From the Desk of Deborah Weinswig

Department Stores: Thoughts from Both Sides of the Atlantic

This week, the Fung Global Retail & Technology team attended World Retail Congress 2017 in Dubai. On the first day of the conference, we heard two respected names in department-store retailing hold forth on the shifts and challenges retailers are facing: Terry Lundgren, Executive Chairman of Macy’s, offered his thoughts on the US market, and Sir Ian Cheshire, Chairman of Debenhams, focused on the UK market. There was significant overlap in the two executives’ thinking on a number of topics, including the impacts of product ubiquity and price transparency, and the need for retailers to offer customers engaging experiences.

Terry Lundgren on the US

Lundgren noted that US department stores have been hit by a whirlwind of factors, including shifting consumer shopping habits, changing consumer spending priorities and depressed tourist spending as a result of the strong dollar. Lundgren remains bullish on prospects for the department-store format, however, and he outlined three major factors that can sustain demand at brick-and-mortar stores in a tough environment:

- Exclusive product. Retail is primarily about product and, in an age of mobile-enabled price transparency and near-endless choice online, product uniqueness is a real competitive advantage. This is not just about private label, Lundgren noted: for example, in the US, Tommy Hilfiger is sold only at Macy’s.

- Exciting store experiences. Stores are not different enough from five years ago, Lundgren said. Macy’s could still do a better job of bringing the events it already organizes into more of its stores. For instance, it could bring elements from its Thanksgiving Day Parade and Flower Shows into its wider store estate. Retailers must also invest in store associates, Lundgren said, in order to offer customized experiences at a personal level.

- Investment in e-commerce. Multichannel retailers must continue to integrate channels, with online technology driving traffic in-store and vice versa. Lundgren said that European stores have done a better job of offering click-and-collect services than US stores have, and that some European firms offer examples of best practices in providing positive cross-channel experiences.

Sir Ian Cheshire on the UK

UK department stores have tended to fare better than their US counterparts for a number of reasons, including their earlier adoption of multichannel propositions and their investment in high-quality stores. On retailing more broadly, Cheshire noted three key trends:

- E-commerce drives everything. Almost all growth in all major retail markets is being driven by e-commerce. Mobile Internet has been the game changer, gifting shoppers hypertransparency with regard to product and price.

- Experience, not stuff, is what will matter. At Debenhams, beauty sales are increasingly being made through a makeover rather than a direct product purchase, Cheshire said. And when shoppers are buying beauty products, they are more frequently doing so with friends, as part of a social experience. He concurred with Lundgren’s earlier comment that retailers must invest in customer service.

- The world is seeing a winner-takes-all phenomenon. The gap between retail winners and losers is getting bigger, and those retailers that cannot do something better than Amazon will remain under pressure. Echoing Lundgren’s thoughts earlier in the day, Cheshire argued that retailers must provide customers with something interesting and special, which means opportunities lie with those offering exclusive product and great experiences.

So, different countries, with different sector performances, but a number of overlapping ideas. Despite the fact that US department stores are facing serious difficulties, Lundgren ended on an optimistic note. He referenced Macy’s strategy shifts after previous setbacks, and said that the greatest retail innovations often follow periods of difficulty—which means the current challenges retailers face also represent opportunities for exciting change.

