From the Desk of Deborah Weinswig

Get Ready for Smaller Grocery Stores

Amazon Go, Walmart Pickup with Fuel and Lidl are three banners new to American grocery retail, and they all have one thing in common: a smaller store format.

- Amazon Go will offer grab-and-go foods, meal kits and grocery essentials across 1,800 square feet of retail space when it opens its inaugural store in Seattle in early 2017.

- Walmart Pickup with Fuel offers foods to go, convenience-store basics and an online grocery collection service across 4,000 square feet at each of its two initial gas-station stores.

- Lidl is planning to open stores of around 36,000 square feet (gross) when it launches in the US in 2018, according to the space requirements it lists online. That would make its US stores big fish compared with Aldi’s US stores, which average 16,400 square feet (gross), but only minnows compared with Walmart’s Supercenters, which average 178,000 square feet.

Adding to the flurry of activity is Ahold Delhaize, whose CEO last week noted the “enormous opportunity” to bring smaller store formats to the US grocery sector. Ahold Delhaize already has a strong presence in convenience stores in Europe, and in the US it is testing a 20,000-square-foot format under the Hannaford banner and a 10,000-square-foot format called Bfresh.

Why Smaller Stores Are Well Placed for the Future

We expect demand for smaller grocery stores to increase for one major reason in particular: e-commerce is growing relentlessly, in both food and nonfood categories.

- Hardline general merchandise categories such as media, electronics, toys and furniture are among the earliest categories to migrate online, which can mean reduced footfall and sales for big-store retailers as their shops lose their destination status.

- And once grocery starts to move online, the Internet chips away at the big-basket grocery shopping trips that are the lifeblood of large stores.

Meanwhile, smaller grocery stores that are less focused on general merchandise and whose food offerings provide a complement to online grocery shopping are well positioned to gain. On top of this, we see further tailwinds for smaller-format stores:

- Millennials are often characterized as living faster lives in urban areas, which means they are more likely to turn to the convenience and immediacy of smaller-format stores.

- At the opposite end of the age scale, the fast-growing senior population is increasingly demanding smaller, more-local stores that provide greater accessibility and ease of navigation.

Not All Smooth Sailing

Small grocery formats hold much potential, but that does not mean they are an easy channel to tap. This year, Walmart closed its entire chain of Express convenience stores, which averaged around 15,000 square feet, ending a five-year trial. And Ahold Delhaize’s CEO recently acknowledged that his company had not yet learned “how to crack the nut” of convenience retailing in the US, in part because the company’s American supply chain is not set up for ultra-small stores.

Still, we think the tailwinds for small formats are stronger than the headwinds, and that mass-market grocers must consider smaller formats in the face of competition from disruptors as varied as Amazon, Aldi and Lidl.

