From the Desk of Deborah Weinswig

The Magic Returned to Las Vegas Again This August

This week, the FGRT team attended the August Magic trade show, held every year in Las Vegas, Nevada. The show is produced by UBM, a UK-based event organizer that puts on more than 300 events per year. Magic is held twice a year (in February and August) and its origins lie in a trade show that was launched in 1933 by the Men’s Apparel Guild in California (which was cleverly shortened to “magic”). The show is held at the enormous Las Vegas Convention Center (which also houses CES, the consumer electronics trade show, every January), with additional exhibits in the Mandalay Bay Convention Center. Magic consists of 13 unique communities covering footwear, apparel, accessories and manufacturing. Running concurrently at the Sands Expo Center/Venetian Congress space in Las Vegas was another trade show that featured off-price merchandise.

The 13 communities comprising Magic are:

- FN PLATFORM—an international showcase for men’s, women’s, juniors’ and children’s footwear from more than 20 countries

- WWDMAGIC—women’s and juniors’ apparel and accessories, focused on emerging designers

- THE TENTS—a platform for luxury and designer, contemporary men’s, and dual-gender labels

- PROJECT—the contemporary marketplace of top buyers and innovative designers

- PROJECT WOMENS—women’s contemporary collections, denim and accessories

- THE COLLECTIVE—established men’s and young men’s classic collections and lifestyle-driven and licensed apparel

- STITCH—contemporary, sportswear, lifestyle and international brands from focused and ready-to-wear designers

- POOLTRADESHOW—new and emerging brands seeking retail customers

- WSA@MAGIC—trendy, affordable footwear (buy now, wear now) for men, women, juniors and children

- CURVE LAS VEGAS—lingerie and swimwear

- CHILDREN’S CLUB MAGIC—contemporary children’s brands

- SOURCING AT MAGIC—links to the entire global supply chain

- FOOTWEAR SOURCING AT MAGIC—connections to footwear factories around the globe

The FGRT team attended presentations, seminars and panel discussions and met with a variety of apparel and media leaders at Magic. Discussion and presentation topics included retail, sourcing, social media, apparel manufacturing, automated manufacturing technology, fashion, store layout and design, outsourcing to countries such as Vietnam and China, and many others.

Given how competitive the retail industry is, Magic offered an enormous amount of free information for show visitors, emerging designers and retail store managers. One Magic veteran even gave a presentation on how to approach and manage the show, as the extent and scope of the event can easily overwhelm first-time visitors. Attendees characterized the show as exhausting, due to the sheer volume of apparel on display and the need to both gauge consumer demand and calculate the profitability of a given garment that must be ordered well in advance at the show.

Many of the presenters offered free consulting sessions to attendees. One former apparel designer simply offered a checklist of the steps that new designers must undertake, in the proper order, if they want to turn a design into a completed collection that adheres to fit guidelines. The presenter noted that taking the steps in order can help reduce mistakes and increase the likelihood of success. The topic of fit was mentioned numerous times, as poor fit is one of the main reasons garments are either not purchased initially or are returned by shoppers. Ensuring that customers find the optimal fit can dramatically reduce return costs, which can make or break the profitability of a retailer. The same presenter also provided tips on the necessity of accurately estimating the cost of a garment and reducing waste and, therefore, costs.

The FGRT team will continue to attend and share key takeaways from important industry conferences and events.

