Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

FBIC had the opportunity to attend the inaugural two-day RISE conference in Hong Kong held at the Hong Kong Convention and Exhibition Centre on July 31 and August 1. The conference was organized by Ci Labs, which produces WebSummit, Europe’s largest tech conference. RISE was the first large-scale tech event in Asia and somewhat of an experiment to test the vibrancy of the regional tech scene.

With 5,000 attendees and 525 start-ups displaying over two days, representing 72 countries as far afield as Colombia and Nigeria, RISE was a success by any measure. The conference’s status was confirmed by the presence of the heaviest hitters from Asia (Xiaomi, Alibaba, Baidu and SoftBank) as well as from the US (Sequoia Capital, Google, Facebook, Amazon, and 500 Startups) and by attracting hot start ups from around the world such as Glow, Stripe, and Freshdesk.

With all of these power players in one place, there was a steady stream of news and announcements:

FBIC had the opportunity to attend the inaugural two-day RISE conference in Hong Kong held at the Hong Kong Convention and Exhibition Centre on July 31 and August 1. The conference was organized by Ci Labs, which produces WebSummit, Europe’s largest tech conference. RISE was the first large-scale tech event in Asia and somewhat of an experiment to test the vibrancy of the regional tech scene.

With 5,000 attendees and 525 start-ups displaying over two days, representing 72 countries as far afield as Colombia and Nigeria, RISE was a success by any measure. The conference’s status was confirmed by the presence of the heaviest hitters from Asia (Xiaomi, Alibaba, Baidu and SoftBank) as well as from the US (Sequoia Capital, Google, Facebook, Amazon, and 500 Startups) and by attracting hot start ups from around the world such as Glow, Stripe, and Freshdesk.

With all of these power players in one place, there was a steady stream of news and announcements:

- Google for Work President Amit Singh commented that “desktop applications are on the way out, but there’s still more email than ever before.”

- Xiaomi launched the Mi Note (with the first one hand delivered in Hong Kong by Xiaomi VP Hugo Barra in an Uber).

Those attendees not trying to wedge their way into the talks and pitch contests could walk the floor. Presentation booths were loosely arranged by development stage of the start-up, either “Alpha” or “Enterprise.” This made for some interesting combinations: a company that turns waste palm oil into coal (NextFuels) presented next to a start-up that automates bespoke tailor orders to factories (Bespokify). But all the start-ups were looking for the same things: investors and validation of their concepts. Based on the feedback, there were enough positive conversations with potential investors to make trips from afar on tight startup budgets worthwhile for most, although some presenters from Tokyo, Beijing and elsewhere asked, “Why don’t we have this in my city?”

After two intense and immensely exciting days, it is clear that RISE had tapped into a huge swell of start-up interest in Asia. The organizers promised to be back in Hong Kong next year and we are already looking forward to what the conference will have to offer in twelve months’ time.

.

Those attendees not trying to wedge their way into the talks and pitch contests could walk the floor. Presentation booths were loosely arranged by development stage of the start-up, either “Alpha” or “Enterprise.” This made for some interesting combinations: a company that turns waste palm oil into coal (NextFuels) presented next to a start-up that automates bespoke tailor orders to factories (Bespokify). But all the start-ups were looking for the same things: investors and validation of their concepts. Based on the feedback, there were enough positive conversations with potential investors to make trips from afar on tight startup budgets worthwhile for most, although some presenters from Tokyo, Beijing and elsewhere asked, “Why don’t we have this in my city?”

After two intense and immensely exciting days, it is clear that RISE had tapped into a huge swell of start-up interest in Asia. The organizers promised to be back in Hong Kong next year and we are already looking forward to what the conference will have to offer in twelve months’ time.

.

