Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

The robots are coming! Not to conquer the earth, but to sweep your floor, greet you when you enter a store and possibly, to manufacture the clothes that you wear. And actually, robots have already been here for many years in automobile and other types of manufacturing and are now being used to move goods in warehouses.

Robotics has brought great benefits to the electronics and automotive industries in terms of improving quality and reducing labor costs, and they could offer similar benefits to retailers. While retailing is currently not a heavy user of robots, but that could soon change, with Amazon leading the way.

In advance of the 2014 holiday rush, Amazon deployed more than 15,000 Kiva robots in 10 fulfillment centers, a move that it estimated could cut operating costs by 20%. Kiva robots zip along the floor of a warehouse, pick up items from shelves and pallets, and transfer them to cartons and totes. In addition to these robots, Amazon uses Robo-Stow, a robotic arm it developed, which along with machine-vision systems, can unload and register a trailer full of goods in half an hour (this previously took hours). Amazon has publicly announced that it is also testing another kind of robot—flying drones—for aerial package delivery.

Walmart uses an undisclosed number of robots in its US distribution centers to pick, pack and sort items for its e-commerce business. Its robots tape packages for shipping and stamp shipping labels on packages. With an algorithm developed at its Silicon Valley-located Walmart Labs, the company has been able to locate and sort items much more efficiently, reducing delivery time by 15%.

In addition to these giants, several other companies are developing robotics technology for use in warehouses, and continuous price and performance improvements in robotics are reaching an inflection point, spurring adoption by many other industries. One startup, Symbotic (formerly known as CasePick Systems), is developing warehouse robots that can optimize fulfillment, transportation and logistics. Another company, UK-based Ocado, is developing autonomous robots for use in automated grocery distribution centers.

Some retailers and companies are using robots in their stores today. Japanese retailer Mitsukoshi installed a robotic greeter made by Toshiba in its Tokyo stores, and Bank of Tokyo-Mitsubishi UFJ is testing Nao, a customer service robot that can answer questions in 19 languages. Home-improvement chain operator Lowe’s is using Silicon Valley-designed robots to greet customers and guide them to the merchandise they seek.

Garment manufacturing, though remains a very labor-intensive process, and even in this age of automation, human labor is necessary at every stage of production. Though most manufacturing is currently performed overseas due to lower labor and other costs, there are several potential benefits to domestic manufacturing, including quality control, quick turnaround, and lower shipping costs, among others. Over time, continued technological development should reduce the cost of robotic technology to overcome high initial capital investment, which could lead to the return of some production to domestic locations.

Robotics companies are working to address these challenges of garment-making by developing fully automated sewing machines that have the potential to reduce direct labor costs. While some parts of apparel manufacturing have already been automated, garment cutting and sewing still require human labor. One tech startup, SoftWear Automation, has developed an automated sewing machine that it hopes will revolutionize the garment industry. Its SAM-1000 sewing machine is designed to function completely without a human operator, potentially transforming the entire garment-manufacturing industry.

We at FBIC Global Retail & Technology are looking forward to the robot invasion!

The robots are coming! Not to conquer the earth, but to sweep your floor, greet you when you enter a store and possibly, to manufacture the clothes that you wear. And actually, robots have already been here for many years in automobile and other types of manufacturing and are now being used to move goods in warehouses.

Robotics has brought great benefits to the electronics and automotive industries in terms of improving quality and reducing labor costs, and they could offer similar benefits to retailers. While retailing is currently not a heavy user of robots, but that could soon change, with Amazon leading the way.

In advance of the 2014 holiday rush, Amazon deployed more than 15,000 Kiva robots in 10 fulfillment centers, a move that it estimated could cut operating costs by 20%. Kiva robots zip along the floor of a warehouse, pick up items from shelves and pallets, and transfer them to cartons and totes. In addition to these robots, Amazon uses Robo-Stow, a robotic arm it developed, which along with machine-vision systems, can unload and register a trailer full of goods in half an hour (this previously took hours). Amazon has publicly announced that it is also testing another kind of robot—flying drones—for aerial package delivery.

