FROM THE DESK OF DEBORAH WEINSWIG

What a week it has been for retailing and holidays in the US! (And in the UK, to a certain extent.) Thanksgiving has transformed into a huge retail commerce day. Once upon a time, Thanksgiving (which fell on November 26 this year) was a pure holiday, and we gorged ourselves silly on turkey and stuffing, became reacquainted with our relatives, and watched football on TV. Last year, however, many retailers announced that they would launch their Black Friday sales on Thanksgiving night and, in some areas, lines of shoppers snaked around the mall on Thanksgiving Thursday in anticipation of the stores’ opening.

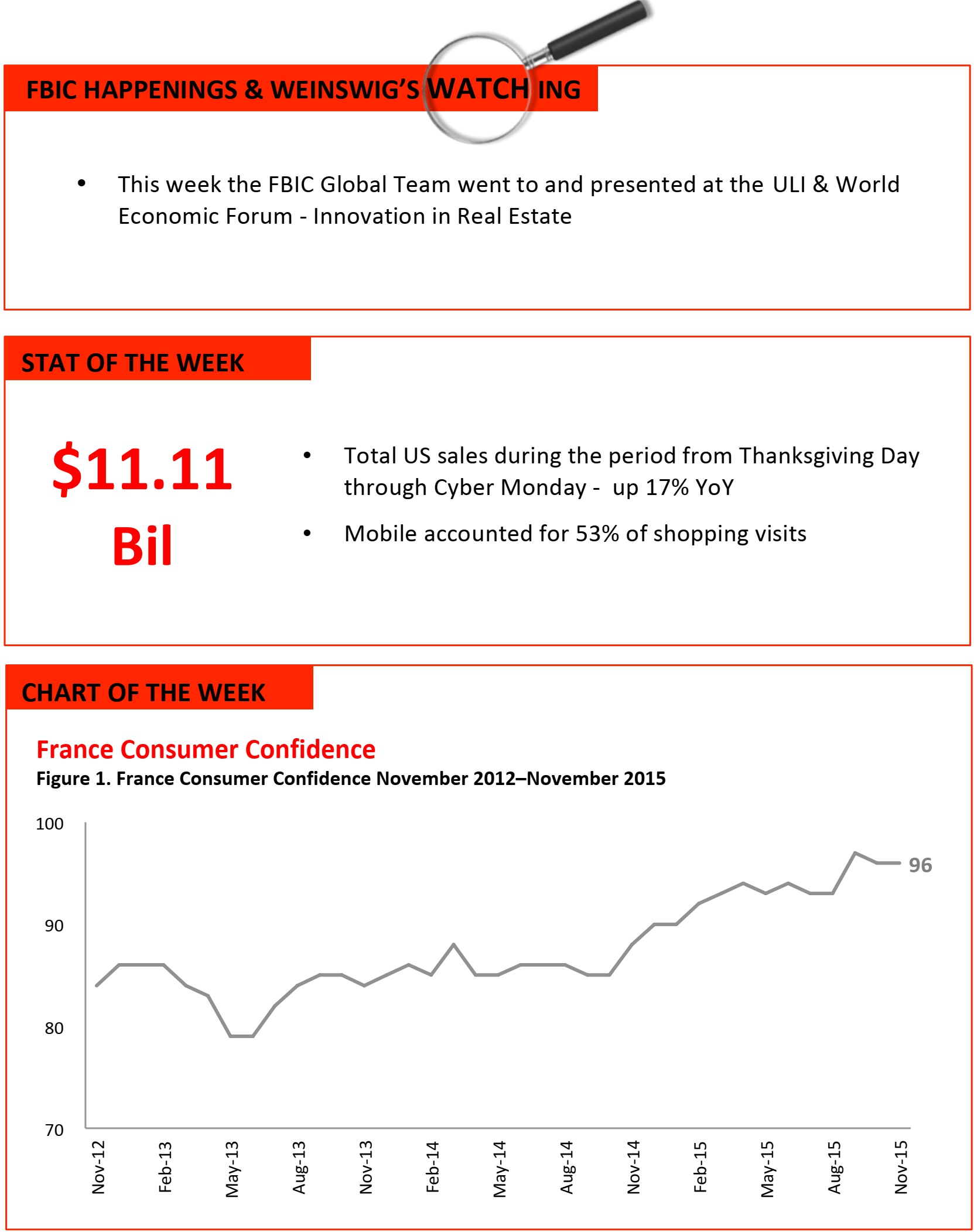

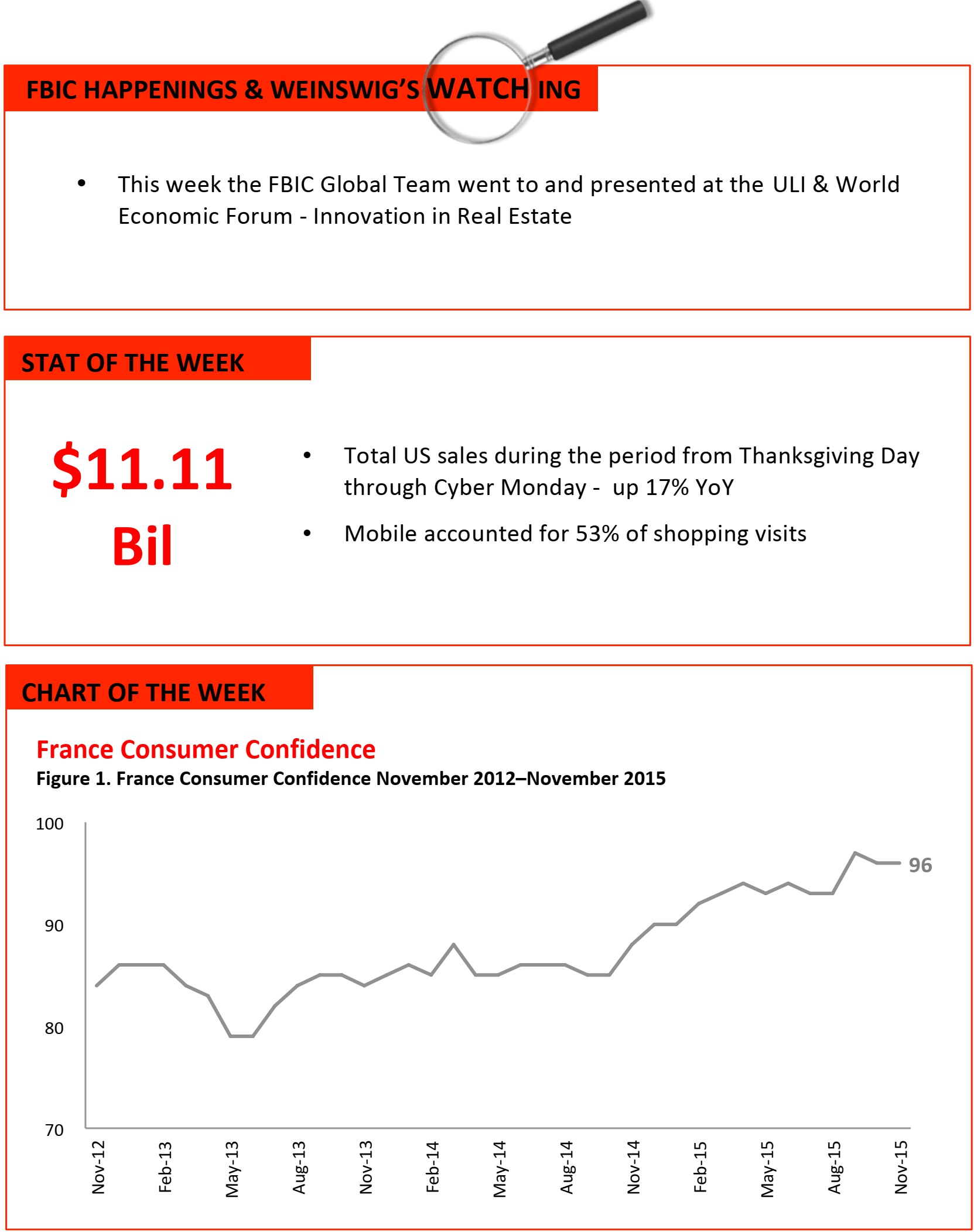

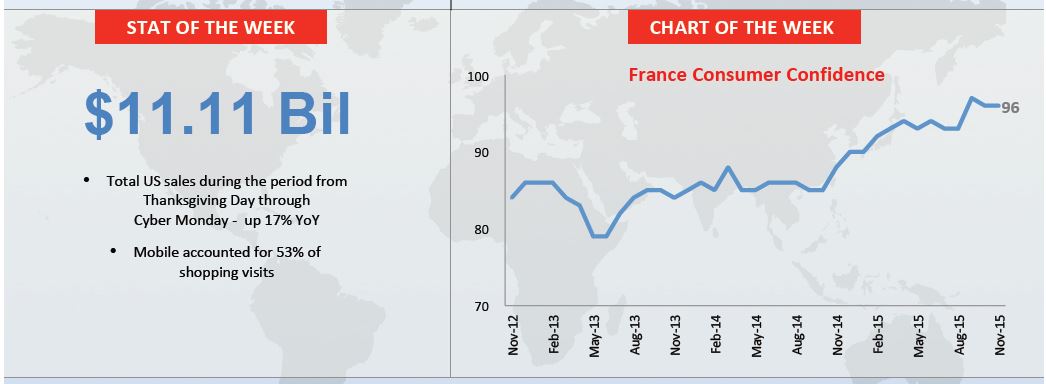

This year, many retailers reversed course and announced that they would stay closed on Thanksgiving, giving their workers a break. Nevertheless, Adobe Digital Index (ADI) estimated that this year’s Thanksgiving Day sales would amount to $1.7 billion, up by more than 25% from last year and representing more than 15% of the $11.1 billion in sales generated from Thanksgiving through Cyber Monday (“Thanksgiving week”). With consumers willing to spend this large and growing amount, shopping on Thanksgiving is likely here to stay.

Black Friday is the up-and-coming number-two shopping holiday. The term “Black Friday” actually originated in the accounting world—where profits were traditionally written in black ink and losses in red. It described the shopping day after Thanksgiving, when sales were high enough to push retailers into profitability for the first time in the year. However, the day has evolved into a competitive shopping event due to the “doorbuster” deals that many retailers offer when they open their stores early Friday morning. With the advent of e-commerce and the Thanksgiving night openings, the day has become much less aggressive. The stores we visited on Black Friday were peaceful during the morning, as the most competitive shoppers had likely exhausted themselves the night before. Store traffic did pick up during the course of the day, however, at the locations we visited.