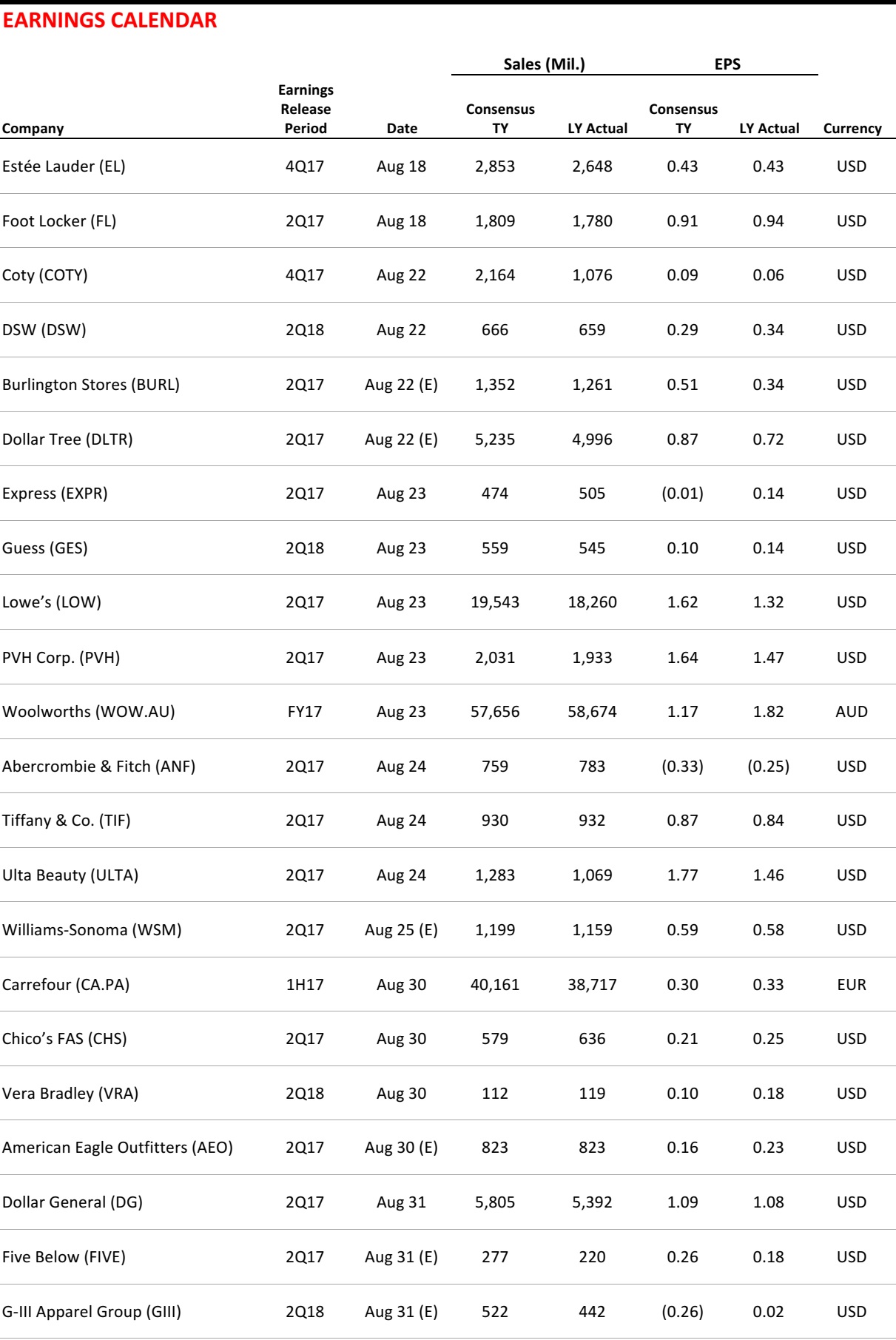

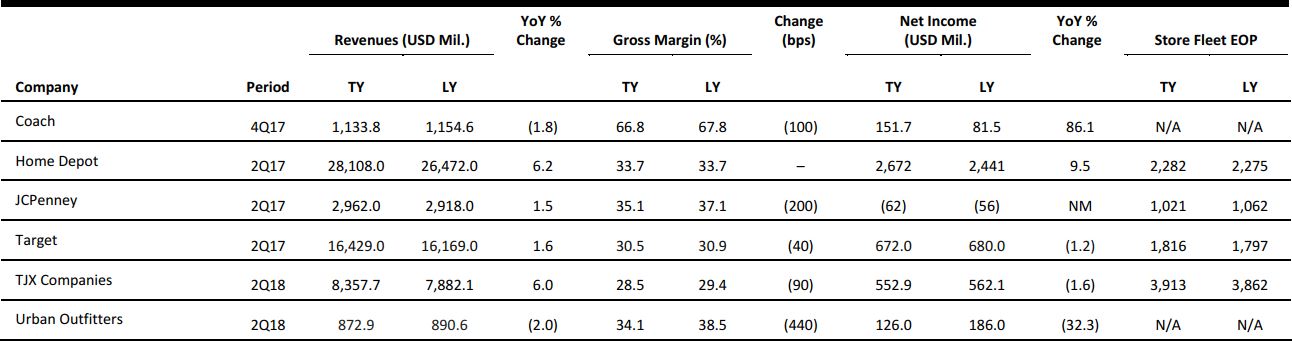

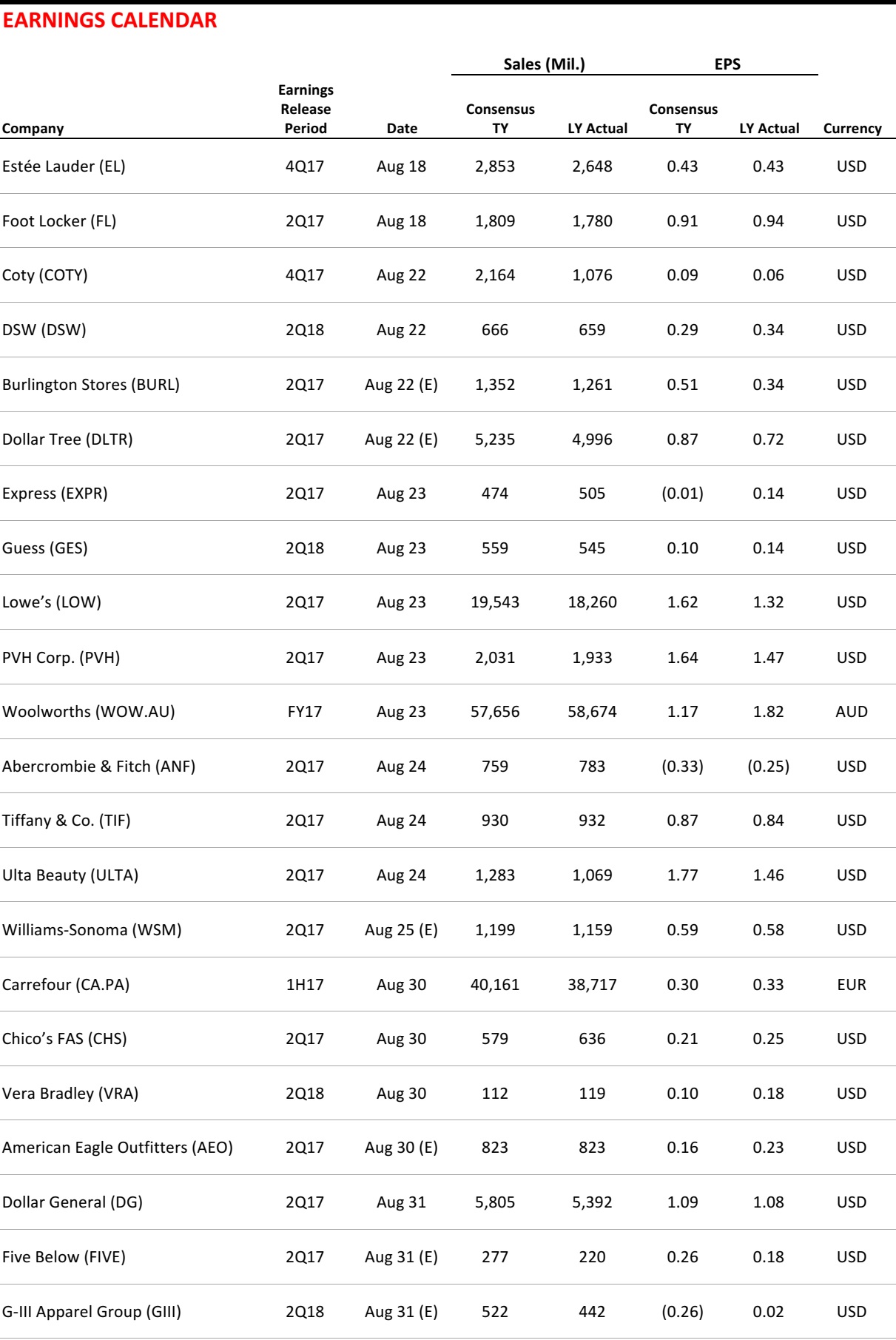

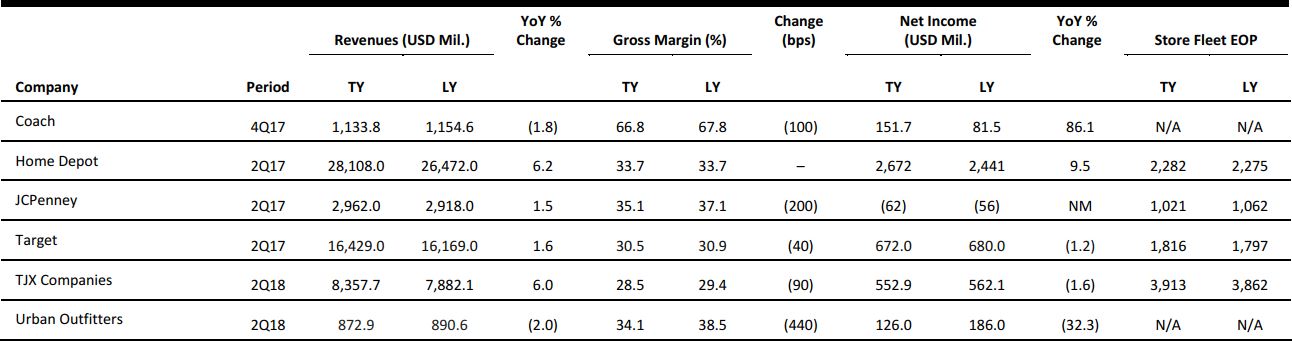

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Amazon’s Private-Label Business Is Booming Thanks to Device Sales, Expanded Fashion Lines

(August 17) TechCrunch.com

Amazon’s Private-Label Business Is Booming Thanks to Device Sales, Expanded Fashion Lines

(August 17) TechCrunch.com

- Amazon has been doubling down on its private-label business in recent months, though many of its own brands are not easily identifiable to consumers, as they do not indicate that they are made by Amazon. But these private labels have been gaining steam, according to a new report out this week from 1010data.

- During the first half of the year, Amazon’s private labels accounted for just 2% of total units sold, excluding the marketplace and subscriptions, but the retailer boosted that figure to 12% during Prime Day, the report found.