Walmart uses an undisclosed number of robots in its US distribution centers to pick, pack and sort items for its e-commerce business. Its robots tape packages for shipping and stamp shipping labels on packages. With an algorithm developed at its Silicon Valley-located Walmart Labs, the company has been able to locate and sort items much more efficiently, reducing delivery time by 15%.

In addition to these giants, several other companies are developing robotics technology for use in warehouses, and continuous price and performance improvements in robotics are reaching an inflection point, spurring adoption by many other industries. One startup, Symbotic (formerly known as CasePick Systems), is developing warehouse robots that can optimize fulfillment, transportation and logistics. Another company, UK-based Ocado, is developing autonomous robots for use in automated grocery distribution centers.

Some retailers and companies are using robots in their stores today. Japanese retailer Mitsukoshi installed a robotic greeter made by Toshiba in its Tokyo stores, and Bank of Tokyo-Mitsubishi UFJ is testing Nao, a customer service robot that can answer questions in 19 languages. Home-improvement chain operator Lowe’s is using Silicon Valley-designed robots to greet customers and guide them to the merchandise they seek.

Garment manufacturing, though remains a very labor-intensive process, and even in this age of automation, human labor is necessary at every stage of production. Though most manufacturing is currently performed overseas due to lower labor and other costs, there are several potential benefits to domestic manufacturing, including quality control, quick turnaround, and lower shipping costs, among others. Over time, continued technological development should reduce the cost of robotic technology to overcome high initial capital investment, which could lead to the return of some production to domestic locations.

Robotics companies are working to address these challenges of garment-making by developing fully automated sewing machines that have the potential to reduce direct labor costs. While some parts of apparel manufacturing have already been automated, garment cutting and sewing still require human labor. One tech startup, SoftWear Automation, has developed an automated sewing machine that it hopes will revolutionize the garment industry. Its SAM-1000 sewing machine is designed to function completely without a human operator, potentially transforming the entire garment-manufacturing industry.

We at FBIC Global Retail & Technology are looking forward to the robot invasion!

