Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

AmazonFresh Set For UK Shores? We could write about Amazon on this page every week, such is the constant stream of news and innovation coming from the company. We usually show some restraint, but we will turn to the company this week to look at the prospects for its reported extension of AmazonFresh grocery service into the UK market—a grocery market that is already in a state of turmoil. Earlier this month, Amazon signed a 10-year lease on a former Tesco warehouse in Surrey, near London. The deal for the 305,000 sq. ft. warehouse fueled speculation that Amazon was set to launch its grocery operation in Britain. It is not the first time a European launch has been rumored. In 2014, there was expectation of a German launch for AmazonFresh, but that did not transpire. If AmazonFresh does launch in the UK, it will be entering the most mature and competitive online grocery market in the West. Internet sales accounted for around 6% of UK grocery spend in 2014, according to Kantar Worldpanel. In proportional terms, that is not much—but it is 6% of a large total market. And, of course, it is a channel that is growing fast: in June 2015, UK food retailers’ Internet sales grew 13% year over year, according to the UK’s Office for National Statistics.

So far, this has been a channel dominated by store-based retailers. Ocado is the only British grocery Internet pure play of note, but it trails Tesco, Asda and Sainsbury’s in online market share, Kantar Worldpanel says.

So it is the big grocery players who stand to lose out if Amazon enters the market. If it does, we can be sure it will offer a proposition designed to delight customers and infuriate rivals. And it is evident that turning a profit is not Amazon’s first priority, so the company is likely to subsidize its grocery operation in a bid to gain share.

The biggest UK grocers are already facing upheavals, primarily due to international invaders: the rapid growth of German discounters Aldi and Lidl has hit the big British grocers hard, and forced them into a price war to compete for frugal shoppers. Food-price deflation and falling sector sales have been the results of this fierce competition.

Aldi and Lidl have wrought havoc in the UK with a combined market share of less than 10%. This shows how smaller players can disrupt major, established players, especially in a market as volume-sensitive as grocery.

The UK grocery retailers, already in the middle of major upheavals, will undoubtedly be watching any Amazon venture keenly, and they will be right to do so.

If AmazonFresh does launch in the UK, it will be entering the most mature and competitive online grocery market in the West. Internet sales accounted for around 6% of UK grocery spend in 2014, according to Kantar Worldpanel. In proportional terms, that is not much—but it is 6% of a large total market. And, of course, it is a channel that is growing fast: in June 2015, UK food retailers’ Internet sales grew 13% year over year, according to the UK’s Office for National Statistics.

So far, this has been a channel dominated by store-based retailers. Ocado is the only British grocery Internet pure play of note, but it trails Tesco, Asda and Sainsbury’s in online market share, Kantar Worldpanel says.

So it is the big grocery players who stand to lose out if Amazon enters the market. If it does, we can be sure it will offer a proposition designed to delight customers and infuriate rivals. And it is evident that turning a profit is not Amazon’s first priority, so the company is likely to subsidize its grocery operation in a bid to gain share.

The biggest UK grocers are already facing upheavals, primarily due to international invaders: the rapid growth of German discounters Aldi and Lidl has hit the big British grocers hard, and forced them into a price war to compete for frugal shoppers. Food-price deflation and falling sector sales have been the results of this fierce competition.

Aldi and Lidl have wrought havoc in the UK with a combined market share of less than 10%. This shows how smaller players can disrupt major, established players, especially in a market as volume-sensitive as grocery.

The UK grocery retailers, already in the middle of major upheavals, will undoubtedly be watching any Amazon venture keenly, and they will be right to do so.

