FROM THE DESK OF DEBORAH WEINSWIG

Unseasonably Warm Autumn Likely to Prompt Weekend of Discounts

The signs increasingly point to this holiday season being a disappointing one for apparel retailers. On both sides of the Atlantic, shoppers have enjoyed unusually warm autumn weather. As we write this, the temperature in London is 15° Celsius (59° Fahrenheit)—a near-unprecedentedly warm day just a week before Christmas. The warm weather this year has significantly reduced demand for winterwear, such as knitwear, jackets, coats and boots.

Just this week, fashion giant H&M reported its sales figures for November, the fourth quarter and the fiscal year: revenues in local currencies were up by just 4% worldwide in November, compared to 9% for the entire fourth quarter and 11% for the full year ending November. The company noted the “unseasonably mild weather in North America and in many of the H&M group’s large sales markets in Europe.”

In the UK, the weather has been unusually mild since September, so, by the time Black Friday arrived, many stores were keen to shift winter stock: we noted in our

UK Black Friday 2015 Flash Report that apparel retailers in London had offered deeper discounts on categories such as coats and knitwear. But, given the muted demand we observed in the UK on Black Friday, especially at clothing stores, we doubt the event shifted enough excess inventory to satisfy British retailers.

In the US this December, we are seeing a stronger focus on winter apparel in promotions from stores such as Kohl’s and Target (see our

Weekly Global Retail Promo Update). Weather data firm Planalytics this week said outwear sales were down by as much as 31% in Boston, 34% in Chicago, 36% in New York and 38% in Philadelphia in the week ended December 12. US stores lost $185 million in sales due to the warm weather in November, Planalytics said.

In the UK, chains such as Marks & Spencer and Debenhams are running deep promotions on clothing and footwear to drive sales. So, it is of little surprise that Deloitte this week predicted that discounts at UK retailers this coming weekend (December 19-20) will be the deepest since the downturn of 2008. The average discount in UK retail will rise from a current 41.8% to 45% this weekend, Deloitte said—and the firm forecasts that fashion retailers will lead the charge.

We think this coming weekend, which includes “Super Saturday”—the final Saturday before Christmas—will see a glut of discounting from apparel retailers eager to shift stock. But there may be bright spots. One consolation for retailers more generally will be that a warm Super Saturday will bolster footfall. Another is that reduced spending on clothing and footwear will free up cash for consumers to spend on other categories, such as tech. Finally, in fashion, the exceptions may be those brands that are so popular that shoppers will buy them even if the weather does not demand it: after all, outerwear-skewed British retailer Super Group this week reported that its retail comps were up by 17.2% in the half year through October 24—well after the warm autumn began.

For more on the weather’s impact on retail, see our

Weekly Weather Flash. For more on the promotions major US and UK retailers are running, see our

Weekly Global Retail Promo Update.