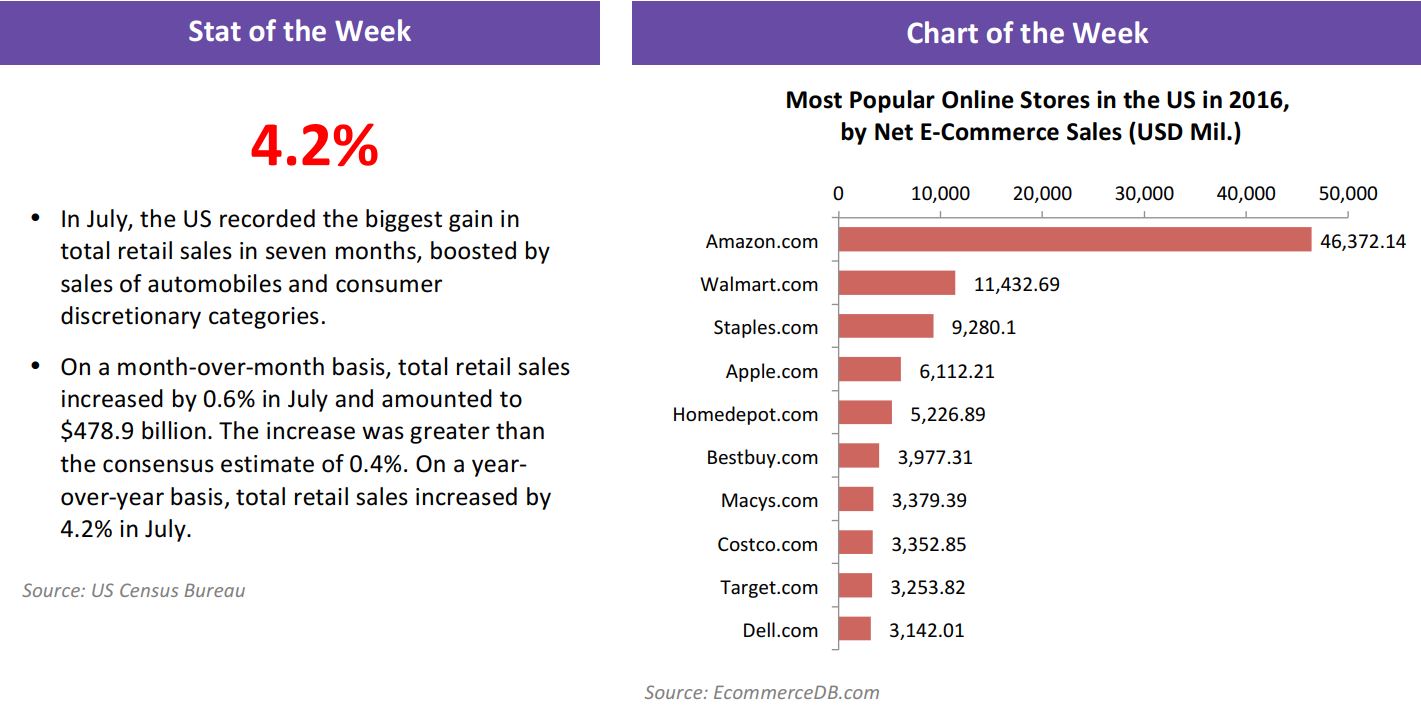

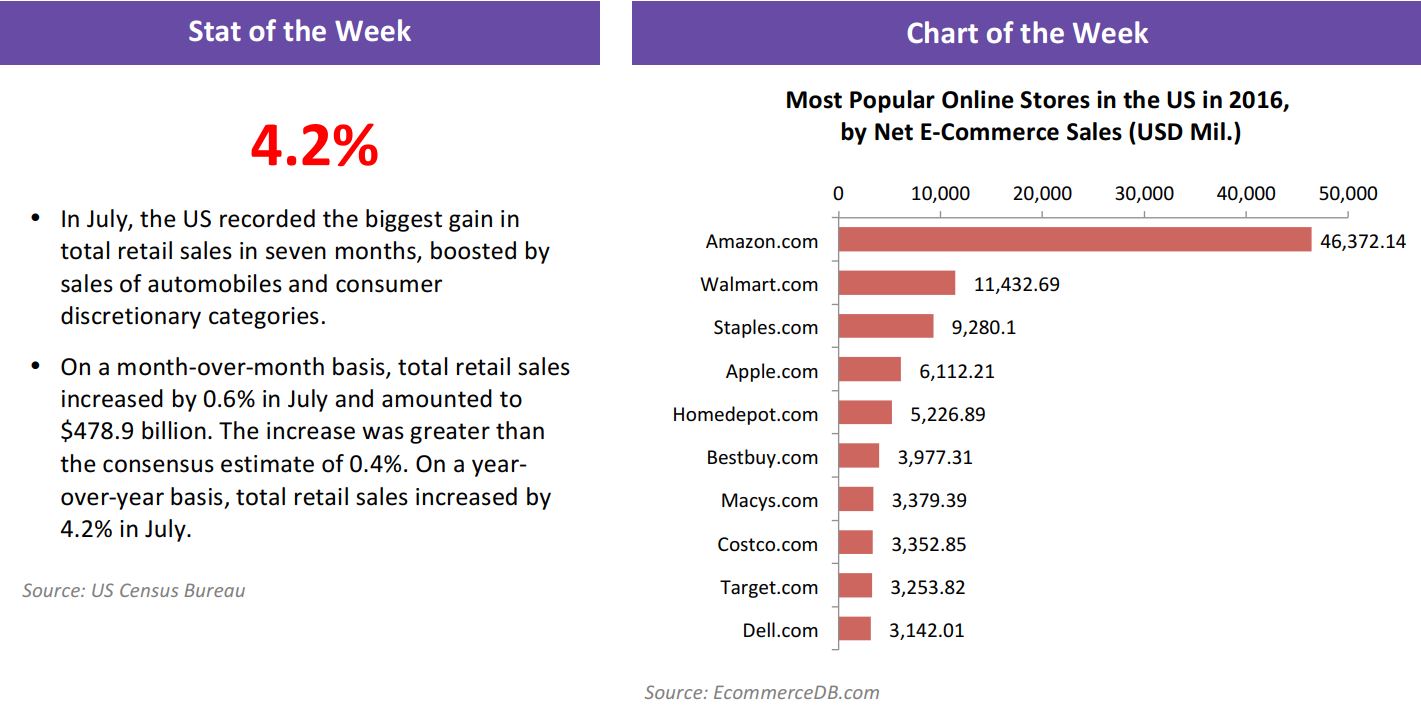

US Retail Sales Rose by 0.6% in July, vs. 0.4% Increase Expected

(August 15) CNBC.com

US Retail Sales Rose by 0.6% in July, vs. 0.4% Increase Expected

(August 15) CNBC.com

- US retail sales recorded their biggest increase in seven months in July as consumers boosted their purchases of motor vehicles as well as their discretionary spending, suggesting the economy continued to gain momentum early in the third quarter.

- The Commerce Department said on Tuesday that retail sales jumped 0.6% last month. That was the largest gain since December 2016 and followed June’s upwardly revised 0.3% rise. Economists polled by Reuters had forecast a retail sales increase of 0.4% in July after a previously reported 0.2% decline.

Moody’s Plays Down US Retail Fallout

(August 15) IrishTimes.com

Moody’s Plays Down US Retail Fallout

(August 15) IrishTimes.com

- The number of US retailers that have gone bankrupt in 2017 has surpassed last year’s total, but the sector’s woes will have a “limited” impact on the structured finance market, where bonds are backed by a pool of underlying loans, according to Moody’s. This year, 24 US retailers have gone bankrupt, against 11 by this time last year out of a 2016 total of 18, according to data from S&P Global Market Intelligence.

- But Moody’s said concerns were overblown. Despite the deepening challenges, the risks to CMBSs, CLOs, REITs and asset-backed securities based on credit card loans were “marginal,” the rating agency concluded.

Consumers Keep Spending, but Not in Stores

(August 15) The Wall Street Journal

Consumers Keep Spending, but Not in Stores

(August 15) The Wall Street Journal

- Bad news for struggling US retailers: Consumer spending is looking decent, but it is not showing up in their stores. Market share losses to Amazon and similar companies remain a big part of retailers’ problem. Sales at nonstore retailers—a category that includes many online retailers—rose by 1.3% last month from June and were up 11.5% from a year earlier.

