FROM THE DESK OF DEBORAH WEINSWIG

A Transatlantic Look at Department Stores

As acres of press coverage attest to, the department-store format is among the most challenged in American retail. In this week’s letter, we look beyond the US to identify similarities and differences between department stores in the US and Europe, and to see what learnings these comparisons might present.

In Europe, as in the US, retailers at the very middle of the market are those facing the most challenges: department stores that target a very broad demographic or that offer little in-store differentiation tend to be losing share to more fashionable specialists and to price-competitive Internet-only retailers. The most obvious casualty of this has been BHS in the UK, which is closing the last of its 158 stores as we write. Premium-positioned retailers look to be faring better, with consumers continuing to appreciate the quality of the shopping experience they provide.

Overall, we think the department-store sectors in the major European countries are more robust than the US sector is, for the following reasons:

Premium Elements Even in the Midmarket: In the UK, the core traditional department-store sector retains a more premium positioning than it does in the US. Middle-ground UK retailers such as Debenhams incorporate premium elements in their stores—for instance, well-maintained beauty halls that feature a heavy presence of prestige brands. By contrast, standards at US stores are often more underwhelming or more functional, leaving these retailers at greater risk of losing share to price-led pure plays and more fashionable specialists.

A Prestige Sector in France: The French department-store sector is firmly positioned upscale, and is also strongly focused on Paris. This reflects, in part, the importance of tourists to French retailers such as Galeries Lafayette and Printemps. The latest numbers from these privately owned chains, covering the first part of 2015, showed solid top-line growth.

Less Cannibalization Through Off-Price: European department-store retailers have not yet established off-price chains, while many of their peers in the US already have. As a result, European department stores are not cannibalizing any sales from their own full-price stores. That said, Hudson’s Bay Company, the new owner of Galeria Kaufhof, and Galeries Lafayette have both recently announced their initial moves into off-price formats.

Less Promotional than the US: The European sector focuses less on price promotions than the US sector does and there is much less of a couponing culture in Europe. In the UK, Debenhams and M&S are cutting back on the number of promotions they run, to offer more consistent pricing to shoppers.