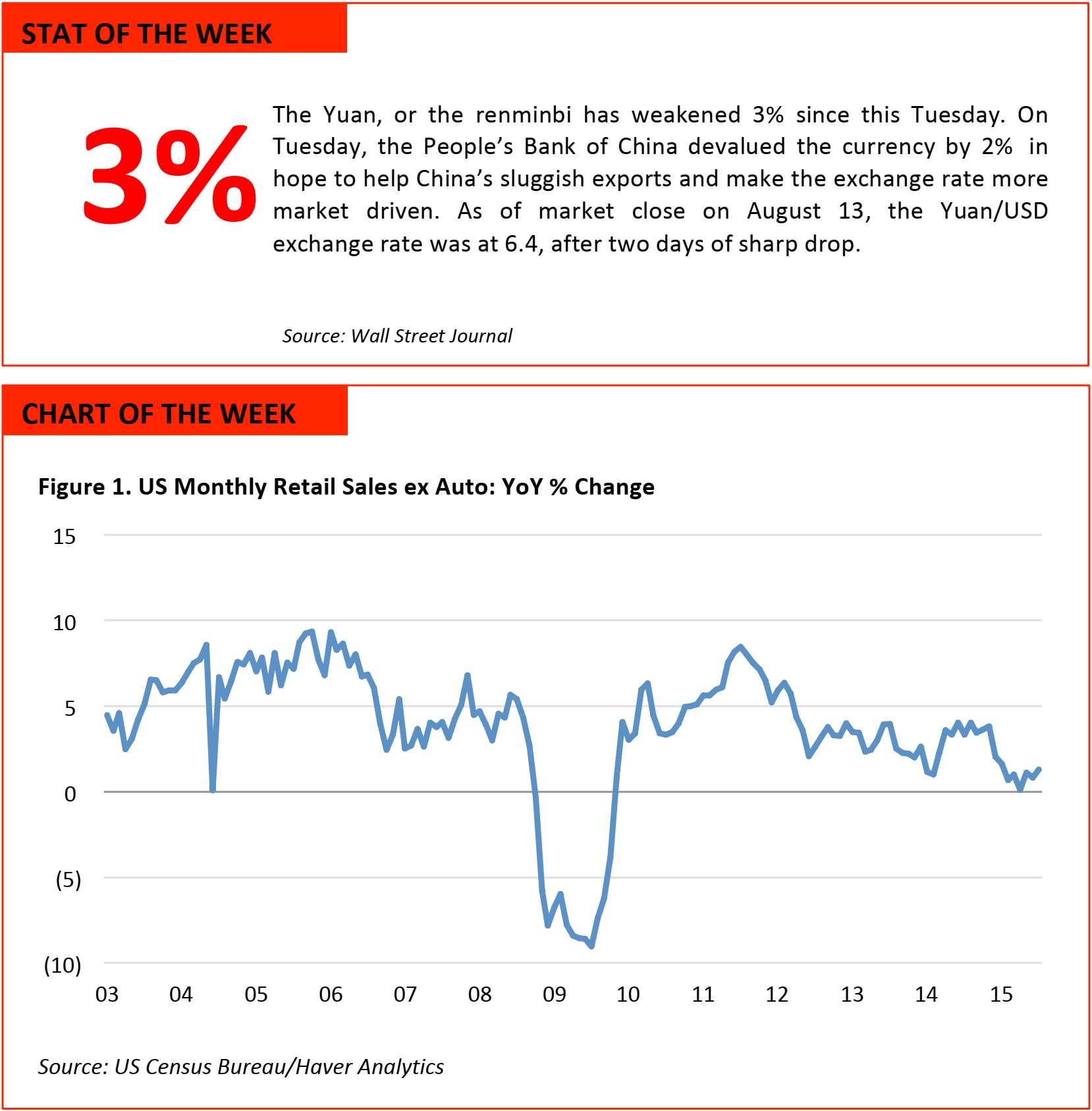

- US retail sales posted solid results in July, rising 0.6% month over month (adjusted). The results met economists’ expectations.

- Also, total retail sales numbers for June were revised up, to 0.0% from -0.3%.

- Eleven out of 13 major categories posted sales gains. Consumers spent more money eating out, buying new cars and improving their homes. However, sales at department stores and electronics stores continue to decline.

- The results were in line with economists’ optimism for the second half of 2015. A strong job market, solid income growth and rising home values are likely to lead to steady retail spending gains over the next few months. The latest jobless claims total for the week ended August 8 was 274,000, close to a four-decade low.

