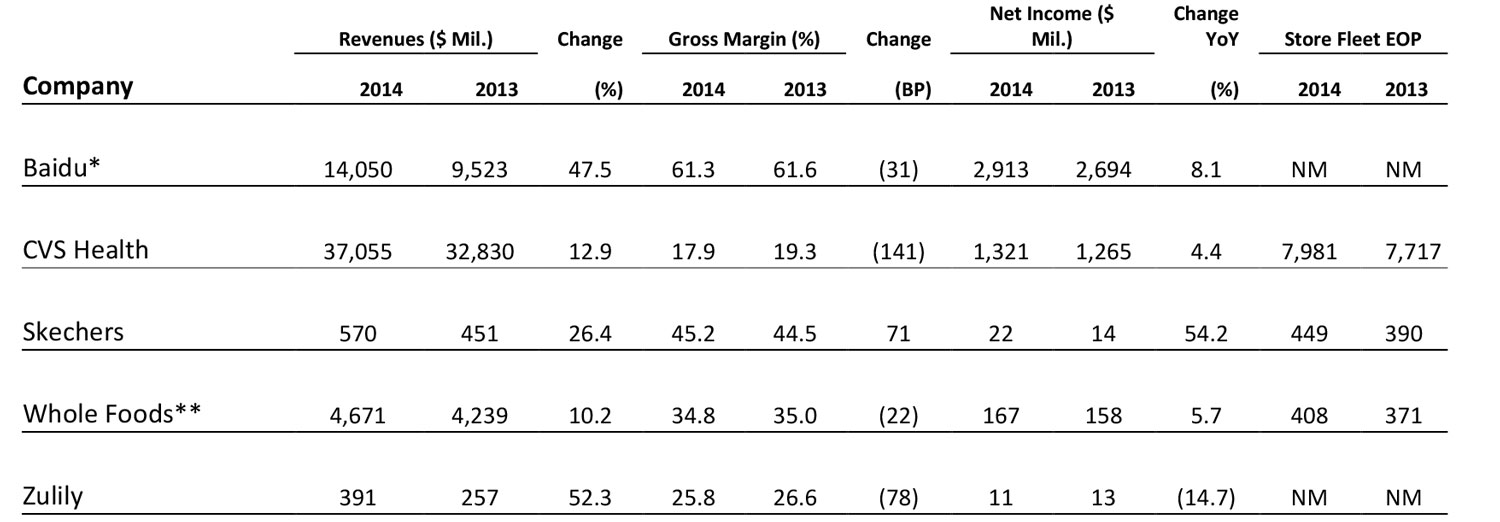

Source: Company reports

*Numbers for Baidu reported in RMB

** FY ends Sept.

Source: Company reports

*Numbers for Baidu reported in RMB

** FY ends Sept.

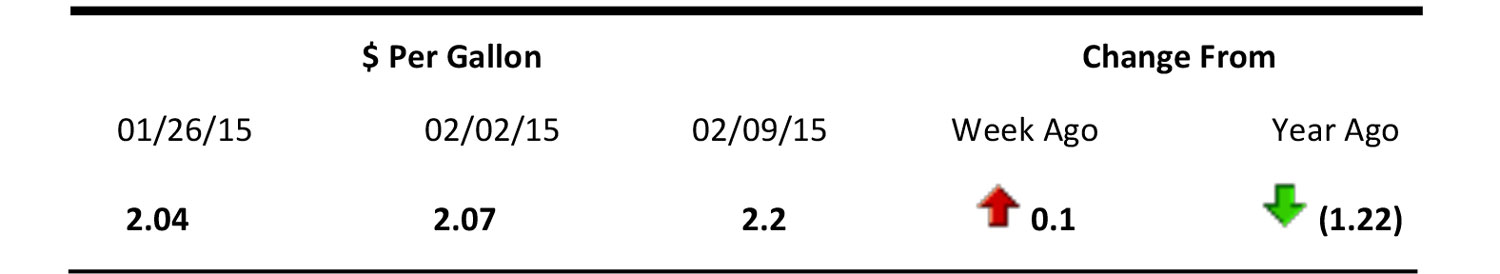

US Regular Gasoline Prices

Source: US Energy Information Administration

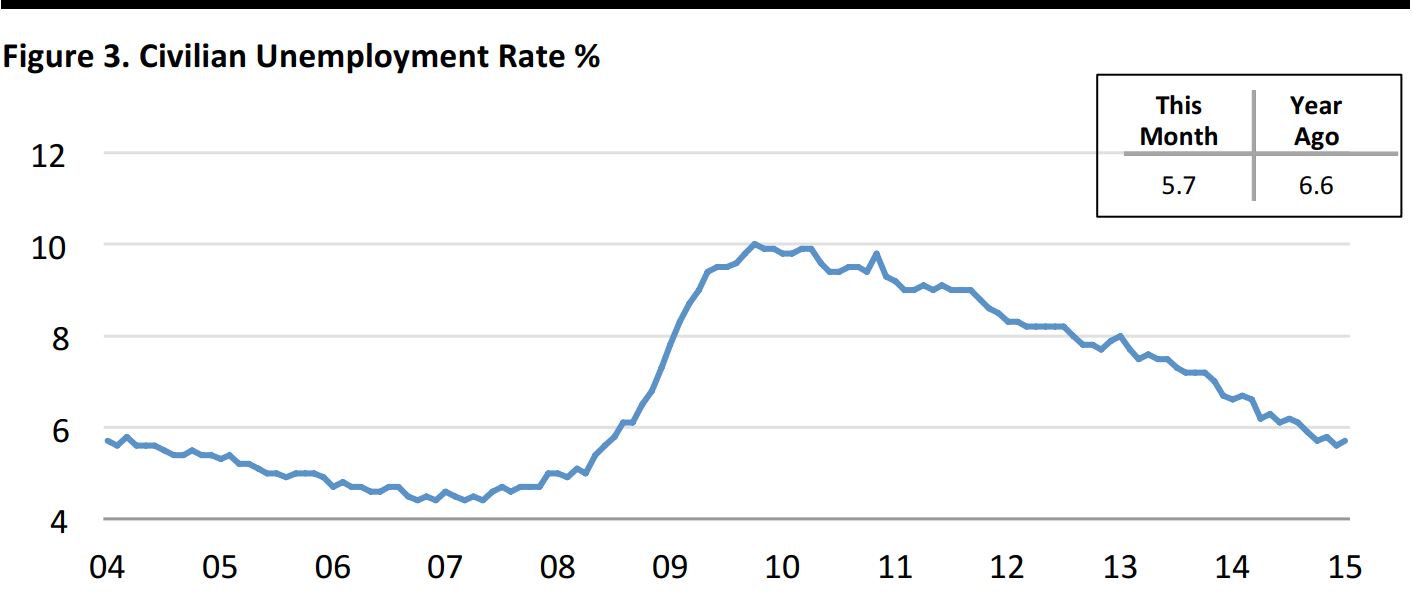

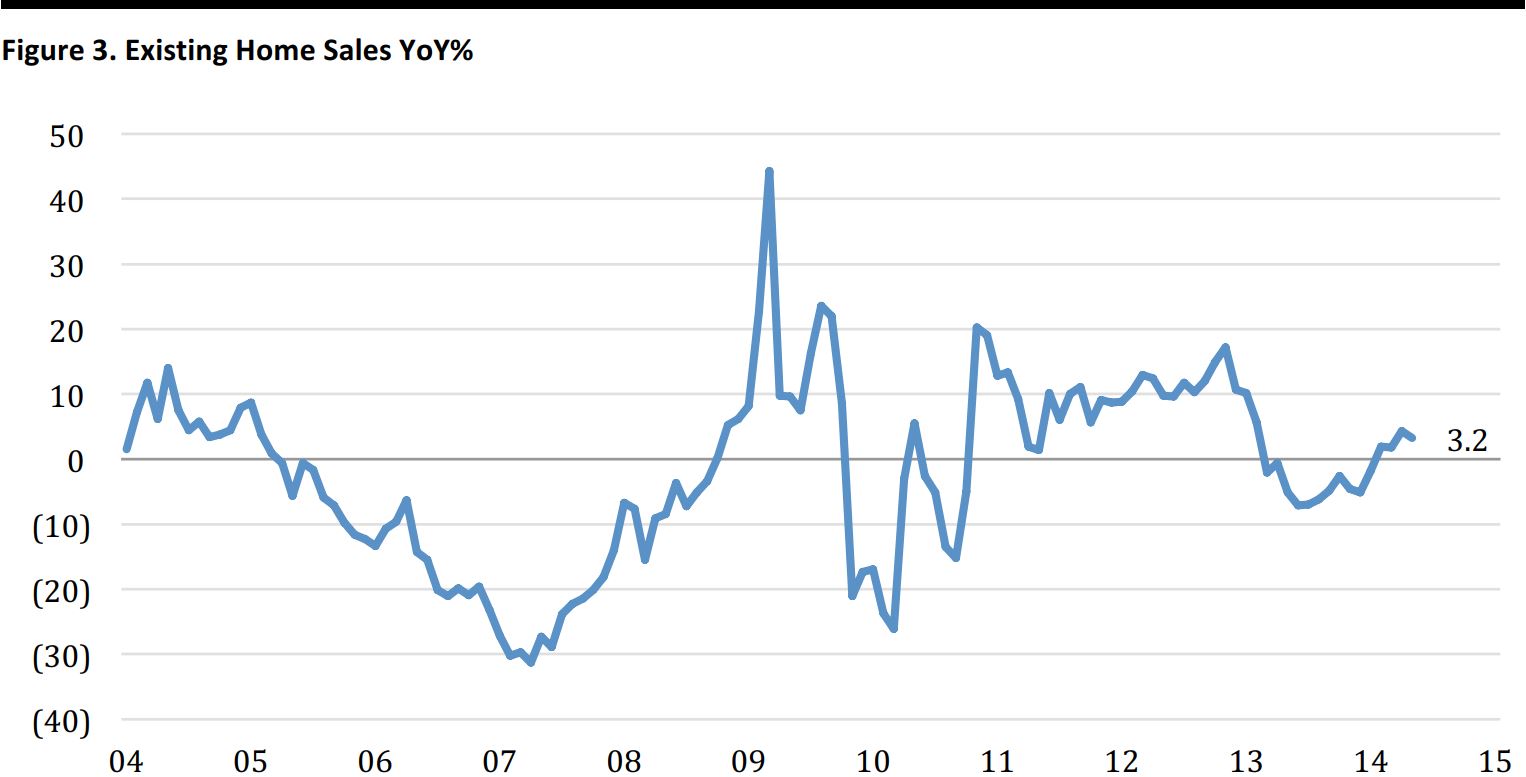

US MACROECONOMIC UPDATE

A Modest Uptick in Unemployment Rate is Simultaneous with an improving Labor Market

Through January 31, 2015 Seasonally adjusted Source: Bureau of Labor Statistics

- The unemployment rate rose modestly in January, to 5.7% from 5.6% in December, as the improving labor market drove more people to begin job searches

- The economy created more than a million jobs in the last three months, 257,000 of them in January alone

- During January, job gains occurred in retail, construction, healthcare, financial activities and manufacturing

- The 5.7% unemployment rate doesn’t reflect the job picture for many Americans. Among the more dire unemployment statistics include an 18.8% unemployment rate for teenagers and 10.3% unemployment rate for African Americans. (These metrics have exhibited modest improvement in the last few months

