FROM THE DESK OF DEBORAH WEINSWIG

Amazon Unveils Its Vision of the Grocery Store of the Future, Amazon Go!

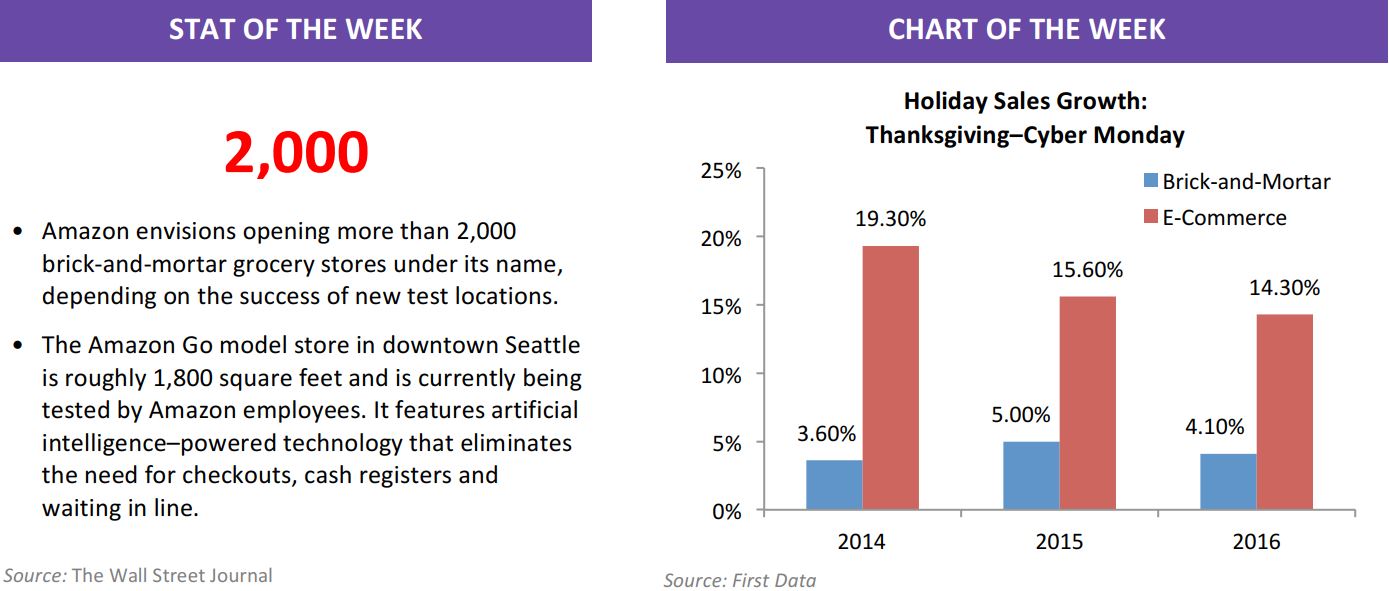

This week, Amazon released a

video of its store of the future, called Amazon Go, which the company said had been four years in the making. In the video, the customer scans a QR code upon entering the store, places items in a basket or bag, and simply walks out of the store when finished shopping—without having to stand in a checkout line or launch a payment process. After the customer leaves the store, the items are charged to the shopper’s Amazon account and he or she receives a receipt via email.

According to The Wall Street Journal, the company is also working on two other grocery-store formats, a larger store format and a store that features curbside pickup but no in-store shopping capability. Amazon has launched a prototype store in Seattle, Washington, which is open to employees in the beta program and is scheduled to open to the public in early 2017.

Amazon plans for its grocery stores to offer staples such as bread and milk, as well as artisan-made cheeses and locally made chocolates. The stores are also targeting several other food segments, including quick service, restaurants and subscription boxes. They will feature favorite products from local kitchens and bakeries, as well as on-site chefs who will prepare meals and create Amazon Meal Kits, which will include all the ingredients needed to prepare a meal in under a half hour. This type of store is expected to occupy 1,800 square feet of retail space.

This store would be a panacea for those of us who hate standing in line at the grocery store, especially when we have only a couple of items and are behind a customer with an overflowing shopping cart or one who is scrambling to find a means of payment. Amazon’s setup also eliminates the need to wait for a price check on an item that has not been entered into the system, and it offers a measure of anonymity for customers who may find purchasing certain items embarrassing.