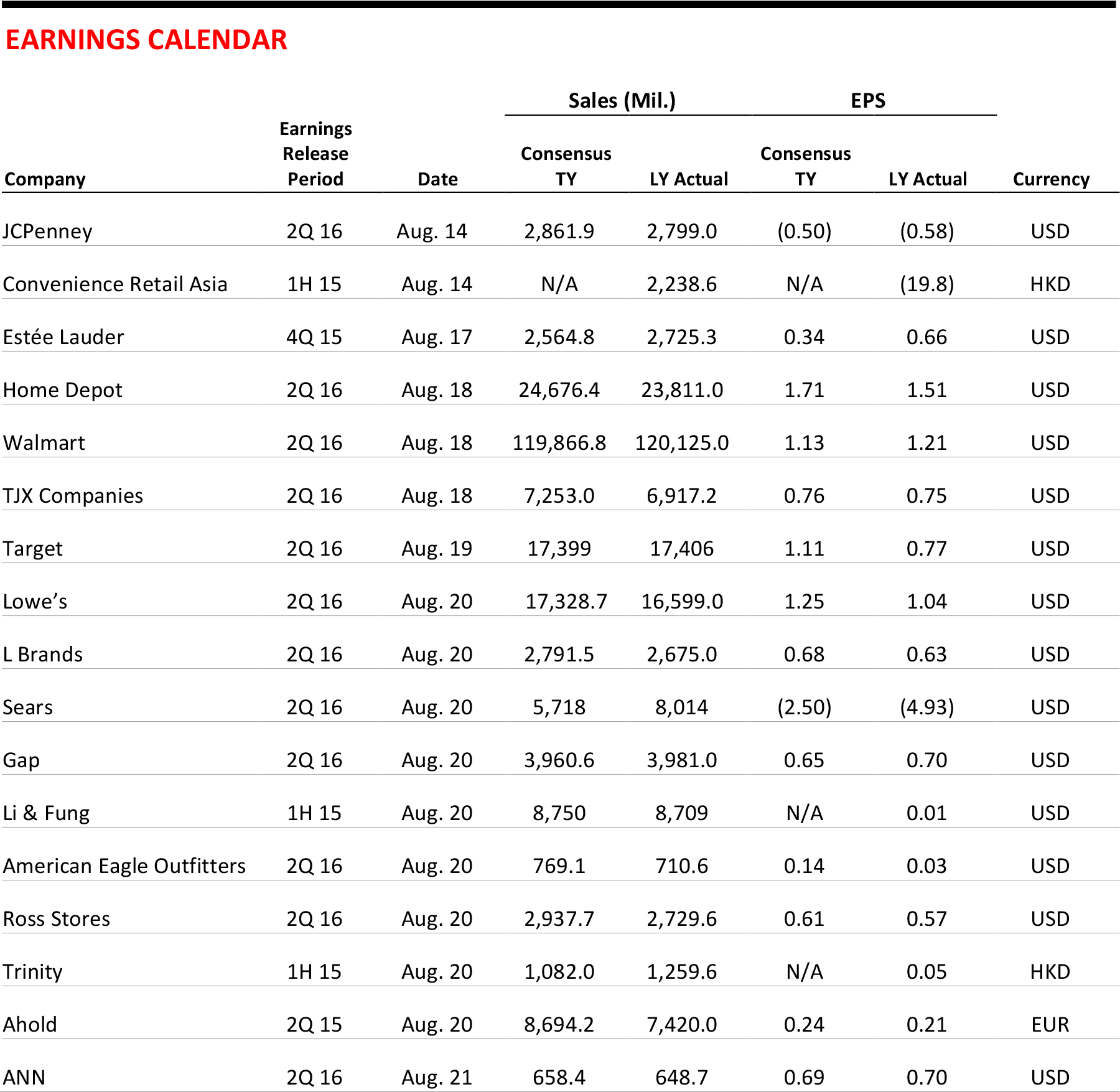

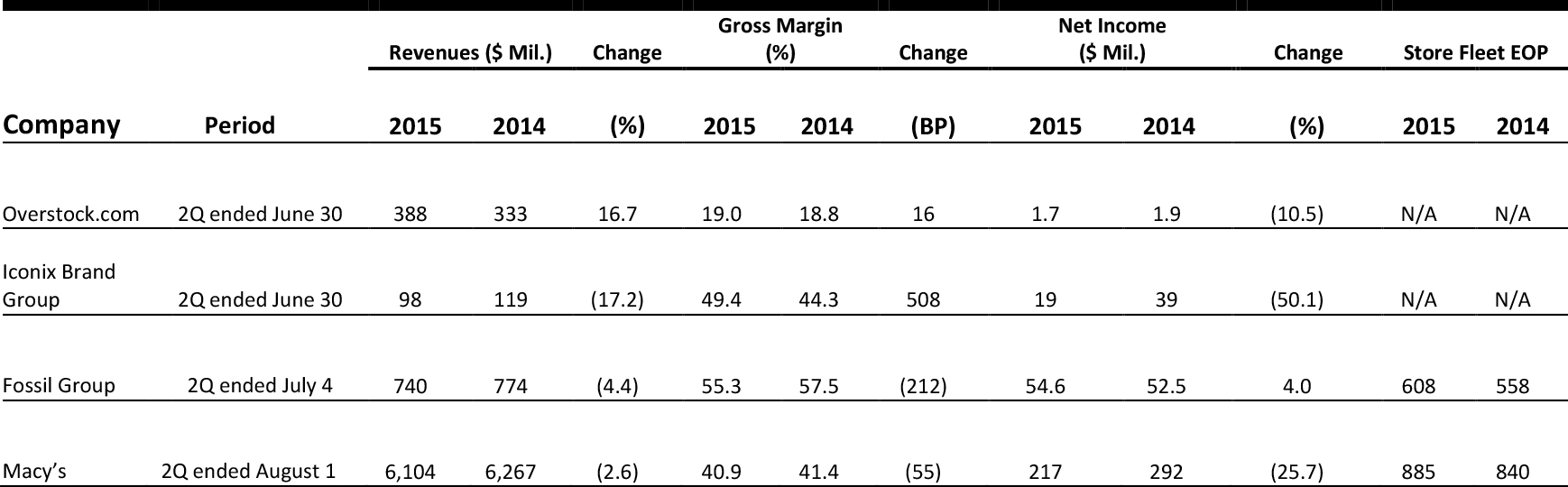

US RETAIL EARNINGS

Source: Company reports

US RETAIL EARNINGS

- By using links to third-party retail vendors, Jet Anywhere allows subscribers to enjoy discounts outside the Jet.com website. But some retailers have complained that Jet.com placed links to their sites without consulting them or getting their permission, and that some of these links promised consumers cash back for making purchases.

