FROM THE DESK OF DEBORAH WEINSWIG

Recent Spate of Top Management Changes at Retailers and Brands

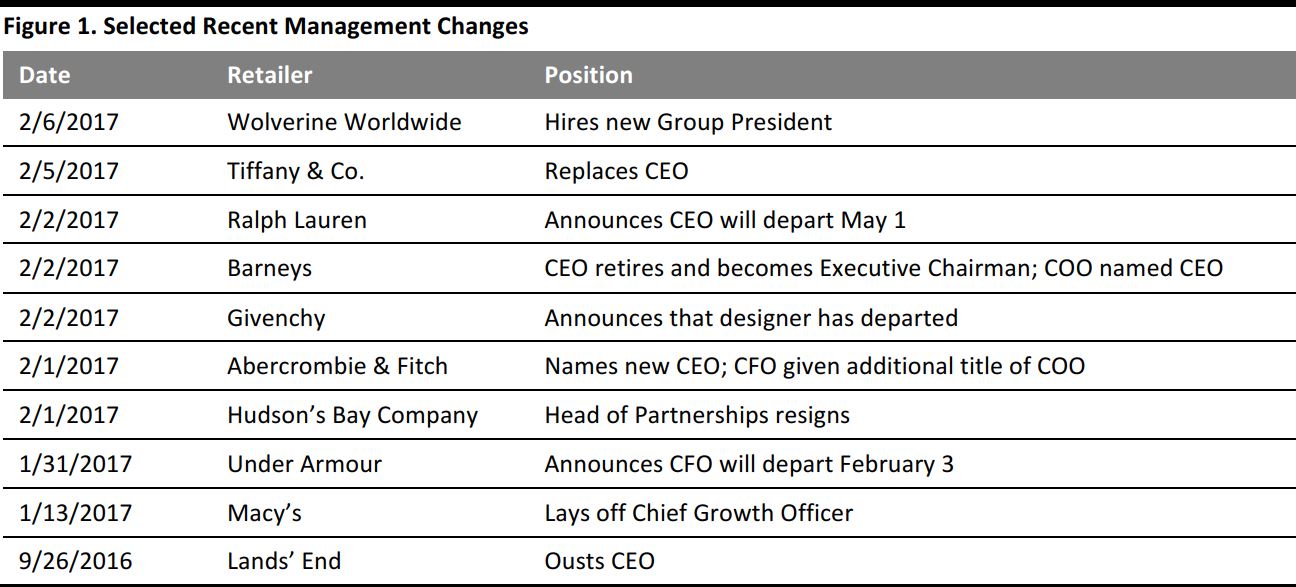

As many large retailers and brands face lower foot traffic and negative same-store sales, along with the relentless encroachment of e-commerce, we are seeing turbulence in senior leadership at a number of companies.

