Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

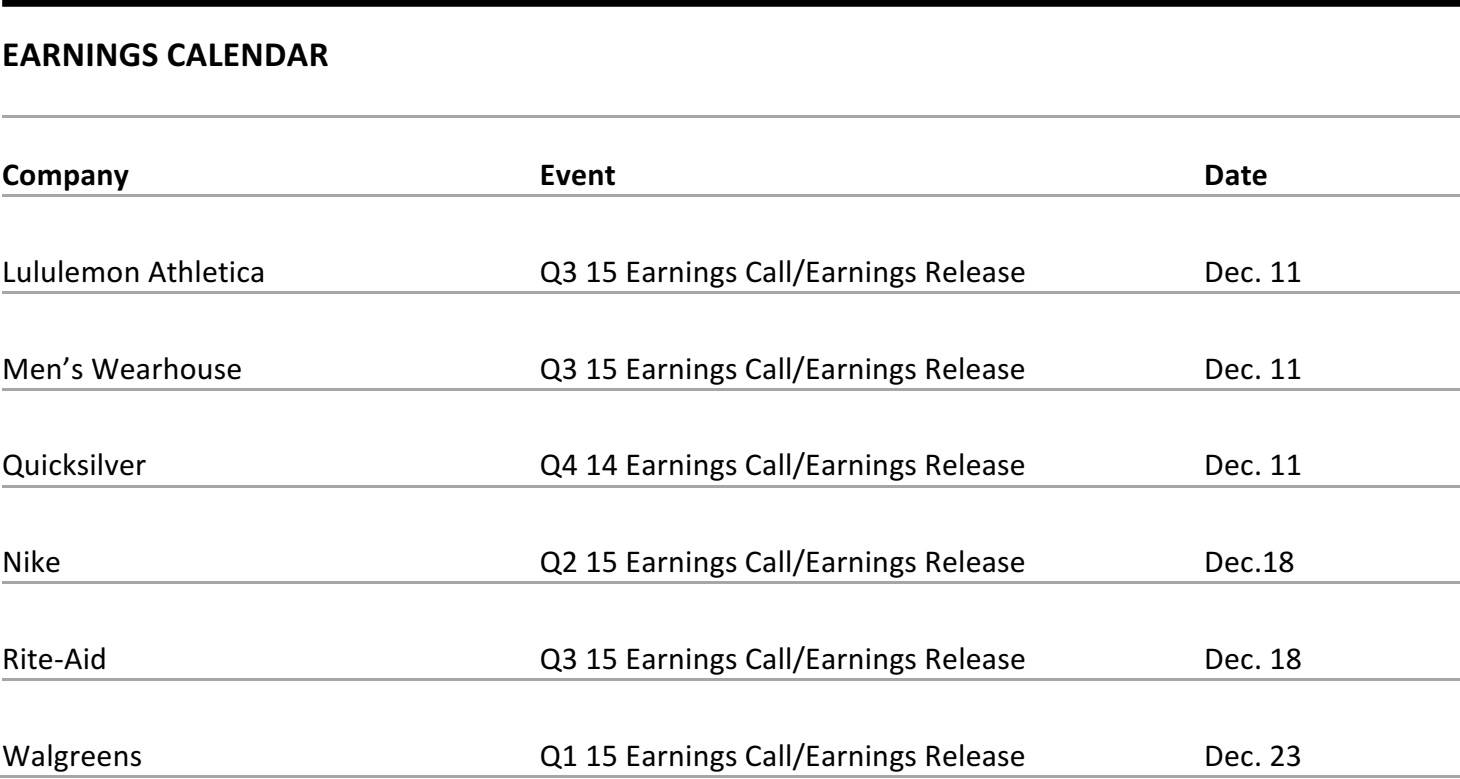

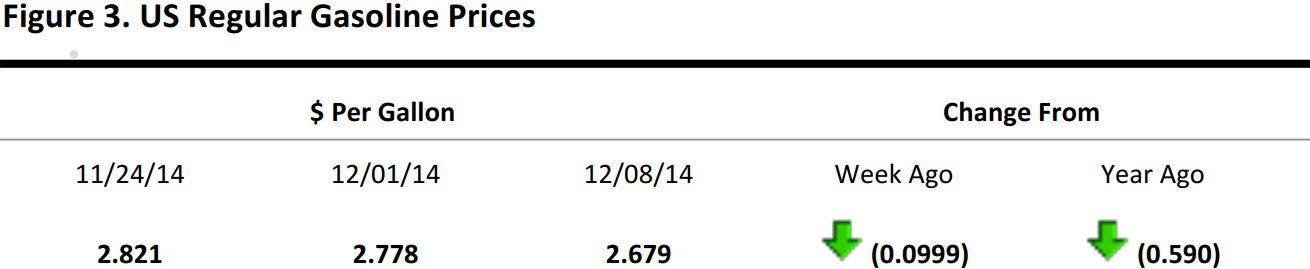

As the battle for all those procrastinating holiday shoppers heats up, brick-and-mortar retailers are pulling out all the stops to lure customers into the stores. One highly effective tactic this season has been "click and collect," which offers customers the convenience of online with the speed of same- or next-day delivery—and hopefully sparks a few impulse purchases in the process. In an especially inspired variation on this theme, Kohl’s this week announced that it will keep its stores open for 100 straight hours between December 19 and December 24. The chain is using this marathon stretch to allow shoppers to take advantage of its “order online, pick up in the store” option. Will others follow suit? Promotional activity remains fierce. Retailers are striking while the iron is hot: As we saw with the recently released November US retail sales, consumers are finally starting to respond to the stimulus of lower gasoline prices and a healthier economy. Excluding the volatile auto segment, sales rose 0.5% in November, up 4.3% YoY. That’s twice the annual 2.2% growth we saw in November a year ago. Staple categories such as health care and personal care (i.e., drug stores) and restaurants continued to capture most of this increased spending power. Both are strongly outperforming this year, as are building materials and electronics stores. Though general merchandisers’ sales showed momentum in November (rising 0.5%), they continued to lag for the year, reflecting a 1.1% YoY drop in the department store subcategory. Notably, clothing and accessory store sales also outpaced overall retail sales for the month, rising 1.2%, likely hoisted by holiday promotions. Even so, the category is still trailing for the year so far. Meanwhile, online retailers posted a 1.0% gain for November, up 8.7% YoY.US Retail Sales (Percent Change)

