From the Desk of Deborah Weinswig

2016: A US Election Fueled by Social Media

2016 proved to be a unique election year in the US, with nonestablishment Republican presidential candidate Donald Trump skillfully employing social media to speak directly to the American people and beating the presumed leading candidate, former US Senator and Secretary of State Hillary Clinton.

US 2016: What We Saw

Although Clinton had led in opinion polls throughout the presidential campaign, in the end, those polls seemed to neglect the sentiment of many Americans in some key rural areas, giving Trump a win in the Electoral College despite having received millions fewer votes than Clinton. There appeared to be parallels between the US vote and the Brexit vote, and similar sentiment was seen in other countries around the world, with voters choosing candidates who focused on domestic issues. In addition, Trump positioned himself as a nonestablishment candidate who promised to “drain the swamp” of corruption and influence in Washington, DC, as well as reverse unfair trade policies and bring manufacturing jobs back to the US.

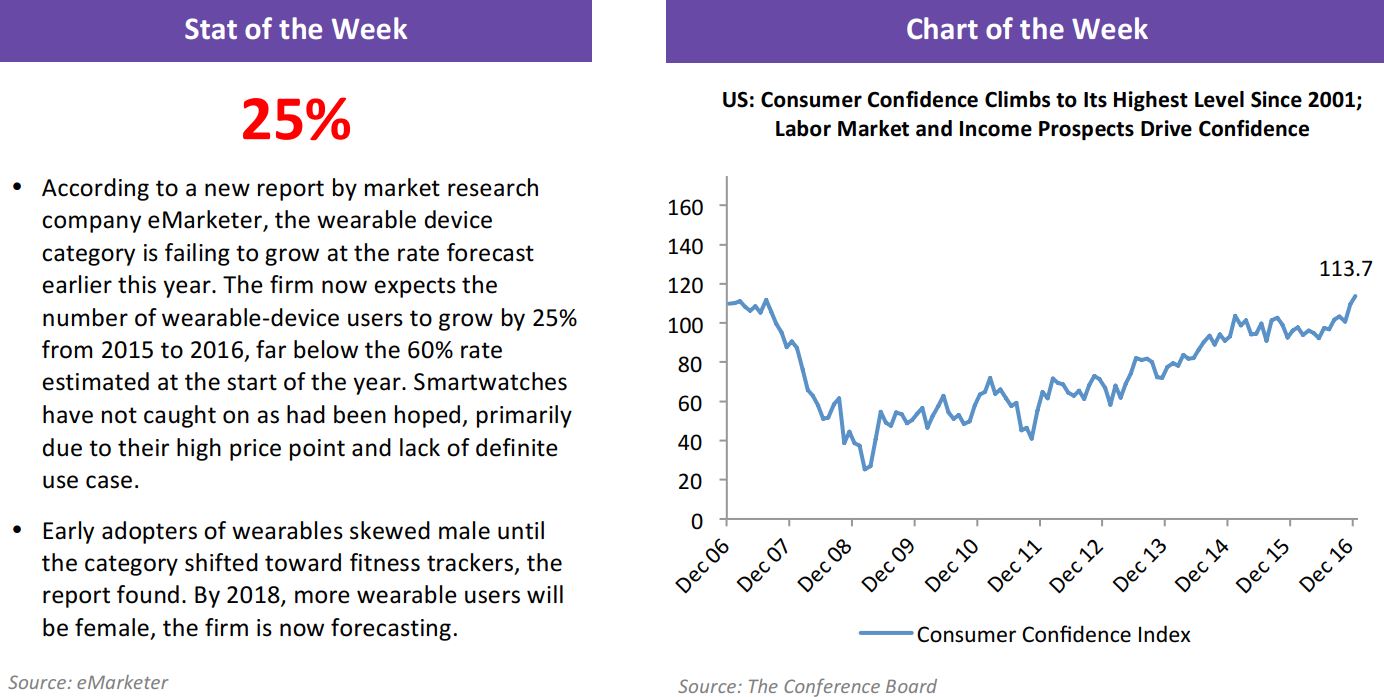

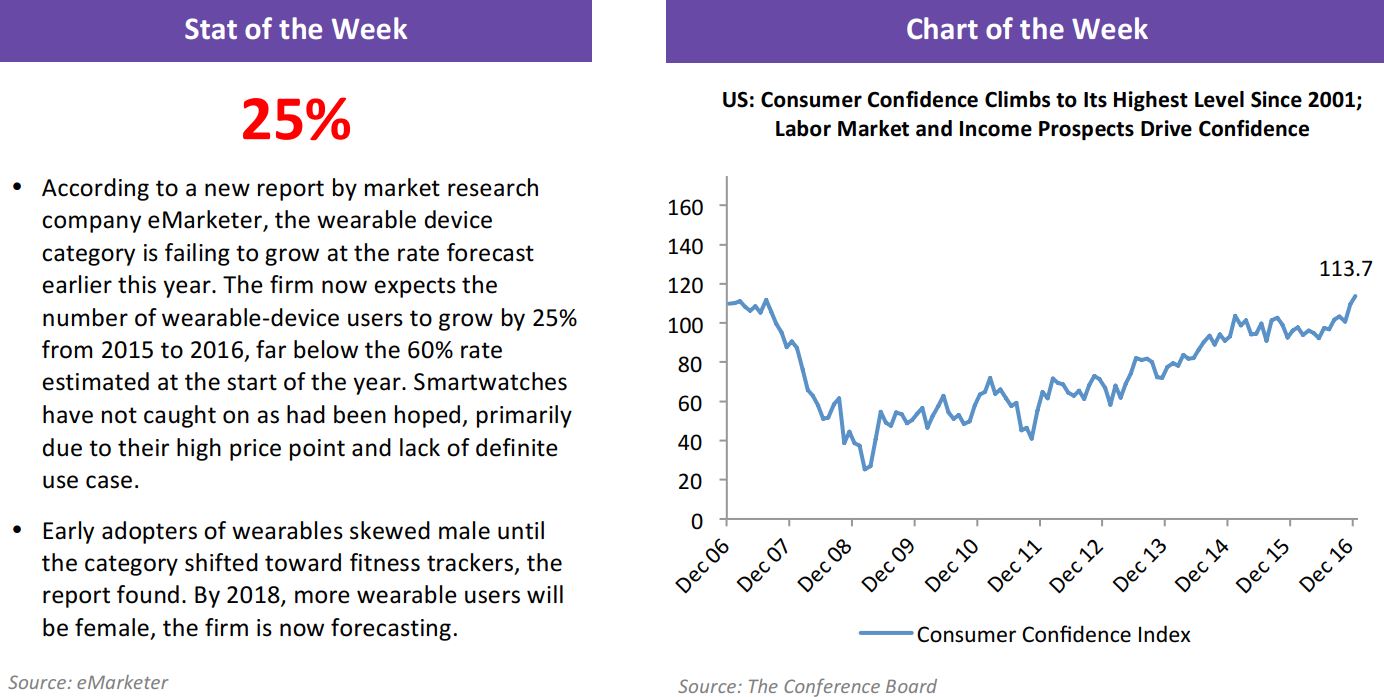

In 2016, the US economy and consumer spending chugged right along. GDP growth accelerated during the year, with the third quarter’s growth rate coming in at 3.5%, up from 1.2% in the second quarter. At the same time, consumers appeared increasingly ready to take out their wallets. US personal income was flat month over month in November, but real consumer spending was up slightly and the personal saving rate was down slightly. US retail sales remained solid in November, up 3.8% year over year, aided by a low, 4.6% unemployment rate and gasoline prices holding steady in the low-$2-per-gallon range throughout the year.

US 2017: What We Expect

On the political front, the Republicans will benefit from a clean sweep, as they now control the White House, the House of Representatives and the Senate. The US business community is currently experiencing a tremendous feeling of euphoria, as Trump and his Republican colleagues are likely to create a probusiness climate and roll back government supervision and regulation. Moreover, Trump’s positive view of the potential of the US economy downplays the need to control the budget deficit. He has pledged to increase investment in infrastructure, which should create immediate economic benefits from spending, plus economic benefits for decades to come.