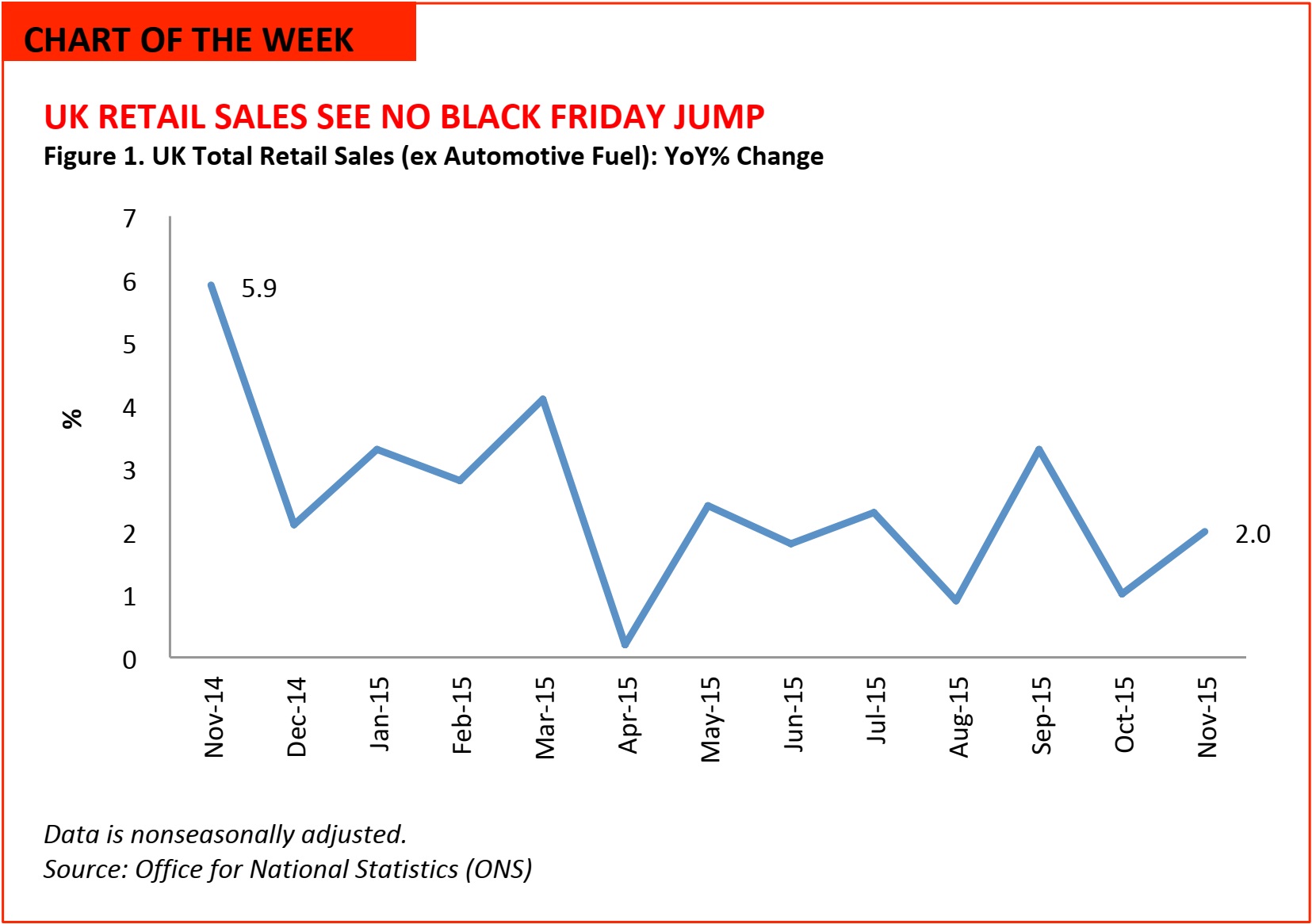

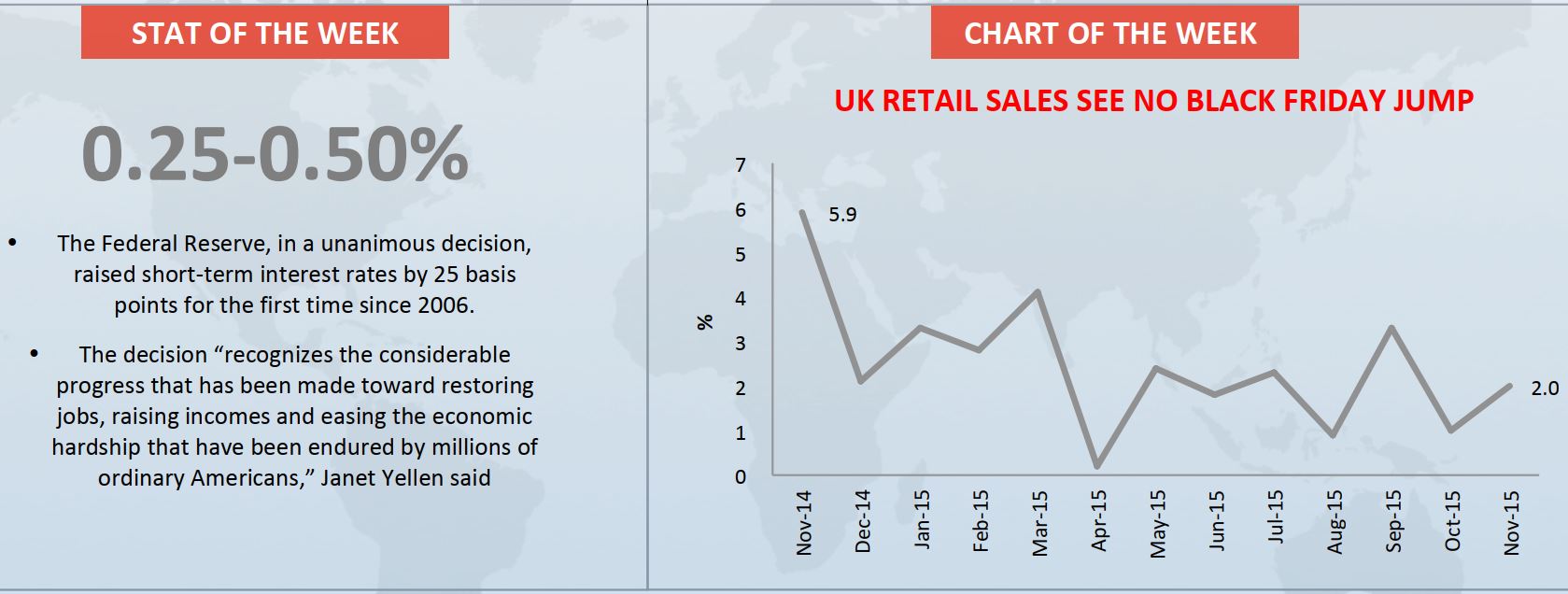

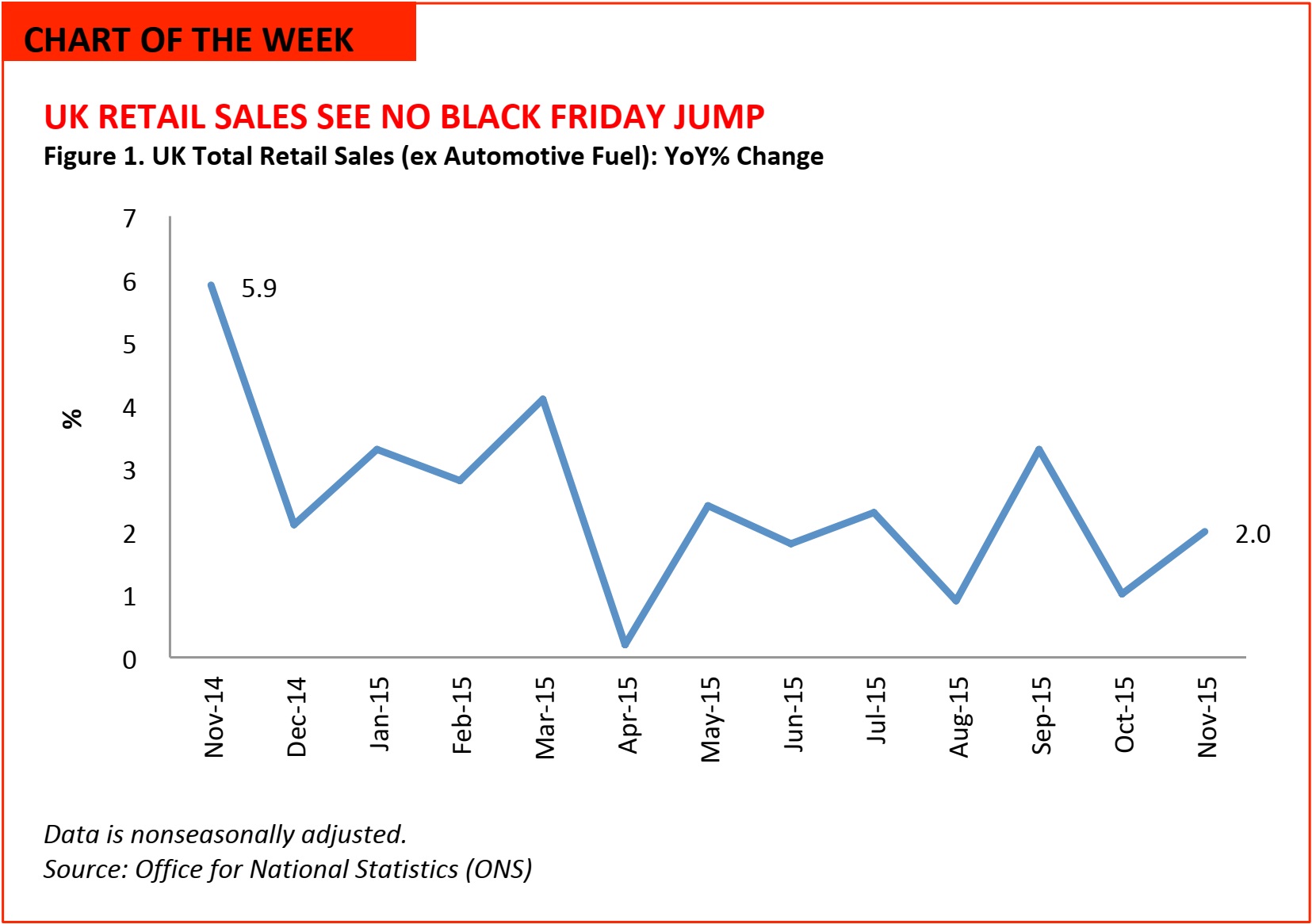

- The November UK retail sales did not see a boost from Black Friday, delivering a total growth of just 2.0% compared to a 5.9% surge last November.

- Electrical goods retailers and department stores were the exceptions: electronics stores enjoyed a 7.1% increase in sales and department stores delivered a 4.7% led by John Lewis.