Through November 30, 2014

Source: US Department of Commerce

Through November 30, 2014

Source: US Department of Commerce

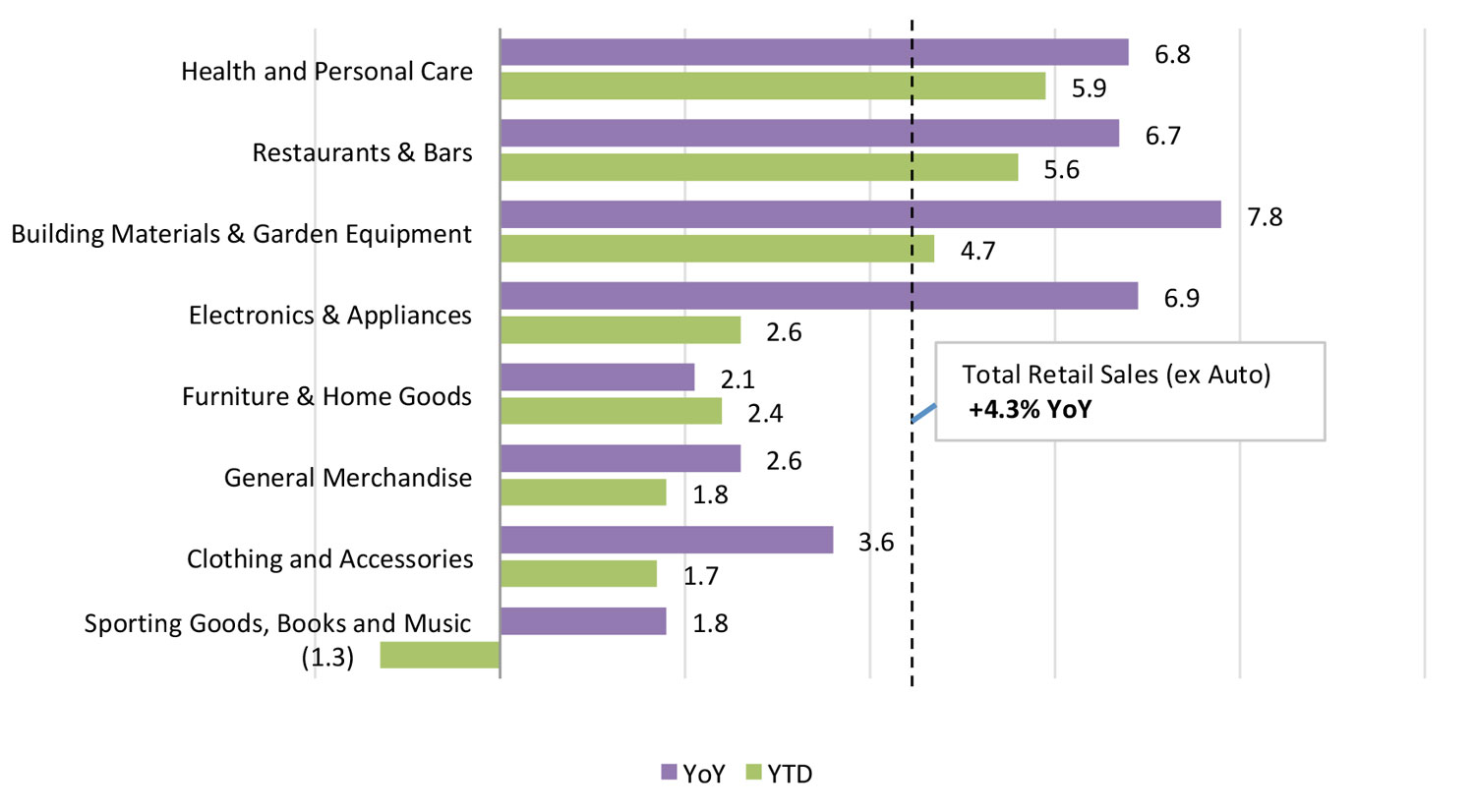

US WEEKLY TRAFFIC AND SALES

Sales Edge Higher but In-Store Traffic Slumps amid Stiff Online Competition

Note: The ICSC-Goldman Sachs index is a statistically derived estimate of industry sales that is weighted by sales volume.

- ICSC shows the most robust retail sales growth in nine weeks (up 2.9%), thanks to strong performances at wholesale clubs and electronics stores

- ICSC reported that sales gained 4%-4.5% for the week, helped by lower gasoline prices

- According to ShopperTrak, US store traffic dipped (-3.6%) and apparel traffic was the worst in six weeks, as Cyber Monday deals took center stage. Electronics and wireless store traffic rose by mid-single digits