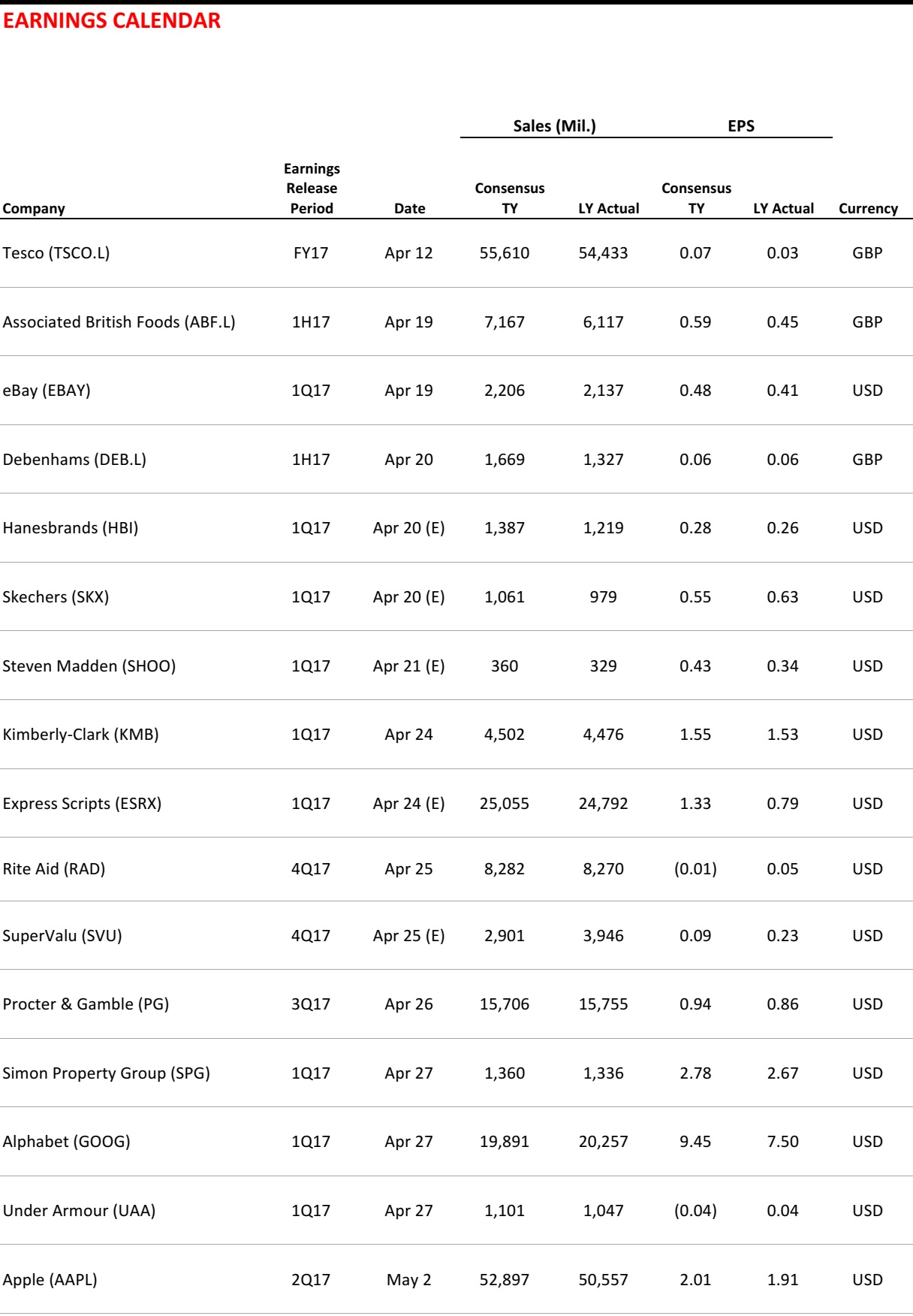

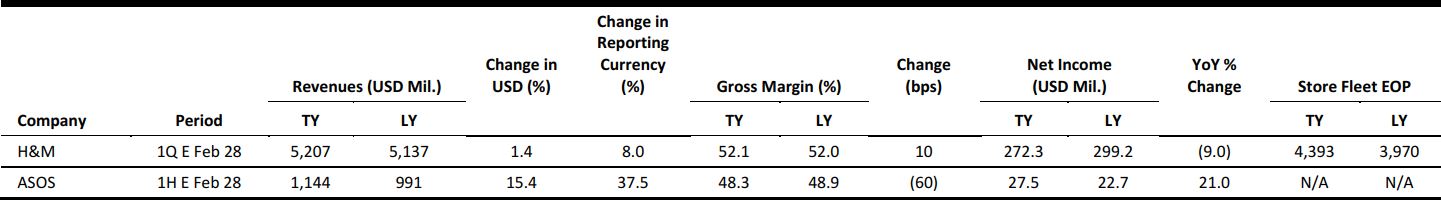

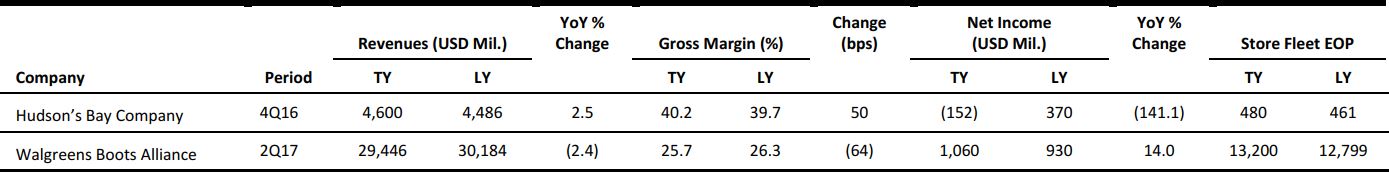

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Baby Dove to Launch in US

(April 5) WWD.com

Baby Dove to Launch in US

(April 5) WWD.com

- Unilever-owned personal-care brand Baby Dove entered international markets two years ago, and is now launching in the US as well as in Canada and the UK.

- The line consists of bar soaps, baby washes, shampoo, lotions and wipes. The products are divided into two different ranges, rich moisture and sensitive moisture. The latter range, which is fragrance free, was formulated with the US market in mind. Prices range from $2.49 for wipes to $5.99 for lotions and washes.

Ralph Cuts Deep: Closes Fifth Avenue Polo Flagship

(April 4) WWD.com

Ralph Cuts Deep: Closes Fifth Avenue Polo Flagship

(April 4) WWD.com

- In a surprising move, Ralph Lauren said on Tuesday that it would close its high-profile Polo flagship store on Fifth Avenue in New York City. The store opened only three years ago and was seen at the time as key to relaunching the brand and expanding it into womenswear.

- The store included the introduction of the Ralph’s Coffee format and sat adjacent to the designer’s first New York restaurant, the Polo Bar, which will remain open.

Avery Dennison RFID Announces Partnership with Target

(April 3) Finance.Yahoo.com

Avery Dennison RFID Announces Partnership with Target

(April 3) Finance.Yahoo.com

- Avery Dennison has announced a global radio frequency identification (RFID) partnership with Target. The agreement is part of Target’s deployment of RFID technology to more than 1,600 stores to help maximize inventory availability and deliver an enhanced guest experience.

- RFID technology uses radio waves to identify and track tags attached to objects. The tags can store information electronically. Retailers are increasingly relying on RFID not only for supply chain activity, but also to create a seamless experience for apparel customers.

J.Crew Creative Director Jenna Lyons Out After Years of Plummeting Sales

(April 3) NewsFactor.com

J.Crew Creative Director Jenna Lyons Out After Years of Plummeting Sales

(April 3) NewsFactor.com

- After proving unable to arrest J.Crew’s dramatic sales declines, Jenna Lyons is out of her job as the clothing chain’s executive creative director, the company announced on Monday.

- As second in command to CEO Mickey Drexler, Lyons was in charge of all product design, visual and brand presentation, and J.Crew’s overall aesthetic. In an interview with the Business of Fashion news site, which first reported the news, Drexler said Lyons was leaving by mutual agreement.