This improvement in sentiment has influenced financial markets, providing a “Trump bump” in the form of higher stock prices for investors. The S&P 500 Index is up nearly 9% in the two months since the election, and this market appreciation creates a wealth effect for consumers, with paper in the market giving them confidence to increase consumption and investment.

The combination of positive sentiment and a wave of new infrastructure spending is likely to jump-start the US economy, which could bring a return of the specter of inflation farther down the road. While the Federal Reserve left interest rates unchanged during the run-up to the election, only raising them in December, rates are still well below normalized levels, and the Fed is expected to raise rates three or four times next year. Still, a few fractional percentage-point increases are unlikely to put the brakes on consumer spending.

On the heels of a solid year that saw improving economic growth, we are looking ahead to an environment that will likely be characterized by greater business confidence and the end of political gridlock in Washington. It now appears that the US stands at the beginning of a period of improved economic activity, which should translate to greater confidence in consumer spending.

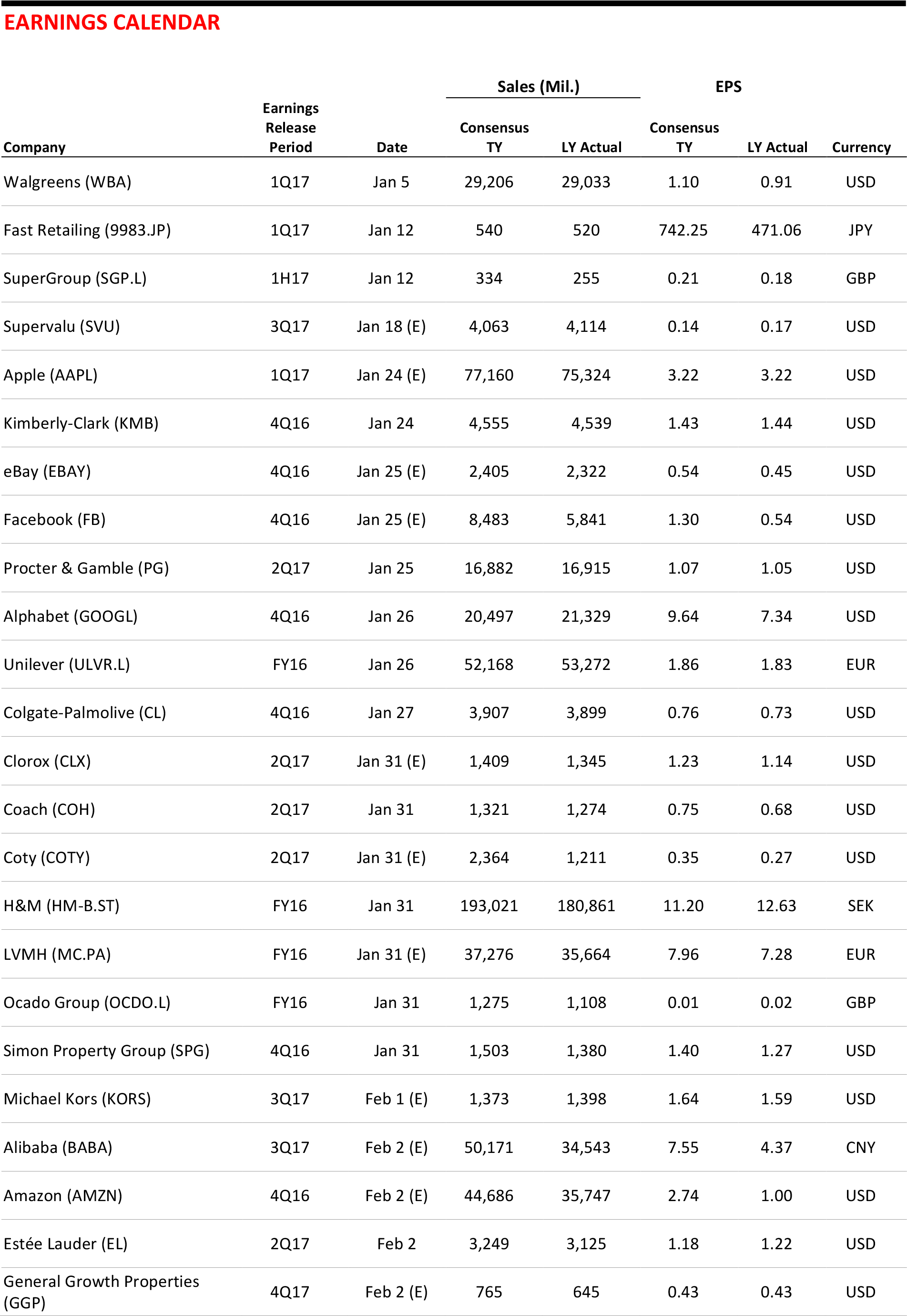

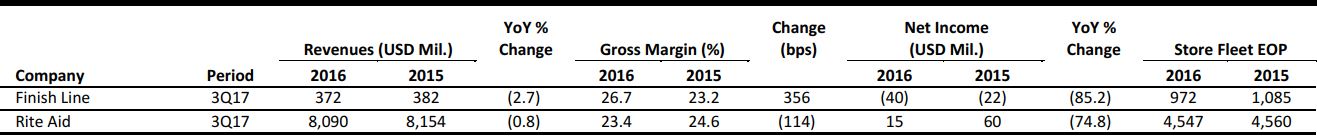

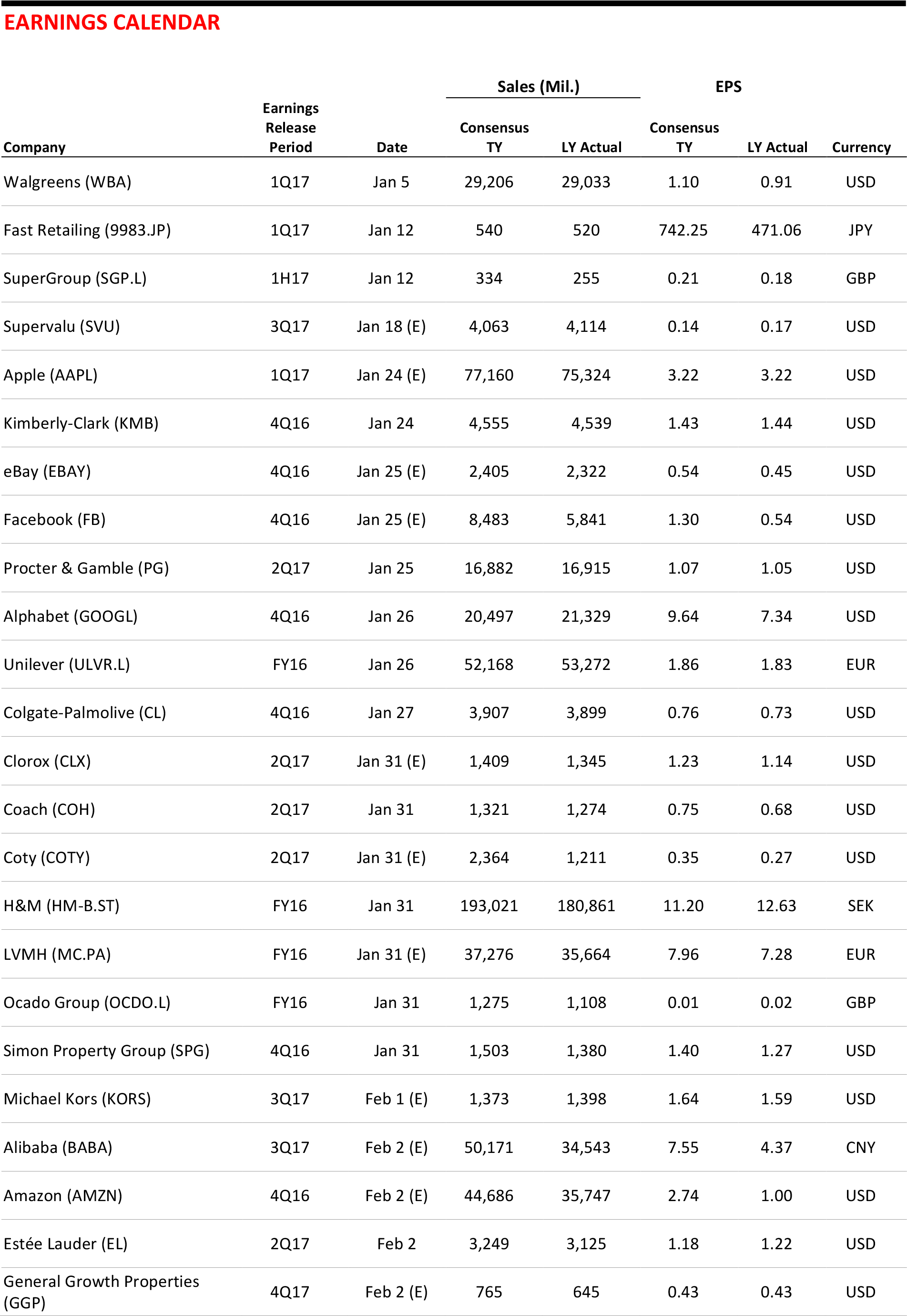

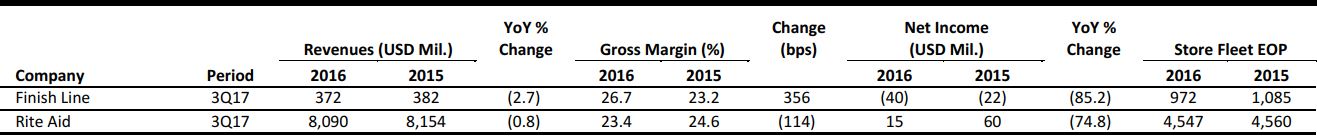

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Last-Minute Spending Surge Lifts US Holiday Shopping Season

(December 28) Reuters.com

Last-Minute Spending Surge Lifts US Holiday Shopping Season

(December 28) Reuters.com

- A jump in consumer spending in the final stretch of December significantly offset a slow start to the US holiday shopping season, and is likely to help many retailers beat sales forecasts, industry research groups said on Tuesday.

- The December spending boost is in contrast to a muted November, when early holiday promotions and expectations among consumers that deals would always be available took a toll. Spending over the Thanksgiving weekend in November fell by 3.5% from a year ago despite a strong jump in online sales, according to the National Retail Federation.

Some US Retailers Hold Out Against E-Commerce

(December 26) Gulfnews.com

Some US Retailers Hold Out Against E-Commerce

(December 26) Gulfnews.com

- Cyber Monday set a new record for online sales, which reached $3.45 billion, according to Adobe Digital Insights. The National Retail Federation said more people shopped online throughout Black Friday weekend than shopped in physical stores.

- But there are some stores bucking the trend. T.J.Maxx and Marshalls, for example, are rarities in the retail universe: stores that do not care about online sales because their businesses are based on the real-life retail experience. Inventory shifts regularly, so no visit is the same—the promise of discovering great items on the cheap is what draws shoppers in.

Retail Growth to Remain Stable, Omnichannel Key in 2017

(December 26) RetailDive.com

Retail Growth to Remain Stable, Omnichannel Key in 2017

(December 26) RetailDive.com

- US retail sales, excluding automobiles and gasoline, are anticipated to grow by 3%–4% in 2017, in line with the 3.8% growth predicted for 2016, according to Fitch Ratings’ 2017 Outlook The agency expects e-commerce to account for more than half of the growth, with in-store growth limited to 1%.

