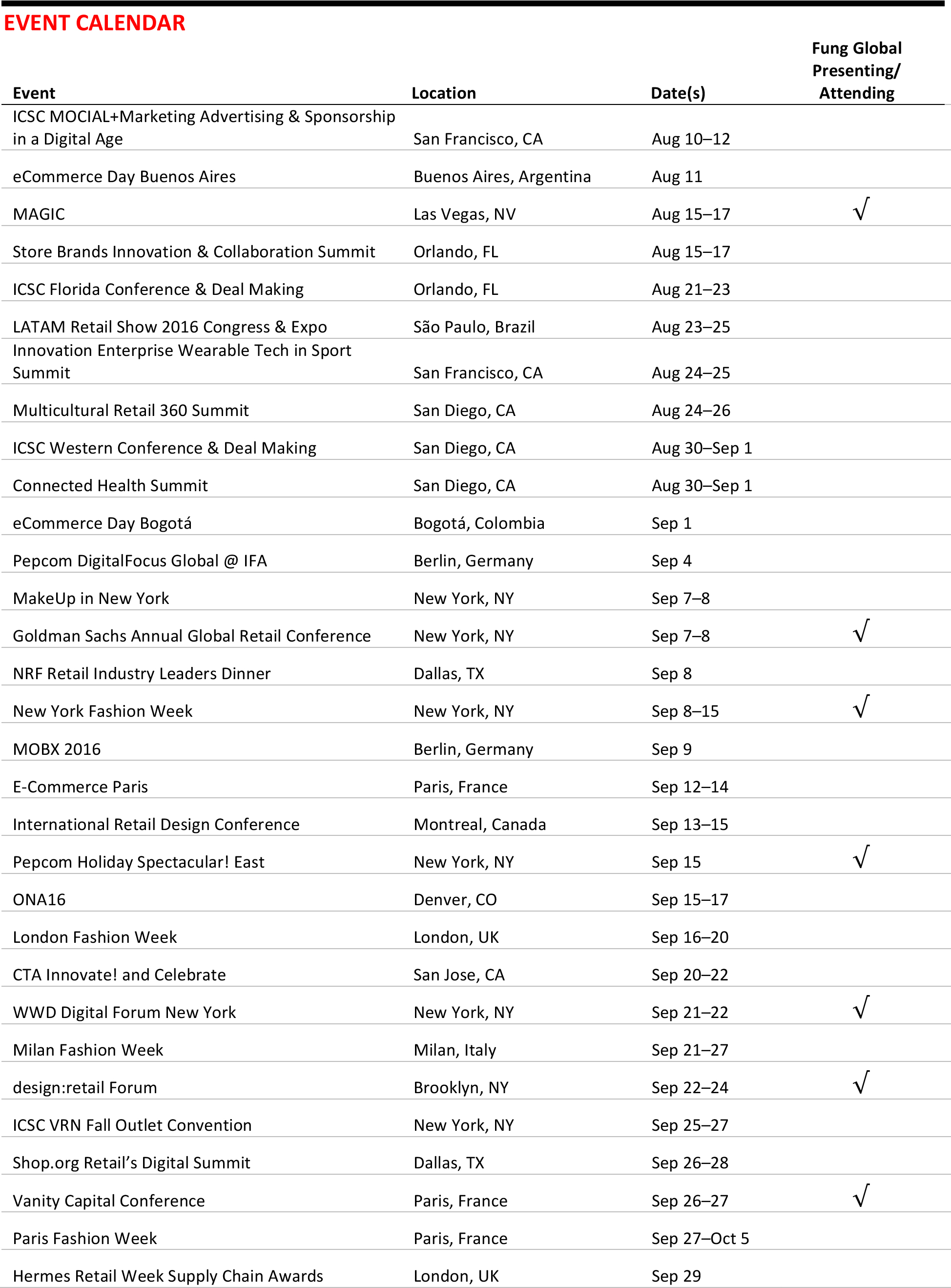

FROM THE DESK OF DEBORAH WEINSWIG

Is it Time to Start Counting Stores as a Marketing Cost?

“Too many retailers are operating too many stores,” is a familiar line in retail, heard in both the US and Europe as more and more shopping migrates online. It is a claim with particular resonance in the US, which has substantially more retail sales area per capita than other Western countries.

We do not doubt there is scope to trim physical store footprints, but in this week’s note, we consider the value of stores beyond the transactional purpose they serve.

