FROM THE DESK OF DEBORAH WEINSWIG

So here we are in the final stretch of the holiday season. Our sights are now concentrated on Super Saturday (aka, the Saturday before Christmas), retailers’ last chance to corral all those last-minute shoppers who didn’t take advantage of the earlier promotional bonanza this season. Holiday sales patterns are all askew this year, disrupted by the November-long holiday deal activity. As we covered in our recent Flash Report, it looks like Super Saturday is going to grab the crown away from Black Friday as the strongest day of the year in terms of sales and traffic. And with Christmas falling on a Thursday this year, market watchers are betting that the Friday after Christmas (Boxing Day) will see the second-heaviest traffic.

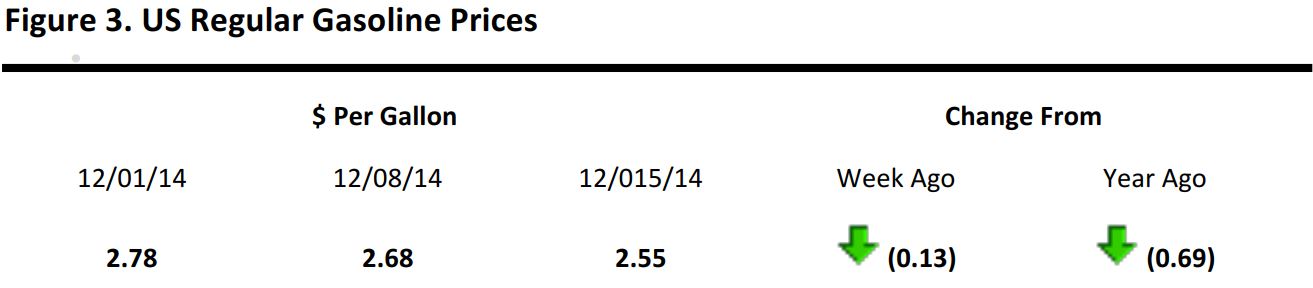

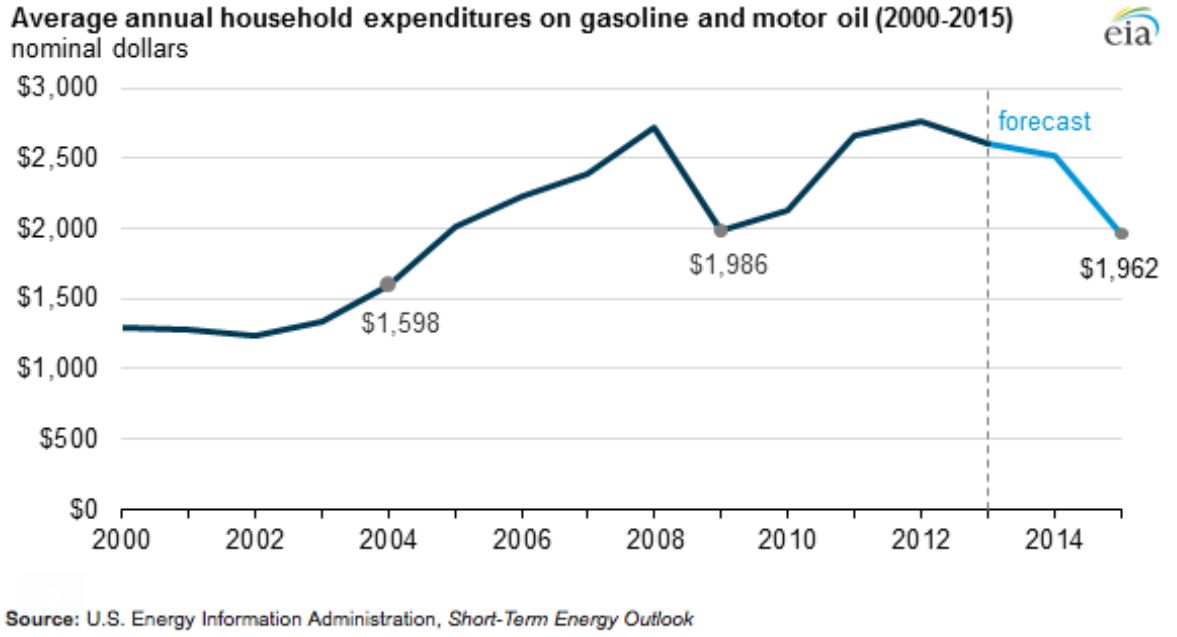

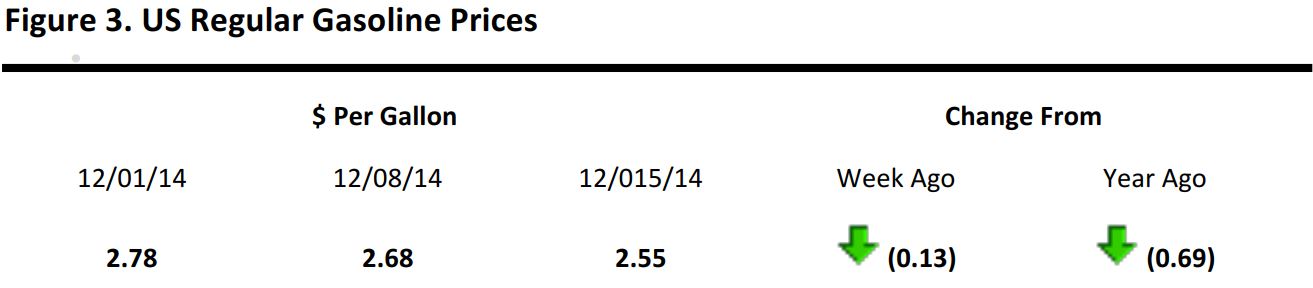

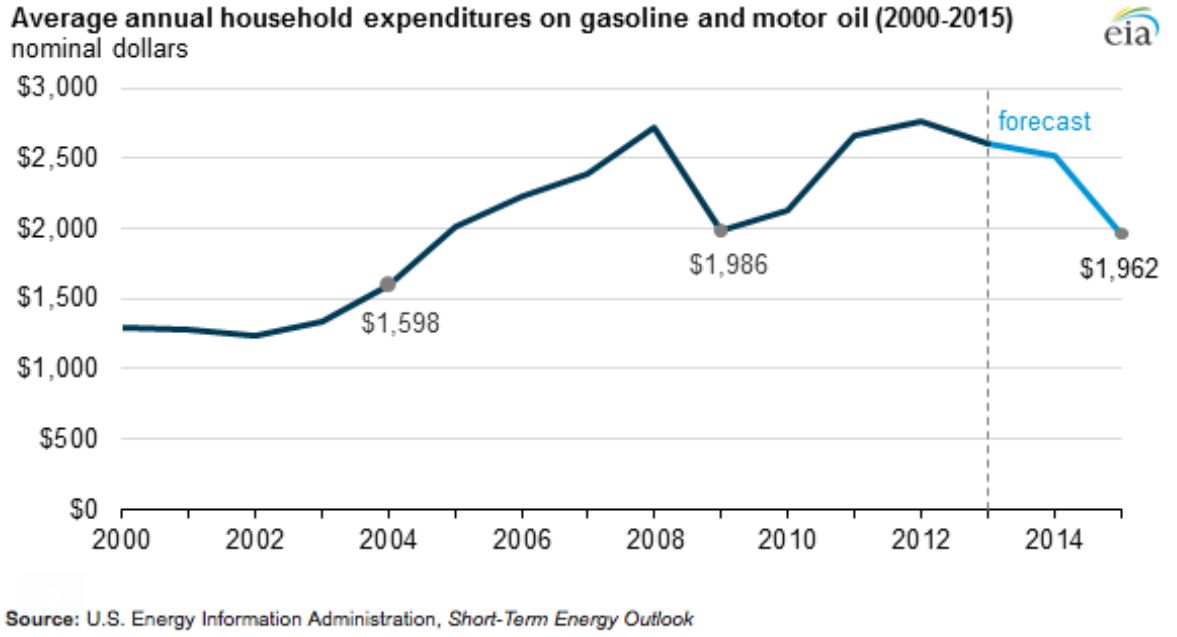

Meanwhile, Santa continues to get a helping hand from tumbling oil prices. This energy bonus is already showing up in healthier sales for retailers of all stripes, and should be “the gift that keeps on giving” in the New Year too. The Energy Information Administration, a prominent authority on such matters, estimates that the average US household will save about $550 on gasoline in 2015 versus 2014. Lower prices at the pump and more fuel-efficient cars have reduced the number of gallons Americans used to fill their tanks each year.

Also catching our eye this week was the 1.1% drop in apparel prices in November, undoubtedly reflecting the intense promotional focus on cold-weather clothing this holiday. That was significantly sharper than the MoM decline last November, when prices fell 0.4%. Including the decline in October, apparel prices are down 0.3% for latest 12 months, though that pales in comparison to the 4.8% drop for energy-related prices (and the 10.5% plunge in gasoline prices). These are great times for bargain-hungry US consumers!