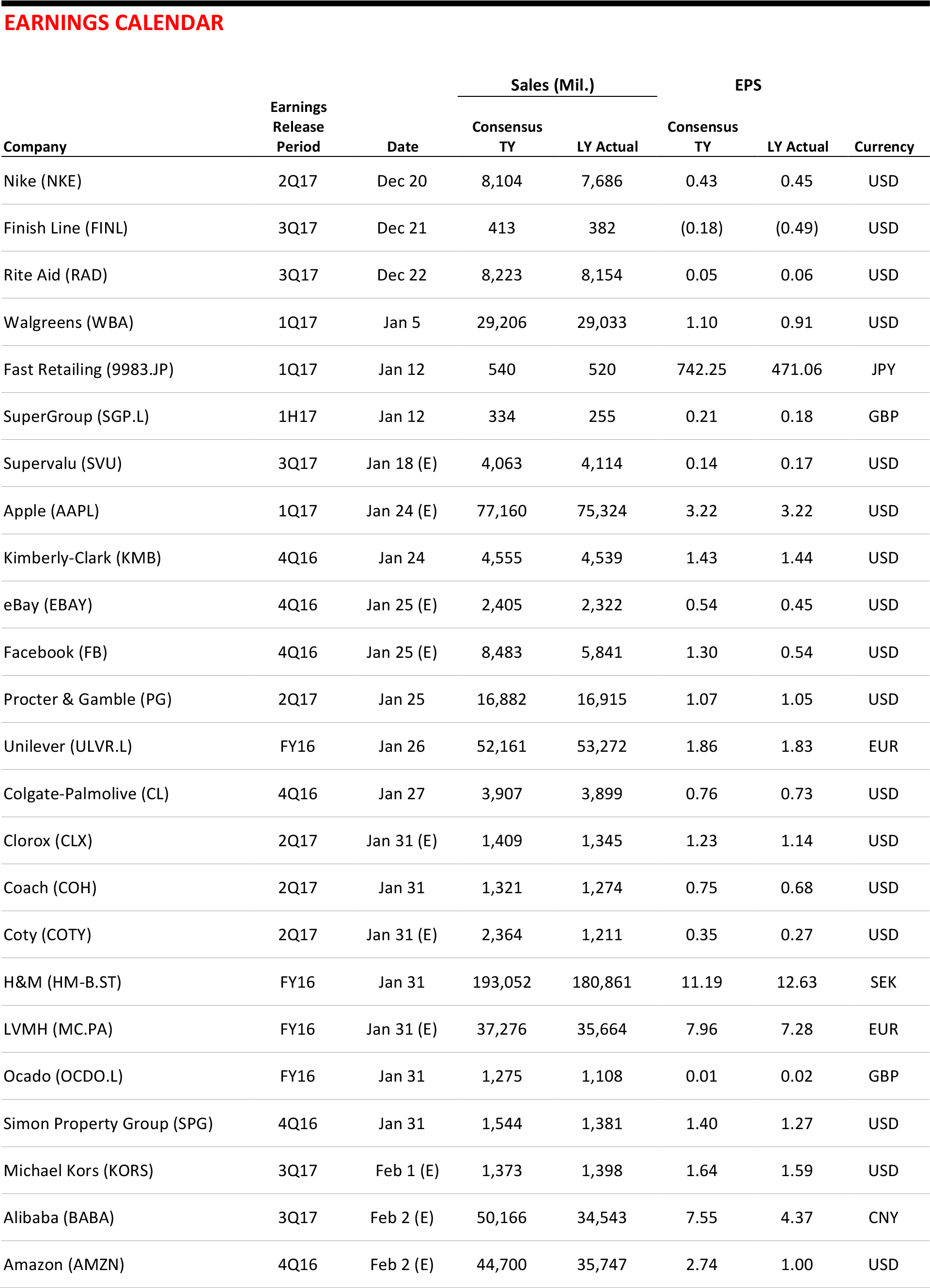

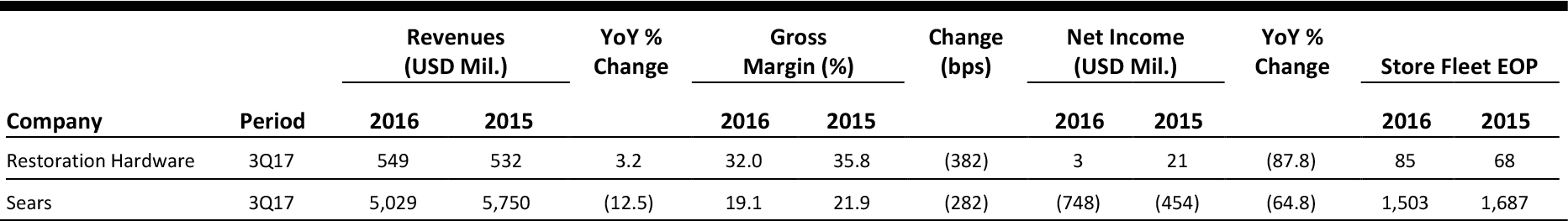

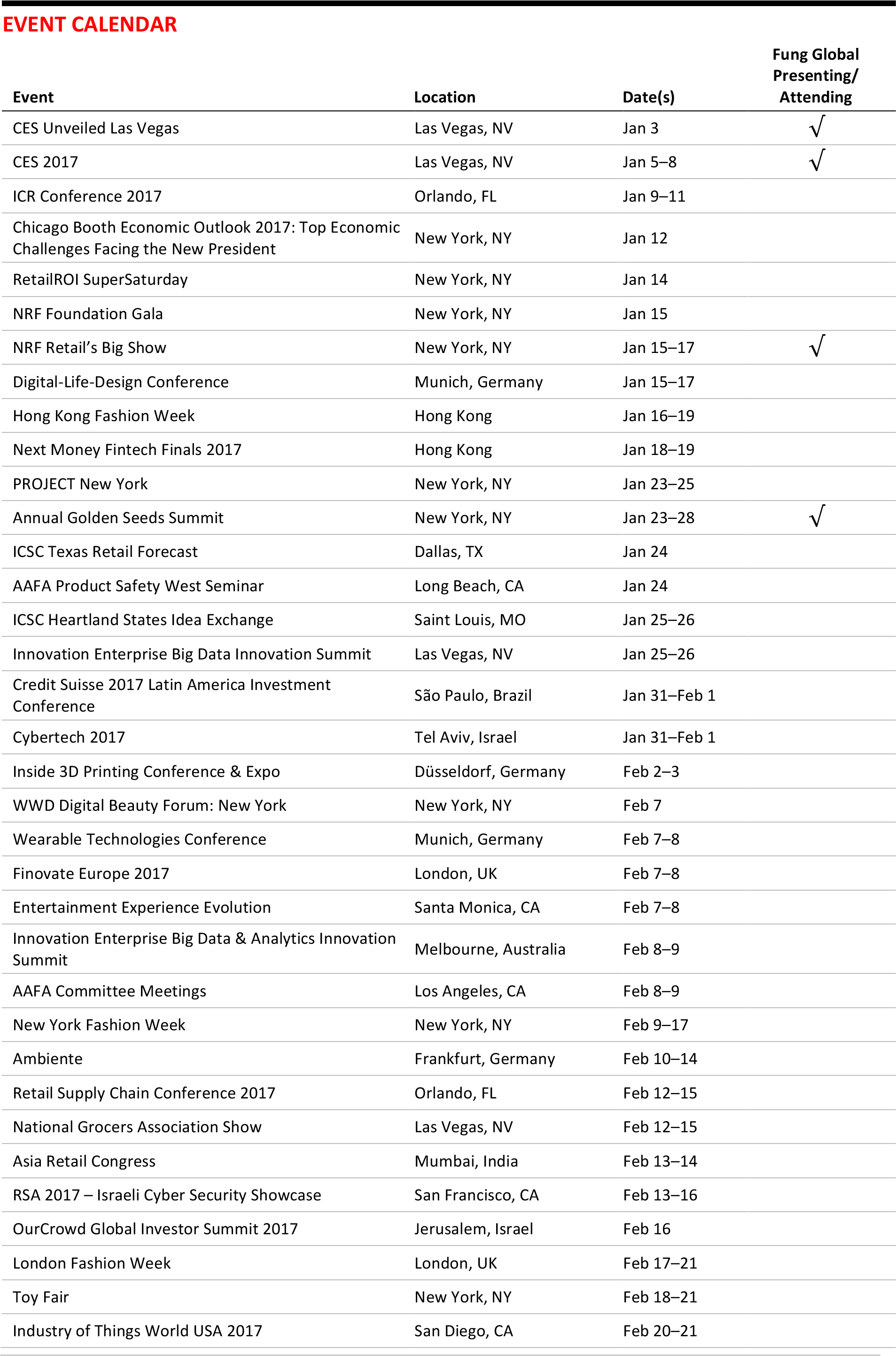