There is a huge amount of technology behind this seemingly simple shopping experience, which Amazon has named Just Walk Out. The stores employ computer vision, deep learning and sensor fusion (the combining of results from multiple types of sensors) to optically determine which item the customer has taken off the shelf.

In addition to reading the label on each item, the system must also optically track customers in the store once they have scanned in to determine who is taking what item. The Amazon video shows an indecisive customer take an item from the shelf, put it back on the shelf and, ultimately, return to take it again, showing that its system can also handle items that are replaced on the shelf. The store’s technology can process items that are placed in shopping bags or carried by hand out of the store.

It is notable that—despite all the leading-edge technology used to track store visitors and the items they pick up in the store—customers still check into the store by scanning a relatively low-tech QR code when they enter. That technology has allowed retailers to track customers through their smartphones in stores for a number of years. At Amazon Go stores, customer sign-in will likely occur via an upcoming Amazon Go app, and the stores will apparently be accessible to all Amazon customers, with no additional benefits for Prime members.

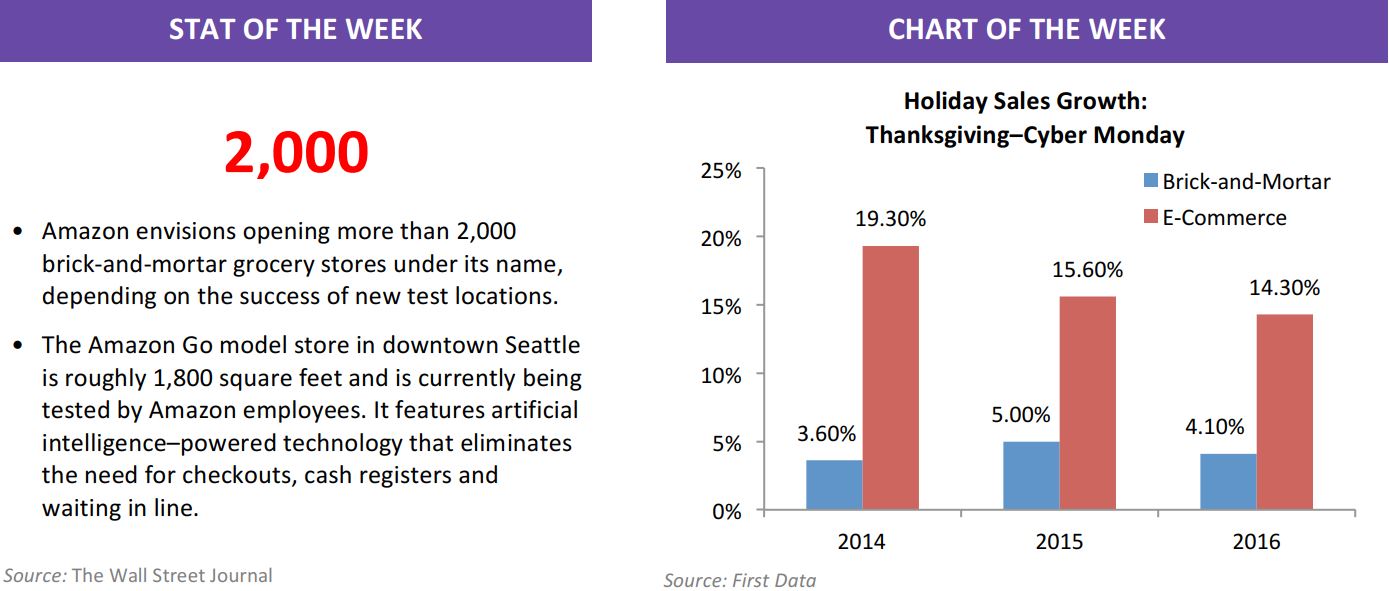

There has been much discussion recently about the job-destroying potential of new technologies, and the new Amazon stores have added fuel to the fire. Amazon’s Just Walk Out technology eliminates the need for greeters, checkout clerks and baggers, as well as the people who manage them. Amazon reportedly plans to open 2,000 grocery stores, and these are expected to create relatively few new jobs. However, Amazon will likely have to hire experienced technical support experts, chefs and food technicians that might not be needed in a traditional grocery store.

