FROM THE DESK OF DEBORAH WEINSWIG

UNTAPPED OPPORTUNITIES IN THE EUROPEAN OFF-PRICE SPACE

Exporting the Off-Price Model

We have noted several times before that off-price is a driving force in apparel retailing in the US. These stores sell a mix of big-name brands, including prior season stock, at prices that are lower than normal. The name brand goods are typically mixed in with a range of private label brands at these stores.

T.J.Maxx is the off-price leader in the US, but low-growth US department stores are spying opportunities and piling into the format: Macy’s Backstage, Kohl’s Off/Aisle and Find @ Lord & Taylor were three new chains launched in 2015.

So far, however, the off-price boom has been confined to North America. In Europe, the TJX Companies, owner of T.J.Maxx/T.K.Maxx, has had the store-based off-price segment largely to itself—although Internet pure plays such as Amazon and ASOS are effectively competing in the same space.

In March, Hudson’s Bay Company announced a €1 billion investment in its recently acquired German department store chain, Galeria Kaufhof. One reported element of this investment is the introduction of Hudson Bay’s off-price chain, Saks Off 5th, to Germany; some media reports say 40 Saks Off 5th stores could be opened in the country.

Are There Off-Price Opportunities in Germany?

We think there are real opportunities to develop the off-price segment in Europe, and especially in Germany. We note three positive trends:

First, T.K.Maxx has seen success in Europe, where it operates stores in Germany, the UK, Poland and, since early 2015, Austria. The company grew its total European sales by 21% (in euro terms) between fiscal years 2013 and 2015, helped by new stores. As measured by sales per square foot, T.K.Maxx grew its underlying sales by 6% (in euro terms) over the same period.

Second, the German department store sector needs reviving. As we noted in our 2015 Global Department Store Retailing report, the German sector is low growth and somewhat uninspiring. It is dominated by two midmarket players: Galeria Kaufhof and Karstadt. Faced with heightened competition from global fashion players and from pure plays such as Amazon and Zalando, the sector has consistently lost share of retail sales in recent years.

Third, consumers in Germany are notoriously price sensitive and, as a result, the country is home to a substantial discount sector that ranges from grocery (Aldi, Lidl, Netto Marken-Discount) to apparel (KiK, NKD, Takko). The big apparel discounters, however, sell only private labels; off-price retailers bring big-name brands to the budget segment.

And Elsewhere in Europe?

We do not see the opportunities as being limited to Germany. The midmarket department-store malaise is not confined to Germany, nor is the demand for budget shopping. Amid the boom in grocery discounters, low-price Internet pure plays and pound shops, off-price is beginning to look like the (largely) untapped segment of European budget retailing.

Of course, these opportunities translate into threats for existing players in the European market. Not only does this format further entrench an expectation of cut-price retailing among shoppers, it adds yet more capacity to the mass-market segment. This competition would likely be felt most by the midmarket department stores and apparel specialists that are already seeing demand slide.

If off-price does take off in Europe, a number of these retailers—notably multibrand department stores—may face the choice their counterparts in the States have already confronted: tap the growing off-price opportunity and risk some cannibalization, or stand by while rivals reap the rewards of doing so.