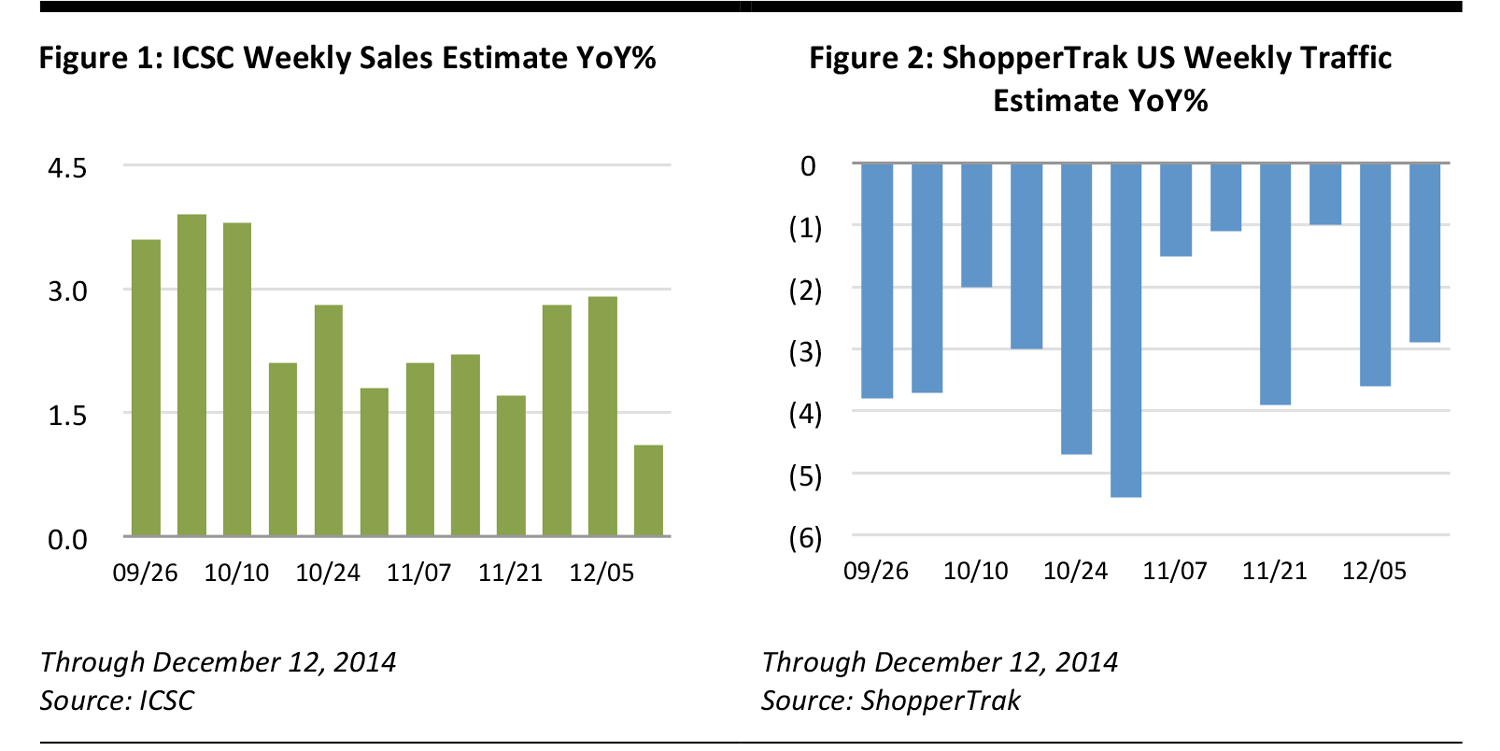

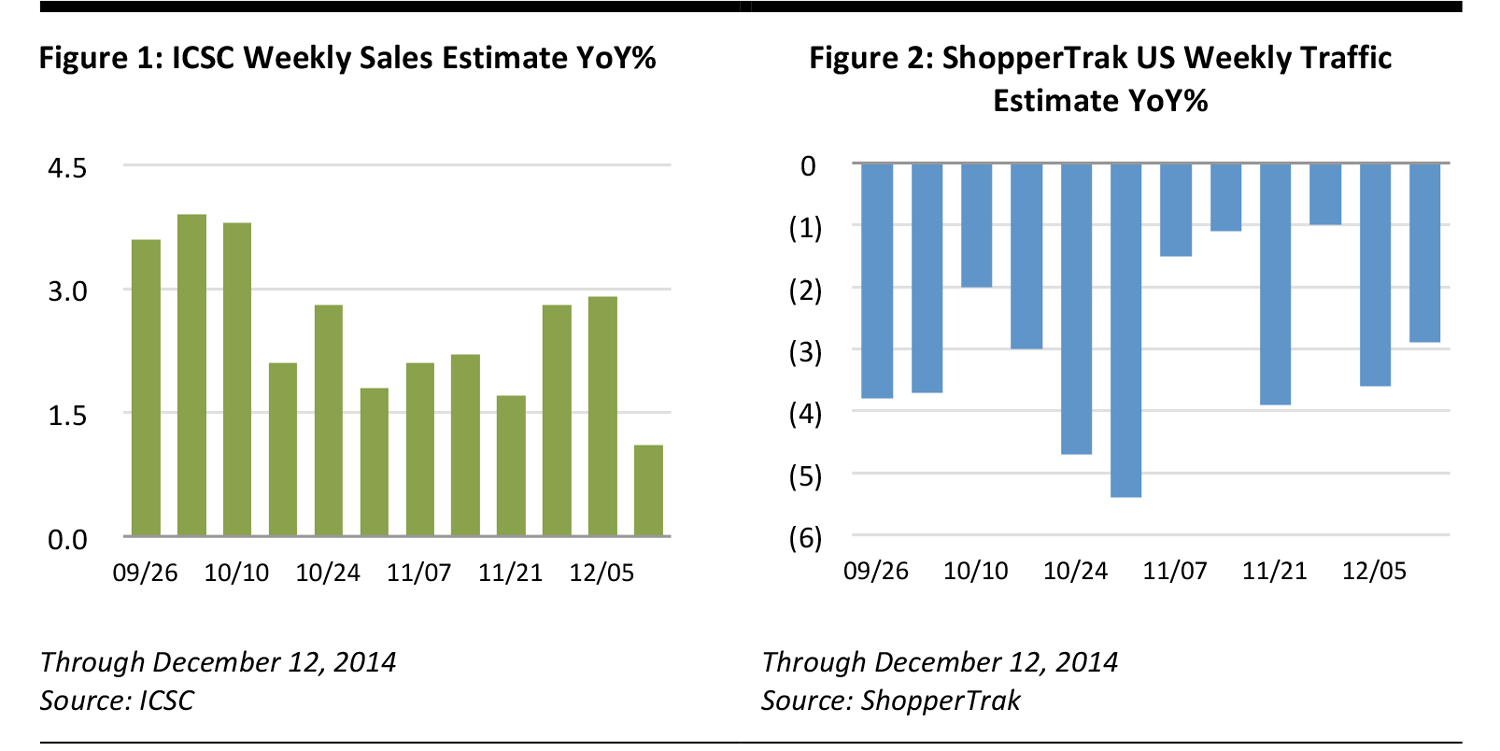

US WEEKLY TRAFFIC AND SALES

Retail Sales and Traffic Fluctuate as Shoppers Delay Shopping Until the Last Minute

Note: The ICSC-Goldman Sachs index is a statistically derived estimate of industry sales that is weighted by sales volume.

- According to ICSC, sales growth slowed to 1.1% over the past week, the slowest pace since March. ICSC continues to forecast sales growth of 4%-4.5% for the month, as spending gets a boost from lower gasoline prices.

- According to ShopperTrak, US store traffic dipped (-2.9%) as only 57% of shoppers had completed their shopping by this week versus 64% last year. Traffic is likely to rise in the coming week as Christmas day draws closer

- Electronics and wireless store traffic rose by low-single digits, a slowdown from last week’s pace.