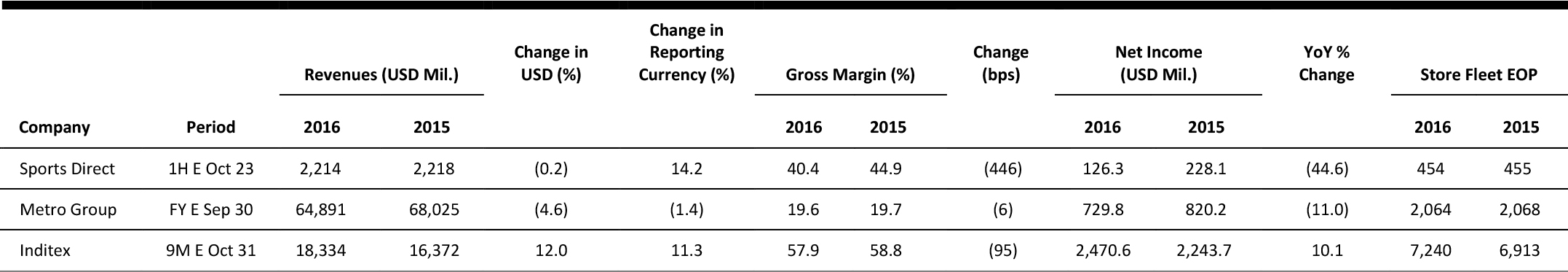

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Nordstrom Launches Chatbot for Holiday Shoppers

