From the Desk of Deborah Weinswig

2016: A Year to Remember in Europe

2016 proved to be an eventful year on both sides of the Atlantic. In Europe, the UK’s Brexit vote was the biggest shock of the year, and it is one our global research team has covered in depth: we have just published the ninth report in our Brexit Briefings series. Here, we summarize the main impacts and prospects arising from the UK’s decision to leave the European Union (EU).

UK 2016: What We Saw

The Brexit vote prompted a change of UK prime minister and the depreciation of the British pound. What it did not precipitate is recession, mass layoffs, a collapse in house prices, a decline in retail sales, or any number of other negative economic effects that various research bodies and financial institutions forecast for the immediate aftermath of a “Leave” vote.

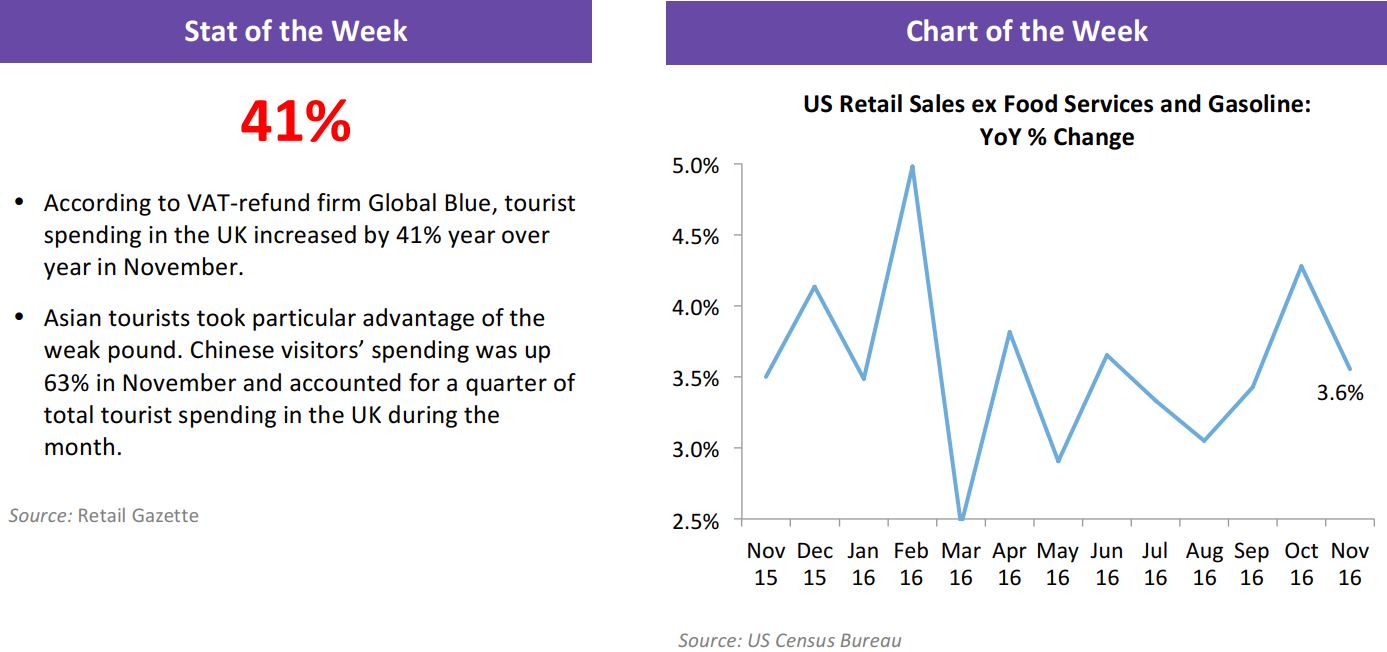

Instead, the UK enjoyed the fastest economic growth of the G7 nations. And retail, in particular, benefited from the Brexit vote. British shoppers kept on spending while the depreciating pound attracted tourist shoppers to the UK, boosted cross-border sales on UK websites and flattered the international sales of UK-domiciled retailers. These factors fed into the acceleration of retail sales that we have seen in recent months: as we reported this week, UK retail sales jumped by 6% in each of October and November, and sales are on course to make this the bumper holiday trading period that we forecast back in October.

UK 2017: What We Expect

Softer growth and higher consumer prices are the headline macroeconomic negatives expected for 2017. The UK government’s Office for Budget Responsibility (OBR) forecasts that the UK economy will grow by 1.4% next year, down from 2.1% in 2016. And the OBR expects consumer prices inflation to be higher as the weaker pound feeds into shop prices; the office expects inflation to peak at 2.7% in the fourth quarter of 2017.