Black Friday is allegedly nipping at the heels of Cyber Monday to take the crown for the biggest shopping day of Thanksgiving week, and ADI forecasted $2.7 billion in Black Friday sales this year, an increase of 15% over last year. Although the original Black Friday sales were brick-and-mortar events, the day is gradually becoming Cyber Black Friday, since more than half of mobile-device users now shop via their smartphones and tablets (56.7% and 57.7%, respectively). Black Friday still remains an apparel-centric day, though, with more than half of purchasers buying apparel that day.

Moreover, Black Friday is becoming a phenomenon in countries that do not typically celebrate Thanksgiving, a uniquely American holiday. ADI reported that 56% of the buzz surrounding the day came from outside the US, as compared to just 30% for Cyber Monday. Shoppers in the UK, for example, spent £1.1 billion (US$1.6 billion) on Black Friday purchases this year, a 36% increase from last year, according to Experian-IMRG.

Cyber Monday is still the heavyweight champ…and is going mobile. This year’s Cyber Monday sales hit $3.07 billion, up 16% year over year and 3% higher than ADI had estimated. There has been much talk of retailers launching their Black Friday and Cyber Monday promotions earlier, leading to a “smearing” of holiday sales; however, the figures say otherwise. The gap between Black Friday and Cyber Monday sales widened somewhat this year, with the 14% sales growth on Black Friday lagging behind the 16% growth on Cyber Monday. And, as the name suggests, Cyber Monday was lackluster for brick-and-mortar retailers, with ShopperTrak estimating a 10.4% drop in store traffic and RetailNext estimating a 4.7% drop.

This year’s Cyber Monday represented a significant milestone for mobile commerce. Mobile accounted for 53% of shopping visits and 32% of online sales this year on Cyber Monday, according to ADI. And mobile traffic and transactions were overwhelmingly conducted on smartphones, rather than on tablets. Smartphones contributed 77% of mobile traffic and 63% of mobile online sales during the Thanksgiving week. Walmart reported that 70% of the traffic on Walmart.com came from mobile during the week. In contrast to Black Friday, on Cyber Monday, most of the hot products were electronic in nature, including TVs, video game consoles, HDTVs, tablets and, of course, Star Wars toys.