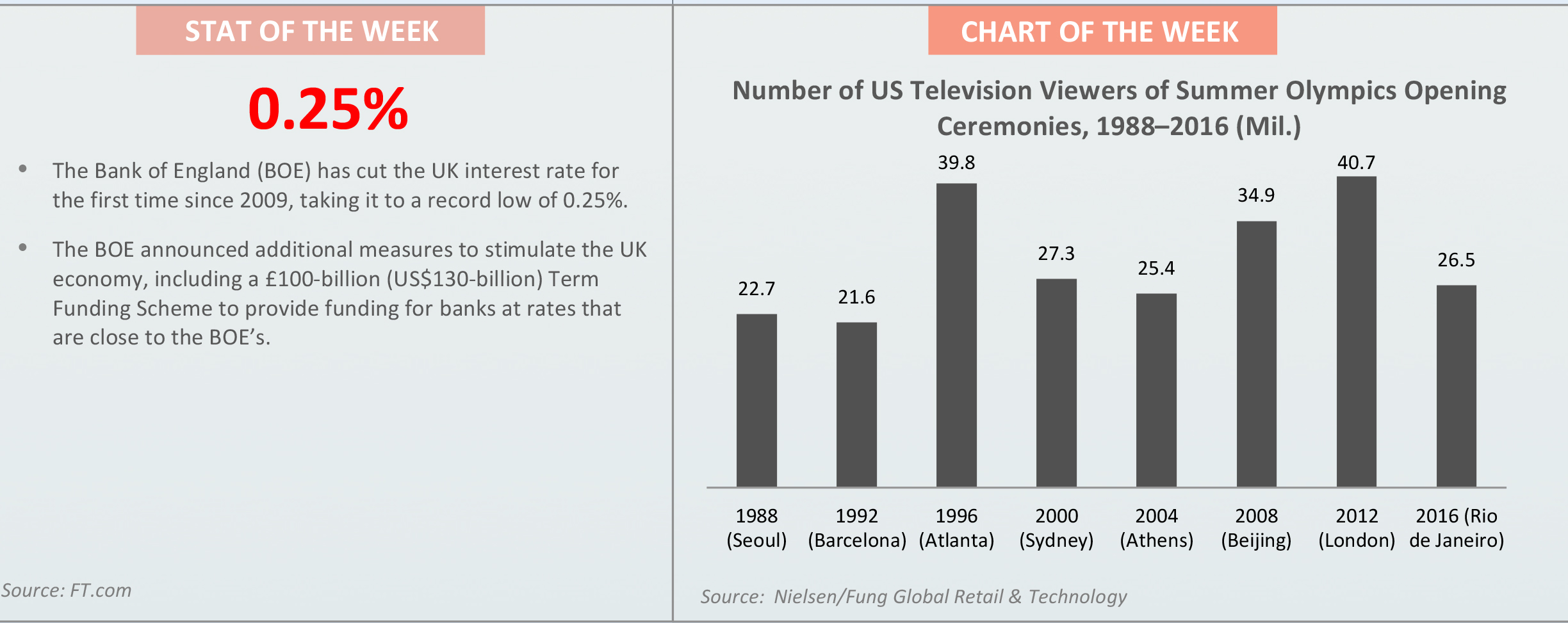

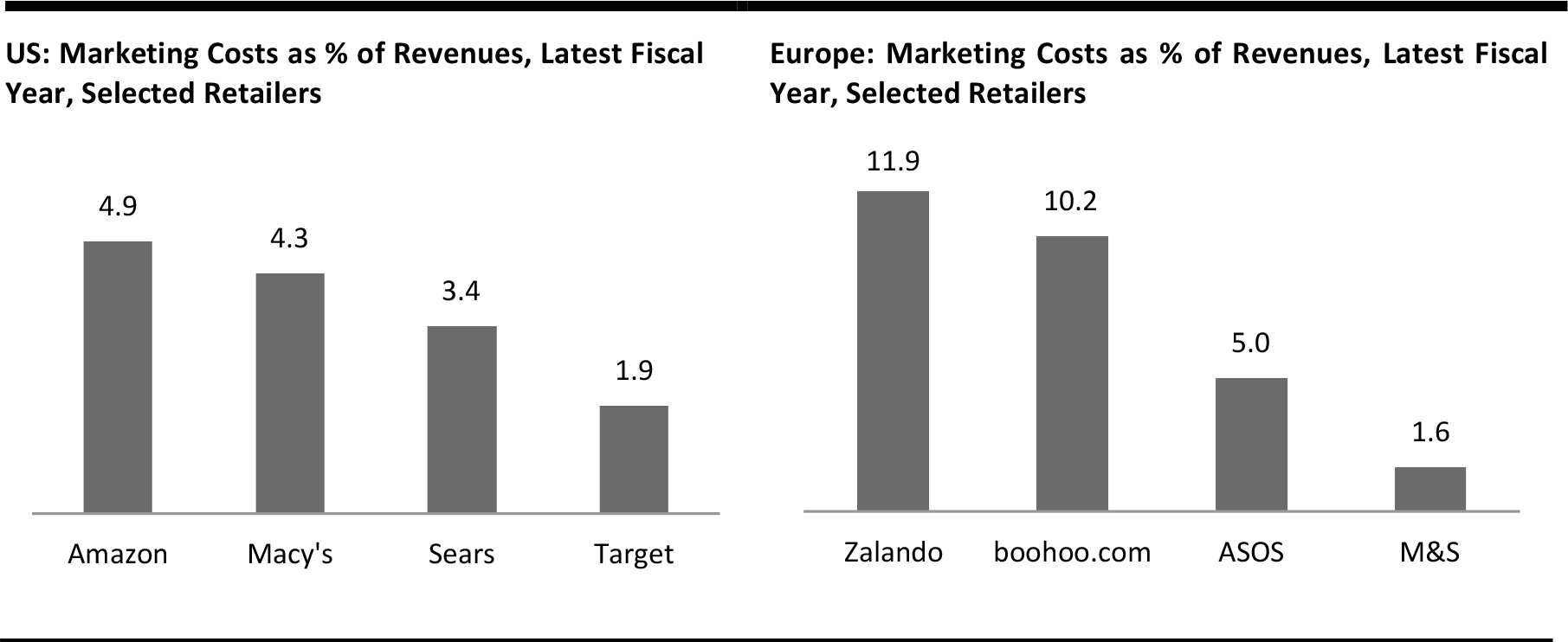

Without Stores, Marketing Costs Rise

Stores save retailers money on marketing costs. Data from Internet pure plays consistently suggest retailers without stores spend more on marketing than their peers with physical shops. In the US, for instance, Amazon outspends general-merchandise peers such as Macy’s, Sears and Target on marketing, when measured as a share of sales. In Europe, where fewer retailers split out their marketing costs, the numbers suggest pure plays such as Zalando, boohoo.com and ASOS spend considerably more on marketing than brick-and-mortar stores such as Marks & Spencer (M&S).