RETAIL HEADLINES OF THE WEEK

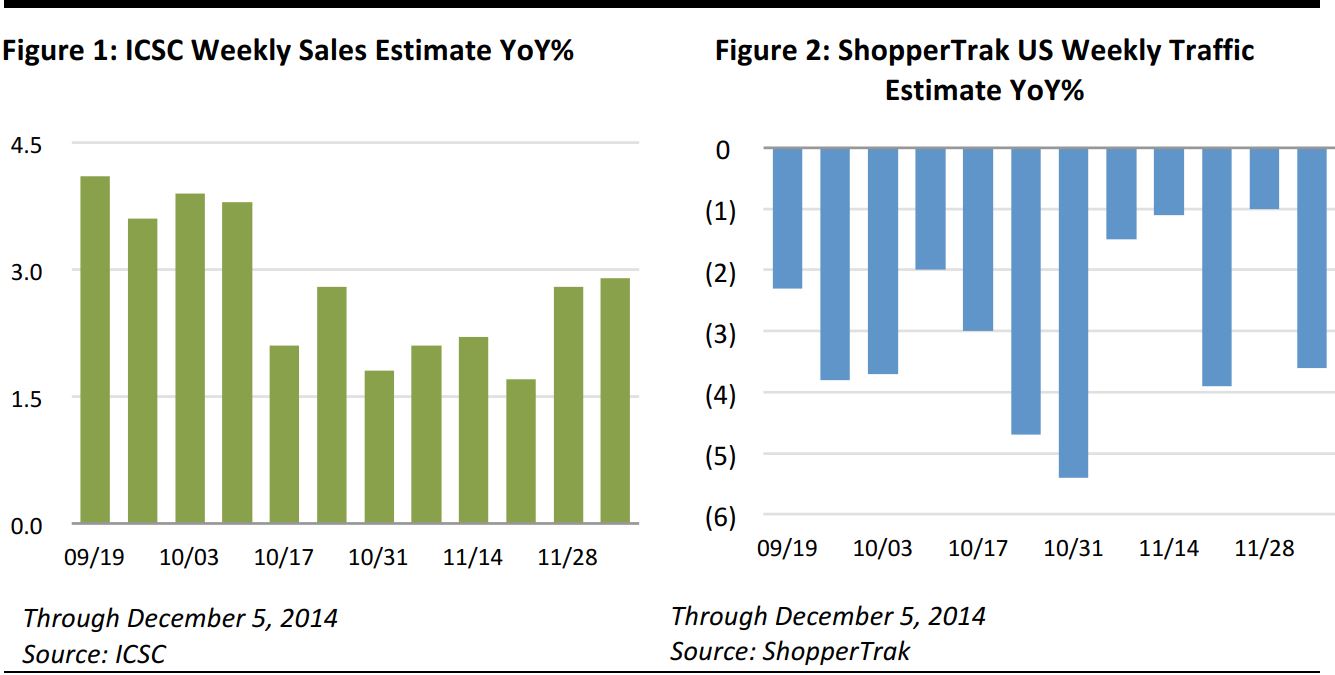

Selected Retail Company Earnings Results

Source: Company reports *Hudson's Bay numbers are reported in Canadian dollars. The YoY changes reflect acquisition of Saks Fifth Avenue **Inditex reported nine-month results, ended October 31. All results are in Euros

- Same-store sales grew 2.8%

- Growth was led by rapidly expanding market share in consumables, especially in tobacco products, perishables, candy and snacks; home and apparel categories are also going strong

- Total merchandise inventories were $2.79 billion at quarter-end, up 2% YoY on a per-store basis

- The company remains committed to acquiring Family Dollar (an update on the offer is slated prior to Family Dollar’s shareholder meeting on December 23)

- Management lowered full-year guidance for sales growth to the lower end of 8% from 8%-9%, and for same-store sales to 3% from a 3%-3.5% range

- Consolidated comps rose 2.7%, reflecting gains of 19.2% at its off-price chain Saks Fifth Avenue OFF 5th, of 1.7% at its Department Store Group (DSG) and of 1% at Saks Fifth Avenue

- CEO Richard Baker identified strategic growth areas: digital sales, OFF 5th and the expansion of Saks Fifth Avenue and OFF 5th to Canada

- Men’s apparel, ladies’ shoes, cosmetics and Topshop/Topman drove sales gains at DSG; men’s wear, accessories and fragrance led sales growth at Saks Fifth Avenue; and strong sales across categories at OFF 5th