Still, there is much more shopping that needs to be done! Thanksgiving week represents just one-eighth of the total $83 billion in holiday sales that ADI estimates will be rung up this year, and our team will continue to monitor and report on the progress of the holiday shopping season.

What a week it has been for retailing and holidays in the US! (And in the UK, to a certain extent.) Thanksgiving has transformed into a huge retail commerce day. Once upon a time, Thanksgiving (which fell on November 26 this year) was a pure holiday, and we gorged ourselves silly on turkey and stuffing, became reacquainted with our relatives, and watched football on TV. Last year, however, many retailers announced that they would launch their Black Friday sales on Thanksgiving night and, in some areas, lines of shoppers snaked around the mall on Thanksgiving Thursday in anticipation of the stores’ opening.

This year, many retailers reversed course and announced that they would stay closed on Thanksgiving, giving their workers a break. Nevertheless, Adobe Digital Index (ADI) estimated that this year’s Thanksgiving Day sales would amount to $1.7 billion, up by more than 25% from last year and representing more than 15% of the $11.1 billion in sales generated from Thanksgiving through Cyber Monday (“Thanksgiving week”). With consumers willing to spend this large and growing amount, shopping on Thanksgiving is likely here to stay.

Black Friday is the up-and-coming number-two shopping holiday. The term “Black Friday” actually originated in the accounting world—where profits were traditionally written in black ink and losses in red. It described the shopping day after Thanksgiving, when sales were high enough to push retailers into profitability for the first time in the year. However, the day has evolved into a competitive shopping event due to the “doorbuster” deals that many retailers offer when they open their stores early Friday morning. With the advent of e-commerce and the Thanksgiving night openings, the day has become much less aggressive. The stores we visited on Black Friday were peaceful during the morning, as the most competitive shoppers had likely exhausted themselves the night before. Store traffic did pick up during the course of the day, however, at the locations we visited.

Black Friday is allegedly nipping at the heels of Cyber Monday to take the crown for the biggest shopping day of Thanksgiving week, and ADI forecasted $2.7 billion in Black Friday sales this year, an increase of 15% over last year. Although the original Black Friday sales were brick-and-mortar events, the day is gradually becoming Cyber Black Friday, since more than half of mobile-device users now shop via their smartphones and tablets (56.7% and 57.7%, respectively). Black Friday still remains an apparel-centric day, though, with more than half of purchasers buying apparel that day.

Moreover, Black Friday is becoming a phenomenon in countries that do not typically celebrate Thanksgiving, a uniquely American holiday. ADI reported that 56% of the buzz surrounding the day came from outside the US, as compared to just 30% for Cyber Monday. Shoppers in the UK, for example, spent £1.1 billion (US$1.6 billion) on Black Friday purchases this year, a 36% increase from last year, according to Experian-IMRG.

Cyber Monday is still the heavyweight champ…and is going mobile. This year’s Cyber Monday sales hit $3.07 billion, up 16% year over year and 3% higher than ADI had estimated. There has been much talk of retailers launching their Black Friday and Cyber Monday promotions earlier, leading to a “smearing” of holiday sales; however, the figures say otherwise. The gap between Black Friday and Cyber Monday sales widened somewhat this year, with the 14% sales growth on Black Friday lagging behind the 16% growth on Cyber Monday. And, as the name suggests, Cyber Monday was lackluster for brick-and-mortar retailers, with ShopperTrak estimating a 10.4% drop in store traffic and RetailNext estimating a 4.7% drop.

This year’s Cyber Monday represented a significant milestone for mobile commerce. Mobile accounted for 53% of shopping visits and 32% of online sales this year on Cyber Monday, according to ADI. And mobile traffic and transactions were overwhelmingly conducted on smartphones, rather than on tablets. Smartphones contributed 77% of mobile traffic and 63% of mobile online sales during the Thanksgiving week. Walmart reported that 70% of the traffic on Walmart.com came from mobile during the week. In contrast to Black Friday, on Cyber Monday, most of the hot products were electronic in nature, including TVs, video game consoles, HDTVs, tablets and, of course, Star Wars toys.

Still, there is much more shopping that needs to be done! Thanksgiving week represents just one-eighth of the total $83 billion in holiday sales that ADI estimates will be rung up this year, and our team will continue to monitor and report on the progress of the holiday shopping season.