Fung Global Retail & Technology considers Amazon’s first brick-and-mortar grocery store an impressive demonstration of what is possible in retail today. The stores could potentially eliminate much of the drudgery of grocery shopping while enhancing the experience of cooking and discovering new kinds of food.

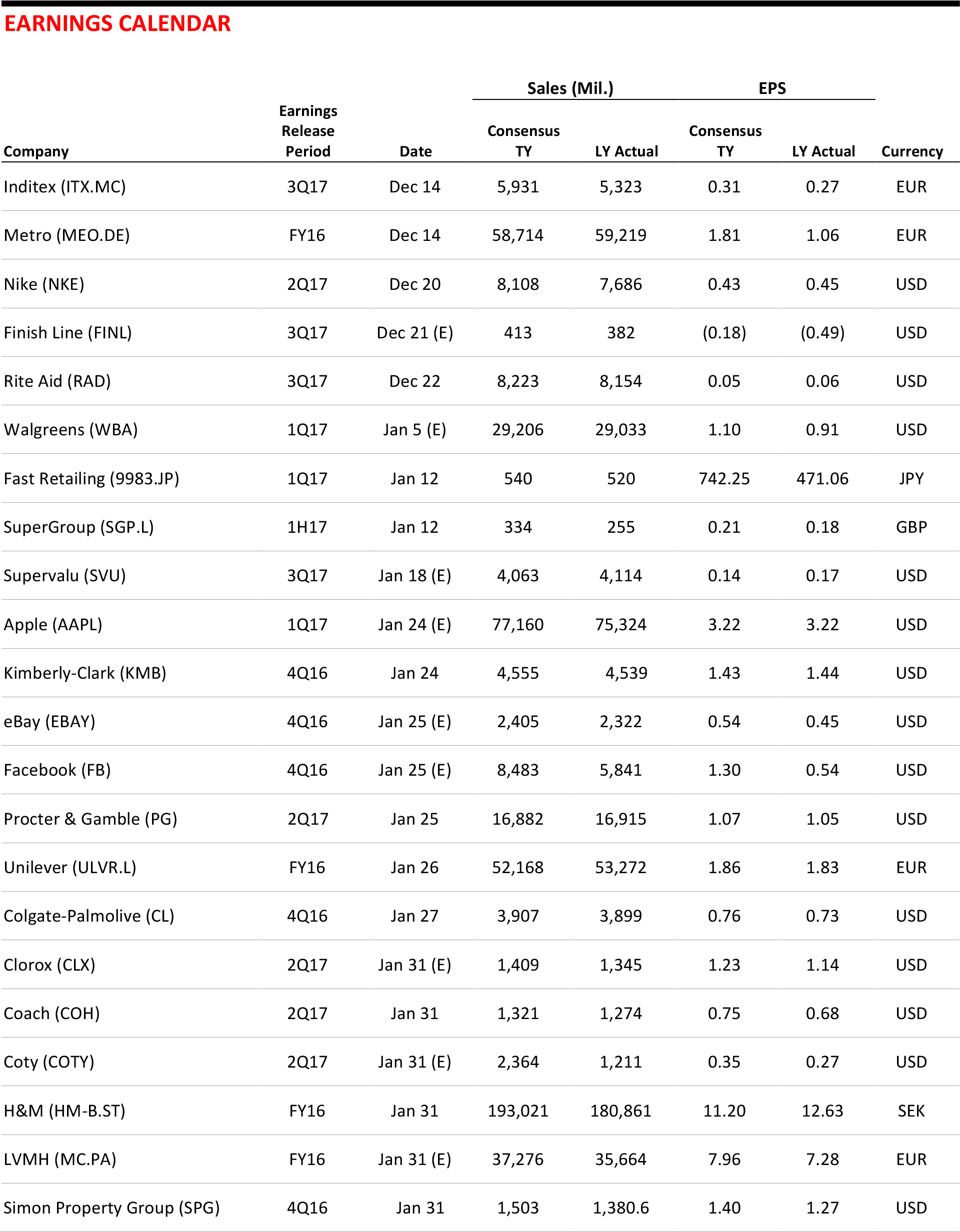

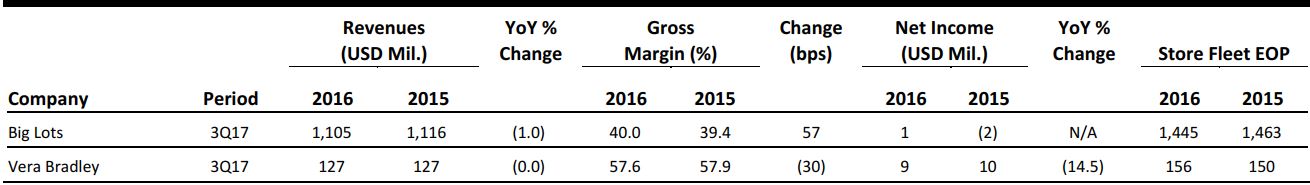

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Supreme Court’s Decision a Blow to Fashion Designers

(December 7) Women’s Wear Daily

Supreme Court’s Decision a Blow to Fashion Designers

(December 7) Women’s Wear Daily

- The Supreme Court’s ruling in favor of Samsung Electronics over Apple could create a more expensive process for designers to protect their creations. It says that damages in a patent infringement case need not be derived from the profits of an entire product, but could instead be based on the profits from an infringing component part covered by the patent.

- This could disrupt the fashion industry. Design patent experts say the ruling ultimately overturns decades of patent protection and removes the biggest deterrents to infringers—infringement awards based on the total disgorgement of profits from the end product.

Pop-Ups, the New Darling of Retail

(December 4) The Wall Street Journal

Pop-Ups, the New Darling of Retail

(December 4) The Wall Street Journal

- Due to Manhattan’s softening retail market, retailers are able to use pop-up shops to test the waters in the most expensive shopping districts, often at discounted rates. More and more landlords understand the concept of temporary stores.

