From the Desk of Deborah Weinswig

Facial Recognition: Coming Soon to a Smartphone Near You

Facial recognition has long been the stuff of science fiction, with books and movies including scenes of facial or retinal scans being used to identify entrants to sensitive military complexes. The technology has also been used for certain niche purposes for many years, such as to keep criminals and undesirables out of gambling casinos. In addition, the City of London has as many as a million CCTV cameras stationed throughout the city in order to help identify and catch suspected bad guys.

Now, facial identification is coming to a smartphone near you. Advances in artificial intelligence over the past few years, particularly the use of deep-learning technology for pattern recognition—combined with inexpensive, high-resolution image sensors in cellphones—have put the technology in the palms of our hands.

Apple, which has historically combined off-the-shelf technologies in innovative ways and then used savvy marketing to push its new products, often receives credit for “inventing” novel approaches. The company is once again at the epicenter of buzz with its upcoming iPhone models, which are rumored to include facial recognition hardware. Recent iPhone models rely on a fingerprint sensor that works with the “home” button to identify the user, but future models are thought to include an all-glass front screen. That would negate the need for the button, but also eliminate the spot where the fingerprint sensor was located on older models.

The new iPhone 8 is expected to include an array of infrared lasers called vertical cavity surface-emitting lasers (VCSELs), which will capture a 3D image of the operator’s face. Although facial recognition is a tricky task, it is much simpler to identify a subject’s facial features from just a few feet away than it is to identify them from a grainy surveillance video captured by a camera positioned on a wall or building much farther away. Removing the sole front-panel button from the iPhone would also boost the phone’s overall minimalism, which would likely please the orchestrator of the original iPhone, Steve Jobs. In addition, the removal of the front-panel button would eliminate false presses, refusals to authenticate due to dirty fingers and the associated smudges that inevitably result from unlocking the phone.

Even though Apple’s global share of the smartphone market is about 15%, the company’s influence over the tech industry is much greater. The 3D sensor array offers many interesting possibilities in concert with ARKit, Apple’s software toolkit for building augmented-reality apps for the iPhone and iPad. Although augmented-reality technology is here today, so far there has not been a “killer app” that has spurred widespread adoption.

As noted above, Apple was not the first company to develop facial recognition technology for consumer applications. Intel demonstrated its RealSense technology at the CES trade show in 2016, with CEO Brian Krzanich participating in a demo that aimed to open a door lock using facial recognition technology. The demo failed—as demos often do—to Krzanich’s chagrin, but it showed what was possible with the technology. Intel also demonstrated a laptop version of a camera that enabled users to log into a computer without entering a password. After the user logged in, the computer’s software provided all necessary passwords, without the user having to memorize (and forget…and reset) them.

A quick Internet search shows a variety of Intel RealSense webcams at prices starting at $50, but these are much too large and expensive to be integrated into a smartphone. Thus, a technological leap in both hardware and software was necessary, and the latest generations of smartphones from Samsung, LG and Sony offer various levels of facial recognition technology. Android’s Ice Cream Sandwich smartphone operating system has facial recognition functionality built in.

Biometric tools such as fingerprint and facial recognition are opening the door to a new phase of device usage and consumer friendliness. Consumers will no longer have to memorize easily forgettable passwords and codes, nor will they have to press their thumb to their phone to unlock it: they will only have to hold the phone in front of their face—no button pushing needed. 3D imaging arrays and built-in augmented-reality software put an enormous amount of computing and imaging power in the hands of consumers, and tech-savvy retailers are likely to start imagining how they can use these technologies to empower consumers and make shopping an easier and more pleasurable experience.

