From the Desk of Deborah Weinswig

Amazon: The Sleeping Dragon in Private Label

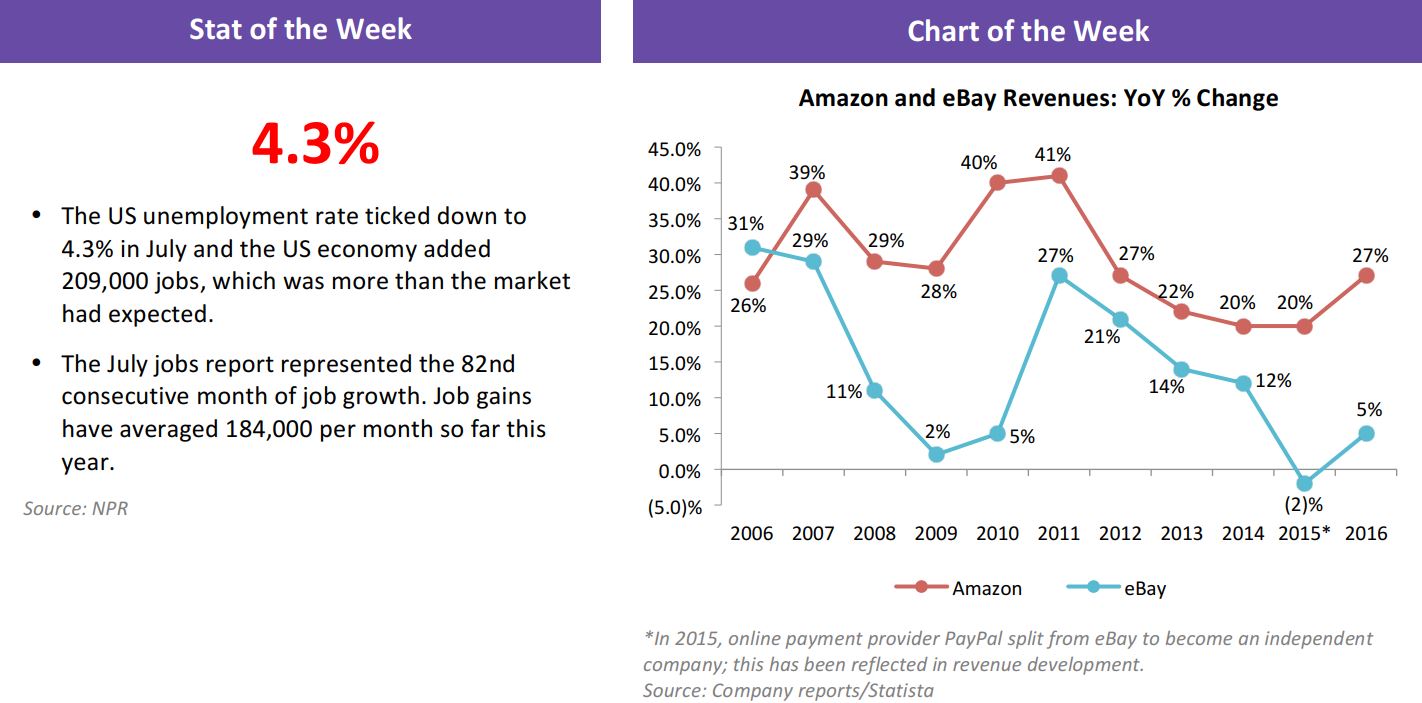

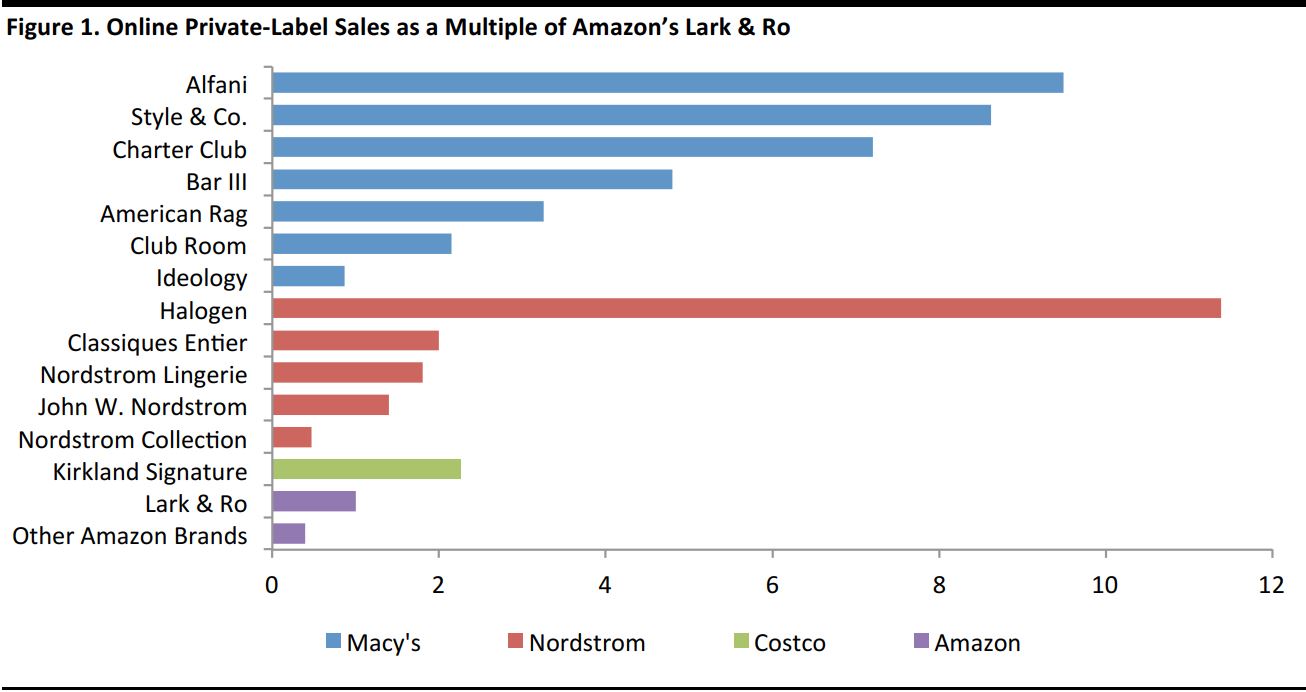

Amazon is much more than a household name, given that nearly half of US households already have an Amazon Prime membership, according to Cowen and Company estimates. However, Amazon’s emerging private-label brands have not yet achieved widespread name recognition, and a recent Slice Intelligence study bears this out. The study compares the online sales of several private-label grocery and apparel brands belonging to Macy’s, Nordstrom and Costco with those of Amazon.

Base: 68,032 US online shoppers surveyed January 1, 2016–February 28, 2017

Source: Slice Intelligence

Amazon began quietly launching its private-label apparel brands in early 2016, so it is not completely fair to compare its own brands with many of the other long-standing brands shown above.

The private-label brands that Amazon initially rolled out—Lark & Ro and Society New York, among others—received a good deal of coverage following their soft launch. However, Amazon has several other brands already available or waiting in the wings. For instance, there is the AmazonBasics brand of linens, furniture and IT gadgets and the Amazon Essentials brand of shirts, nightwear, shorts and underwear.

The sleuths at digital news site Quartz sifted through more than 800 trademarks that Amazon has applied for or received, and came up with the following 19 brands that are available on Amazon.com:

Source: Qz.com

The above list is in addition to another 10 trademarks Amazon owns that are not included on its website and nine companies incorporated in Delaware that are listed at the same physical address.

While Amazon’s private-label brands are not yet on the tips of all our tongues, they do offer compelling value in addition to the convenience of being available on Amazon’s platform, and there appears to be a slew of new brands on the horizon.