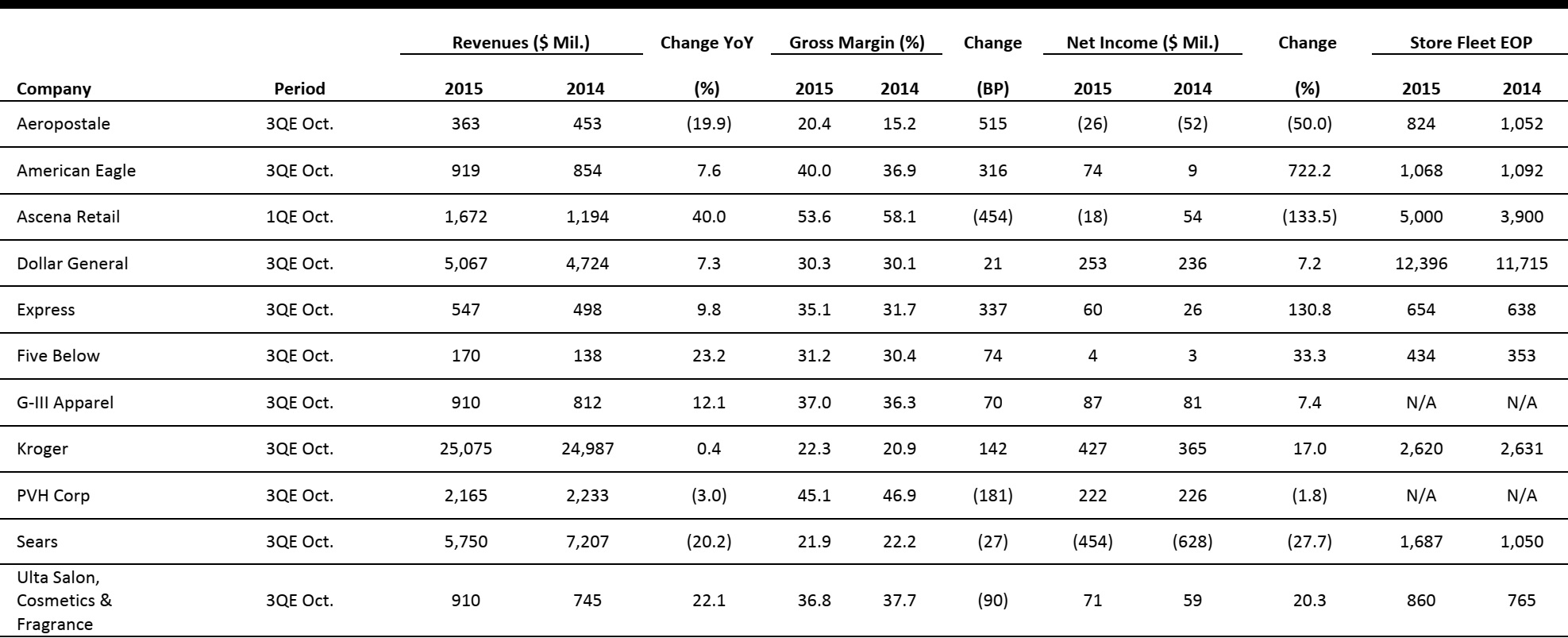

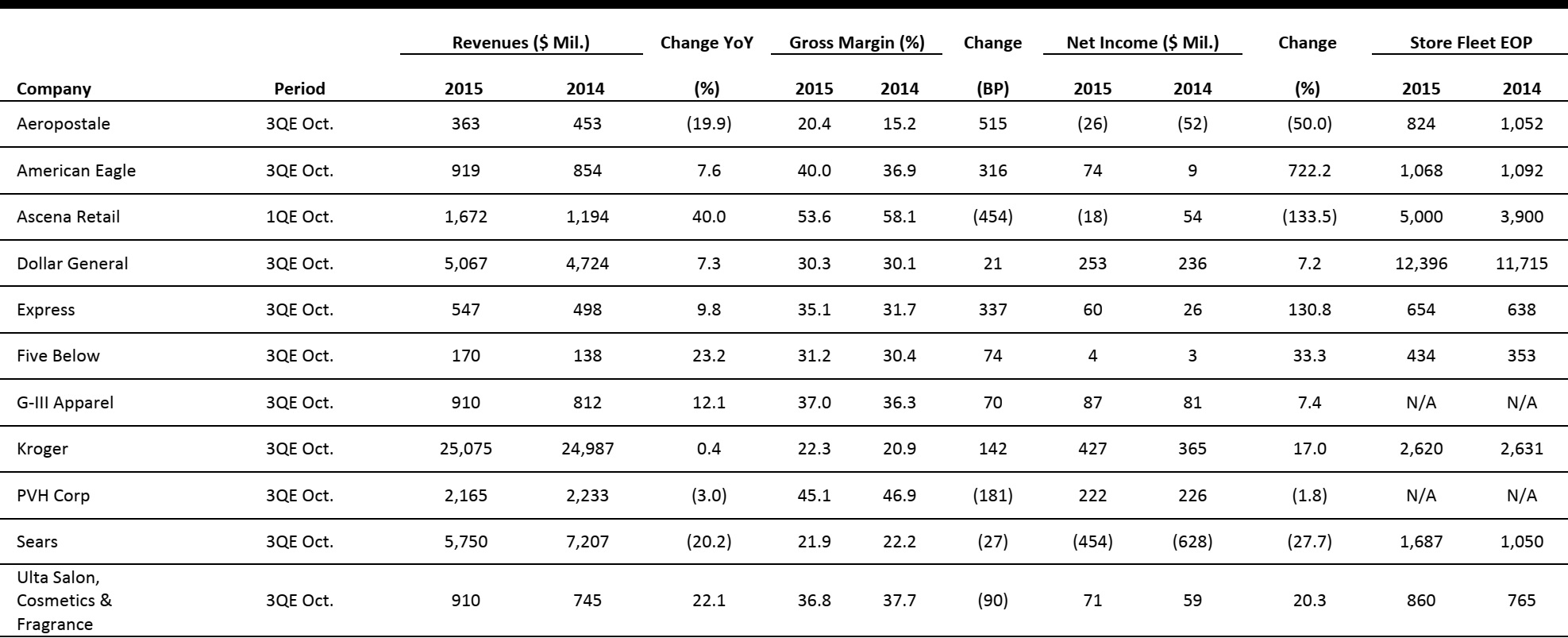

- In November, the consumer confidence index in France stood at 96, which was in line with the trend over the last few months, but below its long-term average of 100.

- The index shows that the financial and economic situation in France is virtually stable, while fears of unemployment have decreased sharply.