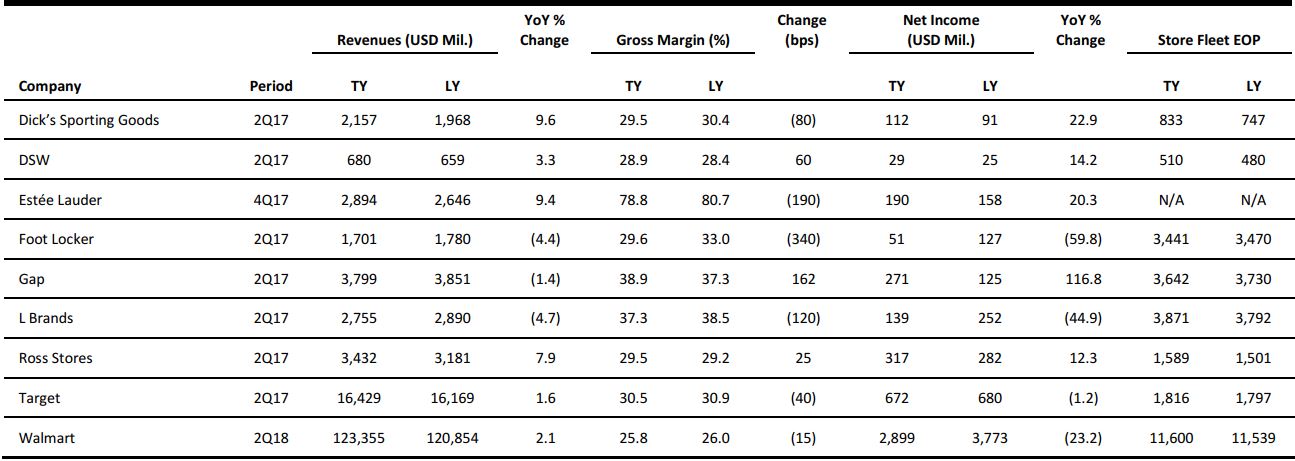

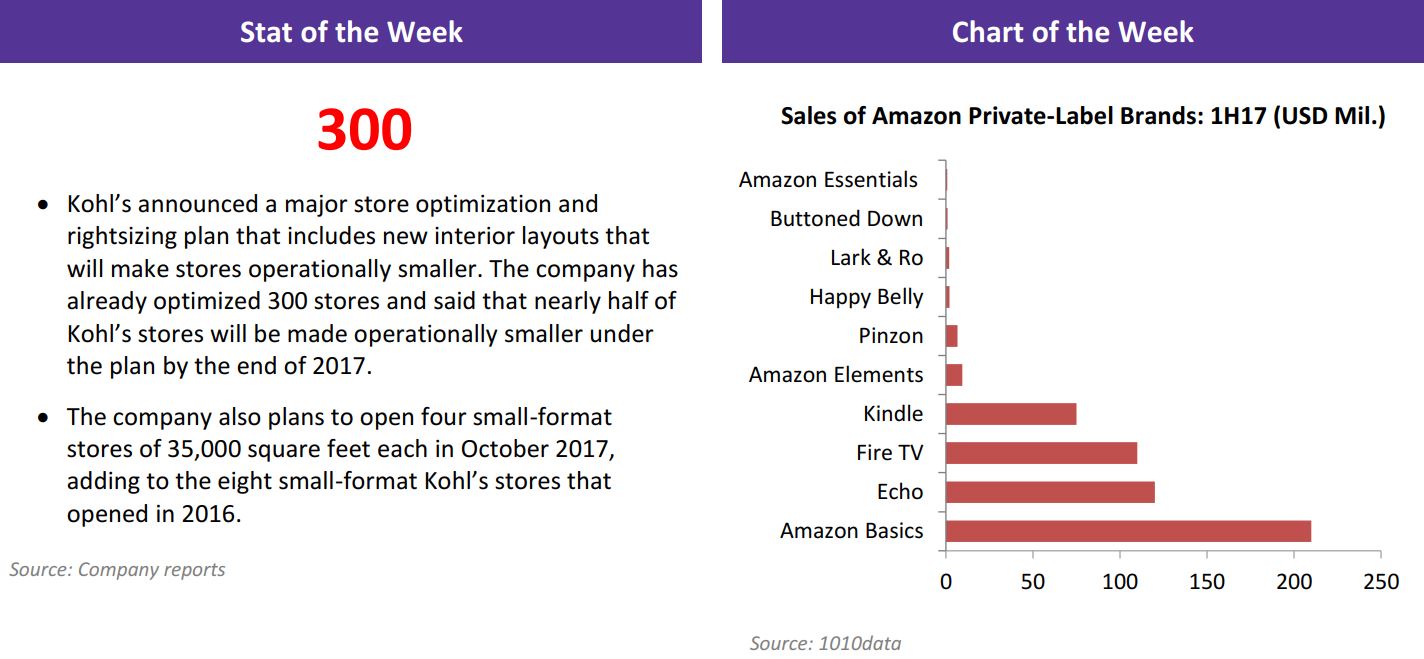

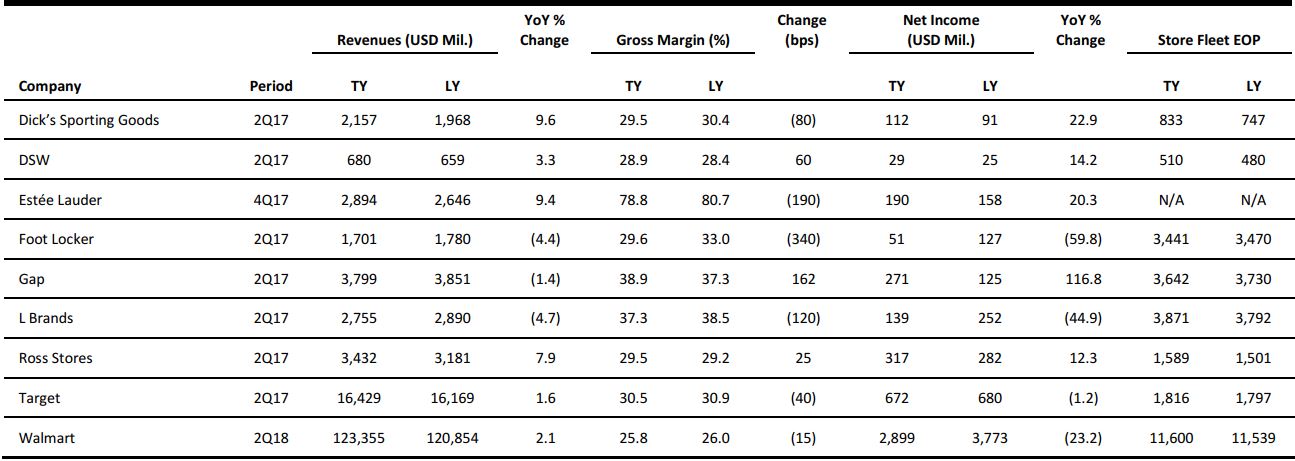

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Kleiner Perkins to Invest $40 Million in Toronto-Based Tulip.io

(August 22) The Wall Street Journal

Kleiner Perkins to Invest $40 Million in Toronto-Based Tulip.io

(August 22) The Wall Street Journal

- Tulip.io, whose mobile software allows sales associates and retailers to engage more effectively with customers, has raised $40 million in a new round of venture capital financing led by Kleiner Perkins Caufield & Byers.

- The financing, which marks Kleiner Perkins’ largest investment in a Canadian technology startup, will help Tulip double its staff, expand to retailers in Europe, South America and Asia, and develop its software for other industries such as the hospitality sector. The company’s software is already being used by major US retailers such as Hudson’s Bay Company’s Saks Fifth Avenue and Coach, and is used across 25 countries and in seven languages.

Walmart Nears a Pilot Deal to Offer Customers Installment Loans

(August 22) The Wall Street Journal

Walmart Nears a Pilot Deal to Offer Customers Installment Loans

(August 22) The Wall Street Journal

- Upstart financing firm Affirm is in talks to offer installment loans to Walmart customers, said people familiar with the matter. The development is the latest sign of retailers’ desire to reach new customers with limited credit histories and of the intensifying competition facing credit card providers.