- Omnichannel services will be critical as retailers continue to adapt to shifting consumer habits. “Spending focus on services and experiences appears here to stay, so the dividing line between best-in-class retailers and market share donors is increasingly going to be determined by which retailers can cater to the evolving landscape,” said David Silverman, Senior Director of US Corporates at Fitch Ratings.

Retailers Go into 2017 with Too Many Stores

(December 22) CBS MoneyWatch

Retailers Go into 2017 with Too Many Stores

(December 22) CBS MoneyWatch

- US retailers have too many stores. And even though they have already announced slews of store closings, it is increasingly likely that they will have to shutter even more over the next few years. Consumers keep shifting their spending online, which has left the US overstored, or awash in unwanted retail space.

- According to real estate information firm CoStar, nearly 1 billion square feet of retail space will be rationalized in the coming years through store closures and conversions to other uses. Many retailers also are seeking rent reductions, as their productivity has slumped to an industry average of $330 in sales per square foot from $350 per square foot a decade ago.

Amazon Calls 2016 Holiday Season Its Best Ever

(December 27) Reuters.com

Amazon Calls 2016 Holiday Season Its Best Ever

(December 27) Reuters.com

- Top online retailer Amazon.com said it shipped more than 1 billion items worldwide this holiday season, which it called its best ever. The company’s shares rose by 1.6% in afternoon trading on Tuesday.

- The Amazon Echo home assistant and its smaller version, the Echo Dot, topped the best-sellers list. Sales of voice-controlled Echo devices were nine times higher than they were during last year’s holiday season, the company said. Amazon did not disclose comparable sales figures from a year earlier.

EUROPEAN RETAIL HEADLINES

House of Fraser Opens First China Store

(December 22) FT.com

House of Fraser Opens First China Store

(December 22) FT.com

- Last week, UK department-store chain House of Fraser opened its long-anticipated first Chinese store, in Nanjing. House of Fraser was acquired by China’s Sanpower Group in 2014 and the first Chinese opening had originally been planned for 2015.

- The new store is located in a Sanpower-owned shopping space. The company is expected to carve space for House of Fraser stores in its existing shopping centers, rather than buying or renting new sites.

CBI Survey Finds Strong UK Pre-Christmas Trading

(December 20) Press release

CBI Survey Finds Strong UK Pre-Christmas Trading

(December 20) Press release

- UK retail sales growth accelerated in December, with volumes rising at their fastest pace since September 2015, according to the Confederation of British Industry’s latest monthly Distributive Trades Survey. In the poll of 112 companies, 51% of retailers said that sales volumes were up, while 16% said they were down, giving a balance of 35%.

- Some 26% of retailers said the volume of sales was above average for the time of year, and 5% said they were below average, giving a balance of 21%. The findings follow recent data from the Office for National Statistics, which showed that UK retail sales jumped by 6.1% year over year in November.

Brits Spend £805 Million Online on Christmas Day

(December 20) RetailGazette.co.uk and company press release

Brits Spend £805 Million Online on Christmas Day

(December 20) RetailGazette.co.uk and company press release

- Research firm IMRG forecast that UK shoppers would spend £805 million (US$984 million) on online purchases on Christmas Day, up 10% from last year. The company forecast that Boxing Day online sales would be £984 million (US$1,203 million), up 15% over last year.

- Separately, Amazon announced on December 22 that it expected its busiest Christmas Day ever, and that its sales on the holiday had doubled in five years. Christmas Day is one of Amazon’s busiest days for streaming and downloading content. Last year, sales of physical products peaked at 9:06 p.m. on the holiday.

Coop Unveils Smart Supermarket in Milan

(December 19) RetailDetail.eu

Coop Unveils Smart Supermarket in Milan

(December 19) RetailDetail.eu

- Italian supermarket group Coop has unveiled a high-tech “supermarket of the future” in Milan that uses augmented reality, interactive touchscreens and a video wall with 54 screens to educate shoppers about their purchases and eating behavior.