In retail, we expect performance to continue to be solid, although we anticipate growth will settle at lower levels than we are seeing in the current boom period.

In 2017, the UK will face rising input prices as a result of the weakened pound. While one risk from inflation is that it will hit consumers’ discretionary spending, another is that retailers and producers will have to absorb increased costs, at the price of their margins. Grocery and apparel retail are particularly competitive; retailers in these sectors have very limited scope to pass on cost increases and, so, will be forced to take hits to their margins.

A further potential headwind to the consumer market—and one that is unrelated to Brexit—is the recent growth in consumer credit, which has helped buoy retail sales. Unsecured consumer credit grew by more than 7% in October (latest), the fastest rate since November 2006, according to financial industry trade association BBA. Accelerating growth in credit card borrowing, loans and overdrafts prompted Bank of England Governor Mark Carney to recently warn of inflated levels of household debt. Brexit uncertainty makes an interest rate increase look unlikely in 2017, but any substantial squeeze in wage growth or softening of the job market could leave some households unable to service their obligations and prompt other consumers to retrench their spending in order to pay down debt.

So far, however, British consumer demand has proved resilient amid substantial uncertainty. We see no convincing reason for this resilience to fall away in 2017.

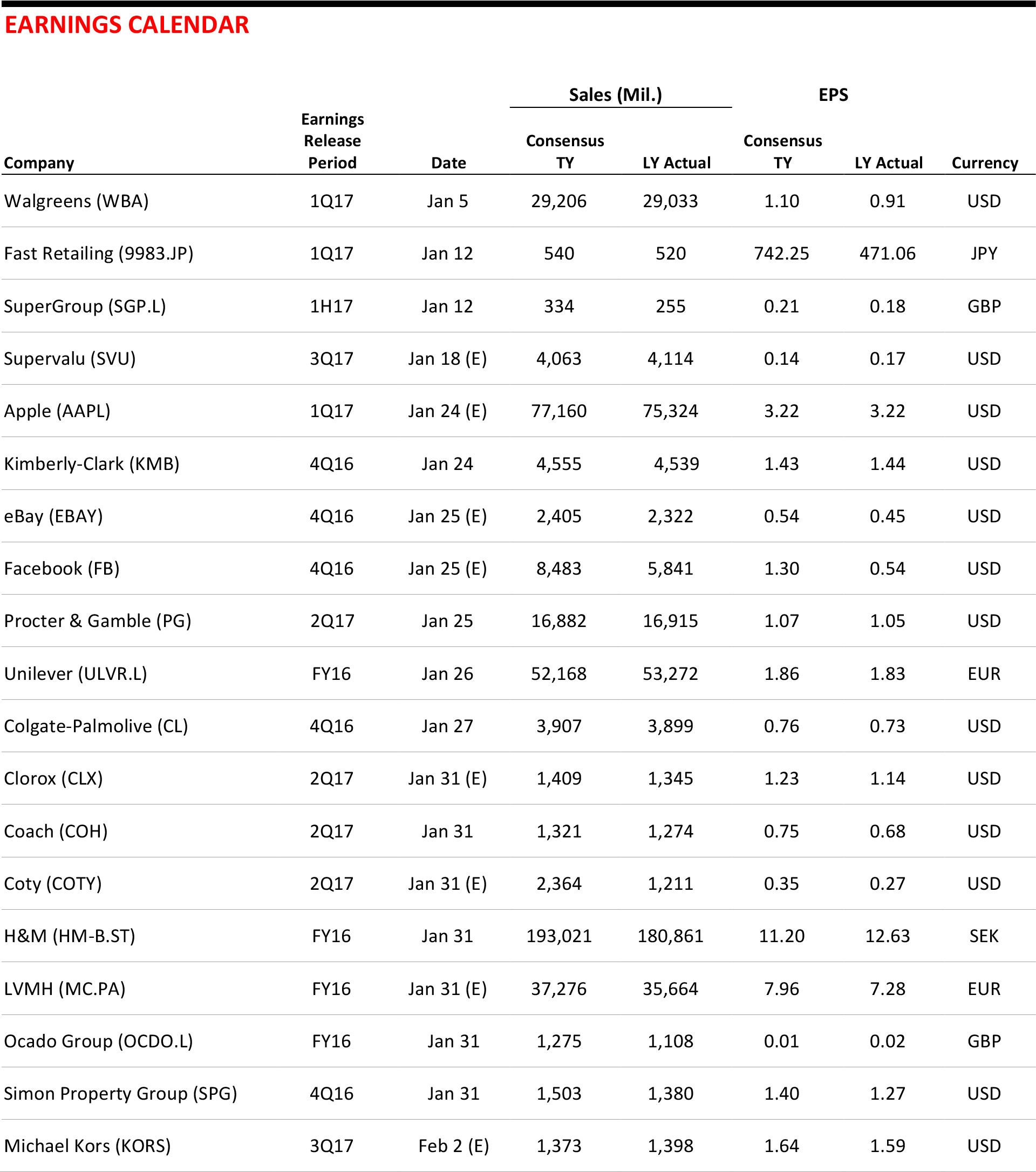

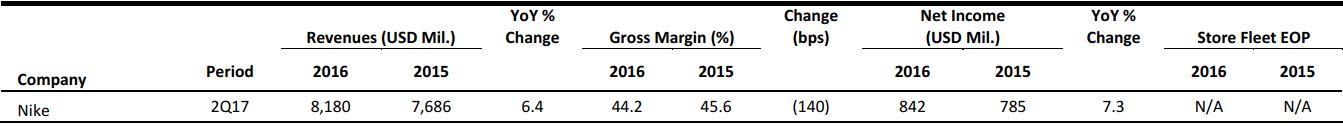

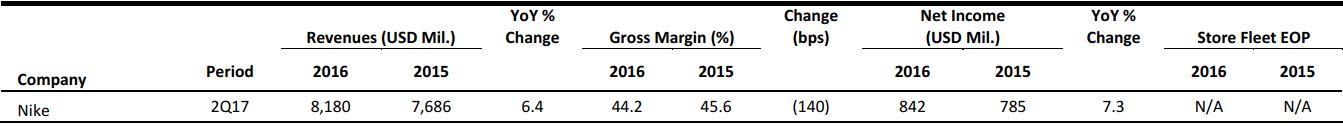

US RETAIL EARNINGS

�

Source: Company reports

US RETAIL HEADLINES

Lands’ End Picks Retail Veteran and Luggage Executive Jerome Griffith as New CEO

(December 19) WSJ.com

Lands’ End Picks Retail Veteran and Luggage Executive Jerome Griffith as New CEO

(December 19) WSJ.com

- Catalog retailer Lands’ End named Jerome Griffith as its new CEO. Griffith most recently ran luggage retailer Tumi. The 59-year-old is known for his love of the outdoors, in line with the Lands’ End ethos.