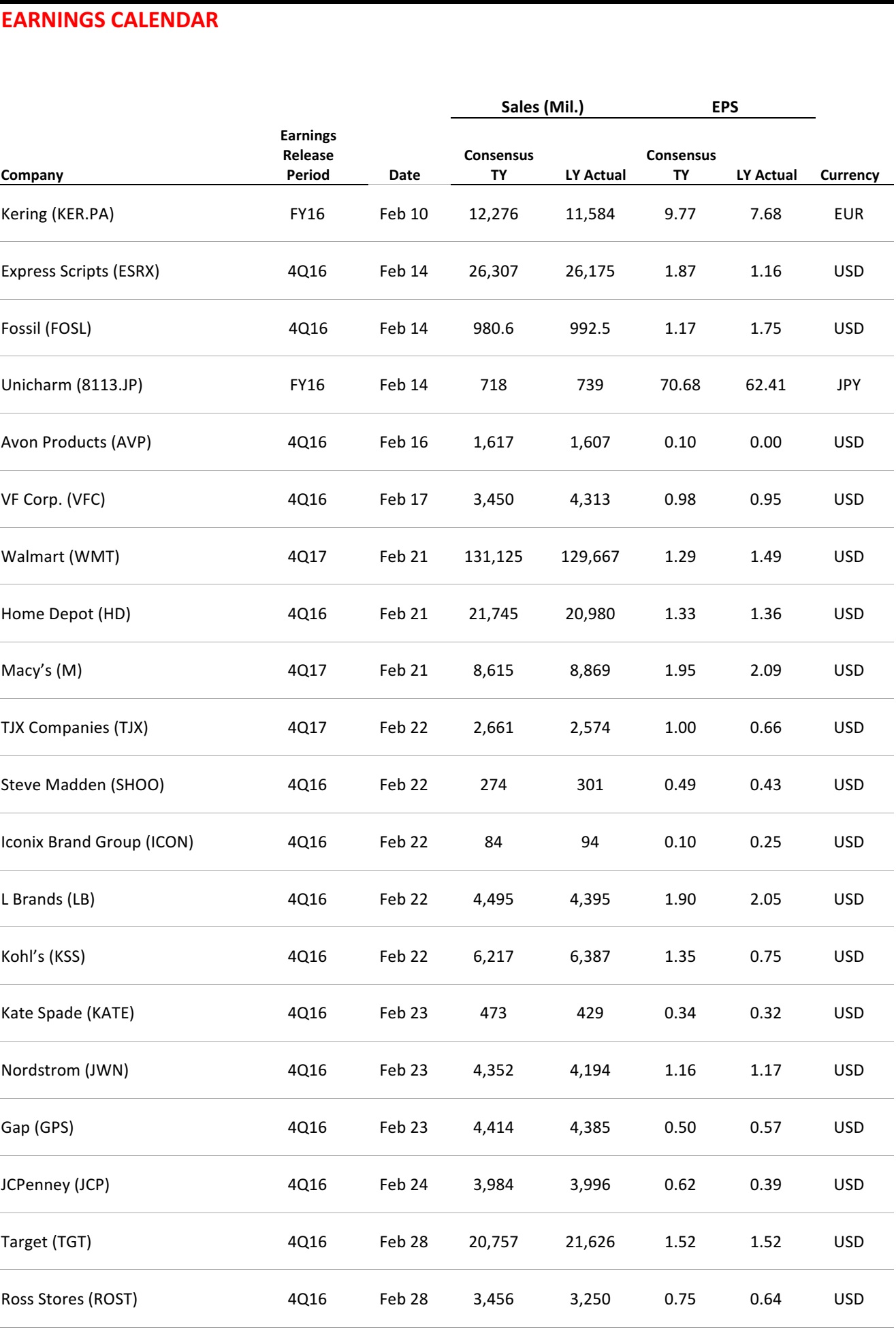

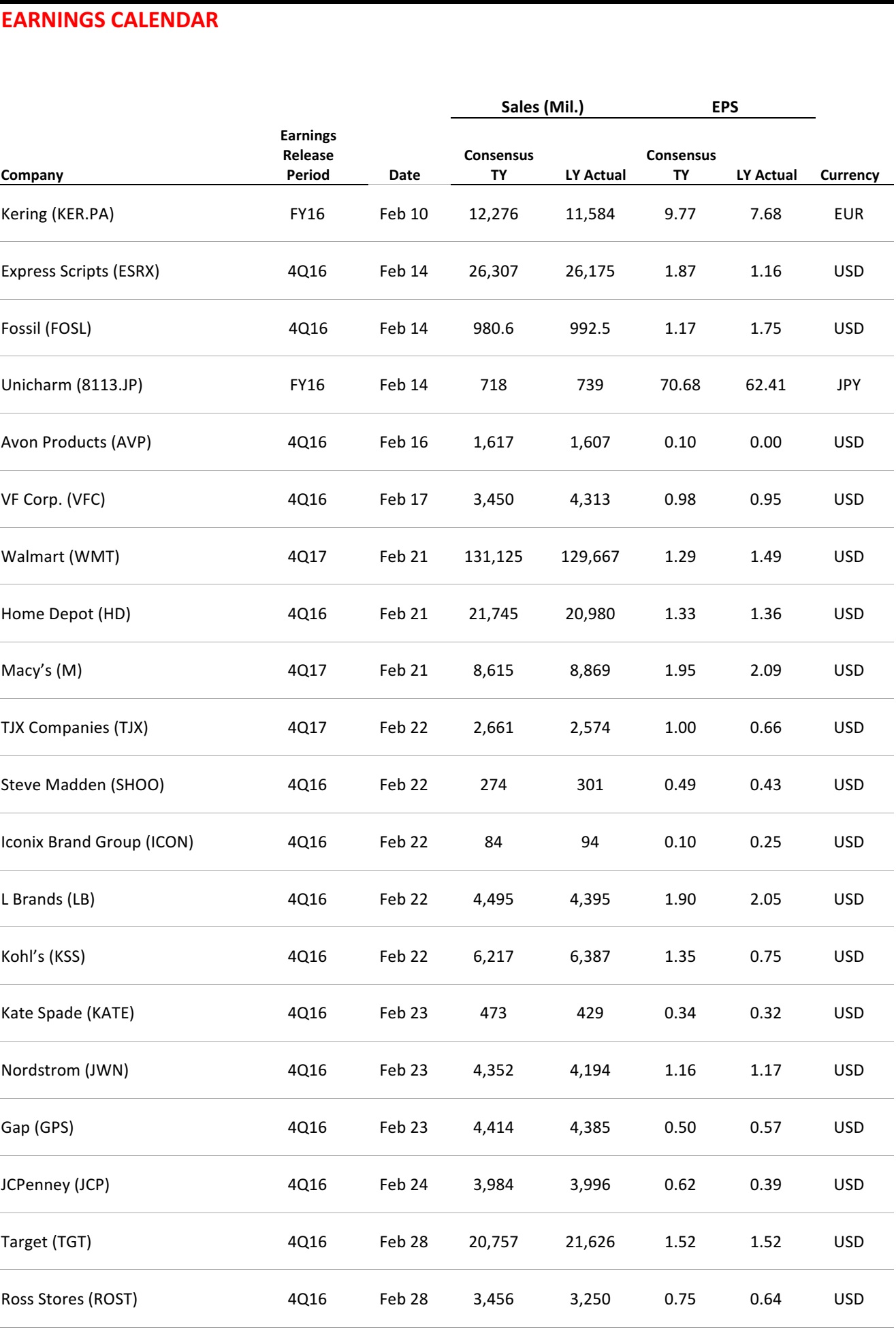

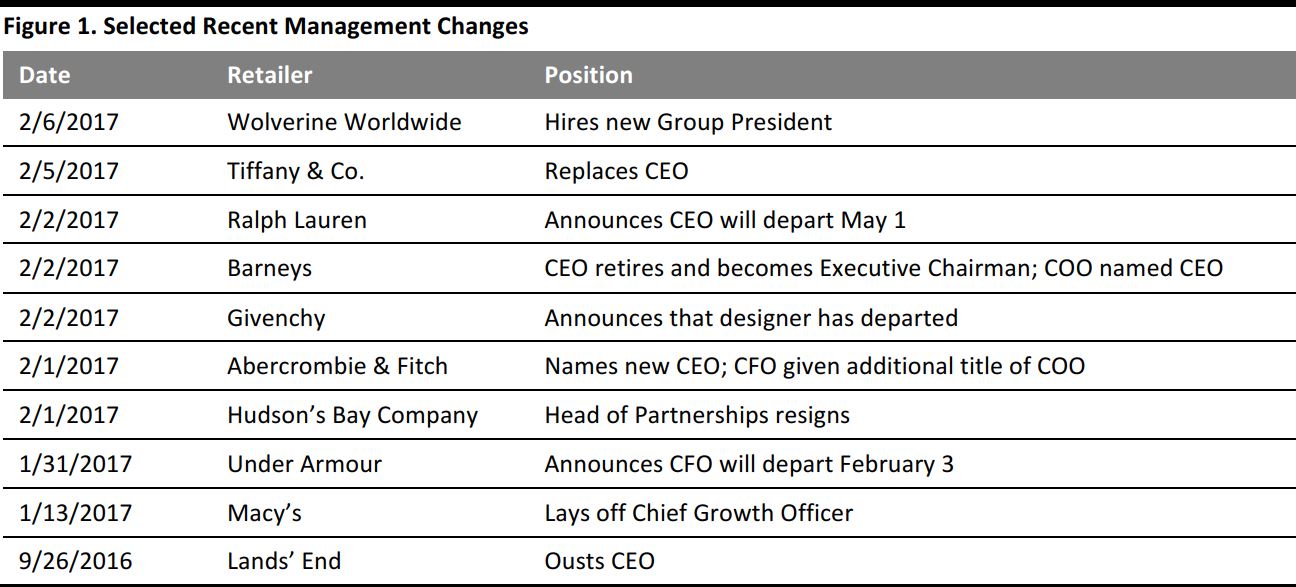

The table below shows selected recent management changes at major retailers and brands. It is notable that so many departures have occurred in such a short time, largely in the first week of February. Although the timing of these management changes may be highly coincidental, many of them were announced shortly after the close of most retailers’ business years in January—and likely reflect these companies’ desire to start their new fiscal year with the right leadership in place.

Source: Company reports

Clearly, each of these retailers has had a different reason for effecting a management change. Interestingly, Tiffany & Co. was the only company listed above that tied the immediate ouster of its CEO to weak financial results; Frédéric Cuménal had served as the company’s CEO for only 22 months.

Many of the other management changes were not directly related to financial results; rather, they were described as voluntary departures. In the case of Ralph Lauren, CEO Stefan Larsson’s departure was characterized as a difference of opinion between Larsson and Executive Chairman and Chief Creative Officer Ralph Lauren on the strategic direction the company should take in the future. Such clashes between a company’s founder and hired management are not unusual. At Givenchy, designer Riccardo Tisci elected not to renew his contract, effectively ensuring his departure, amid rumors that he is planning to join Versace. Under Armour ousted its CFO after its growth rate slowed.

In some cases, management just changed titles. Barneys CEO Mark Lee retired as part of a delayed 2012 succession plan, and was named Executive Chairman. At Abercrombie & Fitch, CFO Joanne Crevoiserat added the title of COO to her business card.

There were also several new hires among retailers recently. Wolverine Worldwide hired Todd Spaletto, who had served as president of The North Face brand for six years, as President of the Wolverine Outdoor and Lifestyle Group. Wolverine also promoted 19-year veteran Jim Zwiers to Executive Vice President to lead the firm’s transformation initiatives.