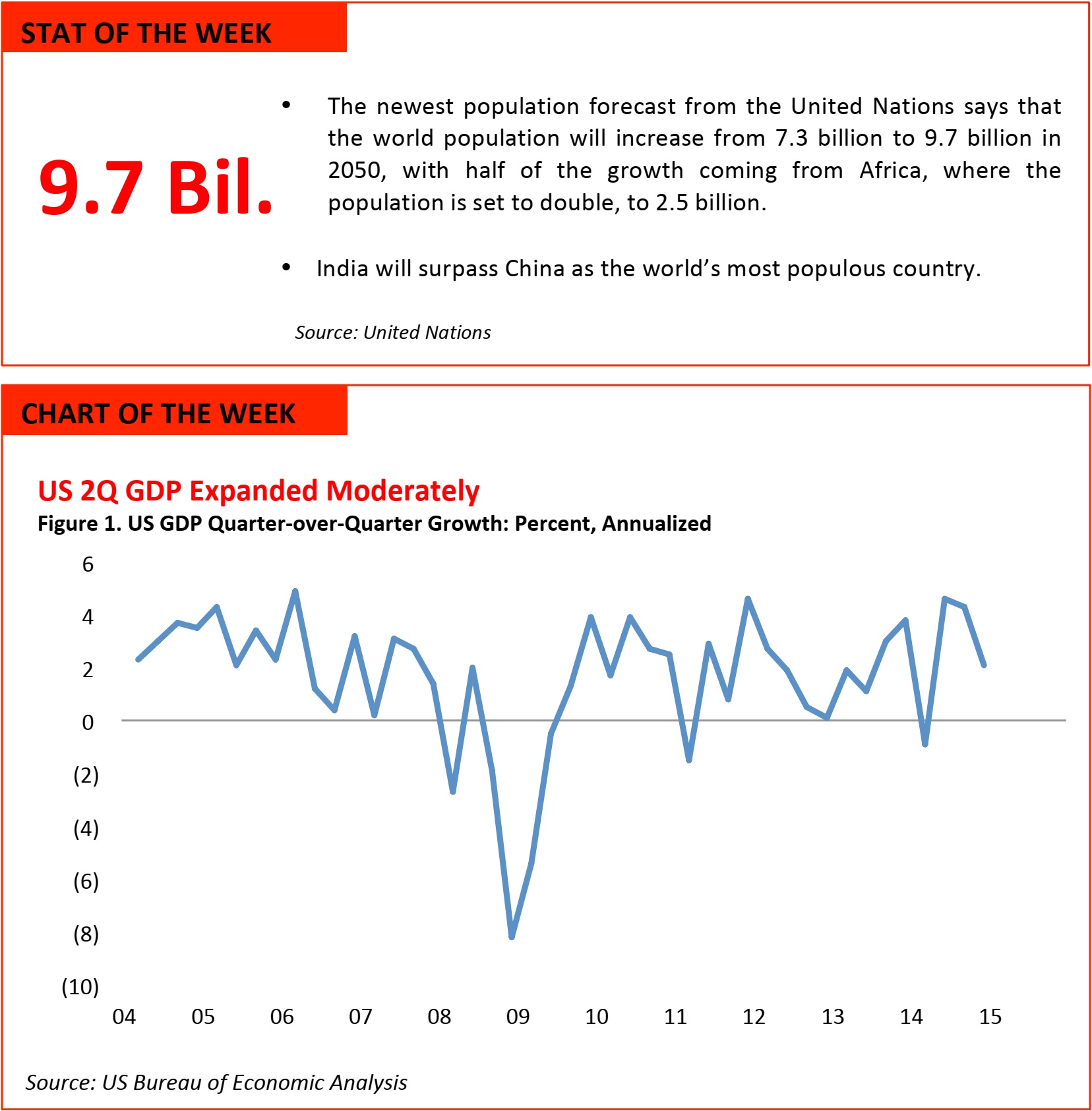

- US GDP grew at a seasonally adjusted annual rate of 2.3% in the second quarter of 2015, missing economists’ estimate of 2.7% growth. First-quarter growth was revised up, to 0.6%, from a contraction of 0.2%.

- The recent figures follow a post-recession pattern of a slow start in the first half and a slight bounce back in the second half. So far, GDP has grown at a year-to-date rate of 1.5%, versus 1.9% during the same period last year.

- Slow consumer spending and the rising dollar drove the overall moderate growth.