- Retailers that sell items that so far have proved more difficult to sell online have done better. For example, sales at building material and garden equipment stores have been strong, according to the Commerce Department. Another problem is that retailers have little scope for raising prices, given that wages are growing only slowly and that low inflation is ingrained in consumers’ expectations.

E-Commerce Will Make Up 17% of All US Retail Sales by 2022—and One Company Is the Main Reason

(August 11) BusinessInsider.com

E-Commerce Will Make Up 17% of All US Retail Sales by 2022—and One Company Is the Main Reason

(August 11) BusinessInsider.com

- According to Forrester’s new Online Retail Forecast as cited by Digital Commerce 360, online sales will account for 17% of all US retail sales by 2022, up from a projected 12.7% in 2017. The report also expects US online sales to grow by 13% year over year in 2017, which is five times faster than projected offline sales growth and is in line with the National Retail Federation’s estimates.

- Unsurprisingly, Amazon is expected to be a major driver of this online sales growth. The report states that 83% of US online adults bought something on Amazon in 2016, and that 55% of them used Amazon as a research tool before making a purchase.

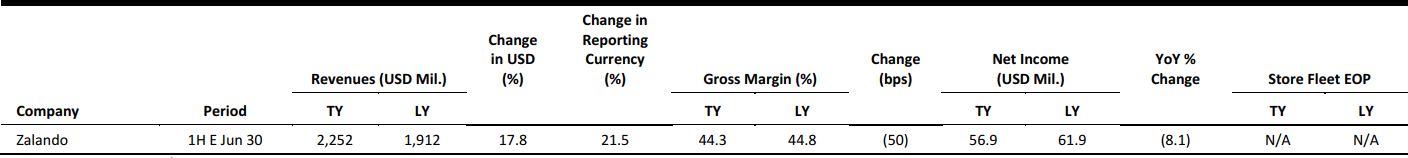

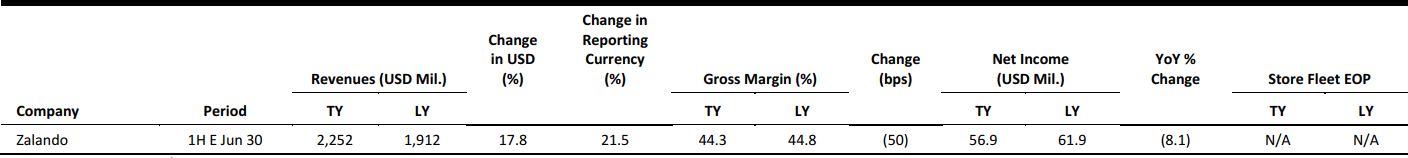

EUROPE RETAIL EARNINGS

EUROPE RETAIL HEADLINES

Sainsbury’s Pilots UK’s First 30-Minute Click-and-Collect Service

(August 11) Company press release

Sainsbury’s Pilots UK’s First 30-Minute Click-and-Collect Service

(August 11) Company press release

- British grocer Sainsbury’s has launched a trial that enables customers to put in an order and pick up their purchases in-store 30 minutes later via the Chop Chop app. The launch will see the retailer become the UK’s first supermarket to offer collection in under an hour.