- Affirm, based in San Francisco, and Walmart, based in Bentonville, AR, are nearing an agreement on a pilot in which Affirm would offer installment loans to some Walmart shoppers in the US as soon as this fall, the people said.

Low Price Is the Only Winner in Retail

(August 18) The Wall Street Journal

Low Price Is the Only Winner in Retail

(August 18) The Wall Street Journal

- It might seem like the most basic retail maxim, but the second quarter drilled it home for investors: low prices matter. The only winners in the second quarter in an otherwise bleak retail landscape were the ones offering the lowest prices.

- The list of companies that posted sales growth in the quarter, including Walmart, Target, Ross Stores and Amazon.com, share one major characteristic: low prices. Even Gap got a boost from 5% same-store sales growth at its inexpensive Old Navy brand. The trend is grim for brands that have commanded premiums and for traditional retailers, especially because they all need to be investing in e-commerce just to keep up.

More Parents Holding Off on Back-to-School Shopping

(August 22) NRF press release

More Parents Holding Off on Back-to-School Shopping

(August 22) NRF press release

- Even though more parents started back-to-school shopping early this year, many families still have a lot of shopping left to do as they prepare their children for the start of school. According to the National Retail Federation’s (NRF’s) annual survey, the average family with children in grades K–12 had completed only 45% of their shopping as of early August.