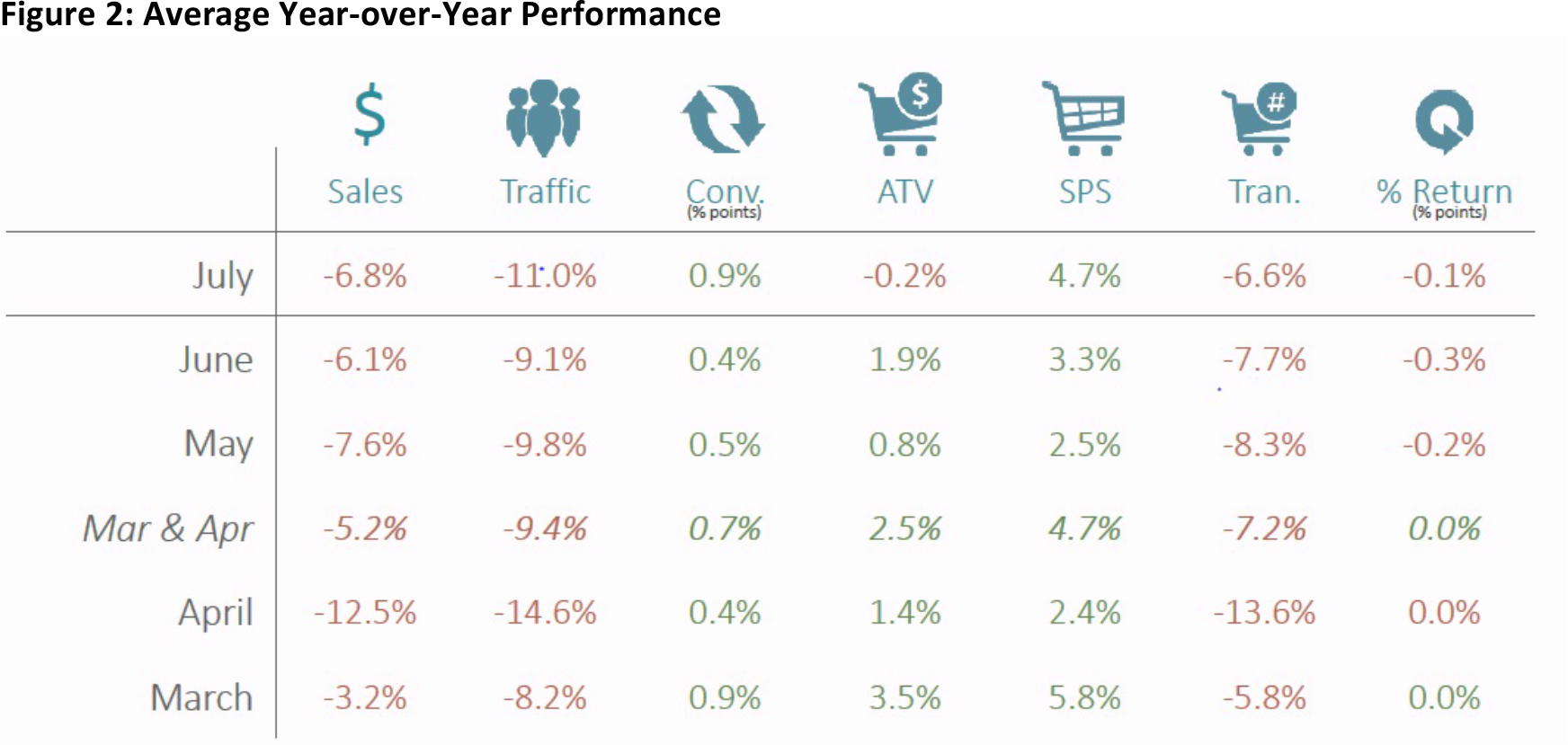

July US Retail Traffic Performance

Source: RetailNext

- July sales showed an uptick in sales per shopper of 4.7%, a significant improvement from June’s 3.3%.