- Reaffirmed guidance: total sales $7.8 billion-$8.1 billion; low-to-mid single digit comp growth, driven by strong digital sales; capital spending of $380 million-$420 million

- Same-store sales rose +5%, with US up +6% and international up +1%

- The 6% growth in membership fees offset for the nearly 7% increase in merchandise costs and higher SG&A

- Costco’s sales got a boost from lower gasoline prices, as customers filling their tanks at Costco’s gas station likely ended up spending more in the store

- Same-store sales surged 10.5% for the nine months ended October 31

- Global expansion remains on track: Zara opened a global flagship store in central Shanghai on November 29. Inditex opened 230 new stores in 50 markets in 2014 so far

- Inventories were €2.3 billion at quarter-end, up +20% YoY

Source: US Energy Information Administration

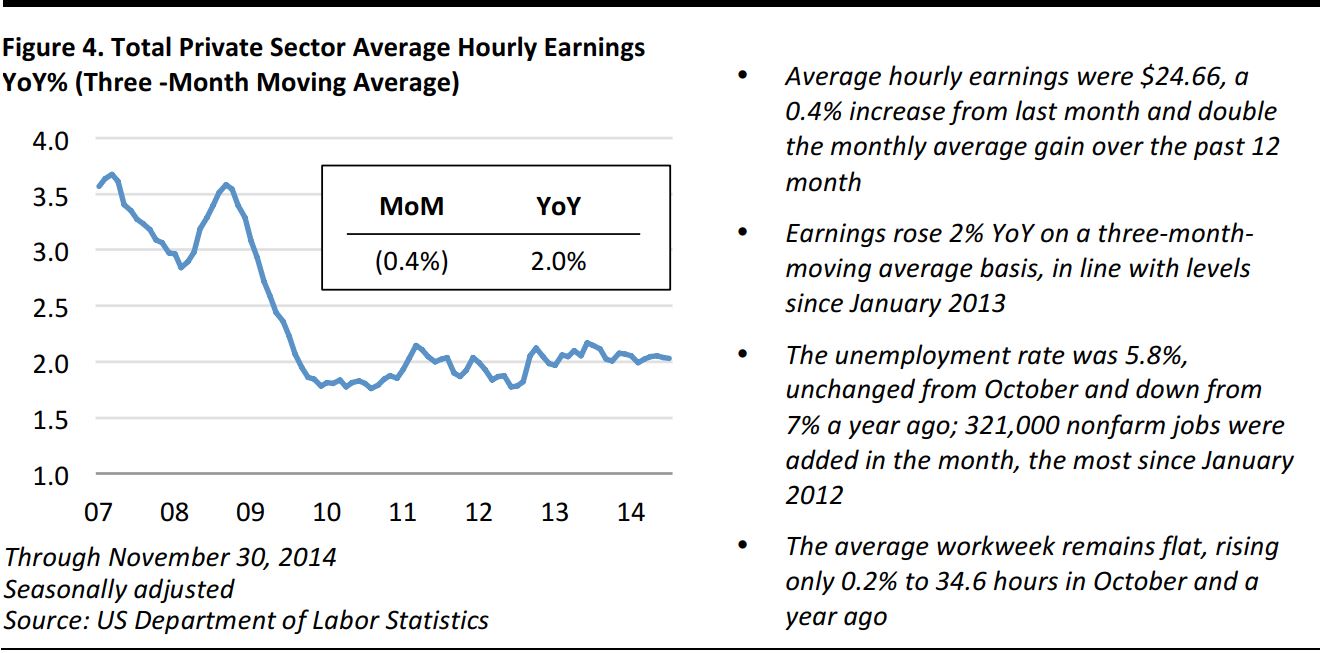

US MACRO ECONOMIC UPDATE

US Wage Growth Remains Lackluster

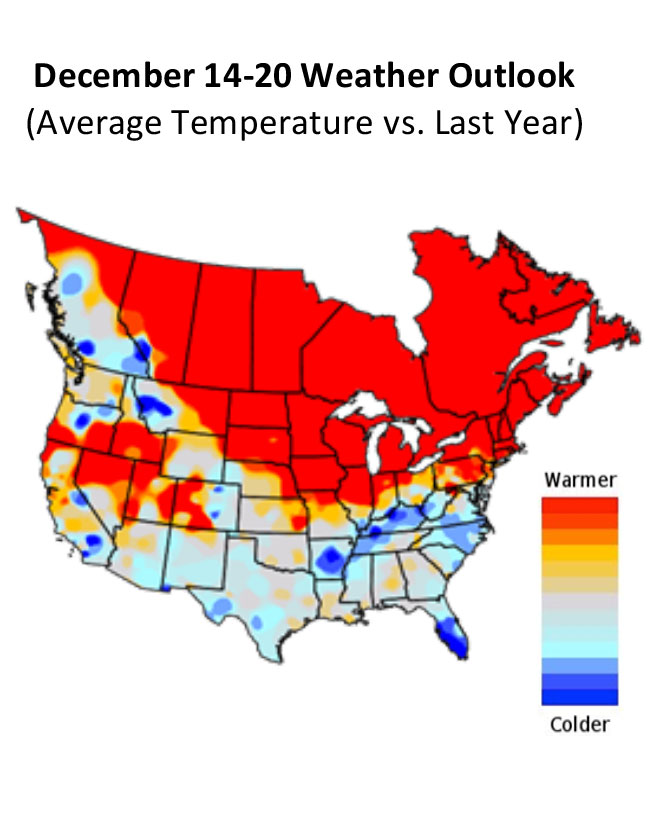

US WEATHER ANALYTICS: Week of Dec. 14 – 20

Much warmer temperatures across the country

- A mild December continues across the Northern Tier states

- Weather across the Great Lakes and Northeast regions will begin mild and end cold for the week. Overall, major markets in the Midwest, Northeast and Mid-Atlantic region will trend warmer than last year

- Rain is expected from the Northwest to the Southern Plains

- The prospects for snow continue to be limited to a few markets along the Northern Tier states and mountain regions in the West Weather-driven demand: Outwear +1% versus a year ago

CHINA HEADLINES OF THE WEEK