Source: Reuters

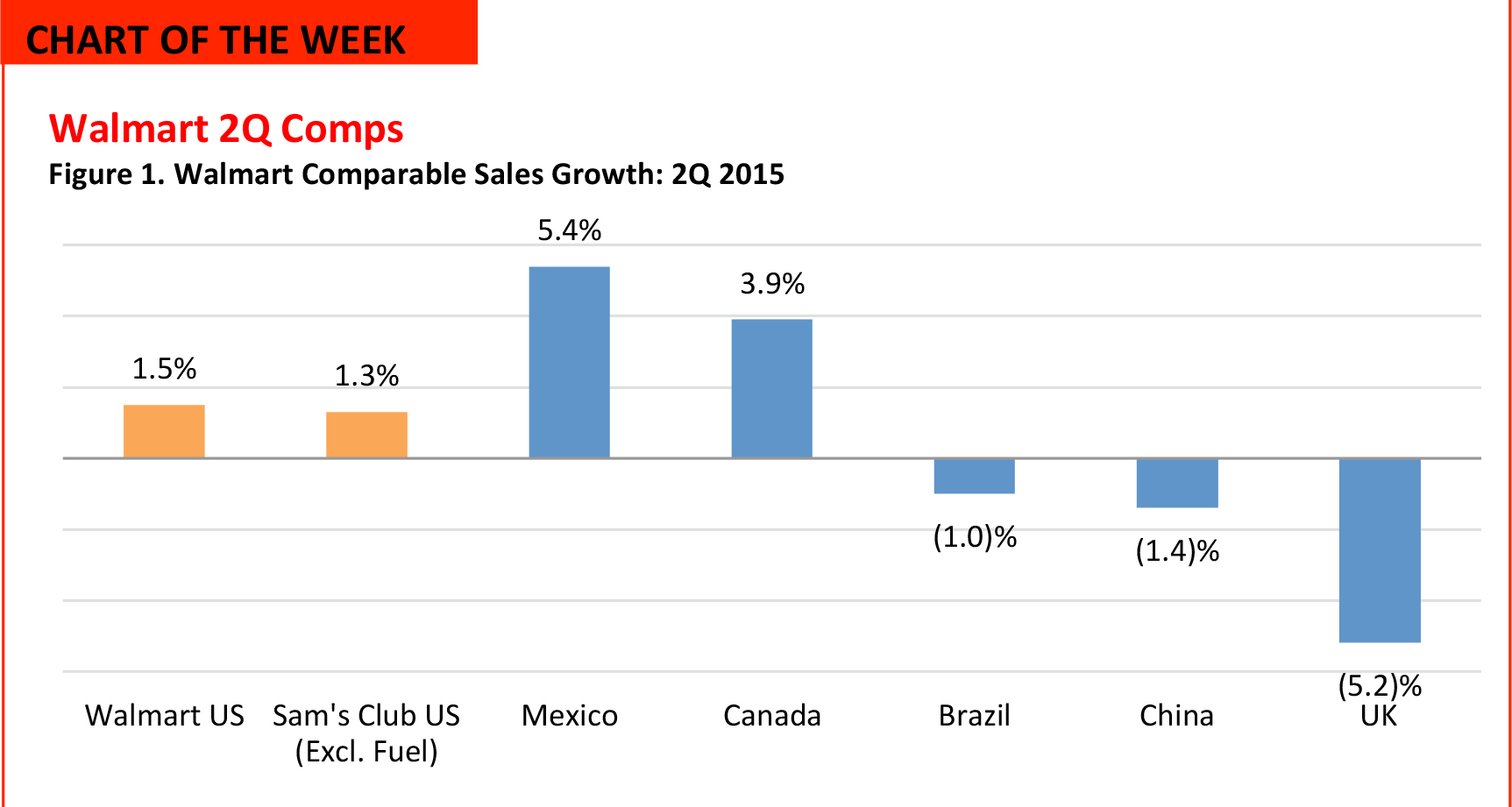

Source: Walmart

- A solid quarter for Walmart in the US and strong performance in some international markets were partially offset by weakness in Brazil, China and the UK.

- Walmart said the economic environment proved challenging in Brazil, but that it had outperformed the market; sales were impacted by a tough comparison due to the occurrence of the World Cup soccer tournament last year.