- However, the average transaction value dropped by 0.2%, driven by the fourth week of the month, when most metrics dropped.

- The South experienced a traffic decline of 9.8% and a sales decline of 5.3%. Sales per shopper exhibited the largest regional increase, 5.1%.

- The Northeast faced the steepest decline in traffic, which fell 13.9%, and in sales, which fell 11.3%. Sales per shopper in the region experienced a relatively strong increase of 3.2%. The Northeast faced very warm temperatures relative to previous years.

US RETAIL EARNINGS

US RETAIL HEADLINES

- Marvin Ellison officially took over as CEO at JCPenney this past Saturday. He is the company’s third CEO in four years. Ellison had been working side-by-side with the outgoing CEO for the last 10 months as President, CEO designee and board member to ensure a smooth transition.

- Ellison has been tasked with hitting $1.2 billion in EBITDA (earnings before interest, taxes, depreciation and amortization) by 2017. He was previously executive vice president of US stores at Home Depot.

- Walmart is in advanced talks to open big-box stores in Nigeria’s economic hub in Lagos. Walmart’s top EMEA executive, Shelley Broader, recently met the state governor of Lagos.

- The megacity has over 21 million people, 4 million of whom are middle-class. Walmart currently has operations in 13 African countries, including Nigeria. Nigeria doesn’t have any other large retail chains aside from South African retailer Shoprite, which has been in the country since 2005 and operates 12 stores.

- JCPenney has hired top talents from Home Depot and Target to strengthen its online presence. Michael Amend, formerly vice president of online, mobile and omnichannel at Home Depot, joined JCPenney as EVP of omnichannel on August 4.

- Mike Robbins, formerly Target’s SVP of global supply chain, will assume a similar supply chain role at JCPenney on August 10. These appointments follow Marvin Ellison’s move into the CEO role on August 1. Ellison is a veteran of both Home Depot and Target.

- Pretty Little Liars star Shay Mitchell signed a deal with Kohl’s to launch Fit to Wander, a collection of sports bras, graphic tees, fashion tanks and leggings for the back-to-school season. The line includes leggings with adjustable waistbands and bras with racer-back straps for a full range of motion.

- The leggings and sports bras are made from a polyester-Spandex blend called Wandertech.

- Neiman Marcus Group submitted a filing to securities regulators on August 3 that says it is preparing an IPO of up to $100 million. It has yet to work out details such as bankers, number of shares to be sold and price range for the offerings.

- A private equity firm acquired the luxury retailer for $6 billion from previous owners TPG and Warburg Pincus, which had owned the chain since 2005.

ASIA HEADLINES

Xiaomi Regains Top Spot in China’s Smartphone Market

(August 3) TechCrunch

Xiaomi Regains Top Spot in China’s Smartphone Market

(August 3) TechCrunch

- Figures from Counterpoint Research placed Xiaomi first in China’s smartphone market, with a 15.8% share, ahead of Huawei (15.4%), Apple (12.2%) and Vivo (8.1%), with Samsung fifth.

- While Apple lost the top spot, Canalys and Counterpoint Research both commented that it put in a strong quarter, considering that its flagship devices (the iPhone 6 and iPhone 6 Plus) are no longer new to the market.

- The Wall Street Journal first reported in June that Alibaba and Foxconn were in talks to jointly invest $500 million in Snapdeal, which was valued at approximately $5 billion. SoftBank was already Snapdeal’s largest shareholder, having poured $627 million into the company last fall.

- Flipkart holds a 44% slice of India’s $6.3 billion e-commerce market, according to Morgan Stanley. Snapdeal is in second place with a 32% share, while Amazon India holds 15%.

- China’s top Airbnb-like site, Tujia, secured its biggest round of VC funding to date, US$300 million. Cofounder and CEO Luo Jun relayed the news on his personal Weibo account (via QQ Tech).

- Luo added that Tujia, which started operations in 2011, is now valued at over US$1 billion, so it’s officially a start-up “unicorn.” It has raised a total of US$455 million from private investors in four major funding rounds.