- The store sells 6,000 products, some of which are presented on smart tables. Screens alongside the tables display information about the source and nutritional value of the products.

Spar Austria Acquires 62 Billa Stores in Croatia

(December 19) ESMmagazine.com

Spar Austria Acquires 62 Billa Stores in Croatia

(December 19) ESMmagazine.com

- Spar Austria has acquired 62 stores operated by the Rewe Group under the Billa banner in Croatia. The company announced that the acquisition was completed on December 15, but it did not reveal the purchase price.

- The Billa stores employ around 1,900 people in Croatia, while Spar employs more than 3,000 people in the 19 hypermarkets and 38 supermarkets it runs in the country. This acquisition will take its store count to over a hundred.

ASIA RETAIL HEADLINES

Tencent and NavInfo Buy into Here Maps and Form Chinese Joint Venture

(December 29) ZDNet.com

Tencent and NavInfo Buy into Here Maps and Form Chinese Joint Venture

(December 29) ZDNet.com

- Chinese tech giant Tencent, Beijing-based mapping company NavInfo and Singapore state-owned investment firm GIC announced they would jointly take a 10% share in mapping company Here. Current Here owners Audi, BMW and Daimler will reduce their collective stake by 10%.

- Here will form a joint venture with NavInfo to provide mapping services to the Chinese market, focusing on services for autonomous cars, and Tencent will look to use Here’s location services in its platforms.

Alibaba Plans to Invest US$7 Billion in Content over the Next Three Years

(December 29) CNBC

Alibaba Plans to Invest US$7 Billion in Content over the Next Three Years

(December 29) CNBC

- Alibaba Digital Media and Entertainment Group, the entertainment affiliate of Alibaba, plans to invest more than ¥50 billion (US$7.2 billion) over the next three years. The company had previously said it would spend ¥10 billion (US$1.4 billion) on new projects.

- Alibaba’s entertainment business underwent a major reorganization in October, marking a total consolidation of the company’s media assets. The former CEO of Alibaba’s UCWeb unit, Yu Yongfu, became the chairman and CEO of the new operation.

Amazon India Expands Revenue with Heavy Investments

(December 26) TechinAsia.com

Amazon India Expands Revenue with Heavy Investments

(December 26) TechinAsia.com

- Amazon India’s revenues surged to US$335 million in the fiscal year ended March 2016, compared with US$151 million in the previous year. However, the company’s loss expanded to US$527 million from US$254 million due to heavy investments and spending on wages and advertising. Amazon has a commitment to spend US$5 billion in India to take on local rival Flipkart, which posted revenues of US$288 million and losses of US$340 million during the same period.

- Amazon has invested in establishing infrastructure, opening new fulfillment centers and technology advancement in India. The company has also invested in launching new products and services for its customers and its sellers.

Silver Lake to Join US$1.2 Billion Round in Alibaba’s Koubei

(December 23) Bloomberg.com

Silver Lake to Join US$1.2 Billion Round in Alibaba’s Koubei

(December 23) Bloomberg.com

- Alibaba Group’s on-demand services unit, Koubei, is close to securing US$1.2 billion in funding. Investors include the largest technology-focused private equity firm, Silver Lake Management; China’s sovereign wealth fund, China Investment; and Yunfeng Capital, a fund backed by Alibaba Cofounder Jack Ma. The funding values the two-year-old startup at about US$8 billion.

- On-demand local services have attracted major spending from Chinese Internet companies, including Alibaba and Tencent, in past years, as more people have turned to smart devices to order takeout, schedule beauty treatments and hire domestic helpers.

LATAM RETAIL HEADLINES

Mexico’s Puebla State Aims to Improve Apparel Sector Working Conditions

(December 28) WWD.com

Mexico’s Puebla State Aims to Improve Apparel Sector Working Conditions

(December 28) WWD.com

- Mexico’s Puebla State, home to factories that produce apparel for brands such as Gap and Zara, is working to improve labor rights after human-rights groups claimed that some firms violate wage laws and employ children.