- Customers will be able to select and pay for up to 25 items for collection in 30 minutes, seven days a week, with no fee for the service. This comes as Sainsbury’s pause

- s its talks regarding a takeover of the Nisa convenience chain over competition concerns.

SMCP to File for IPO with a Valuation of Up to $2.4 Billion

(August 11) BusinessofFashion.com

SMCP to File for IPO with a Valuation of Up to $2.4 Billion

(August 11) BusinessofFashion.com

- French fashion retailer SMCP has chosen Bank of America Merrill Lynch, JP Morgan and KKR Capital Markets as joint global coordinators to assist with its floatation in Paris this autumn.

- Based on the enterprise-value-to-EBITDA multiple of Italy’s Moncler, another fast-growing fashion company, SMCP could be worth around €2 billion (US$2.4 billion).

ASOS Launches Visual Search Function

(August 10) TechCrunch.com

ASOS Launches Visual Search Function

(August 10) TechCrunch.com

- Fashion e-commerce retailer ASOS has launched a visual search feature on its iOS app that allows users to take a photo or screenshot of a garment or fashion accessory and have the app show items similar to what they are trying to find.

- The retailer stated that the move is due to the high levels of traffic from mobile devices and that the visual search feature would be rolled out to the Android app “soon.”

Tesco to Roll Out Digital Kiosks as Largest Contactless Retailer in Ireland

(August 11) RetailTechnology.co.uk

Tesco to Roll Out Digital Kiosks as Largest Contactless Retailer in Ireland

(August 11) RetailTechnology.co.uk

- British supermarket giant Tesco is to roll out interactive digital kiosks at 140 of its Tesco Extra stores in the UK, in a £1.2 million (US$1.6 million) contract with Evoke Creative.

- The new dual-sided kiosks will allow customers to browse and select products, and then operate a ticket system for staff to assist with further information and queries. Tesco has recently been named the largest contactless retailer in Ireland.

Zara Launches First Stand-Alone Babywear Store

(August 14) DrapersOnline.com

Zara Launches First Stand-Alone Babywear Store

(August 14) DrapersOnline.com

- International fashion retailer Zara opened its first Zara Baby store in London this week. The store sells exclusively baby clothing.

- The offering includes a newborn-to-12-month range called Mini Collection, as well as Baby Boy and Baby Girl ranges for children ages three months to four years. Prices range from £3.99–£39.99 (US$5.14–US$51.50).

ASIA TECH HEADLINES

In India, an Uber for Farm Machinery Aims to Make a Difference in Rural Areas

(August 15) TechCrunch.com

In India, an Uber for Farm Machinery Aims to Make a Difference in Rural Areas

(August 15) TechCrunch.com

- Uber has inspired businesses to adopt its asset-light and on-demand approach to their industries. A startup called EM3 Agri Services is helping rural farmers in India get their hands on specialist equipment and machines that would ordinarily be out of their reach. The goal is to help them earn their livelihood with cutting-edge technology without breaking the bank.

- EM3 works with farmers who own equipment such as tractors, harvesters and other mechanical implements, allowing them to “rent out” their assets to help pay off the purchase or generate additional revenue. Farmers, typically those in remote regions with small holdings and limited capital, then get access to quality implements and machines on a pay-as-you-use basis.

PCCW Media Raises $110 Million for Its Video and Music Streaming Services in Asia

(August 16) TechCrunch.com

PCCW Media Raises $110 Million for Its Video and Music Streaming Services in Asia

(August 16) TechCrunch.com

- Hong Kong’s PCCW has pulled in $110 million for its range of video and music streaming services. Hony Capital, which recently backed WeWork’s China business, Foxconn Ventures and Singapore sovereign fund Temasek have taken an 18% share in the PCCW International OTT business. PCCW Media, which is listed on the Hong Kong Stock Exchange, will retain majority ownership.

- “We saw that there are strategic investors we feel we are very complementary…in different parts of the OTT space. Foxconn is a transforming company, [while] Temasek and Hony have [backed] companies that have been successful in the media space,” said Janice Lee, PCCW Media Managing Director.

Toyota, Intel and Others Form Big Data Group for Automotive Tech

(August 11) TechCrunch.com

Toyota, Intel and Others Form Big Data Group for Automotive Tech

(August 11) TechCrunch.com

- A collection of prominent names in the tech industry have teamed up with Toyota to work on developing big data systems to support self-driving cars and other future automotive advances. Denso, Ericsson, Intel and NTT Docomo joined hands with the Japanese car giant to announce the Automotive Edge Computing Consortium. The group said it has plans to add “relevant global technology leaders” to its membership this year.

- The companies have come together to tackle concerns around data usage in connected cars of the future, a critical component to making real-time mapping, driving assistance and other services go from theory to working in practice. Handling the huge volumes of data in a reliable and secure manner is critical.