- In China, Walmart noted headwinds from slower economic growth and said it continued to outperform the market, gaining share in hypermarkets and maintaining share in the modern trade channel.

- In the UK, Walmart’s Asda subsidiary had a very weak quarter, with total sales down 4.1% in the context of grocery price wars. The company said comp declines had been driven by declining traffic, especially in fresh food categories. Asda’s CEO Andy Clarke predicted that this quarterly slump was the “nadir” for Asda.

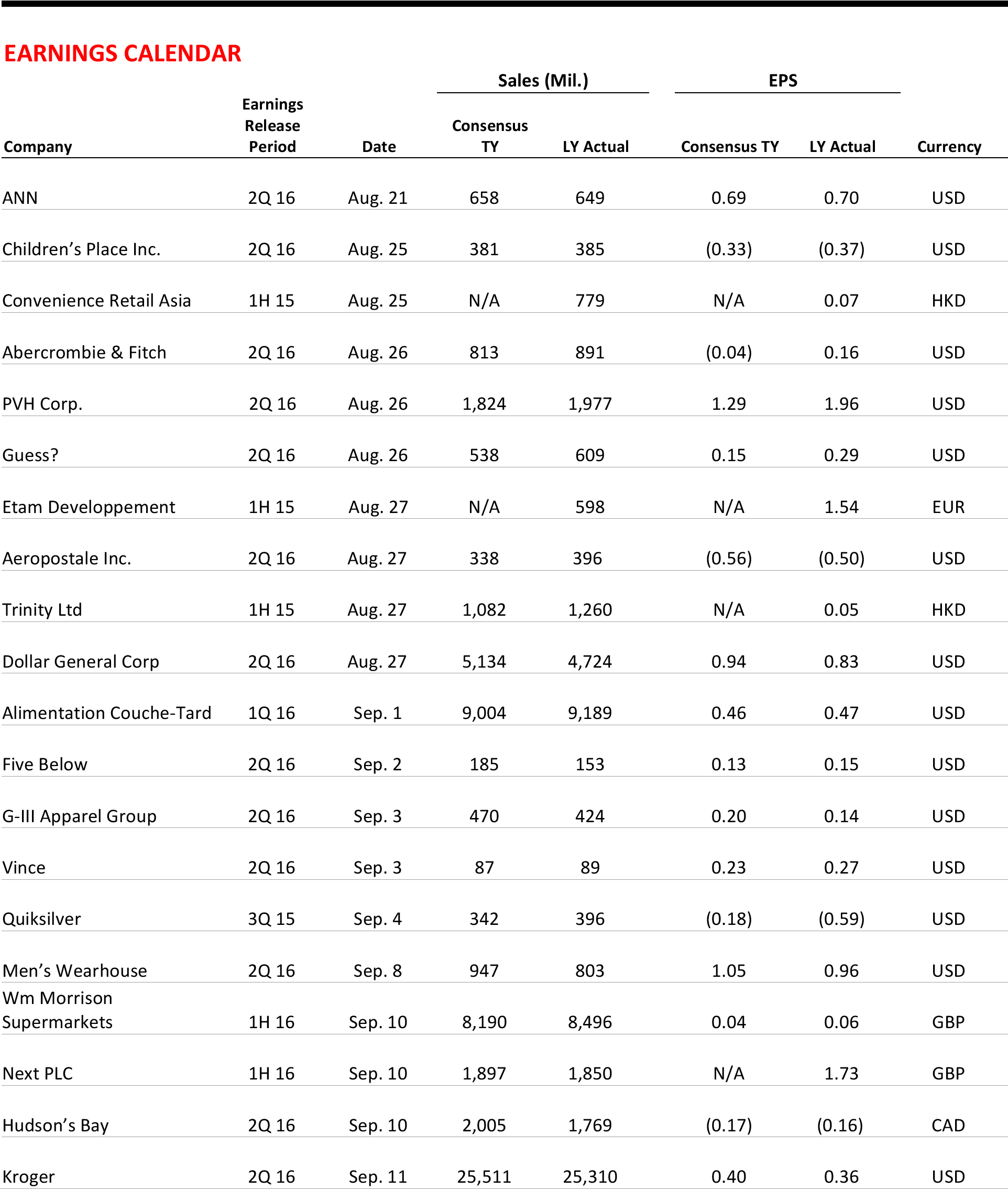

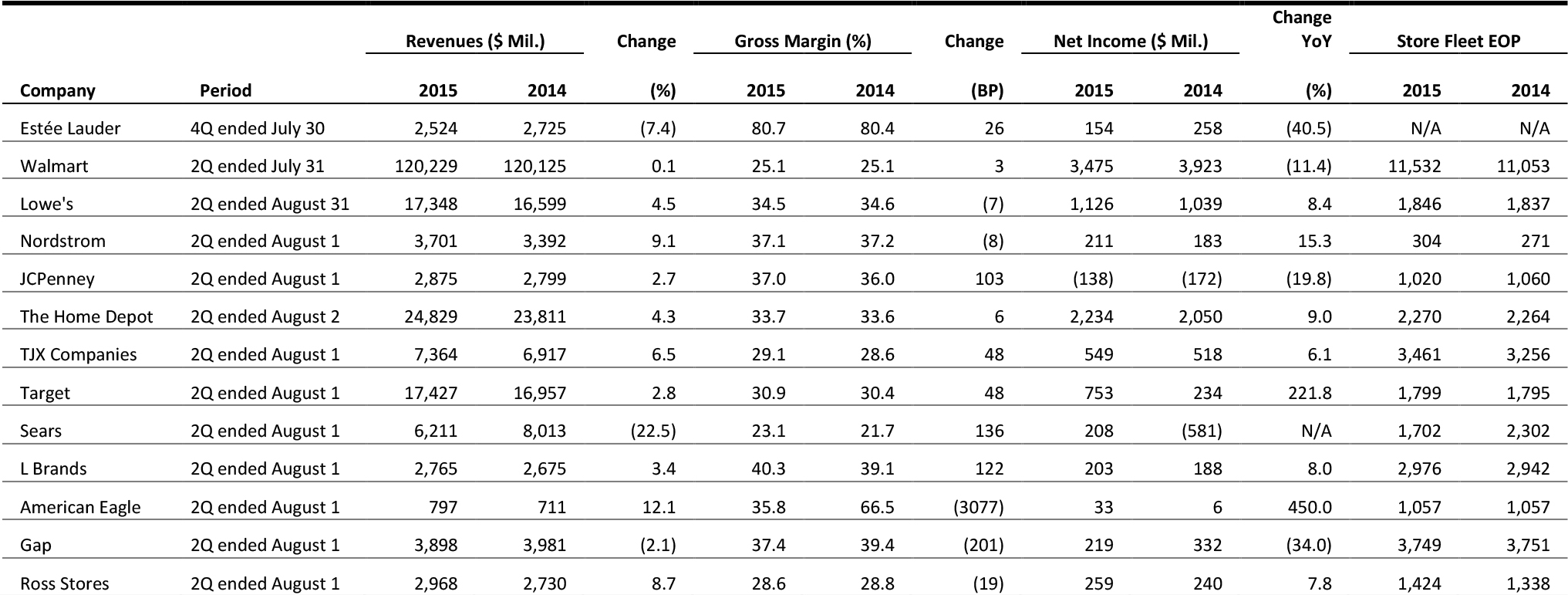

US RETAIL EARNINGS

Source: Company reports

Target Elevates Mulligan to COO and Hires New CFO

(August 17) Women’s Wear Daily

Target Elevates Mulligan to COO and Hires New CFO

(August 17) Women’s Wear Daily

- John Mulligan, current CFO of Target, will move to a new role as Executive Vice President and COO, effective September 1. Mulligan has been the CFO of Target since 2012.