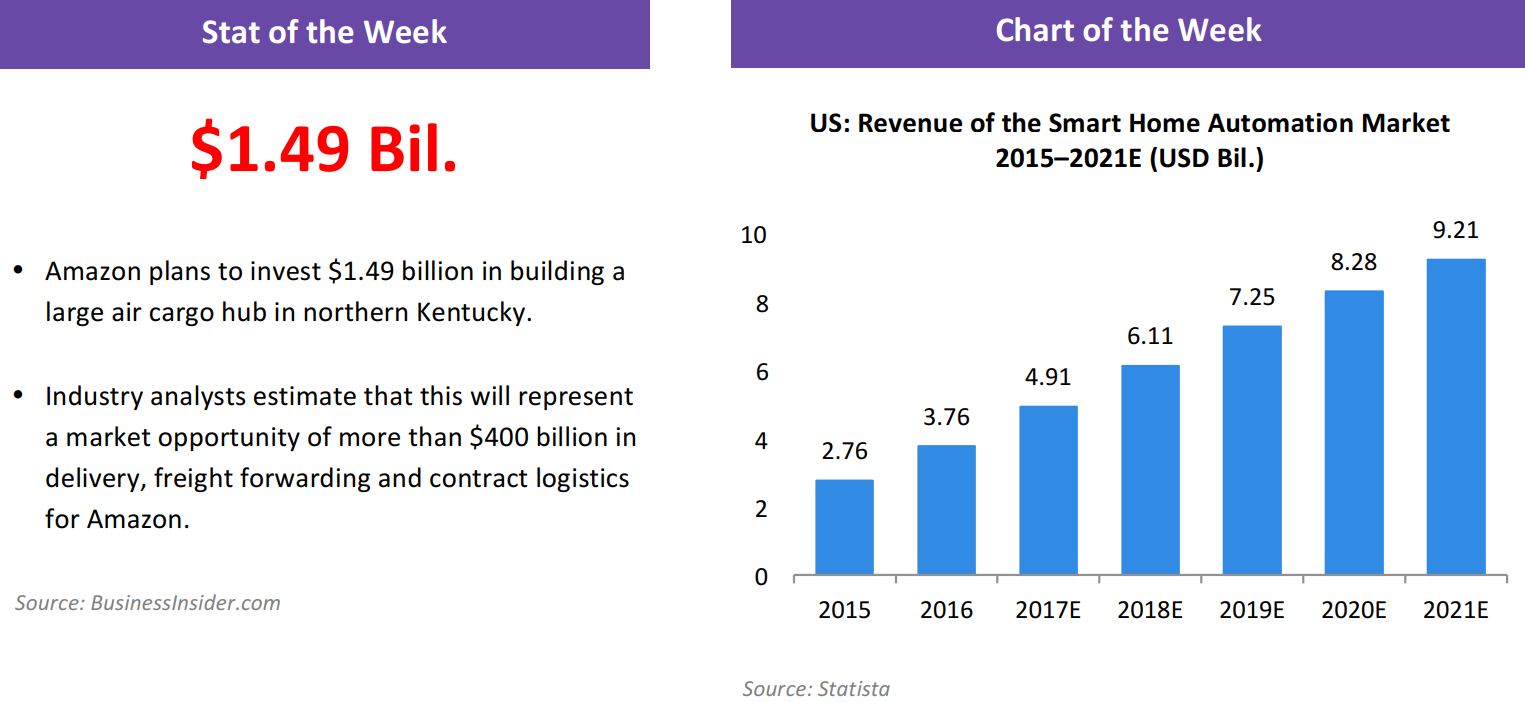

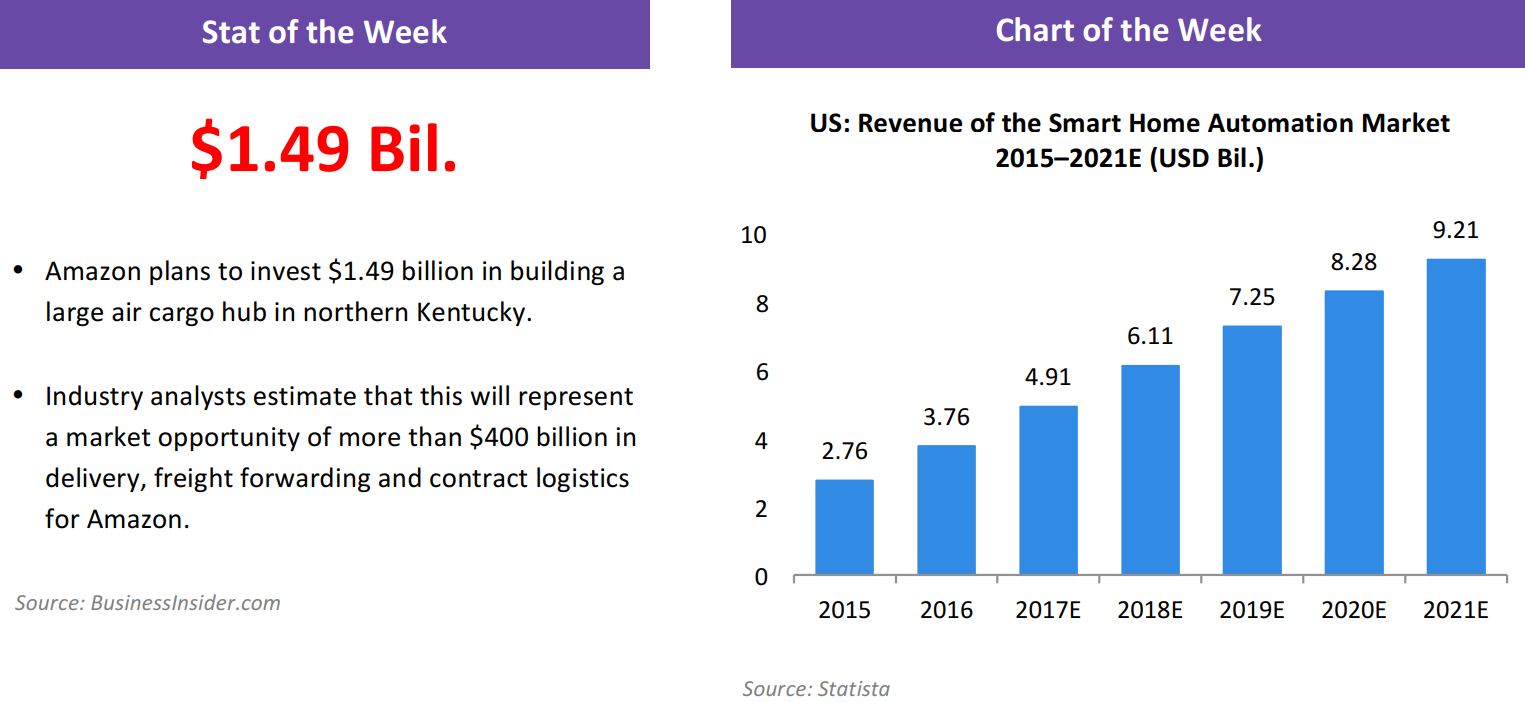

While February has already seen much turbulence in the C-suites of large retailers and brands, weak results have driven stock prices lower—which is likely to result in even more management changes. Amazon’s market value exceeds the combined market value of eight top US retailers, most of which have seen their value decline by double digits since 2006. Meanwhile, Amazon’s market value has increased by nearly 2,000%.

The Fung Global Retail & Technology team will continue to follow management changes and retailers’ efforts to slow the encroachment of e-commerce.