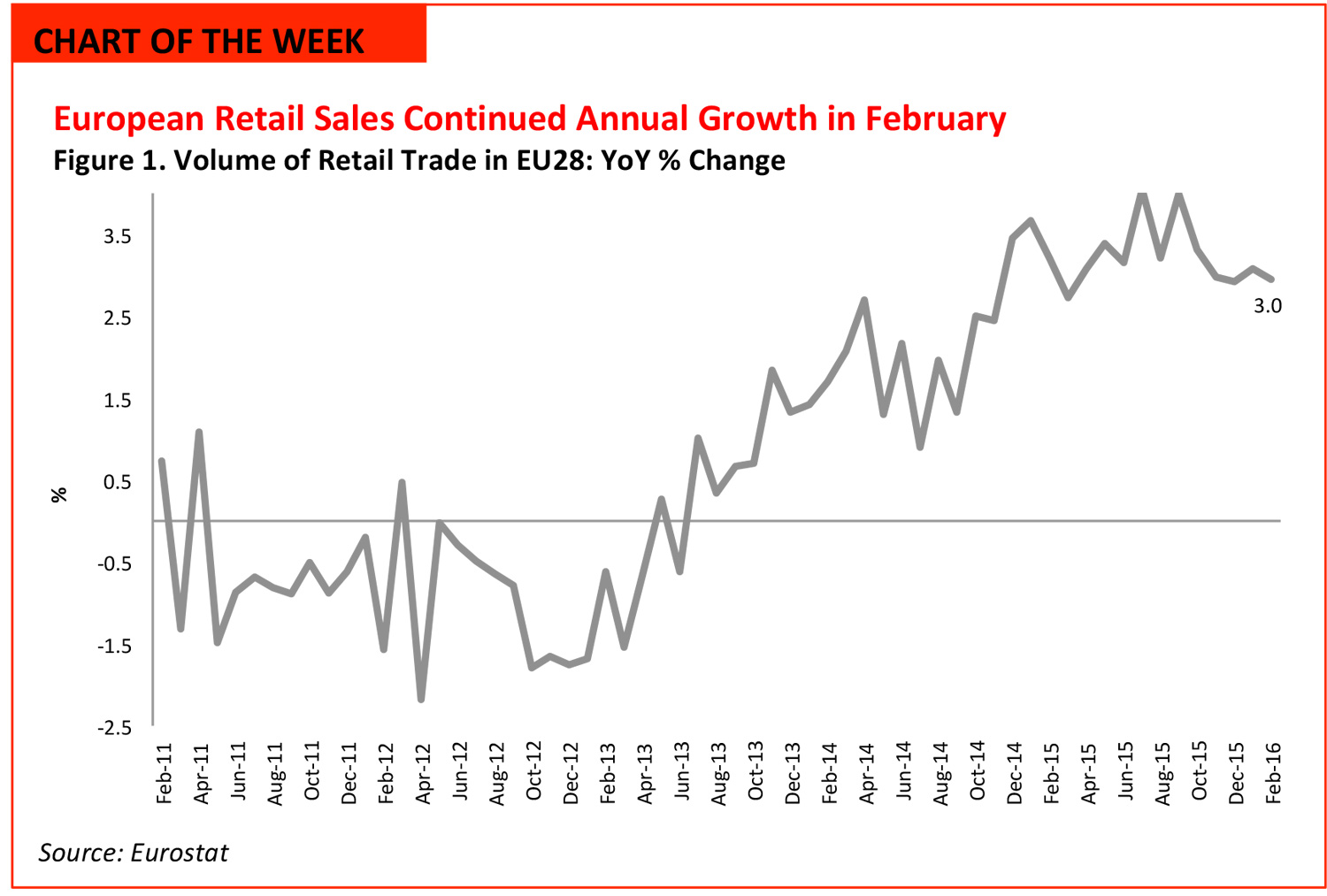

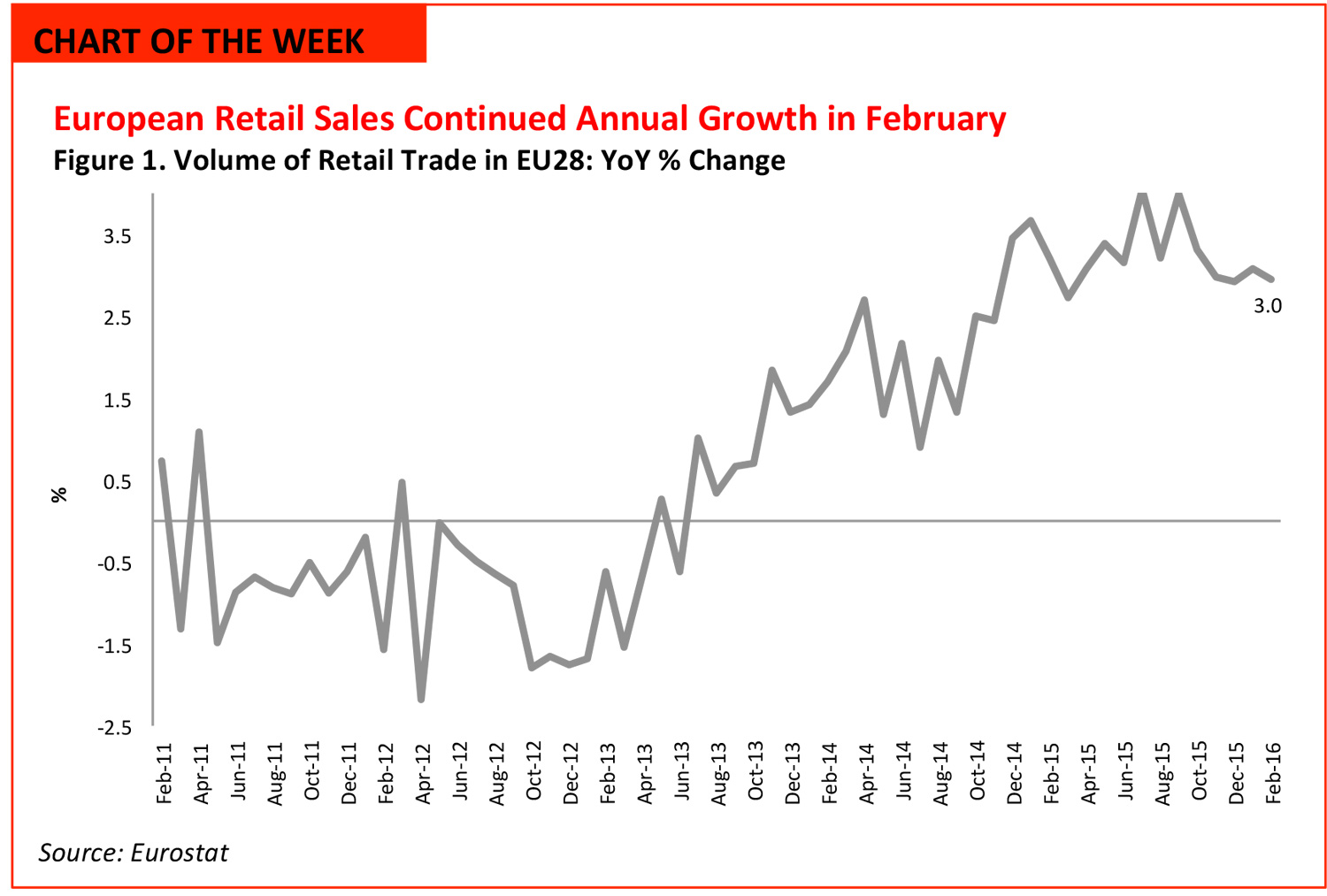

- Year over year, the volume of retail trade in the EU28 increased by 3% in February (data adjusted for calendar effects).

- Food retailers grew sales by 3.2% and nonfood retailers grew sales by 2.8% year over year in February.

- Retail growth among the EU member countries was highest in Romania (up 19.3%) and Luxembourg (up 18.3%), while sales decreased in Belgium (down 2.4%), Slovenia (down 1.4%) and Denmark (down 1.0%).

