Web Developers

From Deborah’s Desk

For several years, we have used the Weinswig Hourglass Model to illustrate how outperformance in retail is increasingly polarized at the high and low ends, while the middle market is pinched. The past year showed that our model is still relevant.

For several years, we have used the Weinswig Hourglass Model to illustrate how outperformance in retail is increasingly polarized at the high and low ends, while the middle market is pinched. The past year showed that our model is still relevant.

Apparel: Off-Price and Budget Fashion Blossom

The budget boom was a major theme of 2015, and one element of this was the flourishing of the off-price channel in the US. Macy’s launched its Backstage concept, with plans for around 50 stores; Kohl’s unveiled its Off-Aisle concept; Hudson’s Bay Company announced its Find @ Lord & Taylor format; and Nordstrom opened 27 new off-price Nordstrom Rack stores across its first three quarters. Meanwhile, segment leader T.J.Maxx continued its strong performance, posting quarterly comps of 5%–6% all year (fiscal year to date). We covered the off-price theme in our Global Department Stores report, published in June 2015. Elsewhere in budget apparel retailing, Primark launched in the US in September, announcing that it would eventually open eight stores in the market. Primark has seen success in many international markets and there is no reason to think the US will be any different. Other value-positioned apparel players, such as H&M and boohoo.com, continued to grow strongly. But this is not simply about price: this new generation of lower-price apparel retailers is distinguished from other budget stores by their fashionable pitch. We covered these companies throughout 2015, including in stand-alone reports on Primark and boohoo.com.Other Discount Players Outperform

Grocery discounters, too, are almost certain to have registered another year of outperformance on the global stage—although private ownership of the two biggest discounters, Schwarz Group (owner of Lidl) and Aldi, means that hard data are scarce. Schwarz Group overtook Tesco to become the world’s third-biggest grocery retailer in 2014, and it likely closed the gap with second-place Kroger in 2015. Lidl is set to join Aldi in the US market by 2018, and we think it is likely do well, as we noted in our November 2015 report European Grocery Discounters. The broader discount sector saw further strong performance from leading dollar stores in the US, ongoing expansion among major pound store chains in the UK, and further robust growth from Costco as well as top-line improvement at Sam’s Club. Reflecting the discount sector’s maturation, consolidation was a recurring theme in 2015, with Dollar Tree acquiring Family Dollar in the US and Poundland purchasing 99p Stores in the UK. We covered the UK discount sector in our February What’s Next for UK Pound Shops? and December UK Second Grocery Discount Boom reports.Premium Outperforms, but a Tougher Year for Luxury

