From the Desk of Deborah Weinswig

Walmart and JD.com Strengthen Partnership and Launch New 8/8 Shopping Festival

The past week brought news that Walmart and JD.com, China’s largest e-commerce company by revenue, are expanding the strategic partnership they formed last year. One element of this is the launch of a new shopping event—the JD-Walmart 8/8 omnichannel shopping festival—which will take place next week, on August 8. Here, we wrap up key points from the announcement.

Key Features of the Expanding Partnership

Inventory integration: Walmart and JD.com will roll out a jointly developed supply chain system to integrate inventory management. When an order is placed on JD.com, the system will analyze the inventory data of both companies and determine whether to deliver from the closest Walmart or the closest JD.com warehouse. Pilot projects will be launched in six cities.

Store and platform integration: JD.com recently set up its first JD Home store, which mainly sells electronic products, inside a Walmart store in Shenzhen. JD.com is also establishing pickup stations at Walmart stores. Meanwhile, Walmart has launched five online stores on JD platforms, and 134 Walmart stores have joined the JD Daojia rapid delivery platform.

Customer integration: The two companies seek to integrate their customer bases with the launch of the joint 8/8 omnichannel shopping festival. To support the launch, customers shopping at any of the 400-plus Walmart stores in China since July 20 have been able to earn coupons for the 8/8 event by scanning a QR code in-store.

8/8: A “New Singles’ Day”

With promised savings, interaction and entertainment, 8/8 has more than an echo of Alibaba’s Singles’ Day shopping event. We have few details so far, even though it is less than a week away, but JD.com says that the event will offer savings across the various JD and Walmart channels as well as rewards for shopping on multiple channels. The event will feature a livestream broadcast from Walmart’s first US store and opportunities for shoppers to interact by sharing their experiences to earn rewards.

The companies say the 8/8 event will help Walmart reach 99% of the Chinese population covered by JD.com’s logistics network. JD.com is no doubt hoping that it reaps publicity and revenues akin to those generated by last year’s Singles’ Day,

when Alibaba enjoyed a 24% uplift in gross merchandise volume, which reached $17.8 billion.

What Does It Mean?

We see these as takeaways from the partnership:

- International retailers continue to see greater opportunities in China when they collaborate with local players. In particular, the Walmart-JD.com partnership confirms the extent to which major retailers must focus on marketplace websites in order to cater to Chinese shoppers.

- The cooperation is further evidence of retailers blurring channels—including in terms of inventory management—to serve customer demand for convenience and immediacy.

- The 8/8 event suggests that entertainment has a role at the heart of retailing.

Source: Company reports

US RETAIL & TECH HEADLINES

Study: Majority of Retailers Feel “Vulnerable” to a Data Breach

(August 1) Chain Store Age

Study: Majority of Retailers Feel “Vulnerable” to a Data Breach

(August 1) Chain Store Age

- While the number of cyberattacks has declined in the last year, a majority of companies still feel susceptible to data threats. This is according to the 2017 Thales Data Threat Report, Retail Edition, from Thales e-Security and analyst firm 451 Research. The study is based on responses from more than 1,100 senior security executives, including in the retail segment, from across the globe.

- According to data, 52% of companies experienced a data breach in the past, and 88% fear they are vulnerable to a cyberattack. Meanwhile, 19% stated they are “very” or “extremely” vulnerable.