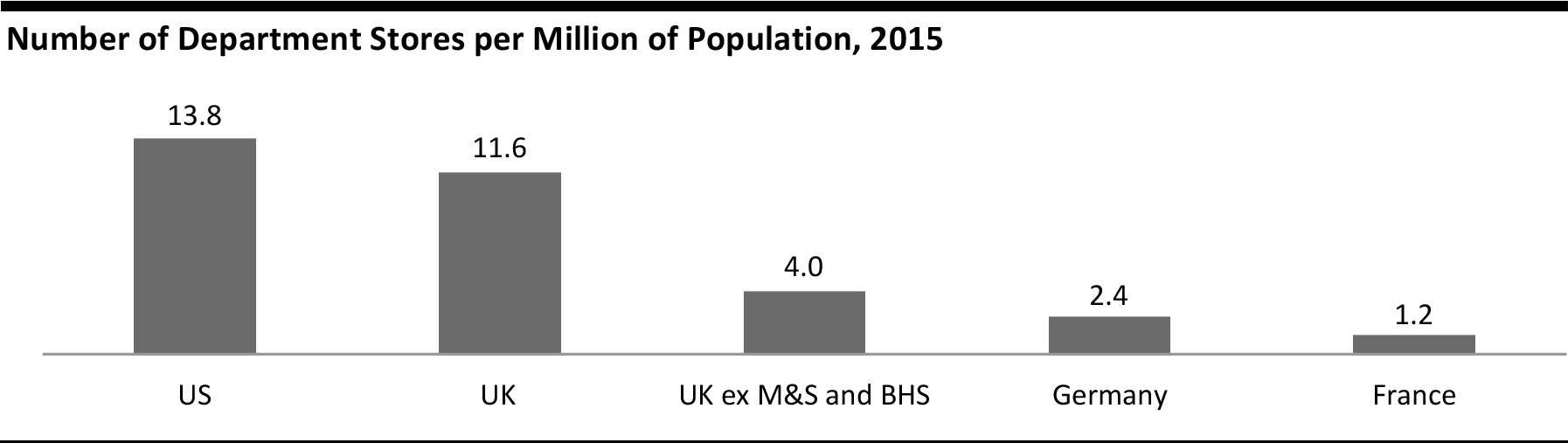

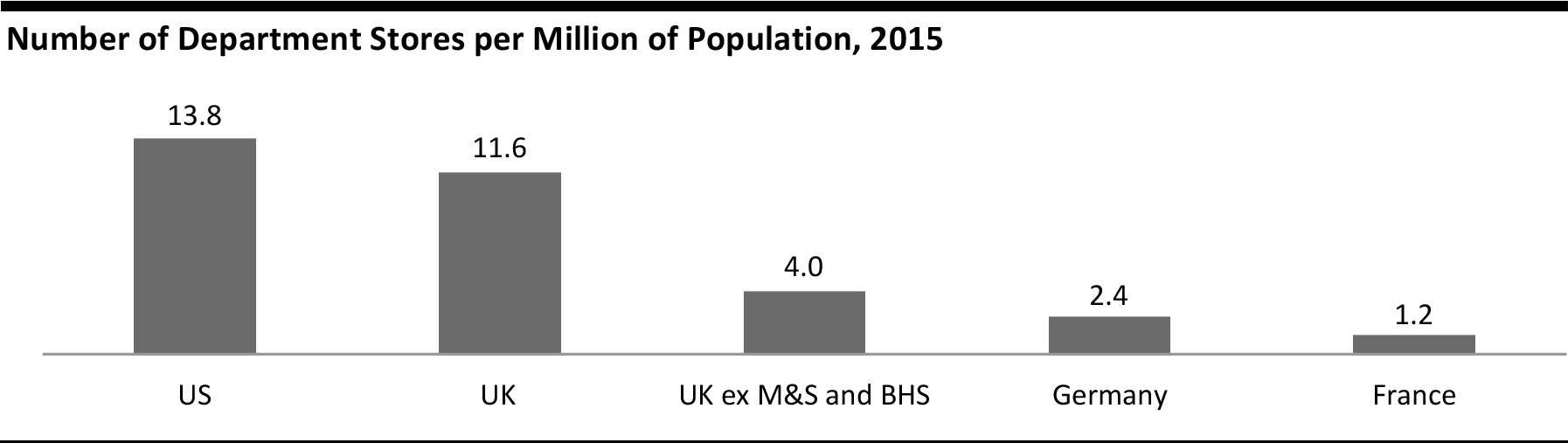

Fewer Department Stores per Person: On a per-capita basis, the US has more department stores than the UK, Germany or France does, as we show in the graph below. This means potential overspacing in the sector is less of an issue in Europe. The UK numbers below are pushed up substantially by M&S, and less so by BHS, but neither is a conventional multibrand department store—and if we exclude them, the differences between the US and the UK become more apparent.

Based on totals of major department-store chains

Source: Euromonitor International/US Census Bureau/Office for National Statistics/Eurostat/Fung Global Retail & Technology

So, what do we take from this? First, despite some commentators’ negative sentiment, department stores have a future, with new ideas such as off-price promising to inject renewed momentum into the midmarket segment. Second, the in-store experience appears to be ever more important, as shown by premium retailers outperforming their middle-ground peers. Third, and finally, we think our data on number of stores per capita draw attention to the fact that the US market still has a very substantial number of department stores: some big American names are closing tranches of stores and, in the context of our data, these look like sensible moves.