- Sony is eyeing the selfie-taking market with its new Xperia C5 Ultra, which has a 13-megapixel camera on the front and rear of the device. The Xperia M5 is a slightly higher-end midrange device; it’s a waterproof smartphone with a 13-megapixel front-facing camera and a 21.5-megapixel main snapper.

- A drawback of both devices is that they ship with only 16GB of storage, only 10GB of which will actually be available for use. To compensate for this, both devices’ USD cards will support up to 200GB of additional storage.

- The Associated Press reported that the Tokyo Metro Police arrested 30-year-old Mark Karpeles on suspicion of falsifying financial records in the Mt. Gox computer system in order to inflate his own bank account by $1 million.

- Karpeles allegedly fiddled with the bitcoin exchange’s systems in 2013. If found guilty, he could face up to five years in prison or a fine of up to ¥500,000 (US$4,000). Last year, Mt. Gox shut its doors without warning, leaving upwards of 850,000 bitcoin belonging to traders missing in action.

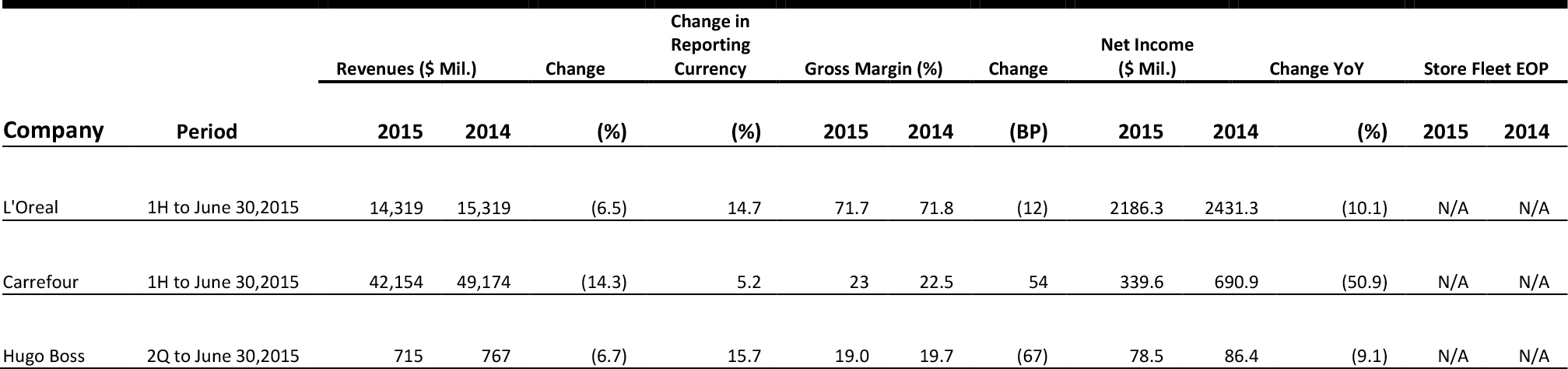

EUROPEAN RETAIL EARNINGS

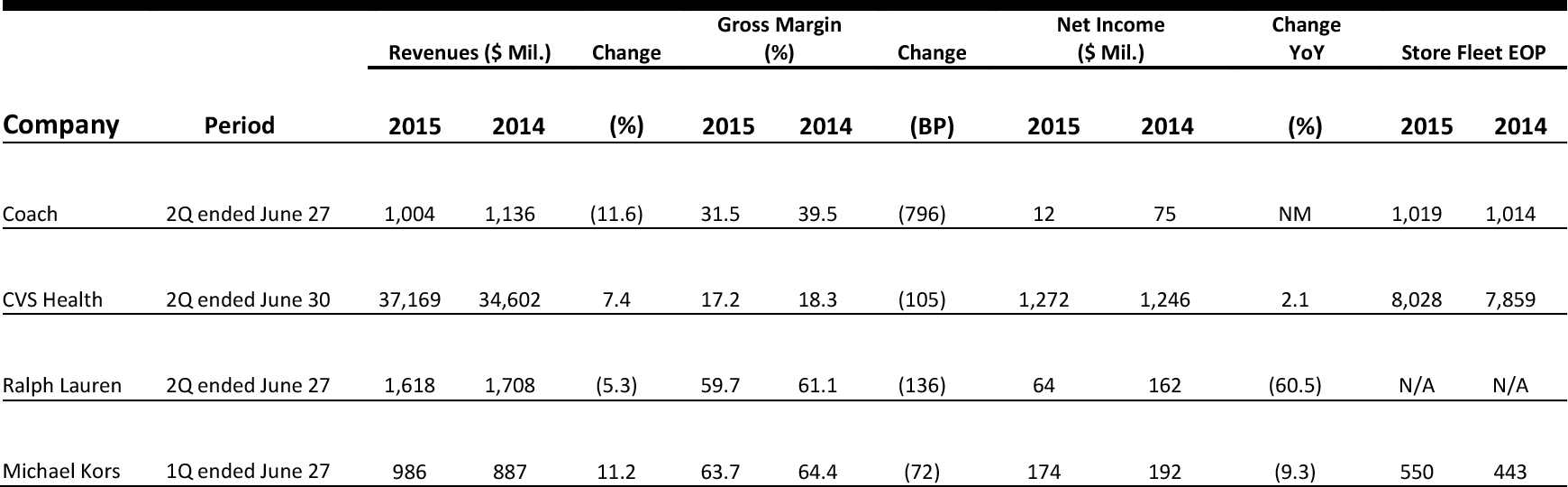

*Net income is from continuing operations. Source: Company reports

EUROPEAN RETAIL HEADLINES

- Louis Vuitton’s monogram bags and Bulgari jewels drove up LVMH’s revenue by 9% in the second quarter despite a dismal performance in Asian markets. Total revenues were up 23%, to €8.38 billion (US$9.27 billion). For the first half of the year, profit from continuing operations climbed 15%, to €2.95 billion (US$3.30 billion), and net profit rose 5%, to €1.58 billion (US$1.76 billion).

- Region-wise, in the second quarter, organic growth in Asia-Pacific excluding Japan dropped by 5%. However, growth in Japan, the US and Europe rose 34%, 12% and 14%, respectively. The group did not give explicit guidance for the second half of the year, stating only that it will increase its global leadership position in luxury goods.