- His appointment marks a big change from the company’s former CEO, high-fashion purveyor Federica Marchionni, who was forced out in September. Marchionni took the company in the wrong direction, debuting spike heels and slimmer fits for younger customers, and turning off its customer base.

Fred’s Pharmacy to Acquire 865 Rite Aid Stores for $950 Million

(December 20) RetailDive.com

Fred’s Pharmacy to Acquire 865 Rite Aid Stores for $950 Million

(December 20) RetailDive.com

- Fred’s Pharmacy has signed an agreement with Walgreens Boots Alliance and Rite Aid to purchase 865 stores across the Eastern and Western US, along with assets related to store operations, for a total of $950 million in cash.

- The transaction is expected to close after the completion of Walgreens’ proposed $9.4 billion acquisition of Rite Aid, subject to the approval of the Federal Trade Commission.

J.Crew’s Debt Looms as Retailer Seeks to Regain First-Lady Glow

(December 21) Bloomberg.com

J.Crew’s Debt Looms as Retailer Seeks to Regain First-Lady Glow

(December 21) Bloomberg.com

- Crew is going to try to use 2017 to turn around a two-year sales slump in order to avoid facing a mounting wall of debt. The company’s $2 billion in debt becomes current in 2018, and J.Crew needs to revive its sales to avoid default.

- In order to revive sales, the company is focusing on its preppy heritage, expanding its discount business and fueling the growth of Madewell, its millennial-focused brand.

The Limited May File for Bankruptcy and Shut Down Its 240 Stores

(December 21) Fortune.com

The Limited May File for Bankruptcy and Shut Down Its 240 Stores

(December 21) Fortune.com

- Declining traffic at malls and a surfeit of merchandise on the market have hit The Limited hard. The company is planning to file for Chapter 11 bankruptcy protection in the coming weeks, with liquidation likely.

- The Limited said it is exploring a number of options that would provide it with greater financial flexibility. The mall-based retailer’s comparable store sales fell by 11% last quarter.