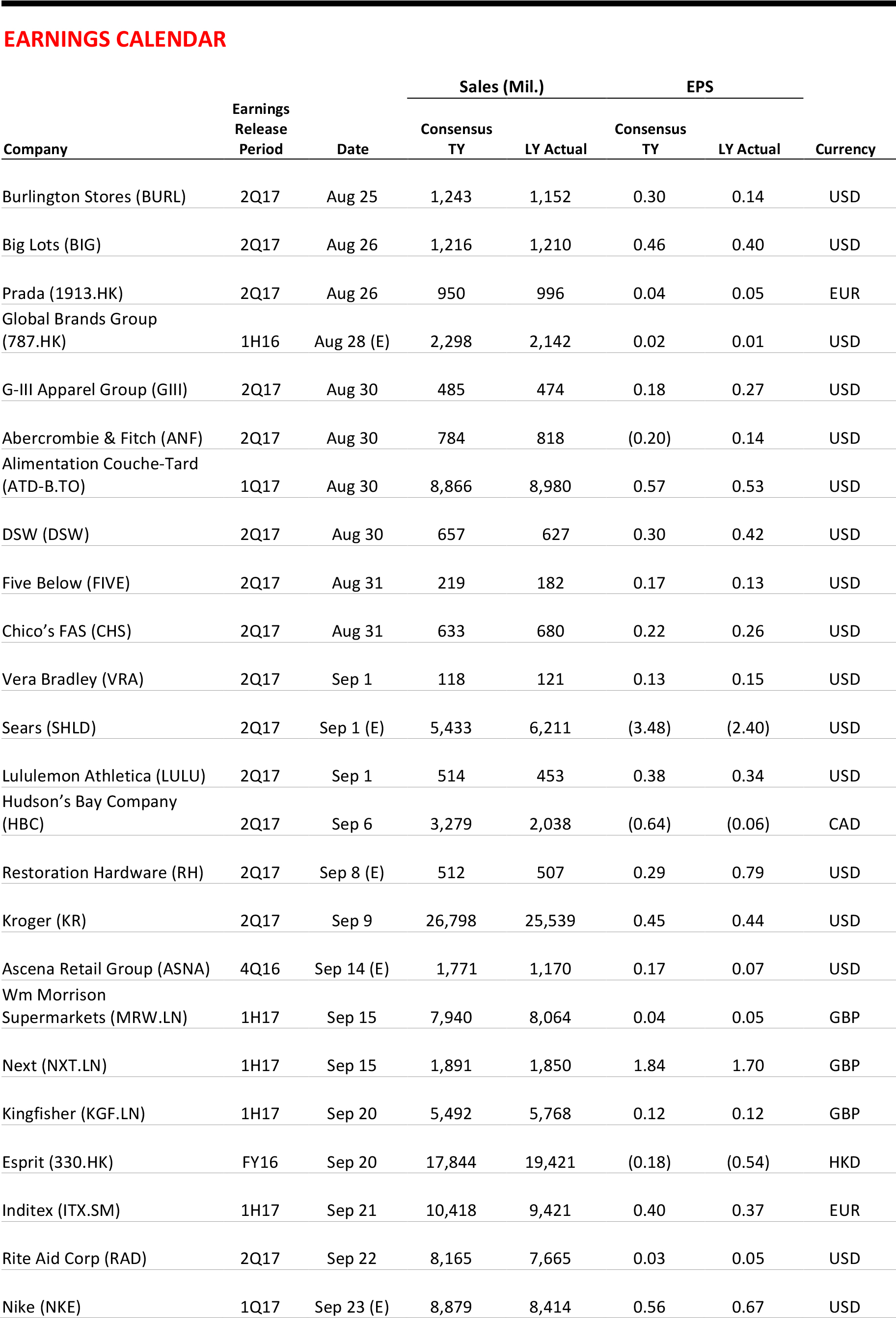

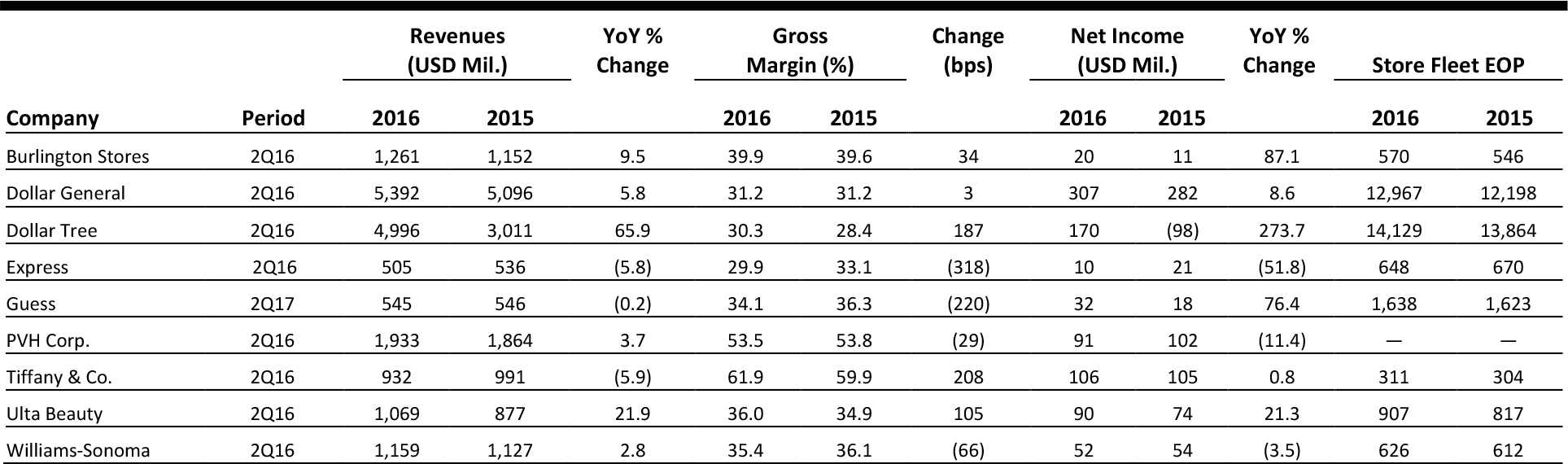

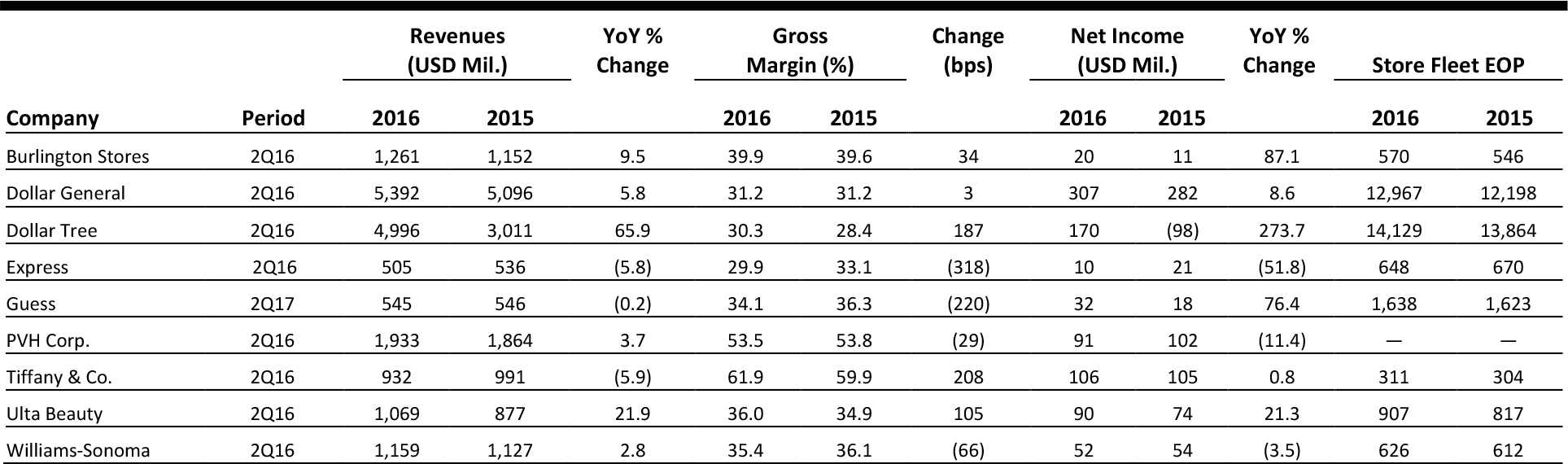

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

RFID Adoption Gathers Momentum amid Drive to Improve Inventory

RFID Adoption Gathers Momentum amid Drive to Improve Inventory

(August 23) Women’s Wear Daily

- As companies reassess inventory management to bolster profits and meet omnichannel-retailing demand, adoption of RFID technology is gaining momentum. RFID’s increased accuracy and software solutions have fostered retailers’ willingness to finally adopt the 15-year-old technology.