RETAIL HEADLINES OF THE WEEK

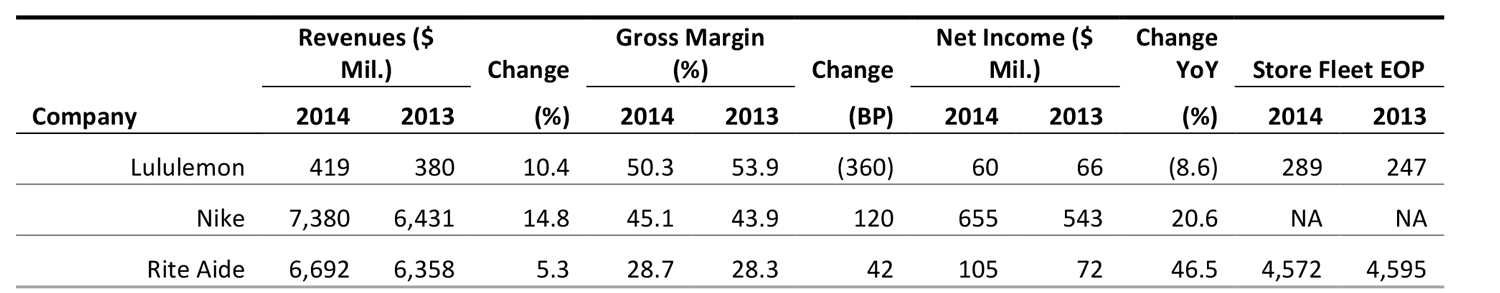

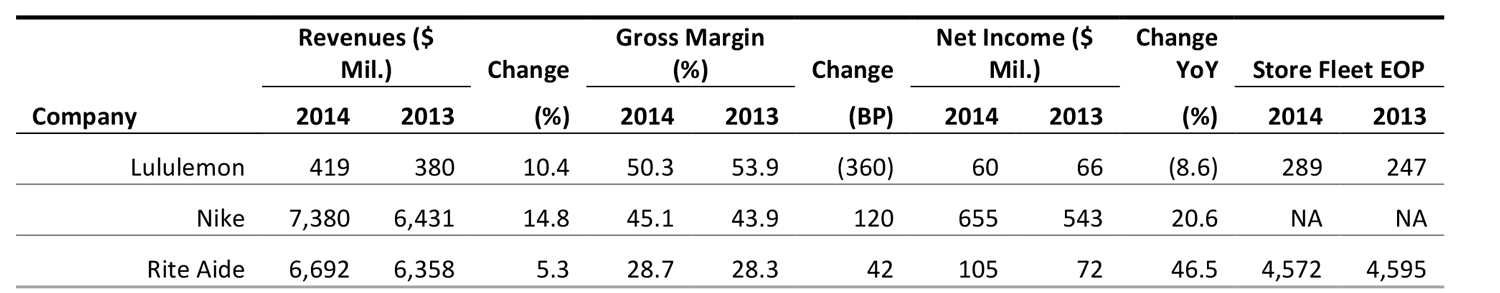

Selected Retail Company Earnings Results

Source: Company reports

Lululemon’s Women’s Business Improves

Lululemon’s Women’s Business Improves (December 11)

Company report

- Total comp sales rose 3% in 3Q, as a +27% increase in direct-to-consumer revenues was offset by a comp-store sales decline of (-3%). Total comp sales were flat in Q2.

- The QoQ improvement was driven by the rebalanced women’s product assortment, a successful cold-weather layering program and strong growth across men’s categories.

- The new distribution center in Columbus, Ohio, will reduce average transit times for US online orders by 46%.

- The company just opened a store in Singapore, plans to open its first store in the Middle East by Q2 2015, and plans a total of 40 new stores in Europe and Asia by 2017.

- West Coast port problems could lower 4Q revenues by an estimated $10 million.

Maintains Strong Position in US Healthcare System

Analyst meeting (December 16)

Maintains Strong Position in US Healthcare System

Analyst meeting (December 16)

- Management expects 2015 EPS growth of 12.5%-15.75% on a revenue gain of 7%-8.25%.

- Growth should be driven by the generic purchasing joint venture with Red Oak, an improved generic pipeline, the successful integration of the pharmacy benefit manager (PBM) model through Caremark and efficient front-end planning.

- CVS’ health branding received a boost from the elimination of tobacco from all stores, as well as from increased emphasis on health and beauty lines. CVS will continue to launch new and exclusive brands within beauty.

Names Gerald “Jerry” Storch as CEO

Names Gerald “Jerry” Storch as CEO (December 17)

Company report

- Effective January 6, 2015, Storch will be responsible for Hudson’s Bay, Lord & Taylor, Saks Fifth Avenue, Saks OFF 5TH, Home Outfitters and HBC Digital.

- Richard Baker will continue as Governor and Executive Chairman. Baker and Storch together will compose the Office of the Chairman.

- Storch’s 30-year retailing career includes posts as Chairman and CEO of Toys”R”Us and Vice Chairman of Target.

Raises Guidance after Strong 3Q

Raises Guidance after Strong 3Q (December 18)

Company report

- Same-store sales rose +5.4%, reflecting a +1.6% gain in front-end sales and a +7.2% pickup in pharmacy sales. Pharmacy sales results included a negative 228 basis-point impact from new generics introductions.