American Apparel Gets Approval to Liquidate Nine Locations

(December 19) WSJ.com

American Apparel Gets Approval to Liquidate Nine Locations

(December 19) WSJ.com

- American Apparel is planning to close nine of its stores by December 31, including locations in New York and Washington, DC. The approval came from the US Bankruptcy Court, allowing the company to put up “going out of business” signage at the nine stores over the next two weeks.

- Liquidation sales are expected to generate about $600,000 in income for American Apparel, and the closures of stores in expensive neighborhoods such as New York City’s Tribeca and Washington’s Georgetown will save $200,000 a month in rent.

EUROPEAN RETAIL HEADLINES

Asda Kicks Off Christmas Discounting, Cuts Vegetable Prices by Up to 57%

(December 19) RetailGazette.co.uk

Asda Kicks Off Christmas Discounting, Cuts Vegetable Prices by Up to 57%

(December 19) RetailGazette.co.uk

- Struggling British grocer Asda is taking on the discounters with a series of deep price cuts to seasonal produce lines ahead of the Christmas peak. Between December 19 and 27, Asda will sell vegetables at discounts of up to 57%.

- Customers need to pay only 20p (US$0.25) for 360 grams of broccoli, half a kilogram of sprouts and parsnips, and a kilogram of carrots. Asda stated that customers would collectively save about £2.2 million (US$2.7 million) on the seasonal vegetables.

Carrefour Introduces One-Hour Delivery Service

(December 19) RetailAnalysis.igd.com

Carrefour Introduces One-Hour Delivery Service

(December 19) RetailAnalysis.igd.com

- French supermarket giant Carrefour has launched a superfast delivery service in Paris and Neuilly-sur-Seine, in France. Customers can choose from a range of 2,000 staple items for delivery within an hour.

- Customers are charged €4.90 (US$5.09) for the service, which does not include a minimum purchase or a subscription fee.

Topshop Expands to Mainland China

(December 16) FT.com

Topshop Expands to Mainland China

(December 16) FT.com

- Arcadia-owned fashion chain Topshop has unveiled plans to open stores in Mainland China nearly two years after its online launch in the country. The retailer will initially open five stores in partnership with online retailer ShangPin.com.

- com already sells merchandise from the Topshop and Miss Selfridge brands online in China. Topshop intends to open 75 more stores in the country if the initial ones are a success.

UK Retail Sales Surge 6.1% in November

(December 15) Press release

UK Retail Sales Surge 6.1% in November

(December 15) Press release

- Total UK retail sales jumped by an exceptional 6.1% year over year in November, the Office for National Statistics reported. The increase was up from an already strong 6.0% jump in October. Internet pure plays, whose sales increased by 28% year over year, boosted the overall figures. Clothing stores saw a second consecutive month of positive growth.

- Black Friday prompted a recovery in growth at electrical goods retailers and a jump in online sales at clothing and footwear specialists.

Boohoo.com Acquires PrettyLittleThing

(December 14) Press release

Boohoo.com Acquires PrettyLittleThing

(December 14) Press release

- UK fashion pure play Boohoo.com has acquired 66% of smaller fashion pure play PrettyLittleThing for a cash consideration of £3.3 billion (US$4.1 billion). The transaction is expected to be consolidated on January 3, 2017.

- Previously, Boohoo.com held an option to acquire 100% of PrettyLittleThing. The current cash consideration is calculated pro rata on this option, which will allow Boohoo.com to acquire the remainder of the stake by February 28, 2022.

ASIA TECH HEADLINES

Microsoft Plans to Use Machine Learning to Improve Eyecare in India

(December 20) TechCrunch.com

Microsoft Plans to Use Machine Learning to Improve Eyecare in India

(December 20) TechCrunch.com

- Microsoft announced the launch of a new research group in India, the Microsoft Intelligent Network for Eyecare, to bring data-driven eyecare services to the country. Microsoft is partnering with the L V Prasad Eye Institute to use machine learning to identify conditions that lead to blindness and to improve eyecare for children.

- The move follows a similar partnership between Google’s DeepMind and the UK’s National Health Service to analyze eye scans to spot conditions that can lead to blindness.

Alibaba’s Lazada Braces for a Southeast Asian Brawl with Amazon

(December 15) Bloomberg.com

Alibaba’s Lazada Braces for a Southeast Asian Brawl with Amazon

(December 15) Bloomberg.com

- As Amazon plans to enter Southeast Asia next year with its launch in Singapore, Lazada, Southeast Asia’s largest e-commerce site, is expanding its delivery network via partners in China and South Korea. Lazada, already present in Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam, has 12 warehouses and 92 distribution centers and is looking to shore up its supply chain through acquisitions.