- Retailers are also influenced by loss prevention and a feeling of needing to catch up to competitors as more companies adopt RFID. The technology allows companies to not only boost in-store inventory accuracy, but also improve store execution. And, as retail continues to embrace omnichannel, RFID allows companies to more efficiently use stores for same-day delivery.

Revolve Uses “Style Codes” to Hack Snapchat and Instagram

Revolve Uses “Style Codes” to Hack Snapchat and Instagram

(August 23) Glossy

- Online retailer Revolve is making it easier for customers to find products featured in its Instagram and Snapchat posts. The company is now including “style codes,” unique product identifiers equivalent to SKU numbers, in social media posts. Followers can search these codes on the retailer’s site or on Google to find the product page.

- According to Revolve’s VP of Brand Marketing, when a product is listed with its style code, it appears on the company’s best-seller list the next day. Including style codes has also increased consumer engagement with Revolve’s Instagram and Snapchat accounts.

Nordstrom Expands Space Concept to Four New Locations

Nordstrom Expands Space Concept to Four New Locations

(August 22) Women’s Wear Daily

- Nordstrom will launch Space—its in-store concept boutique dedicated to advanced fashion—in four new locations in Nashville, Los Angeles and Toronto over the next few months. Olivia Kim, Nordstrom’s VP of Creative Projects, introduced the concept last year.

- According to Kim, Space has attracted a new customer to Nordstrom, while the company’s existing customer has enthusiastically embraced Space’s brands, which include Vetements, Commes des Garçons and Simone Rocha. Currently, there are four Space locations, in Seattle, Vancouver, Chicago and San Francisco.

Prediction: There Will Be No More Billion-Dollar Brands

Prediction: There Will Be No More Billion-Dollar Brands

(August 18) Lean Luxe

- There will never be another startup luxury brand that will reach $1 billion in revenue, says Lawrence Lenihan, CEO of Resonance, an early-stage fashion investment firm. He says many of the investments in these companies will not drive the returns investors hope for and that much of the capital will be lost.

- The Internet allows brands to no longer be constrained by geography or capital in reaching their customer, so they are able to build a business that targets a very specific group without having to worry about there being enough of those customers in a certain geographic location. Launching a brand has become cheaper, and the emotional appeal of the brand spurs consumers to share their niche find across social media, Lenihan says.