Source: Company reports/S&P Capital IQ/Fung Global Retail & Technology

We think this inevitably leads to the possibility that physical stores may be considered in part, if not in whole, as a marketing effort rather than only a transactional channel. If this is the case, their value cannot be measured simply by profit margins, and retailers should resist the urge to respond to dwindling store profitability in a kneejerk fashion by cutting their physical network.

Apple is perhaps the preeminent example of how stores can serve a marketing function, with its flagship store network that benefits from very high staffing levels, prestigious locations and premium fittings. Admittedly, Apple’s reward for this is exceptionally high sales densities. But even for those more mundane retailers that cannot make a spectacle of their stores, a physical presence keeps them in the forefront of consumers’ minds. A number of retailers have noted, for instance, that online sales tend to be higher in geographic areas where they opened stores. And this marketing gain is before we consider any cross-channel synergies, such as buy-online, collect-in-store services.

Dwindling Store Profitability Needs to Be Offset Against Marketing Costs

The difference between the marketing costs of pure plays and brick-and-mortar stores is the latter could, in theory, see profit per-store fall and take that hit as a marketing cost. It appears retailers that retreat drastically from physical retail have to spend considerably more on marketing to attract shoppers.

We reiterate, store closures are a likely and, in a number of cases, desirable response to changing shopping habits. But, it is clear the costs of operating these stores cannot be fully untangled from the costs of marketing a business to consumers, and retailers and analysts must accept cost blurring as part of a store’s evolution.