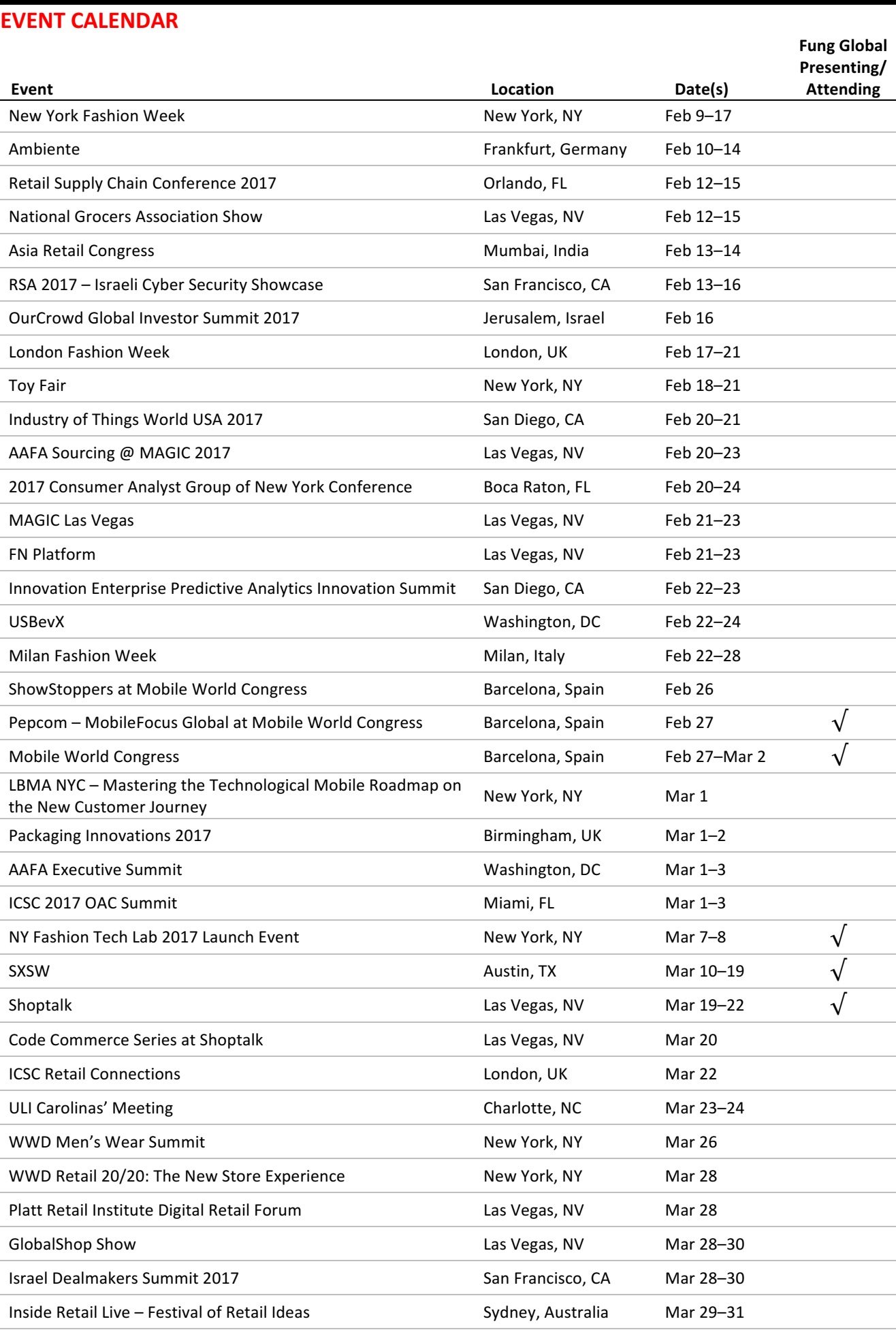

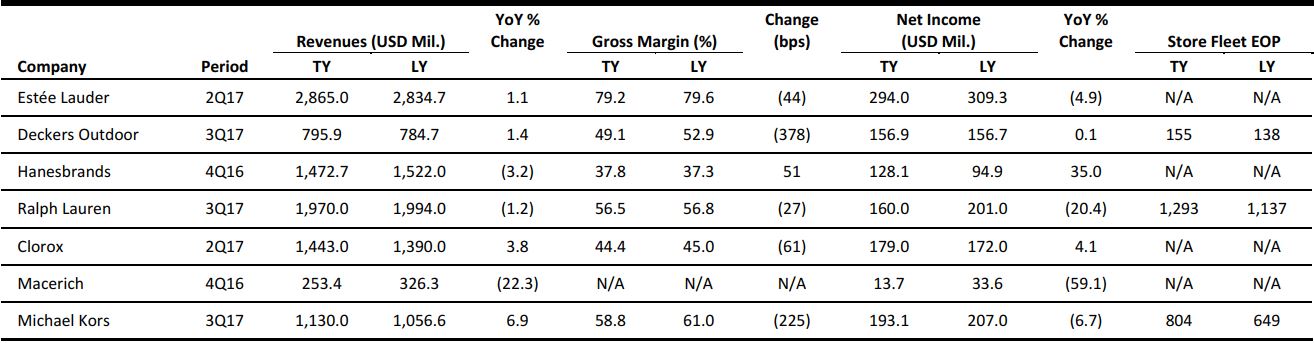

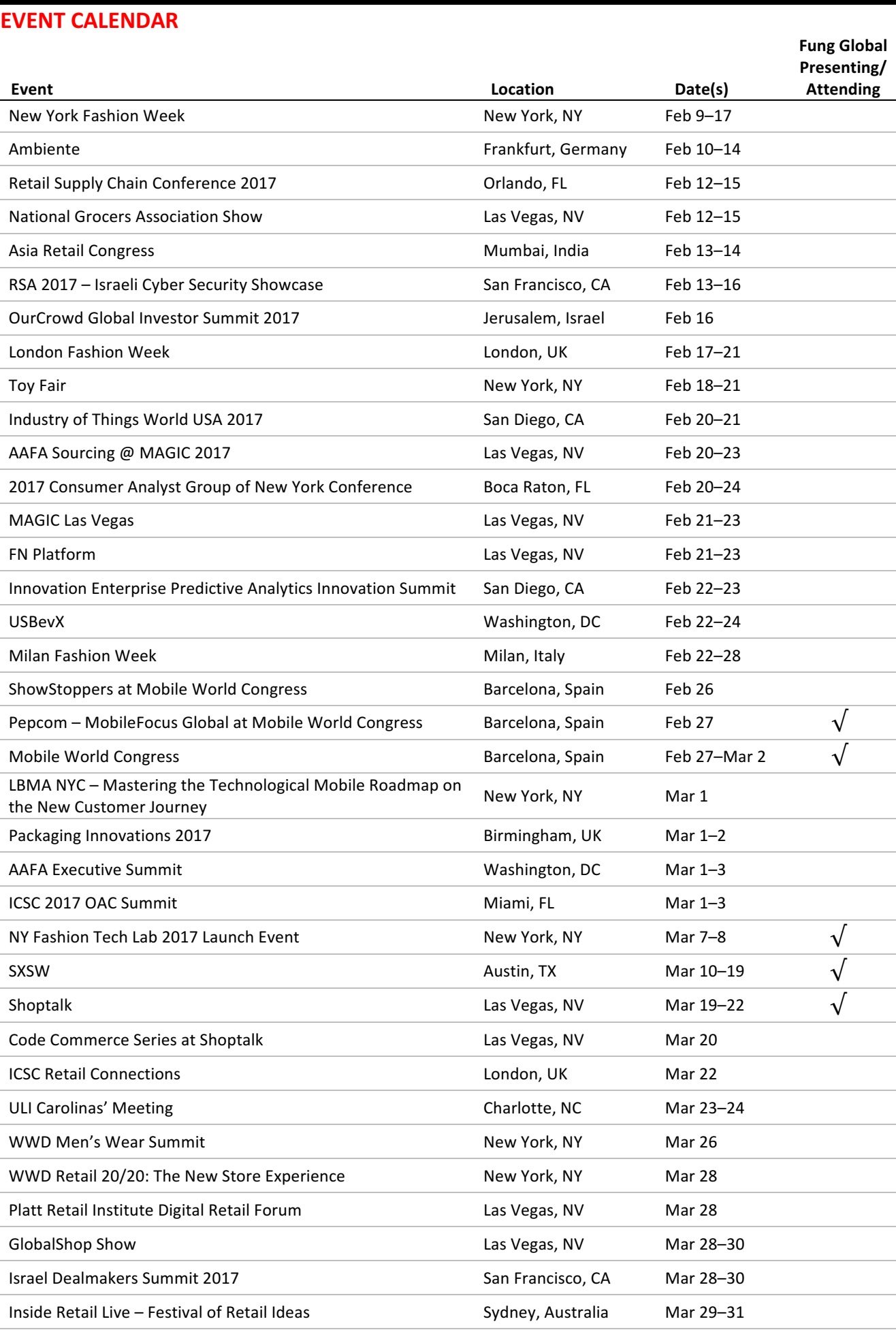

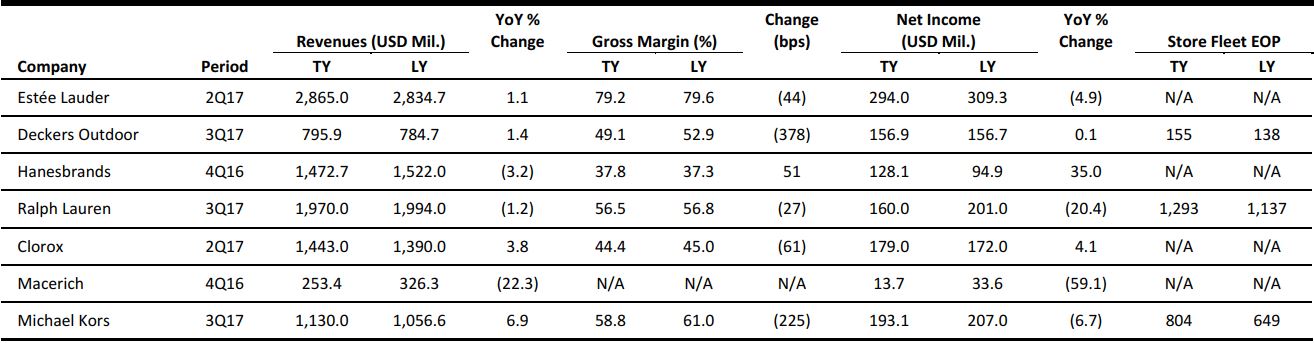

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Walmart Ups Stake in JD.com

(February 7) BusinessInsider.com

Walmart Ups Stake in JD.com

(February 7) BusinessInsider.com

- Walmart recently announced that it has increased its stake in Chinese e-commerce giant JD.com to 12.1%, worth roughly $4.87 billion. The figure is up from the 10.8% stake it had in October and the 5.9% stake it had in June of last year. Rising wages and income in China and JD.com’s growth led to Walmart’s decision. Inflation in China remains under 2%, while wages have increased by 8%–9% over the last few years, according to data cited by Forbes. Meanwhile, JD.com has been in full-fledged growth mode, increasing revenue, gross merchandise volume and delivery methods to reach underserved markets.

- Walmart appears intent on expanding in China’s e-commerce market as an investor, rather than through its own operations. The company plans to shut down its own e-commerce mobile app in China in favor of highlighting JD.com’s global flagship store. JD.com will also serve as the online shopping platform for more than 20 Walmart stores across China in the near future.

A Digital Bottleneck: Mobile Payments Breed New Challenges for To-Go Retailers

(February 7) Salon.com

A Digital Bottleneck: Mobile Payments Breed New Challenges for To-Go Retailers

(February 7) Salon.com

- Sweetgreen, a 10-year-old farm-to-table salad chain, recently opened a new concept outlet on the Upper East Side of Manhattan. The restaurant, in a heavily trafficked location just two blocks from Bloomingdale’s, offers no seating and has a street-facing pickup window.