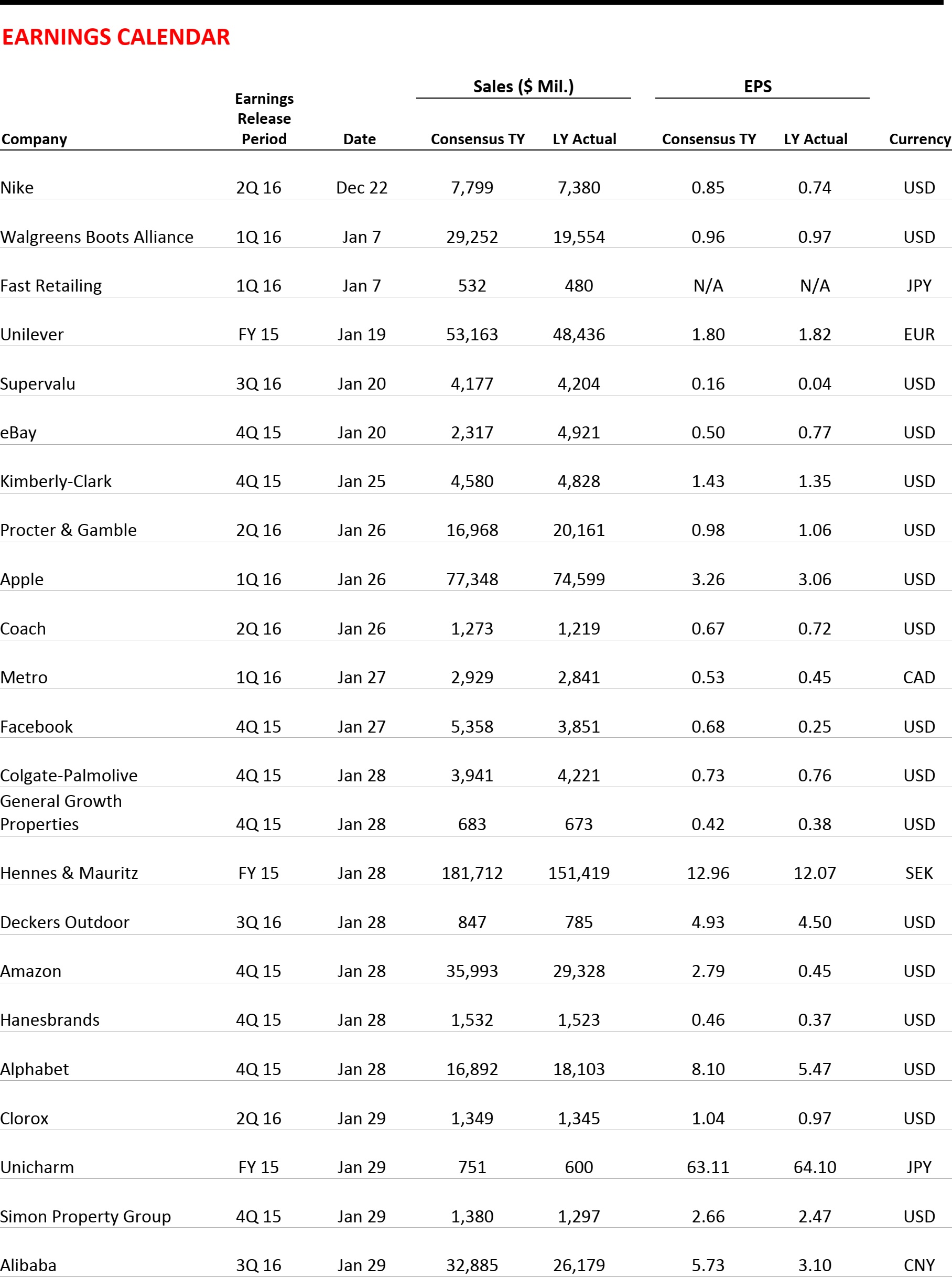

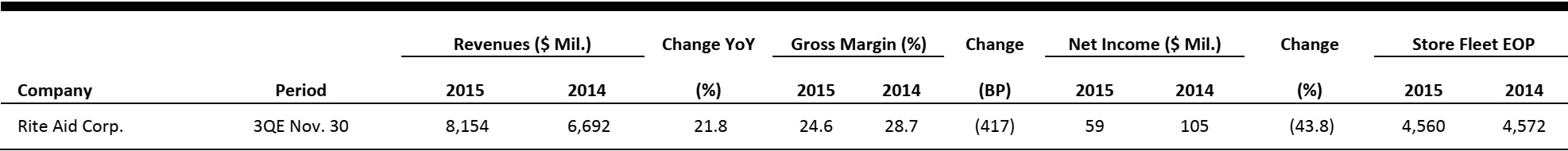

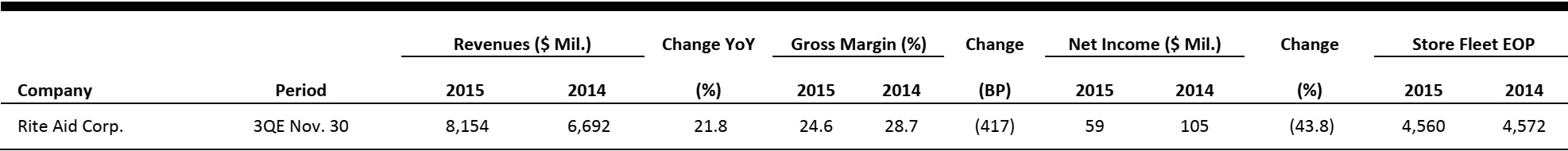

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

CVS Health Finalizes Target Pharmacy Deal

(December 16) Drug Store News

- CVS Health has completed its acquisition of Target’s pharmacy and clinic businesses for approximately $1.9 billion, the two companies announced Wednesday. CVS Health acquired Target’s 1,672 pharmacies across 47 states and will operate them through a store-within-a-store format branded as CVS/pharmacy.

- A CVS/pharmacy will be included in all new Target stores that offer pharmacy services. Seventy-nine Target clinic locations will be rebranded as MinuteClinic, and CVS Health will open as many as 20 new clinics in Target stores within the next three years.

US Consumer Prices Unchanged in November

(December 15) Associated Press

- US consumer prices were unchanged in November, as declines in energy and food held down overall costs. The flat reading followed a modest, 0.2% increase in October and outright declines in August and September, the Labor Department reported Tuesday.

- But core inflation was up by 2% over the 12 months ending November. That was the fastest pace that inflation had increased in more than a year, and is the kind of increase Fed officials want to see to justify interest rate hikes.

Amazon Is Capturing a Bigger Slice of US Online Holiday Spending

(December 16) Bloomberg

- com is increasing its share of US online spending during the holiday season, even as Walmart, Target and other rivals seek to attract consumers with promotional sales and free deliveries.

- Amazon took in 39.3% of e-commerce spending from November 1 through December 6, up from 37.9% during the same period last year, according to Slice Intelligence, which gathers data through the email receipts of 3.5 million shoppers. To match Amazon’s share, one would have to combine the web sales of the next 21 leading retailers, including Walmart, Target, Best Buy, Macy’s, Home Depot, Nordstrom and Costco, Slice data indicated.

Krispy Kreme Pushes into Starbucks’ Turf with New Focus on Coffee

(December 16) Bloomberg

- Krispy Kreme Doughnuts, facing slower sales growth and more demanding customers, is pushing deeper into Starbucks’ territory. The company is doing more to promote its coffee, which for years was an afterthought at the doughnut chain.

- Depending on how the effort goes, coffee could make up 10% of restaurant sales in the US, up from just 5% now, CEO Tony Thompson said in an interview. The coffee shift would have a significant impact on profit, since the product carries a much higher margin than baked goods do, Thompson said.