University of Michigan Consumer Sentiment Shows Steady Improvement

Through January 31, 2015 Source: University of Michigan

- Positive consumer sentiment jumped to its highest level in 11 years as steady job gains and plunging gas prices brightened the outlook for US households

- Americans were the most upbeat about the economic outlook they have been in a decade as a healing job market providesfor better employment prospects

- The survey’s current conditions index, which captures Americans’ assessments of their personal finances, rose to 109.3 this January, the highest level since January 2007

- 2015 inflation expectations fell to 2.5% in January from 2.8% in December

CHINA TECH HEADLINES

- On February 4, Qualcomm agreed to pay a $975 million antitrust fine and reduce the amount of royalties it can receive from selling its chips to Chinese cellphone and consumer-electronics vendors

- At stake was the $13.2 billion in sales that Qualcomm generated in China in its last fiscal year, as well as its royalty policies and the consequences from the settlement for its business in other countries

- Domestic Chinese cellphone makers are likely to benefit from the settlement, as it requires Qualcomm to compensate Chinese patent holders when its customers cross-license their technology, whereas cross-licensing was previously free of charge

- On February 9, Alibaba Group announced a $590 million investment in exchange for for an undisclosed minority stake in Chinese domestic handset maker Meizu

- The investment is notable in that it pairs Alibaba’s YunOS 3.0 operating system with a hardware manufacturer

- Meizu is a minor player in the Chinese cellphone market, trailing giants such as Xiaomi, Huawei and Lenovo. The company’s press release stated that “[the] investment in Meizu represents a significant expansion of the Alibaba Group ecosystem and an important step in our overall mobile strategy. … This strategic collaboration with Alibaba Group will enable Meizu to further develop our smartphone business and our smart devices ecosyste

- Canon announced plans to acquire Swedish video-equipment maker Axis AB for about $2.8 billion in a move to diversify away from declining businesses

- The price represents a 49.8% premium to Axis’ closing share price on Feb. 9. In its most recent fiscal year, revenues declined 21% at Canon’s office-equipment division and 33% in its digital-camera division