- Southeast Asia’s population numbers 620 million. As consumers in the region have gotten more accustomed to shopping online, it has become one of the fastest-growing e-commerce markets in the world.

Zhongan Said to Consider China Listing Instead of Hong Kong IPO

(December 20) Bloomberg.com

Zhongan Said to Consider China Listing Instead of Hong Kong IPO

(December 20) Bloomberg.com

- Zhongan Online P&C Insurance is considering a listing in Mainland China instead of in Hong Kong or the US amid lukewarm overseas interest. It also seeks to avoid competing with a potential offering from Ant Financial, an affiliate of Alibaba Group. Ant Financial is Zhongan’s largest shareholder, holding a 16% stake. Tencent and Ping An Insurance Group each hold a 12% stake in the company.

- Zhongan has more than 400 million customers and provides online insurance in the automotive, healthcare and online-shopping sectors, a market expected to reach ¥2 trillion (US$300 billion) by 2025.

VIPKid Raises $125 Million to Match Chinese Kids with American Teachers

(December 20) Bloomberg.com

VIPKid Raises $125 Million to Match Chinese Kids with American Teachers

(December 20) Bloomberg.com

- VIPKid is an online platform that matches Chinese students aged 5–12 with predominantly North American instructors to provide online classes in English, math, science and other subjects. In China, there are hundreds of millions of kids whose parents are willing to pay for high-quality education. In the US and Canada, where teachers are often underpaid, teachers can make use of the platform to put their skills as educators to profitable use.

- Cindy Mi, the founder of VIPKid, aims to give Chinese kids the kind of education American children receive in top schools in the US. The platform started with 200 teachers and has grown to 5,000 working with 50,000 children. Mi plans to expand to 25,000 teachers and 200,000 children next year.

LATAM RETAIL HEADLINES

Expanded Panama Canal Welcomes 500th Neopanamax Transit

(December 19) WWD.com

Expanded Panama Canal Welcomes 500th Neopanamax Transit

(December 19) WWD.com

- Just six months after the inauguration of the expanded Panama Canal, the canal welcomed its 500th transit of a Neopanamax ship, the container vessel YM Unity, which was traveling from Asia to the US.

- This is a significant milestone for the expanded canal, which has been experiencing steady traffic since it opened. The new locks are 70 feet wider and 18 feet deeper than the originals, though they use less water due to water-saving basins that recycle 60% of the water per transit.

Mexico October Retail Sales Post Biggest Rise in Seven Months

(December 20) Reuters.com

Mexico October Retail Sales Post Biggest Rise in Seven Months

(December 20) Reuters.com

- Mexico’s national statistics agency said retail sales in the country rose by 1.6% in October month over month, when adjusted for seasonal swings.

- The monthly increase was the biggest since March, and the fifth increase in the last six months. In unadjusted terms, sales advanced by 9.3% in October year over year.

UberEats Arrives in Colombia, Delivery Service App Competition Heats Up

(December 21) America-Retail.com

UberEats Arrives in Colombia, Delivery Service App Competition Heats Up

(December 21) America-Retail.com

- UberEats has arrived in Colombia, allowing Colombians to order food for delivery directly from the app. The existing delivery infrastructure requires that most people still call a restaurant to order food.

- Registered restaurants say their sales have increased by nearly 20% since the launch of the delivery app.

The Danish Fashion Brand Empowering Women in Peruvian Prisons

(December 16) Independent.co.uk

The Danish Fashion Brand Empowering Women in Peruvian Prisons

(December 16) Independent.co.uk

- Fashion brand Carcel, started in Copenhagen, aims to help women in Peruvian prisons find dignity in their work by enlisting them to help make clothes for the brand. The women can voluntarily sign up to work and earn a fair wage making sustainable clothing.

- The clothes are made from alpaca wool, and cost US$125–US$250 per item. The business helps the women accrue money while in prison, so they have the ability to rebuild their lives when they exit.

Boohoo.com Acquires PrettyLittleThing

(December 14) Press release

Boohoo.com Acquires PrettyLittleThing

(December 14) Press release

UberEats Arrives in Colombia, Delivery Service App Competition Heats Up

(December 21) America-Retail.com

UberEats Arrives in Colombia, Delivery Service App Competition Heats Up

(December 21) America-Retail.com