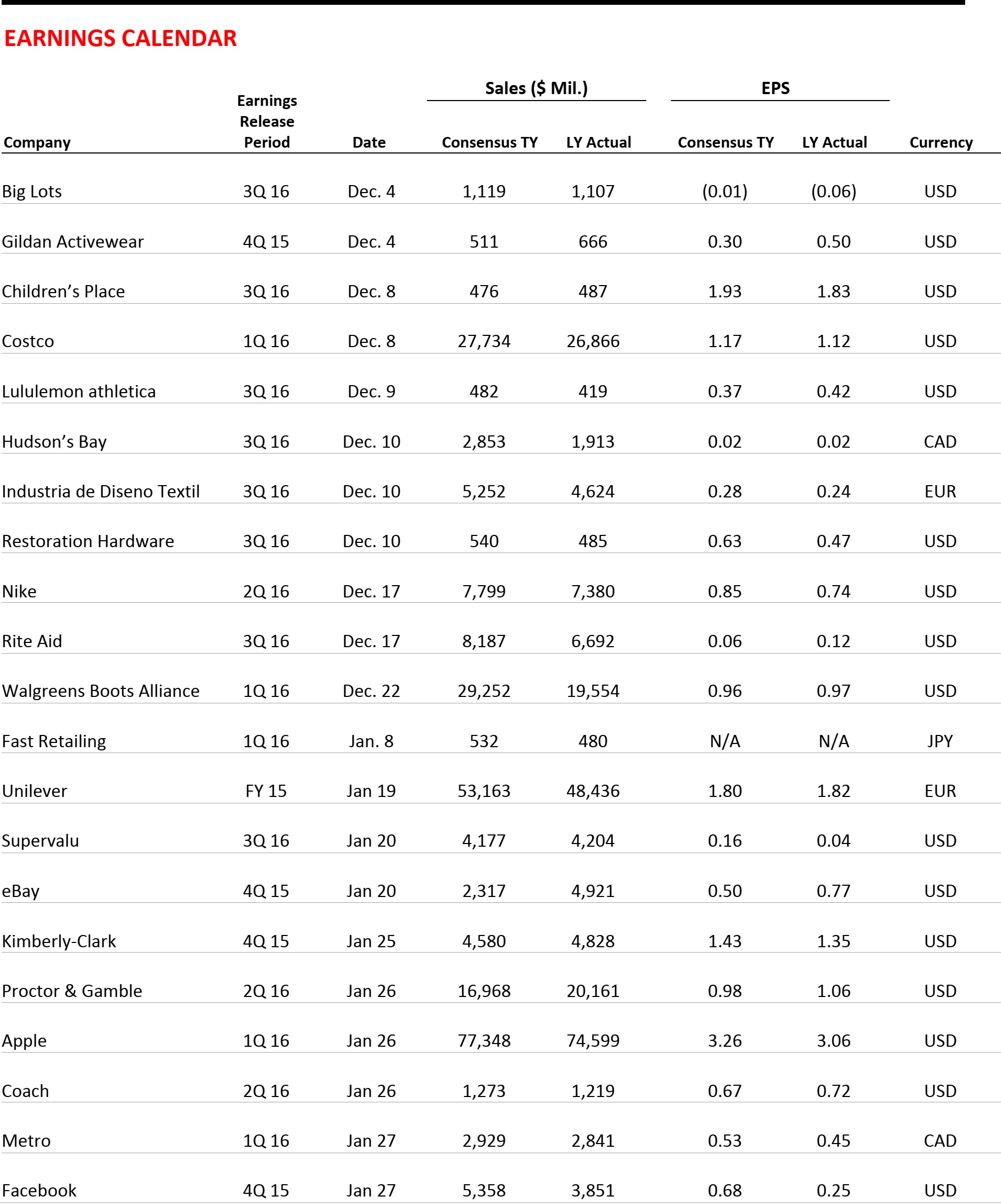

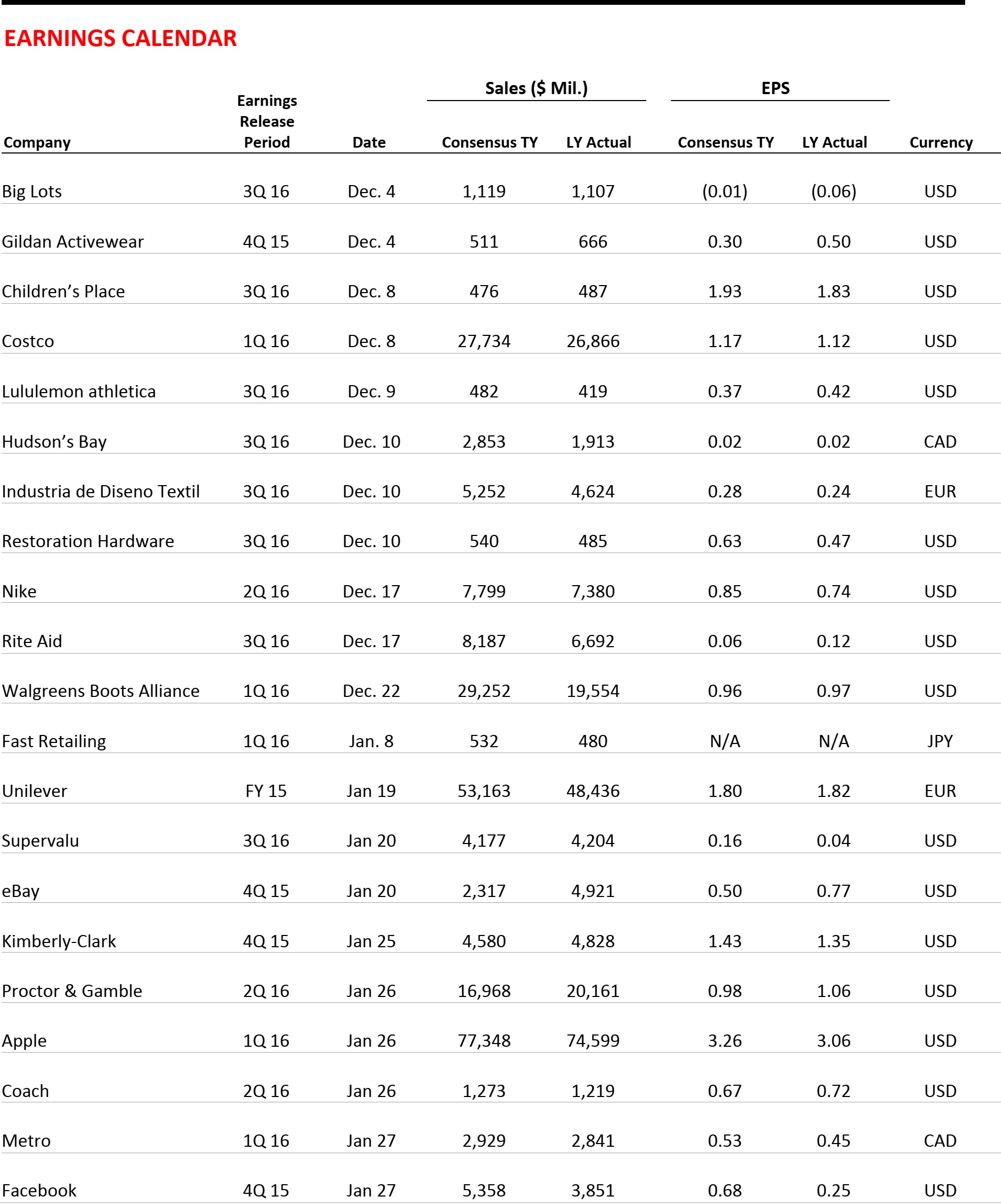

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

Cyber Monday: A Reported Record $3 Billion in Online Sales

(November 30) CNBC

Cyber Monday: A Reported Record $3 Billion in Online Sales

(November 30) CNBC

- According to Adobe Digital Index, Cyber Monday sales reached $3.07 billion, surpassing $3 billion for the first time, and up 16% from last year. Over the five-day Thanksgiving sales period, total online sales were reported to be $11.11 billion, up 17% from last year. The results were better than the firm had predicted.