(December 12) BI Intelligence

Nordstrom Launches Chatbot for Holiday Shoppers

(December 12) BI Intelligence

- Nordstrom launched its first chatbot on the Facebook Messenger and Kik messaging services to help holiday shoppers find gift items. The chatbot helps users select gifts by asking them a series of questions about the person they are shopping for. It then chooses gifts from Nordstrom’s online store that match their answers.

- Users can also type in a request for gift ideas that are forwarded to Nordstrom customer service representatives, who then respond with customized gift ideas based on the request. The chatbot will available to consumers until December 24.

Owner of Famous Footwear Acquires US Footwear Retailer

(December 14) Chain Store Age

Owner of Famous Footwear Acquires US Footwear Retailer

(December 14) Chain Store Age

- Allen Edmonds, the nearly 100-year-old men’s footwear and accessories brand whose products are handmade in Port Washington, Wisconsin, has a new owner. Caleres announced it has acquired Allen Edmonds from private equity firm Brentwood Associates for $255 million.

- In addition to operating stores under the Famous Footwear banner, Caleres has a diverse portfolio of footwear brands. Brentwood acquired Allen Edmonds in 2013, and under its ownership, the brand expanded its direct-to-consumer business significantly, increasing its store count from 45 in 2013 to 70 currently and growing its e-commerce business in excess of 20% per year.

Beauty Retailer L’Occitane Opens Experiential Store in New York City

(December 14) Drug Store News

Beauty Retailer L’Occitane Opens Experiential Store in New York City

(December 14) Drug Store News

- French beauty retailer L’Occitane is looking to redefine the beauty shopping experience with the opening of a new flagship store in the Flatiron District of Manhattan. L’Occitane says the store presents a new shopping model designed for today’s consumers, addressing their varying needs for information and immediacy, all while channeling the rich heritage, natural beauty and art de vivre of Provence.

- The store features the first L’Occitane Smart Beauty Fitting Room, where clients can explore, discover and personalize their shopping experience on a digital platform that allows them to browse products in a private, digital format. The browsing experience is complemented by a physical and sensorial product-sampling experience.

Holiday Season Can Be Do-or-Die for Small Retailers

(December 13) Utah Business

Holiday Season Can Be Do-or-Die for Small Retailers

(December 13) Utah Business

- Many small retailers earn 25% or more of their total annual revenues during the Christmas shopping season. Stagnant holiday sales can be the beginning of a slow death spiral in the coming year. Small, locally owned retailers do not typically have the sales volume and financial resources to compete with the huge discounts offered by big national chains.

- Moreover, small retailers’ profit margins tend to be thinner than those of the big players, giving them less wiggle room on discounts.

Amazon Conducts First Commercial Drone Delivery

(December 14) The Wall Street Journal

Amazon Conducts First Commercial Drone Delivery

(December 14) The Wall Street Journal

- Amazon.com’s drone delivery program has lifted off—from a rural corner of England. Last week, Amazon made its first customer delivery by drone. The drone carried a package containing popcorn and a Fire TV video-streaming device several miles to a two-story farmhouse near Cambridge in 13 minutes.

- The delivery marks the start of operations for Amazon’s drone program following three years of skepticism and regulatory hurdles. Prime Air, as the initiative is known, aims to get packages to customers within 30 minutes.