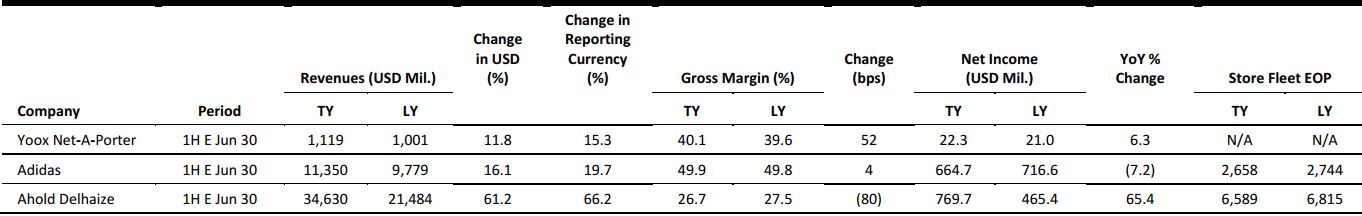

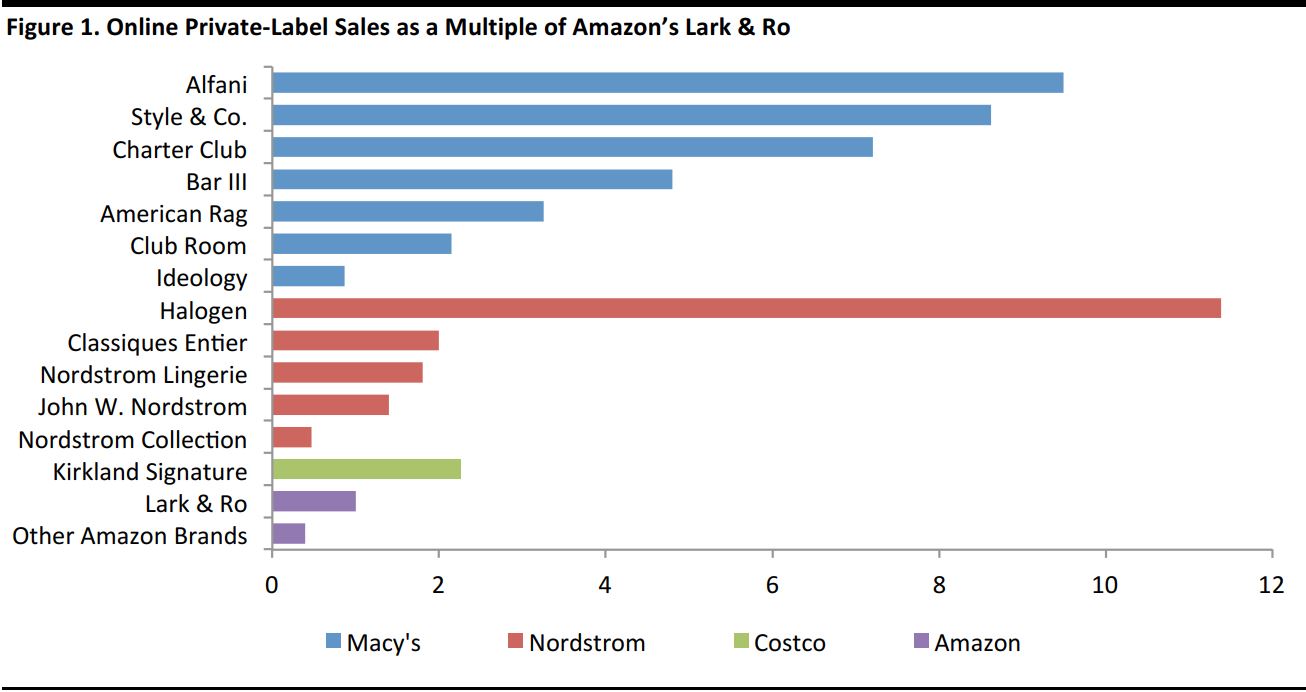

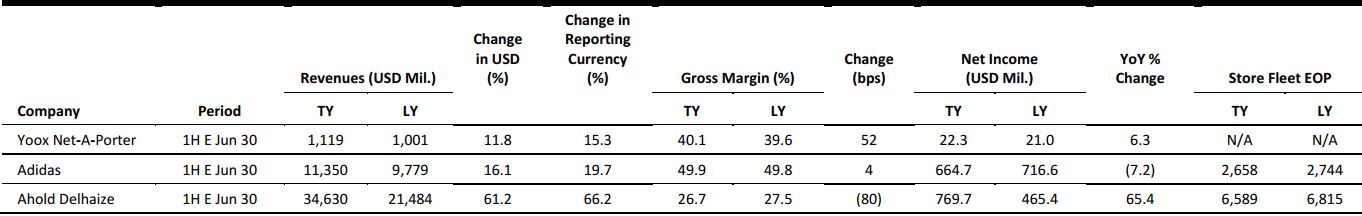

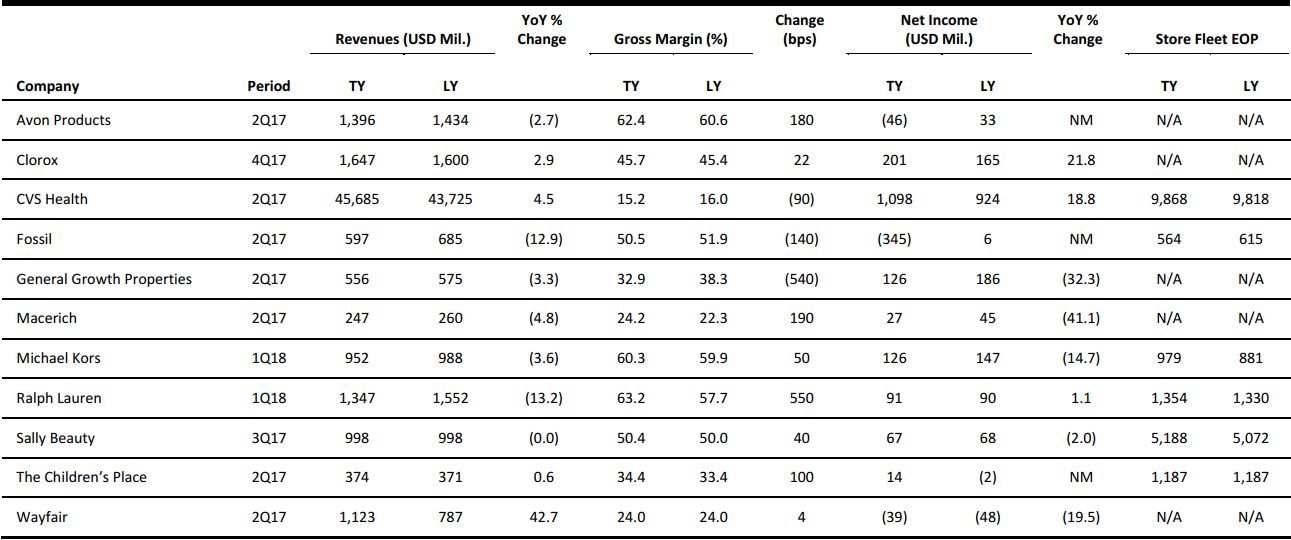

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Michael Kors, Ralph Lauren Make Progress on Turnaround Efforts

(August 8) The Wall Street Journal

Michael Kors, Ralph Lauren Make Progress on Turnaround Efforts

(August 8) The Wall Street Journal

- Two big US apparel and accessories brands, Michael Kors and Ralph Lauren, showed some progress Tuesday on efforts to wean themselves—and shoppers—off heavy promotions.

- Both companies reported sharp sales declines in their latest quarters, as they had reduced discounts at their own retail stores and pulled back the amount of goods sold through department stores. However, profits were better than expected and executives at Michael Kors pointed to signs of improved consumer spending in the US.

Amazon Prime Will Be in More than Half of US Households by Year’s End

(August 8) CNBC.com

Amazon Prime Will Be in More than Half of US Households by Year’s End

(August 8) CNBC.com

- Amazon’s Prime program—which has boasted impressive growth in recent years—should finally be in more than 50% of American homes before the year is over, Cowen and Company has predicted. According to the firm’s monthly survey of 2,500 US consumers, about 49% of respondents already had a Prime membership this July.

- Amazon’s latest Prime Day, which added more Prime subscriptions over a 24-hour period than ever before, is what will drive membership over the 50% threshold, said Cowen in a note to clients. Back-to-school shopping and the 2017 holiday season are expected to give the Internet giant another welcome boost.

Walmart Is Taking a Direct Shot at Amazon and Making Checkout Lanes Obsolete

(August 7) BusinessInsider.com

Walmart Is Taking a Direct Shot at Amazon and Making Checkout Lanes Obsolete

(August 7) BusinessInsider.com

- Walmart is rolling out a new technology in its stores that enables shoppers to scan and pay for their items without checkout lanes, registers or cashiers.

- Shoppers who have downloaded Walmart’s Scan & Go app can scan the barcodes of the items they wish to purchase. Once they are finished shopping, they click a button to pay for their goods and then show their digital receipt to a store greeter on their way out the door.