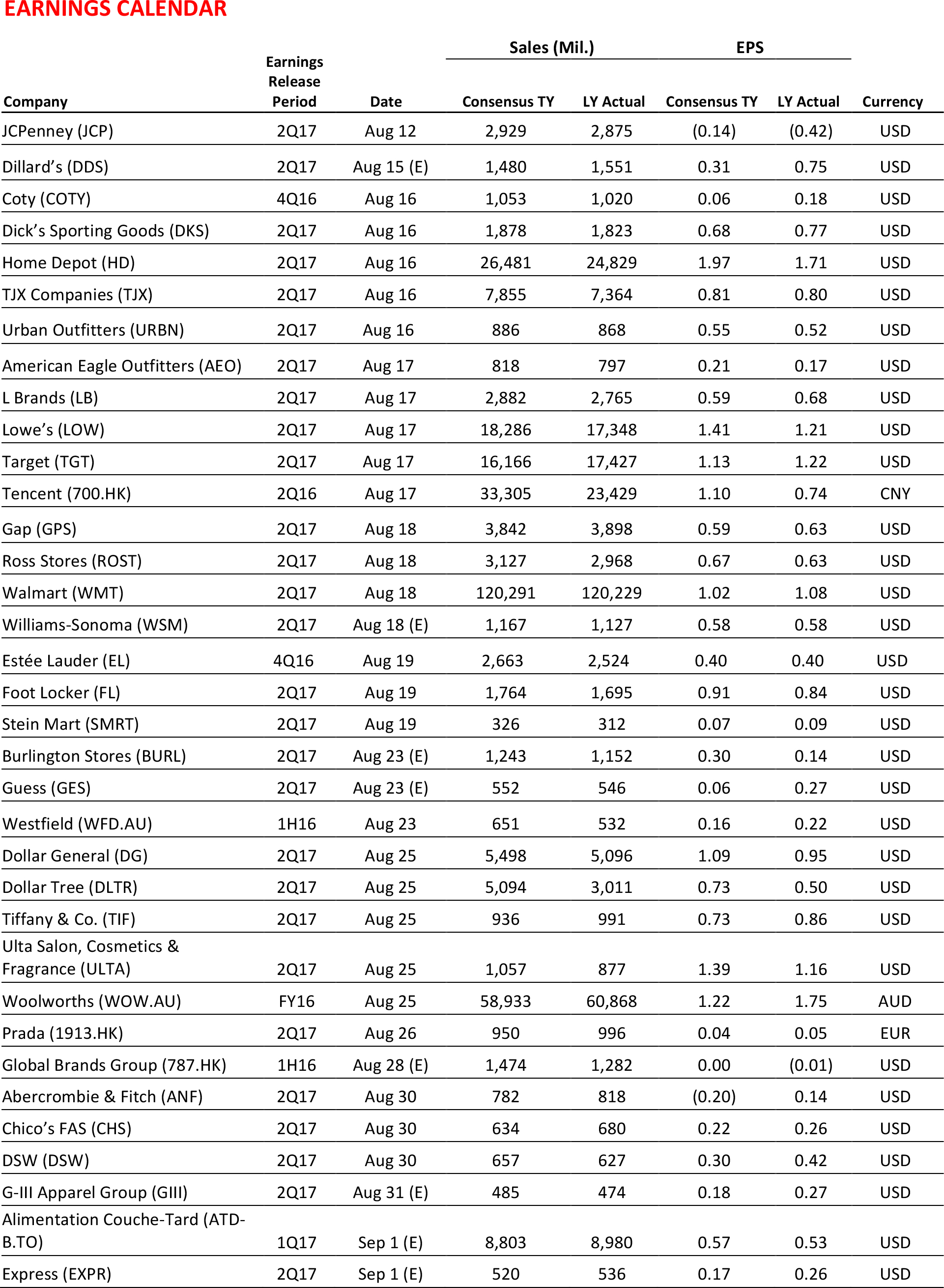

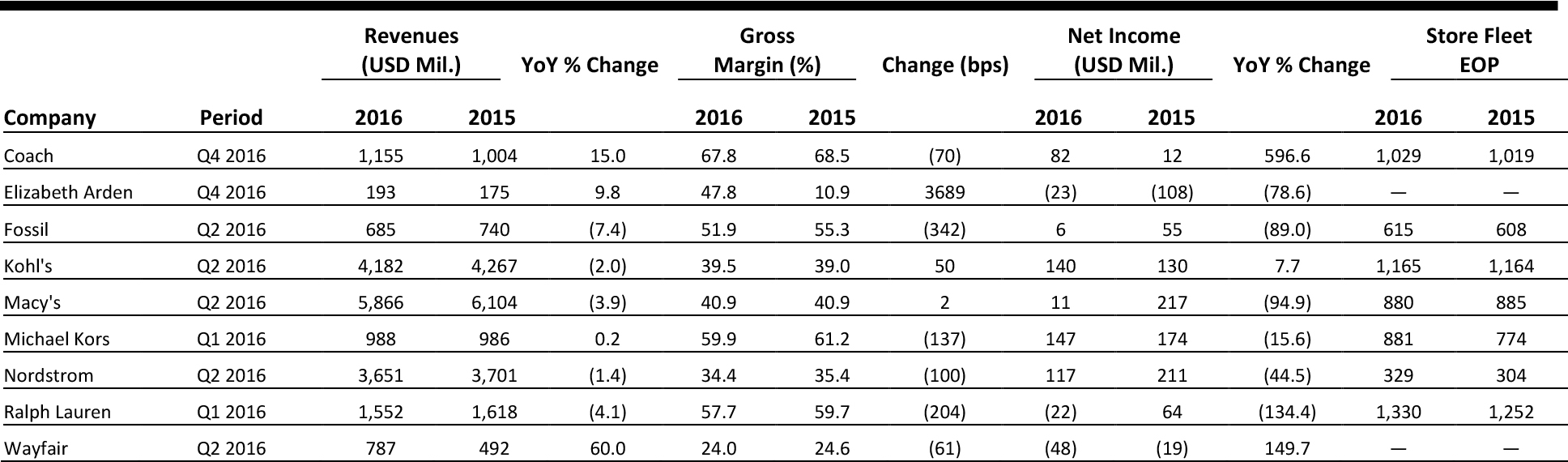

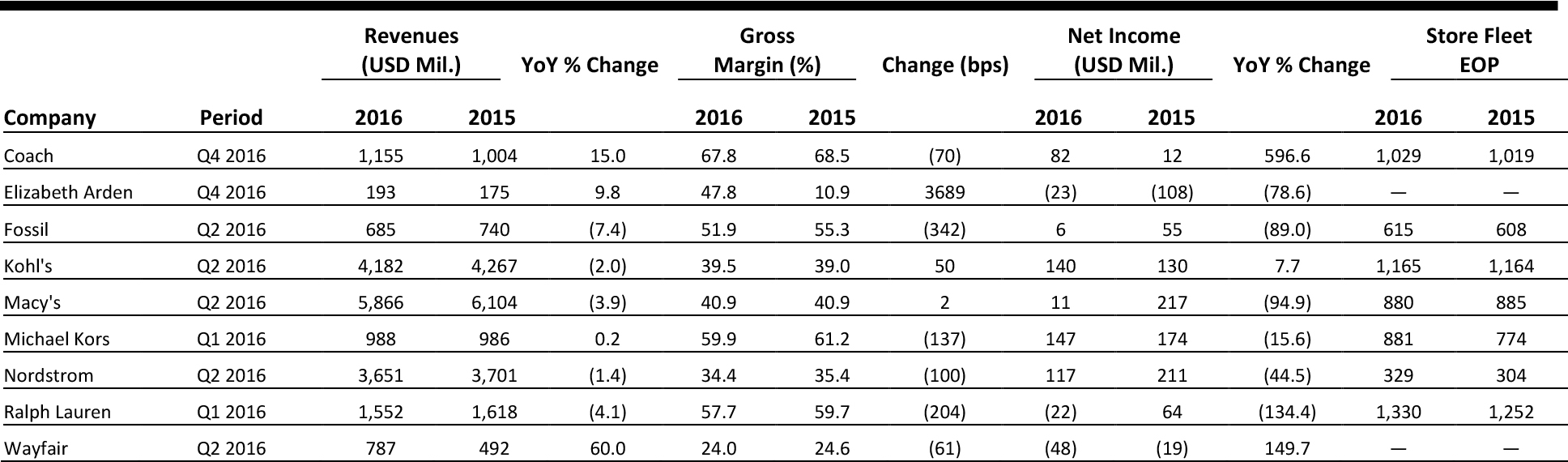

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

While Some Retailers Ignore Snapchat, Others Are Killing It with Lens and Geofilter Ads

(August 7) Adweek

While Some Retailers Ignore Snapchat, Others Are Killing It with Lens and Geofilter Ads

(August 7) Adweek

- A recent study found that 60% of the 65 most-visited merchants have not launched Snapchat accounts. Leading into the back-to-school season, Snapchat is a veritable gold mine of digital marketing opportunities, especially among the coveted Gen Z and millennial generations.

- Another study found that 47% of Snapchatters have sent a snap to friends while in a store and 75% have been informed or influenced by Snapchat during a shopping trip. Furthermore, Snapchat’s users between 13 and 34 years of age tend to spend across retail categories.

Moody’s Says Off-Price Retail Market Share to Keep Growing

(August 9) Women’s Wear Daily

Moody’s Says Off-Price Retail Market Share to Keep Growing

(August 9) Women’s Wear Daily

- Moody’s Investors Service believes off-price retailers will continue to take market share from department stores, and that revenue will grow by 6% to 8% in the next five years. TJX Companies, Ross Stores, Burlington Coat Factory and Nordstrom Rack dominate the space.

- As traditional department stores are struggling with sales and closing stores, off-price retailers are expanding and adding stores. Store traffic is strong at off-price because shoppers are willing to make a trip to the physical store in search of a bargain.