- The 1,800-square-foot outlet is designed to cater to a growing category of urban US consumers who have rapidly embraced mobile order-and-go technology. Tech-savvy, usually younger and often wealthier, these consumers are comfortable using their smartphones as a replacement for cash or card transactions. However, Starbucks, which also has a successful mobile payment operation, has learned that demand for mobile-based orders can overwhelm in-store operations during peak demand hours, causing employees to scramble.

Consumers Could See 20% Price Hike with Border Adjustment Tax, Retail Group Says

(February 6) CNBC.com

Consumers Could See 20% Price Hike with Border Adjustment Tax, Retail Group Says

(February 6) CNBC.com

- The Republicans’ plan to enact a border adjustment tax will leave consumers digging deeper into their pockets, an advisor to a coalition of major retailers told CNBC on Monday. The measure is part of the House GOP’s corporate tax plan and would tax imports and exempt exports.

- “It will force consumers to pay as much as 20% more for the products they need. Gasoline is estimated to go up as much as 35 cents a gallon,” said Americans for Affordable Products advisor Brian Dodge in an interview. “Common household goods, apparel, things that people count on every day, pajamas, will cost more and really just so a certain, select group of corporations can avoid paying taxes forever. We think that’s bad policy,” he added. The Americans for Affordable Products coalition is made up of retailers that include as Walmart, Macy’s and Nike.