SoftBank’s Vision Fund Backs Flipkart in Record India Tech Investment

(August 10) TechCrunch.com

SoftBank’s Vision Fund Backs Flipkart in Record India Tech Investment

(August 10) TechCrunch.com

- Flipkart confirmed that SoftBank has invested in its business via its $100 billion Vision Fund as part of an extension to the $1.4 billion financing round that was announced in April. The Vision Fund is buying a mix of primary and secondary sales, but the size of the investment has not been disclosed.

- Flipkart says that the fresh injection leaves it with over $4 billion on its balance sheet. That is a pretty handy arsenal for battling Amazon’s India unit, which Amazon CEO Jeff Bezos has committed to continuing to fund after already injecting some $5 billion to date. With the investment, SoftBank joins the likes of Microsoft, Tencent and eBay, all of which participated in Flipkart’s April funding round.

LATAM RETAIL AND TECH HEADLINES

Brazilian Outsourcer CI&T Buys US Digital Experience Firm

(August 15) ZDNet.com

Brazilian Outsourcer CI&T Buys US Digital Experience Firm

(August 15) ZDNet.com

- Brazilian IT outsourcing firm CI&T has acquired Silicon Valley strategy and customer experience design firm Comrade to boost its ability to deliver transformation projects and widen its US footprint.

- CI&T had already been focusing on going beyond coding to offer other services based on lean methodologies to support digital transformation projects, such as business strategy, digital marketing and user experience. The company expects that its new American subsidiary will further enhance those capabilities, as Comrade will continue to operate as a digital strategy and design agency.

Oracle Selects Brazilian Startups for Acceleration Program

(August 14) ZDNet.com

Oracle Selects Brazilian Startups for Acceleration Program

(August 14) ZDNet.com

- Oracle has picked six Brazilian startups to take part in the local version of its Cloud Accelerator program. This is the first group that will participate in the program, which will provide guidance and advice from executives at the software firm for a six-month period.

- “We were excited to see the initial reaction from the Brazilian startup community—all ventures with disruptive projects and great ideas for global opportunities,” said Reggie Bradford, Oracle’s SVP of Startup Ecosystem and Accelerator.

Qualcomm and Logicalis Eye IoT Opportunities in Brazil

(August 3) ZDNet.com

Qualcomm and Logicalis Eye IoT Opportunities in Brazil

(August 3) ZDNet.com

- Chipmaker Qualcomm will partner with IT services firm Logicalis to create a portfolio of Internet of Things (IoT) services and products geared toward Brazilian clients. The companies will seek to exploit opportunities within manufacturing, agribusiness, healthcare and smart cities. Qualcomm technologies will be applied for connected sensors and other products, while Logicalis will contribute with its development, integration and consulting expertise.

- Of the key segments that the partnership will be focusing on, agribusiness—one of the most significant for the Brazilian economy overall—will be the focus of the first initiative. The project will be a supply chain tracking application intended to reduce waste and crop losses and will be based on Qualcomm’s system-on-a-chip technology combined with Logicalis’s Eugenio platform on the back end.

Brazil Retail Sales Jump in June, Boosted by Cheaper Credit

(August 15) Reuters.com

Brazil Retail Sales Jump in June, Boosted by Cheaper Credit

(August 15) Reuters.com

- Retail sales in Brazil rose by more than expected in June, government data showed on Tuesday, suggesting the central bank’s string of large interest rate cuts may be starting to boost the economic recovery.

- Sales volumes excluding cars and building materials rose by 1.2% from the preceding month, after seasonal adjustments, government statistics agency IBGE said. That followed an upwardly revised increase of 0.2% for May.