On the New Playing Field in Retail, Under Armour Takes a Hit

(August 1) The Wall Street Journal

On the New Playing Field in Retail, Under Armour Takes a Hit

(August 1) The Wall Street Journal

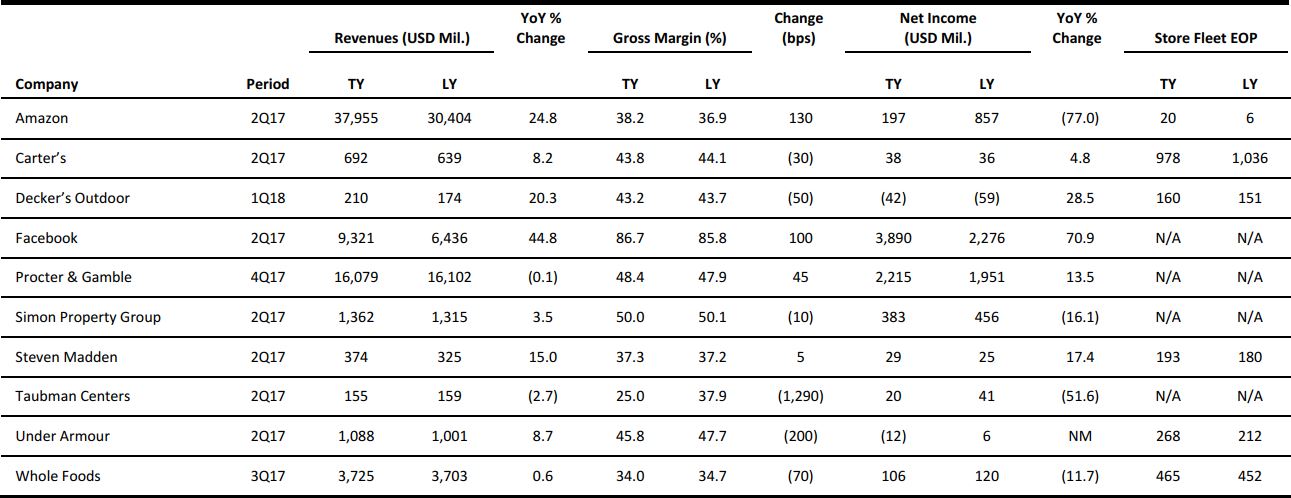

- Under Armour is cutting almost 2% of its work force and it lowered its full-year revenue outlook, overshadowing a strong second quarter and amplifying the pitfalls now facing companies across the retail sports sector.

- It may be an even tougher path for the Baltimore company, which has grown phenomenally in recent years and may now be suffering some growing pains. Under Armour now expects full-year revenue growth of 9%–11%, down from a previous outlook of 11%–12% growth.

Office Depot in Talks to Take over Staples

(July 31) PYMNTS.com

Office Depot in Talks to Take over Staples

(July 31) PYMNTS.com

- There have been further talks of Office Depot potentially engulfing Staples’ brick-and-mortar locations. Staples was acquired by Sycamore Partners for $6.9 billion about a month ago. With 1,500 Staples store locations at its disposal, Office Depot would take the reins on possibly the largest big-box office supply retail chain in the country.

- The latest talks stemmed from Staples’ June public filing, in which it revealed that there were two parties involved in the bidding war to snap it up. Despite Office Depot’s $625–$700 million offer, Sycamore Partners won the battle.

Retail Discounters Flourish as Traditional Department Stores Struggle

(July 31) Marketplace.org

Retail Discounters Flourish as Traditional Department Stores Struggle

(July 31) Marketplace.org

- Off-price retailers have become a bright spot amid the doom and gloom of widespread closures of brick-and-mortar stores and online shopping’s growing dominance. T.J. Maxx, Ross and others are expanding at a time when legacy department stores are shuttering locations. And discounters and shoppers who feel like they scored a deal are not the only ones benefiting from the new retail landscape.

- Wholesale distributors that help stock the shelves of places such as Dollar General and Marshalls are also reaping big rewards. These days, off-price retailers order some merchandise specifically made for them.

Private Equity Takes Fire as Some Retailers Struggle

(July 30) The Wall Street Journal

Private Equity Takes Fire as Some Retailers Struggle

(July 30) The Wall Street Journal

- A wave of retail bankruptcies washing through the courts has revived an old debate about the role of private equity firms in accelerating the problems of companies in distress.

- Payless ShoeSource, Gymboree, Rue21 and True Religion were all acquired by private equity firms during the past decade. Now, lawyers for creditors have questioned whether private equity firms share blame for the retailers’ financial collapse, in some cases by loading debt on the companies.

Source: Company reports/FGRT

EUROPE RETAIL HEADLINES

Aldi Nord’s Major Innovation Plan Approved

(July 27) RetailDetail.eu

Aldi Nord’s Major Innovation Plan Approved

(July 27) RetailDetail.eu

- Supermarket chain Aldi Nord announced that it plans to invest €5.2 billion (US$6.1 billion) to remodel all of its stores in Germany, Belgium and the Netherlands.

- This marks the retailer’s largest investment ever and, over the next few years, will result in every supermarket being remodeled to focus more on a customer-friendly experience, with a wider product range and more fresh food.