Why Back-to-School Is Expected to Be a Bright Spot for Struggling Retailers

(August 8) FootwearNews.com

Why Back-to-School Is Expected to Be a Bright Spot for Struggling Retailers

(August 8) FootwearNews.com

- It has been a challenging year for retailers, but the all-important back-to-school season could be a bright spot. The National Retail Federation (NRF) is forecasting a five-year high in back-to-school spending, driven by stronger employment levels and a continued increase in wages.

- According to the trade association’s annual survey, conducted by Prosper Insights & Analytics, total spending for school and college combined is expected to hit $83.6 billion, up from $75.8 billion last year. “Families are now in a state of mind where they feel a lot more confident about the economy,” said NRF President and CEO Matthew Shay.

Walmart Prepared to Fight Back Against Aldi and Lidl

(August 4) RetailDive.com

Walmart Prepared to Fight Back Against Aldi and Lidl

(August 4) RetailDive.com

- Walmart, Target and other grocery players are responding to the growth of no-frills German grocery retailers Aldi and Lidl with aggressive pricing and product placement in stores, according to a note from Oppenheimer & Co. cited by Supermarket News.

- While Aldi and Lidl have demonstrated extreme competitiveness on prices, which experts have told Retail Dive are as much as 30% lower than Walmart’s in Southeastern stores, Lidl beat Walmart by just 2% in overall basket prices, according to Supermarket News. The analysis also found that Target had reduced prices on some of its private-label items by 10% or 20%, and that Kroger, Food Lion, Family Dollar and Dollar General are also moving prices down.