- Dozens of the nation’s largest retailers, including Macy’s, Amazon, Home Depot, Walmart, Gap, Walgreens and L’Oréal, requested that their brands be removed. CEO Marc Lore believes Jet Anywhere encourages other retailers to sell products directly through Jet by showing them that the site can bring them traffic. Since launch, Jet Anywhere has accounted for 15% gross value of merchandise purchased.

- Macy’s reported disappointing financial results for the second quarter. The company’s same-store sales declined by 2.1%, and profit fell to $217 million from $292 million a year earlier. Total sales fell 2.6%, to $6.1 billion, missing analysts’ estimates of $6.23 billion. CEO Terry J. Lundgren reported that a strong US dollar significantly lowered international tourist spending.

- Macy’s is accelerating its fast-growing online business through integrated omnichannel buying and planning of merchandise. The company will begin e-commerce selling in China in the fall through a joint venture with Fung Retailing Limited that will be 65% owned by Macy’s and 35% owned by Fung Retailing. Macy’s has expanded same-day delivery markets and integrated six Macy’s Backstage off-price stores in New York City. Also, Macy’s and Tishman Speyer announced their plan for a major development in Brooklyn. Macy’s will receive $170 million in cash from Tishman Speyer for its Brooklyn real estate assets, along with an additional $100 million over the next three years.

- Target is teaming up with Canadian footwear chain ALDO on a new product line of shoes and accessories, according to Footwear News. Target hopes to reach the young, millennial, contemporary and fashion-forward consumer. Retail prices will range from $35 to $49 for a pair of shoes.

- The ALDO brand, called A+, is expected to launch at all Target stores this month. Target already partners with Stride Rite and Steve Madden, and it plans to continue its focus on shoe partnerships. “Target is exploring additional exclusive partnership and shoe launches for the future,” said Stacia Anderson, SVP of apparel and accessories for Target.

Gap Continues to Struggle

(August 3) The Wall Street Journal

Gap Continues to Struggle

(August 3) The Wall Street Journal

- In July, sales at the company’s namesake stores fell 7%, compared with a 2% decrease a year earlier. Same-store sales at Gap’s Banana Republic fell 10%, compared with 6% growth a year earlier.

- CEO Arthur Peck announced that Gap plans to close roughly a quarter of its namesake stores in North America, the second major round of cuts in four years. With consumers doing more and more shopping online, Gap has an issue with its large numbers of stores across the US.

- Sephora is expected to introduce its subscription box, called Play!, in September. The $10-a-month subscription will first be available to consumers in Boston and Cincinnati. The crowded $20–$25 market does not scare Sephora, which will use its corporate siblings at LVMH to help fill its boxes with renowned brands. Sephora’s vendors have responded positively to this initiative.

- SVP of Marketing and Brand Deborah Yeh said that the extensive research available on products from both the online and brick-and-mortar channels will facilitate product choice. According to NPD Group, 90% of people who receive subscription boxes end up buying a product.

ASIA HEADLINES

- Alibaba announced it is paying ¥28.3 billion (US$4.63 billion) to take a 19.99% stake in Suning, a major Chinese electronics retailer that has 1,600 physical stores in 289 cities across China.

- The Alibaba-Suning deal is about both online and offline partnerships. Suning will have a storefront on Alibaba’s Tmall marketplace and will open up its vast logistics network to Alibaba’s Cainiao logistics platform.

- Alibaba merchants on Taobao and Tmall can ship their items faster to buyers using Suning’s 57 regional distribution centers, 353 city forwarding centers and 1,700 last-mile delivery stations across China.