Sales Tax Is Less of a Factor in Online Shoppers’ Buying Decisions

(August 9) Internet Retailer

Sales Tax Is Less of a Factor in Online Shoppers’ Buying Decisions

(August 9) Internet Retailer

- Online shoppers are less deterred by sales tax when making an online purchase than they were a few years ago. Only 29% of respondents to a recent Bizrate Insights survey said sales tax was an important factor, while 37% of those surveyed in 2013 and 2011 said it was.

- These results may be due to the fact that more online retailers are charging sales tax as they build more warehouses around the country. For example, Amazon now collects sales tax in 28 states compared with just six states four years ago.

The Rise of Indie Fast Fashion

(August 9) Business of Fashion

The Rise of Indie Fast Fashion

(August 9) Business of Fashion

- Smaller, independent fast-fashion labels are carving out a niche in the market. As fast fashion has yet to become an online phenomenon, startups in the space have a wonderful opportunity to sell directly to the consumer online, keeping their prices low and their retail strategy nimble.

- These indie fashion companies, such as Style Mafia, Finery London, W Concept and Genuine People, pay close attention to social media to quickly churn out the latest designs. In a challenging market, fast fashion might be the best chance for new a designer-entrepreneur to run a creditworthy business.

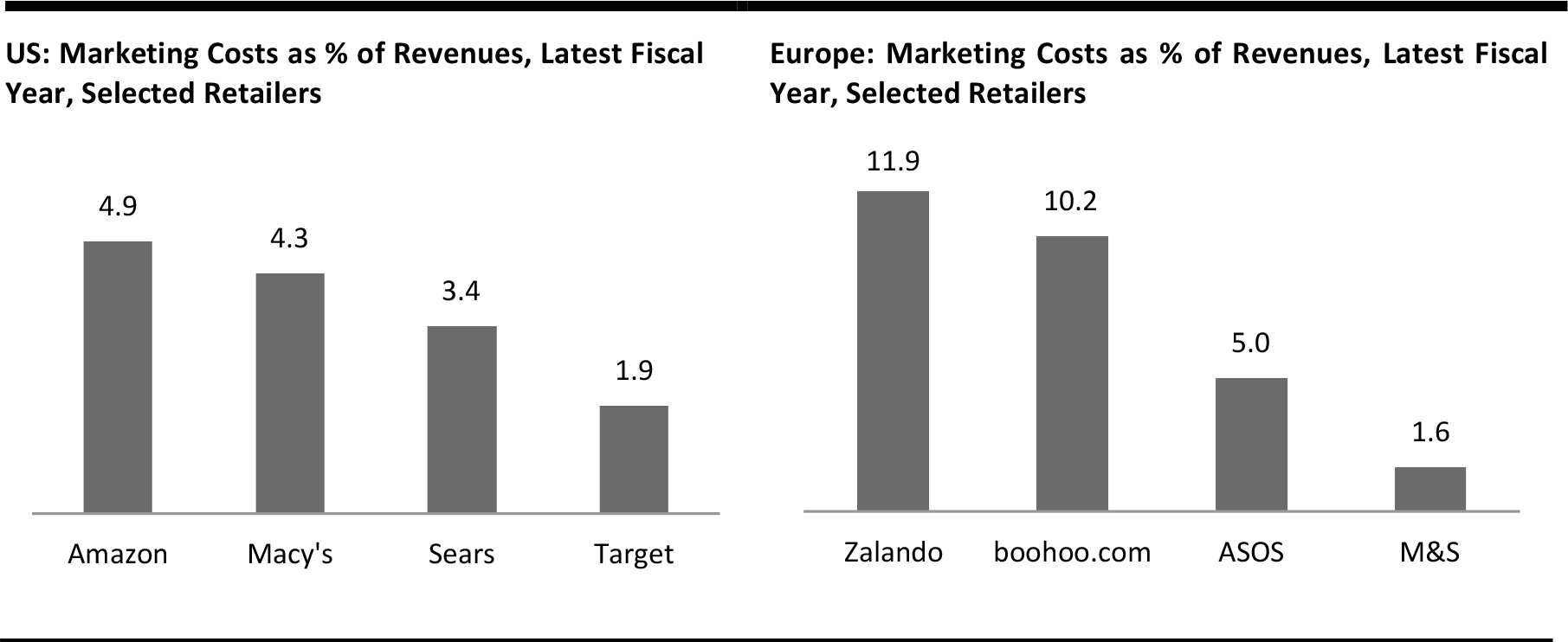

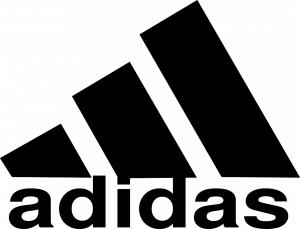

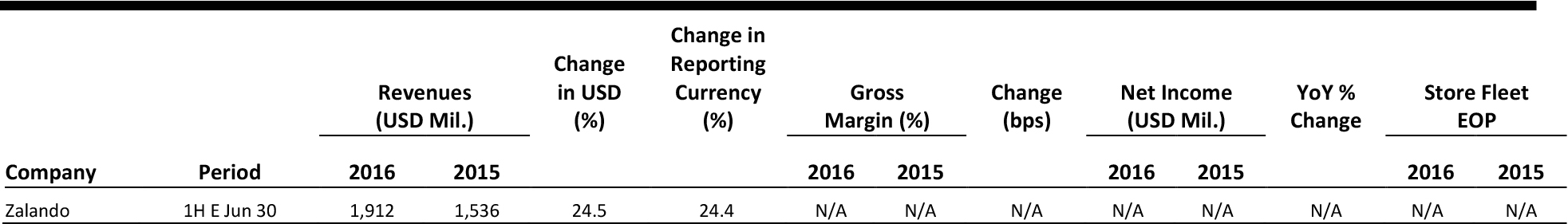

EUROPE RETAIL EARNINGS

EUROPE RETAIL HEADLINES

Groupe Casino Confirms Takeover Offer for Cnova

(August 9) Investor.lesechos.fr

Groupe Casino Confirms Takeover Offer for Cnova

(August 9) Investor.lesechos.fr

- French retailer Groupe Casino confirmed its intention to launch a voluntary tender offer for the remaining publicly traded shares of its e-commerce company, Cnova. The transaction will simplify Casino’s structure and allow Cnova to focus on e-commerce in France through the French Cdiscount unit. The transaction follows the merging of Cnova’s Brazilian unit with Via Varejo, Casino’s appliance and consumer electronics business in Brazil.