- That is down from a peak of 52% at the same time in 2013 and 48% last year, and it is the lowest level since the figure hit 40% in 2012. Of parents surveyed August 1–9, only 13% had completed all their shopping—and 23% had not started at all. The number of parents who planned to start shopping at least two months before the beginning of school was up this year, at 27%, compared with 22% last year.

US E-Commerce Sales Surge 16.3% in Second Quarter

(August 17) SGB Media

US E-Commerce Sales Surge 16.3% in Second Quarter

(August 17) SGB Media

- The US Census Bureau estimated that US retail e-commerce sales for the second quarter of 2017, adjusted for seasonal variation but not for price changes, totaled $111.5 billion, an increase of 16.2% from the second quarter of 2016.

- Total retail sales increased by 4.1%, to $1.27 trillion, in the same period. E-commerce sales in the second quarter of 2017 accounted for 8.9% of total sales; however, a deeper look into the numbers reveals a much higher share of business for the Internet channel.

EUROPE RETAIL HEADLINES

UK Retail Sales Grow Ahead of Inflation in July

(August 17) ONS press release

UK Retail Sales Grow Ahead of Inflation in July

(August 17) ONS press release

- July was another solid month for UK retail, according to the Office for National Statistics (ONS), with sales up 4.2% year over year. The rate was comfortably ahead of sectorwide inflation of 2.7%, meaning that Brits continued to grow their retail spending in real terms.

- Year over year, clothing specialists’ sales were up 6.0%, while Internet pure plays and mail order retailers grew sales by 20.9%, and grocery retailers enjoyed a 3.6% increase in sales.

Lidl Becomes UK’s Seventh-Largest Grocery Retailer

(August 22) Kantar Worldpanel press release

Lidl Becomes UK’s Seventh-Largest Grocery Retailer

(August 22) Kantar Worldpanel press release

- Discounter Lidl has become the UK’s seventh-largest grocery retailer, according to new data from market measurement firm Kantar Worldpanel. Lidl grew its UK sales by 18.9% in the 12 weeks ended August 13. Fellow discounter Aldi, which is already the UK’s fifth-largest grocery retailer, grew sales by 17.2%.

- Market leader Tesco saw sales increase by 3%, while Sainsbury’s was up 2.0%, Asda 1.4% and Morrisons 2.6%. The total grocery market grew by 4.0% and inflation stood at 3.3% in the 12-week period.

Missguided Brother Label Mennace Launches in September

(August 21) DrapersOnline.com

Missguided Brother Label Mennace Launches in September

(August 21) DrapersOnline.com

- The chief executive of Missguided, Nitin Passi, is set to launch a menswear brand, Mennace, on a separate, stand-alone e-commerce site in September.

- The brand, which is separate from Missguided but sits within the same group, launched a capsule collection on ASOS last December, but will now roll out a full collection, including hoodies, joggers, jeans, T-shirts and jackets.

Sports Direct Increases Stake in Debenhams to 21%

(August 22) RetailGazette.co.uk

Sports Direct Increases Stake in Debenhams to 21%

(August 22) RetailGazette.co.uk

- British sporting goods retailer Sports Direct has increased its stake in Debenhams yet again, from 19% to 21%. In April, the retailer had only a 13.38% stake.

- Sports Direct owner Mike Ashley has not revealed the intentions behind boosting his company’s holding, although media sources predict that this will lead to a takeover.

Aldi Sells Games in Germany

(August 21) RetailDetail.eu

Aldi Sells Games in Germany

(August 21) RetailDetail.eu

- Both Aldi Nord and Aldi Süd will start selling online video games in Germany beginning August 21, the day before Europe’s largest gaming convention begins.

- The discounter’s web shop will house games from more than 100 developers and studios as well as from every major gaming platform, making Aldi one of the largest gaming stores in Germany.

ASIA TECH HEADLINES

Alibaba Leads $1.1 Billion Investment in Indonesia-Based E-Commerce Firm Tokopedia

(August 17) TechCrunch.com

Alibaba Leads $1.1 Billion Investment in Indonesia-Based E-Commerce Firm Tokopedia

(August 17) TechCrunch.com

- Alibaba has continued its push into Southeast Asia after leading a $1.1 billion investment in Tokopedia, an e-commerce firm based in Indonesia. Tokopedia, which was founded in 2009, operates a marketplace that allows small retailers and large brands to sell to consumers in Indonesia, Southeast Asia’s largest economy.