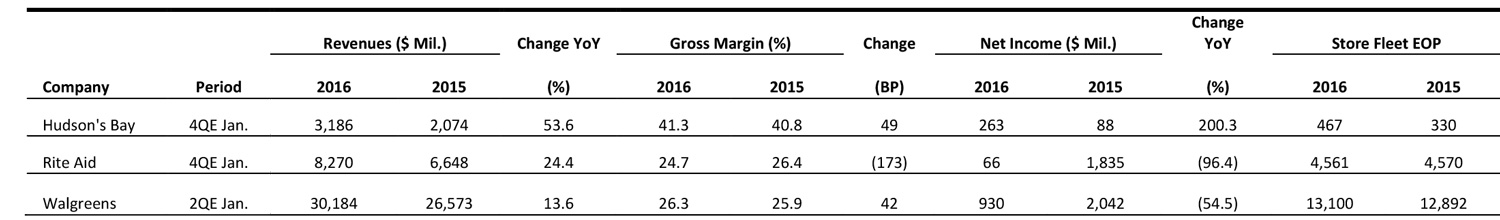

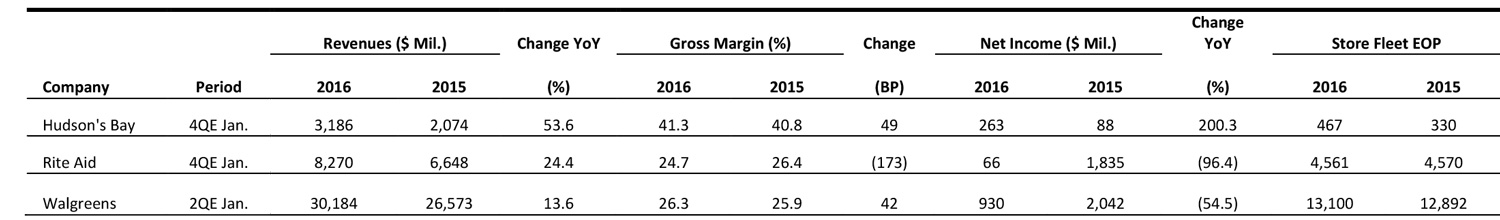

US RETAIL EARNINGS

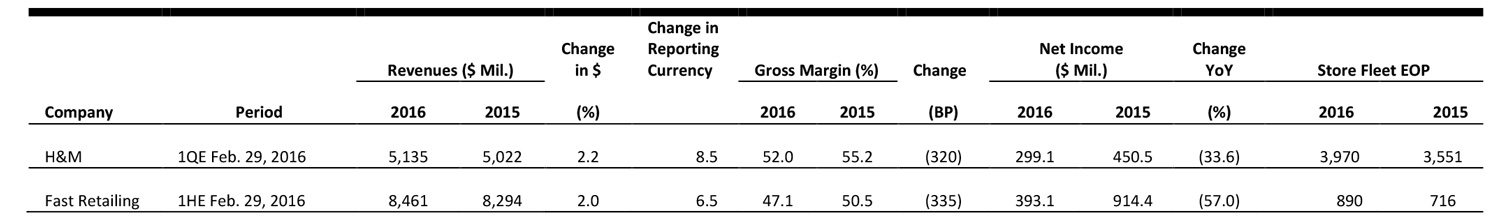

Source: Company reports

US RETAIL HEADLINES

The Sharing Economy Does Not Share the Wealth

(April 6) Bloomberg

The Sharing Economy Does Not Share the Wealth

(April 6) Bloomberg

- As companies such as Uber and Airbnb become profitable, city and state tax authorities are fighting hard to make them play by the same rules as traditional businesses. According to policy experts, this is a battle that is likely to shift to the national level.

- For example, two of Airbnb’s subsidiaries are in Ireland, allowing the company to avoid both the 35% top tax rate in the US and the 12.5% income tax in Ireland. The IRS has not yet tried to calculate the potential revenue loss from such operations.

Industry Suppliers See Retail Sales Outpacing GDP Growth

(March 30) Women’s Wear Daily

Industry Suppliers See Retail Sales Outpacing GDP Growth

(March 30) Women’s Wear Daily

- According to the Global Retail Manufacturers and Importers Survey from Capital Business Credit, 75% of suppliers and importers surveyed “expect retail sales to significantly outpace the gross domestic product for the spring and summer shopping season.” Respondents also expect retail sales to grow by 4% or more, which is greater than the 2%–3% gain expected by economists.

- Reorders for spring and summer goods are up, according to the report. As a result, 45.5% of those surveyed believe spring and summer sales will be better than last year and 39% believe they will remain the same.

The CFDA and Cadillac Have a Plan to Boost Fashion Retail

(April 5) Vogue

The CFDA and Cadillac Have a Plan to Boost Fashion Retail

(April 5) Vogue

- The Council of Fashion Designers of America is partnering with Cadillac to figure out how to fix the broken retail system. The partners are working on a program called Retail Lab, which will work to help American designers bolster their retail efforts.

- Six designers will get the opportunity to install a custom retail pop-up show on the ground floor of Cadillac’s global headquarters in New York City. Cadillac will also provide each designer with a $75,000 grant to cover the cost of displays, marketing and wholesale buys.

The Surprising Thing that Got the Biggest Share of Online Shopping Dollars in 2015

(April 6) The Washington Post

The Surprising Thing that Got the Biggest Share of Online Shopping Dollars in 2015

(April 6) The Washington Post

- A new report from comScore shows that last year, for the first time, e-commerce spending on apparel and accessories outpaced e-commerce spending on computer hardware. In 2015, online clothing sales totaled $51.5 billion, while online personal computer and tablet sales totaled $51.1 billion.

- Consumers are becoming more comfortable shopping for clothing online. Return policies have improved, allowing consumers to return items with little hassle and often at no cost, reducing the risk of making a purchase online.