US Convenience Stores Continue Growth

(February 2) FuelMarketerNews.com

US Convenience Stores Continue Growth

(February 2) FuelMarketerNews.com

- The US convenience store count increased to a record 154,535 stores as of December 31, 2016, a 0.2% increase (340 stores) from the year prior, according to the 2017 National Association of Convenience Stores/Nielsen Convenience Industry Store Count. The industry store count has increased by 63% over the last three decades.

- Within the retail universe that Nielsen tracks, convenience stores account for more than one-third (34.1%) of all outlets in the US. In fact, the convenience store count alone is 25% higher than the combined store counts of superettes, supermarkets and supercenters (51,191 stores); drugstores (43,636 stores); and dollar stores (28,832 stores).

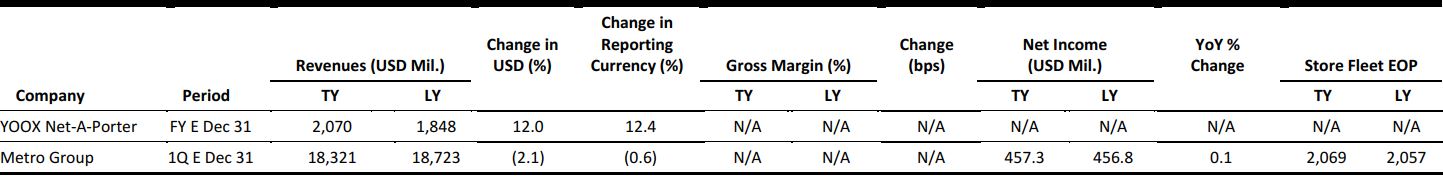

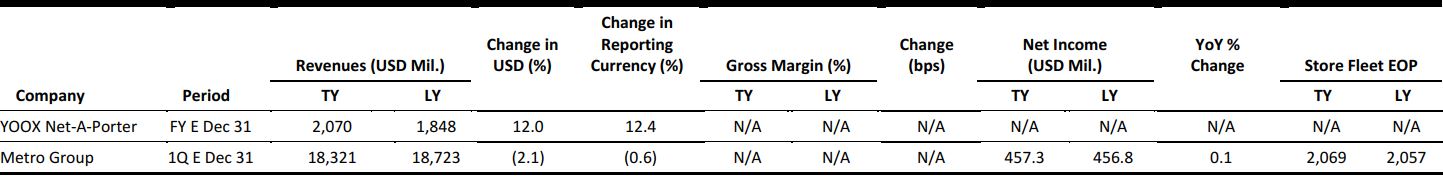

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

UK Retail Sales Growth Slows to 0.1% in January

(February 7) Press release

UK Retail Sales Growth Slows to 0.1% in January

(February 7) Press release

- Total retail sales growth in the UK slowed to 0.1% in January 2017, according to new data from the British Retail Consortium; the rate was below the three-month average of 1.1%. Comparable sales declined by 0.6% year over year.

- Over the three months ended January 28, food sales grew by 2.0%, nonfood sales grew by 0.3% and online sales grew by 8.6%, while in-store sales dropped by 2.2%.

Boohoo.com a Step Closer to Completing the Acquisition of Nasty Gal

(February 6) Company press release

Boohoo.com a Step Closer to Completing the Acquisition of Nasty Gal

(February 6) Company press release

- UK fashion pure play Boohoo.com announced that it is a step closer to acquiring US Internet fashion retailer Nasty Gal, according to an agreement between the two made in late December 2016. The acquisition was subject to the outcome of bids for Nasty Gal and to court approval.

- Nasty Gal did not receive suitable offers from other bidders, leaving Boohoo.com as the sole contender to acquire its assets. Boohoo.com now awaits final approval from a US bankruptcy court that will allow the UK retailer to complete the acquisition on February 28.

New Look Sees Sales Slightly Edge Up and Profits Slump in Christmas Trading

(February 7) Company press release

New Look Sees Sales Slightly Edge Up and Profits Slump in Christmas Trading

(February 7) Company press release

- UK young-fashion retailer New Look reported sales growth of 0.8% in its fiscal third quarter ended December 24, 2016. UK comps declined by 4.7%, while group comps declined by 4.6%.

- The company’s own-website sales jumped by 18.2%, while third-party e-commerce sales surged by 73.0%. However, profit before tax plunged by 37.6%, to £30.1 million (US$37.4 million). Management stated that it expects “UK trading conditions to remain challenging through 4Q17 and into FY18.”

LVMH Sets Up Investment Vehicle for Emerging Luxury Brands

(February 3) Reuters.com

LVMH Sets Up Investment Vehicle for Emerging Luxury Brands

(February 3) Reuters.com

- French luxury brand LVMH announced that it has set up LVMH Luxury Ventures, a special investment vehicle that will identify and invest in small, emerging brands in the fashion, beauty and accessories categories.

- LVMH Luxury Ventures will buy a portion of companies in these categories that post sales of €2–€5 million (US$2.1–US$5.3 million) and exhibit potential for high growth. The vehicle will begin with a funding pool of €50 million (US$53.3 million) and will initially invest €2–€10 million (US$2.1–US$10.7 million) in the selected companies.

Zalando to Host Second Edition of Bread & Butter in September 2017

(February 2) Drapers.com

Zalando to Host Second Edition of Bread & Butter in September 2017

(February 2) Drapers.com

- German fashion pure play Zalando will host the second edition of its “trend” show, Bread & Butter, from September 1–3 in Berlin. The show was formerly a B2B event, but was relaunched for a consumer audience in 2016, attracting more than 20,000 attendees.

- Carsten Hendrich, VP of Brand Marketing at Zalando, said that the theme for this year is “BOLD” and that the event, which includes brands such as Adidas, Converse, Lee and Vans, hopes to leverage technology and live social media channels to reach an even wider audience than it did last year, when it was digitally broadcast across 15 countries.