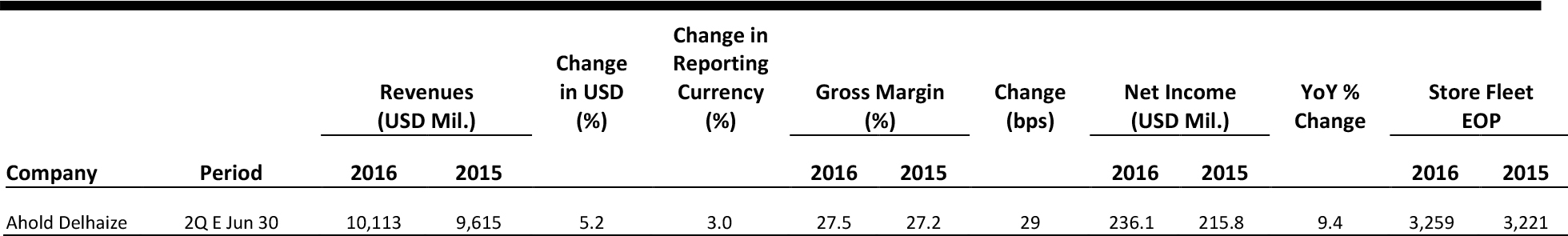

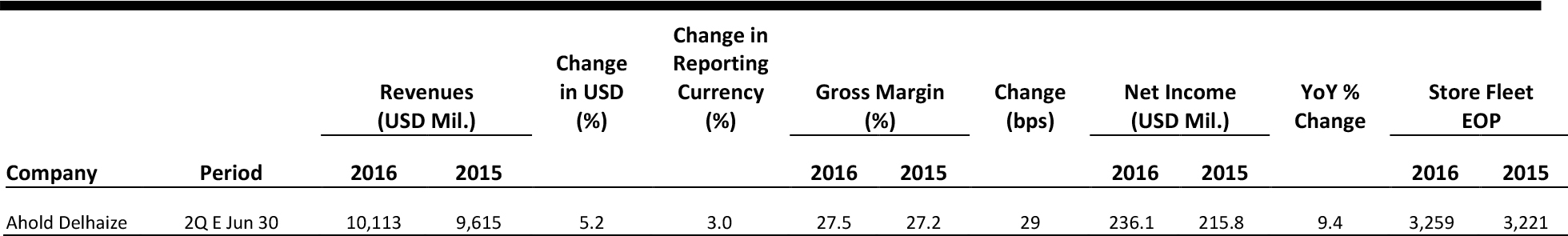

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Missguided to Open First Physical Store

Missguided to Open First Physical Store

(August 22) Retailgazette.co.uk

- UK online retailer Missguided has revealed plans to open its first brick-and-mortar store in the Westfield Stratford City shopping mall in London this November. The company may open three more stores in 2017.

- This follows “very strong” international growth, according to the privately owned company’s CEO. Its strong performance has been credited to its partnerships with ASOS, Zalando and Nordstrom and its collaborations with celebrities such as Nicole Scherzinger and Pamela Anderson.

Alipay Expands in Europe

Alipay Expands in Europe

(August 22) Retaildetail.eu

- Alibaba Group’s payment service, Alipay, has signed a deal with France-based Ingenico Group, a technology partner for many major European retailers. The deal allows these retailers the option of accepting Alipay as a payment service.

- Alipay already has 450 million users in China and wants to grow its number of transactions among the 120 million Chinese tourists who spent an average of US$875 per capita in 2015.

Tesco Follows London’s Night Tube with 24-Hour Stores

Tesco Follows London’s Night Tube with 24-Hour Stores

(August 22) Retailbulletin.com

- UK supermarket chain Tesco has trialed 24-hour opening at seven additional London stores on Fridays and Saturdays in order to capitalize on the new Night Tube service, the round-the-clock London Underground service that launched last weekend.

- On the Night Tube’s opening weekend, Tesco also operated “hydration stations” at the front of the stores from 3 a.m. to 7 a.m. to promote the 24-hour opening times. Employees at these stations handed out Tesco Finest Orange Juice and bottled water.

Just Eat Buys Takeaway.com’s British Operations

Just Eat Buys Takeaway.com’s British Operations

(August 18) UK.businessinsider.com

- Home delivery service Takeaway.com has closed its UK operations and sold its British assets to delivery rival Just Eat. A Takeaway.com spokesman told Business Insider that the company’s growth rate was “insufficient to sustain a healthy business.”

- Takeaway.com continues to operate in Europe, including in the Netherlands, Germany, Poland and France.

UK Grocery Sector Grows Faster

UK Grocery Sector Grows Faster

(August 23) Company press release

- The UK grocery sector grew sales by 0.3% in the 12 weeks ended August 14, according to the latest figures from market-measurement company Kantar Worldpanel. This was the sector’s fastest growth since March 2016 and came despite sector deflation of 1.3%.

- Aldi and Lidl continued to lead growth, with sales up 10.4% and 12.2%, respectively, according to Kantar. Sales fell at each of the big four British grocery chains: by 0.4% at Tesco, by 0.6% at Sainsbury’s, by 1.8% at Morrisons and by 5.5% at Asda.

ASIA TECH HEADLINES

Xiaomi to Launch Smartphone in the US

Xiaomi to Launch Smartphone in the US

(August 22) ZDNet

- China’s popular budget smartphone maker Xiaomi comfirmed its plan to enter the US smartphone market in the near future. The company will use a marketing strategy focused on social media and other parts of the web, similar to the strategy it has used to expand in other markets.

- Xiaomi has entered the US before with other products, such as fitness wearables, headphones and tech accessories.

China’s “Selfie” App Maker Meitu Plans Hong Kong IPO

China’s “Selfie” App Maker Meitu Plans Hong Kong IPO

(August 21) The Wall Street Journal

- One of China’s most popular selfie app makers, Meitu, filed an application with Hong Kong regulators for an IPO that could raise $500 million–$1 billion. The IPO is expected to be in the fourth quarter.