- Soundbrenner is a metronome that looks like a smartwatch that is designed for musicians. The wearable device can be strapped onto the wearer’s wrist, arm or ankle, and pulses the rhythm of music through haptic feedback.

- A unique beats-per-minute tap feature enables musicians to tap the face of the device to set the desired tempo. They can then turn the wheel of the device to increase or decrease tempo.

- Amazon India launched a beauty store that will offer beauty products from 17 luxury brands covering hair, skin and body treatments for both men and women.

- The brands include L’Occitane, Crabtree & Evelyn, Kama Ayurveda, Forest Essentials, Davidoff, Calvin Klein, Dermalogica, Ren, Temple Spa, Leighton Denny, Jo Hansford, Shaze, Dr. Lipp, Eve Snow, Pangea Organics and The Camel Soap Factory.

- Alibaba has launched an English-language version of its online system for reporting intellectual property infringement that occurs on its Taobao and Tmall marketplaces.

- The system, called TaoProtect, is designed to make it easier for companies to report merchants who are selling counterfeit products on Taobao and Tmall, facilitating the efficient removal of counterfeits.

- The English version of TaoProtect aims to make the system more accessible to Western companies.

- Chinese Internet giant Tencent led a US$90 million series C funding round for medical search startup Practo. The startup raised $30 million in February. Google Capital, Yuri Milner, Sofina, Altimeter, and existing investors Sequoia Capital and Matrix Capital Markets also took part in the new round.

- Bangalore-based Practo has a two-sided business model. One side is a marketplace that connects patients with doctors and medical organizations, while the other side offers practice management software, called Practo Ray, to build relationships with the latter.

- The company claims to have 200,000 doctors, 8,000 hospitals and 5,000 diagnostic centers across 35 cities in India on its platform. It has expanded into Singapore and Manila, and it aims to further expand into 10 international markets across Southeast Asia, Latin America, the Middle East and Eastern Europe by March of next year.

- Huawei said that its tablets have enjoyed the biggest market share in Finland in the past few weeks. In the second quarter of this year, about 30,000 Huawei tablets were sold in Finland, surpassing the numbers sold by rivals Samsung and Apple.

- While Huawei’s share in the Finnish tablet market has reached a peak of about 35%, Apple has reached the highest sales value, followed by Samsung and Huawei.

- Samsung Electronics has basked in the success of its Galaxy smartphone, making billions of dollars competing with Apple in the premium mobile market.

- Recently, though, it has been forced to slash prices and accept lower margins at its mobile division in order to stave off competition from rivals that include Huawei and Xiaomi in the mid-to-low end of the market.

- Samsung is stuck with the same Android operating system used by its low-cost competitors, which are producing increasingly capable phones of their own.