- Celesio, owner of LloydsPharmacy and Sainsbury’s, announced that LloydsPharmacy will acquire the Sainsbury’s pharmacy business for £125 million (US$195 million). Through this strategic partnership, Sainsbury’s will also receive commercial rent payments from LloydsPharmacy for each location.

- LloydsPharmacy will acquire 281 pharmacies, 277 of which are in-store and four of which are in hospitals. These will be rebranded as LloydsPharmacy, and approximately 2,500 Sainsbury’s pharmacy employees will be transferred to the acquirer. The deal is likely to be completed by the end of February 2016.

- Etsy, the online marketplace for handmade items, is set to launch in Selfridges and will form part of the “festive concept space” at the store, which will run from October 22 until Christmas. The two-month partnership might become more permanent if the venture turns out well. Etsy already has 30 permanent locations in Nordstrom stores in the US.

- Selfridges’ Ultralounge will be transformed into the Astrolounge concept space, and Etsy will stock products based on Selfridges’ theme of “Journey to the Stars.” Etsy sellers will sell astrology-themed products such as dream catchers and astrological prints and pincushions to emulate the moon and planets. The sellers might also conduct live crafting sessions.

- Carrefour reported stronger-than-expected operating profit for the first half of the year. Operating profit rose 2.6%, to €726 million (US$794 million), at constant exchange rate. Its shares were up 0.34% on the day of the announcement and outperformed a stagnant European retail sector. Revenues for the period increased to €37.7 billion (US$58.75 billion), with 2.9% growth in organic sales.

- Europe accounts for 73% of Carrefour’s sales, and the operating profits for the region, excluding its home market of France, tripled in the first six months of the year. However, operating profit in France fell by 20.9%. The CEO stated that Carrefour was on a “sustainable” course to recovery, as Europe contributed significantly to earnings and the Latin American business was bearing up well through a slowing economy.