- The company expects its shares to be valued higher because of the relative scarcity of tech firms in the Hong Kong stock market, where only 10% of the listed firms are tech based.

Japan’s Sharp to Review TV Licensing Deals

(August 23) Reuters

Japan’s Sharp to Review TV Licensing Deals

(August 23) Reuters

- Japanese electronics maker Sharp will review its TV brand licensing deals overseas, as it believes the business can return to profitability with the cooperation of Foxconn.

- The company lost money in its TV business in the second quarter of 2016, and planned to leave the business by licensing its brands to other groups.

Lenovo to Preinstall Microsoft Office and OneDrive

Lenovo to Preinstall Microsoft Office and OneDrive

(August 23) ZDNet

- Lenovo will preinstall Microsoft Office, Skype and OneDrive on a number of its Android devices to fulfill its patent-licensing deal with Microsoft.

- Microsoft says the cooperation between the two companies will enable customers around the world to be more productive and more connected, and to achieve more.

LATAM RETAIL HEADLINES

Barco Increases Investment in Brazil as Display Use Grows

Barco Increases Investment in Brazil as Display Use Grows

(August 22) Retail Design World

- Global visualization specialist company Barco, which creates intelligent display networks for retailers, said it is planning to increase its presence in Brazil after more than 20 years of trading in Latin America.

- The company expects Brazil to become one of its “premier markets,” and so has taken steps to grow market share, strengthen partnerships and grow its team locally.

Mexico’s Biggest Luxury Chain Wins over Investors with M&A Burst

Mexico’s Biggest Luxury Chain Wins over Investors with M&A Burst

(August 23) Bloomberg

- El Puerto de Liverpool, Mexico’s biggest department-store operator, made its second major purchase this summer and won over investors. The company agreed to acquire a minority stake in Chile’s Ripley for at least US$300 million.

- This purchase follows the company’s shocking choice to purchase the Suburbia clothing chain from Walmart in a deal valued at US$1 billion. The company’s shares took a dive following that announcement, but have now more than recovered. The Ripley stake will help the company make a gradual entrance into the South American market.

Safilo Heads for Argentina

Safilo Heads for Argentina

(August 23) Fashion Network

- Italian eyewear group Safilo has announced plans to open stores in Argentina, only two years after it announced new store openings in both Mexico and Brazil. Safilo is partnering with local company Ocsa to distribute specialized optics in Argentina via selected eyewear stores.

- Over the past two years, the company has significantly strengthened its business in Latin America, distributing several collections of prestigious international brands to the region.

Brazil Inflation Seen Steady in Mid-August on High Food Prices

Brazil Inflation Seen Steady in Mid-August on High Food Prices

(August 22) Reuters

- Brazil’s inflation rate likely remained around 9% in the 12 months ended mid-August, which is above the official target, although it is still on track to ease in the coming months despite the country’s recession.

- Monthly consumer prices increased by only 0.47%, down from a 0.54% increase in mid-July. The central bank has pledged to slow price increases to at least 6.5% by the end of 2016.

Argentina: Cencosud’s Proximity Plans

Argentina: Cencosud’s Proximity Plans

(August 24) IGD Retail Analysis

- Cencosud is planning to open eight Jumbo proximity stores in Argentina before the end of 2016, and is looking for locations in the capital and Gran Buenos Aires districts. The project is part of a US$40 million investment in Argentina in 2016.

- The company’s hypermarkets have faced a crisis in recent years, and the main focus of the project will be proximity stores and supermarkets that are slightly different from the traditional Jumbo hypermarkets.

RFID Adoption Gathers Momentum amid Drive to Improve Inventory

(August 23) Women’s Wear Daily

RFID Adoption Gathers Momentum amid Drive to Improve Inventory

(August 23) Women’s Wear Daily

Nordstrom Expands Space Concept to Four New Locations

(August 22) Women’s Wear Daily

Nordstrom Expands Space Concept to Four New Locations

(August 22) Women’s Wear Daily

Barco Increases Investment in Brazil as Display Use Grows

(August 22) Retail Design World

Barco Increases Investment in Brazil as Display Use Grows

(August 22) Retail Design World