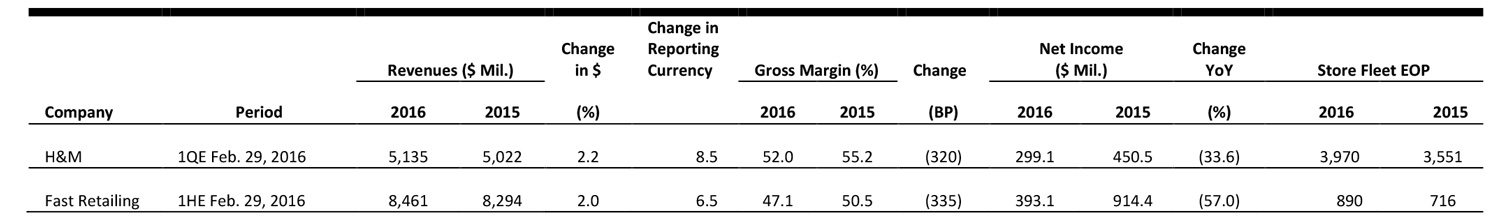

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

UK Supermarket Sales Boosted by Early Easter

(April 5) Kantar Worldpanel

UK Supermarket Sales Boosted by Early Easter

(April 5) Kantar Worldpanel

- Total UK grocery sales rose by 1.1% year over year in the 12 weeks ending March 27, market research company Kantar Worldpanel said this week. Kantar said this is the fastest growth the sector has seen all year, and was helped by an early Easter.

- Sainsbury’s continued to lead the big four grocers, with sales up 1.2% year over year in the 12 weeks. Tesco’s decline lessened for the fourth month in a row; its sales were down 0.2% year over year. Sales at Morrisons fell by 2.4% year over year, impacted by store closures. Kantar did not disclose sales growth for Asda, which has recorded steep sales declines in previous periods.

Suitsupply Plans Further Expansion

(April 4) Retaildetail.eu

Suitsupply Plans Further Expansion

(April 4) Retaildetail.eu

- Suitsupply, a Netherlands-based bespoke suit retailer, said it intends to continue opening physical stores in new countries over the next few months. Founder Fokke De Jong told Dutch Radio 1 that Suitsupply plans to open physical stores in Australia—which is one of its largest online markets—and also in Denmark and Sweden, which are two of its top three European e-commerce markets. The company currently has e-commerce operations in 15 countries.

- De Jong mentioned that Suitsupply plans to concentrate on expanding its omni-channel offering by dividing its resources equally between fashion and technology. He also expressed that Suitsupply was ahead of its time when it launched an online suit supply service several years ago, and that it is now riding its wave of success.