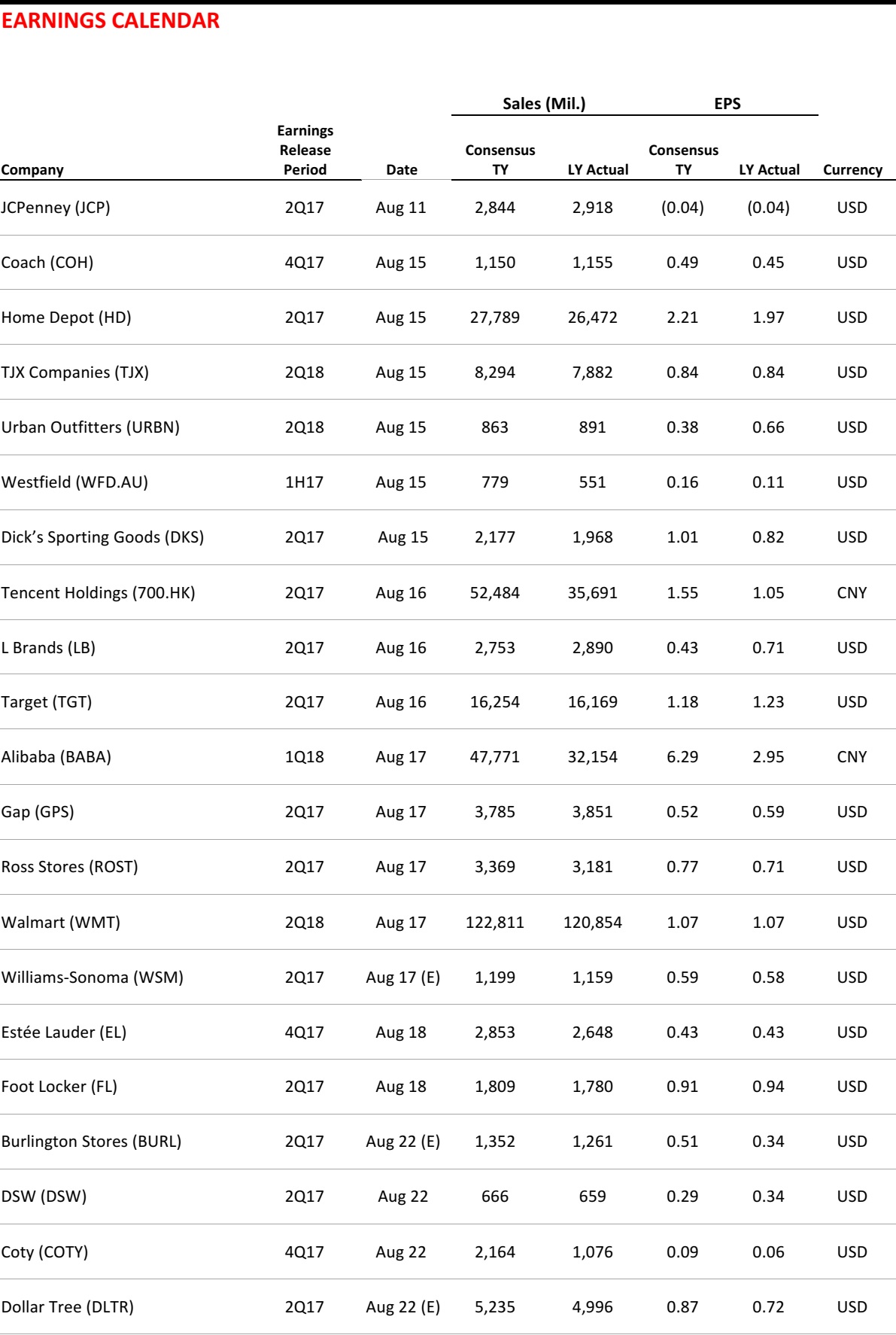

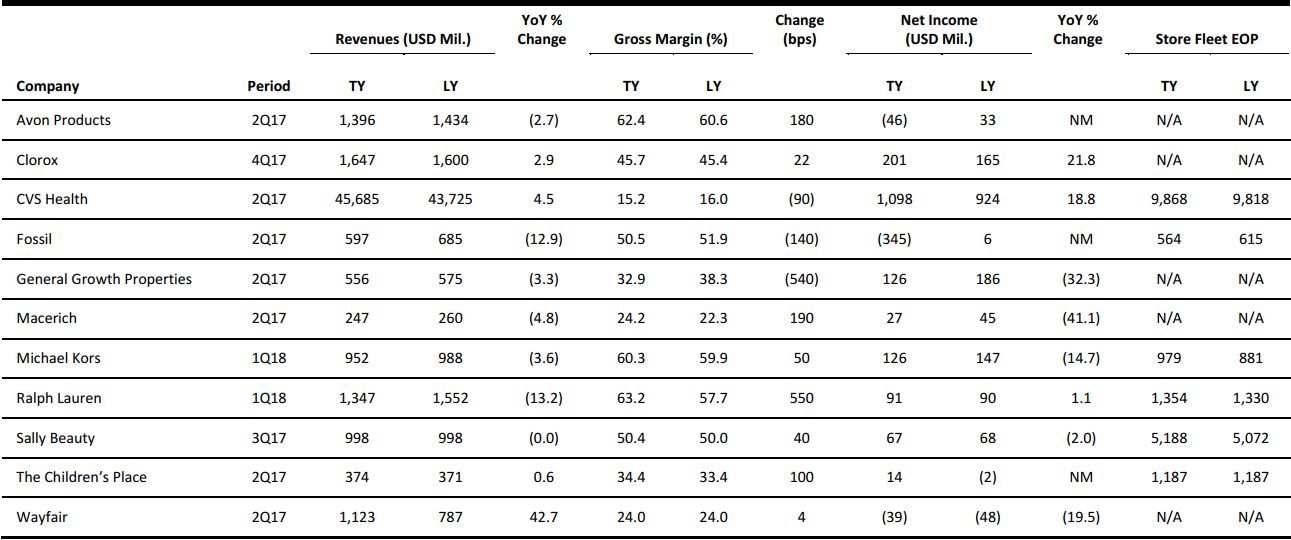

EUROPE RETAIL EARNINGS

Source: Company reports/FGRT

EUROPE RETAIL HEADLINES

Food Drives UK Retail Sales Growth in July

(August 8) BRC press release

Food Drives UK Retail Sales Growth in July

(August 8) BRC press release

- Retail sales in the UK rose by 1.4% in July; the rate was slightly below June’s 2.0% increase. Comparable sales in July increased by 0.9%, a rate that was slightly slower than June’s 1.2%, driven by food sales, as nonfood sales fell during the month, the British Retail Consortium (BRC) said.

- BRC Chief Executive Helen Dickinson mentioned that “despite the gloomy picture for nonfood overall,” homewares performed best in July after registering slow sales the previous month. Dickinson also noted that many apparel retailers gained from early interest in their newly launched autumn collections.

Slow Start to Fiscal Year 2018 for New Look as Sales Decline in the First Quarter

(August 8) Company press release

Slow Start to Fiscal Year 2018 for New Look as Sales Decline in the First Quarter

(August 8) Company press release

- British apparel retailer New Look had a disappointing start to its fiscal year, reporting a 4.4% decline in revenue for the first quarter. UK comps decreased by 7.5% and the retailer’s own website sales fell by 0.6%, but third-party e-commerce sales jumped 15.7%.

- New Look CEO Anders Kristiansen remarked that business in the UK market had been challenging, as expected, and that the retailer is working on diversifying the markets where it operates to reduce its reliance on the UK high street.

Sainsbury’s Reveals Plans to Hike Pay for Staff

(August 8) Retail-Week.com

Sainsbury’s Reveals Plans to Hike Pay for Staff

(August 8) Retail-Week.com

- British grocer Sainsbury’s has revealed plans to invest in a pay increase of 4.4% for some 135,000 eligible store staff in the UK. This will take their hourly pay to £8 (US$10) an hour, which is above the UK’s national living wage.