EUROPEAN RETAIL HEADLINES

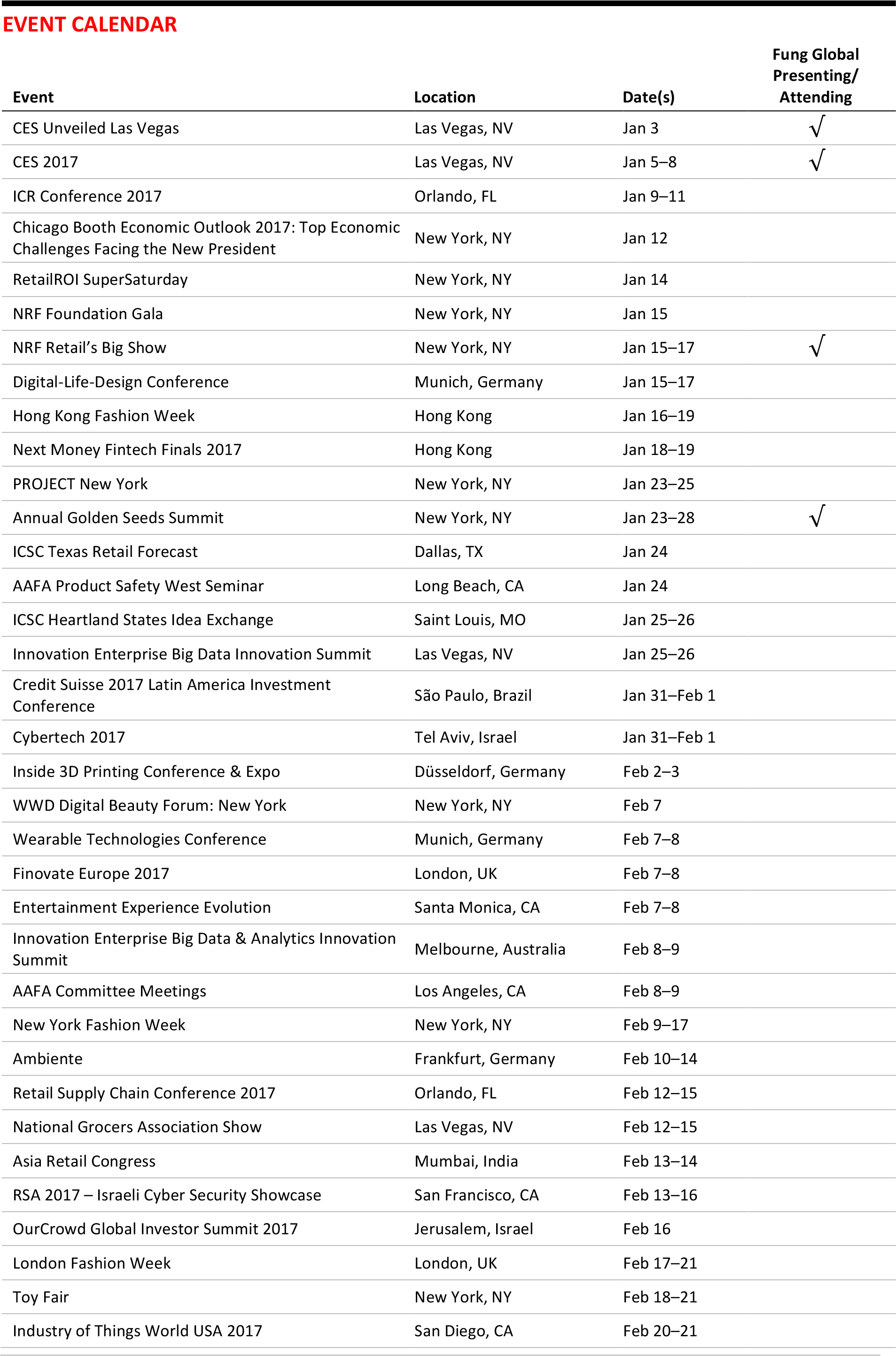

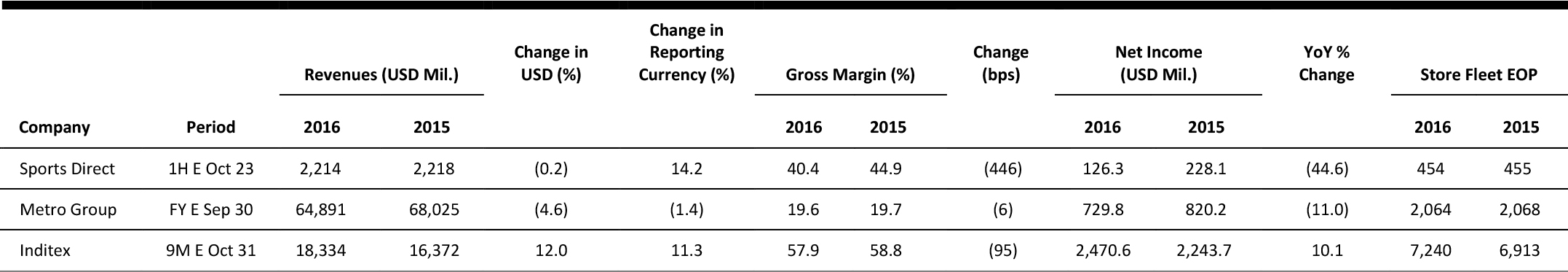

Source: Company reports

ASOS to Create 1,500 Roles in the UK

(December 12) Press release

ASOS to Create 1,500 Roles in the UK

(December 12) Press release

- British online fashion retailer ASOS this week revealed plans to hire 1,500 people to work at its head office in Camden, London, where 2,500 are currently employed.