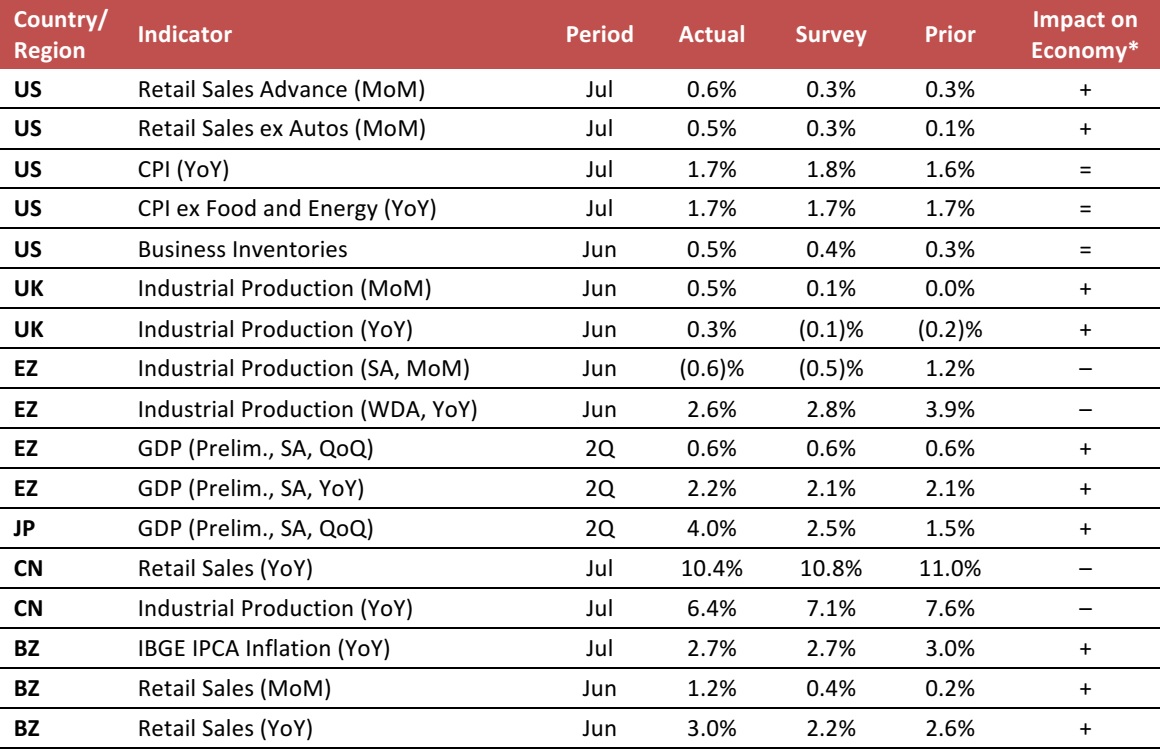

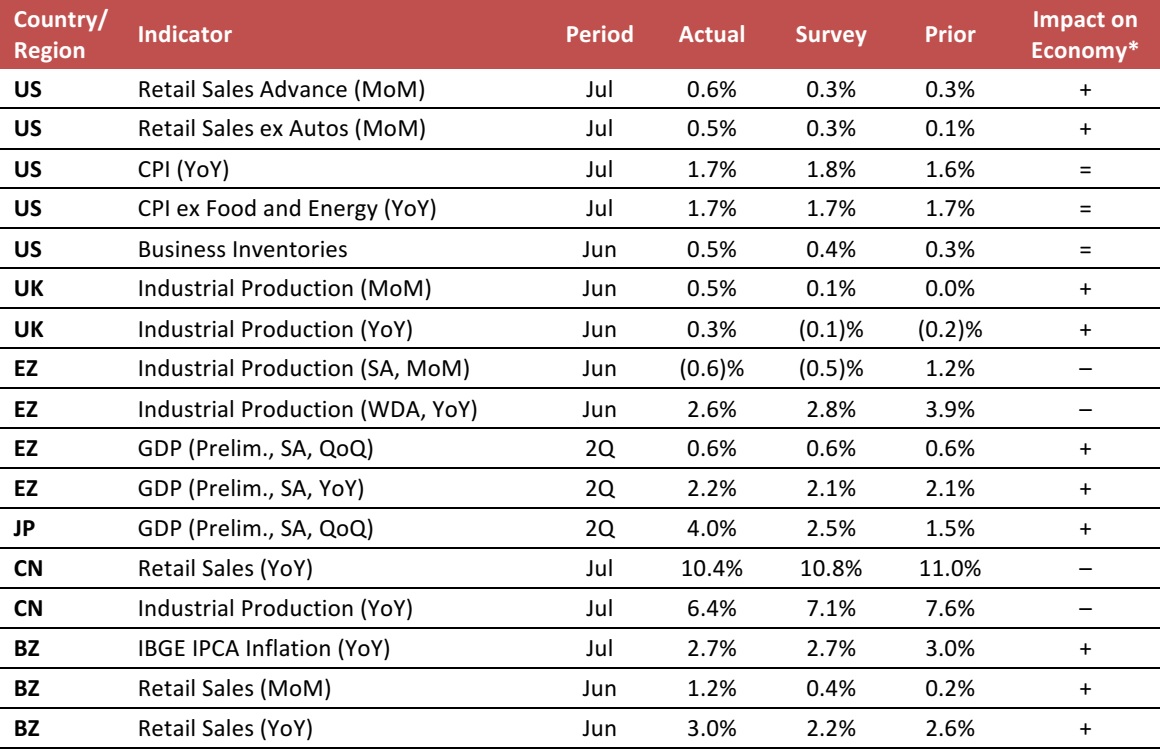

MACRO UPDATE

Key points from global macro indicators released August 9–16, 2017:

- US: US retail sales increased by 0.6% month over month in July. The Consumer Price Index moderated upward by 1.7% year over year in July. In June, business inventories edged up by 0.5%, which was higher than the consensus estimate.

- Europe: In the UK, industrial production increased by 0.5% month over month in June, beating the market’s expectation. In the eurozone, industrial production dropped by 0.6% month over month in June. Eurozone GDP increased by 2.2% year over year in the second quarter.

- Asia-Pacific: In Japan, GDP in the second quarter increased by 4.0% quarter over quarter, which was better than the consensus estimate. In China in July, retail sales increased by 10.4% year over year and industrial production increased by 6.4% year over year; both figures were below consensus estimates.

- Latin America: In Brazil, inflation increased by 2.7% year over year in July. Retail sales increased by 1.2% month over month in June, ahead of the consensus estimate.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Bureau of Labor Statistics/UK Office for National Statistics/Eurostat/The Economic and Social Research Institute/National Bureau of Statistics of China/Instituto Brasileiro de Geografia e Estatística (IBGE)/FGRT

In India, an Uber for Farm Machinery Aims to Make a Difference in Rural Areas

(August 15) TechCrunch.com

In India, an Uber for Farm Machinery Aims to Make a Difference in Rural Areas

(August 15) TechCrunch.com