- The news comes after The Sunday Telegraph reported that Sainsbury’s expects to lay off 1,000 staff from its central office as part of its plans to save £500 million (US$652 million).

Lidl to Open Up to 200 Stores in Ireland

(August 3) Independent.ie

Lidl to Open Up to 200 Stores in Ireland

(August 3) Independent.ie

- German discount grocer Lidl intends to take its Irish store count up to 200 by 2018. The company already has 152 stores in Ireland.

- The retailer said that it has set aside €300 million (US$355 million) to expand its footprint across the country. That figure is in addition to the €400 million (US$473 million) that Lidl is investing between 2016 and 2018 to grow its network and distribution in Ireland.

Unilever’s Venture Arm Invests in Online Home Services Booking Startup

(August 1) TechCrunch.com

Unilever’s Venture Arm Invests in Online Home Services Booking Startup

(August 1) TechCrunch.com

- Unilever Ventures has invested “several million” euros in Helpling, a Rocket Internet–founded startup that allows people to book home cleaning services through its app and website.

- Helpling cofounder Benedikt Franke said that Unilever’s investment presents new partnership opportunities for both companies, “including leveraging Helpling as a distribution channel.” Franke said that Unilever and Helpling were already working together to develop cobranded marketing campaigns, content and in-store promotions.

ASIA TECH HEADLINES

China Will Spend $1.5 Trillion on Foreign Companies in a Decade: Report

(August 8) Bloomberg.com

China Will Spend $1.5 Trillion on Foreign Companies in a Decade: Report

(August 8) Bloomberg.com

- Chinese acquirers will spend $1.5 trillion buying companies abroad in the next decade, 70% more than in the previous 10 years, even as regulators at home and abroad block deals, law firm Linklaters said in a report Tuesday.