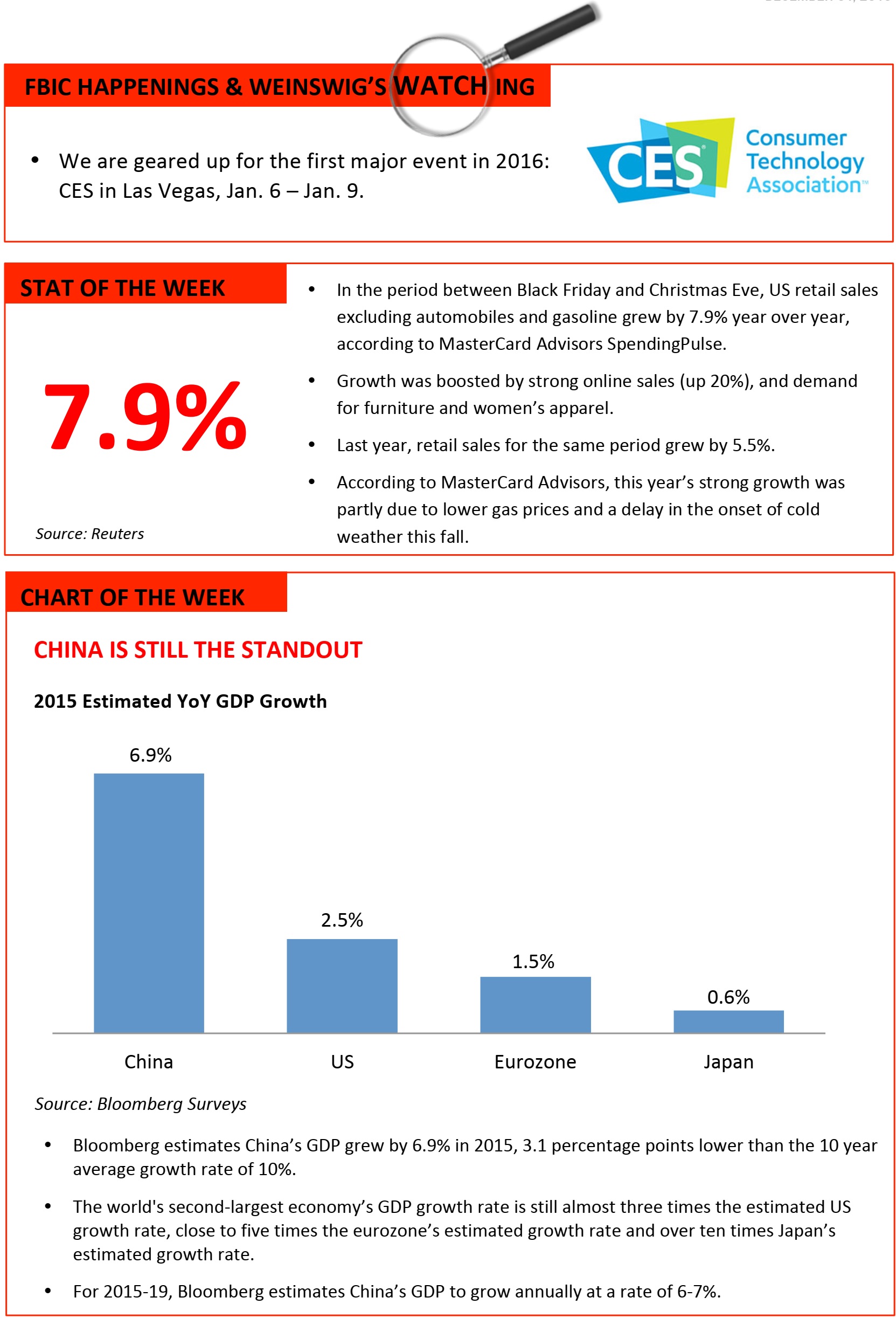

For those at the top of the hourglass, 2015 was generally a tougher year than 2014 was. Premium players, whether Nordstrom in the US or House of Fraser in the UK, generally continued to outperform their midmarket counterparts. But the high end was hit by macro trends such as currency effects and the Chinese economic slowdown. Even though the sector faltered most in the Asia-Pacific region, “the US market did not deliver” in 2015, according to Bain’s latest global luxury report, as the strength of the dollar hit sales to tourists. Bain nevertheless confirmed that Chinese consumers are continuing to flock to mature markets “in droves”—bearing out the findings of our Chinese Shoppers Going Global report, published in September 2015, and boding well for tourist-driven sales growth in Europe and the US.Midmarket Likely to Remain Squeezed

So, 2015 was stronger at the bottom of the hourglass than at the top. And the budget boom continued to put the squeeze on big names from Sears in the US to Tesco in the UK. In 2016, we expect the midmarket segment to remain under pressure: major discount chains will continue to expand, raising the standards of budget retailing and so drawing in more shoppers. Meanwhile, interest rate increases—already announced in the US and widely expected in the UK—will pinch discretionary spending among the family-life-stage shoppers that are core for many midmarket retailers. As a result, 2016 is likely to be another “hourglass year.”We wish all our readers a happy and prosperous new year.

US RETAIL HEADLINES

- Consumer confidence had a somewhat stronger tone in December, with the Conference Board Consumer Confidence Index rising to 96.5.

- In addition, confidence in November was revised higher, to 92.6 from 90.4, which was the lowest level seen in more than a year.

Third Time Is the Charm for UPS at Christmas, but FedEx Stumbles

(December 29) Reuters

Third Time Is the Charm for UPS at Christmas, but FedEx Stumbles

(December 29) Reuters

- After two consecutive years of problems during its holiday peak package season, UPS delivered on time at Christmas this year, while its main rival, FedEx, had a last-minute stumble that left some gifts undelivered until after the holiday.

- In the week running up to December 24, UPS had an on-time delivery rate of 97%–98%. The company’s on-time rate on a normal day, when daily package volumes are around half of those during peak, is 98%–99%. FedEx, on the other hand, struggled, and said in a statement that this was because of a “surge of last-minute e-commerce shipments.”

- US Internet connection speeds tripled over the course of three and a half years to keep up with consumer demand, but the US still lags many other countries in terms of connection speed. Faster connections have been driven by demand for growing amounts of bandwidth to stream movies, play video games and download data.

- The Federal Communications Commission said in a report on Wednesday that average download connection speeds had increased to nearly 31 megabits per second (Mbps) in September 2014 from about 10 Mbps in March 2011.