- The company hired Cathy Smith as its new CFO. Smith was previously CFO of Express Scripts and served in various roles at Walmart International and GameStop.

QVC to Aquire Zulily for $2.4 Billion

(August 17) The Wall Street Journal

QVC to Aquire Zulily for $2.4 Billion

(August 17) The Wall Street Journal

- Television shopping network QVC is buying flash-sales e-tailer Zulily for $2.4 billion. This price is equivalent to a 49% premium to Zulily’s $12.57 closing price prior to the announcement. The offered price is lower than the $22 per share price that was offered when Zulily went public.

- Zulily will continue to be run by its current management. QVC President and CEO Michael George mentioned that the goal of this acquisition was to accelerate growth.

- Kohl’s announced that it will reveal the LC Lauren Conrad Runway Collection during a runway show on Wednesday, September 9. Customers will be able to view the collection via a shoppable livestream on LCRunway.com.

- The chic, vintage-inspired collection includes apparel, shoes, handbags, jewelry and sunglasses for $12 to $200. The collection will be available during a limited time at Kohl’s stores and on Kohls.com.

Amazon Expected to Launch New Click-and-Collect “Flex Service”

(August 18) Retail Week

Amazon Expected to Launch New Click-and-Collect “Flex Service”

(August 18) Retail Week

- Tech blog GeekWire discovered a “confidential” new Amazon facility that will likely be used to launch Prime Now one-hour delivery in the Seattle area, in addition to a completely new service called “Amazon Flex.”

- Signs inside the facility indicate Amazon Flex will likely allow customers to pick up items themselves from the Prime Now center.

- Abercrombie & Fitch announced a new leadership team on August 18. The company tapped into talent pools from a wide range of companies, including Club Monaco, Jack Spade, PVH and Carter’s.

- The company created six new positions, part of a strategy to organize executives by brand, rather than by product. All but one of the new positions will be filled by recently hired outsiders; they include Kurt Hoffman, General Manager for the men’s division (who joined from Club Monaco in March); Amy Sveda, General Manager for the kids’ division (who joined from Carter’s in May); and Kristina Szasz, Head of Design for the women’s division (who joined from PVH in September 2014).

ASIA HEADLINES

BuzzFeed Expands Further into Asia with Yahoo Japan

(August 18) TNW News

BuzzFeed Expands Further into Asia with Yahoo Japan

(August 18) TNW News

- BuzzFeed announced that it is partnering with Yahoo Japan to bring localized, shareable content to readers in Japan.

- With its other international launches (Brazil, the UK, France, Australia, India, Germany, Mexico and Canada), BuzzFeed has maintained complete ownership of its operations. This deal, however, will be a joint venture with Yahoo Japan that will harness the latter’s expertise in localizing content.

- South Korea’s LG Display said it would focus investment on organic light-emitting diode (OLED) displays, as it expects the technology to steer clear of price wars and help the company stay ahead of the competition.

- LG Display and sister firm LG Electronics have been the biggest proponents of OLED, which boasts improved color rendition and lower power consumption. LG Display hopes early investment in OLED will help it dominate when the technology becomes mainstream.

European Social Media App Plag** Wants to Gain 1 Million Users in Southeast Asia

(August 17) e27.co

European Social Media App Plag** Wants to Gain 1 Million Users in Southeast Asia

(August 17) e27.co

- Launched in November 2014, 60% of Plag** users come from Europe, where the app claims it signed up 100,000 users within its first six weeks. The Lithuanian startup debuted in the Asian market in Japan, where 10% of its users currently reside. The company plans to further expand to Southeast Asia and targets 1 million users in the region within the next year.

- Laura Kornelija, Marketing and Business Development Manager of Plag**, says, “We are offering the chance to interact directly with absolutely anyone in the world by eliminating ‘following’ or friend lists.”

- Singapore-based mobile games studio iCandy Interactive announced that it received Australian Securities & Investments Commission approval for an IPO on the Australian Stock Exchange at the end of September.