- Management now looks for 2015 comp sales to increase in the +4.25%-3.75% range, versus its previously stated 3.0%-4.0% range, and for EPS in the range of $0.31-$0.37, up from the previous outlook of $0.22-$0.33 and versus $0.23 in 2014.

Nike Continues its Strong Sprint in 3Q

Nike Continues its Strong Sprint in 3Q (December 18)

Company report

- Total revenue rose 15% to $7.4 billion, or up 18% on a currency neutral basis.

- Global future orders for Nike brand footwear and apparel increased 7% YoY through April 2015, or 11% on a currency neutral basis.

- Footwear outpaced consolidated revenue growth at an 18% pace (21% currency neutral), led by 29% (30%) growth in Greater China.

Source: US Energy Information Administration

US MACROECONOMIC UPDATE

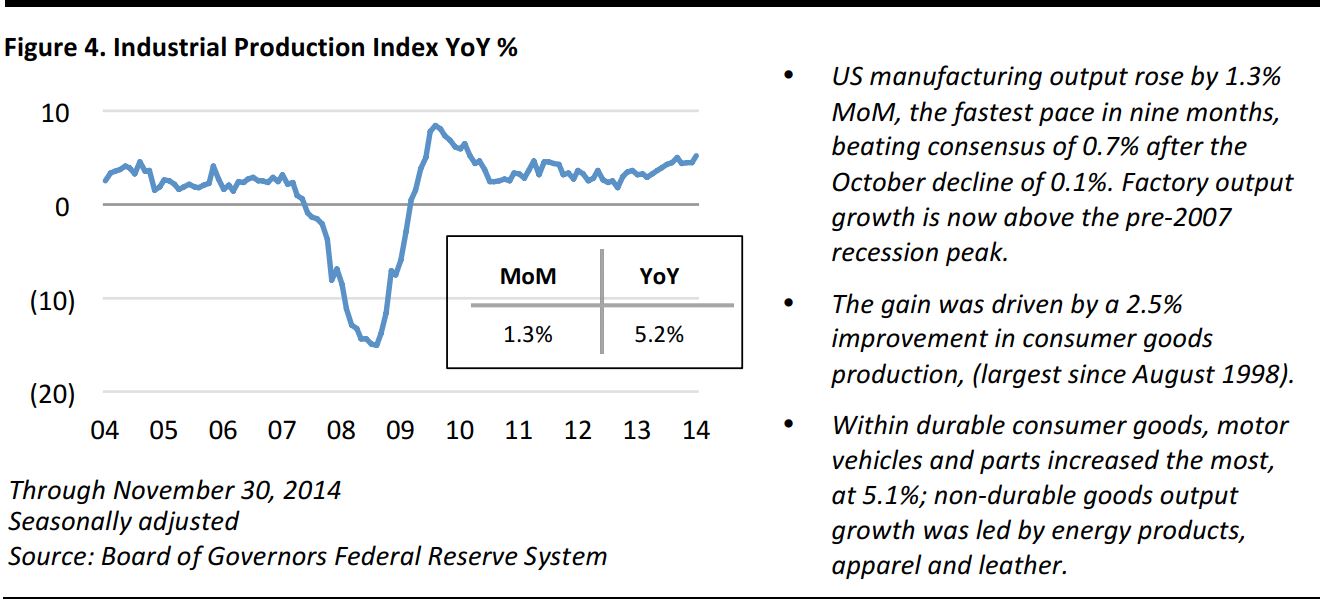

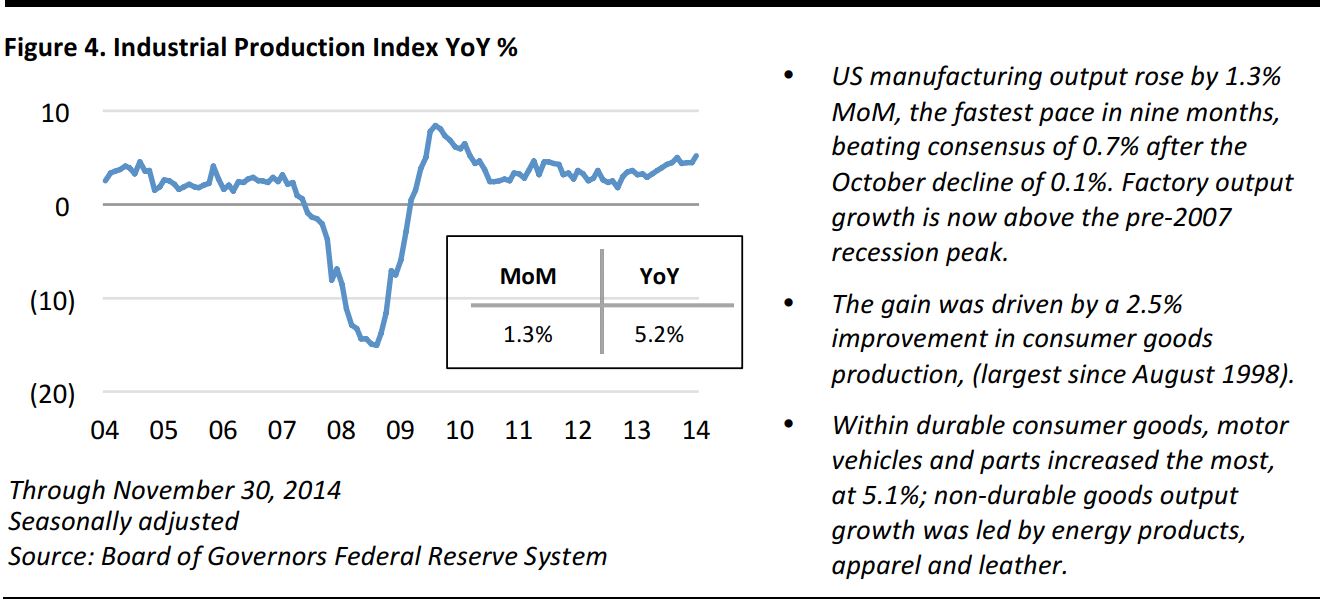

US Industrial Output Soared in November, Driven by Consumer Goods Production

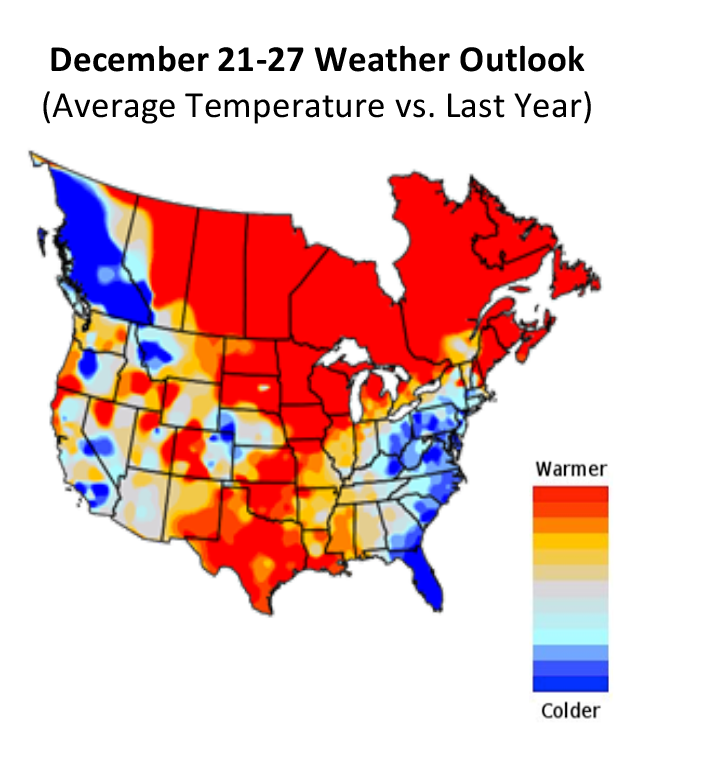

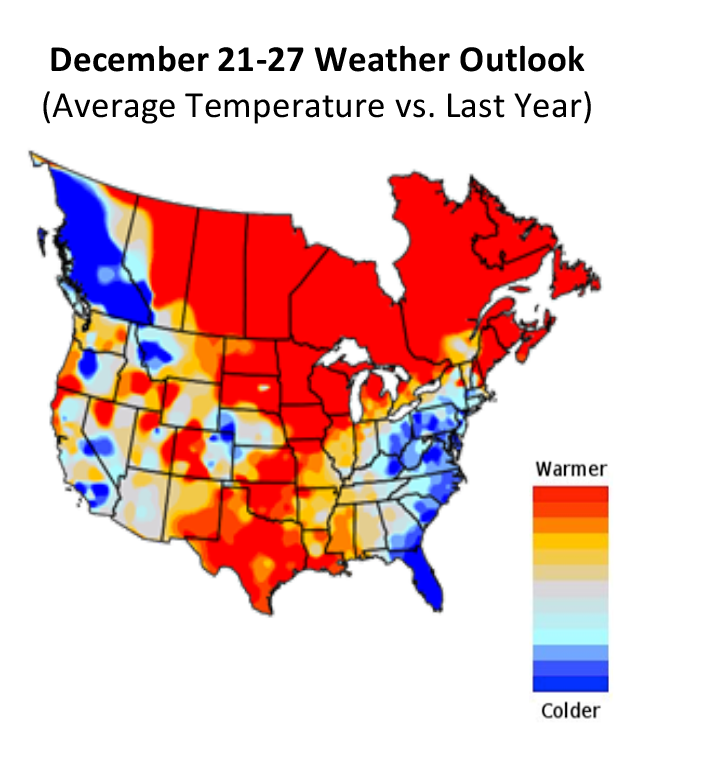

US WEATHER ANALYTICS: Week of Dec. 21 – 27

A White Christmas for Much of the Country Drives Winter-Category Sales

- A White Pre-Christmas. Before Christmas Day, a storm will move off the East Coast and another storm will come ashore in the West and move into the Southern Plains and Texas. Wintery conditions are possible for the Plains and Midwest just in time for Christmas.

- Colder Temperatures Post-Holiday. A much colder surge will hit the interior and eastern regions of North America later in the week.

- Pacific Northwest to Remain Stormy. An active storm track will continue, with heavy rain and mountain snow driving demand for rainwear and windshield wipers.