- The cash offer amounts to US$5.50 per share, which represents a premium of 82% over the closing price of US$3.03 on April 27, 2016, the last trading day prior to the first public announcement of the possibility of the offer.

Morrisons Extends Supply Deal with Ocado

(August 9) Retail-week.com

Morrisons Extends Supply Deal with Ocado

(August 9) Retail-week.com

- UK supermarket chain Morrisons has renegotiated its existing supply deal with online supermarket Ocado.

- Morrisons will share some of the capacity of Ocado’s customer fulfillment center currently under construction in Erith, in Southeast London. Ocado will also license to Morrisons the store pick module from its Ocado Smart Platform solution, which is required to fulfill online orders from stores.

Amazon Reveals Branded Cargo Plane “Amazon One”

(August 8) Retail-week.com

Amazon Reveals Branded Cargo Plane “Amazon One”

(August 8) Retail-week.com

- Online giant Amazon has announced an agreement to lease 40 air cargo planes from its air cargo partners Atlas Air Worldwide and Air Transport Services Group in order to expand delivery capacity to Prime members.

- The company will reveal its first branded Prime air cargo plane, called Amazon One, at Seattle’s annual Seafair Air Show. Amazon is already leasing 11 delivery cargo planes.

Tesco Extends PayQwiq App to 100 More Stores

(August 8) Retail-week.com

Tesco Extends PayQwiq App to 100 More Stores

(August 8) Retail-week.com

- UK supermarket chain Tesco extended its mobile payment app, PayQwiq, to an additional 100 stores across Northern Ireland and Plymouth. The company has already piloted the app in 500 stores in Edinburgh and London, and is targeting a full rollout across its entire store estate by the end of the year.

- The smartphone app, developed by Tesco Bank, allows shoppers to store their debit card and Tesco Clubcard details and pay for orders worth up to £400 ($US520).

Adidas Reports Strong 1H16 Results

(August 4) Retaildetail.eu

Adidas Reports Strong 1H16 Results

(August 4) Retaildetail.eu

- Adidas reported strong 1H16 revenue growth, of 21% year over year on a constant-currency basis, boosted by the UEFA European Football Championship and the Rio Olympic Games.

- Adidas raised its FY16 guidance and now forecasts constant-currency annual sales growth in the high teens, up from 15% previously. The company also expects its operating margin to expand by 100 basis points year over year, to 7.5%, which is higher than the previously estimated margin expansion of 50 basis points, to 7.0%.

Sainsbury’s Launches New Athleisure Range

(August 3) Theretailbulletin.com

Sainsbury’s Launches New Athleisure Range

(August 3) Theretailbulletin.com

- UK supermarket chain Sainsbury’s is launching a new range of athleisure items in 170 stores and online. The move underlines Sainsbury’s plans to grow its nonfood business and maximize store space.

- More than 8 million customers have purchased apparel from Sainsbury’s over the past year, and the category is close to generating £1 billion (US$1.3 billion) in revenues.

ASIA TECH HEADLINES

Alibaba Helps Foreign Technology Companies Operate in China

(August 9) Bloomberg

Alibaba Helps Foreign Technology Companies Operate in China

(August 9) Bloomberg

- Alibaba is helping overseas technology partners operate in China with Alibaba Cloud, which is able to help clients with joint ventures and marketing. The company revealed its goal to sign up 50 partners over the next 12 months.

- Alibaba is anticipating that Internet-based computing and big data will boost growth in coming years. The company’s cloud division contributed only 4.7% of revenue in the first quarter, but is growing the fastest of all of Alibaba’s divisions.

Facebook to Launch Cheap Wi-Fi Service in India

(August 8) TechinAsia

Facebook to Launch Cheap Wi-Fi Service in India

(August 8) TechinAsia

- Facebook is testing Express Wi-Fi, which enables users in rural India to purchase affordable data packages from local Internet service providers to access the Internet via local hotspots. The service is set to hit the market soon.

- The company’s Wi-Fi project is likely to generate a big user base, as India currently has 462 million net users, although it has the lowest average connection speed among Asian countries.

Japan Display Reveals INCJ’s Promise of Full Support

(August 9) Reuters

Japan Display Reveals INCJ’s Promise of Full Support

(August 9) Reuters

- Japan Display revealed that its top investor, the state-backed Innovation Network Corporation of Japan (INCJ), has promised to give the company its full support. INCJ will help Japan Display deal with the problem of cash loss, considering that smartphone demand has slowed.

- The display maker estimated that operating profit for the third quarter of 2016 will be ¥1 billion (US$9.9 million). Earlier this year, it indicated that it plans to start mass producing OLEDs in 2018; the company trails its South Korean rivals in OLED technology.

Malaysia’s Touristly Secures Investment from Tune Labs

(August 8) e27.co

Malaysia’s Touristly Secures Investment from Tune Labs

(August 8) e27.co

- Malaysian travel startup Touristly announced that it has secured a strategic investment from Tune Labs, a Kuala Lumpur–based incubator and accelerator.