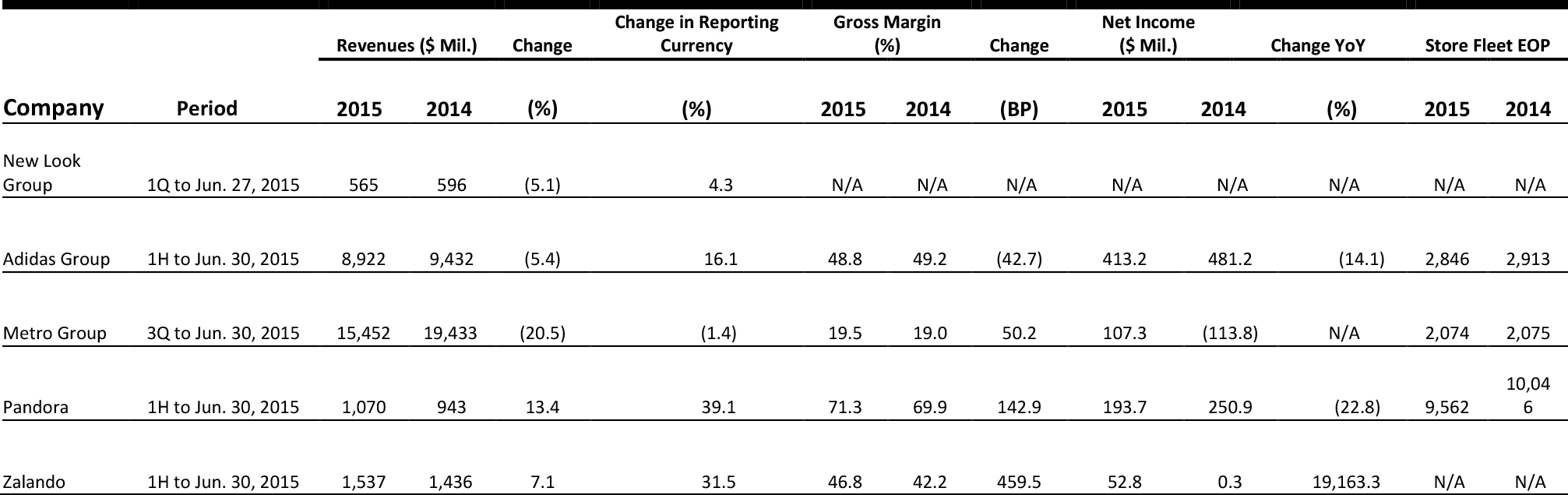

EUROPEAN RETAIL EARNINGS

Source: Company reports

EUROPEAN RETAIL HEADLINES

- Adjusted retail sales volume dropped 0.6% in June from May, but was up 1.2% from the same time last year in the 19 countries that use the euro, according to Eurostat, the EU’s statistics agency. That was the largest drop in month-over-month sales since September 2014.

- Month-over-month retail trade volume in Germany fell 2.3% in May, according to Eurostat; it was hoped that the positive effects of economic recovery in the region would improve the state of the eurozone, as German purchases from the weaker areas of the eurozone increased. Consumer prices in the eurozone hardly increased from July 2014 levels.

- As the year-to-date gain in Inditex’s shares surged 36% on August 5, 2015, the company’s valuation crossed €100 billion (US$109 billion), making it one of only 80 companies worldwide to have that sort of market value. Inditex is the only Spanish company in the world to have this high a valuation, surpassing Banco Santander and Telefónica.

- Amancio Ortega, the owner of Inditex, benefited the most from the stock surge, as he moved ahead of Warren Buffett to become the second-richest person in the world, according to the Bloomberg Billionaires Index. Ortega has a seat on Inditex’s board, and he established the company in 1975. Inditex owns leading brands such as Zara, Massimo Dutti, Bershka and Pull & Bear, and has 6,700 stores in 90 countries.

- Second-quarter net profit at Adidas increased by 1.4%, to €146 million (US$161 million), from €144 million (US$159 million) a year ago. The growth was driven by strong sales in China and Western Europe, and good performance from its Adidas and Reebok brands. Sales rose 5%, to €3.9 billion (US$4.3 billion), compared to the same time last year, when the FIFA World Cup contributed to the company’s revenue.

- The TaylorMade-Adidas Golf unit, however, suffered bad performance, with sales down 26% in the quarter; the company stated that it is in touch with Guggenheim Partners’ investment bank to help it restructure the unit and sell the least lucrative parts of it.

- Adidas also announced it plans to acquire Runtastic, an Austrian developer and manufacturer of fitness and health applications and hardware, for €220 million (US$243 million).

- German discount supermarket Aldi has announced that it intends to increase operations in the UK by opening 130 new stores and hiring 8,000 staff as part of a £600 million (US$935 million) expansion. The company aims to increase the number of its UK staff to 35,000 by 2022.

- Aldi entered the UK in 1990 and surpassed Waitrose this April, with 5.3% market share, to become the UK’s sixth-largest supermarket. It has also launched its campaign as an official partner of Team GB for the 2016 Olympics, and has recruited six Team GB athletes as part of the partnership.

- Amazon has agreed to a 10-year lease on a warehouse in Surrey, UK, that was formerly used by Tesco. The facility is equipped with grocery storage and handling facilities, but has been unused since Tesco vacated it at the end of 2014. Clegg Food Projects—a solutions provider for food processing and distribution—has been appointed to renovate the property.

- Amazon has acquired a second warehouse in Leicestershire, and though it was not previously used for food distribution, it reportedly has the necessary planning permissions to distribute groceries. Previous reports had speculated that Amazon would launch its grocery distribution service, Amazon Fresh, in London. These leases, however, hint at a wider launch across the UK.