- Retailers with brick-and-mortar operations are signing shorter leases and being more cautious as they face the rapid growth of online shopping. With pop-up shops, retailers are willing to “meet consumers where they are going to go.”

Amazon Go Looks Like a Game Changer for Retail Industry

(December 5) Forbes.com

Amazon Go Looks Like a Game Changer for Retail Industry

(December 5) Forbes.com

- Amazon has been creeping its way into brick-and-mortar retailing for a while now, and Amazon Go could drastically change every segment of retailing. The idea is simple—save customers time and hassle by requiring no checkout before they leave the store with their items.

- The technology will presumably work with any type of retail item with an appropriate sensor, and could easily be applied to fashion, electronics, home products and any of the other millions of products sold through Amazon.

Visa Acquisition Adds New Level of Digital Commerce Security

(December 1) ChainStoreAge.com

Visa Acquisition Adds New Level of Digital Commerce Security

(December 1) ChainStoreAge.com

- Visa is acquiring CardinalCommerce, an e-commerce payment authentication provider. The move promises consumers greater digital security with making payments on their mobile devices, tablets and other devices.

- The platform will be integrated into Visa over the next 18 months. This will enable a more secure way to make online payments, enable seamless digital transactions, help merchants grow their businesses and accelerate innovation in commerce. CardinalCommerce will continue to operate and serve its existing clients as a subsidiary of Visa.