- iCandy is looking to raise up to A$3.5 million (US$2.6 million), or A$4.5 million (US$3.3 million) if oversubscription is factored in, over a market capitalization of A$45 million (US$33.1 million).

- Infinium Robotics has been anticipating a proliferation of drones, and Google and Amazon have been looking to employ drones to deliver goods to customers.

- In preparation for the flourishing of drones, NASA’s Ames Research Center and the Silicon Valley Chapter of the Association for Unmanned Vehicle Systems International co-hosted a conference in the US last month. Infinium Robotics CEO Junyang Woon was invited to speak on one of the panels, which was also attended by Google and Amazon executives.

GrabTaxi Raises US$400 Million, Led by China’s Sovereign Wealth Fund

(August 14) TechinAsia

GrabTaxi Raises US$400 Million, Led by China’s Sovereign Wealth Fund

(August 14) TechinAsia

- Southeast Asia’s leading transportation app, GrabTaxi, has raised US$400 million in a funding round led by China Investment Corp., China’s sovereign wealth fund, according to The Wall Street Journal.

- GrabTaxi has been aggressively poaching Uber drivers for its own platform. Its app, though, is widely considered to be inferior to Uber’s app.

LeTV Announces Three New Smart Bikes, and It’s Taking Them Global

(August 14) TechinAsia

LeTV Announces Three New Smart Bikes, and It’s Taking Them Global

(August 14) TechinAsia

- In Beijing last week, Chinese company LeTV revealed its new smart bike, which comes in three different models.

- The bikes’ smart features include standard ones such as route mapping, speed tracking and light signals as well as more unique ones such as fingerprint identification, a smart lock and a push-to-talk two-way radio that lets riders communicate with other riders nearby.

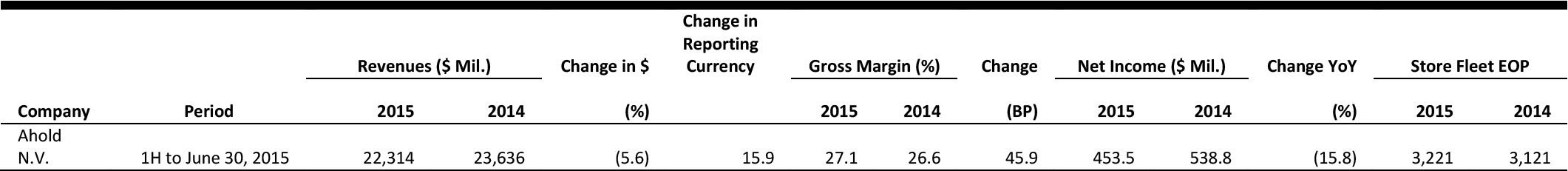

EUROPEAN RETAIL EARNINGS

Source: Company reports

UK Retail Footfall Growth Highest in 11 Years

(August 12) Ipsos-RetailPerformance.com

UK Retail Footfall Growth Highest in 11 Years

(August 12) Ipsos-RetailPerformance.com

- UK retailers saw a 3.7% rise in footfall in July, according to the Retail Traffic Index compiled by global consultancy Ipsos Retail Performance. This was the highest year-over-year rate in any month in 11 years.

- The index is derived from the number of shoppers entering over 4,000 nonfood retail stores in the UK. The first week of July began strongly, with footfall at its highest point since the final week of 2014; the upward trend continued through the month, making the last week of July the busiest of the year so far.

- Sainsbury’s unveiled a new website for its Tu clothing brand that allows customers to shop for the clothes online. Over 400 Sainsbury’s stores already sell a selection of Tu clothing, but only about 160 stores stock the full range. Tu was launched 10 years ago, and its sales have grown to £800 million (US$1,250 million).

- The new online shop offers womenswear, menswear and childrenswear that can be bought for next day delivery, standard delivery or click-and-collect. Shoppers who choose the click-and-collect option will be able to pick up purchased goods from about 710 stores, including 112 convenience stores.