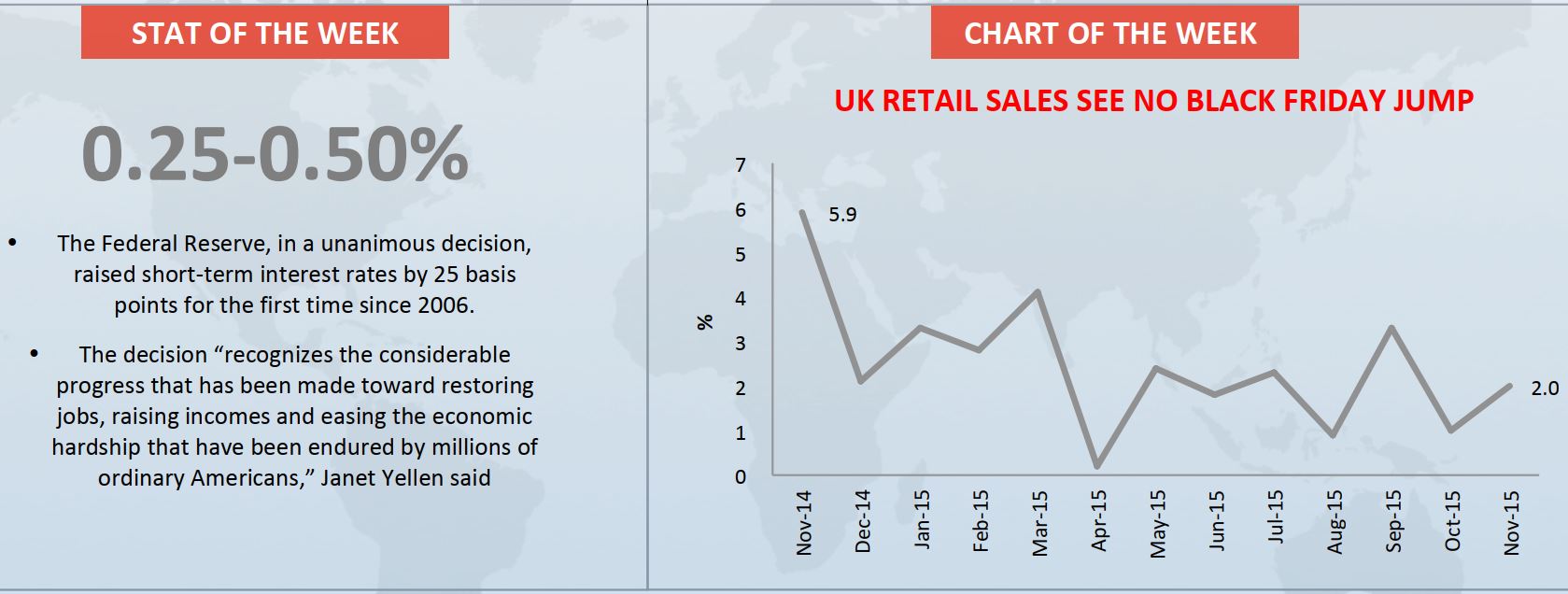

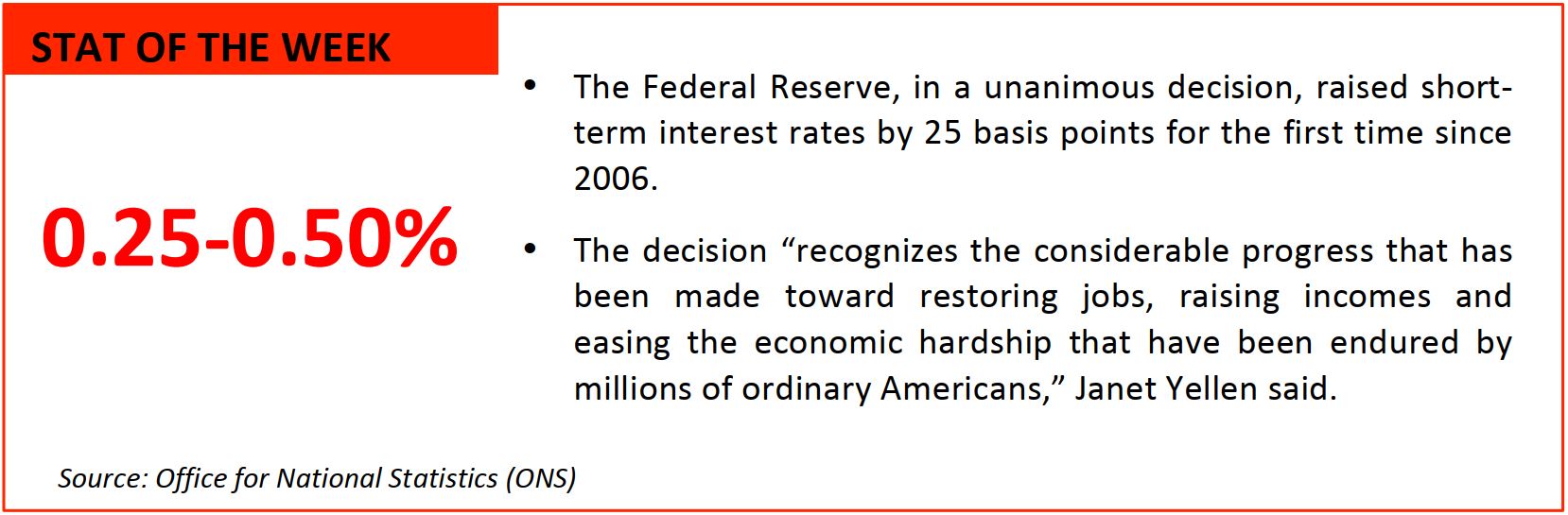

The Federal Reserve Raises Key Interest Rate for the First Time in Almost a Decade

(December 16) The New York Times

- The Federal Reserve said on Wednesday that it would raise short-term interest rates for the first time since the financial crisis struck, a vote of confidence in the strength of the American economy at a time when much of the rest of the global economy is struggling.

- The widely anticipated decision, a milestone in the Fed’s post-crisis stimulus campaign, ends a seven-year period in which the Fed held short-term rates near zero. Even as it raises its benchmark interest rate by 0.25 percentage points, to a range of 0.25% to 0.5%, the Fed emphasized that subsequent increases would come slowly.

- In an interview with Forbes, Vucko said that Indochino’s pivot from being solely online to including offline retail introduced “a lot more strain” into operations. When the company was originally launched in 2007, it was conceived to allow customers to measure themselves at home and then use those measurements to order custom suits online. Indochino began opening offline showrooms late last year.