ASIA TECH HEADLINES

Chinese Photo-Sharing App Kuaishou Planning US IPO Later This Year

(February 7) TechCrunch.com

Chinese Photo-Sharing App Kuaishou Planning US IPO Later This Year

(February 7) TechCrunch.com

- Chinese photo-sharing app Kuaishou is planning to go public in the US later this year. The app, which has more than 40 million daily active users and 100 million monthly active users, was most recently valued at around $3 billion.

- Snap is expected to go public in March after publicly filing last week, which will set the tone for tech IPOs this year. The Kuaishou IPO is targeted for the back half of the year.

Alibaba Said to Lead $200 Million Funding for Paytm’s E-Commerce Unit

(February 3) Bloomberg.com

Alibaba Said to Lead $200 Million Funding for Paytm’s E-Commerce Unit

(February 3) Bloomberg.com

- China’s Alibaba Group will lead a $200 million round of investment in newly established Indian online retailer Paytm E-commerce, according to a person familiar with the matter. The investment by Alibaba and private equity firm SAIF Partners values the company at $1.1 billion.

- Paytm E-commerce was spun out of One97 Communications, the operator of the Paytm digital payments service, in which Alibaba and its Ant Financial affiliate own a substantial stake. The deal will deepen Alibaba’s investment in a burgeoning e-commerce market now dominated by Amazon and Flipkart.

Sharp Climbs the Most in Two Weeks After Narrowing Loss Outlook

(February 6) Bloomberg.com

Sharp Climbs the Most in Two Weeks After Narrowing Loss Outlook

(February 6) Bloomberg.com

- After narrowing its full-year loss outlook and posting its first quarterly profit in more than two years, Japanese electronics maker Sharp saw its stock rise the most it had in two weeks. The company’s stock climbed as much as 4.5% in Tokyo on Monday, its biggest intraday jump since January 23.

- A Tokyo-based analyst at Credit Suisse reported that Sharp has been making steady progress on restructuring since Foxconn bought control of the company in August. The analyst expects Sharp’s share price formation to be driven mainly by investor expectations for ongoing improvements.

Fintech Is Stimulating Chinese Consumption and Capital Flow

(February 7) TechCrunch.com

Fintech Is Stimulating Chinese Consumption and Capital Flow

(February 7) TechCrunch.com

- Chinese digital lending company Dumiao aggregates reams of data to create real-time credit scorecards on prospective borrowers at the point of sale, eliminating paperwork and human underwriters. With information on 20 million prospective borrowers across 300 cities in China, Dumiao processes approximately 1 million applications per month.

- Chinese policymakers are encouraging consumption, and fintech companies are spurring purchases and investments that range from daily necessities to international real estate deals. Dumiao CEO Jing Zhou said that “China is experiencing a huge mobile revolution where everybody does everything on mobile.”

LATAM RETAIL AND TECH HEADLINES

Private Equity Fund Carlyle Invests in Brazilian Tech Firm FS

(February 3) ZDNet.com

Private Equity Fund Carlyle Invests in Brazilian Tech Firm FS

(February 3) ZDNet.com

- Private equity firm The Carlyle Group has made its first investment in the technology sector in Brazil by acquiring a minority interest in mobile and security services provider FS. Brazilian newspaper O Estado de São Paulo suggests that the transaction value exceeds R$100 million (US$32 million).

- FS provides digital security, mobile learning and interactive services as well as cloud, insurance, assistance and specialized technical support to more than 36 million subscribers.

Jaguar Land Rover Plans to Inject More Capital into Its Brazilian Factory

(February 7) Financial Times

Jaguar Land Rover Plans to Inject More Capital into Its Brazilian Factory

(February 7) Financial Times

- Luxury carmaker Jaguar Land Rover is ramping up a new, £240 million (US$301 million) factory it opened in the state of Rio de Janeiro last year, even though Brazil is suffering from its worst recession in more than a century, leading to a 20% decline in car sales across the industry last year.

- Even as Brazil’s economy contracted for the second year running in 2016, foreign direct investment in December hit US$15.4 billion, a record high for that month, the country’s central bank said. That brought total foreign direct investment for the year to US$78.9 billion, up 6% from 2015.

Brazilian Healthcare Insurer Intermédica Hires Banks for IPO

(February 6) Reuters.com

Brazilian Healthcare Insurer Intermédica Hires Banks for IPO

(February 6) Reuters.com

- Brazilian healthcare services provider NotreDame Intermédica Sistema de Saude has hired banks to manage its IPO, which could be launched with a series of investor meetings as early as this week, according to two people with direct knowledge of the company’s plans.

- Morgan Stanley has been hired as the leading underwriter for the IPO, alongside the investment banking units of Banco Bradesco, Credit Suisse, Itaú Unibanco, JPMorgan Chase and UBS.

Mexican Cinema Chain Will Import Popcorn from Argentina Without NAFTA

(February 6) TheGuardian.com

Mexican Cinema Chain Will Import Popcorn from Argentina Without NAFTA

(February 6) TheGuardian.com

- Alejandro Ramirez, the head of Cinepolis de Mexico, Mexico’s largest cinema chain, has said the impending renegotiation of the North American Free Trade Agreement (NAFTA) means that the US popcorn industry is at risk. Mexico is the largest US popcorn market and accounts for almost a third of all exports.

- Ramirez told Bloomberg.com, “We import all of our corn for movie theaters from the US, thanks to the fact that there’s free trade. If that wasn’t the case—if we go to pre-NAFTA tariff levels—then it would be cheaper to bring it from Argentina.”

Boohoo.com a Step Closer to Completing the Acquisition of Nasty Gal

(February 6) Company press release

Boohoo.com a Step Closer to Completing the Acquisition of Nasty Gal

(February 6) Company press release

Chinese Photo-Sharing App Kuaishou Planning US IPO Later This Year

(February 7) TechCrunch.com

Chinese Photo-Sharing App Kuaishou Planning US IPO Later This Year

(February 7) TechCrunch.com