- German company Metro Group has posted a profit of €115 million (US$180 million) at the end of the third quarter of its fiscal year, which is a considerable improvement from last year’s loss of €63 million (US$98 million). The group’s turnover, however, fell 1.4%, to €14 billion (US$22 billion), with turnover from Metro Cash & Carry dropping 1.3%, to €7.45 billion (US$11.6 billion), with just 0.1% growth in comps, mainly because of a weak ruble.

- Media-Saturn Group’s turnover rose 1.2%, to €4.62 billion (US$7.19 billion), with a mere 0.2% increase in comps; the turnover at Real, the department store chain, fell 8%, to €1.88 billion (US$2.07 billion), because of mediocre performance from its Eastern European stores, where comps dropped 0.6%.

- After several years of negotiations, Costco will finally open its first store in France, in spring 2016. The American membership-only retailer is expected to trigger a price war according to reports, and several large French retailers have banded together since last year in order to receive better bargains from suppliers.

- Costco intends to open up to 15 stores in France over the next 10 years. Costco’s competitors had protested its entry in France over recent years, and the French government had delayed its plans to enter the country. The American giant finally received permission to construct its first store in the suburbs of Paris in May 2014.

- StyleLounge, a European metasearch engine for fashion and lifestyle products, has reportedly raised €2.3 million (US$3.6 million), which it intends to use for further expansion in Europe. The Germany-based startup recently entered France and the Netherlands, and plans to launch in five more European countries by the end of the year.

- StyleLounge works with more than 100 partners in Germany, which provide over 1.2 million products; the engine helps users find and compare prices—including discounts, vouchers, shipping and returns—for clothing and lifestyle products, and checks their availability across stores, without the user having to visit each retailer’s website.

LATAM HEADLINES

- After 20 years in the region, Skechers has formed a new Latin American subsidiary and plans to transition 21 of its stores to the subsidiary and company-owned outlets.

- The new subsidiary will manage operations in more than 30 countries, including Colombia, Costa Rica, Panama and Peru.

- Skechers experienced more than 60% growth in its international wholesale business in the second quarter, and plans to deploy its strengths in marketing, advertising, capital and infrastructure to help its Latin American business reach its potential.

- Havaianas, the Brazilian footwear maker, is joining a new strategic alliance with Walt Disney World Resort, Disneyland Resort and Disney Vacation Club.

- The footwear maker has produced Disney-themed flip-flops for the past four years, and products will soon be available for sale at 22 retail locations across the above-mentioned properties and Disney’s Blizzard Beach Water Park, Typhoon Lagoon and California Adventure.

- Havaianas is also working with Disney to develop cobranded flip-flops and will sponsor all runDisney races starting in November.

Starbucks Opens First Restaurant in Panama

(August 7) EPRRetailNews.com

Starbucks Opens First Restaurant in Panama

(August 7) EPRRetailNews.com

- Starbucks and its licensing partner in Latin America, Premium Restaurants of America (PRA), opened the first Starbucks in Panama, making the country Starbucks’s 15th market in Latin America and its 67th worldwide.

- Starbucks now has 880 stores in Latin America, with more than 12,000 employees.

- El Salvador–based PRA has opened a total of 19 Starbucks outlets, including eight in El Salvador, five in Costa Rica, five in Guatemala, and the most recent addition in Panama.

- Procter & Gamble (P&G) is investing for growth and in R&D to promote its haircare and deodorant brands in Latin America, particularly in Mexico and Brazil.

- P&G recently participated in the Inexmoda show, using more than 2,300 products across its brands to groom 400 models.

- Leading P&G brands in Latin America include Pantene, Head & Shoulders, Old Spice, Right Guard and Escudo, and the company recently launched its Aussie brand in Brazil.

- Colombiamoda, the fashion and sourcing show for Colombian fashion, plans to double in size by 2020 by attracting more buyers and increasing its exhibition space.

- In the 26th annual show, revenue from potential sourcing contracts increased by 11%, to $341 million, and the number of buyers increased by 20%, to 13,271.

- As part of its growth plans, show owner Inexmoda plans to launch a fashion trade show called B Capital in Bogotá in late September, the week after Bogotá Fashion Week.