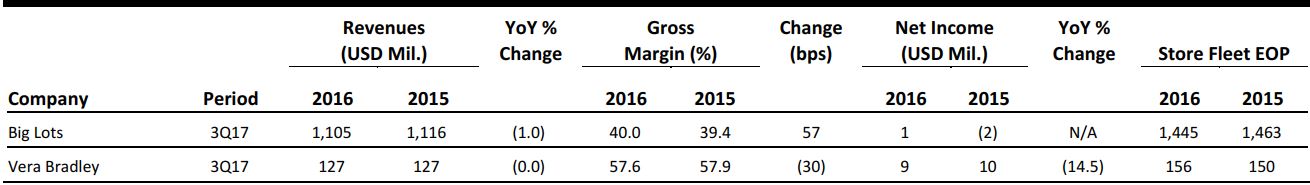

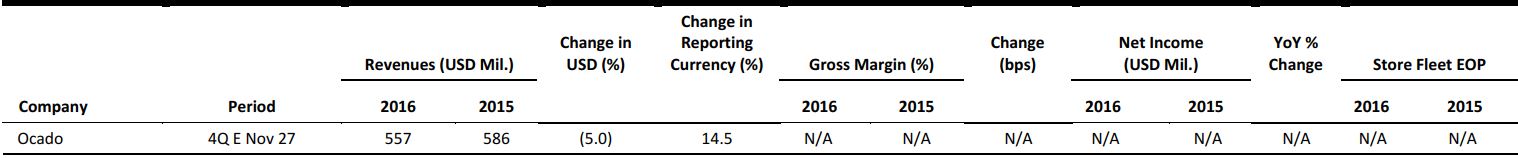

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

Missguided Sales Jump 34%

(December 2) Retail-Week.com

Missguided Sales Jump 34%

(December 2) Retail-Week.com

- Privately owned British fashion pure play Missguided reported a 34% jump in sales, to £117 million (US$148 million) in the year ended March 2016. However, EBITDA fell by 53%, to £2.6 million (US$3.3 million), as the company made investments in marketing, technology, infrastructure and recruitment.

- Missguided said that its profitability had improved in the six months ended September, with sales up 60%. The company recently opened its first permanent brick-and-mortar store, at the Westfield Stratford City mall in London.

Black Friday Boosts Online Sales, Reports British Retail Consortium

(December 6) Press release

Black Friday Boosts Online Sales, Reports British Retail Consortium

(December 6) Press release

- UK retail sales rose by 0.6% on a comparable basis in November, according to new data from the British Retail Consortium. Total sales were up 1.3%, slightly below the three-month average of 1.6%. Over the three months ended November, food comps were flat and nonfood comps were up 1.5%.

- Boosted by Black Friday, online sales of nonfood products grew by 10.9% in November, and reached the highest penetration rate recorded so far: e-commerce accounted for 27.6% of all nonfood sales in the month.

Ahold Delhaize Aims to Double Online Sales by 2020

(December 7) Company press release

Ahold Delhaize Aims to Double Online Sales by 2020

(December 7) Company press release

- Retail group Ahold Delhaize plans to double its online sales between 2016 and 2020, it announced at its 2016 Capital Markets Day this week. In 2016, it expects to generate some €2.3 billion (US$2.5 billion) in online sales, with slightly more than half coming from Bol.com and the remainder from its online grocery operations. The company also said that its integration is on track, with “clear visibility” to generating €500 million (US$538 million) in net synergies in 2019.

- Ahold Delhaize showcased how it is offering greater personalization offline as well as online, with some 30 million loyalty-program members receiving personalized communications across its grocery banners. CEO Dick Boer noted the “enormous opportunity” in bringing smaller-store retailing to the US, but said the company’s supply chain is not set up for convenience stores.

Coast and Warehouse Report Improved Profitability

(December 2) Retail-Week.com

Coast and Warehouse Report Improved Profitability

(December 2) Retail-Week.com

- Privately owned British womenswear chains Coast, Oasis and Warehouse reported generally improved bottom-line performances for the year ended February 2016, although none disclosed figures for top-line growth. Online sales were up by double digits at each of the three chains.

- Coast posted pretax profits of £1.3 million (US$1.6 million), versus a loss of £10.8 million (US$13.6 million) in the prior year. Oasis reported flat pretax profits flat of £6.3 million (US$7.9 million). At Warehouse, pretax losses narrowed from £3.1 million (US$3.9 million) to £1.3 million (US$1.6 million). Administrators for failed Icelandic bank Kaupthing, which owned the chains, are reported to be looking for new owners.

House of Fraser Abandons Plans for new Distribution Center

(December 7) Retail-Week.com

House of Fraser Abandons Plans for new Distribution Center

(December 7) Retail-Week.com

- UK department-store chain House of Fraser has scrapped plans for a new distribution center, following a review of its operations. The company had submitted a planning application in May, but now says it has identified “significant potential for internal efficiencies in our existing business.”

- House of Fraser CEO Nigel Oddy has resigned, it was recently revealed, and will leave the company in early 2017.

ASIA TECH HEADLINES

Panasonic in Talks to Buy ZKW to Accelerate Push into Auto Electronics

(December 5) TechWireAsia.com

Panasonic in Talks to Buy ZKW to Accelerate Push into Auto Electronics

(December 5) TechWireAsia.com

- Japan’s Panasonic is in talks to buy European automotive light maker ZKW Group for up to US$1 billion. The acquisition could expand Panasonic’s automotive lineup, which currently centers on batteries and navigation systems.