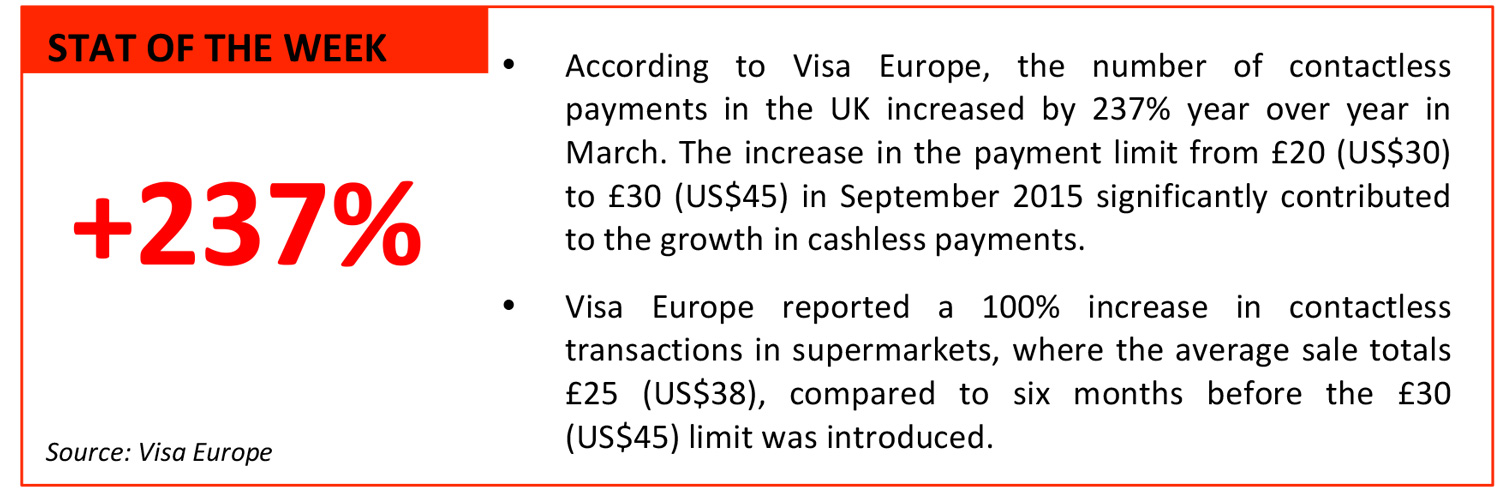

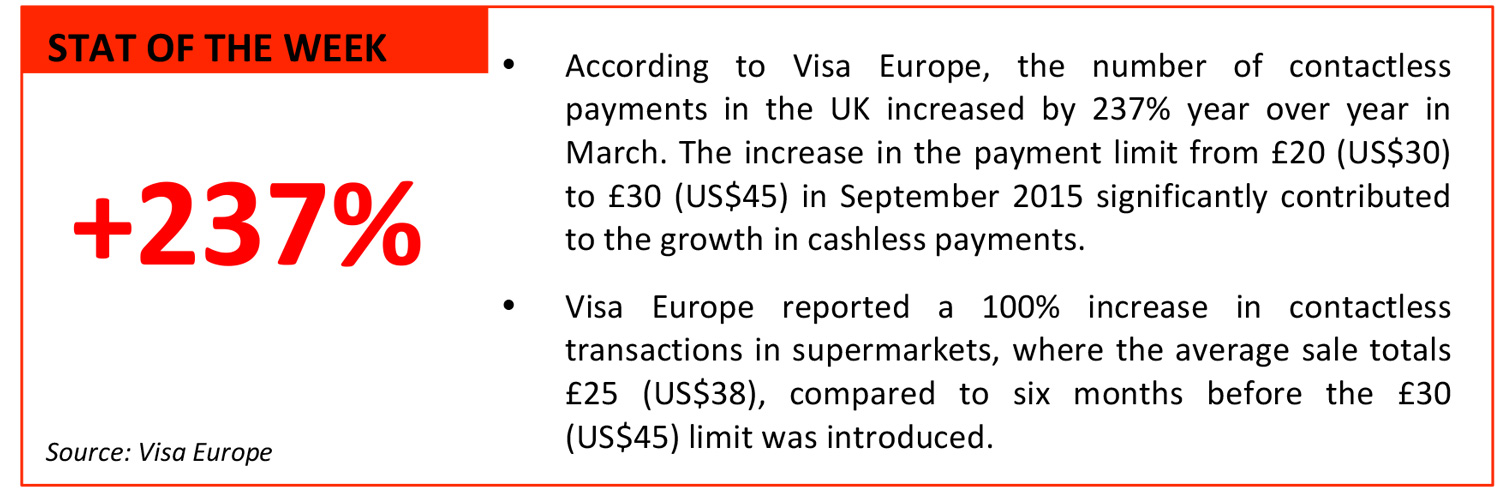

Introduction of £30 Spending Limit Leads to Contactless Payments Surge in the UK

(April 4) Retail-week.com

Introduction of £30 Spending Limit Leads to Contactless Payments Surge in the UK

(April 4) Retail-week.com

- An increase in the upper limit for contactless payments has prompted a jump in transaction numbers in the UK. The limit for contactless card payments was upped from £20 (US$30) to £30 (US$45) in September 2015. Between October 2015 and March 2016, the number of contactless transactions surged by 237%, according to research from Visa Europe.

- Visa Europe also noted that contactless payments now comprise 10% of all face-to-face transactions worth £20–£30 (US$30–US$45). The number of contactless transactions in this range is growing at an average monthly rate of 19.1%, while the number of transactions below £20 (US$30) is growing by a mere 8%. The research also found that supermarkets, where the average purchase totals £25 (US$38), were among the retailers that benefited most.

Valentino Reportedly Offers to Buy Balmain

(April 3) Businessoffashion.com

Valentino Reportedly Offers to Buy Balmain

(April 3) Businessoffashion.com

- Luxury Italian fashion brand Valentino has offered to buy French fashion house Pierre Balmain for €500 million (US$565 million), according to French news reports. Valentino, owned by Qatari buyout firm Mayhoola for Investments, is reportedly up against a Chinese group and an American investor in the race for Balmain.

- Previous news reports had speculated that the owners of Balmain, which saw success under the creative leadership of Olivier Rousteing, have been looking to sell the company. The French fashion house reportedly has until Thursday to decide on Valentino’s offer; both firms declined to comment on the developments.

H&M Launches Its Online Shop in Seven New European Countries

(March 31) Company press release

H&M Launches Its Online Shop in Seven New European Countries

(March 31) Company press release

- Swedish fast-fashion chain H&M announced that it launched transactional websites for customers in Croatia, Estonia, Latvia, Lithuania, Slovenia, Luxembourg and Ireland on March 31, 2016.

- The retailer added that customers will be able to shop the same collections online as in stores for men, women, children and teens, with some exclusive “online-only” items available all year-round. Customers will also be able to shop the retailer’s home décor collection, called H&M Home, through the websites. H&M this week reported its first-quarter update; see the European Retailers Earnings Table in this report and our separate Flash Report for details.