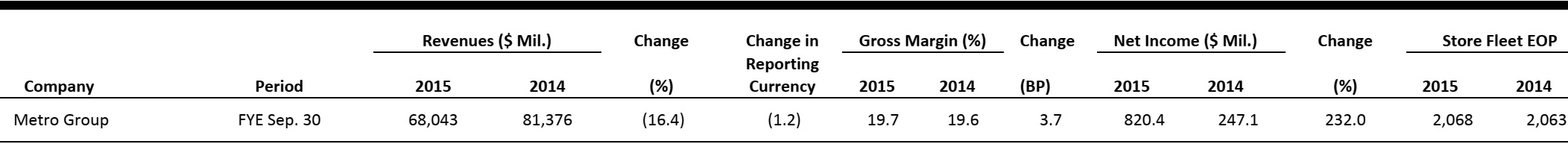

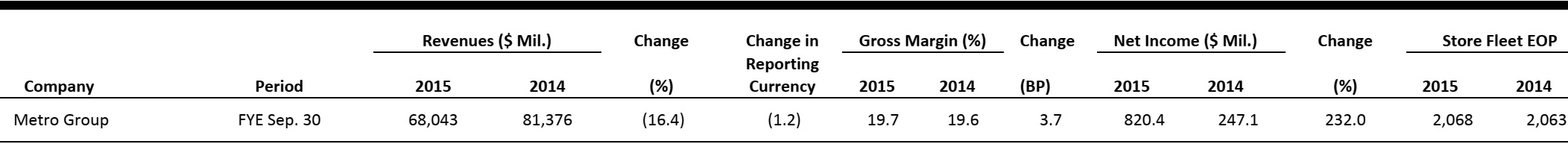

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

H&M Post Lower-Than-Expected Monthly Sales, Blames Bad Weather Across US, Europe

(December 15) Company Press Release

H&M Post Lower-Than-Expected Monthly Sales, Blames Bad Weather Across US, Europe

(December 15) Company Press Release

- The Swedish fast fashion chain released its monthly trading statement saying that November sales were “negatively affected by the unseasonably mild weather in North America and in many of the H&M group’s large sales markets in Europe.” November sales rose 4% in local currencies, and it is the second time this year that H&M’s monthly growth has fallen below 10%.

- In the financial year 2015, that is from 1 December, 2014 to 30 November, 2015, sales, including VAT, increased by 11% in local currencies and 19% in Swedish Krona, amounting to SEK 209.9 billion ($24.8 billion). The company is expected to publish its full-year report on 28 January, 2016.

Morrisons Returns To Convenience Store Format Just Months After M Local Sale

(December 14) theguardian.com

Morrisons Returns To Convenience Store Format Just Months After M Local Sale

(December 14) theguardian.com

- Just three months after selling its struggling chain of M Local shops, British grocer Morrisons has returned to the convenience store market. The retailer has opened its first in the new format, called Morrisons Daily, at a petrol station in the town of Crewe. It is expected to open four more as part of its trial.

- The Morrisons Daily shops will operate 24 hours a day, and sell sandwiches, fruit and vegetables, meat, fish, ready meals, groceries, and other fresh and chilled food. The retailer has opened the Morrisons Daily store in collaboration with Motor Fuel Group, which operates 373 petrol stations across the UK.

John Lewis to Invest £500 Mil. (US $758 Mil.) On Ecommerce

(December 14) retailgazette.com

John Lewis to Invest £500 Mil. (US $758 Mil.) On Ecommerce

(December 14) retailgazette.com

- British high street retailer, John Lewis, is reportedly going to spend £500 million ($758 million) on its ecommerce activities, as it predicts that online sales will overtake store sales in the next four years. The Managing Director of John Lewis, Andy Street, stated that online sales trends have grown at a faster pace than originally expected.

- The investment will see considerable expansion in the retailer’s recruitment of IT staff, and increased spending on customer analytics, warehousing and information technology. Street has estimated that over 500 new IT personnel could be employed at the London head office. He added that John Lewis had already increased its IT investment “six-fold over the last six years and the number of people involved has increased three times.”

Lidl Renovates Stores Under New Formula

(December 14) retaildetail.eu

Lidl Renovates Stores Under New Formula

(December 14) retaildetail.eu

- Hard discount grocery retailer, Lidl, has started renovating its German stores. The first of the stores under the new design opened in Offenau last week. The new formula will have more glass and aluminum as part of its structural design to give it a fresh look and a spacious feel.

- Lidl is expected to invest nearly €1.5 million ($1.6 million) on the remodeling costs for each store. The redesign dictates that each store needs to have a minimum area of 17,222 sq. ft. The Schwarz Group, Lidl’s parent company, aims to renovate all of its 3,200 German stores over the next 4 years, which could result in a whopping €6 billion ($6.7 billion) investment budget.

Kurt Geiger To Get New Owner

(December 14) retail-week.com

Kurt Geiger To Get New Owner

(December 14) retail-week.com

- Private equity group Cinven has reportedly agreed to acquire the UK’s biggest shoe retailer by sales, Kurt Geiger, for £245 million ($371 million) from Sycamore Partners. Lion Capital, another PE group, is also said to be in the race to acquire Kurt Geiger.

- Established in 1963, the shoe retailer could possibly see its third owner in four years, should this deal go through. Kurt Geiger operates through 180 stores and concessions in 80 countries. It had appointed Goldman Sachs earlier this year, to help explore its options of either spinning off part or all of its business, or launching an IPO.

ASIA TECH HEADLINES

Oxford University to Launch Cybersecurity Centre in Victoria

(December 14) ZDNet

Oxford University to Launch Cybersecurity Centre in Victoria

(December 14) ZDNet

- Melbourne is set to receive the first international office of Oxford University’s Global Cyber Security Capacity Centre (GCSCC), after an agreement was signed on Tuesday by Phillip Dalidakis, the Victorian Minister for Small Business, Innovation and Trade.