- “The partnership with Alibaba will enhance the scale and quality of Tokopedia’s offerings to its customers and make it easier for merchants and partners to do business across the archipelago and beyond,” the companies said in an announcement.

Alibaba, Tencent, Didi and Other Tech Firms Pour $12 Billion into Mobile Operator China Unicom

(August 16) TechCrunch.com

Alibaba, Tencent, Didi and Other Tech Firms Pour $12 Billion into Mobile Operator China Unicom

(August 16) TechCrunch.com

- China is about to take net neutrality to the next level after a group of influential tech companies that includes Baidu, Alibaba, Tencent, Didi Chuxing and JD.com agreed to invest nearly $12 billion into state-run mobile operator China Unicom, the second-largest operator in China, with 269 million mobile customers.

- The investment is being made as part of China’s “mixed ownership” strategy, which was announced in 2014 and encourages state entities to take on private capital. China Unicom said in a filing that the deal will help it rethink its corporate structure and encourage more innovative thinking within its struggling business units.

Jurassic Park Spurs UK Game Maker Backed by Tencent to Record

(August 22) Bloomberg.com

Jurassic Park Spurs UK Game Maker Backed by Tencent to Record

(August 22) Bloomberg.com

- Frontier Developments, a British video-game maker backed by Tencent, will release Jurassic World Evolution for PC, PlayStation 4 and Xbox One consoles in the summer of 2018. The franchise could double Frontier’s revenue by 2019, said Liberum analyst Andrew Bryant.

- Frontier will likely benefit from marketing spending by Comcast’s Universal Pictures, whose Jurassic World: Fallen Kingdom movie is due for US release in June next year. “It’s clearly very exciting,” Bryant said. “As a franchise, Jurassic World is huge. What’s important is that this title is tied with the film release, so Frontier benefits from the marketing spend by Universal.”

Alibaba’s Profit Doubles to $2.1 Billion After Another Huge Quarter of Business

(August 17) TechCrunch.com

Alibaba’s Profit Doubles to $2.1 Billion After Another Huge Quarter of Business

(August 17) TechCrunch.com

- Chinese e-commerce giant Alibaba reported net profit of ¥14 billion (US$2.1 billion) for its recent quarter, up 96% year over year. Total revenue grew by 56%, to ¥2 billion (US$7.4 billion), with the firm reporting 466 million active buyers over the previous 12-month period.

- “Alibaba had a strong start to fiscal 2018, reflecting the strength and diversity of our businesses and the value we bring to customers on our platforms. Our technology is driving significant growth across our business and strengthening our position beyond core commerce,” Alibaba CEO Daniel Zhang said.

LATAM RETAIL AND TECH HEADLINES

SAS Appoints New Brazil Head

(August 17) ZDNet.com

SAS Appoints New Brazil Head

(August 17) ZDNet.com

- Analytics software company SAS has promoted its former head of its commercial division to president of its Brazilian subsidiary. As part of a transitional period, Cássio Pantaleoni will be working until the end of the year alongside Conrado Leister, who had been acting as president for both Brazil and Latin America and the Caribbean.

- According to SAS, the decision to split Leister’s role is the result of the positive performance it has seen over the last few quarters in Brazil. Despite the economic and political instability the country has undergone of late, Brazil is still one of the company’s top five global markets.

Brazilian Fashion Retailer Worth More than Ralph Lauren

(August 18) LeadersLeague.com

Brazilian Fashion Retailer Worth More than Ralph Lauren

(August 18) LeadersLeague.com

- On June 16, the Brazilian publication Exame reported that Lojas Renner, a Brazilian prêt-à-porter retailer, has overtaken famous American brand Ralph Lauren in terms of market value. Lojas Renner was worth $5.75 billion, while Ralph Lauren was worth $5.64 billion, the magazine said.

- These numbers were gathered by the company Economatica at Exame’s request in order to compare the size of the fashion companies in the US and Brazil. Per the research, US-based TJX Companies is the most valuable fashion retailer in both nations, with more than $47.4 billion of stocks in the market.

Dufry Opens 400-Square-Meter Shop at T2 Mexico City Airport

(August 18) TRBusiness.com

Dufry Opens 400-Square-Meter Shop at T2 Mexico City Airport

(August 18) TRBusiness.com

- The Dufry Group has inaugurated its new store at Mexico’s Benito Juárez International Airport Terminal 2. The travel retailer was awarded the right to operate the concession earlier this year at the same time that it sealed an agreement with Madrid-based cruise line Grupo Pullmantur.