Marks & Spencer Reports a Further Decline in General Merchandise Sales

(April 4) Company press release

Marks & Spencer Reports a Further Decline in General Merchandise Sales

(April 4) Company press release

- UK clothing and food retailer Marks & Spencer reported that total fourth-quarter UK sales grew by 1.6% and that UK comps fell by 1.1%. The company’s keenly watched UK General Merchandise segment posted a comp decline of 2.7% in the quarter, ahead of the 5.8% decline in the third quarter and slightly ahead of expectations.

- The company’s UK Food division posted flat comps in the quarter, down from 0.4% comparable-store sales growth in the third quarter. International sales were up 3.8% in total, on a constant-currency basis.

ASIA TECH HEADLINES

Pouch Cashless Wristbands Make Concerts a Safer Experience

(April 5) TechinAsia

Pouch Cashless Wristbands Make Concerts a Safer Experience

(April 5) TechinAsia

- Singapore-based startup Pouch introduced NFC wristbands that are becoming popular among event organizers. The wristbands, worn by attendees, help organizers solve problems at concerts and crowded exhibitions, such as security issues, theft, fraud, and event flow and control.

- Guests wearing the wristbands can use them to pay for goods, freeing them from the need to carry cash and minimizing their risk of getting pickpocketed. Wearers can reload the wristbands online via a credit card or bank deposit. Reloading booths, which accept both cash and credit card payments, are available on-site at events.

Point-of-Sale Startup Scores Seed Round Thanks to Crowdfunding

(April 4) TechinAsia

Point-of-Sale Startup Scores Seed Round Thanks to Crowdfunding

(April 4) TechinAsia

- Singapore-based startup Sphere announced it has raised a seed round worth US$252,000. Sphere makes a point-of-sale system for restaurants and other F&B businesses that is similar to Taiwan-based iChef, which raised US$5.6 million in a series A round in February.

- Sphere provides table management software, a waiter app, a payment system, cloud storage, tablets, and routers and receipt printers, and it plans to enable restaurants to integrate data across multiple systems.

Xiaomi Leads US$25 Million Round for Music-/Movie-Streaming Firm Hungama

(April 4) TechCrunch

Xiaomi Leads US$25 Million Round for Music-/Movie-Streaming Firm Hungama

(April 4) TechCrunch

- Xiaomi announced its lead on a US$25 million round for Hungama, a video- and music-streaming service that claims 65 million users, saying that it will integrate Hungama’s services into its content platform in India “in the near future.”

- Existing Hungama investors also participated in the deal: they include Intel Capital, Bessemer Venture Partners and billionaire investor and trader Rakesh Jhunjhunwala. Intel Capital and Bessemer Venture Partners provided the company’s last funding, a US$40 million round in 2014, and Intel Capital also invested an undisclosed sum in 2012.

Zomato Launches Its Restaurant Point-of-Sale System

(April 4) TechCrunch

Zomato Launches Its Restaurant Point-of-Sale System

(April 4) TechCrunch

- Zomato has launched Zomato Base, a cloud-based, Android point-of-sale system for restaurants. The system is built on top of MaplePOS, which Zomato acquired last year as part of its plan to expand into new verticals.

- In response to steep competition, Zomato decided to expand into payments, reservations, white label apps and restaurant management softwear. The startup raised US$60 million last year, and its total funding to date is about US$224 million.

At $3.75 Billion, Garena Is the Most Valuable Startup in Southeast Asia

(April 1) TechinAsia

At $3.75 Billion, Garena Is the Most Valuable Startup in Southeast Asia

(April 1) TechinAsia

- Garena is largely made up of three big business units: digital content, e-commerce and payments. Its digital content business is providing profit to fund its fast-growing units, which include Shopee, a mobile e-commerce marketplace, and AirPay, an e-payment platform.

- Shopee, inspired by Taobao, is focusing on growth and is not profitable. The company is on track to generate over US$300 million in revenue this year. AirPay processed US$337 million in annualized gross transaction volume as of February 2016, and is profitable at the gross margin level (not including marketing and operating costs).

LATAM RETAIL HEADLINES

Latin America Seen as Ripe for Retail M&A Boom

(April 5) WWD.com

Latin America Seen as Ripe for Retail M&A Boom

(April 5) WWD.com

- Struggling economies in Latin America are making for attractive, and highly discounted, long-term assets, according to bankers and analysts. Bankers expect M&A activity in the region to increase by 10%–20% this year.