- Sales from mobile devices also set a new record: $799 million. Strong online sales performance is further evidence that shoppers increasingly prefer shopping online to shopping in-store during the holidays.

Birchbox Assembles a Team for Brick-and-Mortar Expansion

(November 30) Women’s Wear Daily

Birchbox Assembles a Team for Brick-and-Mortar Expansion

(November 30) Women’s Wear Daily

- Online beauty subscription company Birchbox has hired a team of seasoned experts and hopes to expand to multi-channel in 2016. Philppe Pinatel has been named Chief Operations Officer and President. Pinatel has a combined 20 years of experience at Sephora and Guerlain.

- Ben Fay was appointed Vice President of Retail Development and Customer Experience. He will oversee the execution of Birchbox’s offline expansion. Fay comes from a retail store design background and previously worked at Apple and JCPenney.

Amazon Released a Video to Showcase Its Drone Delivery Capability over Thanksgiving Weekend

(November 30) NPR

Amazon Released a Video to Showcase Its Drone Delivery Capability over Thanksgiving Weekend

(November 30) NPR

- Amazon released a video over Thanksgiving weekend showing a drone delivering a small package from a warehouse to a suburban neighborhood in about 30 minutes. Amazon says its drones will be able to fly lower than 400 feet and carry packages of no more than five pounds.

- “It looks like science fiction, but it’s real. One day, seeing Prime Air vehicles will be as normal as seeing mail trucks on the road,” the company said in a press release.

EUROPEAN RETAIL HEADLINES

Amazon.co.uk Sees Record Sales This Black Friday

(November 28) Company press release

Amazon.co.uk Sees Record Sales This Black Friday

(November 28) Company press release

- Black Friday 2015 was Amazon.co.uk’s busiest day ever, the company said, with more than 7.4 million products ordered. It added that an average of 86 items were sold every second, and that this year’s event beat the previous all-time sales record set on Black Friday 2014, when more than 5.5 million products were ordered.

- co.uk revealed that its top-selling items across all products were Amazon devices, with the new Fire tablet coming in at number one, followed by the Fire TV Stick. Sales of the Amazon Fire TV were up by more than six times, year over year, this Black Friday weekend.

Black Friday 2015 Sees Shopping Center and Retail Park Visitor Numbers Fall by 4%

(November 30) Theretailbulletin.com

Black Friday 2015 Sees Shopping Center and Retail Park Visitor Numbers Fall by 4%

(November 30) Theretailbulletin.com

- The number of visitors to UK shopping centers and retail parks on Black Friday fell by 4% from last year, according to the British Council of Shopping Centres (BCSC) and retail intelligence company FootFall. The BCSC said that the fall was marginal compared to last year, when footfall declined by 10% from the previous year.

- Ed Cooke, the Director of Policy and Public Affairs at the BCSC, stated that a high number of shoppers still like to make purchases in person, or pick up goods ordered online from stores, despite the high growth in online retail over the Black Friday period. He added that this is evident especially in the period preceding the busy holiday season.

Mango Launches App for Apple TV

(November 30) Retaildetail.eu

Mango Launches App for Apple TV

(November 30) Retaildetail.eu

- Spanish fashion brand Mango has extended its e-commerce offering through a new Apple TV app. Mango’s ad campaigns can be viewed in the app, and customers will be able to explore the associated product range. The app also provides additional information on clothing via clips in 20 different languages.

- While browsing, customers can add desired products to their shopping basket and later complete the checkout process through a tablet, smartphone or computer. Online sales currently account for 9.1% of the company’s total turnover, and 30% of these sales are made through Mango’s mobile apps.

Swatch and Visa to Introduce Watch-Based Payment

Swatch and Visa to Introduce Watch-Based Payment

(November 30) Techweekeurope.co.uk)

- Iconic Swiss watchmaker Swatch has signed a deal with Visa that extends the latter’s mobile payment offering. Visa cardholders in Switzerland, Brazil and the US will be able to tap and pay for transactions with the Swatch Bellamy, the Swiss company’s new “pay-by-the-wrist” watch.

- The watch’s dial incorporates a near-field communication chip that allows users to hold their watches up to a point-of-sale device and pay for their purchase, similar to the way Apple Pay works. The service is expected to launch sometime early in 2016.

Groupe Casino and Dia Form Purchasing Alliance

(December 1) Retaildetail.eu

Groupe Casino and Dia Form Purchasing Alliance

(December 1) Retaildetail.eu

- French multinational grocery retailer Groupe Casino and Spanish international discount supermarket chain Dia have formed an alliance to purchase products together. The alliance will be called ICDC Services and will cater to their private label ranges.

- The venture is expected to provide many synergies in terms of expertise, geographic locations and store formats. It is hoped that it will boost both companies’ competitiveness relative to their major suppliers, amid an ongoing price war and diminishing margins in European distribution.

ASIA TECH HEADLINES

Samsung Injects New Blood into Mobile Division

(December 1) ZDNet

Samsung Injects New Blood into Mobile Division

(December 1) ZDNet

- Samsung has named Koh Dong-jin as President and Head of its mobile division. He will take over the day-to-day running of the company’s stagnating smartphone business. The role was previously held by JK Shin, who will resume his post as CEO of the mobile division.

- Samsung has seen profits drop in the last two years due to tough competition from Apple in the high-end market segment and emerging Chinese vendors in the low-end segment.

What Does Indiegogo’s Partnership with Brookstone Mean for Asian Startups’ Crowdfunding?

(December 1) TechinAsia

What Does Indiegogo’s Partnership with Brookstone Mean for Asian Startups’ Crowdfunding?

(December 1) TechinAsia

- Indiegogo’s partnership with offline partner Brookstone means that startups that ran successful Indiegogo campaigns will now have direct access to physical stores across hundreds of locations in the US.

- Given enough support, Brookstone is willing to take over the hurdle of getting products that have been funded via Indiegogo to actual stores in the US. To put it simply, the retailer is willing to streamline startups’ ability to capitalize on crowdfunding success.

Hong Kong–Based Oddup Raises US$1 Million in Seed Round

(November 30) e27.co

Hong Kong–Based Oddup Raises US$1 Million in Seed Round

(November 30) e27.co

- Oddup announced that it had secured US$1 million in seed funding, led by Kima Ventures, Click Ventures and Bigcolors, with participation from Big Bloom, Glooh Ventures and a group of angel investors.