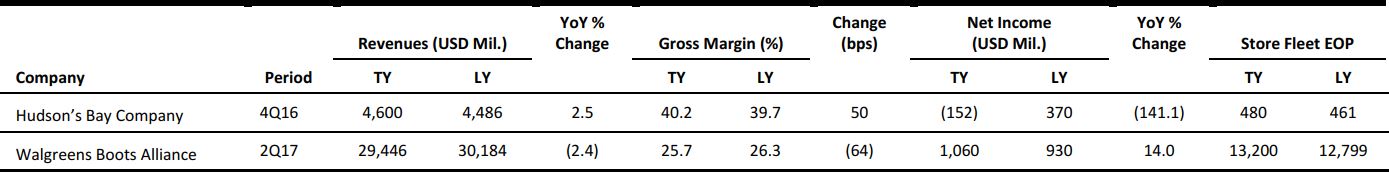

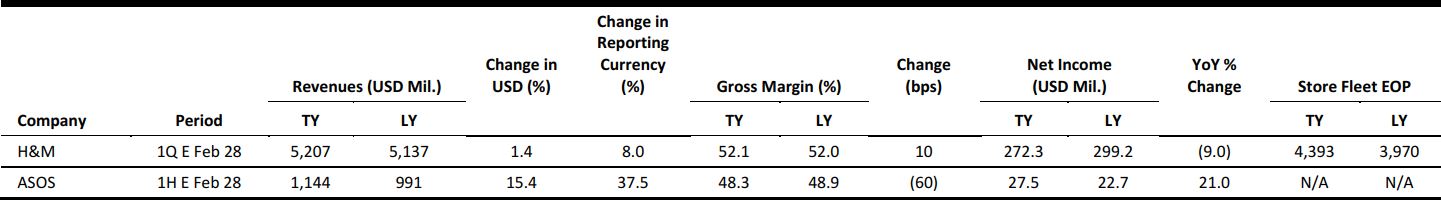

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Coty Enters Strategic Partnership with Burberry

(April 3) Company press release

Coty Enters Strategic Partnership with Burberry

(April 3) Company press release

- Coty announced that it has entered into an agreement to acquire the long-term global licensing rights for Burberry’s beauty and fragrances business for $162 million, plus a $63 million payment for inventory.

- Under the agreement, Coty will develop, manufacture and distribute the full range of Burberry beauty products globally. Burberry’s beauty business accounted for 7% of the luxury brand’s revenue in the first half of fiscal 2017.

John Lewis Boss Says Department Store Needs Reinventing

(March 30) BBC.co.uk

John Lewis Boss Says Department Store Needs Reinventing

(March 30) BBC.co.uk

- Paula Nickolds, the first female managing director of John Lewis, aims to create a new retail model that focuses on the “holistic provision of services.” She told the BBC that shops need to be more experience-led.

- One goal Nickolds will work toward is increasing the company’s own-brand and exclusive products offering. John Lewis wants more than 50% of the products it sells to be available exclusively at its stores, up from the current level of 37%, Nickolds said.

H&M Aims to Use 100% Recycled Materials by 2030

(April 4) Company press release

H&M Aims to Use 100% Recycled Materials by 2030

(April 4) Company press release

- Swedish fast-fashion chain H&M has pledged to use 100% recycled or other sustainably sourced materials in its merchandise by 2030, up from 26% currently. The company also said that it aims to become climate-positive through its entire value chain by 2040, and that it will work to reduce its greenhouse gas emissions.

- In order to fulfill this pledge, H&M aims to switch to 100% renewable electricity, manage water responsibly across its value chain and achieve a climate-neutral supply chain.

Amazon Expands Business-to-Business Marketplace to UK

(April 4) FT.com

Amazon Expands Business-to-Business Marketplace to UK

(April 4) FT.com

- Amazon has added a trade counter to its UK website that will sell office equipment to corporate customers, which account for about 40% of online spending.

- The service provides business-friendly features such as the ability to track purchases and set spending limits, and also includes an expanded range of products aimed at commercial users and not available to individual consumers.

vanHaren Schoenen to Open First Store in Belgium

(April 3) RetailDetail.eu

vanHaren Schoenen to Open First Store in Belgium

(April 3) RetailDetail.eu

- Dutch shoe chain vanHaren Schoenen, part of global footwear group Deichmann, will open its flagship Belgian store in Aalst on April 7. This is the first launch in the chain’s ambitious expansion plan, which includes the opening of a further six stores in the country this year.

- The chain is in negotiations to open stores in several other locations in Belgium as it seeks growth as a value retailer in the country.

ASIA TECH HEADLINES

Toyota Research Institute Puts $35 Million into AI–Powered Materials Research

(March 30) TechCrunch.com

Toyota Research Institute Puts $35 Million into AI–Powered Materials Research

(March 30) TechCrunch.com

- Toyota’s dedicated research organization, Toyota Research Institute, is investing $35 million in collaborative research efforts with a number of university and corporate partners. The research will focus on materials science.

- Toyota Research Institute believes progress in artificial intelligence can help further efforts in this key area of basic research, particularly with regard to fuel cell catalysts, batteries and functional polymers designed for energy storage.