- Touristly is currently working to integrate its services with airlines, hotels, travel loyalty programs and travel agencies. Its partnerships include AirAsia BIG, a loyalty program, and Tune Hotels, which provides on-ground activity concierge services.

LATAM RETAIL HEADLINES

Amazon Fashion Launches in Mexico Despite Major Challenges

(August 8) WWD.com

Amazon Fashion Launches in Mexico Despite Major Challenges

(August 8) WWD.com

- Amazon Fashion launched in Mexico on July 28, entering a market that faces many challenges in terms of e-commerce. The e-store will include millions of items of clothing and accessories in a variety of colors and sizes, and the company plans to offer free shipping and returns for “eligible articles.”

- Amazon.com.mx launched last summer, and this is the first time the site has expanded. Amazon Fashion will offer international labels such as Calvin Klein and Desigual along with Mexican brands such as Adrianna Papell.

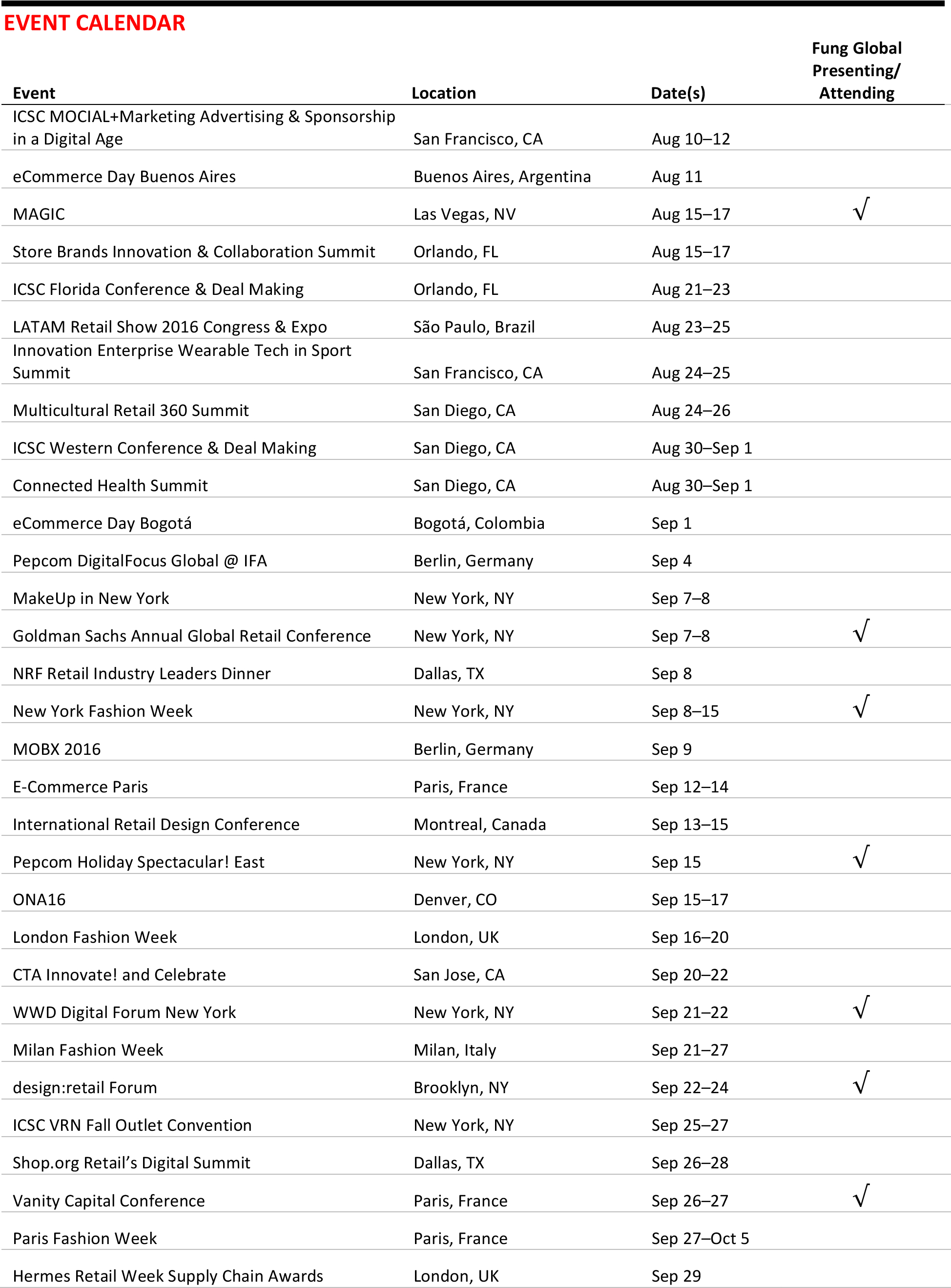

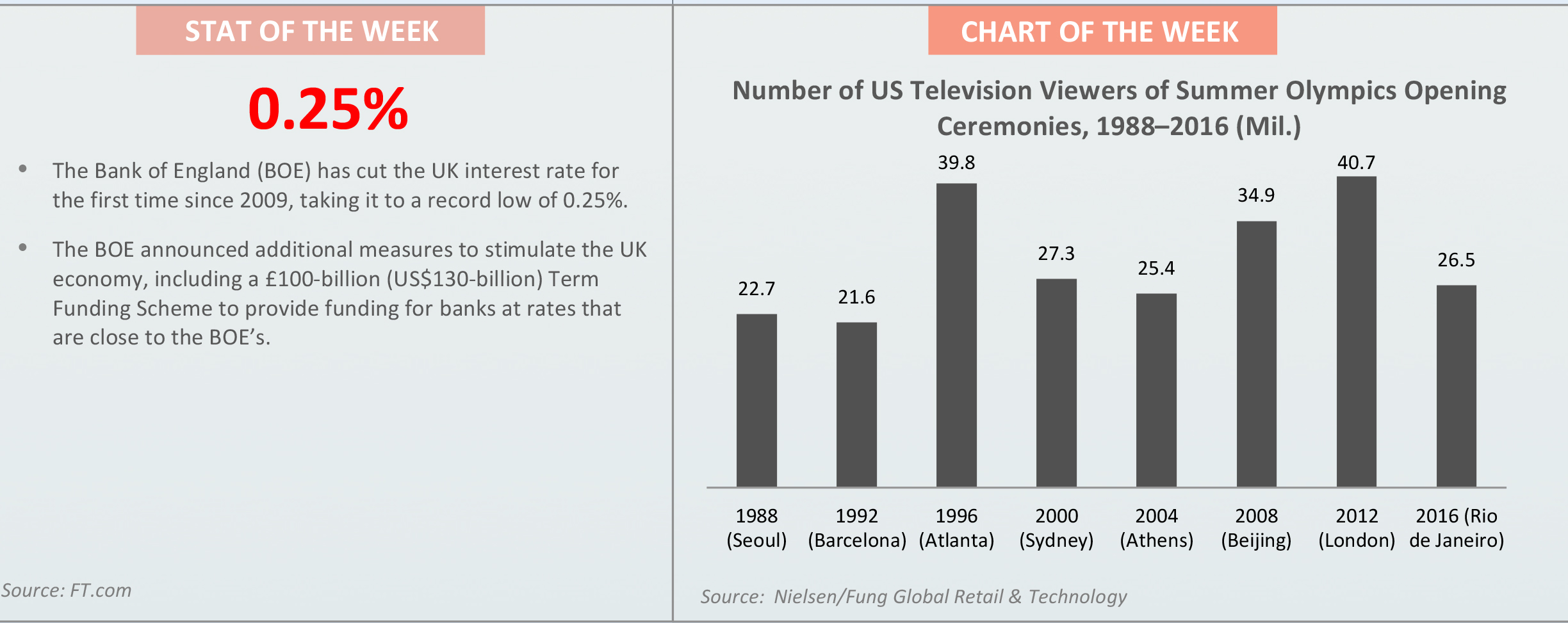

NBC Fails to Score Gold with Olympics Opening Ceremony

(August 8) The Wall Street Journal

NBC Fails to Score Gold with Olympics Opening Ceremony

(August 8) The Wall Street Journal

- The NBC broadcast of the Opening Ceremony for the Rio 2016 Olympics drew 26.5 million viewers, a 35% decline from the London 2012 Opening Ceremony, which was watched by 40.7 million viewers. The ratings were the lowest for an Opening Ceremony since the 2004 Olympics in Athens.

- The next night, 20.7 million viewers tuned in to NBC to watch the first night of the Games, but that total was down 28% from the first night of the London Games. NBC expects these figures to change when digital video recorders and online consumption are factored in later on.

Brazil’s Retail Sales Unexpectedly Rise as Confidence Grows

(August 9) Bloomberg

Brazil’s Retail Sales Unexpectedly Rise as Confidence Grows

(August 9) Bloomberg

- Brazil’s retail sales increased by 0.1% in June following a 0.9% drop in May. This growth came as a surprise, as economists had forecasted a 0.4% drop for the month of June. Consumer confidence in the country has been improving since Michel Temer became Acting President in May.