- Axis is the global leader in network security cameras, with a 17.5% share in 2013 according to IHS Technology, followed by China’s Hikvision (13%) and Panasonic Corp. (9.1%). The acquisition stems from a product co-development program that began in 2002

EUROPE/UK HEADLINES

- Metro Group, the German multi-sector retailer and wholesaler, posted group comps up 2.1% for the quarter ending 31 December 2014, another report of mixed performances in its retail chains

- Electrical goods chain Media-Saturn continued to perform well, with total sales up 4.1% (5.6% in local currencies) and comps up 3.8%. Growth was underpinned by a 28% surge in online sales

- Hypermarket chain Real posted a 14.4% slump in sales due to the divestiture of Eastern European operations in 2014. In the remaining market of Germany, comps nudged up 0.9%

- Department store Galeria Kaufhof saw a 1.0% fall in sales, with comps down 1.4%. The company attributed this to the unseasonably mild autumn weather and said it saw a “strong sales increase” at Christmas

- Outside of retail, Metro Cash & Carry posted a 3.6% fall in total sales (up 1.1% in local currencies), with comps up 1.4%

- Total UK retail sales rose just 0.2% on a comparable basis and 1.6% in total YoY in January 2015, according to the British Retail Consortium-KPMG Retail Sales Monitor. Growth was depressed by deflation in shop prices: adjusting for deflation, total YoY growth was 2.9%

- David McCorquodale, Head of Retail, KPMG, said "These figures demonstrate the difficult cycle that retailers are trapped in. Demand is now almost solely driven by discounts, with shoppers very reluctant to buy goods at full price”

- Meanwhile, the UK grocery market grew by 1.1% in the 12 weeks ended February 1, 2015, according to market-share measurement service Kantar Worldpanel. Like-for-like grocery prices were down 1.2% in this period, as major grocery retailers competed fiercely on price

- Tesco returned to positive sales growth for the first time since 2014, with a 0.3% increase in turnover helped along by Black Friday. Aldi grew sales 21.2% and fellow discounter Lidl saw revenues grow 14.2%. Sales at major supermarket chains Sainsbury’s, Asda and Morrisons were down

- Aldi and Lidl hold 4.9% and 3.5% market share respectively, compared to Tesco’s 29.0% share

- British fashion chain New Look posted a 1.7% decline in comps in the 13 weeks to 27 December, but said it had seen a positive response to new ranges in 2015. New Look’s UK comps were down 1.0% in the quarter while group e-commerce revenues jumped 28.6%

- The company said its sales had been hit by unusually warm autumn weather in 2014 and that Christmas trading had been “exceptionally strong.”

- New Look’s CEO said the company is “ready” for a stock market flotation though he said such a decision was not up to him. New Look pulled an IPO at the last moment in 2010 blaming an “unfavourable market backdrop”.

LATIN AMERICA HEADLINES

- Wal-Mart de Mexico SAB (Walmex), the largest retailer in Mexico, reported a 5.6% increase in sales at stores open more than 12 months, the biggest increase in two years and exceeding analyst estimates

- Coinciding with the earnings report was a government study that reported a 7.8% month-on-month increase in consumer confidence. The reported sales increase was significantly higher than Bloomberg’s estimate of 3.4% economic growth for Mexico’s economy in 2015

- On February 9, the Venezuelan government announced a free market in which individuals and businesses can exchange Bolivars for US dollars, which will likely lead to a devaluation of the currency

- At the same time, the government plans to maintain an existing three-tier exchange rate system with a fixed rate of 6.3 Bolivars to the dollar for essential imported goods such as food, medicine, and agricultural supplies. These goods represent 70% of the needs of the Venezuelan economy

- In the second tier, some businesses such as automotive-part suppliers will be able to buy dollars at a rate of 12-to-1. The new free-market system would replace the existing third tier, which has run at 50 Bolivars to the dollar. The new, lower currency rates could force American businesses to write down the value of assets held in Venezuela

- Brazilian retail sales (excluding autos and building materials) declined sharply, down 2.6% sequentially from November and capping the softest year in more than a decade, according to the country’s IGBE statistic agency

- For the full year, Brazil’s retail sales grew 2.2%; the slowest rate in 11 years, and below the 7.5% average growth rate for the past four years

- All ten retail sectors tracked by IBGE experienced a decrease in sales, with home appliances recording a 9.8% sequential decrease and clothing seeing a 7.3% sequential decrease. On an annual basis, December retail sales declined 0.3%