- The GCSCC carries out audits of national cybersecurity risks and capabilities that help countries to plan investments and strategies to improve their digital security.

China’s Baidu Says to Develop Self-driving Buses Within 3 Years

(December 14) Channel NewsAsia

China’s Baidu Says to Develop Self-driving Buses Within 3 Years

(December 14) Channel NewsAsia

- China’s top online search firm Baidu Inc. said it aims to put self-driving buses on the road in three years and mass produce theme within five years, after it set up a business unit to oversee all its efforts relate3d to automobiles.

- The unit will also include its initiative in partnership with BMW AG to develop an autonomous passenger vehicle, which may also be put into mass production within five years, a spokesman told Reuters on Monday.

Insurance and Chinese Fintechs Dominate 2015: KPMG

(December 14) ZDNet

Insurance and Chinese Fintechs Dominate 2015: KPMG

(December 14) ZDNet

- The Fintech 100 list, published jointly by KPMG Fintech and H2 Ventures, has indicated in 2015 there was a dramatic increase in insurance and Chinese-based fintech startups.

- The list was topped by Chinese insurance company ZhongAn, which did a $930 million Series A and a $10 billion valuation in 2015. Marketplace lending startups Qufengqi and Lufax came in the fourth place and eleventh respectively. A total of six Chinese companies made it to the top 50, and a total of seven made the 100 list.

Alibaba to Buy South China Morning Post for $266 Million

(December 14) Bloomberg News

Alibaba to Buy South China Morning Post for $266 Million

(December 14) Bloomberg News

- Alibaba Group Holdings Ltd., the e-commerce giant headed by billionaire Jack Ma, agreed to buy Hong Kong’s South China Morning Post and other affiliated media assets for HK$2.06 billion ($266 million).

- The deal includes the century-old newspaper, outdoor advertising, digital assets and magazines, SCMP Group Ltd. said in a filing Monday. Control of the city’s premier English-language broadsheet has unchanged since media magnate Rupert Murdoch sold most of his stake to Malaysia billionaire Robert Kuok in 1993.

MIT’s ‘Social Robot’ Jibo Gets $16M Funging to Charm Asia

(December 11) TechinAsia

MIT’s ‘Social Robot’ Jibo Gets $16M Funging to Charm Asia

(December 11) TechinAsia

- Japanese video game, slot machine, and resort conglomerate Sega Sammy Holdings and IT services giant CAC Holdings joined the US$16 million series A round as Fenox Venture Capital’s limited partners(LPs) and will work with Jibo to facilitate the robot’s Asian expansion plans via sales and marketing channels.

- Jibo can be used as a personal assistant, digital companion, and cameraman. It leverages artificial intelligence to learn about an individual’s daily habits and preferences. The cameras also allow the robot to track faces, so it can follow individuals as they move around to create a more personal, attentive feeling.

LATAM RETAIL HEADLINES

Brazilian Retail Sales Exhibit a Surprise Rebound in October

(December 16) Bloomberg

Brazilian Retail Sales Exhibit a Surprise Rebound in October

(December 16) Bloomberg

- Brazilian retail sales increased 0.6% MoM in October, following a revised 0.3% decrease in September, well above the median estimate of a decline of 1.1%. Analysts commented that this data point was an outlier and unsustainable

- Sales of food, beverages and tobacco at supermarkets and hypermarkets increased 2%, and sales of furniture and appliances, which are usually financed by credit, increased 0.6%

Brazilian Debt Receives Second Downgrade to Below-Investment Grade

(December 16) Bloomberg

Brazilian Debt Receives Second Downgrade to Below-Investment Grade

(December 16) Bloomberg

- Brazil’s stocks and currency declined after ratings agency Fitch downgrade Brazil’s credit rating by one notch to BB+ with a negative outlook

- Fitch based its downgrade on a deeper-than-expected recession, continuing adverse fiscal developments and an uncertain political environment.

E-commerce Growth Slowing in Latin America

(December 16) eMarketer.com

E-commerce Growth Slowing in Latin America

(December 16) eMarketer.com

- Total retail sales in Latin America are expected to hit US $1.8 trillion in 2015, according to eMarketer’s with Latin America will represent 8.1% of the worldwide total in 2015

- Retail sales growth is expected to slow to 22.9% in 2015 from 26.1% in 2014 and continue to decelerate to 15.3% in 2018, before rebounding in 2019, primarily due to a slowdown in Brazil offset somewhat by strong growth in Mexico.

Colombia: Fastest-Growing South American Economy in Q3

(December 16) latincorrespondent.com

Colombia: Fastest-Growing South American Economy in Q3

(December 16) latincorrespondent.com

- Colombia reported 3.2% YoY economic growth in Q3, helped by trade and agriculture exports, while the inflation rate increased to 6.4% in November, up from 5.9% in October

- Agriculture grew by 4.5%, fueled by a 29.1% increase in coffee exports and a 28.9% increase in palm oil exports, and manufacturing recovered after declining in the first two quarters of the year.

Liverpool Still Looking at Ripley to Double Online Sales

(December 1) WWD

Liverpool Still Looking at Ripley to Double Online Sales

(December 1) WWD

- Mexican department store company Liverpool is still interested in acquiring a 50% share of Chilean retailer Ripley and denied that Ripley is looking to acquire Mexican retailer Suburbia, according to a Liverpool representative

- The Mexican press has speculated that Wal-Mart de Mexico was considering selling Suburbia to raise its profitability and that Liverpool is seeking acquisitions in Central America.