Morrisons Pens McColl’s Supply Deal

(August 1) Retail-Week.com

Morrisons Pens McColl’s Supply Deal

(August 1) Retail-Week.com

- British supermarket chain Morrisons has penned a wholesale deal to supply McColl’s convenience stores and newsagents across the UK. The deal will see Morrisons replace all of McColl’s existing supply arrangements.

- The “phased” deal will get under way in January 2018, with Morrisons set to supply McColl’s 1,000 convenience stores as well as its portfolio of 350 newsagents

American Eagle Outfitters Pulls Out of UK

(July 26) Retail-Week.com

American Eagle Outfitters Pulls Out of UK

(July 26) Retail-Week.com

- US fashion retailer American Eagle Outfitters has closed all three of its UK stores and is also understood to be shutting down its British e-commerce platform, less than three years after it launched operations in the country.

- According to Retail Week, the decision comes after the retailer struggled to gain a foothold in the ultracompetitive UK fashion market.

Ceconomy Becomes Largest Shareholder of Fnac Darty

(July 26) RetailDetail.eu

Ceconomy Becomes Largest Shareholder of Fnac Darty

(July 26) RetailDetail.eu

- Metro Group’s former consumer electronics division, Ceconomy, has acquired 24.3% of Fnac Darty’s shares for €453 million (US$535 million), with the option to fully acquire Fnac Darty in the next two years.

- The purchase will enable Ceconomy to appoint three board members and provides a major stepping-stone into the lucrative French market.

Sports Direct Increases Stake in French Connection

(July 27) FT.com

Sports Direct Increases Stake in French Connection

(July 27) FT.com

- British retailing group Sports Direct increased its stake in retailer French Connection from 11.3% to 27% in two stages this week. This is just below the point at which it would be required to make a takeover offer.

- Gatemore Capital Management subsequently sold its 8% stake in loss-making French Connection.

ASIA TECH HEADLINES

Women Gamers Outnumber Men on Mobile Blockbuster Honour of Kings

(August 1) Bloomberg.com

Women Gamers Outnumber Men on Mobile Blockbuster Honour of Kings

(August 1) Bloomberg.com

- Honour of Kings now boasts the highest proportion of female players for a hardcore or battle-arena mobile game title, genres still dominated by males. That success in roping in a long-neglected constituency is a big reason the title has become Tencent’s most profitable mobile game.

- Females accounted for 54.1% of users as of May, according to IDG Capital–backed Internet consultancy Jiguang. That outstrips the 35%-or-lower average for similar games on computers or consoles, as well as comparable mobile title Vainglory, according to industry consultancy Newzoo.

Xiaomi Secures $1 Billion Loan to Expand Its International Presence and Offline Retail Footprint

(July 29) TechCrunch.com

Xiaomi Secures $1 Billion Loan to Expand Its International Presence and Offline Retail Footprint

(July 29) TechCrunch.com

- Chinese smartphone maker Xiaomi has secured a $1 billion loan in order to develop its international focus and build out its offline sales presence. The loan is aimed at furthering Xiaomi’s key focuses as put forward by CEO Lei Jun this year. They include growing the company’s international footprint—Xiaomi now sells, or has sales partners, in more than 20 countries—and building out an offline presence.

- The company has opened 149 Mi Home stores in China and one in India, where it hopes to reach 100 stores over the next two years. The stores are aimed at fusing the online and offline commerce worlds to enable customers to get the best of both

Expedia Invests $350 Million in Traveloka to Create Southeast Asia’s Newest Unicorn

(July 28) TechCrunch.com

Expedia Invests $350 Million in Traveloka to Create Southeast Asia’s Newest Unicorn

(July 28) TechCrunch.com

- Expedia is deepening its focus on Southeast Asia following its investment of $350 million in Traveloka, an online travel portal based in Indonesia. A source close to the deal confirmed that the investment values Traveloka at more than $1 billion. That means the startup has joined the likes of Grab, Sea (formerly Garena), Go-Jek and Lazada in the region’s unicorn club.

- Traveloka was founded in Indonesia in 2012, and it services Southeast Asia’s six primary markets—Indonesia, Thailand, Malaysia, Singapore, Vietnam and the Philippines. The startup previously raised seed funding rounds from East Ventures and Rocket Internet’s Global Founders Capital, but its most recent public round was way back in 2013.