- Weather-driven demand: Winter Boots +5% YoY

CHINA HEADLINES OF THE WEEK

China retail sales grow by double-digits in November (December 12).

China retail sales grow by double-digits in November (December 12). China's retail sales grew 11.7%, YoY to 2.4 trillion Yuan (US$ 379.6 billion) in November, slightly up from 11.5% growth in October. The country's retail sales rose 12% YoY to 23.7 trillion Yuan (US$ 3.8 trillion) in the first 11 months. (NBS)

China’s online sales Surge in 3Q (December 1).

China’s online sales Surge in 3Q (December 1). The transaction value of China’s online shopping market increased 49.8% YoY, reaching 691.4 billion Yuan (US$ 111.7 billion) in 3Q, accounting for 10.6% of the country’s total retail sales for the period. Total transaction value of mobile shopping jumped 250.9% YoY to 231.0 billion Yuan (US$ 37.3 billion) in 3Q, accounting for 33.4% of the total online shopping market. (iResearch)

Baidu Banks on Uber (December 17). Chinese Internet search giant Baidu has invested up to US$ 600 million in Uber, an American taxi service and rideshare company. The investment is aimed at giving Uber much-needed local market knowledge and technical resources in China; meanwhile, Uber would help Baidu gain more traffic and boost its location-based services.

(Inside Retail Asia)

to target middle classes (December 4).