- Government policies encouraging Chinese companies to invest in manufacturing capabilities, particularly for advanced technology, and international trade will help maintain deal flow, said Linklaters, which specializes in advising on mergers and acquisitions. Chinese buyers have spent about $880 billion on assets in other countries in the last 10 years, according to the data.

Iflix Raises $133 Million for Its Netflix-Style Service for Emerging Markets

(August 8) TechCrunch.com

Iflix Raises $133 Million for Its Netflix-Style Service for Emerging Markets

(August 8) TechCrunch.com

- Iflix, an Asia-based startup providing Netflix-like streaming services in emerging markets, has landed $133 million in fresh funding to accelerate its business. Iflix was started in May 2015, and was initially launched in selected Asian markets. Today, its streaming service is priced around $3 per month and is available in 19 countries thanks to expansions into the Middle East and Africa.

- The business has raised close to $300 million from investors to date. It started out with a $30 million prelaunch round in 2015, before adding $45 million from Sky last year and completing a $90 million raise in March of this year.

SoftBank Transfers Its $5 Billion Stake in Nvidia to the Vision Fund

(August 8) TechCrunch.com

SoftBank Transfers Its $5 Billion Stake in Nvidia to the Vision Fund

(August 8) TechCrunch.com

- SoftBank has confirmed that its 4.9% stake in Nvidia is to be transferred to the Vision Fund, its colossal investment vehicle that is targeting a $100 billion final close. The Japanese tech firm bought the position in chipmaker Nvidia, which has forayed into artificial intelligence and self-driving car tech in recent years, back in May for a reported $4 billion.

- Beyond Nvidia, the Vision Fund is also picking up SoftBank’s share of medtech startup Guardant Health, which raised a $360 million round led by SoftBank in May. There is plenty of crossover beyond those deals. Previously, Softbank sold one-quarter of ARM, the chip giant it acquired last year for north of $30 billion, to the Vision Fund.

WeWork Is Pouring $500 Million into Southeast Asia

(August 7) TechCrunch.com

WeWork Is Pouring $500 Million into Southeast Asia

(August 7) TechCrunch.com

- Less than two weeks ago, WeWork secured $500 million from Chinese private equity firm Hony Capital, Japanese Internet giant SoftBank, Greenland Holdings and China Oceanwide. The company then announced that it is pouring that exact amount—$500 million—into expanding into Southeast Asia and South Korea. Interestingly, WeWork says this $500 million is new and not the same capital, although it is not disclosing where the money is coming from.

- As part of its announcement, WeWork says it has spent an undisclosed amount to acquire a 1.5-year-old, Singapore-based coworking company called Spacemob. Spacemob founder and CEO Turochas Fuad will become managing director of Southeast Asia for WeWork and Spacemob’s roughly 20 employees will also join WeWork.

LATAM RETAIL AND TECH HEADLINES

SAP Launches First Digital Transformation Center in LatAm

(August 4) ZDNet.com

SAP Launches First Digital Transformation Center in LatAm

(August 4) ZDNet.com

- SAP is pushing ahead with its efforts to promote its next-generation digital innovation platform, Leonardo, launching the first facility dedicated to the technology in Brazil. Based within the company’s existing innovation lab in the city of São Leopoldo in southern Brazil, the center is the first in South America to be focused on Leonardo.

- The company chose to locate the center in São Leopoldo because the innovation lab there is already an established facility, staffed by about 1,000 specialists in areas ranging from design and prototyping to the Internet of Things and blockchain.

Brazilian Fashion Retailer Deploys Oracle Retail in More than 470 Stores

(August 3) RetailTouchPoints.com

Brazilian Fashion Retailer Deploys Oracle Retail in More than 470 Stores

(August 3) RetailTouchPoints.com

- Brazilian fashion retailer Lojas Renner is on a mission to transform its operations and establish a foundation for growth. But the company, which operates more than 470 stores under the Renner, Youcom and Camicado brands, had previously experienced challenges in upgrading to new solutions because of the brands’ disparate solutions landscape.

- “We chose to modernize and simplify with Oracle Retail to reduce operating and support costs to prepare for omnichannel in Brazil,” said Emerson Silveira Kuze, Chief Information Officer of Lojas Renner. “This required Renner’s processes to be revised to conform to global best practices built into the Oracle solution. This shift in vision allowed Renner to move forward in adopting worldwide standards of efficiency and productivity in its management, while reducing implementation costs and future system upgrades.”

Brazilian Server Market Sees Uplift

(August 3) ZDNet.com

Brazilian Server Market Sees Uplift

(August 3) ZDNet.com

- Sales of x86 servers increased by 12% in the first quarter of 2017, but predictions for the entire year are not so positive, according to IDC. Revenue over the period reached $116 million, versus $104 million in the first quarter of 2016.

- “The x86 server vendors adopted a more aggressive behavior in early 2017, with many promotional campaigns. In addition, there was still a stock surplus [from] 2016, which influenced the revenue increase and even the number of units sold,” says Luis Altamirano, research analyst at IDC Brazil.

Brazilian Bank Offers Free Wi-Fi Access in São Paulo

(August 7) ZDNet.com

Brazilian Bank Offers Free Wi-Fi Access in São Paulo

(August 7) ZDNet.com

- A Brazilian bank is offering free Wi-Fi access to passers-by in one of São Paulo’s postcard locations in the largest service provision initiative carried out by the private sector in the country so far. The service will be provided by Banco do Brasil for a year to users via a 2.7-kilometer fiber optic network rolled out in Avenida Paulista.

- Currently, Banco do Brasil has 12.5 million mobile-banking customers, and the goal is to increase that number to 15 million within the coming months. The minimum connection speed provided will be 1 Mbps, regardless of the number of connected users. Avenida Paulista has an approximate footfall of 1.5 million people daily.