EUROPE RETAIL HEADLINES

- UK online retail sales rose by 21% year over year on Christmas Day, web services firm PCA Predict said this week. Analysts at Experian and IMRG had forecasted that £728 million would be spent online on Christmas Day in the UK, a year-over-year increase of 11%.

- This year, a number of British retailers, including Currys, Amazon and John Lewis, launched their post-Christmas sales online on Christmas Eve. John Lewis said it saw a 10.7% year-over-year rise in online revenues on Christmas Day.

Footfall Declines Before Christmas, but Rises After

(December 28) BBCnews.com

Footfall Declines Before Christmas, but Rises After

(December 28) BBCnews.com

- UK stores saw visitor numbers fall in the days before Christmas, according to footfall-measurement firm Springboard. On the Monday and Tuesday before Christmas, the number of shoppers visiting UK stores fell by 9% year over year. However, Springboard also said that post-Christmas sales drew in more shoppers than they did last year, with footfall on Boxing Day (December 26) rising by9% year over year.

- Despite the growth of online shopping, some retailers saw strong in-store demand on Boxing Day. London department store Selfridges said it took in more than £2 million between 9 am and 10 am on Boxing Day, its best first hour of trade ever. The New West End Company, which represents London retailers, said around 50% of West End Boxing Day shoppers were likely to be tourists.

- The biggest investor in UK grocery giant Tesco has cut its stake in the retailer. Norway’s Government Pension Fund Global sold 27 million Tesco shares, taking its holding below 6%.

- Tesco’s share price was 20% lower on Christmas Eve (latest reported) than it was at the start of 2015. However, the share price on Christmas Eve was 40% lower than the peak seen in 2015. Tesco is scheduled to report its Christmas trading results on January 14.

- The European Commission plans to crack down on high shipping costs for cross-border purchases in the new year. A Commission spokesperson said it will “launch measures to enhance price transparency and regulatory oversight” of cross-border parcel delivery charges by national postal operators early in 2016.

- Options reportedly under consideration by the Commission include strengthening powers for national regulators to enforce current EU rules on fair pricing. The Commission will also establish a price-comparison website to improve transparency of cross-border postal charges.

- co.uk is set to expand the range of products offered through its Amazon Pantry online grocery service, the company’s UK CEO, Christopher North, said this week. “We are really happy with the early numbers. In the new year we are going to be adding a lot more products,” North said.

- Amazon Pantry launched in the UK in November 2015 with an initial range of 4,000 items. Pantry differs from Amazon’s US-only complete grocery service, Amazon Fresh, due to its ambient-only offering that is shipped via regular mail..

LATAM RETAIL HEADLINES

- New Argentine President Mauricio Macri recently removed limits on how many pesos could be changed into other currencies, causing a 30% decline in the official value of the Argentinian in less than 24 hours.

- In the long run, the change should lead to increased confidence in the Argentine economy and attract greater foreign investment.

Brazilian November Budget Deficit Equals 9.3% of GDP

(December 28) The Wall Street Journal

Brazilian November Budget Deficit Equals 9.3% of GDP

(December 28) The Wall Street Journal

- Brazil’s November government deficit was equal to 9.3% of GDP, a slight improvement from from October’s budget gap of 9.5% of GDP, according to the Brazilian central bank

- The country’s gross debt was 65.1% of GDP in November, as compared to 64.9% of GDP in October, and the government has abandoned its target of achieving a primary surplus of 1.1% of GDP in 2015

Brazil Christmas Sales Decline 15%

(December 28) Reuters

Brazil Christmas Sales Decline 15%

(December 28) Reuters

- During the week of Dec. 1824, Brazilian retailers recorded sales of BRL 50.6 billion (US $13.1 billion), down 15% from BRL 59.2 billion (US $15.3 billion) during the same pre-Christmas week last year, according to the São Paulo Commerce Federation.

- The study also found a 2.8% decline in credit checks on clients with the Boa Vista credit agency and a 12% decrease in the wider retail market, which also includes vehicles and construction supplies

- Mexico's economic activity increased 2.7% in October, owing to 3.6% growth in the primary sector, 1% growth in the secondary sector, and 3.8% growth in tertiary sector, according to the National Statistics Institute, or INEGI.

- The Mexican economy grew 2.4% in the first half of this year, and the official GDP growth forecast is a range of 2.0% to 2.8%.

- Walmart Stores is considering closing about 30 stores, representing about 5% of its 588 stores in Brazil.

- The company is also considering generating additional revenue through leasing portions of existing stores to home furnishings retailers.