- Foreign and local investment firms should keep their eyes open for the retail bargains that are popping up all over Latin America. Near-term revenues will likely not make targets, but there should be a good return on investment within five years, according to analysts.

H&M Sets Expansion Drive in Mexico

(April 3) WWD.com

H&M Sets Expansion Drive in Mexico

(April 3) WWD.com

- H&M is continuing its expansion in Mexico, and announced plans to open 10 additional stores in the country in 2016, with more to come by 2019. The company opened seven stores in Mexico in 2015, and company insiders are optimistic that Mexico City alone could be home to nearly 30 stores.

- H&M grew by 150% in Mexico in 2015, compared to only 15% globally. The company is currently considering manufacturing in Mexico; the plan is reportedly gaining traction in light of H&M’s intention to expand into footwear, jerseys and woven goods.

Wal-Mart de Mexico Sales Growth Slows in March

(April 5) Dow Jones Business News

Wal-Mart de Mexico Sales Growth Slows in March

(April 5) Dow Jones Business News

- Wal-Mart de Mexico’s sales growth slowed to 9.8% in March, although the retailer still closed the first quarter with double-digit growth of 13%.

- March same-store sales in Mexico for stores that have been open at least one year rose by 6.7% year over year. In Central America, same-store sales grew by 2.8% during the month.

Blackstone Denies It Is Seeking to Acquire Brazilian Mall Operator

(April 3) Reuters

Blackstone Denies It Is Seeking to Acquire Brazilian Mall Operator

(April 3) Reuters

- Brazilian newspaper O Globo published a report saying that the Blackstone Group is considering an acquisition of Brazilian shopping mall operator BR Malls Participações. Blackstone publicly denied the claim in an emailed statement.

- The paper said the acquisition was set to be Brazil’s largest real estate transaction of all time, valued at US$3.4 billion, although no sources were cited regarding this information.

Suburbia Receives Seven Acquisition Offers

(April 6) Dinero en Imagen

Suburbia Receives Seven Acquisition Offers

(April 6) Dinero en Imagen

- Walmart has reportedly received bids from seven different groups for the purchase of its Mexico-based Suburbia apparel unit. Six of the seven bids were from domestic companies, and they include brand management companies and private equity groups.

- The remaining bid was from the Chile-based Falabella department store chain. The value of the 117 Suburbia stores is estimated to be around US$1 billion.

We have noted several times before that off-price is a driving force in apparel retailing in the US. These stores sell a mix of big-name brands, including prior season stock, at prices that are lower than normal. The name brand goods are typically mixed in with a range of private label brands at these stores.

T.J.Maxx is the off-price leader in the US, but low-growth US department stores are spying opportunities and piling into the format: Macy’s Backstage, Kohl’s Off/Aisle and Find @ Lord & Taylor were three new chains launched in 2015.

So far, however, the off-price boom has been confined to North America. In Europe, the TJX Companies, owner of T.J.Maxx/T.K.Maxx, has had the store-based off-price segment largely to itself—although Internet pure plays such as Amazon and ASOS are effectively competing in the same space.

In March, Hudson’s Bay Company announced a €1 billion investment in its recently acquired German department store chain, Galeria Kaufhof. One reported element of this investment is the introduction of Hudson Bay’s off-price chain, Saks Off 5th, to Germany; some media reports say 40 Saks Off 5th stores could be opened in the country.

We have noted several times before that off-price is a driving force in apparel retailing in the US. These stores sell a mix of big-name brands, including prior season stock, at prices that are lower than normal. The name brand goods are typically mixed in with a range of private label brands at these stores.

T.J.Maxx is the off-price leader in the US, but low-growth US department stores are spying opportunities and piling into the format: Macy’s Backstage, Kohl’s Off/Aisle and Find @ Lord & Taylor were three new chains launched in 2015.

So far, however, the off-price boom has been confined to North America. In Europe, the TJX Companies, owner of T.J.Maxx/T.K.Maxx, has had the store-based off-price segment largely to itself—although Internet pure plays such as Amazon and ASOS are effectively competing in the same space.

In March, Hudson’s Bay Company announced a €1 billion investment in its recently acquired German department store chain, Galeria Kaufhof. One reported element of this investment is the introduction of Hudson Bay’s off-price chain, Saks Off 5th, to Germany; some media reports say 40 Saks Off 5th stores could be opened in the country.

The CFDA and Cadillac Have a Plan to Boost Fashion Retail

(April 5) Vogue

The CFDA and Cadillac Have a Plan to Boost Fashion Retail

(April 5) Vogue