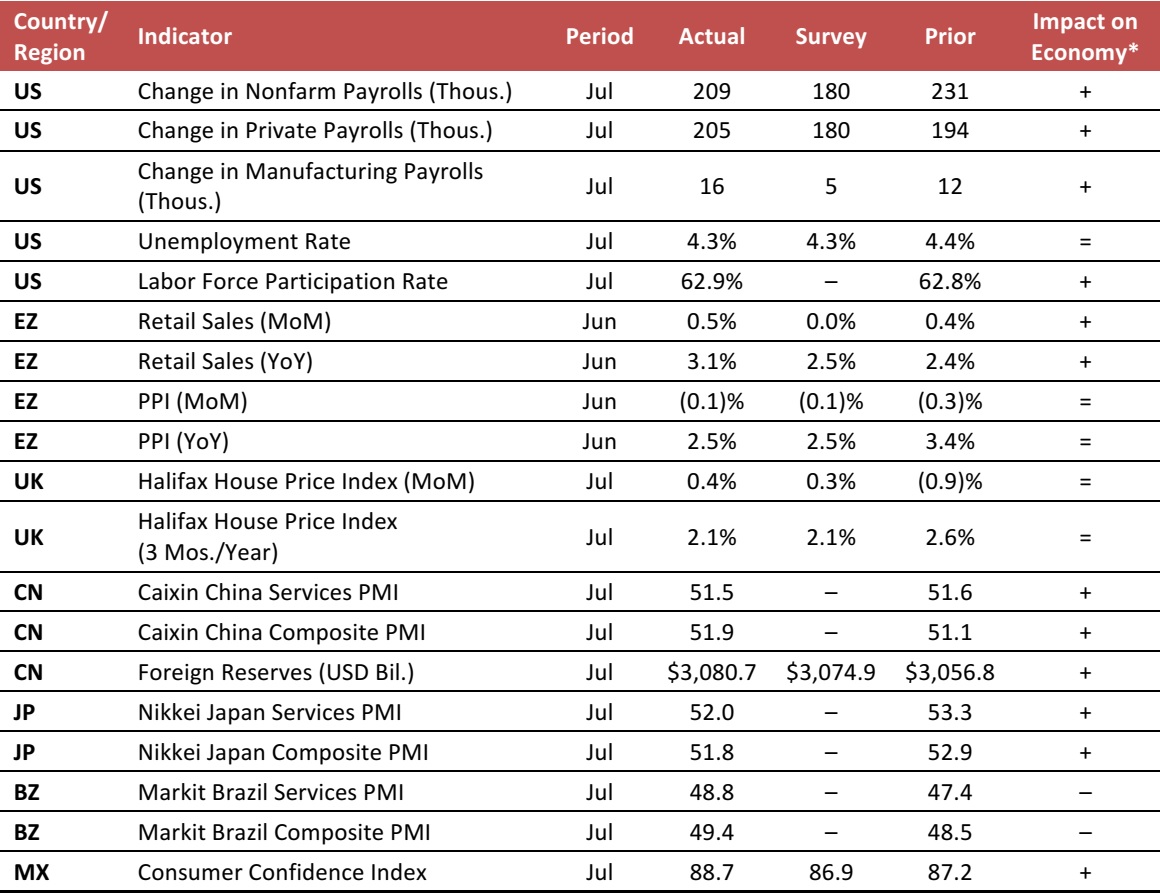

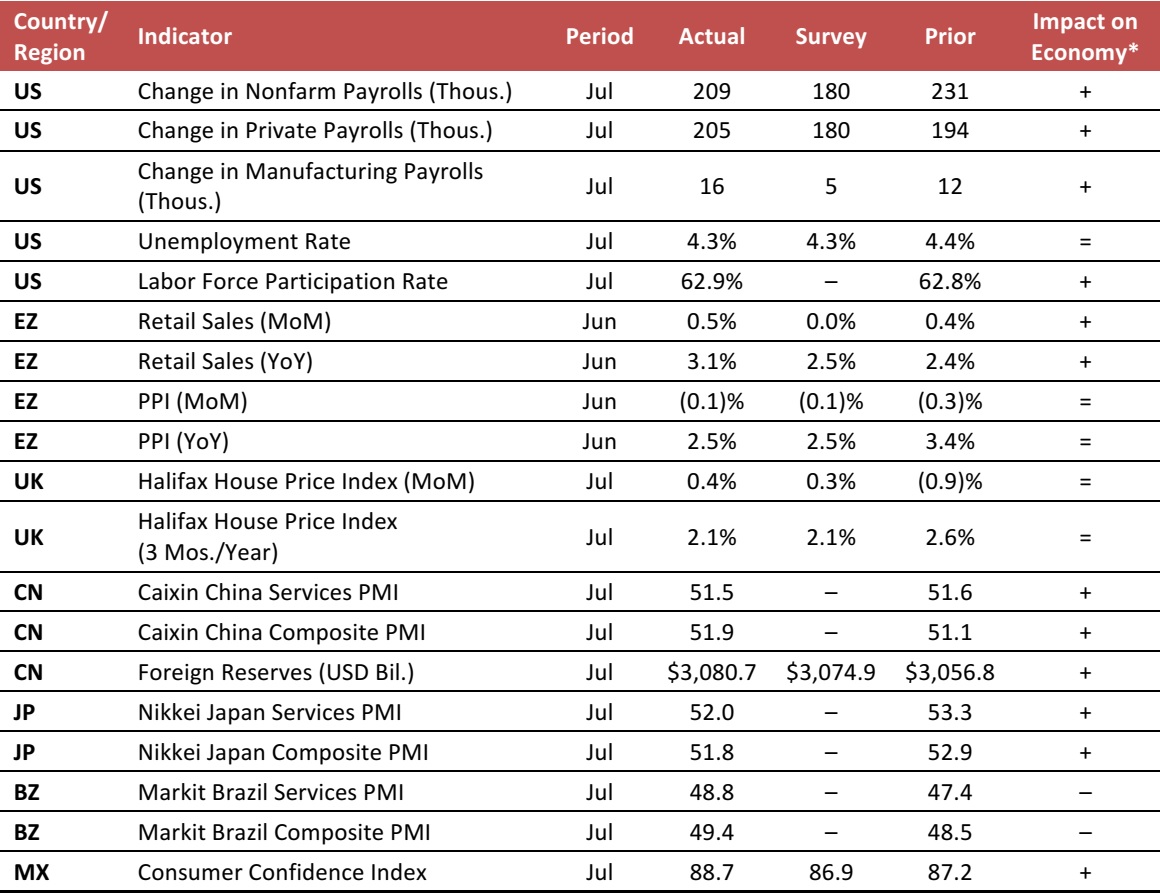

MACRO UPDATE

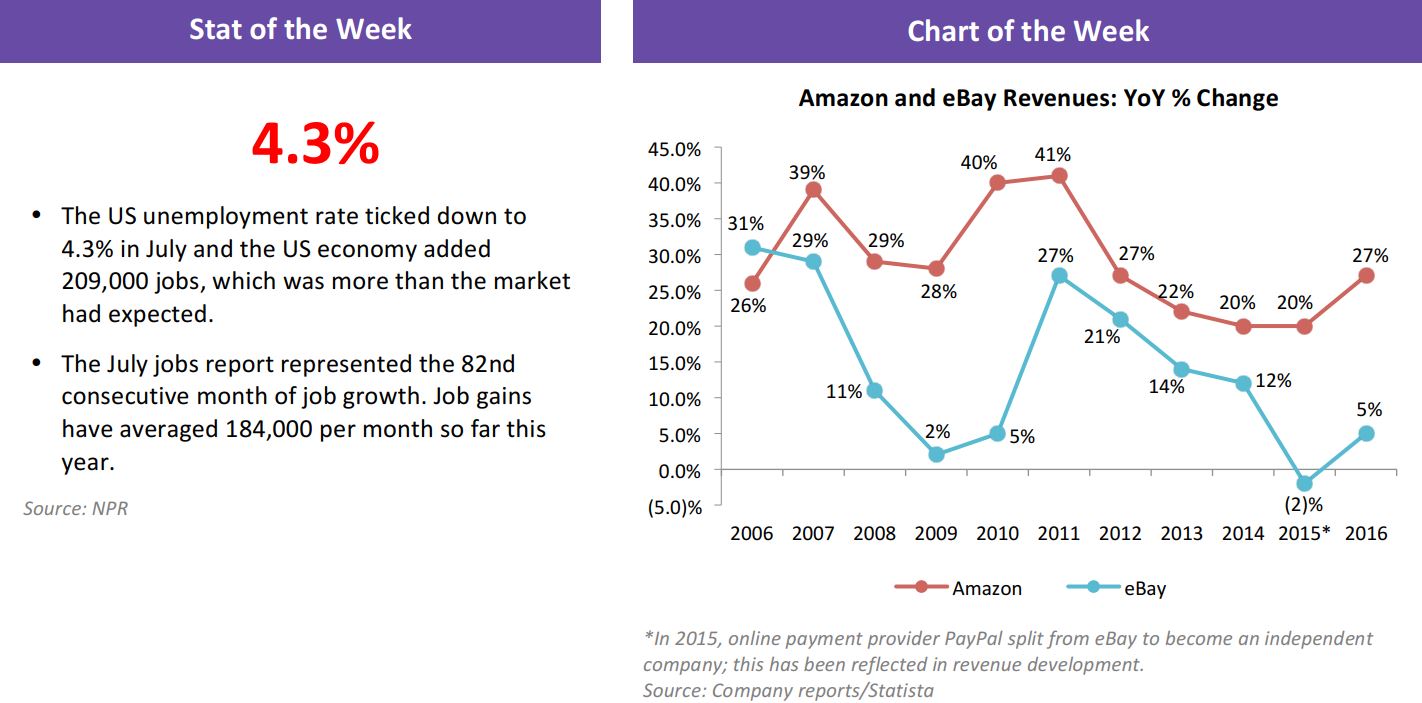

Key points from global macro indicators released August 2–9, 2017:

- US: In July, nonfarm payrolls increased by 209,000, which was better than analysts had estimated. The unemployment rate stood at 4.3% in July, while the labor force participation rate ticked up by 0.1%, to 62.9%.

- Europe: In the eurozone, retail sales increased by 0.5% month over month in June and by 3.1% year over year. The Producer Price Index (PPI) decreased by 0.1% month over month in June, in line with the market’s estimate. In the UK, house prices moderated upward in July.

- Asia-Pacific: In China, the Caixin Services Purchasing Managers’ Index (PMI) stood at 51.5 in July, above the expansion threshold of 50.0. Foreign reserves in China ticked up to $3,080.7 billion. In Japan, the Nikkei Services PMI ticked down to 52.0, staying above the expansion threshold.

- Latin America: In Brazil, the Markit Services PMI ticked up to 48.8 in July, remaining below the expansion threshold of 50.0. In Mexico, the Consumer Confidence Index improved to 88.7 in July.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Eurostat/Halifax/The People’s Bank of China/Markit/Instituto Nacional de Estadística y Geografía (INEGI)/FGRT

Why Back-to-School Is Expected to Be a Bright Spot for Struggling Retailers

(August 8) FootwearNews.com

Why Back-to-School Is Expected to Be a Bright Spot for Struggling Retailers

(August 8) FootwearNews.com