- The Hong Kong–based company rates startups in China, Hong Kong, Singapore and Taiwan on a scale of 1 to 100, with a higher score signifying a less-risky investment for potential VCs and angels. The analytics are based on trends, expected future valuations and potential high returns.

Indonesia’s MNC Gets into Online Travel with Mister Aladin

(November 30) TechinAsia

Indonesia’s MNC Gets into Online Travel with Mister Aladin

(November 30) TechinAsia

- Mister Aladin, a hotel-booking site from Indonesia’s family-owned MNC Media conglomerate, features hotels across the nation, as well as special villas in Bali.

- Teddy Pun, CEO of Mister Aladin, commented, “Many travel bookings are still done with traditional travel agents, but that trend will move to digital very fast. If one combines all these factors, the online travel market [in Indonesia] is just too big to ignore.”

Data Breach at Hong Kong Toymaker VTech Highlights Broader Problems

(November 30) ChannelNewsAsia

Data Breach at Hong Kong Toymaker VTech Highlights Broader Problems

(November 30) ChannelNewsAsia

- The theft of data from toymaker VTech highlights a growing problem with basic cyber security measures at small, nonfinancial companies that handle electronic customer data, industry watchers said on Monday.

- “Smaller companies might be targeted less often, but the implications…can be just as serious,” said Bryce Boland, Asia Pacific Chief Technology Officer of cyber security firm FireEye. “As larger companies implement stronger security measures, smaller companies become relatively easy targets for cyber crime.”

LATAM RETAIL HEADLINES

Brazilian Mall Operators Are Going Shopping

(December 1) Bloomberg

Brazilian Mall Operators Are Going Shopping

(December 1) Bloomberg

- Although Brazilian retail sales declined by 7.4% for the year to date through September, there has been a flurry of acquisition activity in the country.

- Israeli real estate company Gazit-Globe recently purchased a 4.3% stake in Shopping Eldorado, a mall near an upper-class residential neighborhood in São Paulo, in addition to two assets from General Shopping Brazil and a 5.2% stake in BR Malls. The acquisitions totaled more than more than BRL 1 billion (US$259 million).

Brazilian Third-Quarter GDP Trails Forecasts

(December 1) Bloomberg

Brazilian Third-Quarter GDP Trails Forecasts

(December 1) Bloomberg

- In the third quarter, Brazilian GDP contracted by 1.7%, quarter over quarter, missing consensus estimates of a 1.2% contraction, and following a 2.1% quarter-over-quarter decline in the second quarter.

- A Goldman Sachs economist commented that the initial recessionary adjustment of the Brazilian economy to global macroeconomic imbalances is turning into an outright depression due to a deep contraction in domestic demand.

Genius Brands and Neroli Open First Dedicated Psycho Bunny Retail Store in Panama City

(November 30) CNN Money

Genius Brands and Neroli Open First Dedicated Psycho Bunny Retail Store in Panama City

(November 30) CNN Money

- Genius Brands International is collaborating with Neroli Group, Psycho Bunny’s core sportswear distributor in Latin America, on the launch of Psycho Bunny’s flagship retail store in Panama City, a hub for international banking and commerce.

- Neroli has previously brought Psycho Bunny to consumers in Belize, Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Colombia, Venezuela, Ecuador, Peru, Chile, Bolivia, Paraguay, Uruguay, Curaçao, Aruba, Trinidad, San Andrés, Turks and Caicos, and St. Martin.

Brazilian Bargain Seekers Increasingly Turning to Discounters

(November 25) Financial Times

Brazilian Bargain Seekers Increasingly Turning to Discounters

(November 25) Financial Times

- A new generation of bargain hunters is turning to discount and cash-and-carry chains, repeating a trend from the 1980s, according to FT Confidential Research, and discount chains are also stealing market share from supermarkets in Argentina, Mexico, Colombia and Chile.

- Prior to the current economic crisis, Brazilian cash-and-carry stores experienced a sales compound annual growth rate of 18.7% from 2011–2014, as compared to an average of 8.5% for hypermarkets and 10.2% for supermarkets during the same period, according to RetailNet Group.

Saks Mexico Planning to Open 15 More In-Shop Stores, Plus One Large Store

(November 23) WWD.com

Saks Mexico Planning to Open 15 More In-Shop Stores, Plus One Large Store

(November 23) WWD.com

- Saks Fifth Avenue Mexico will open about 15 shops-in-shop in its store in Mexico City’s affluent Santa Fe quarter, as well as a third store in the city’s upwardly mobile Perisur area.

- Saks plans to remodel part of its 170,000-square-foot Santa Fe location to enable large shops-in-shop, in addition to its 106,000-square-foot Perisur location.

What a week it has been for retailing and holidays in the US! (And in the UK, to a certain extent.) Thanksgiving has transformed into a huge retail commerce day. Once upon a time, Thanksgiving (which fell on November 26 this year) was a pure holiday, and we gorged ourselves silly on turkey and stuffing, became reacquainted with our relatives, and watched football on TV. Last year, however, many retailers announced that they would launch their Black Friday sales on Thanksgiving night and, in some areas, lines of shoppers snaked around the mall on Thanksgiving Thursday in anticipation of the stores’ opening.

This year, many retailers reversed course and announced that they would stay closed on Thanksgiving, giving their workers a break. Nevertheless, Adobe Digital Index (ADI) estimated that this year’s Thanksgiving Day sales would amount to $1.7 billion, up by more than 25% from last year and representing more than 15% of the $11.1 billion in sales generated from Thanksgiving through Cyber Monday (“Thanksgiving week”). With consumers willing to spend this large and growing amount, shopping on Thanksgiving is likely here to stay.

Black Friday is the up-and-coming number-two shopping holiday. The term “Black Friday” actually originated in the accounting world—where profits were traditionally written in black ink and losses in red. It described the shopping day after Thanksgiving, when sales were high enough to push retailers into profitability for the first time in the year. However, the day has evolved into a competitive shopping event due to the “doorbuster” deals that many retailers offer when they open their stores early Friday morning. With the advent of e-commerce and the Thanksgiving night openings, the day has become much less aggressive. The stores we visited on Black Friday were peaceful during the morning, as the most competitive shoppers had likely exhausted themselves the night before. Store traffic did pick up during the course of the day, however, at the locations we visited.