- The company is looking to hire talent for various roles across the technology, marketing, content and retail functions. ASOS has taken an additional 40,000 square feet of space in the building where it is headquartered and plans to invest some £40 million (US$51 million) to renovate the area.

Groupe Casino Looking to Offload Struggling Brazilian Business

(December 12) RetailAnalysis.igd.com

Groupe Casino Looking to Offload Struggling Brazilian Business

(December 12) RetailAnalysis.igd.com

- French retail giant Groupe Casino’s Brazil arm, GPA, is looking to sell its struggling Via Varejo electronics and furniture banner. Casino holds a 43.4% stake in Via Varejo, and the banner operates some 970 stores in the region.

- The move has garnered much interest from the likes of local player Lojas Americanas, Chile-based Falabella and South Africa–based Steinhoff.

Robert Swannell, Marks & Spencer Chairman, to Retire in 2017

(December 13) Press release

Robert Swannell, Marks & Spencer Chairman, to Retire in 2017

(December 13) Press release

- British retailer Marks & Spencer has announced that its current chairman, Robert Swannell, will retire in 2017. Senior Independent Director Vindi Banga will lead the process to seek and appoint a new chairman, until which time Swannell will remain in the role.

- Swannell has served as chairman of the company for six years.

Oui to Open 10 Franchise Stores Across the UK in 2017

(December 13) RetailGazette.co.uk

Oui to Open 10 Franchise Stores Across the UK in 2017

(December 13) RetailGazette.co.uk

- German womenswear brand Oui announced that it will open 10 franchise stores in 2017, and about 30–35 stores in the next five years across the UK. Despite Oui being sold at House of Fraser and John Lewis, this would be the first time the brand has opened its own stores in the UK since the 1980s.

- Oui operates more than 50 stores, with 40 in Germany and the rest in Austria and the Netherlands.

Dixons Carphone Reports Sales Increase of 11% in 1H17

(December 14) Press release

Dixons Carphone Reports Sales Increase of 11% in 1H17

(December 14) Press release

- British electrical-goods retailer Dixons Carphone this week reported sales of £4.9 billion (US$6.2 billion) for the first half of its fiscal 2017 year (ended October 29, 2016), an increase of 11% year over year. Profit after tax was £125 million (US$159 million), up 45% from the same period last year.

- At constant currency, sales in the UK and Ireland grew by 4%, sales in the Nordics by 23% and sales in Southern Europe by 20%. Group comps increased by 4%.

ASIA TECH HEADLINES

Grab in Collaboration with Japan’s Honda

(December 12) Reuters.com

Grab in Collaboration with Japan’s Honda

(December 12) Reuters.com

- Ride-hailing service Grab said that Japan’s Honda Motor has invested in the firm to collaborate on motorbike-hailing services. The partnership might be expanded to other vehicles, according to Grab.

- The investment is part of a $750 million funding round announced previously. Grab received investments from China Investment Corp., Chinese ride-hailing firm Didi Chuxing and Singapore’s Vertex Ventures.

Tencent Is on the Lookout for Hollywood Deals

(December 11) Bloomberg.com

Tencent Is on the Lookout for Hollywood Deals

(December 11) Bloomberg.com

- Tencent Pictures, the film unit of Tencent, is looking for acquisitions that can accelerate its plans to make its own blockbusters. Potential targets could be in Hollywood and include companies on both the creative and production sides of filmmaking.

- Tencent Pictures, Dalian Wanda and Alibaba Pictures are all trying to gain a larger share of China’s box-office business, which is projected to be worth $10.4 billion.

Apple May Invest $1 Billion in SoftBank’s Technology Fund

(December 13) Bloomberg.com

Apple May Invest $1 Billion in SoftBank’s Technology Fund

(December 13) Bloomberg.com

- Apple has held talks about investing as much as $1 billion in SoftBank’s $100-billion technology fund that is set to be launched next year.