to target middle classes (December 4). Lane Crawford Joyce Group, Asia's premier fashion retail and brand management Group, announced the establishment of a new business to service partnerships with large-scale international brands targeting China's middle class. It targets high-profile international fashion and lifestyle brands with the potential to operate more than 100 points of sale across Tier-1 to Tier-4 cities in China. Walton Brown, the retail management business arm under the Group, will provide total geographic and channel coverage of the China market by offering distribution through retail, wholesale, e-commerce, travel retail and outlets to the brands.

(Company press release)

Wangfujing Department Store teams up with Tencent (December 11).

Wangfujing Department Store teams up with Tencent (December 11). Wangfujing Department Store, a prominent Chinese department store chain, has teamed up with Tencent, one of the largest Internet service portals in China, to launch a new electronic-membership card, named “Wangfu UKA,” which incorporates a number of bank-card functions. With technology support from Tencent, shoppers who hold a “Wangfu UKA” account can store value, transfer funds, make purchases and settle payments with their mobile devices. The card also enables the Wangfujing Department Store to access the shopping records and patterns of its members. The retailer plans to add a credit function on the “Wangfu UKA” and officially launch the card in early 2015.

(chinasspp.com)

Lululemon’s Women’s Business Improves (December 11)

Company report

Lululemon’s Women’s Business Improves (December 11)

Company report

Names Gerald “Jerry” Storch as CEO (December 17)

Company report

Names Gerald “Jerry” Storch as CEO (December 17)

Company report