Black Friday is allegedly nipping at the heels of Cyber Monday to take the crown for the biggest shopping day of Thanksgiving week, and ADI forecasted $2.7 billion in Black Friday sales this year, an increase of 15% over last year. Although the original Black Friday sales were brick-and-mortar events, the day is gradually becoming Cyber Black Friday, since more than half of mobile-device users now shop via their smartphones and tablets (56.7% and 57.7%, respectively). Black Friday still remains an apparel-centric day, though, with more than half of purchasers buying apparel that day.

Moreover, Black Friday is becoming a phenomenon in countries that do not typically celebrate Thanksgiving, a uniquely American holiday. ADI reported that 56% of the buzz surrounding the day came from outside the US, as compared to just 30% for Cyber Monday. Shoppers in the UK, for example, spent £1.1 billion (US$1.6 billion) on Black Friday purchases this year, a 36% increase from last year, according to Experian-IMRG.

Cyber Monday is still the heavyweight champ…and is going mobile. This year’s Cyber Monday sales hit $3.07 billion, up 16% year over year and 3% higher than ADI had estimated. There has been much talk of retailers launching their Black Friday and Cyber Monday promotions earlier, leading to a “smearing” of holiday sales; however, the figures say otherwise. The gap between Black Friday and Cyber Monday sales widened somewhat this year, with the 14% sales growth on Black Friday lagging behind the 16% growth on Cyber Monday. And, as the name suggests, Cyber Monday was lackluster for brick-and-mortar retailers, with ShopperTrak estimating a 10.4% drop in store traffic and RetailNext estimating a 4.7% drop.

This year’s Cyber Monday represented a significant milestone for mobile commerce. Mobile accounted for 53% of shopping visits and 32% of online sales this year on Cyber Monday, according to ADI. And mobile traffic and transactions were overwhelmingly conducted on smartphones, rather than on tablets. Smartphones contributed 77% of mobile traffic and 63% of mobile online sales during the Thanksgiving week. Walmart reported that 70% of the traffic on Walmart.com came from mobile during the week. In contrast to Black Friday, on Cyber Monday, most of the hot products were electronic in nature, including TVs, video game consoles, HDTVs, tablets and, of course, Star Wars toys.

Still, there is much more shopping that needs to be done! Thanksgiving week represents just one-eighth of the total $83 billion in holiday sales that ADI estimates will be rung up this year, and our team will continue to monitor and report on the progress of the holiday shopping season.

What a week it has been for retailing and holidays in the US! (And in the UK, to a certain extent.) Thanksgiving has transformed into a huge retail commerce day. Once upon a time, Thanksgiving (which fell on November 26 this year) was a pure holiday, and we gorged ourselves silly on turkey and stuffing, became reacquainted with our relatives, and watched football on TV. Last year, however, many retailers announced that they would launch their Black Friday sales on Thanksgiving night and, in some areas, lines of shoppers snaked around the mall on Thanksgiving Thursday in anticipation of the stores’ opening.

This year, many retailers reversed course and announced that they would stay closed on Thanksgiving, giving their workers a break. Nevertheless, Adobe Digital Index (ADI) estimated that this year’s Thanksgiving Day sales would amount to $1.7 billion, up by more than 25% from last year and representing more than 15% of the $11.1 billion in sales generated from Thanksgiving through Cyber Monday (“Thanksgiving week”). With consumers willing to spend this large and growing amount, shopping on Thanksgiving is likely here to stay.

Black Friday is the up-and-coming number-two shopping holiday. The term “Black Friday” actually originated in the accounting world—where profits were traditionally written in black ink and losses in red. It described the shopping day after Thanksgiving, when sales were high enough to push retailers into profitability for the first time in the year. However, the day has evolved into a competitive shopping event due to the “doorbuster” deals that many retailers offer when they open their stores early Friday morning. With the advent of e-commerce and the Thanksgiving night openings, the day has become much less aggressive. The stores we visited on Black Friday were peaceful during the morning, as the most competitive shoppers had likely exhausted themselves the night before. Store traffic did pick up during the course of the day, however, at the locations we visited.

Black Friday is allegedly nipping at the heels of Cyber Monday to take the crown for the biggest shopping day of Thanksgiving week, and ADI forecasted $2.7 billion in Black Friday sales this year, an increase of 15% over last year. Although the original Black Friday sales were brick-and-mortar events, the day is gradually becoming Cyber Black Friday, since more than half of mobile-device users now shop via their smartphones and tablets (56.7% and 57.7%, respectively). Black Friday still remains an apparel-centric day, though, with more than half of purchasers buying apparel that day.

Moreover, Black Friday is becoming a phenomenon in countries that do not typically celebrate Thanksgiving, a uniquely American holiday. ADI reported that 56% of the buzz surrounding the day came from outside the US, as compared to just 30% for Cyber Monday. Shoppers in the UK, for example, spent £1.1 billion (US$1.6 billion) on Black Friday purchases this year, a 36% increase from last year, according to Experian-IMRG.

Cyber Monday is still the heavyweight champ…and is going mobile. This year’s Cyber Monday sales hit $3.07 billion, up 16% year over year and 3% higher than ADI had estimated. There has been much talk of retailers launching their Black Friday and Cyber Monday promotions earlier, leading to a “smearing” of holiday sales; however, the figures say otherwise. The gap between Black Friday and Cyber Monday sales widened somewhat this year, with the 14% sales growth on Black Friday lagging behind the 16% growth on Cyber Monday. And, as the name suggests, Cyber Monday was lackluster for brick-and-mortar retailers, with ShopperTrak estimating a 10.4% drop in store traffic and RetailNext estimating a 4.7% drop.

This year’s Cyber Monday represented a significant milestone for mobile commerce. Mobile accounted for 53% of shopping visits and 32% of online sales this year on Cyber Monday, according to ADI. And mobile traffic and transactions were overwhelmingly conducted on smartphones, rather than on tablets. Smartphones contributed 77% of mobile traffic and 63% of mobile online sales during the Thanksgiving week. Walmart reported that 70% of the traffic on Walmart.com came from mobile during the week. In contrast to Black Friday, on Cyber Monday, most of the hot products were electronic in nature, including TVs, video game consoles, HDTVs, tablets and, of course, Star Wars toys.

Still, there is much more shopping that needs to be done! Thanksgiving week represents just one-eighth of the total $83 billion in holiday sales that ADI estimates will be rung up this year, and our team will continue to monitor and report on the progress of the holiday shopping season.