The signs increasingly point to this holiday season being a disappointing one for apparel retailers. On both sides of the Atlantic, shoppers have enjoyed unusually warm autumn weather. As we write this, the temperature in London is 15° Celsius (59° Fahrenheit)—a near-unprecedentedly warm day just a week before Christmas. The warm weather this year has significantly reduced demand for winterwear, such as knitwear, jackets, coats and boots.

Just this week, fashion giant H&M reported its sales figures for November, the fourth quarter and the fiscal year: revenues in local currencies were up by just 4% worldwide in November, compared to 9% for the entire fourth quarter and 11% for the full year ending November. The company noted the “unseasonably mild weather in North America and in many of the H&M group’s large sales markets in Europe.”

In the UK, the weather has been unusually mild since September, so, by the time Black Friday arrived, many stores were keen to shift winter stock: we noted in our UK Black Friday 2015 Flash Report that apparel retailers in London had offered deeper discounts on categories such as coats and knitwear. But, given the muted demand we observed in the UK on Black Friday, especially at clothing stores, we doubt the event shifted enough excess inventory to satisfy British retailers.

In the US this December, we are seeing a stronger focus on winter apparel in promotions from stores such as Kohl’s and Target (see our Weekly Global Retail Promo Update). Weather data firm Planalytics this week said outwear sales were down by as much as 31% in Boston, 34% in Chicago, 36% in New York and 38% in Philadelphia in the week ended December 12. US stores lost $185 million in sales due to the warm weather in November, Planalytics said.

In the UK, chains such as Marks & Spencer and Debenhams are running deep promotions on clothing and footwear to drive sales. So, it is of little surprise that Deloitte this week predicted that discounts at UK retailers this coming weekend (December 19-20) will be the deepest since the downturn of 2008. The average discount in UK retail will rise from a current 41.8% to 45% this weekend, Deloitte said—and the firm forecasts that fashion retailers will lead the charge.

We think this coming weekend, which includes “Super Saturday”—the final Saturday before Christmas—will see a glut of discounting from apparel retailers eager to shift stock. But there may be bright spots. One consolation for retailers more generally will be that a warm Super Saturday will bolster footfall. Another is that reduced spending on clothing and footwear will free up cash for consumers to spend on other categories, such as tech. Finally, in fashion, the exceptions may be those brands that are so popular that shoppers will buy them even if the weather does not demand it: after all, outerwear-skewed British retailer Super Group this week reported that its retail comps were up by 17.2% in the half year through October 24—well after the warm autumn began.

For more on the weather’s impact on retail, see our Weekly Weather Flash. For more on the promotions major US and UK retailers are running, see our Weekly Global Retail Promo Update.

The signs increasingly point to this holiday season being a disappointing one for apparel retailers. On both sides of the Atlantic, shoppers have enjoyed unusually warm autumn weather. As we write this, the temperature in London is 15° Celsius (59° Fahrenheit)—a near-unprecedentedly warm day just a week before Christmas. The warm weather this year has significantly reduced demand for winterwear, such as knitwear, jackets, coats and boots.

Just this week, fashion giant H&M reported its sales figures for November, the fourth quarter and the fiscal year: revenues in local currencies were up by just 4% worldwide in November, compared to 9% for the entire fourth quarter and 11% for the full year ending November. The company noted the “unseasonably mild weather in North America and in many of the H&M group’s large sales markets in Europe.”

In the UK, the weather has been unusually mild since September, so, by the time Black Friday arrived, many stores were keen to shift winter stock: we noted in our UK Black Friday 2015 Flash Report that apparel retailers in London had offered deeper discounts on categories such as coats and knitwear. But, given the muted demand we observed in the UK on Black Friday, especially at clothing stores, we doubt the event shifted enough excess inventory to satisfy British retailers.

In the US this December, we are seeing a stronger focus on winter apparel in promotions from stores such as Kohl’s and Target (see our Weekly Global Retail Promo Update). Weather data firm Planalytics this week said outwear sales were down by as much as 31% in Boston, 34% in Chicago, 36% in New York and 38% in Philadelphia in the week ended December 12. US stores lost $185 million in sales due to the warm weather in November, Planalytics said.

In the UK, chains such as Marks & Spencer and Debenhams are running deep promotions on clothing and footwear to drive sales. So, it is of little surprise that Deloitte this week predicted that discounts at UK retailers this coming weekend (December 19-20) will be the deepest since the downturn of 2008. The average discount in UK retail will rise from a current 41.8% to 45% this weekend, Deloitte said—and the firm forecasts that fashion retailers will lead the charge.

We think this coming weekend, which includes “Super Saturday”—the final Saturday before Christmas—will see a glut of discounting from apparel retailers eager to shift stock. But there may be bright spots. One consolation for retailers more generally will be that a warm Super Saturday will bolster footfall. Another is that reduced spending on clothing and footwear will free up cash for consumers to spend on other categories, such as tech. Finally, in fashion, the exceptions may be those brands that are so popular that shoppers will buy them even if the weather does not demand it: after all, outerwear-skewed British retailer Super Group this week reported that its retail comps were up by 17.2% in the half year through October 24—well after the warm autumn began.

For more on the weather’s impact on retail, see our Weekly Weather Flash. For more on the promotions major US and UK retailers are running, see our Weekly Global Retail Promo Update.

Brazilian Retail Sales Exhibit a Surprise Rebound in October

(December 16) Bloomberg

Brazilian Retail Sales Exhibit a Surprise Rebound in October

(December 16) Bloomberg

Brazilian Debt Receives Second Downgrade to Below-Investment Grade

(December 16) Bloomberg

Brazilian Debt Receives Second Downgrade to Below-Investment Grade

(December 16) Bloomberg