- Retail sales dropped by 5.3% in June versus the same month last year, though inflation is beginning to come down. Sales of food, beverage and tobacco products at hypermarkets and supermarkets fell by 0.4% during the month, while apparel sales grew by 0.7%.

H&M Goes Green with Olympic Ceremony Flag Bearer’s Outfit

(August 6) WWD.com

H&M Goes Green with Olympic Ceremony Flag Bearer’s Outfit

(August 6) WWD.com

- Amid concerns over pollution in Rio de Janeiro, H&M designed an environmentally friendly statement dress for the Swedish flag bearer, Therese Alshammar, to wear during the Opening Ceremony of the Rio 2016 Games. The dress was made from fabric from recycled garments gathered through H&M’s garment collection initiative.

- H&M revealed in 2013 that it had signed a four-year contract with the Swedish Olympic Committee and the Swedish Paralympic Committee to design and create outfits for the athletes for both the Opening and Closing Ceremonies, along with leisure clothing to be worn during travel or in the Olympic Village.

Athletes Are Not the Only Ones Who Have Waited Years to Compete in the 2016 Olympics

(August 5) Quartz

Athletes Are Not the Only Ones Who Have Waited Years to Compete in the 2016 Olympics

(August 5) Quartz

- Brands such as Nike and Adidas are vying for the public gaze at the Rio 2016 Olympic Games, outfitting athletes with clothing as part of complicated sponsorships. Athletes sponsored by Nike, for example, are allowed to choose competitive wear of their choice—meaning they can wear Adidas running shoes when competing—but outside competition, they are required to wear only Nike gear.

- Nike sponsors more than 1,500 athletes, and the company is debuting its partially 3D-printed prototype shoes, known as the Zoom Superfly Elite, at the Rio Games.

�

Sales Tax Is Less of a Factor in Online Shoppers’ Buying Decisions

(August 9) Internet Retailer

Sales Tax Is Less of a Factor in Online Shoppers’ Buying Decisions

(August 9) Internet Retailer

H&M Goes Green with Olympic Ceremony Flag Bearer’s Outfit

(August 6) WWD.com

H&M Goes Green with Olympic Ceremony Flag Bearer’s Outfit

(August 6) WWD.com

Athletes Are Not the Only Ones Who Have Waited Years to Compete in the 2016 Olympics

(August 5) Quartz

Athletes Are Not the Only Ones Who Have Waited Years to Compete in the 2016 Olympics

(August 5) Quartz