Tencent Expands WeChat’s E-Commerce Platform in Europe

(March 31) Financial Times

Tencent Expands WeChat’s E-Commerce Platform in Europe

(March 31) Financial Times

- Tencent-owned WeChat, China’s most popular social media platform, is planning to expand its e-commerce and payment services for brands in Europe. The company wants to work with European brands to enable them to sell their products through its Chinese online retail platform.

- WeChat will first offer its e-commerce platform for British companies to use to sell goods in China. It will then start operating in other markets such as France and Germany. It has only one office in Europe so far, in Milan.

Samsung Promises “New Beginning” with Galaxy S8 Launch

(March 30) Financial Times

Samsung Promises “New Beginning” with Galaxy S8 Launch

(March 30) Financial Times

- Samsung launched its new Galaxy S8 smartphone with an event in New York that promised a “new beginning” for mobile handset design as well as for the South Korean company itself, which has suffered a series of corporate crises in recent years.

- The S8 features Samsung’s new virtual assistant, Bixby, which it hopes will be a challenger to Apple’s Siri and Amazon’s Alexa. The device also offers an improved front-facing camera for sharper selfies and a new face-recognition system that unlocks the phone.

Facebook’s Shot at India Redemption

(April 4) Bloomberg.com

Facebook’s Shot at India Redemption

(April 4) Bloomberg.com

- Following the rejection of its plan to offer free Internet service in India, Facebook may soon find that the fastest way to consumers’ hearts is through their wallets. Its WhatsApp service is preparing to start offering digital payments in the country, a move that would leverage India’s rush to online transactions following November’s sudden demonetization.

- The service would probably tap into India’s Unified Payments Interface system, which is regulated by the Reserve Bank of India and was set up to facilitate the transfer of funds instantly over mobile devices.

LATAM RETAIL AND TECH HEADLINES

GPA Invests to Drive New Brazilian Growth

(March 29) RetailAnalysis.IGD.com

GPA Invests to Drive New Brazilian Growth

(March 29) RetailAnalysis.IGD.com

- GPA, Brazil’s largest retail company, plans to invest $384 million in 2017, split between its cash-and-carry business, Assaí, and its grocery formats. It will also open 20–30 new Assaí outlets, focusing on less affluent cities in northeastern Brazil.

- In spite of some recent improvements in trading, there is an opportunity for GPA to upgrade its hypermarkets, a channel that continues to struggle.

Carrefour to Keep Investing in Brazil

(March 30) LeadersLeague.com

Carrefour to Keep Investing in Brazil

(March 30) LeadersLeague.com

- In 2016, French retail group Carrefour invested €500 million in Brazil and Argentina, with the former receiving most of the resources. On March 25, the company’s Brazilian CEO, Charles Desmartis, announced that the supermarket chain will keep up the pace of its investments in the country.

- Brazil is currently the second-largest market for Carrefour, accounting for 16% of its global revenue, which reached €77 billion in 2016. In January and February, the group opened five more Carrefour Express stores in Brazil.

Qualcomm Joins Forces with Brazil to Manufacture IoT Chips

(March 30) NearshoreAmericas.com

Qualcomm Joins Forces with Brazil to Manufacture IoT Chips

(March 30) NearshoreAmericas.com

- Qualcomm and Taiwan’s ASE Group have teamed up with trade and technology agencies within Brazil’s federal government to produce semiconductor chips that are used widely in Internet of Things (IoT) devices.

- The consortium will pour $200 million into a high-tech manufacturing plant in Campinas, a city northwest of São Paulo. The Ministry of Science, Technology, Innovation and Communication and the Ministry of Industry, Foreign Trade and Services are part of the consortium, and the Brazilian Development Bank is the chief financier.

Walmart Chile Announces Investment Plan

(March 31) RetailAnalysis.IGD.com

Walmart Chile Announces Investment Plan

(March 31) RetailAnalysis.IGD.com

- Walmart has announced plans to invest $800 million in Chile over the next three years, the latest in a series of financial commitments to its Latin American markets. Walmart plans to open 55–60 stores in the country between 2017 and 2019. These will mainly be medium-sized formats such as Express de Lider and Super Bodega aCuenta.

- Walmart is transforming its Ekono discount stores into convenience outlets, adding more perishable foods, among other changes. Walmart is also investing $180 million in a distribution center at El Peñón that is currently under construction.