- Panasonic is shifting its focus to corporate clients to escape price competition from lower-margin consumer electronics manufacturers.

Grab Launches a New Carpooling Service

(December 6) e27.co

Grab Launches a New Carpooling Service

(December 6) e27.co

- Ride-sharing provider Grab launched a new commercial carpooling service called GrabShare, which is expected to provide more efficient services for users. GrabShare will be able to deliver optimized passenger matches with the help of its algorithm, and will enable passengers to cut some fares by up to 30%.

- The service uses professional GrabCar Economy car drivers, who depend on driving GrabCars for their livelihood and are thus more obligated to pick up passengers.

Moxian Signs Cooperation Agreement with China UnionPay Subsidiary

(December 5) PR Newswire

Moxian Signs Cooperation Agreement with China UnionPay Subsidiary

(December 5) PR Newswire

- Singaporean tech company Moxian, an offline-to-online (O2O) integrated social media platform operator, announced that it has signed a cooperation agreement with Beijing Chinaums, a subsidiary of China UnionPay.

- The move aims to create a safer and more convenient payment environment and more effective mobile marketing solutions for brick-and-mortar businesses.

Fujitsu Launches Company in Finland to Produce Vegetables with Artificial-Light Plant Factory

(December 6) Japan Today

Fujitsu Launches Company in Finland to Produce Vegetables with Artificial-Light Plant Factory

(December 6) Japan Today

- Japan’s Fujitsu has established a new company in Finland, Fujitsu Greenhouse Technology Finland Oy, to operate a plant factory equipped with an agricultural information and communication technology system and to produce and sell agricultural products.

- Fujitsu aims to package the know-how and cloud services resulting from this business and deploy them throughout the European Union.

LATAM RETAIL HEADLINES

Brazil’s Natura Adding Stores for New Growth

(December 7) WWD.com

Brazil’s Natura Adding Stores for New Growth

(December 7) WWD.com

- Direct-selling beauty giant Natura is looking to expand its brick-and-mortar presence to help its sagging sales and profits. The company plans to open a large number of retail stores in order to generate up to 15% of sales from multichannel platforms, up from the current 2%.

- By the end of 2016, after openings in São Paulo and Paris, Natura will have five stand-alone shops. The company also plans to enter pharmacies, and has additional plans for its Red Natura e-commerce platform, which has generated sales increases of more than 10%.

AllSaints Expands to South America

(December 6) Retail Gazette

AllSaints Expands to South America

(December 6) Retail Gazette

- British fashion retailer AllSaints has expanded into South America, with the retailing of goods in both Chile and Peru. The company is partnering with Cencosud in the region, selling its clothing in Paris department stores in both countries.

- The company said it has plans to expand further into the region in the near future. AllSaints currently operates in 22 countries.

MasterCard Launches Fingerprint and “Selfie” Payment Authentication in Brazil and Mexico

(November 30) EssentialRetail.com

MasterCard Launches Fingerprint and “Selfie” Payment Authentication in Brazil and Mexico

(November 30) EssentialRetail.com

- MasterCard has launched its biometric payment capability in Latin America. Customers in both Brazil and Mexico are now able to authenticate payments with a fingerprint or by taking a selfie.

- The company’s Identity Check Mobile system allows users to verify their identity by using fingerprint-scanning or facial-recognition technology, eliminating the need to remember passwords in order to confirm online payments.

Guess Looks to Latin America for Growth

(December 5) Apparel News

Guess Looks to Latin America for Growth

(December 5) Apparel News

- Guess opened its first store in Paraguay in early December. The store is a 2,700-square-foot space in the Paseo La Galería shopping center in Paraguay’s capital, Asunció The company has looked to Latin America since 1994 for growth, though the expansion has accelerated in recent years.

- Guess now has 47 stores in Latin America, and the expansion has been largely driven by the brand’s new CEO, Victor Herrero, a Spaniard who once worked for Zara’s parent company.

Guess Looks to Latin America for Growth

(December 5) Apparel News

Guess Looks to Latin America for Growth

(December 5) Apparel News