Baidu Teams Up with PayPal to Take Its Chinese Mobile Wallet Global

(July 27) TechCrunch.com

Baidu Teams Up with PayPal to Take Its Chinese Mobile Wallet Global

(July 27) TechCrunch.com

- PayPal has continued its strategy of expanding its mobile presence with its announcement of a tie-up with Baidu. The arrangement will enable Baidu’s 100 million mobile wallet users to make payments to PayPal’s 17 million merchants through the Baidu service.

- The move for Baidu represents a quick way to increase the competition with China’s leading mobile wallet companies, Alibaba’s Alipay (500 million users) and Tencent’s WeChat Pay (600 million users), which together account for more than 90% of China’s mobile wallet market.

LATAM RETAIL AND TECH HEADLINES

Digital Bank Accounts in Brazil to See 229% Increase by End of 2017

(July 31) ZDNet.com

Digital Bank Accounts in Brazil to See 229% Increase by End of 2017

(July 31) ZDNet.com

- Brazil is expected to see a 229% increase in the number of entirely digital bank accounts by the end of 2017, recent research suggests. There are currently 1 million online bank accounts in the country and the number is expected to reach 3.3 million by year-end, according to the Brazilian Federation of Banks (FEBRABAN).

- According to FEBRABAN, investment levels in banking technology remained the same compared with 2015 despite the economic instability seen in Brazil over the last few years. “Facing these challenges demanded a lot of innovation power from banks within their business offerings. This is proven by the levels of investment seen last year,” said FEBRABAN President Murilo Portugal.

Walmex Says Second-Quarter Profit More than Doubled on Suburbia Sale

(July 28) Reuters.com

Walmex Says Second-Quarter Profit More than Doubled on Suburbia Sale

(July 28) Reuters.com

- Walmex said net profit in the second quarter more than doubled due to the sale of clothing chain Suburbia to department store and shopping mall operator El Puerto De Liverpool. Walmex, Mexico’s biggest retailer, said it opened 21 stores from April to June, taking its total number of locations to 3,046.

- In a report to Mexico’s bourse, Walmex said that net profit rose by 118%, to MXN 13.5 billion (US$743 million) over the three-month period. Total revenue rose by 9% year over year in the second quarter, to MXN 135.7 billion (US$7.62 billion). Online sales rose by 35%, but the segment still accounts for less than 1% of Walmex’s total sales.

São Paulo, Brazil, Seeks Tech Startups

(July 28) ZDNet.com

São Paulo, Brazil, Seeks Tech Startups

(July 28) ZDNet.com

- The city government of São Paulo, Brazil, will be selecting a group of technology-based startups for the second edition of its fostering scheme, SP Stars. Some 50 startups will be selected to take part in the initiative, which will, for the first time, also include five international ventures.

- During a four-month period, the ventures will undergo a mentoring program and get access to advice from international tech companies that include Google, LinkedIn and Cabify. The initiative will support early-stage ventures as well as startups in more advanced development stages. The latter group will also take part in workshops geared toward international expansion.

Chilean Retailer Tricot Aims for $150 Million August IPO

(July 27) Reuters.com

Chilean Retailer Tricot Aims for $150 Million August IPO

(July 27) Reuters.com

- Chilean clothing retailer Tricot will carry out an IPO on the Santiago Stock Exchange in August with the hope of raising around $150 million, the operation’s advisors told investors in a presentation.

- The funds raised “will be used principally for an expansion plan that includes opening stores and an increase in the financial business,” said Jose Zamorano, Executive Director of Corporate Finance at BTG Pactual Chile. Tricot plans to open 29 new stores over the next five years throughout the country and increase credit loans by 73%.