- Foreign apparel labels operating in Mexico are stepping up efforts to “certify” suppliers to meet stricter labor and safety operational standards. The Mexican apparel industry lobby, Canaive, and Mexico City are helping orchestrate the new standards, according to Jose Manuel Martinez, Canaive’s General Manager at the national level.

Brazil’s Shopping Mall Sales Fall 3% During Christmas Season

(December 27) RioTimesOnline.com

Brazil’s Shopping Mall Sales Fall 3% During Christmas Season

(December 27) RioTimesOnline.com

- Brazilian shopping mall retailers are reporting negative sales results for the Christmas season. Sales in shopping malls fell by 3% during the end-of-year period, according to a survey released on Monday by the Brazilian Shopping Tenants Association. The association also released data that shows that although 19 shopping malls were opened in 2016 across the country, 18,100 stores were closed in these centers during the period. The number of stores operating in malls throughout Brazil in 2016 totaled 121,638, down 12.9% from 139,738 in 2015.

- The survey shows that consumers opted for smaller, less-expensive gifts this year, leading to decreases in sales of furniture and gifts for the home (down 9%), technology and communication (down 6.5%) and home appliances (down 4.5%). The main increases were registered in the perfume and cosmetics segments (up 7.3%), jewelry and watches (up 3.5%) and footwear (up 3%).

Mexican Government to Bump Up Gasoline Prices in January

(December 27) WSJ.com

Mexican Government to Bump Up Gasoline Prices in January

(December 27) WSJ.com

- The maximum retail price of regular gasoline in Mexico will rise by 14%, on average, as of January 1. The move was widely expected and is intended to incorporate higher oil prices and a weaker peso into the cost as Mexico moves to market-set prices for fuel in 2017.

- The increase, announced Tuesday, is by far the largest monthly jump in gasoline prices going back to 2000. During 2016, the price of regular gasoline rose by just 3%, thanks to government price caps. Analysts and gasoline trade groups expect that the shift to market prices will mean further increases during the year, with some estimating that the total increase during 2017 could be more than 20%.

Brazil’s Public Accounts Worsen in November as Slump Drags On

(December 26) Bloomberg.com

Brazil’s Public Accounts Worsen in November as Slump Drags On

(December 26) Bloomberg.com

- Brazil’s public accounts deteriorated in November as the country’s worst recession in a century dragged on, according to a partial snapshot of government finances published by the national treasury on Monday.

- The central government’s primary budget deficit, which excludes interest payments and the finances of states and municipalities, hit R$38.4 billion (US$11.7 billion) in November—its worst-ever result for the month. That compares with a one-off surplus of R$40.8 billion (US$12.4 billion) in October and a median forecast of a R$41 billion (US$12.5 billion) deficit from analysts surveyed by Bloomberg.

Mexican Factory Exports Jump in November; Jobless Rate Steady

(December 23) Reuters.com

Mexican Factory Exports Jump in November; Jobless Rate Steady

(December 23) Reuters.com

- Mexican factory exports bounced back in November from a deep slump in the previous month, while the unemployment rate held steady, data from the national statistics agency showed on Friday.

- Adjusted for seasonal swings, factory exports rose by 4.6% in November from October, when they had their sharpest drop in nearly four years. Mexico exports mostly factory-made goods, and uneven demand from its top trading partner, the US, has weighed on the economy.

Tencent and NavInfo Buy into Here Maps and Form Chinese Joint Venture

(December 29) ZDNet.com

Tencent and NavInfo Buy into Here Maps and Form Chinese Joint Venture

(December 29) ZDNet.com

Brazil’s Shopping Mall Sales Fall 3% During Christmas Season

(December 27) RioTimesOnline.com

Brazil’s Shopping Mall Sales Fall 3% During Christmas Season

(December 27) RioTimesOnline.com

Brazil’s Public Accounts Worsen in November as Slump Drags On

(December 26) Bloomberg.com

Brazil’s Public Accounts Worsen in November as Slump Drags On

(December 26) Bloomberg.com