- Fashion house Balenciaga announced in a statement that its contract with designer Alexander Wang will not be renewed beyond its initial term, and that it was a joint decision. Balenciaga gave no specific reasons for the split, but Wang implied that he wanted to focus on his brand in New York.

- The statement also indicated that Wang’s last show will be the Balenciaga spring 2016 show during Paris Fashion Week in October, and that a new creative director will be announced “in due course.”

- Ikea is set to open its first store in Morocco before the end of this year and plans to open five more in the country. The Swedish retailer has already hired staff and nearly 300 people will work at the store.

- Ikea is present in 44 countries globally, and in Morocco it will be competing with large furniture retailers such as Mobilia and Kitea. The first Ikea store will be in Zenata and the next one is set to open in the capital, Rabat. Ikea aims to reach over 10 million Moroccans through its expansion in the country.

- Hugo Boss reported net profit growth of 13%, to €70.6 million (US$77.3 million), in the second quarter, and sales rose 16%, to €647 million (US$709 million), driven mainly by strong retail and online sales. The German fashion company’s strategy of expanding its own-store network boosted sales in those stores by 12% while sales in other shops fell by 3%.

- The company also announced plans to open 65 new stores rather than 50 as previously announced and that it will move into a new property on London’s Regent Street that’s double the size of its current selling space. The CFO also stated that Hugo Boss plans to launch a new handbag in September that can be personalized in various colors and fabrics.

- Selfridges opened its Christmas shop at its flagship store this week. The store will stock more than 1,300 decorations and 60,000 baubles. With 143 days to go until Christmas, the store hopes to get the most out of trade from summer tourists.

- The shop will be on the fourth floor of the store and will occupy around 3,000 square feet initially before being doubled in size in autumn. The decorations will be based on black-and-white monochrome and iconic London themes, and will include personalized items.

LATAM HEADLINES

- Duty Free Americas (DFA) President Leon Falic expects 2% sales growth, to US$1.25 billion, in 2015, despite restrained Brazilian travel and spending.

- While sales of luxury goods are expected to remain soft, Falic expects sales of liquor and fragrances to more than offset the softness in luxury categories.

- Falic expects the slowdown in Brazilian travel to be somewhat offset by greater numbers of travelers from Asia, in particular business travelers from South Korea and China.

- Following 270 deployments in the UK, Telefónica plans to deploy its queue-management technology in Movistar mobile phone shops in Spain and Latin America.

- The cloud-based system enables retailers to manage customers’ store visits, including providing them with personalized updates via SMS, paper tickets or in-store displays.

- The system is currently being used in House of Fraser department stores in the UK and Ireland, as well as at restaurants such as Honest Burgers, Bodean’s BBQ and The Diner Bills.

- Éxito acquired an 18% stake (and 50% of voting shares) in Brazilian grocer Pão de Açúcar and a 100% stake in Argentina’s Libertad for US$1.8 billion, strengthening its presence in South America.

- Éxito completed the divestitures as part of a regional restructuring.

- Pão de Açúcar has revenues of US$27.8 billion from 2,100 super- and hypermarkets, and Libertad has revenues of US$495 million from 27 stores.

- GPA, Brazil’s largest retailer, recently reported progress in store renovations, rent reductions and locating new real estate.

- Despite weak demand, high interest rates and the highest inflation rate in 11 years, the company expects to show results from its cost-cutting program in upcoming months.

- GPA plans to invest US$28.6 million (R$100 million) this year to remodel its Extra supermarkets for higher profitability by reducing square footage for electronics and increasing the area for fresh fruits and vegetables and meats.

- On July 29, Brazil’s central bank raised its benchmark interest rate to 14.25% from 13.75%. It was the bank’s 16th raise since April 2013, and received a unanimous vote from its committee.

- The bank’s statement said that rates will be held high for a prolonged period in order to bring inflation down to its target rate of 4.5% by the end of 2016.

- The Brazilian inflation rate is currently 9.3% and forecast to decline to 9.2% at the end of 2015.