- Located in the international departures hall and spanning 400 square meters, the main store stocks a wide assortment of fragrances, food and beverages, tobacco and luxury accessories. In addition, the shop will stock local delicacies such as fine tequila, mezcal, Mexican chocolate, hot sauces and gourmet coffee.

Bxblue to Move Payroll-Secured Loans Online in Brazil

(August 15) Reuters.com

Bxblue to Move Payroll-Secured Loans Online in Brazil

(August 15) Reuters.com

- Payroll-secured loans are a $40-billion-a-year business in Brazil, but that business largely happens offline. A startup in Y Combinator called Bxblue wants to change that by creating a marketplace for borrowers to evaluate multiple loan options all in one place.

- In Brazil, one of the more popular personal loan products is available to government employees and pensioners. Lenders offer attractive personal loans to this group because their income is regular and guaranteed, and the banks can automatically deduct payments directly from a borrower’s paycheck.

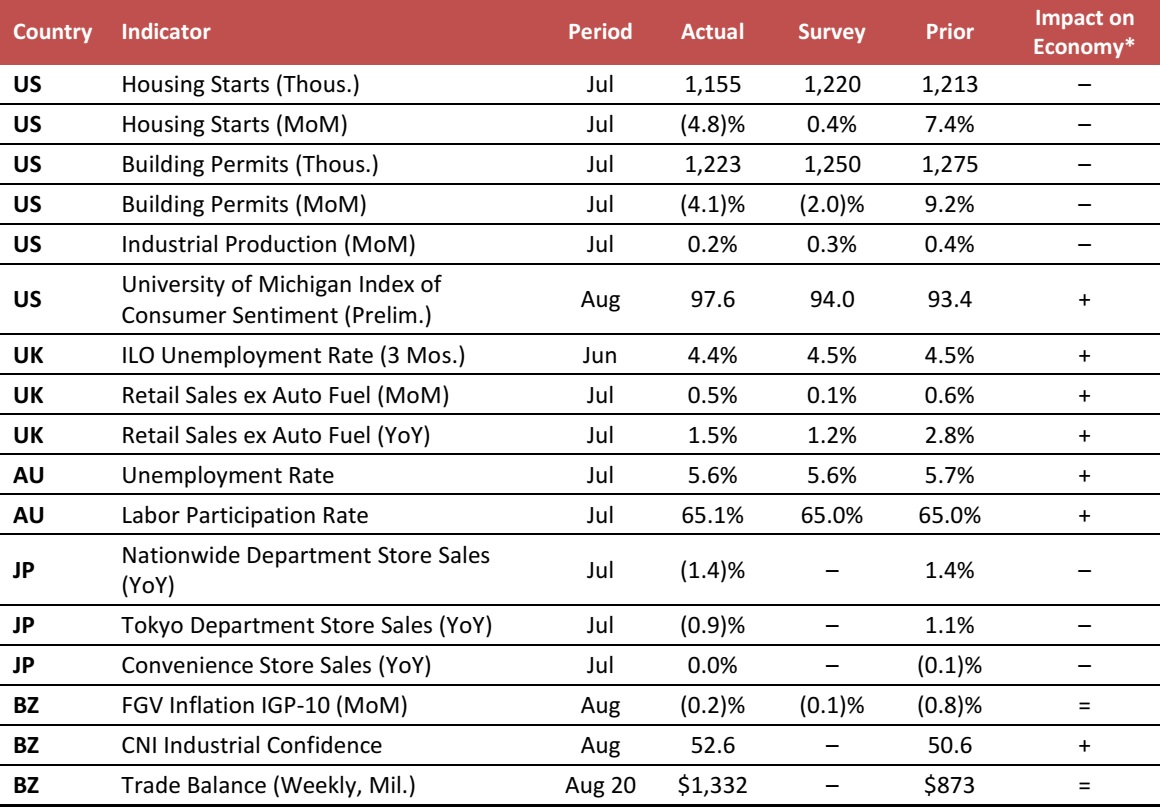

MACRO UPDATE

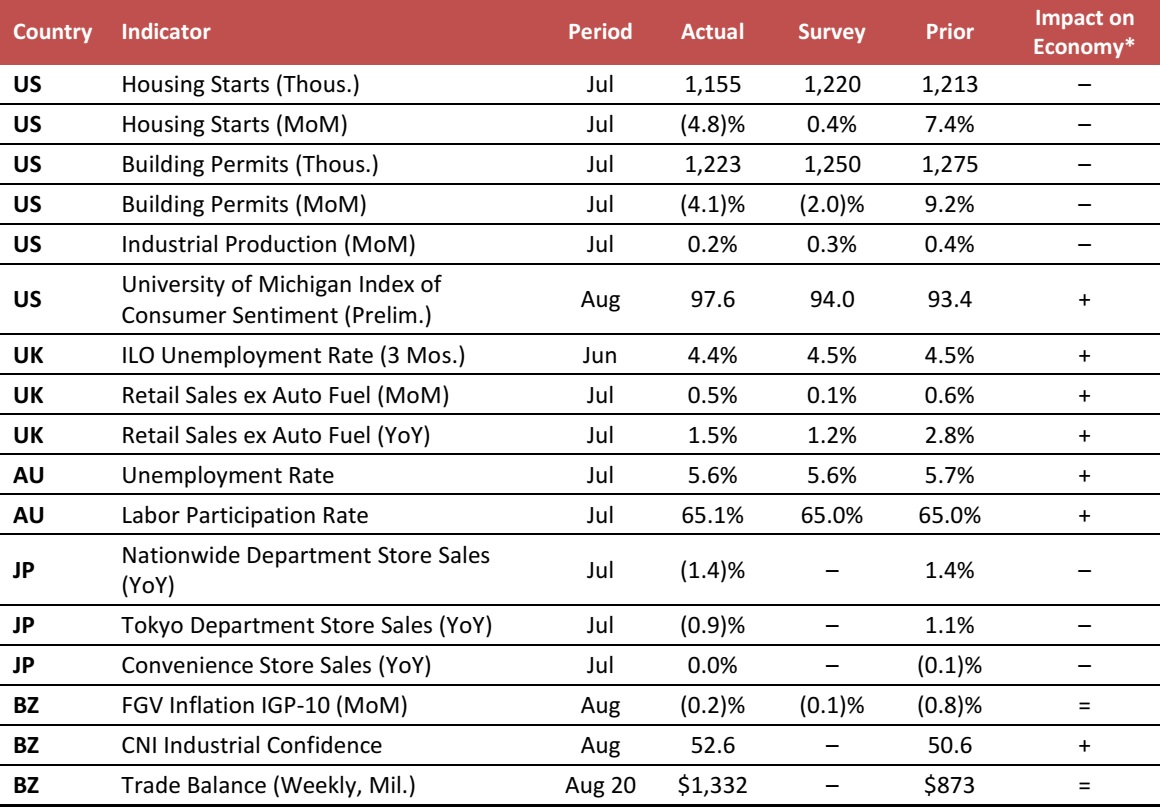

Key points from global macro indicators released August 16–23, 2017:

- US: In July, US housing starts dropped by 4.8% month over month, to 1.16 million, while industrial production increased by 0.2% month over month. Both readings came in weaker than consensus estimates. Consumer sentiment ticked up to 97.6 in August.

- Europe: In the UK, the unemployment rate edged down to 4.4% in June; the rate was slightly lower than the consensus estimate. UK retail sales were stronger than expected in July: excluding auto fuel, retail sales grew by 0.5% month over month, compared with the market’s estimate of 0.1% growth.

- Asia-Pacific: In Australia, the unemployment rate stood at 5.6% in July, in line with the market’s expectation, while the labor participation rate ticked up slightly, to 65.1%. In Japan, department store sales fell by 1.4% year over year in July.

- Latin America: In Brazil, the FGV General Price Index-10 (IGP-10) decreased by 0.2% month over month in August. Industrial confidence in Brazil increased to 52.6 in August and the country’s trade balance increased to $1.3 billion.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Federal Reserve Board/University of Michigan/UK Office for National Statistics/Eurostat/Australian Bureau of Statistics/Japan Department Store Association/Japan Franchise Association/Fundação Getulio Vargas/Confederação Nacional da Indústria/Ministério da Indústria, Comércio Exterior e Serviços/FGRT

More Parents Holding Off on Back-to-School Shopping

(August 22) NRF press release

More Parents Holding Off on Back-to-School Shopping

(August 22) NRF press release