MACRO UPDATE

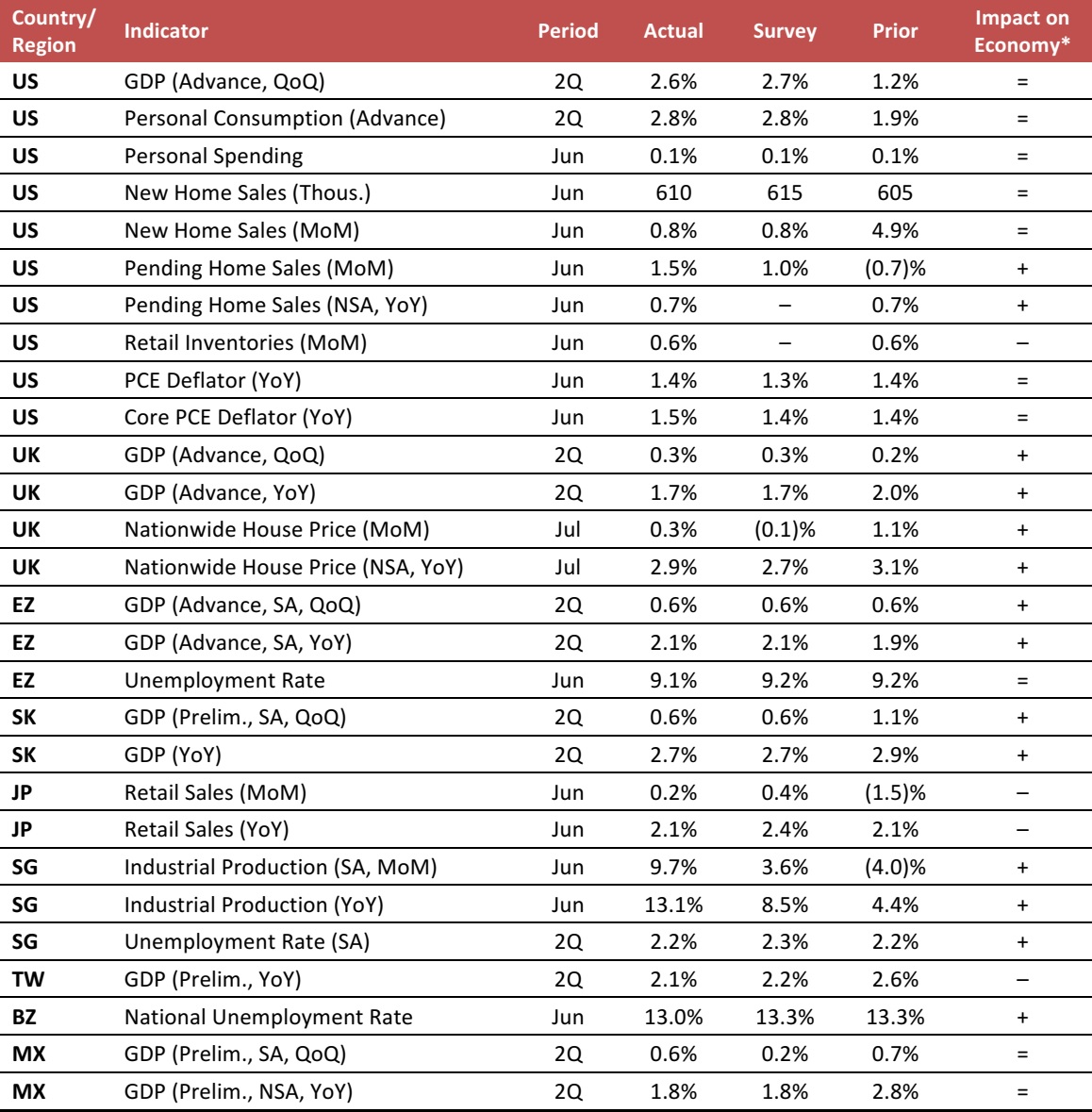

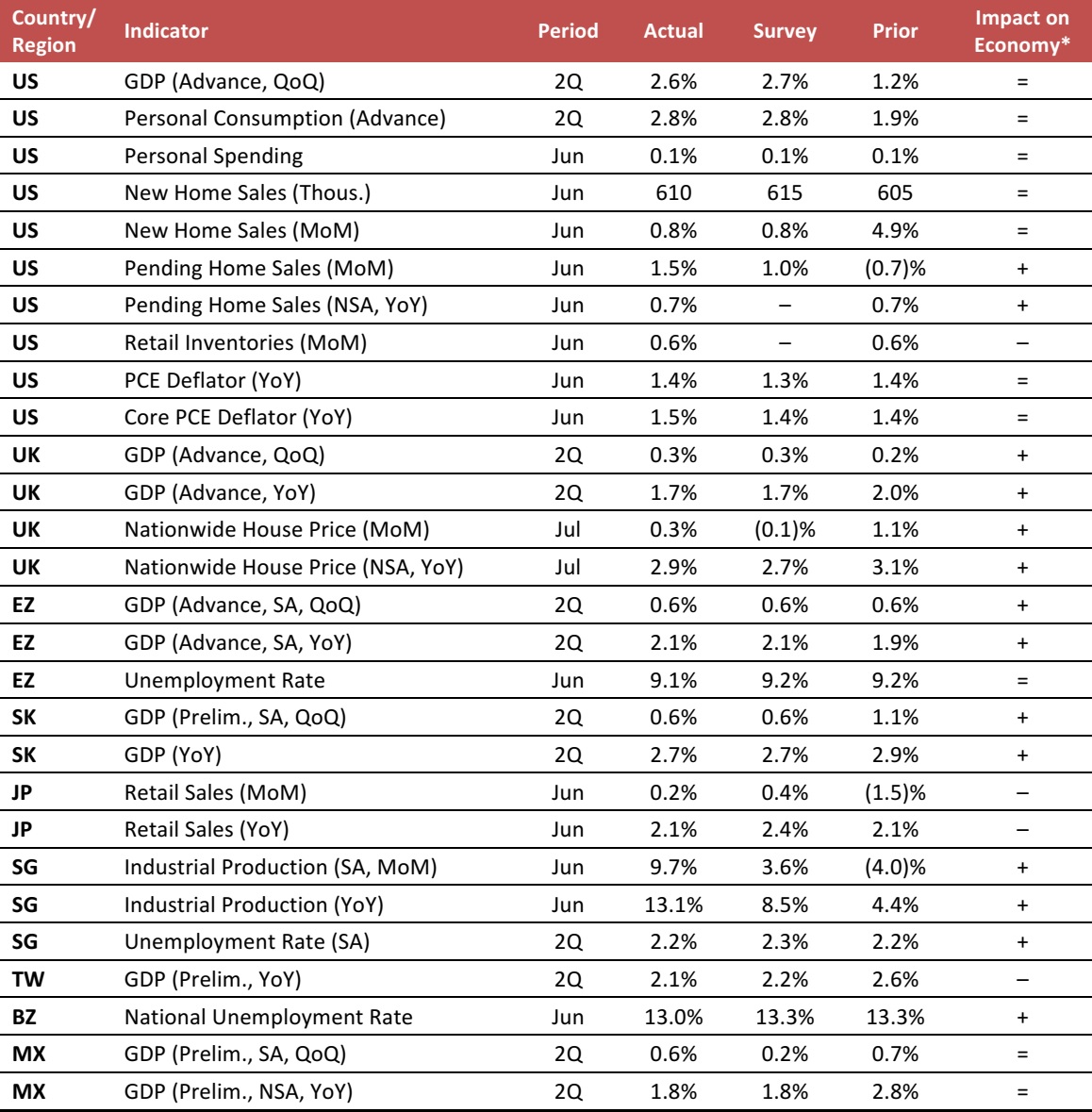

Key points from global macro indicators released July 26–August 2, 2017:

- US: In the second quarter, US GDP increased by 2.6% quarter over quarter; the increase was slightly lower than the market had expected. Home sales increased moderately in June, while inflation stayed below the Federal Reserve’s target.

- Europe: In the UK, GDP increased by 0.3% quarter over quarter in the second quarter and house prices edged up in July. In the eurozone, GDP in the second quarter increased by 0.6% quarter over quarter and the unemployment rate edged down to 9.1% in June.

- Asia-Pacific: In South Korea, GDP in the second quarter increased by 0.6% quarter over quarter. Retail sales in Japan showed weaker-than-expected growth in June. In Taiwan, GDP in the second quarter increased by 2.1% year over year; the increase was slightly weaker than had been expected.

- Latin America: In Brazil, the unemployment rate registered at 13.0% in June. In Mexico, GDP increased by 0.6% quarter over quarter in the second quarter, exceeding the consensus estimate.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/US Census Bureau/National Association of Realtors/UK Office for National Statistics/Nationwide Building Society/Eurostat/Bank of Korea/Singapore Economic Development Board/Singapore Ministry of Manpower/Taiwan Directorate-General of Personnel Administration/Instituto Brasileiro de Geografia e Estatística (IBGE)/Instituto Nacional de Estadística y Geografía (INEGI)/FGRT

Xiaomi Secures $1 Billion Loan to Expand Its International Presence and Offline Retail Footprint

(July 29) TechCrunch.com

Xiaomi Secures $1 Billion Loan to Expand Its International Presence and Offline Retail Footprint

(July 29) TechCrunch.com