- SoftBank CEO Masayoshi Son met President-elect Donald Trump last week and pledged to invest half of the $100 billion into the US, creating 50,000 new jobs.

Huawei Releases X-Ethernet Technology for 5G

(December 13) TelecomAsia.net

Huawei Releases X-Ethernet Technology for 5G

(December 13) TelecomAsia.net

- Huawei has developed a new X-Ethernet technology for 5G networks that addresses the problems presented by the high bandwidth, determinacy, low-latency, hard isolation and low-cost requirements of 5G. The development is crucial for enabling new technologies, including Internet-of-Things technologies.

- The company’s rival vendor, Nokia Networks, has meanwhile announced a partnership with Vodafone to test cloud-based radio access technology that would enable a smooth transition from 4G to 5G.

Alibaba to Help Develop E-Commerce in Thailand

(December 13) RetailinAsia.com

Alibaba to Help Develop E-Commerce in Thailand

(December 13) RetailinAsia.com

- Alibaba signed agreements with Thailand’s Ministry of Commerce to help Thailand develop e-commerce as Deputy Prime Minister Somkid Jatusripitak headed a visit to Alibaba’s headquarters in Hangzhou.

- Alibaba will help small and medium-sized Thai firms expand their businesses on local and international e-commerce sites, develop an efficient logistics system to support e-commerce development, and train Thai government officials on big data and artificial intelligence. Alibaba Chairman Jack Ma said that Thailand can create its own digital economic miracle by embracing new technology and helping young people thrive in the new economy.

LATAM RETAIL HEADLINES

Walmart’s Mexican Subsidiary to Invest $1.3 Billion

(December 11) WWD.com

Walmart’s Mexican Subsidiary to Invest $1.3 Billion

(December 11) WWD.com

- Walmart’s Mexican subsidiary, Walmex, plans to invest $1.3 billion in order to expand its logistics and infrastructure by 2020, while creating an additional 10,000 jobs. Analysts said the announcement was just a government tactic to quell nerves in Mexico over the stated policies of US President-elect Donald Trump.

- Analysts in Mexico said that Walmex is already investing $689 million per year at current exchange, so the larger sum will likely be a continuation of that trend, and take nearly three years to complete. Walmex denies these allegations, and claims the investments are completely new.

Retail Sales in Brazil Decline by 8.2% from Last Year

(December 13) The Rio Times

Retail Sales in Brazil Decline by 8.2% from Last Year

(December 13) The Rio Times

- Retail sales in Brazil fell in October by 8.2% year over year. The figure represented the 19th consecutive monthly decline, and contributed to a cumulative decline of 6.8% in the last 12 months. The October drop was due to weak sales in supermarkets, food and beverages, and fuels and lubricants.

- On the plus side, computer equipment and materials, clothing and footwear, books, newspapers and magazines all posted growth. Furniture and appliance sales remained stable during the month.

Amazon Comes to Chile: Company Will Open First Office Before the End of 2016

(December 12) Emol.com

Amazon Comes to Chile: Company Will Open First Office Before the End of 2016

(December 12) Emol.com

- Amazon is set to open its first office in Chile, which will focus on Amazon Web Services. The opening coincides with the opening of a new office in Colombia. In Latin America, Amazon already has offices in Mexico and Brazil.

- While Amazon Web Services operates independently from Amazon.com, the new office in Chile will allow the parent company to be closer to customers and expand contact with local partners.

Peru Leads Retail Sector Development in Latin America

(December 14) América Retail

Peru Leads Retail Sector Development in Latin America

(December 14) América Retail

- A recent A.T. Kearney ranking of attractive retail markets for investment put Peru as ninth in the world and first in Latin America, ahead of Colombia and Brazil. Colombia was the 15th-most attractive market globally, while the Dominican Republic, Brazil and Paraguay all made the top 25.

- Peru’s high ranking is largely due to the government’s continued efforts to stimulate commercial integration and to free trade agreements that have helped open the economy and attract foreign investment.

Apple May Invest $1 Billion in SoftBank’s Technology Fund

(December 13) Bloomberg.com

Apple May Invest $1 Billion in SoftBank’s Technology Fund

(December 13) Bloomberg.com