- Wm Morrison is close to selling M Local, its convenience store division, to investment firm Greybull. About 150 of the M Local stores, which generate more than £300 million (US$469 million) in sales, are likely to be sold to the investor.

- Greybull’s bid was preferred over that of rival investor Alteri, which had shown interest in buying BHS earlier this year. Greybull is expected to complete the takeover process with the support of an experienced industry team, and to supply sizeable working capital to the division.

- Asda nose-dived to its worst quarterly sales performance in the 16 years it has been owned by US retail giant Walmart. Comparable sales declined by 4.7% in the 11 weeks ending June 30, after a fall of 3.9% in the previous quarter.

- Asda, along with rivals Sainsbury’s and Tesco, is in the midst of a price war that began when hard discounters Aldi and Lidl lowered their prices. Asda CEO Andy Clarke remarked that although Asda’s focus is on price, it will highlight other factors, such as quality and service, to its customers.

- British fashion retailer Austin Reed announced plans to close its Regent Street flagship store, following the closure of 31 stores earlier this year. The sale is estimated to bring in over £20 million (US$31 million).

- It is rumored that Mango, which occupies the neighboring premises, has shown interest in the property and that Uniqlo may be interested as well. Austin Reed has been burdened with financial debt and reached a voluntary agreement with its landlords in January to sell the property.

LATAM HEADLINES

- Chile’s economy expanded by 1.9% year over year in the second quarter, largely thanks to strength in services and construction.

- Domestic demand increased by 2% in the quarter, driven by consumer spending.

- Moody’s Investors Service predicted 2016 growth of near the median of its peers, along with a low debt burden and the strongest fiscal positions of any sovereign issuer globally.

Lindt to Open Six Brazilian Stores by the End of the Year

(August 18) Bloomberg

Lindt to Open Six Brazilian Stores by the End of the Year

(August 18) Bloomberg

- Lindt & Sprüngli, the world’s largest maker of premium chocolate, plans to open six stores in Brazil in advance of the 2016 Olympics.

- The chocolate maker has already opened nine shops in Brazil this year, including two in Rio de Janeiro.

- Lindt has also already opened 20 shops this year in Switzerland, the US, Canada, Germany and Australia, and it plans to open another 20–30 new stores per year.

- Colombia’s prospects look the brightest of the Latin American countries, which are suffering from declining commodity prices, slowing growth and broadening corruption scandals.

- Colombia led the region in terms of GDP growth in 2014, with 4.6% growth, which is expected to slow to 3.2% this year.

- The yields on the country’s debt remain stable, however, suggesting that the currency situation is likely to stabilize, that exports should recover and that economic growth should pick up again.

Several Latin American Countries Struggling Against Inflation

(August 16) The Wall Street Journal

Several Latin American Countries Struggling Against Inflation

(August 16) The Wall Street Journal

- Inflation in Latin America this year is expected to run at three times the average rate for emerging markets, according to Barclays’ estimates.

- Brazil’s inflation rate is running at 9.6%, Uruguay’s is at 8.5% and Argentina’s is expected to exceed 30%.

- After Venezuela’s inflation rate hit 68% last December, the country stopped publishing official estimates, and markets are pricing in a 98% chance that the country will default on its sovereign debt in the next five years, according to Barclays.

US Fast-Food Chains See Opportunities in Brazil

(August 14) The Wall Street Journal

US Fast-Food Chains See Opportunities in Brazil

(August 14) The Wall Street Journal

- Chains including Subway, Domino’s Pizza, Dunkin’ Donuts, Johnny Rockets, McDonald’s, Outback and Sbarro are opening new outlets in Brazil.

- The chains are benefiting from Brazil’s economic weakness, and they are signing up new franchisees, negotiating favorable leases and expanding while peers are consolidating.

- Despite Brazil’s status as one of the largest beef producers, restaurant chain Outback is the number-one foreign chain visited by Brazilians, and the company plans to add another dozen outlets to its 64 existing restaurants in Brazil.