Global luxury brands see slowing sales in China (December 9). Prada, a fashion and luxury goods group that owns Miu Miu, Church’s and Car Shoe announced that the net income for the first three quarters declined by 27.6% YoY, to €319.3 million. During the period, the retail channel contracted by 4.3% YoY as a result of a general slowdown in demand, particularly in Hong Kong and Macau; net retail sales in the Greater China market also fell by 4.1% YoY. Prada said it will focus on the development of Miu Miu and Prada men’s business. Other global luxury brands also reported slowing profit growth, partly attributable to weaker sales in China. Gucci’s 3Q sales decreased by 1.6% YoY; Burberry’s first-half 2014 profit fell 12.4% YoY and Richemont’s first-half 2014 operating profit also dropped 4% YoY. China Business News Daily

Global luxury brands see slowing sales in China (December 9). Prada, a fashion and luxury goods group that owns Miu Miu, Church’s and Car Shoe announced that the net income for the first three quarters declined by 27.6% YoY, to €319.3 million. During the period, the retail channel contracted by 4.3% YoY as a result of a general slowdown in demand, particularly in Hong Kong and Macau; net retail sales in the Greater China market also fell by 4.1% YoY. Prada said it will focus on the development of Miu Miu and Prada men’s business. Other global luxury brands also reported slowing profit growth, partly attributable to weaker sales in China. Gucci’s 3Q sales decreased by 1.6% YoY; Burberry’s first-half 2014 profit fell 12.4% YoY and Richemont’s first-half 2014 operating profit also dropped 4% YoY. China Business News Daily